In the article we will consider what this is - a share contribution.

To achieve various economic as well as social goals, people and organizations create entire associations that are based on membership. Within a market economy, they act as a third force and are considered an alternative to the private and public sectors. The cooperative has a direct connection with the economic and other interests of its members. In order to form such an association and achieve its goals, a fund is created, which is formed from the share contributions of members of the cooperative. This is a kind of direct investment. This is, first of all, money that is invested by shareholders at various stages in order to ensure the statutory activities of cooperatives and in exchange for a share in property. Next, we’ll talk in more detail about what a share is and what it gives to the members of the cooperative.

Concept

The definition of this category is specified in the law entitled “On Agricultural Cooperation”. Similar to it, a share is a property contribution to a fund made by a member of a cooperative in cash. In civil law, it is presented as the opportunity to participate in the property of a cooperative, which is obtained after paying fees or by investing money.

Its value can have a direct impact on the distribution of profits between all participants. However, it does not affect the right to participate in management: each member at the general meeting has exactly one vote. Occupation of certain positions in the cooperative does not at all depend on the exact size of the contribution made by the participant. This is an important feature that is reflected in the Civil Code.

2.5. Principles of operation of the cooperative

The principles of the cooperative's activities are established in clause 3, art. 3 of Law No. 190-FZ. But if you intend to expand and specify the principles established by the Law, this section can be presented in the following approximate wording:

The cooperative is created for an unlimited period of activity and operates on the basis of the following principles:

- Financial mutual assistance of shareholders.

- Restrictions on the participation in the activities of the Cooperative of persons who are not its shareholders19.

Note:

Following this principle, the cooperative ensures the preferential participation of shareholders in the work of elected and appointed bodies, as well as in work in the cooperative under labor and civil law contracts.

- The voluntariness of joining the Cooperative and the freedom to leave it, regardless of the consent of other shareholders.

- Self-government ensured by the participation of shareholders in the management of the Cooperative.

- Equality of rights and obligations of all shareholders, in particular:

- Equality of rights of all shareholders when making decisions at the general meeting, regardless of the size of their shareholding - “one shareholder - one vote.”

- All shareholders have an equal obligation to comply with the requirements of the charter, internal regulations and decisions of the Cooperative bodies.

- Equal conditions for shareholders’ access to participation in mutual financial assistance.

- Equal access of shareholders to information about the activities of the Cooperative, financial and operational reporting materials.

- Joint and several joint liability by shareholders for the obligations of the Cooperative within the limits of the unpaid portion of the additional contribution of each shareholder.

Note:

The condition of subsidiary liability is explained to the shareholder upon joining the cooperative, and his consent to bear such liability for the obligations of the cooperative that arose before his entry into the cooperative is confirmed in the application and admission to the cooperative.

Distribution of responsibility for the Cooperative's obligations is proportional to the share of each shareholder's shareholding in the Cooperative's mutual fund, their chosen method of participation in mutual financial assistance and social status.

Note 1:

The law does not establish a procedure for distributing the amount of subsidiary liability among shareholders. It can be distributed equally among shareholders or in proportion to the size of the accumulation. The principle of distributing subsidiary liability in proportion to the size of the share accumulation seems more fair, since the income of the cooperative is distributed according to the same principle (clause 2, article 27 of Law No. 190-FZ).

Note 2:

In order to be able to redistribute the burden of fulfilling subsidiary liability between shareholders, borrowers and savers, establish a softer regime or exempt shareholders belonging to socially disadvantaged groups from such liability, it seems advisable to introduce a clause on the distribution of responsibility between shareholders depending on the “chosen their way of participating in mutual financial assistance and social status.”

- Determining the amount and obligation to pay membership fees based on the principle of compensation for the costs of maintaining the Cooperative by participants in shared ownership established by clause 2, art. 247 Civil Code of the Russian Federation. Payment of membership fees to cover the expenses of the Cooperative only by active shareholders, in proportion to the volume, timing and intensity of participation of these shareholders in mutual financial assistance.

Note 1:

Link to clause 2, art. 237 of the Tax Code establishes the principle, defined by law, of mutual compensation of expenses for the maintenance of a cooperative by shareholders - participants in common shared ownership.

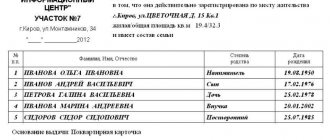

The procedure for a person to join a cooperative

Citizens or legal entities who have made contributions are usually called shareholders. You can become one, for example, when creating or as part of joining an existing community. In the first case, the members are its founders and become shareholders only after state registration of the company as a legal entity. In the second, everyone who wants to join the cooperative first submits an application, which is considered for a month, after which a decision is made. If it is positive, then you need to do the following:

- Pass on the entry fee, which will be used primarily to cover costs associated with joining.

- Pay the fee. Such property is included in the fund. The size is determined by the company's charter.

- Receive a shareholder's book, that is, a document proving membership in the cooperative.

Dividends are calculated in proportion to the contributions made, which are paid upon disposal or transferred to the heir of the share. Shareholders also have the right to apply for work in the cooperative as a matter of priority. The maximum number of participants is not limited.

2.3. Name and location of the cooperative11.

The name and location of the credit cooperative must be indicated in the charter in accordance with clause 3, art. 54 Civil Code of the Russian Federation, clause 1, clause 1, art. 8 of Law No. 190-FZ. As established in paragraph 1, art. 54 of the Civil Code of the Russian Federation, “a legal entity has its own name, which contains an indication of its organizational and legal form.” And the name of a non-profit organization must “contain an indication of the nature of the activities of the legal entity.”

Both of these conditions are ensured by the phrase “Credit consumer cooperative (citizens)__________”, from which follows both the organizational and legal form and the nature of the activities of the cooperative. In accordance with clause 6, art. 7 of Law No. 190-FZ, the indication in the name of the phrase “Credit consumer cooperative” determines the legal capacity of the cooperative in organizing mutual financial assistance.

Note:

The name of the credit cooperative specified in the charter is your company name, the exclusive right to use of which arises from the moment of state registration of the cooperative in accordance with clause 2, art. 1475 of the Civil Code of the Russian Federation. As established in paragraph 2 of Art. 1473 of the Civil Code of the Russian Federation, a company name “cannot consist only of words denoting the type of activity.” Therefore, think about the appropriateness of names like “Credit”, “Loan”, “Mutual Credit Society”, “Credit Union”, etc. This norm of the Civil Code itself does not contain any restrictions, but if any legal entity acts under the same name, the Court will recognize that you do not have a business name and will deny you the right to protect it12.

Along with the full name of the cooperative, its abbreviated name may be indicated in the charter (as a rule, indicating the organizational and legal form in the abbreviation). If you consider this relevant for yourself, you can also indicate in the charter the corporate name of the cooperative in the languages of the peoples of the Russian Federation and (or) in foreign languages.

An example of presenting information about the name of a cooperative:

Name of the cooperative:

- full name in Russian – Credit consumer cooperative “_____________________”;

- abbreviated name in Russian – KPK “____________”.

- full name in English – Credit Consumer Cooperative “___________” ;

- abbreviated name in English CCC “_________” ;

The location of the cooperative is determined by the place of its state registration, which is carried out at the location of the executive body13.

As stated in paragraph 10 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 61 “On some issues in the practice of considering disputes related to the accuracy of the address of a legal entity,” “Arbitration courts must keep in mind that the location of a legal entity reflected in its constituent documents (Clause 3, Article 54 of the Civil Code of the Russian Federation), is determined by indicating the name of the locality (municipal entity). In this regard, changing the information of the Unified State Register of Legal Entities regarding the address of a legal entity within its location specified in the constituent documents does not require amendments to the constituent documents, regardless of whether such an address was previously indicated in them, unless otherwise expressly provided for by the constituent documents documents of a legal entity."

Therefore, indicating in the charter the address of the location of the executive body, you can limit yourself to the name of the locality without describing the address in detail.

It should be borne in mind that registration of a cooperative at the residential address is possible if the owner of the premises has given consent to this. Consent is assumed if one of the shareholders lives in the residential premises at which the cooperative is registered - the initiator of the creation of the cooperative (founder), a person, citizen performing the functions of the sole executive body (elected chairman of the board or director)14.

It is not necessary to stipulate in the charter the right of the cooperative to open branches and representative offices. This right is already established by Art. 55 of the Civil Code, and they should be indicated in the constituent documents only if branches and representative offices are actually created. In accordance with the changes introduced in clause 3, art. 55 of the Civil Code from September 1, 2014, information about branches and representative offices will have to be indicated in the unified state register of legal entities.

An example of information about the location of the cooperative:

Legal address of the Cooperative:___________________________________________

And if there are territorial divisions, add:

The cooperative has the following territorial divisions in the Smolensk region:

- Branch of the Cooperative in the city _________, located at: ________________.

- Representative office of the Cooperative in the city of ____________, located at: ___________________.

It should be borne in mind that the cooperative bears the risk of consequences for not receiving legally significant messages at the address specified in the charter (and in the Unified State Register of Legal Entities) and for the absence of its representative at this address. As established in paragraph 1, art. 165.1, Civil Code of the Russian Federation, “A message is considered delivered in cases where it was received by the person to whom it was sent (the addressee), but due to circumstances depending on him, it was not delivered to him or the addressee did not familiarize himself with it.”

Note:

It is not recommended to further indicate in this section of the charter the general information that “the cooperative has a balance sheet, a seal, is considered created from the moment of state registration, etc.” These are general rules that determine the legal capacity of any legal entity, including a cooperative.

Property share contribution

The basis for the formation of property is a mutual fund, which is formed from contributions from members of the cooperative. They may be mandatory or optional. There is no such division in the share contributions of associated members. When distributing profits, the cooperative has the right to use a certain share of it to increase shares, increasing the size of the fund.

A share contribution is a category that is defined as a share of the property of a credit cooperative. It reflects the extent of the member’s participation in the formation of ownership.

Voluntary contribution - what is it?

How much can a share contribution to a cooperative be? In addition to mandatory contributions, members of the society make voluntary contributions in order to increase the share of their property participation within the cooperative. Thanks to this, savings are formed, which include cooperative annual payments in proportion to the size and time of their circulation for each shareholder. Next, we will consider the existing types of contributions.

Kinds

One type of share contribution is a contribution to the State Insurance Company and Housing Cooperative Society. In our country, housing and garage cooperatives are considered very common. Responsibilities for paying regular deposits fall on the shoulders of members of housing cooperatives and state cooperative societies. The exact amounts and established procedure for payment are determined by the charter. It also contains information about what competence the governing bodies have and what kind of violations await those who refuse to contribute funds.

For what other purposes can you make a contribution? Another type is contributions for infrastructure development. The basis for such contributions is a special type of agreement, where the parties are the developer and the local government. Thus, the first is to pay money to the city budget so that the infrastructure in a given locality develops. The size, along with deadlines and responsibility, is the main condition that must be prescribed in such documents.

Agreement between the cooperative and the shareholder

The main document that determines the procedure for paying money or other property is the share agreement. It establishes all the main points that are associated with the entry, and at the same time, the participation of a citizen in a cooperative institution:

- The terms are reflected along with the amounts of payment of share contributions.

- Responsibilities with rights of shareholders.

- Indication of the rules for terminating this agreement.

- Procedure for returning funds in case of leaving the cooperative.

The paper may also prescribe the rules for holding a meeting of members of the cooperative, display the special rights of the shareholder, and, among other things, regulate the division of cooperative property in various cases. The agreement also determines the form of contribution. Mandatory shares in production cooperatives are established in the same amount for all. In the consumer version, this is done in proportion to the planned volume of citizen participation in the economic activities of the cooperative in question.

The procedure for registering the transfer of shares

If a member of the cooperative does not have the opportunity to continue making share contributions, he can draw up an agreement for the assignment of the share in the housing cooperative. It involves the conclusion of a purchase and sale agreement and assignment of shares.

The assignment of a share is possible if this condition is in the housing cooperative agreement, there are no residents in the apartment, and the expected share contributions have been paid in full.

The procedure for transferring a share has many risks for the buyer, since as a result of its registration he may lose money and not receive ownership rights as a result. This is due to the characteristics of housing cooperatives. The fact is that in order to acquire ownership of real estate, a person must become a member of the housing cooperative, and the assignment of the housing cooperative does not automatically guarantee the buyer that he will be included in the membership. After all, if at a meeting of shareholders a negative decision is made regarding a new member, he will lose money and will not ultimately acquire ownership rights.

To avoid the risk of losing real estate, the purchase and sale agreement must include a clause stating that the funds will be returned if the buyer is refused membership in the housing cooperative.

The procedure for assigning rights of claim to real estate involves going through the following stages:

- The parties sign a purchase and sale agreement.

- The seller writes an official statement to withdraw from the cooperative.

- The buyer writes an application to join the cooperative.

- The buyer is included in the number of members of the cooperative and the buyer and the seller enter into an agreement on the assignment of rights.

- The buyer is given a certificate in his name about the amount of the paid share.

What are the risks under the contract?

If you study what risks a share contribution agreement has, then, first of all, it is necessary to indicate the following pitfalls:

- It is highly likely that the cost of the property may increase by the time construction is completed.

- If the deadlines are not met for any reason, then the housing cooperative will not receive fines for this.

- There is a restriction on the resale of shares.

- Developers may not have permission, and this will increase the risk of ending up with an unscrupulous company.

It is these dangers that are the reason why people choose kindergartens that have much fewer disadvantages. Now let's find out what the advantages are.

Advantages of cooperatives and mutual fund

The fund formed through contributions from members of the cooperative is one of its strongest aspects. In our legislation, such amounts are not declared in any way and are not subject to taxes. This gives a certain amount of freedom in the use and transfer of property that makes up the share capital.

So, for example, not only cash, but also various buildings, along with equipment, land, securities and other property that has a monetary value, can become a voluntary share contribution to the fund. At the same time, the legal regime, taxation and other payments associated with its use will change. According to the agreement, you can even contribute a computer, having discussed its price only with the leaders of the cooperative. Against this background, you can receive a refund in cash without paying absolutely any taxes on these funds. In addition, shareholders can safely use the property, including the money received as collateral for contributions.

The property that makes up the fund is well protected from external interference in the activities of cooperatives on the basis of the legislation in force in the country. Therefore, they are often called alternative categories to the private and public sectors of the economy.

We considered that this is a share contribution.

2.2. Terms and Definitions.

Often, after the preamble, a section “terms and definitions” is introduced into the charter, duplicating the concepts established in clause 3, art. 1, Law No. 190-FZ. This is also not required by law, but if you find it useful to disclose the definitions used, disclose only those that are relevant to your charter. For example, there is no point in duplicating the definitions given in the law of “credit cooperation,” “credit consumer cooperative,” “second-level credit consumer cooperative,” etc.

The law also uses terms that duplicate each other: “member of a credit cooperative (shareholder)”, “share (share accumulation)”. It is reasonable for the charter to choose one of them, for example, “shareholder” and “share accumulation”.

Approximate edition of terms and definitions:

- Shareholder is a citizen or legal entity 5 accepted into the Cooperative on the basis of his voluntary expression of will, recognizing the charter and internal regulations governing internal corporate relations in the Cooperative, enjoying the rights and acting as a shareholder of the Cooperative.

Note 1.

As established in clause 5, art. 52 of the Civil Code, “The founders (participants) of a legal entity have the right to approve regulating corporate relations (clause 1 of Article 2) and internal regulations and other internal documents of the legal entity that are not constituent documents.” Such documents establishing internal corporate legislation in the Cooperative are its internal regulatory documents adopted by the General Meeting in accordance with clause 2, clause 3, art. 17 of Law No. 190-FZ.

Note 2:

The law does not establish restrictions on the participation in the cooperative of citizens of foreign countries and stateless persons. Therefore, if you do not allow such persons to participate in the cooperative, you can limit the definition of shareholders to citizens of the Russian Federation. If the cooperative is built on a strict territorial or professional principle, you can specify the relevant qualifications here.

- Shareholder contributions are funds contributed by a shareholder to the Cooperative to cover expenses associated with the implementation of its statutory activities and for other purposes, and in some cases - to cover losses and debt on obligations not fulfilled by the cooperative, including:

- membership fee - funds contributed by a shareholder in connection with his participation in mutual financial assistance, allocated to cover the expenses of the Cooperative for carrying out statutory activities - organizing and ensuring financial mutual assistance of shareholders and for other purposes related to the implementation of such activities. As established in paragraph 1, paragraph 2, art. 251 of the Tax Code of the Russian Federation, membership fees paid by shareholders relate to targeted revenues for the maintenance of non-profit organizations and the conduct of their statutory activities.”

- A type of membership fee is an additional contribution made if it is necessary to cover losses and debts for obligations not fulfilled by the cooperative.

- entrance fee 5 - funds contributed by the shareholder to the cooperative for a specific purpose to cover the costs associated with registering his membership in the cooperative.

- share contribution - funds transferred by the shareholder to the ownership of the Cooperative for the formation of a share fund that ensures the activities of the Cooperative as a financial institution, and for the formation of the accumulation of shares of the shareholder who transferred the contribution.

There are differences between mandatory and voluntary share contributions:

If you establish the obligation to make a mandatory share contribution only upon joining a cooperative, you can give the following definition:

- compulsory share contribution - a share contribution made by a shareholder upon joining a cooperative and determining the minimum amount of his property participation in the cooperative's share fund.

The expanded composition of mandatory share contributions is determined in the following approximate wording:

- The Cooperative has established the following types of mandatory share contributions :

- Minimum share contribution paid by a shareholder upon joining the Cooperative and determining the minimum amount of his property participation in the cooperative's share fund.

- Security share contribution - made by the shareholder in order to fulfill the “equity quota” for loans received by him from the mutual financial assistance fund7;

- Target share contribution - made by a shareholder in connection with participation in target programs financed from joint funds8.

- Share contribution to the insurance fund - made to shareholders for the purpose of forming a fund for mutual insurance of credit (or other) risks under the terms of participation in mutual financial assistance;

- voluntary share contribution - a share contribution voluntarily made by a shareholder in addition to the mandatory share contribution (mandatory share contributions) during the period of membership in the Cooperative in order to increase the share of his property participation in the share fund and the formation of share accumulation.

- accruals on share contributions (possibly cooperative payments) - funds accrued from a part of the income received by the Cooperative for the financial year in proportion to the amount and period of circulation of each shareholder's share accumulation in the share fund and paid to shareholders or added to their share accumulation9.

- Share accumulation is a unit of his property participation accounted for by a shareholder in the mutual fund of the Cooperative. It is defined as the amount of share contributions of each type made by the shareholder and the cooperative payments attached to them.

- A mutual fund is a fund formed from the savings pooled by shareholders to ensure mutual financial assistance organized by the Cooperative.

- Reserve Fund - a fund formed from a portion of income and targeted financing, used to cover losses and unforeseen expenses of the Cooperative.

Note:

Along with the reserve for covering losses provided for by law, the Regulations on the procedure for the formation and use of the Cooperative’s property may provide for the creation of other reserves. In this case, the definition of the reserve fund can be given as follows:

- Reserve funds are funds formed from a portion of income and targeted financing and used for their intended purpose:

- To cover losses and unforeseen expenses of the Cooperative;

- To maintain liquidity for current obligations;

- To develop promising areas of mutual financial assistance.

- Mutual financial assistance is a pooling of share savings organized by the Cooperative and raising funds from shareholders and other persons to provide loans to shareholders. Mutual financial assistance ensures the savings interests and financial needs of shareholders.

- Mutual Financial Assistance Fund is a fund formed from funds pooled and raised by the cooperative to provide loans to shareholders.

- Internal regulatory documents - regulations and other documents adopted by the general meeting of shareholders and other bodies of the Cooperative, establishing rules, policies and procedures for mutual financial assistance and other internal regulations in the Cooperative.

- Affiliated persons are persons elected or appointed to the bodies of the Cooperative, capable of influencing its activities and recognized as such in accordance with antimonopoly legislation.

Or:

- Affiliated persons – Chairman and members of the Management Board, Director (if provided) as well as persons belonging to the group of persons to which these persons belong10.

Note:

Since the Law (Article 16) introduces restrictions on transactions involving interested parties, it is useful to include in this section the definition of interested parties:

- Interested parties - persons elected or appointed to the bodies of the Cooperative, interested in the Cooperative's transactions with other organizations and citizens, in cases where these persons:

- have labor relations with these organizations or citizens;

- are the founders, participants, members, creditors of these organizations;

- have close family relationships with citizens, being their spouses, parents, children, full and half brothers or sisters, adoptive parents or adopted children, or are creditors of these citizens.

The relations of the cooperative with shareholders who meet the specified criteria in the process of their participation in mutual financial assistance and formalized by agreements for the transfer of a loan, personal savings or the provision of a loan do not relate to transactions in the implementation of which there is an interest.

- Raised funds are funds received by the Cooperative from shareholders on the basis of agreements for the transfer of personal savings and loans, as well as funds received by the Cooperative from legal entities that are not its shareholders on the basis of a loan and (or) credit agreement.

Note.

As established in paragraph 4 of Art. 123.1 of the Civil Code of the Russian Federation, “A non-profit corporate organization is the owner of its property,” including property formed from raised funds and share contributions.

- Reporting period - first quarter, half year, nine months of the calendar year, calendar year.