How to guarantee that a real estate purchase and sale transaction will take place, what kind of preliminary agreement should be drawn up? What should the receipt be like? Why does the seller usually prefer an advance payment for an apartment as an advance payment, although it is the deposit that is legally enshrined in regulations, but the advance payment is not.

What is the difference between these concepts, how to correctly transfer the deposit when selling an apartment, what to choose in the end: an advance payment or a deposit, so that the purchase is guaranteed to be possible - we will understand all the nuances together with JCat.Real Estate.

What are advance and deposit? How to get money back if the terms of the contract are violated?

Natalya Tikhonenko, executive director of financial service QOOD

There is no separate definition of the concept of “advance” in the Civil Code, but it is used in the Civil Code and in many other documents, and in practice there are usually no difficulties with it.

The legal nature of the advance is that the customer or buyer transfers a certain amount of money to the contractor or seller in order for him to perform work, provide services, or deliver goods. Theoretically, the advance can be returned until the parties begin to fulfill contractual obligations; this is how it differs from the deposit. In practice, the advance is rarely returned in full in the event of a unilateral refusal by the buyer from the transaction.

Let's consider a simple purchase and sale transaction. If the buyer refuses obligations, the seller loses the planned profit, so the seller can retain the debtor’s things in accordance with paragraph 1 of Art. 329 of the Civil Code of the Russian Federation. The buyer may respond by telling the court that the amount of penalties provided for in the contract is disproportionate.

If the seller has begun executing the transaction and delivered part of the goods, the buyer must reimburse the costs incurred by the seller, including through an advance payment. This situation is possible only if the seller fulfills his obligations in good faith. Otherwise, the buyer may demand an advance amount from the seller.

If in the same situation, instead of an advance payment, a deposit appears in the transaction, we are no longer talking about its return. In case of unilateral refusal to fulfill his part of the transaction, the buyer may lose the deposit provided. If the seller does not fulfill his obligations, he is obliged to pay the other party double the amount of the deposit, as well as compensate her for losses, unless otherwise specified in the contract. The court has the right, at the request of the defendant, to reduce the amount of half of the specified amount.

Ekaterina Smoleva, lawyer

The advance performs only payment and certification functions, but not security. It is paid before the execution of the contract against the payments due. In any case, the recipient must return the advance, regardless of compliance with the terms of the contract.

A deposit (Part 1 of Article 380 of the Civil Code of the Russian Federation) is a sum of money that one party gives to the other party to ensure the fulfillment of the terms of the contract. If the contract was not fulfilled by the one who gave the deposit, it remains with the other party. If the one who received the deposit does not fulfill the terms of the contract, he is obliged to pay the other party double the amount of the deposit.

By law, if you are in doubt whether the amount paid towards future payments is an earnest money, then it can be considered an advance.

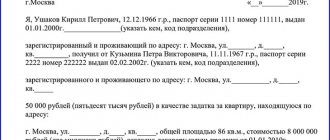

For example, if citizen Ivanov sells an apartment to citizen Petrov without a preliminary agreement, the parties draw up a receipt reflecting their mutual desire to enter into a contract for the sale of the apartment and a deposit of 100,000 rubles, which Petrov transferred to Ivanov as security.

Petrov wanted to make a payment using a bank loan, but the bank refused him, so he asked Ivanov to return the deposit to him. Ivanov, citing the fact that the deposit is not refundable by law, refused him this, but since they did not enter into an agreement, such a sum of money cannot be considered a deposit. It can be recognized as an advance payment that must be returned to Petrov.

Advance share of salary

What amount or share will the first payment of part of the salary be? The law does not answer clearly here either. Of the documents, this issue is indirectly addressed only by the somewhat outdated, but not yet repealed, Resolution of the USSR Council of Ministers No. 566, which states that the amount is established by the organization and should not be lower than the tariff rate.

Is it necessary to withhold alimony from advance wages ?

In modern entrepreneurship, various methods of calculating the advance interest are used, all of them are legal, the choice is up to the employer.

- Payment for actual working hours. The advance is paid on a set date in an amount corresponding to remuneration for the number of days or hours worked. However, it may vary monthly. This method is recommended in the letter of the Ministry of Labor No. 14-1/10/B-660; it must be mentioned in internal documents.

- Fixed percentage of the salary amount. It is more convenient for calculations, since it will be the same at constant wages. It is attractive for employees because they always know how much they can count on by a certain date. If the monthly payments are divided in half, it is convenient to pay half of the due remuneration. A level of 40% is also acceptable; a smaller share is not accepted.

- Fixed amount. An entrepreneur has the right to pay not a share of the salary, but a part of it in the form of the same amount, and recalculate the rest in accordance with the time worked. With this method, the advance payment will remain unchanged, and subsequent payments may differ under different remuneration systems (they will be the same for a fixed salary, but may change for hourly or piecework wages).

What is more profitable for the seller and the buyer?

Natalya Tikhonenko, executive director of financial service QOOD

If a participant in a transaction is not completely sure that he will be able to fulfill his obligations, it is not beneficial for him to use a deposit in the contract - he can say goodbye to this amount forever. If this participant is the seller, he risks being required to pay double the amount of the deposit. The advance payment form, the most common in civil transactions, is “softer” for both parties.

The requirement for a deposit when registering applications is common among organizers of public auctions, including when selling assets of a bankrupt enterprise. An advance will not work here. In the case of participation in public auctions, it is unlikely that it will be possible to avoid an agreement on a deposit, which, as a rule, is no more than 20% of the initial price of the lot.

There is such a thing as a “strong” and “weak” side in a transaction. A strong party is one that is willing and able to conclude an agreement only on its own terms. If the strong party has decided that it is ready to enter into an agreement only with the condition of a deposit, then the weak party can only agree to such a condition or refuse to enter into a transaction at all. The weaker party is unlikely to be able to “push through” its terms and must carefully weigh its options. If you fail to fulfill your obligations, you can lose money.

If neither party wants to set strict conditions, for example, counting on further cooperation, it is better to choose an advance form of payment - this will bring the parties to parity conditions.

Irina Pryadeina, lawyer at legal

In a purchase and sale agreement, a deposit agreement is more beneficial for the buyer. In this case, if the seller violates the obligation, the buyer will return his money, receive compensation and be able to recover losses.

For the seller, an advance payment is often more profitable, because if the transaction fails due to his fault, he must return to the buyer exclusively the amount paid as an advance payment, without incurring any penalties.

Ekaterina Smoleva, lawyer

A deposit is more profitable for the buyer, since it forces the seller to comply with the terms of the contract, otherwise he will have to pay double the amount of the deposit. An advance does not provide such security; it can simply be returned to the buyer if the terms of the contract are violated.

If the seller does not want to guarantee the fulfillment of the contract for a specific buyer (for example, there are many people willing to buy an apartment), then an advance can be used. In this case, the seller will not be obliged to fulfill the conditions, but may simply return the money to the buyer.

If the seller wishes to ensure the fulfillment of obligations under the contract by the buyer, then a deposit can be applied. If the buyer refuses to fulfill the contract, the deposit remains with the seller.

Alexey Kuznetsov, General Director

The main disadvantage of a deposit is that in any unclear situation it will be recognized in court as an advance. The downside of an advance is the lack of a security function, which leads to a lack of sanctions for the parties if the deal fails.

If obligations are not fulfilled, there are no adverse consequences for the guilty party. The advance is simply returned to the person who gave it in full, regardless of which party’s actions caused the deal to fail.

When concluding a purchase and sale transaction, it is better to resort to the help of a deposit. Existing penalties encourage both the seller and the buyer to act in good faith, because if the transaction fails, they will have to answer for their guilty actions. An advance payment as such does not provide any guarantees, does not give weight and significance to the transaction, since it makes it easy to refuse to complete it without adverse consequences.

In my opinion, talking about benefits in this case is only possible if one of the parties is dishonest. If the buyer and seller act in good faith, then no one will be left in the red either when using the deposit or when making an advance payment.

How to confirm an agreement on a deposit or advance payment?

Natalya Tikhonenko, executive director of financial service QOOD

It is enough to indicate in the contract that part of the amount is paid as an advance, and the rest - within a certain time after its execution. It is also possible that the entire transaction amount is transferred as an advance. The advance nature of the transferred funds is also indicated in the purpose of payment in the payment order. Even if the contract does not indicate that payment is an advance, the courts in most cases take this point of view.

The deposit agreement must be in writing. To avoid discrepancies, I recommend indicating in the payment order that it is the amount of the deposit under such and such an agreement that is being transferred, and not some other payment. Otherwise, there will be grounds for doubt on the part of both the parties to the transaction and the court.

Alexey Kuznetsov, General Director

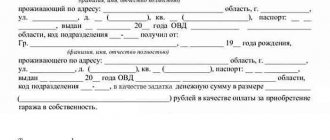

You can confirm the payment of an advance by a receipt given by the recipient, an advance agreement drawn up, or the inclusion of a corresponding clause in the preliminary purchase and sale agreement.

The deposit agreement should be approached with the utmost seriousness, since the law requires compliance with the simple written form of this agreement. Failure to comply will result in the recognition of the deposit as an advance payment, and in the event of a dispute being considered in court, you will not be able to refer to witness testimony to confirm the fact of the transfer of funds (Article 162 of the Civil Code of the Russian Federation).

In documents directly confirming the transfer of the deposit (receipts, payment documents), it should be explicitly stated that the transferred amount is a deposit.

The employer does not pay an advance

If an employer neglects his obligation to pay remuneration for work at least twice a month, this is a direct violation of the law. Such an administrative offense is subject to punishment, according to Article 5.27 of the Code of Administrative Offenses of the Russian Federation:

- officials who established an unlawful procedure for calculating salaries will have to pay a fine in the amount of 1-5 thousand rubles, and in the event of a relapse of such a violation - 10-20 thousand rubles, and possibly receive disqualification for 1-3 years;

- Individual entrepreneurs are required to provide at least two-time payments, otherwise they face a fine of 1-5 thousand or 10-20 thousand in case of repetition;

- a legal entity is liable to its employees for a fine of 30-50 thousand rubles, and repeated involvement is fraught with amounts of 50-70 thousand rubles.

IMPORTANT! The amount of fines is paid to the budget. Additionally, an employee who has suffered from late payment of salary has the right to demand compensation for its delay (Article 235 of the Labor Code of the Russian Federation).

Also read: where to go if you don’t get paid

How does a pledge differ from an advance and a deposit and how is it regulated by law?

Natalya Tikhonenko, executive director of financial service QOOD

The pledge itself does not confirm the reality of the transaction. The collateral can be used to secure obligations that will arise in the future. An example is the conclusion of a credit line agreement or an agreement to provide funds in an overdraft mode. In this case, at the time of concluding the collateral agreement, there is no actual execution of the transaction yet (consensual transaction), but the security already exists.

The law establishes completely different procedures for disputes in the case of the use of collateral and deposit if one of the parties to the transaction has not fulfilled its obligations. When using collateral, the injured party can receive payment or compensation for their costs through the sale of the collateral or keep it for themselves. These procedures are not required for the deposit.

The collateral is property or claims, but not money. Similar rules are only the provisions on the pledge of rights under a bank account agreement, established by Art. 358.9-358.14 Civil Code of the Russian Federation.

Pledge

This word needs to be removed from our list. Where did the previous paragraph begin? From the words “cash”. So they, these funds, cannot in any way be collateral. Collateral is a thing or other property, but never money as such. Remember, for example, what the bank takes as collateral when issuing a mortgage. That's right: the very apartment (thing, property) for the purchase of which he gives his money. Yes, in case of failure to fulfill obligations to repay the mortgage loan, the bank will then, of course, take the money for itself. But they will appear after the sale of the “thing” taken as collateral, that is, an apartment (or a property right to a future thing, if, say, a new building is purchased under the DDU). Is the deposit when buying an apartment from an individual not in the form of money? Well... such “exotic” is the topic of some other article. So we no longer use the word “pledge”, as well as the concept itself. And remember: if something goes wrong, the “cash collateral” agreement will be legally meaningless.