Home / Real estate / Land / Donation

Back

Published: November 24, 2016

Reading time: 13 min

3

1768

A deed of gift for a land plot is a fairly simple and profitable way to transfer ownership of property. It has become widespread among individuals with family ties.

The conclusion of a gift agreement is required if the value of the transferred property exceeds 3,000 rubles. Typically, such transactions are concluded in relation to real estate, country buildings and the lands under them . If the amount of the gift is less than 3,000 rubles, then an oral agreement between the parties is allowed.

- What is a deed of gift: legislative aspects

- Advantages and disadvantages of drawing up a gift agreement

- How to properly draw up a deed of land: the main stages Drawing up and signing an agreement

- Notarization of the gift agreement

What is a deed of gift: legislative aspects

A deed of gift is a standard civil law agreement that implies the transfer of rights to property (in this case, land) from the donor to the donee free of charge.

What distinguishes it from a purchase and sale transaction is its gratuitous nature.

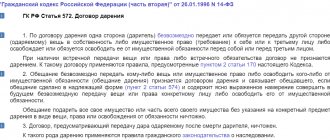

Gift relations in Russia are regulated by the Civil Code (Chapter 32); the specifics of transactions with land plots are prescribed in the Land Code.

The transaction can only be concluded on a voluntary basis.As parties

Contracts can be made by any individual, with or without family ties, legal entities, charitable foundations and government organizations.

Only privatized land can be transferred by deed of gift. It will not work to donate a plot that is leased from the state.

It is allowed to transfer not the entire plot, but its share.

After concluding a donation agreement, the donee becomes the full owner of the land and can dispose of it at his own discretion: rent it out, build a house on it, sell it, donate it, etc. The donor himself will no longer be able to influence how the donee decides to use the plot.

The deed of gift does not have retroactive legal effect. Ownership rights can only be returned if the recipient of the land plot decides to issue a deed of gift in the name of the donor. Or the agreement will be declared void in court (the grounds for cancellation of the deed of gift are given below).

The deed of gift is one of the transactions for which registration with Rosreestr is required.

The parties will have one year to register, otherwise the contract will be canceled.

If the donor died without having time to register the gift agreement with Rosreestr, then such a transaction will not have legal force. It will not be an expression of the last will of the deceased and will not be equal in importance to a will.

The land plot will be divided between relatives who have the right to claim inheritance by law.

Quite often, citizens wonder whether it is possible to donate land separately from the building that stands on it. If the house and the plot belong to different owners, then such a transaction is possible. Otherwise, the plot is transferred only together with a house or other building (in accordance with Article 35 of the Land Code).

It is prohibited to make a gift of property in favor of employees of social services and medical institutions where the donor resides, as well as in favor of civil servants.

Rules for drawing up an agreement

The property donation agreement does not have a unified form and is drawn up according to the rules adopted for all real estate transactions. It must contain the following items:

- place of execution of the contract (name of the locality);

- date of conclusion of the transaction;

- information about the parties indicating full names, passport details and postal addresses at the place of registration;

- an indication of the subject of the contract with a description of its characteristics, making it possible to recognize a specific object among similar ones. The name of the property being donated, its location, cadastral number, area, etc. are indicated;

- details of documents confirming the donor's ownership of real estate;

- conditions under which the recipient will become the owner of the gift;

- signatures of the parties to the transaction.

Advantages and disadvantages of drawing up a gift agreement

Registration of a deed of gift for land has its advantages and disadvantages, which the parties need to take into account before deciding to conclude it.

Most often, gift agreements are concluded between close relatives, which is associated with the taxation of such transactions. Spouses, children, parents, brothers and sisters, grandchildren, and grandparents are exempt from paying taxes on the received land plot.

A gift agreement is not only a profitable, but also a quick way to transfer rights

property. The whole process takes no more than a month.

Since by deed of gift the land is transferred to the benefit of the donee free of charge, such property will be classified as the personal property of one of the spouses and is not subject to division in divorce proceedings.

If the parties to the transaction are not relatives, then the gift acts as income to the donee and he is obliged to pay personal income tax on the value of the land. The tax rate is set at 13%, for non-residents - 30%. The donor himself does not need to pay anything.

In addition to paying tax, the party to the transaction is required to report the concluded gift agreement to the Tax Inspectorate in Form 3-NDFL.

This must be done before April 30 of the year following the conclusion of the contract. Otherwise, a fine of 1,000 rubles will be imposed on the recipient of the gift.

Among the disadvantages of a gift agreement, in addition to its unfavorable taxation when registering a transaction between persons without family ties, is the possibility of challenging the agreement. In this sense, a purchase and sale transaction is more legally protected.

Another disadvantage of the agreement is its unconditionality, i.e. it cannot indicate special conditions for concluding a transaction.

Did you have any difficulties when preparing a deed of land?

There were no difficulties It was difficult for me to run through the authorities I didn’t give anything to anyone

Features of the procedure

There are certain features of transferring land to close relatives, taking into account their status.

Spouse

The husband and wife are close relatives, therefore they are exempt from paying personal income tax in the event of an officially registered marriage. If land that personally belongs to one spouse is donated, the standard rules for drawing up a document apply, as with other relatives.

If the property is shared, it is necessary to obtain consent for the donation from the other half.

For a minor

You can give land to a child, regardless of his age. If the child is under 14 years old, a parent or guardian signs the document on his behalf . In this case, the presence of a minor is not necessary.

How to properly draw up a deed of land: the main steps

Registration of a deed of gift involves going through a number of successive stages, starting with the drawing up of an agreement, and ends with the re-registration of ownership rights to the new owner. Let us consider the components of the donation procedure in more detail.

Drawing up and signing an agreement

To draw up and sign an agreement, you can contact specialized companies, a notary, or use a standard form.

We can take as a basis the model proposed by the Russian Federation Committee on Land Resources back in 1994.

The contract must contain the following parameters:

- name of the parties to the transaction (donor/done);

- a detailed description of the land plot being donated (indicating its area, intended purpose, cadastral number, description of buildings);

- cadastral value (or market) of land and buildings on it;

- presence of land encumbrances and restrictions;

- obligations of the parties (transfer and accept as a gift);

- applications.

When contacting specialized law firms, you should be prepared for the fact that they will charge 5,000-10,000 rubles for preparing a document.

If land is transferred in favor of a minor or incompetent citizen, then the written consent of his guardians and parents is required. The minor himself has no right to act as a donor.

Notarization of the gift agreement

Contacting a notary office for certification of a gift agreement is an optional step. However, they should not be neglected to give the document greater legal force.

To notarize a deed of gift, you will need the following package of documents:

- passports of the parties;

- agreement in triplicate;

- cadastral plan of the site;

- a certificate confirming the absence of buildings on the land or an extract from the Unified State Register of Ownership of the building;

- conclusion on the cadastral (or market) value of the land;

- title documentation for land.

The notary will charge a certain fee for his services.

Its size will be tied to the cadastral value of the land, or to the market value obtained from licensed independent appraisers.

Tariffs for notary services also depend on the category of relationship. To register a plot in favor of a spouse, children, parents, grandchildren, they are set at the level:

- 3000 rub. plus 0.2% of the price of the plot if its value is within 10 million rubles;

- 23,000 rub. + 0.1%, but not more than 50,000 rub. - at a higher cost.

When donating land to other categories of citizens, increased tariffs apply:

- if the price of land is within 1 million - 3000 rubles. + 0.4%;

- up to 10 million rubles — 7000 rub. + 0.2%;

- more than 10 million - 25,000 rubles. plus 0.1%, but not more than RUB 100,000.

If certification of the spouse’s consent is required when registering a gift of land that is jointly owned, the tariff is set at 100 rubles. The cost of drawing up the contract itself with the help of a notary will cost another 1000-2000 rubles.

Notaries also charge a fee for technical and legal work . Its size is determined at the level of the regional notary chamber and averages 2000-5000 rubles.

Exceptional cases

In certain cases, the donor can demand back the donated land and there is a high probability that he will receive it. The donor can file a lawsuit to cancel the contract if the recipient poses a serious threat both to the person who gave him the land free of charge and to his family. For example, caused bodily harm, threatened or attempted murder, and committed other harm to the donor. The agreement may also be declared invalid if the person who accepted the land as a gift does not treat it properly, for example, in a manner inconsistent with its intended purpose or status.

Registration of the agreement in Rosreestr

There is no need to register the gift agreement separately with Rosreestr; this is done simultaneously with the procedure for transferring land ownership rights.

A similar package of documents requested by the notary must be provided to the registration center. An application for re-registration of property rights must also be attached.

You can submit documents in person, by mail or through an authorized representative. IN

the last two cases will require notarization of all information. Re-registration of property rights through the MFC is also allowed.

To register property rights, you must pay a state fee of 2,000 rubles. (RUB 20,000 for legal entities). If agricultural land is donated, the state duty is 350 rubles. Many departments of Rosreestr and MFC have terminals that allow you to pay state fees on the spot.

Based on the documents received, the Rosreestr specialist will issue a receipt and indicate the date of receipt of the certificate.

During this time, Rosreestr employees must carry out a legal assessment of the documents for cleanliness and check the site for the absence of encumbrances.

If the verification is successful, changes will be made to the property records in the register.

Today, citizens have the opportunity to entrust the entire process of registering deeds of gift to specialized legal companies. They will take care of all the worries, from preparing the contract to registering it with Rosreestr. This service will cost about 10-20 thousand rubles.

Where to contact?

The parties can independently conclude an agreement with further registration of the transaction and ownership rights in Rosreestr. also contact a notary and lawyer.

If a minor child or an incapacitated person is involved in the transaction, notarization of the deed of gift is required.

Attention! Donation on behalf of an incapacitated person or a child under 14 years of age is prohibited.

You can submit documents directly to Rosreestr to register the transaction and property rights, or act through an intermediary - the MFC.

Obtaining a certificate of ownership

Within the established time frame, the donee can go to obtain a certificate in his name.

You need to have your passport and a statement confirming the acceptance of documents received at the previous stage. Currently, the document preparation period is no more than 10 days. After receiving a certificate of ownership of the plot, the donee becomes the new full owner of the land plot. It is important to understand that this entails not only the right to freely dispose of the received land, but the obligation to pay land tax.

Possible problems when registering a deed of gift

The deed of gift can be drawn up in simple written form and does not require notarization.

If such an agreement is not certified by a notary, this will not be a basis for recognizing it as void and having no legal force. Therefore, citizens often neglect notary services, preferring to save on them.

But in some cases it is worth having the contract notarized, especially if the parties

there is reason to believe that the relatives will try to challenge the deal in court.

Typically, relatives seek to challenge the deed of gift after the death of the donor so that they have the opportunity to claim the land plot through inheritance according to the law. To argue their position, relatives seek to prove in court that the agreement was concluded under pressure, or that the donor was misled or was not aware of his actions.

Third parties will have three years to challenge the concluded land donation agreement. After the expiration of the specified period, the deed of gift cannot be canceled.

If necessary, the notary will be able to act as a witness in court, and his certification of the document will serve as evidence that the donor was of sound mind at the time of signing the agreement, was aware of the consequences of this transaction and was not under pressure.

One copy of the deed of gift will always be kept by the notary and, if necessary, it will be easy to restore.

It will be almost impossible to challenge a notarized deed of gift by third parties.

Another advantage of notarization: it can speed up the process of re-registering property rights.

The assignment of a postal address to a residential building occurs according to a certain algorithm. In case of non-payment of debts, utility bills may be disconnected. You can read how to find out your debt here.

As a rule, the cost of renting agricultural land is calculated from the cadastral value. You can learn about other calculation methods from our article.