Many married couples do not divide property after a divorce, so a natural question arises: what is the time frame for dividing the property of spouses after a divorce? This is especially important if the couple, while married or before marriage, has not determined who will receive what property in the event of a divorce. Therefore, we have to look for alternative options on how to achieve division of property with maximum benefit for each party.

In order for the procedure to be successful, you can use the norms that are prescribed in the Family Code, as well as in the Civil Code of the Russian Federation, the Civil Procedure Code of the Russian Federation and some federal laws. The division of property after divorce and during divorce is quite similar, although it has distinctive features. But there are nuances that you should definitely pay attention to, and they relate to the statute of limitations. If this period has passed, it may be virtually impossible to divide the property.

Is it possible to divide property after a divorce?

Russian legislation allows for the division of property of spouses after a divorce. More information about this can be found in Article 38 of the Family Code. According to the prescription specified there, the property of the spouses can be divided at various stages of their relationship.

For example, a couple may agree on how to divide property in preparation for the wedding. It is also possible to divide property during marriage, when the relationship has already been officially registered. Naturally, things can be divided at a time when the family relationship has come to an end and the couple is divorcing. In addition, property can be divided even after the former spouses are no longer officially bound by the ties of Hymen.

But when property is divided between spouses after they have divorced, only two procedures provided by law can be used. If both spouses are willing to cooperate, they can enter into a settlement agreement, which will help differentiate property rights. A settlement agreement can help establish almost any share for each of the former couple.

If the former spouses cannot divide the property themselves, and the deadline is running out, it makes sense to send a lawsuit to court. But keep in mind that the court works based on Article 34 of the Criminal Code, so there is a chance that it will provide the spouses with equal shares. In addition, there is a deadline that must be observed if you want the claim to be accepted in court at all.

What property cannot be divided?

It is necessary to clarify that not all property will be considered common upon divorce. Thus, the property that each spouse owned before the marriage was registered, as well as that which he received as a gift or by inheritance, will be considered personal and not joint. Other obvious exceptions include those personal items that only one spouse used, such as clothing, jewelry, or a telephone, which are also personal property.

At the same time, the courts resolve this issue somewhat in two ways, based on the ratio of the value of this property and the standard of living and income of the spouses. For example, if during the marriage the husband bought an expensive iPhone on credit, which the spouses subsequently paid for many months from common funds, the court may return half of the payments to the spouse. This also includes luxury goods (you must admit, the term is also quite vague: what is a luxury for one person is an ordinary household item for another) and exclusive rights to the results of intellectual activity: they belong only to the author.

As for children, their personal belongings (including books, clothes, items necessary for various clubs) do not participate in the division of the property of their parents, but are transferred to the one with whom the children will live in the future. The same applies to bank deposits made by parents in the names of their children: this money belongs to the children.

Legal advice: It is very important to understand that in the division of the common property of spouses, not everything is so simple:

- on the one hand, the personal property of a husband or wife can be recognized as the common property of this couple if there is a fact that one of them invested their own or common funds in this property during the marriage, which in turn increased its price (for example, major repairs of real estate );

- on the other hand, property purchased by a husband or wife after the actual termination of the family relationship during their separation can be considered the personal property of that spouse.

It must be borne in mind that this state of affairs can be achieved both by contract and in court.

Law on division of property after divorce

The division of jointly owned property between spouses is an important component of the lives of ordinary citizens, since a break in relationships in the current rhythm of life is not uncommon, and few people decide to give property that was bought as a couple to their ex-spouse. Even if the divorce has already taken place, the couple can continue to share the property. The protracted duration of the procedure under consideration does not surprise anyone.

The joint capital can be divided after a fairly significant period of time. The law states that the severance of marital relations is not grounds for termination of rights to property. Therefore, if the former spouses decide to divide the common property after a long time has passed after the divorce, they will succeed. Before this, the former spouses can draw up an agreement within the framework of which they determine how the common property will be disposed of. It is not necessary to change the title documents.

But it should be taken into account that after some time, you will still want to divide the joint house. Although there are exceptions. But if you apply to the court with a request for division of property, difficulties may arise. In particular, the judicial authority will refuse to accept the claim and consider the case. Or the applicants will have to provide explanations as to why they waited so long before dividing the property.

The Family Code, which governs such cases, states that to prevent a legal conflict, a former couple can use an agreement on the division of marital property. This allows the situation to be resolved peacefully without a lengthy trial procedure. You can also peacefully resolve the brewing conflict by first drawing up a marriage contract. Then the situation will be controlled by the terms of this agreement.

While the terms of the settlement agreement and prenuptial agreement can be supervised by the Family Code, when it comes to legal proceedings, the Civil Code comes into force. This means that the statute of limitations applies and other nuances are taken into account. For example, when filing a claim you will have to pay a state fee.

Sometimes the division of property of former spouses affects certain issues that are dealt with by federal laws. The law on valuation activities (No. 135) is most often used. For example, if a car or something similar is being shared, an assessment needs to be made of how much that item is currently worth.

If an apartment or a joint house that was purchased with a military mortgage (Federal Law No. 117) or for maternity capital (Federal Law No. 256) is divided, it is imperative to take into account the laws that regulate the receipt of the benefits in question. Moreover, these acts are almost always valid, no matter whether you divide property during marriage or after you have been divorced for a long time.

If the mortgage was taken out by a military personnel

If a mortgage loan under the military program was used to purchase an apartment, there are special rules for dividing it. This is due to the fact that during service in the ranks of the Russian Armed Forces, the mortgage is paid by the Ministry of Defense. Therefore, after a divorce, when dividing the property of the spouses, the other half cannot claim the apartment.

However, you should know the following.

- When leaving the Armed Forces before repaying the debt, the citizen must contribute the remaining funds himself, that is, the funds will be taken from the general family budget. In this state of affairs, the second spouse has the right to demand compensation for the balance of the mortgage paid.

- When using maternity capital to pay off a mortgage loan, the living space is divided in equal shares between all family members.

When getting married, it is necessary to provide for possible situations regarding the division of property, if suddenly family relationships do not work out. In order not to lose your home, you should take into account that even if an apartment was mortgaged before marriage, in 2021 it may be recognized as jointly acquired property. To protect yourself from possible mistakes, it is better to seek the help of a specialist: a lawyer in St. Petersburg will advise on the issue, help draw up the necessary documents and defend the client’s interests at all stages of the case.

The right to division of property of former spouses

The division of joint property of spouses can occur not only at the time of divorce, but also after it, and both former spouses have an equal right to begin the procedure. In addition, spouses have the right to continue to use this property as joint property without dividing it.

The initiative to divide property can come from anyone, and if the other party does not agree, the chances that the division will take place are very high. It’s just that if the second ex-spouse agrees to sign an agreement and divide the property that they managed to accumulate during marriage, then the terms will not be delayed. If you divide property through filing a lawsuit, the court may greatly delay the time frame of the case, which could be resolved in a few days.

Typically, the division of property long after a divorce is carried out because one of the parties violates the rights of the other. For example:

- limits access to common property;

- does not allow them to be used;

- sells it without obtaining the consent of the second owner;

- Serious disagreements arise regarding the order of use of the properties.

To prevent these disagreements from further poisoning your life, it is logical to divide your property and get rid of the irritant.

How and when can you register ownership of real estate?

An apartment purchased with a mortgage is pledged to the bank until it is repaid. Any registration actions are carried out only with the consent of the credit institution.

Allocating a share to a spouse in an apartment with an encumbrance is a complex procedure; the bank may not give permission. In this case, you can allocate ownership rights to your partner to real estate taken on a mortgage before marriage as follows:

- Draw up a marriage contract and indicate in it the obligation to allocate a share in the apartment to the other half after paying off the mortgage loan. This document can be concluded at any time while the spouses are legally married.

- After paying off the mortgage, issue a deed of gift for part of the apartment. The owner has the right to dispose of the property at his own discretion after the encumbrance is removed.

In case of a dispute, ownership of a share in an apartment can be established through the court.

Terms of division of property after divorce

The deadline for dividing property after a couple divorces can occur in many cases, including if the critical factor occurs several years after the couple separated. For example, ex-spouses may divide property decades after a divorce. Nobody forbade them from doing this. Especially if they do not intend to involve the court, but plan to make do with a settlement agreement. In family law, the issue of deadlines is practically not addressed, which cannot be said about court proceedings.

Of course, division of property is possible even after a long time, but you will have to prove why it was delayed for so long, even though the divorce took place. Especially if both spouses continued to use the property and suddenly decided to divide it. It is still better to complete the section “hot on the heels”. It will be easier this way, because the longer you delay, the smaller the evidence base. This means proving where and whose share will be much more difficult.

A spouse who has not used the common property for a long time and then filed a claim for its division may also be denied. Especially if this concerns an apartment where major repairs could have been done over the decades, utilities paid and maintained. And all this at the expense of the second owner, who remained to live here.

Division of a mortgaged apartment during a divorce

A mortgage loan is something that binds spouses even if they divorce. The peculiarity of such a loan is that it is taken out for a long period, sometimes measured in decades.

While the mortgage payments are being repaid, the spouses may decide to divorce, but given the presence of an apartment taken on a mortgage, this will not be easy.

It is important to know : payments for an apartment purchased with a mortgage, even if it is registered in the name of one of the spouses, must be paid by both spouses.

As a general rule, in the event of a divorce, the mortgage loan is divided in half between the spouses, unless otherwise provided by the marriage contract.

To do this, shares in the apartment are allocated and a separate mortgage agreement is concluded with each of the former spouses. In this case, the bank may revise the amount of the monthly mortgage payment depending on the spouse’s income level.

If one of the spouses during a divorce decides to abandon the mortgaged apartment in favor of the other, he has the right to demand reimbursement of the amounts paid on the mortgage loan for this apartment.

In this case, the spouse stops paying for the apartment purchased with a mortgage during the marriage, and a new mortgage agreement can be concluded with the other spouse.

Former spouses have the right to sell an apartment taken on a mortgage. In this case, they first find a buyer, formalize the purchase and sale transaction, close the mortgage and then divide the remaining funds in equal shares.

Limitation period for division of property after divorce

The couple can get by with a settlement agreement, but if this fails, they will have to go to court. But in this case, you need to pay attention to the deadline for dividing the common property of the spouses.

Since cases are supervised by the Civil Code, the terms are regulated according to the same procedure as other civil claims. It is three years. But there is a nuance here regarding the starting point. It begins not from the moment when the spouses divorced, but when the plaintiff realized that his rights were violated.

An example would be a situation where ex-spouses used a joint dacha for many years, but one day the wife found out that her ex-husband had sold the common dacha without asking her permission. As soon as the wife finds out about the violation, the statute of limitations begins to count.

When can property be divided?

As enshrined in Article 38 of the RF IC, division of property can be carried out both during marriage and after its official dissolution. This may be necessary, for example, in the case where a husband or wife has a creditor collecting a debt: to do this, he may demand a forced division of the property in order to then foreclose only on the share of his debtor.

Lawyer's advice: Remember that if the marriage has already been officially dissolved, then demands for the division of jointly acquired property, with rare exceptions, can only be made within three years.

Skipping the statute of limitations for division of property

There are situations when division of property is required after the statute of limitations has passed. Such circumstances are also not hopeless. If there is a significant reason, you can file a lawsuit in order to restore the statute of limitations, and only after that begin the main procedure.

Serious reasons for reinstating the deadline for dividing the common property of spouses may be:

- the plaintiff himself was ill or one of his relatives was ill;

- business trips;

- illiteracy or ignorance of Russian.

If the terms are seriously overdue, it will be almost impossible to file a claim against the joint home unless they are reinstated.

Features and nuances, what should you pay attention to?

For people who live without an official marriage, but still want to get a mortgage loan, there are some nuances. After all, this degree of relationship is not always reliable.

In order to ensure that as a result of separation there are no questions about who owns the property, you should resolve this issue among yourself in advance.

If a man and a woman are officially employed and have a stable income, then the best option and guarantee for both will be joint ownership or common equity.

Features of a mortgage:

- The contract must contain a clause that specifies exactly how the apartment is divided, in half or someone has the larger part. As well as the distribution of loan payments. Thus, having checks and receipts, each of the owners can prove their right to own this property.

- In the event of a quarrel or dissolution of the relationship, both borrowers are obliged to repay the loan. If one of the parties shifts its responsibility to the other, then such behavior can be challenged in court.

- Joint homeownership is a joint liability, meaning both parties are responsible for their property.

How is the property of such spouses divided among the acquired real estate?

Very often, various controversial issues arise with such real estate, because once you start a relationship with a person, you begin to trust him. In the event of separation, without having any documents in hand confirming ownership, it is very difficult to prove your right to property. After all, by right, the person in whose name this apartment is registered remains with the housing, as well as the one who pays the monthly loan installments .

Without evidence of such a joint purchase and the facts of investing money, it is impossible to prove your case in court. The division of real estate can occur as follows:

- If the apartment was registered in the name of one of the spouses, and all loan payment receipts are in one name, then in this case he gets the apartment; it is impossible to convince the court otherwise without real evidence.

- If, when applying for a loan, the contract specified division into shares, that is, everyone receives ownership of that part that is proportional to the repayment of the loan. Thus, the apartment can be divided in half or one will own most of the apartment and the other 1/3. At the same time, it is very important that everyone, when repaying a mortgage, makes the payment in their own name. After all, receipts will be one of the evidence in court when dividing housing.

- Housing can be immediately divided in half, in which case the borrowers bear equal responsibility for the mortgage debt and both are home owners.

The procedure for dividing joint property voluntarily or through the court

The division of property for spouses whose divorce has taken place is carried out practically according to the same scheme as for couples who are just divorcing. Of course, there are changes, but they are minor. In particular, the problem can be solved not only in court, but also peacefully.

If you want to divide property voluntarily, you should draw up a settlement agreement. Samples of such an agreement can be found on the Internet, and there are no clear instructions for writing this document. But there are principles from which you should build when drawing up a document:

- the terms of the sample agreement must comply with current legislation;

- within the framework of the agreement, the rights of interested parties (for example, children) must not be violated;

- all conditions must be feasible without ambiguous interpretations.

Interestingly, an agreement on the division of property between spouses after a divorce allows you to divide everything not only in equal shares. The share can be significantly larger or smaller - if both parties to the agreement agree to this, there will be no problems. If there is no agreement, the document can be declared illegal in court. It is important that the agreement lists and describes all divisible property in as much detail as possible. After preparation, the document samples must be registered with a notary.

It is not always possible to divide property peacefully. Then you should go to court by filing a claim. In order for the claim to be accepted, you will have to pay a state fee. But the procedure is carried out taking into account the equality of the share for everyone.

The division of marital property in court can take place according to the following scenarios:

- the court will establish rules for ownership of common property;

- things that the spouses managed to acquire are sold, and the money is divided;

- if the spouses were able to acquire indivisible property, it remains with one of the owners, who will have to pay compensation to the second for its part.

When it is necessary to divide monetary assets, the easiest way is to divide them in half. The apartment and other property are usually sold to obtain money or compensation is paid to one of the owners.

Property acquired before marriage

Before marriage, a person may own a car, an apartment, a private house or other property that he bought, won, was given as a gift, or was inherited.

The law establishes that such property after marriage will not be part of the joint property of the spouses, but will remain in sole ownership, unless otherwise established by an agreement concluded between the spouses.

Exception : if one of the spouses makes, at his own expense, inseparable improvements to the other spouse’s own property (for example, cosmetic or major repairs), then this property may become jointly acquired and subject to division.

Please note: if property was acquired before marriage using loan funds from one of the spouses, and during the marriage the loan was repaid by both spouses, this property is also not subject to division between the spouses. However, the law provides the right to demand reimbursement of funds paid on the loan in the event of a divorce.

Cases in which property acquired during marriage remains the property of one of the spouses:

- receiving such property as a gift;

- receiving by inheritance.

Thus, one of the spouses who acquired property before marriage can sell it, donate it, or rent it out without the consent of the spouse. In this case, income received from the disposal of such property will also be the sole property of the spouse.

Sample claim for division of property after divorce

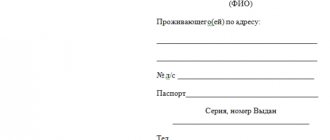

The court accepts claims when the divorce has already been completed, but they must be drawn up according to certain rules. This applies to the content of the document. For example, it should contain information about which authority the claim is being filed and who is filing it (full name and passport details).

It is also important to describe the essence of the appeal and references to regulations that allow you to demand division of property. It is also important to calculate what amount should be divided. This is the price of the claim, on which the state duty will depend. Therefore, it is impossible to do without calculation. It is necessary to indicate a list of documents that are attached to the claim. The date and signature are also indicated.

In order to correctly divide the property of spouses after a divorce, a sample document is needed. It will allow you to correctly navigate and draw up a document without errors.

In addition to the fact that there must be a claim itself, a set of documents is required to confirm the legality of the request when the divorce has already been filed. The following documents must be attached:

- a copy of the receipt for the state duty (will confirm that you paid it);

- copies of participants’ passports;

- birth certificate of children who are also owners of the property;

- papers to confirm rights to divisible property.

You can add additional documents that you think can prove your right to some property. As for the state duty, its size is not a fixed amount. This is a percentage of the value of the property being divided, which must be calculated using the formula presented in Art. 333.19 Tax Code of the Russian Federation. But this amount cannot be less than 400 rubles and more than 60 thousand rubles.

How to make a purchase?

Almost all banks in the country issue mortgages without an official marriage. Moreover, the conditions for such lending are almost the same as for official spouses. In order to take out such a loan, you need to select a bank and clarify the conditions for applying for a loan and filling out documents.

Subtleties of application preparation

- Provide reliable passport information for each borrower.

- Set the loan amount.

- Calculate your average monthly total income.

- Indicate the period for which the obligation to the bank will be repaid.

Other information and documents may also be required depending on bank regulations.

Can they refuse and why?

Every bank needs customers who can repay their debts without interruption. When applying for a mortgage, bank employees check all the information about the future borrower; monthly income is of particular interest.

If one of the common-law spouses does not have official employment or a stable income, this may be the reason for the bank’s refusal.

Banks are wary of borrowers with a bad credit history. It is very important that each spouse has not had problems with banks in the past. Having a timely repaid loan from this bank, as well as providing documents confirming the solvency of the borrowers, will help increase your chances of getting a mortgage loan.

List of documents required from borrowers

- Passport and a copy of all its pages for each borrower.

- Copies of work records certified by a lawyer and certificates of income from work.

- Documents indicating the presence of marital status and children.

- Documents for housing for which a mortgage loan is issued.

Attention! All documents must be original and contain only true information about the borrowers.

This list of documents is standard in all banks for obtaining such a loan. However, for more reliable information, you should contact a representative of this credit institution , since each bank has its own characteristics and the list may vary and be supplemented.

Procedure

A mortgage loan involves collecting a large number of documents and waiting for a response from the bank. To approach this process correctly, you need to understand the procedure for this type of loan. After borrowers have decided on the choice of bank, taking into account interest rates and the most favorable conditions, it is necessary to:

- Contact the bank with an application for a mortgage loan.

- Collect a package of documents, having previously checked the list with a bank employee.

- After a positive response from the bank, an agreement is concluded, which specifies the future owner and methods of paying the loan installments.

- Make a down payment; in different banks it ranges from 15% to 30% of the total cost of the purchased home.

After completing all these steps, the borrower receives documents confirming ownership. At the same time, he is obliged not to violate his credit obligations specified in the agreement.

Property claims after divorce

After the official separation of the relationship, spouses may leave unresolved property claims. They can be resolved by concluding a settlement or going to court. Moreover, even a spouse who, when filing a divorce, indicated that he has no claims against his ex-spouse can restore property claims. While the statute of limitations is still valid, you can demand division of property in court. To avoid such “surprises”, it is advisable to immediately divide the property. Moreover, this can be done even without getting a divorce, but while being married.

You can get legal assistance regarding the division of property after a divorce on our website.

The concept of cohabitation without registration

Previously, this term meant a legalized relationship between a man and a woman without a wedding in a church. Now in the modern world, people have given a new definition to this concept.

A civil marriage is considered a cohabitation of a man and a woman without official registration of marriage , thus a young family has the opportunity to think and make a decision about future marriage.

Today, there are more and more people who do not legalize their relationships. And every young family needs to have all the conditions for development, including housing. Therefore, given such demand, banks decided to create programs for such people that would allow them to purchase the desired apartment.

How to purchase an apartment with a mortgage in a civil marriage?

According to the legislation of the Russian Federation, the very fact of cohabitation does not give rise to any legal consequences for citizens. That is, it does not oblige them to anything, and does not imply joint ownership of property, as in an official marriage. And maintaining a common household and joint expenses can be equated to marriage only by the court and in exceptional cases.

So is it possible to take out a mortgage in a civil marriage ? Can. And this is not uncommon in the real estate market (at least in Moscow). Banks have long discovered a new market segment for issuing mortgage loans - to such informal cohabiting spouses (i.e., people who are not relatives).

And this is beneficial for banks. After all, collateral for an apartment occurs in the usual manner, and responsibility for the loan arises between two people at once. That is, the bank evaluates two sources of income at once (for both common-law spouses), and believes that it will be easier to pay off the mortgage together. This means that credit risk for the bank is reduced. For example, Sberbank and VTB willingly provide mortgages for two people without an official marriage.

Moreover, a joint mortgage for the purchase of a shared apartment outside of marriage can be issued by a bank even to complete strangers who are neither official, common-law spouses, nor relatives. For example, when two or three co-investors buy an apartment together for investment purposes. For a bank, there is no fundamental difference in issuing a mortgage loan to two common-law spouses or two independent co-investors. The law allows this (Article 321 of the Civil Code of the Russian Federation).

But such a joint mortgage for two (not married) has its own characteristics.

!!! Online order Extracts from the Unified State Register and other SERVICES for purchasing an apartment - HERE.

Alternative transaction for the purchase and sale of an apartment - procedure and sequence of actions.

Buying an apartment in a new building

Citizens who know the prices of the real estate market understand that the cost of housing in new buildings is significantly lower than secondary real estate. Sometimes the reason is the incomplete construction of the object itself. The new house has not yet been put into operation. In this case, a solution to a divorce is more difficult to find, since in fact the borrower does not have a property to live in.

When the building is completely ready for use, the borrower must register ownership of it. This work may require a lot of time and effort, and by this period the homeowner may legalize the marriage relationship. In such a situation, real estate will automatically be recognized as joint property and therefore will be subject to division.

The situation with the division of such property cannot be considered fair, but the law does not make any reservations in its articles. Consequently, the property is subject to division into two equal parts.

Features of the new buildings section

There is great difficulty in dividing mortgaged living space if the apartment was purchased in a new building and at the time of the divorce the house is still under construction. It turns out that there is nothing to divide, because The apartment has not yet been legally registered, which means it is not possible to recognize ownership.

However, after commissioning, the second spouse has the right to demand compensation for loan payments made during the existence of the marriage.

If the mortgage was taken out before marriage, are the apartment and money divided after the divorce?

A mortgage issued before marriage into the ownership of either spouse will not be considered jointly acquired property .

In this case, during a divorce, this property will not be divided. This applies to situations where the other half is not a co-borrower. However, in most matters relating to property, there is a pitfall.

As a rule, monthly loan payments are made from the joint funds of the spouses. In such a situation, property may be recognized as joint property if it is proven in court that the mortgage has been repaid from common funds.

The court will divide the property depending on the contribution of the second spouse in repaying the mortgage debt.