Advance is not equal to deposit

From the legal side, an advance is an advance payment under a purchase and sale agreement. Without a contract there is no advance payment. But realtors call an “advance” an unofficial cash advance payment. “Advance” in this case does not provide any guarantees to either the seller or the buyer. Therefore, you need to understand that the “advance” that realtors usually mean and the deposit are two different things. A symbolic “advance” can be discussed verbally and then you can easily refuse your words. And the deposit is drawn up in writing, and an agreement is concluded with it. The deposit must guarantee that the terms of the contract will be fulfilled. The Civil Code clearly states how the deposit can be returned, and what reasons may prevent this:

- If the apartment is not sold due to circumstances beyond our control, the deposit is returned to the buyer. The same applies if both the seller and the acquirer both refused the transaction;

- if the seller is at fault, then the buyer receives his amount multiplied by two;

- if the buyer is at fault, then he may not count on a refund of the deposit.

Another way to make an advance payment for an apartment is a security deposit. It was recently included in the civil code. It represents a prepayment. And when entering it, you can specify any conditions. How it will be returned or not returned at all - all these details will be at the discretion of the seller and buyer.

Let's move on to practice - how to properly carry out a deposit

Stage No. 1 – negotiations

In order to more productively discuss the deposit and the future transaction, all buyers and sellers, their realtors/lawyers, if any, should be present at the negotiations. Negotiations for minors are conducted by their parents (guardians/trustees).

If I make a deposit, I usually discuss the following points:

- Deposit size. As I wrote above, the buyers and sellers themselves must agree on the amount. Usually around 50 - 100 thousand rubles.

- In what form will the deposit be transferred - cash or non-cash?

- Responsibility of the parties after transfer of the deposit.

We usually agree this way: if the sellers refuse to sell the apartment, the deposit is returned to the buyers in double amount + the return period. If buyers, the deposit remains with the sellers.Very important: Discuss in advance the reasons and force majeure conditions for which liability occurs or does not occur. For example, if the seller is unable to complete the deal due to sudden illness, he can return the deposit amount, but not double the amount. Or when buyers have a mortgage - will they have liability if the bank refuses them a mortgage. Whether the deposit remains with the seller in this case or not.

- Additional points.

In addition to the deposit itself, various points can be discussed. For example, this could be a list of documents that sellers are required to provide to buyers. Or a condition that sellers must check out of the apartment before the purchase and sale transaction. And so on.

It is important to discuss everything in advance, because all points need to be listed in the documents below.

Stage No. 2 – after negotiations, we draw up and sign documents

In order for the money to be considered a deposit, be sure to sign 2 documents - a preliminary purchase and sale agreement and an agreement on the deposit. These two documents complement each other.

If you sign only one of these documents, in court, in most cases, the deposit may be recognized as an advance. Unless, of course, the parties go to court. The main difference between an advance and a deposit is that with an advance there is no liability. Even if one of the parties simply does not want to enter into a deal, the seller does not have the right to keep the advance for himself. He must return it to the buyer, and not in double amount.

To prove my words, I have listed below recent court decisions in disputes about deposits. Be sure to read them.

The court recognized the deposit as an advance ↓ Example No. 1. Recognized as an advance. There was only a preliminary agreement.

Situation: The buyer and the seller signed only a preliminary purchase and sale agreement, where they indicated the transfer of a deposit of 100 thousand rubles. They also indicated the period for concluding the purchase and sale agreement (main). Then this period was increased, i.e. additionally signed an extension agreement. But we still didn’t have time to reach a deal. The buyer believes that it was the seller’s fault - the seller avoided completing the transaction because he found another buyer at a higher price. And he demanded a double deposit - 200 thousand rubles. But the seller thinks differently - the buyer did not have the entire amount to purchase the apartment. As a result, the buyer sued to get back the double deposit.

District Court (decision No. 2-1400/2018) : From the preliminary agreement, an obligation arises only to conclude the main purchase and sale agreement - clause 1 of Art. 429 of the Civil Code of the Russian Federation. There is nothing in the law about collecting double deposits through a preliminary agreement. Therefore, an advance was transferred, not a deposit. The court doesn’t care whose fault the deal was not finalized. The advance payment is always returned to the buyer.

The court decided to recover only 100 thousand rubles from the seller, and not 200.

Example No. 2. This is an advance, even if you signed a deposit agreement.

Situation: The buyer gave the seller a deposit in the amount of 50 thousand rubles. To do this, they only signed a deposit agreement. It stated that they must sign the purchase and sale agreement by January 30th. But they never reached a deal. The buyer believes that it was the seller’s fault, so he demanded a double deposit from him - 100 thousand rubles. But the seller did not return anything to him. The buyer went to court to collect from him a double deposit, state duty and for legal services.

District Court (Decision No. 2-214/2018) : The fact that the parties signed an agreement on the deposit does not mean anything. This agreement must be concluded only together with the purchase and sale agreement (main) - clause 1 of Art. 380 Civil Code of the Russian Federation. Only in a purchase and sale agreement does the deposit perform a security function. Since there was no contract, it is an advance.

The court decided to collect from the seller only 50 thousand rubles, state duty and for legal services.

Example No. 3. An advance was transferred. Although the preliminary agreement indicated a deposit.

Situation: The buyer gave a deposit of 60 thousand rubles. The parties signed only a preliminary agreement, which indicated the deadline for signing the main purchase and sale agreement - until April 10. On March 30, the buyer came to the notary, but the seller offered to sign several purchase and sale agreements and an agreement of inseparable improvements. The seller wanted to avoid tax on the sale. The buyer refused to do this because such conditions had not been discussed before and they were not specified in the preliminary agreement. The deal fell through. The buyer believes that it is the seller’s fault, so he must return double the amount of the deposit - 120 thousand rubles. But he refused, and the buyer went to court.

District Court (Decision No. 2-62/18) : Within the meaning of paragraph 1 of Art. 380 of the Civil Code of the Russian Federation, the deposit agreement ensures an obligation that arises only under the concluded purchase and sale agreement (the main one). If the contract was not concluded, then there is no obligation. Since there is no obligation, then the money was transferred in advance. And it must be returned in any case. It doesn’t matter whose fault the deal was not finalized.

Only 60 thousand rubles were collected from the seller. Although they demanded 120.

The court recognized that there was a deposit ↓ Example No. 1. Here the case reached the Supreme Court - one of the highest courts in Russia. He admitted that it was the deposit that was being transferred. There was a preliminary contract and a deposit agreement.

Situation: The buyer gave the seller a deposit of 100 thousand rubles. Upon transfer, they signed a preliminary purchase and sale agreement and an earnest money agreement. The seller also wrote a receipt for receiving the money. The preliminary agreement indicated the deadline by which the purchase and sale agreement (main) must be signed. But the buyer was unable to find the money to buy the apartment on time. And he demanded the seller return these 100 thousand rubles. He believed that he was passing on an advance. The seller refused, so they sued him.

The buyer indicated in the claim that the deposit secures the obligation only under the purchase and sale agreement, but the parties did not sign such an agreement. So it was an advance.

District Court (decision No. 2-882/15) : The buyer does not have the right to demand money back. The parties signed a deposit agreement and specified the necessary requirements in it. In addition, we signed a preliminary purchase and sale agreement, in which we also indicated the amount as a deposit. The buyer's claim was denied and he filed an appeal.

Regional Court (Determination No. 4G-10267/2015) : The deposit is considered as such only when the purchase and sale agreement (main) is signed - Art. 380 and 429 of the Civil Code of the Russian Federation. And since it was not signed, the deposit is considered an advance. As a result, the decision of the district court was overturned and a ruling was made: The seller must return 100 thousand rubles to the buyer. The seller did not agree with this and filed a cassation with the Supreme Court.

Supreme Court (Determination No. 18-КГ16-29) : The regional court is wrong. In paragraph 4 of Art. 380 of the Civil Code of the Russian Federation states that the deposit can be transferred upon the conclusion of a purchase and sale agreement, which is provided for in the preliminary agreement. The parties signed both a preliminary contract and a deposit agreement. The buyer himself is to blame for not finding the money to buy the apartment. He did not fulfill his obligations, which were specified in the preliminary agreement. The regional court's ruling was canceled and the case was sent there for a new trial.

Again the regional court (Determination No. 33-15858/2016) : Now the judicial panel agreed with the Supreme Court. It was determined that a deposit had been transferred. And since the buyer himself is to blame for not reaching a deal, the money remains with the seller.

Example No. 2. This is a deposit. There was an agreement on a deposit and a preliminary contract.

The buyer gave the seller a deposit of 100 thousand rubles. To do this, they signed a deposit agreement and a preliminary contract. In both documents the deposit was indicated. But in the end, the seller refused to sell the apartment because she found another buyer for a higher price. The seller did not return anything to the buyer, so he had to go to court. At the trial, the buyer demanded from the seller a double deposit of 200 thousand rubles, a percentage for the use of other people's money of 15 thousand and a state duty of 5.6 thousand.

District Court (Decision No. 2-3130/2017) : In paragraph 4 of Art. 380 of the Civil Code of the Russian Federation is written - by agreement of the parties, the deposit secures the obligation to conclude the main agreement on the conditions stipulated by the preliminary agreement. There was a preliminary agreement. It was the seller who refused the deal because he found another buyer.

The court collected from the seller a double deposit of 200 thousand rubles, interest for the use of other people's money of 15 thousand and a state duty of 5.6 thousand.

The agreement and preliminary contract can be drawn up in simple written form. There is no need to contact a notary about this; he does not deal with such documents. If you have no experience, it is better to contact a lawyer or realtor.

Other articles

If, after the purchase, the former owner files for bankruptcy, interested parties may challenge the transaction. Here we explained how buyers can protect themselves from this Documents for purchasing a secondary apartment - a complete and current list

Preliminary purchase and sale agreement

Just on the basis of the preliminary agreement, buyers and sellers undertake to enter into a purchase and sale agreement (main) in the future - clause 1 of Art. 429 of the Civil Code of the Russian Federation. The preliminary one is very similar to the main one.

What to include in it:

- Full name and passport details of sellers and buyers. If there are minors under 14 years of age, then data from the birth certificate and passport data of one of the parents. If from 14 to 18 years old, then his passport details and one of his parents. If there is a proxy, his full name, passport details, number and date of execution of the power of attorney.

- Duration of concluding the purchase and sale agreement. For example, before or no later than December 25, 2021. The parties can then increase the term. To do this, you need to sign a written agreement to the preliminary contract.

- The price of the purchased apartment.

- Characteristics of the apartment - exact address, area, etc.

- Based on what document does the seller own the apartment? For example, they bought it, then the details of the purchase and sale agreement are the date of conclusion and state registration number.

- The fact that it is the deposit and its amount that is transferred – in numbers and in words.

- The responsibility of each party for the deposit - if the seller refuses to sell the apartment, then he returns the deposit in double amount + the return period (for example, within three days). If the buyer, then the seller leaves the deposit for himself - Art. 380 and 381 of the Civil Code of the Russian Federation.

- It is even better to indicate for what reasons the deposit is returned to the buyer and does not remain with the seller. For example, if the buyer is not approved for a mortgage. Or due to a sudden illness of one of the parties.

- Payment procedure. For example, the buyer transfers such and such part of the amount as a deposit. The second part is placed in a safe deposit box, which sellers will receive after registering the agreement. The third part will be transferred by the bank to such and such an account of the seller - this is if the buyers have a mortgage.

- Additional points. For example, a list of documents that the seller must provide to buyers. Or who will pay the costs of processing documents and which ones.

The preliminary agreement is signed only by sellers and buyers. Or a confidant. If one of the parties is under 14 years of age, then one of the parents (guardian, trustee) will sign the preliminary agreement for him. If from 14 to 18 years old, then he and one of the parents (guardian, trustee).

How many copies of the preliminary agreement should there be ? Typically the number of copies is equal to the number of sellers and buyers, plus several copies may be needed by different organizations. For example, 2 buyers, 3 sellers - 5 copies. If buyers have a mortgage, the bank needs one more copy - already 6. If there are minors among the buyers or sellers, the guardianship and trusteeship authorities will need a copy - already 7. And so on.

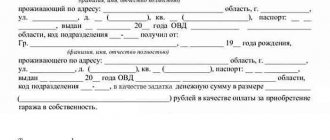

Agreement on deposit

The agreement comes as an annex to the preliminary contract. It must indicate:

- That the agreement is drawn up for the proper execution of the preliminary agreement + the date of its signing.

- Full name and passport details of sellers and buyers. If there are minors under 14 years of age, then data from the birth certificate and passport data of one of the parents. If from 14 to 18 years old, then his passport details and one of his parents. If there is a proxy, his full name, passport details, number and date of execution of the power of attorney.

- The amount of the deposit and that it goes towards the cost of the apartment.

- The responsibility of each party for the deposit - if the seller refuses to sell the apartment, then he returns the deposit in double amount + the return period (for example, within three days). If the buyer, the seller keeps the deposit for himself.

The agreement is signed only by sellers and buyers. Or a confidant. If one of the parties is under 14 years old, one of the parents (guardian, trustee) signs the agreement for him. If from 14 to 18 years old, then he and one of the parents (guardian, trustee).

How many copies of the agreement should there be ? The number of copies is equal to the number of parties to the transaction + additional ones. For example, if there are two buyers and two sellers, then 4. Another one may be required by the buyers’ bank if they have a mortgage. Or guardianship authorities.

Other articles

This article describes in what cases when purchasing you need/don’t need your spouse’s consent. How to sell a mortgaged apartment - a legal scheme

Stage No. 3 - transfer the money and receive a receipt from the seller

When I make deposits, I advise buyers to hand over the money only after receiving a receipt from the sellers.

Money can be transferred in cash or non-cash. If in cash, you need to wait until the seller counts the bills and confirms that the money has been received and has no complaints. If non-cash, it is better to indicate the purpose of the transfer in the payment purpose. For example, “Transfer of deposit and date.” And you still need to additionally take a receipt from the seller for receipt.

Why is it important for the buyer and seller to pay a deposit?

First of all, the deposit is a guarantee that the transaction will take place. For both the seller and the buyer. The latter can be sure that he has already definitely booked this apartment and no one else will buy it. And the owner, who, for example, spent money on completing the transaction, will not be left at a loss if the buyer suddenly refuses to purchase the property. But to ensure there are definitely guarantees, a symbolic “advance” will not do. Here you need to conclude a deposit agreement for an apartment or a purchase and sale agreement. You can also make a security deposit.

Approximate deposit amount

The size of the deposit when purchasing an apartment is not fixed by law, but the generally accepted standards for an advance payment are 5% - 10% of the cost of the apartment. The more precise amount of the deposit when buying an apartment is determined by the specific benefit, for example, the buyer really wants to keep this particular option. The seller insists on increasing the amount of the deposit in cases where the price was inflated. In both situations, the parties are persons interested in the mandatory conclusion of a transaction.

If the client has not fully decided on his choice, he will insist on a minimum deposit, while at the same time looking for more successful options, even if he would not like to lose money.

Sometimes the seller insists on a minimum deposit amount when purchasing an apartment. This is possible if the price was initially lowered to attract buyers, but now the seller has the opportunity to sell the apartment to a buyer who has offered more favorable conditions.

Prepayment amount

As a rule, the average prepayment amount is no more than 100 thousand rubles, and the minimum amount starts from 20 thousand. But it all depends on the region. According to experts, the less you contribute, the better. If the owner of the apartment asks for more, then you should first find out the reason. If it is really compelling, then it is worth fulfilling the request. But at the same time, be sure to draw up a deposit or purchase and sale agreement with a security deposit. So that in case of termination of the transaction, the prepayment will be returned to you.

But if the reason seems suspicious to you, then most likely it is better to refuse the purchase. You will protect yourself from scammers who live off such prepayments. And to be completely sure that this is the real owner of the apartment, check him on all fronts. First, for example, make sure that he is not under investigation and is not a frequent visitor to the bailiffs. Then you must definitely find out who the owner of the property is based on documents, and not according to the seller. to order a USRN extract before making an advance payment . She will tell you who previously owned the apartment, how many owners there are, and whether there are any encumbrances on the property. It will be easier and faster to use the EGRN.Register service. Indicate the property address or cadastral number. And in half an hour the electronic version of the document will be in your hands.

Advantages

When providing a mortgage loan in the traditional way, the real estate for the purchase of which borrowed funds are provided acts as collateral and secures the transaction, insuring the bank’s risks. At the same time, the funds received are used exclusively for the intended purpose - for the purchase or construction of housing. In turn, a mortgage secured by real estate provides much more freedom of choice.

Preferential mortgage Gazprombank, Persons. No. 354

from 5.99%

per annum

up to 3 million

up to 30 years old

Get a loan

Funds received through a loan can be used for specific purposes. Firstly, it can be used as a down payment or as full payment for a new home. In this case, supporting documents must be submitted. Secondly, act as payment for any needs (this includes treatment, business development, repairs, training, etc.). This type of loan is not targeted, so the rates on it are higher, and the period for which it is issued is shorter.

In the second case, the loan provided is still called a mortgage loan due to the fact that it is secured by existing real estate.

What should be in the deposit agreement?

The more specific conditions you write down, the better. First of all, the document must contain personal information: yours and the owner’s. If there are multiple owners, mention them all. In addition, write down detailed information about the apartment, as well as a list of documents that will be needed for the transaction. The contract must include the amount of the advance payment and for how long you are paying it. And also how the deposit can be returned. Be sure to specify the rights and obligations of the parties, as well as their actions at the time of making the prepayment. For example, the buyer may be selling his property, and the seller will complete the paperwork. In addition, indicate in the contract at what time the old owners must move out and check out. And also, if there are any reasons that may interfere with the transaction, they should also be mentioned. The same applies if the property is under mortgage. And the last thing is the place, time of the transaction and who will bear the costs of its execution.

Interest on debt

Most often, borrowing money between friends or close relatives does not include interest payments. But this loan option is also possible and this issue is regulated by the norms of the Civil Code of the Russian Federation. The interest rate, according to the law, is established by decision of the parties and is specified in the security document.

If the amount of interest is not specified, then the creditor has the right to receive an amount that is calculated at the refinancing rate at the time of full repayment of the debt or part of it. The calculation is carried out taking into account the lender’s place of residence or address if the lender is a legal entity.

It is also recommended at the time of registration of documents to discuss the issue of reducing interest in case of early repayment of money.

It’s also not worth setting an unreasonably high interest rate, because in this case the contract can easily be declared invalid due to onerous conditions.

We issue a receipt for receipt of the deposit

This document is needed to confirm the transfer of money. The seller must put it in writing in your presence. Make sure that the seller’s signature is the same as on the passport. In addition, the document must contain the passport details of the owner and buyer. Deposit size. Time and date of compilation. You also need to indicate that the funds are transferred under an agreement. Sometimes a separate receipt is not issued, but information about the receipt of money is included immediately in the contract.

If all the documents are completed correctly, then you should not be afraid that the seller will turn out to be a fraudster. Even if he refuses to return the prepaid money, he can be sued. But before that, notify the owner in writing that you want to return the payment and indicate the reason. As a rule, in almost all cases, if the buyer is truly not to blame for breaking the deal, such courts are successful.

Text: Ksenia Antonova

Be careful when signing documents on transfer of advance payment!

When signing the agreement to transfer the advance to the seller, make sure that this document contains the following information:

- the value of the property you intend to buy. This clause will not have any effect on the return of the advance payment, but will insure you against a sudden price increase at the initiative of the seller;

- the amount you transfer as an advance;

- detailed description of the property;

- the time frame within which the transaction must be completed.

In order to minimize all possible risks associated with the preliminary agreement, it must be signed by both parties.

In addition, it is better to entrust the drafting of the document to an experienced lawyer, who must be present at the procedure for signing the agreement. This is the only way you can count on the case for the return of the advance payment being considered in court, as well as on its successful outcome for you. Share Share Tweet Class

What to do if the debt is not repaid?

If the term of the receipt or loan agreement has expired and the creditor has not received the funds back in full, he has the right to go to court. This can be done the next day after the expiration date. In this case, there is no need to notify the borrower of your actions.

According to the Civil Code of the Russian Federation, funds received on demand (without specifying the repayment period in the agreement) must be transferred to the lender within thirty days from the date of the first demand. Such a requirement is issued in the form of a registered letter and will serve as evidence in future legal proceedings.

If the borrower fails to meet payment deadlines, the lender may also file a lawsuit. Before applying, it is possible to file a claim with the debtor, but this point is not mandatory from the point of view of law.

In a situation where a collateral agreement has been signed, and the borrower is in default more than three times a year, the lender can also file a claim in court to collect the debt at the expense of the collateral.

If the estimated value of the collateral exceeds the amount of the debt, the lender is obliged to return the remaining amount to the borrower. If the collateral is not sold, the lender can keep it and return 25% of the cost to the other party.

Before applying to a notary for a writ of execution, the lender must notify the borrower of its intention. This is done by sending a registered letter. Next, you should wait fourteen days and, if during this period the lender has not received his money, he has the right to contact any notary.

When applying, the notary will not only carry out the writ of execution, but will also check the documents, confirming their legality. This notary service is paid. The fee is 1⁄2 percent of the amount owed.

Attention! The presence of a writ of execution exempts the debtor from paying fines for violating the deadlines under the contract.

Is the deposit returned if you refuse to purchase an apartment?

As mentioned above, the deposit is not returned in case of refusal (or is returned in double amount, if we speak from the seller’s point of view). This is precisely the main difference between this type of arrangement and other options (advance). But the amount of the fine/refund can be any. The parties have the right to agree on conditions that suit everyone.

As a result, the fine may be reduced or increased. Additional conditions or restrictions, time frames, etc. may apply.

Example: The deposit agreement may contain a condition that in case of refusal to sell, the seller must return the deposit in double amount, but this is relevant only 1 month after the conclusion of the agreement. As a result, the seller, during the first month of negotiations, can calmly terminate the transaction and return the deposit amount without penalty. In practice, most often the conditions are still more stringent.