The sale of debtors' property is one of the main tasks of a bailiff. He must sell the property in question to satisfy the needs of the claimant. But before selling the property in question, it must be confiscated, properly registered and auctioned. Without this, it will be impossible to satisfy the interests of the claimant. Violation of the procedure is a valid reason to challenge it. Therefore, it will be useful to familiarize yourself with the legislative norms, enforcement proceedings and how representatives of the FSSP work with property that has been seized.

Bank confiscated cars

Car confiscation is not a rarity at all, but a fairly stable phenomenon. Everyone dreams of buying a repossessed car, because it is a great way to save a significant amount of money. Repossessed cars can be purchased in two ways:

- Buy directly from the debtor.

- Take part in bidding at the auction.

There is a certain percentage of people who believe that the purchase of a confiscated car can be challenged in court. But lawyers unequivocally assure that these risks are reduced to zero. Before registration, the vehicle undergoes all necessary checks, and the buyer can be calm. It is more profitable to buy a confiscated car than to purchase a car from the owner.

Seizure of property: what is it?

Seizure of property is a method used by bailiffs to fulfill the requirements contained in the executive document.

Important!

An arrest can be made even during the time allotted for voluntary execution.

Everything related to the seizure of property is regulated by Federal Law FZ-229 “On Enforcement Proceedings”. In this case, special attention should be paid to Art. 80, since it specifies cases in which property belonging to the debtor may be seized by bailiffs.

Such cases include:

- the need to ensure the safety of items (for example, if the bailiff has reason to believe that some items may be hidden)

- execution of a judicial act containing demands for full or partial confiscation of property

- execution of a court order, which directly states the need to seize the property of an individual

The main condition without which an arrest is impossible is the presence of open enforcement proceedings.

Bank repossessions of real estate

Such objects are 25% cheaper than similar ones on the regular market, and therefore enjoy considerable popularity. Such a difference in price may be a completely reasonable question. The answer is quite simple: in recent years, the cost of housing has been rising, and affording it with one’s own funds has become problematic. Accordingly, people began to take out loans secured by the purchased real estate. It happens that the borrower cannot repay the loan amount, and the property is seized through legal proceedings. There are also cases when property is left on the security of a certain large sum of money.

Bidding for bank confiscation

Anyone can take part in the open auction. The property put up for auction is confiscated, so its price may be 30–50% lower than the market price. To participate you need:

- Select a product, find out the day of the auction, and read the terms of purchase.

- Visually inspect the goods, since the purpose of the auction is to increase the value. The legislation provides for the display of goods before registration for auction. Organizers must show documents for the goods. The buyer himself, when it comes to real estate, should find out as much as possible about the selected lot in order to avoid misunderstandings.

- Register for the auction, pay a fee, it is equal to 5% of the purchase price.

- Take part in the auction. There must be at least two applicants for the lot. The goods are received by whoever named the highest amount, a protocol is drawn up, signed by the presenter and the buyer, and then sent to the organizer.

- After this, you should pay for the purchase and complete the documents.

- If the buyer does not pay on time, the lot will be taken by the participant who offered the lower amount.

If you decide to purchase real estate or a car, you should carefully consider the market for confiscated goods. The cost of the property is much lower, but this does not affect the quality.

Advantages of purchasing at auctions and auctions

Although an auction involves identifying a buyer through competitive bidding methods, this option for acquiring property can significantly save money.

If the cost is less than 500,000 rubles, an auction is not necessary, and the market value is assessed taking into account the standard and physical wear and tear of the objects. Such a purchase will cost significantly less than similar offers on the open market.

It is necessary to take into account the specific timing of implementation. The law establishes a two-month procedural period during which FSSP employees must complete the entire procedure. If no buyer is found within the specified period of time, the price of the property is reduced by 15%. This reduction will continue every two months until a buyer appears.

Is it profitable or unprofitable to buy the seized property of bankrupts? As a rule, the task of the bankruptcy manager is to complete the bankruptcy procedure as quickly as possible, which can lead to a significant reduction in the initial cost of the objects. In addition, not every potential buyer has the opportunity to constantly monitor notices of upcoming auctions, as a result of which a minimum number of participants may apply for the auction.

Confiscation of bailiffs

Since bailiffs are vested with executive power and represent a full-fledged FS, they have the right to seize property for debts, as well as sell seized property. Confiscation by bailiffs is valuable for the consumer due to the fact that only intact property in good condition or expensive property, the market price of which at auction is significantly underestimated, is subject to confiscation.

The sale of seized real estate and inventory is carried out at special auctions, official websites, and consignment stores. Confiscated property includes real estate, furniture, appliances, dishes, art, including antiques. Sales are carried out so that the received goods do not linger. Designed to generate revenue equal to the amount of debt and interest charges on the loan. Often a fixed price is offered for confiscated goods, but if there is demand for the exhibited item, the price can be floating – auction price.

Customs and bank confiscation

Customs and bank confiscation is of wide interest to the masses due to the prevailing opinion about the possible cheapness of purchasing a wide variety of goods. Based on the type of receipt, it can be determined that the consignments of goods seized during the investigation at the border and the identification of inconsistencies in documents are sold as customs confiscated goods. In the vast majority of cases, these are new things, equipment, tools, cosmetics, food. In the latter case, due to the impossibility of proper storage, the batches are sold for pennies in order to prevent staleness and avoid spoilage. The sale of the confiscated lot must cover the fines, which is carried out by court decision.

Real estate or cars selected due to a violation of a bank lending agreement represent 90% of the bank confiscation, being collateral. The remaining 10% are valuables, equipment, and other property purchased with credit funds. Proceeds from the sale of confiscated goods go to pay off the debt or to the state treasury. You can buy not only small things under the hammer, but also recreation centers and factories.

Stages of property sales

This process is carried out in several stages:

- Drawing up a register of creditors.

Typically, claimants are given 2 months during which they must state their claims. Creditors can find out about the bankruptcy of a particular citizen in the EFRSB (publications are made by a financial manager appointed by the court).Interesting incidents arise when selling collateral. If the deadline is missed, the creditor is not included in the register. This happened in case No. A05-3506/2016, where the secured creditor was not included in the register in a timely manner. In this regard, the bankrupt demanded to exclude the mortgaged housing from the bankruptcy estate on the basis that it is his only one.

The lower courts considered that the absence of a secured creditor does not provide such an opportunity, and the apartment should be sold in favor of the remaining claimants. However, the Supreme Court of the Russian Federation, in its ruling dated June 13, 2019 No. 307-ES19-358, did not agree with them and returned the case for a new review.

- Formation of the bankruptcy estate.

This includes the following processes:- inventory;

seizure;

- property valuation.

- protected by legislative immunity;

- costs no more than 10,000 rubles.

- Checking for signs of fictitiousness or premeditation of bankruptcy.

The financial manager is obliged to check whether the debtor has tried to hide any property, and whether he really found himself in difficult circumstances. If, however, signs of premeditation and fictitiousness are present, then the debts will not be written off, and the debtor himself will fall under liability under Art. 196 - 197 of the Criminal Code of the Russian Federation. - Organization of bankruptcy auctions.

This process can be divided into 2 stages:- sale of movable property worth up to 100,000 rubles;

It can be sold through advertisements on thematic platforms. - sale of expensive real estate and other property.

This is carried out through the involvement of an organizer for conducting electronic trading at auctions. It can be carried out in several stages, after which the remaining property:will be offered to creditors as payment of debt;

or will be transferred to the bankrupt back into ownership.

- sale of movable property worth up to 100,000 rubles;

- Termination of the implementation procedure.

At this stage, the financial manager must:- carry out settlements with creditors;

- pay legal costs against the proceeds, including 7% remuneration for himself (the right to 7% of the amount of property sold is guaranteed to him by law - this is one of the features of the sale);

- make settlements with the bankrupt’s spouse if joint property was sold;

- make a report for the court.

In most cases, the assessment is carried out by the financial manager himself, but in controversial situations, professional experts are involved. Their work is paid for by the party that invited the appraisers to participate.

At the same stage, the debtor may apply for exclusion from the bankruptcy estate of property that:

Source

Article 20.6. Remuneration of an arbitration manager in a bankruptcy case

- The arbitration manager has the right to remuneration in a bankruptcy case, as well as to full compensation for expenses actually incurred by him in the performance of his duties in a bankruptcy case.

- Remuneration in a bankruptcy case is paid to the arbitration manager at the expense of the debtor, unless otherwise provided by this Federal Law.

- The remuneration paid to the arbitration manager in a bankruptcy case consists of a fixed amount and an amount of interest. The fixed amount of such remuneration is for: financial manager - twenty-five thousand rubles at a time for carrying out the procedure used in a bankruptcy case.

- The amount of interest on the remuneration of the financial manager in the event of introducing a procedure for the sale of a citizen’s property is seven percent of the amount of proceeds from the sale of the citizen’s property and funds received as a result of the collection of receivables, as well as as a result of the application of the consequences of invalid transactions. This interest is paid to the financial manager upon completion of settlements with creditors.

Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”

Read completely

At the final hearing, the court reviews the report and closes the case, writing off the remaining debts and releasing the citizen from obligations to creditors.

Confiscated stores

Popular confiscated goods stores have moved from offline real trade on store shelves to the network, offering a large variety of items and lots. Most often, sellers are interested in wholesale purchases of consignments of goods, but they often sell the received goods at retail at a slightly inflated cost.

Online shopping in confiscated online stores is convenient due to the simple search for product categories, the ability to compare prices, analyze the quality and type of products offered and items based on photos. The huge assortment most often includes clothes and shoes, as well as branded cosmetics, detained at customs due to incorrect filling out of the declaration and non-payment of duties. The cost of confiscated goods is at least 30% lower than that offered by the manufacturer for a similar product.

How to make money on confiscated property

To understand how to make money from confiscated property, you need to assess your capabilities and financial situation. There are several options, but each of them includes mandatory monitoring of offers from confiscated goods suppliers on popular platforms, where, by definition, the lowest prices are offered. It is best to sell confiscated goods at retail online on your own resource or on social media. networks is a great idea if you have a well-promoted project, group, or by creating a landing page and high-quality advertising. Having your own resource, you can also act as a wholesale distributor, becoming a reseller and making a profit while minimizing losses. The second option is the presence of retail outlets in cities or space for a wholesale warehouse.

In any chosen case, do not forget that the risks are already minimized due to the reduced price and when purchasing a non-perishable product, the price drop is reduced to almost zero.

What is bankruptcy bidding?

Bidding is an auction for the sale of the debtor's property. The sale of the debtor's assets is the final stage of recognizing his insolvency, aimed at satisfying the claims of creditors.

The sale of things during bankruptcy is carried out through electronic auctions. The financial manager himself or hires an appraiser evaluates the property before sale. The manager also organizes the entire bidding process, and then enters into an agreement with the buyer, registering it, if necessary, in Rosreestr. The financial manager has the right to sell movable property less than 100 thousand rubles through direct sales - he publishes advertisements on Avito and other websites or in newspapers.

Types of confiscated goods

There are main types of confiscation:

- customs: seizure of goods at the border and sale by court decision on trading platforms and auctions - new branded clothing/footwear/cosmetics, as well as equipment;

- banking: confiscation of used cars, equipment, real estate in payment of debt on a loan sold through auctions, consignment stores;

- leasing: seized for failure to comply with the terms of the leasing agreement; sold by the companies themselves or specialized organizations for the amount necessary to cancel the debt.

In terms of seizure volumes, the largest share is occupied by medium-sized bank and leasing confiscations (about 90%), seized during legal proceedings. The most valuable, however, is customs confiscation, which gives a chance to purchase expensive branded products for less than their cost from the manufacturer.

How long does it take to sell a property?

According to legal standards, the implementation period is on average 4-6 months. It is possible to extend the period for the sale of property if:

- disputes have arisen between the participants in the process requiring litigation;

- it is impossible to sell the property the first time, and a second and third stage of bidding is necessary;

- Additional time is needed for revaluation or examination of the property put up for sale and other circumstances.

Judicial practice: controversial car for a disabled person

In case No. A41-14878/16, disputes between the debtor and the creditor over property delayed the legal process. The first petitioned to exclude from the bankruptcy estate the car and income to support himself and his disabled wife. He needed a car to take his wife to the hospital and to get to work himself. The Constitutional Court and the Appeal agreed with the arguments and excluded what was required, but the Constitutional Court sided with the bank. The judge ruled that the law provides for the exclusion from the bankruptcy estate only of property or funds in the amount of up to 10 thousand rubles. The case was sent for a new review, and implementation was delayed indefinitely.

How to purchase confiscated property for sale

The entire confiscation can be realized only after a court decision is made. How to purchase confiscated property for sale that has already received confiscated status? It is being put up for auction, information about which is largely provided on the website of the Rosimushchestvo company. Sales take place through specialized retail outlets, public auctions, auctions, consignment shops in real locations and online. In auctions organized by banks, movable and immovable property from cars and dachas to cottages, recreation centers and factories are sold under the hammer every month for next to nothing. At the same time, the purity of the transaction and the availability of a complete package of documents are guaranteed.

Open auctions are carried out by court decision before the confiscation is transferred to the bank - this is another way to purchase valuables at a discount. The bailiff requests only the funds due to the bank, so the price in this case is reduced by a good 10%. By visiting the website of the bailiff service, you can find out about the dates of upcoming events.

Participation in auctions of seized property

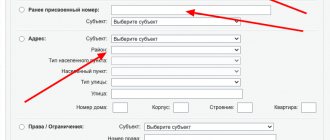

The sale of debtors' property must be carried out by bailiffs. In order to implement it, auctions are used. Anyone can take part in these events. For everything to go legally, you need to follow the correct procedure. To begin with, representatives of the FSSP issue a decision on the valuation of the property. After the examination is completed, a report is drawn up. It is on the basis of the document in question that the value of the property for sale is determined.

After issuing the decree, the bailiff has 20 days to prepare a document transferring the defendant’s property for sale. After drawing up the resolution, the document must be submitted to a specialized organization. The FSSP bailiff has 10 days to do this. When the transfer is completed, you need to draw up a transfer and acceptance certificate. It must be remembered that bailiffs must sell the debtors' property at a price that is higher than that indicated in the valuation act or identical to it.

What could be the benefit?

The value of confiscated items and real estate is established and justified by a court decision based on expert data and reports provided by the banking structure. If the judicial sale is unsuccessful, the price is reduced by 15%. The bank’s desire to return the funds spent plays a role in lowering the price to the lowest possible, and the consumer has a chance to buy value inexpensively.

The main benefit is savings relative to the market price of a similar product. From the legal side, all documents are clean, quickly drawn up, in perfect order, the risk of transaction cancellation or fraud is eliminated. The seized property meets the requirements of quality and visual appeal (almost new). What else could be the benefit? Confiscated cars are checked for cleanliness by the Ministry of Internal Affairs. If they are not implemented in a short time, then, while on the sites, they will rust and the electronics will fail. Be careful when purchasing confiscated items. Official stores must have permission from the Federal Property Fund, while the rest simply sell consumer goods of inadequate quality at a bargain price under the guise of confiscated goods.

Our services and prices

Turnkey bankruptcy of an individual

from RUB 8,460/month.

- Filing a bankruptcy petition

- Collection of necessary documents

- State duty and remuneration of the arbitration manager

- Representation of interests by a lawyer at a court hearing on the introduction of bankruptcy proceedings

- Full support of bankruptcy proceedings by financial managers

Read more

Preparing for bankruptcy proceedings

20 580 ₽

- Drawing up detailed instructions for bankruptcy, based on an analysis of the debtor’s situation

- Preparation of necessary requests to banks and other organizations

- Control of document collection

- Filing a bankruptcy petition

- Representation of interests by a lawyer at a court hearing on the introduction of bankruptcy proceedings

Read more

Analysis of transactions before bankruptcy

10 340 ₽

- Consultation on transactions that may be contested

- Analysis of documents and assessment of risks of invalidation of transactions

- Written instructions - what documents to prepare to secure the transaction

More details

Leasing confiscation

The objects under a leasing agreement are most often special-purpose vehicles, construction and repair equipment. technique. A small crisis can affect the solvency of a small company, causing the business to collapse. In this case, debts can be repaid using confiscated leased property. The leasing cash deposit is seized by bank employees or representatives of a special organization.

In the list of confiscated goods on creditor websites, leased property is shown as a separate category with mandatory mention of the terms of purchase and price. The equipment goes on sale at a low price, the quality of the vehicles is excellent, especially for unstagnant confiscated goods. The purchase allows you to effectively start a business by investing excess funds in the development of the company's activities.