The document is signed after the transfer of funds.

Is this paper always needed, are there any disadvantages for the buyer and seller, rules for drawing up, and is certification required? Let's consider all the questions in the article.

Why is it necessary when buying or selling?

Receipt for receipt of funds for a land plot is a document showing when, where and for what reason payment was made and received. Is a confirmation of the transfer of money.

There are several reasons for writing a paper:

- insufficient reliability of the seller;

- the likelihood of denying the fact of receiving money;

- the need to confirm the costs of purchasing memory.

A receipt will be needed if a citizen plans to return income tax funds. It is compiled at the time of transfer of money and stored with the main package of documentation for the purchased plot.

The paper is a legally significant document - if the owner’s rights are violated, it can be taken to court.

Note! The document is drawn up by the person accepting the money - the seller. If a citizen does not have the opportunity to personally accept finances, a representative does this for him. In this case, the document indicates that the money was received by proxy. Its details must be written down: date, place of issue.

Advantages in drafting a document for both parties

The receipt has a positive meaning for both parties.

Pros for the buyer:

- it is proof for the buyer that the seller received the money;

- transfer of money by receipt guarantees the completion of the transaction and obliges the seller to transfer the property after receiving the full amount.

Pros for the seller:

- since the receipt indicates a specific amount, the buyer will not be able to demand a reduction in the value of the property by more than the amount of the deposit;

- After depositing money, the buyer rarely refuses the transaction.

Attention! If the receipt is drawn up with violations, it does not contain complete information, it can be challenged and declared invalid.

There are no disadvantages to document execution. It is proof of the transfer of funds. This benefits both parties to the transaction.

Advantages and disadvantages for both sides

Having paper is beneficial for both parties to the transaction.

For the buyer, it is a guarantee of concluding a secure transaction with the seller, and for the selling party, it is a guarantee of receiving money. Having a receipt in hand, the parties will protect themselves from possible claims against each other . The disadvantage is that it has a limited validity period (3 years).

In case of possible violations, you can go to court within the specified period. After the expiration of the limitation period, the receipt is considered invalid.

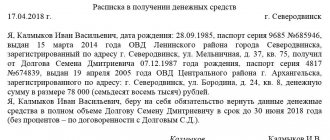

Sample receipt for receipt of funds for an apartment

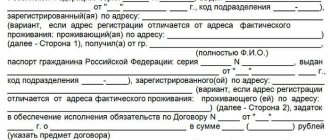

We offer standard receipt templates that are suitable for any real estate purchase and sale transaction.

This receipt text can be written by hand

Standard receipt for receiving money for an apartment, sample

Sample fragment of a receipt to which witnesses have been added

Rules for document execution

The current legislative power does not put forward requirements for the form of the receipt for receipt of the deposit. The main thing is to indicate the truthful information of all participants in the process (seller, buyer, witnesses). Receipt - an appendix to the purchase and sale agreement.

To correctly draw up a document, it is important to use a ready-made form as a sample - then the transaction will be concluded in accordance with legal rules.

The document should contain the following points:

- name of the document - receipt;

- date and place of compilation;

- Full name and passport details of participants;

- information about citizenship;

- registration address;

- contact information (phone number, email address);

- information about the fact of transfer of the deposit, its amount and purpose of payment;

- information about the purchased plot (location, area, land category, cadastral number).

The receipt is written by hand. At the end, the signatures of the parties to the transaction are placed and the date of preparation is indicated.

When preparing a document, you must adhere to the following rules:

The seller must provide confirmation of receipt of money personally (indicating the amount).- No corrections allowed.

- When drawing up it is allowed to invite witnesses. They must not be relatives of one of the parties.

- The amount is indicated in numbers (with explanation).

- Before transferring funds, you must verify the signatures on the receipt and your passport. If they do not match, the document will be considered invalid.

- Compiled in two copies - photocopies of the document are not acceptable.

A receipt is considered invalid if illegal actions were used in its preparation, the witnesses were people with mental disorders, and one of the participants was a minor citizen.

Reference! If there are witnesses present when drawing up the receipt, their passport details and signature with a transcript are indicated under the borrower’s signature. If money is transferred to the seller in parts, a receipt is issued for each transfer.

Legal blog

08.23.19, Deineka E.R., Chief lawyer of LLC “AN “TRIUMPHAL ARCH”

Mutual settlements under a transaction can be carried out by the parties to the transaction by settlements in cash or by bank transfer.

Confirmation of cash payments is a handwritten receipt. For non-cash payments, bank documents (payment order, account statement) are received to confirm mutual settlements. In this case, drawing up a receipt is not required.

If the buyer insists on a receipt, then the contents of the receipt should not record the receipt of funds, but confirm their crediting to the account. For example: I, full name, real estate seller.... I confirm that a sum of money has been credited to the account in the amount as payment under the DCT using a letter of credit...

In addition, any document containing elements of a receipt (passport details of the parties, amount of money, basis) can also confirm mutual settlements between the parties. For example, an act of mutual settlements, an act of acceptance of the transfer of an object with a clause on mutual settlements.

Exception to the rule:

non-cash payments by opening a letter of credit in alternative transactions (the buyer of the first object opens a letter of credit for the seller of the second object, the third object in the chain, etc.) It is worth noting that lawyers do not like this scheme of mutual settlements, because is fraught with many pitfalls. However, given the tendency of one of the well-known banks to insist on non-cash payments, despite the fact that a chain of transactions develops and it is not convenient for the parties to pay through a letter of credit, additional documents have to be drawn up in order to somehow justify the fact that the seller received money not from the buyer, but from a third party, as well as the fact that the buyer paid money not to the seller, but to a third party. Receiving an account statement in this case will not confirm the transfer of funds from the buyer's account to the seller's account.

Non-cash payments by opening a letter of credit in alternative transactions require more careful attention to the preparation of financial documents, including because the buyer may subsequently apply for a tax deduction. Receipt of funds by the seller not from the buyer, but from a third party, may be grounds for refusal to receive a tax deduction. In this case, it would be a good idea to get advice from a tax consultant. Practice for such situations has not yet been developed.

Additional documents, depending on the number of objects and parties to the transaction (the lawyer will analyze the situation and make a decision on the preparation of an additional document), may be an order from the seller of the first property (the order is given to his buyer) to send the funds due to him for the alienated property to the seller of the second property , which he in turn acquires; agreement between the parties to the transaction on the procedure for mutual settlements (if several real estate objects are involved in the transactions).

To understand the seriousness of correct execution of financial documents for a transaction, I will give one example from judicial practice. The court decision was made without the participation of the defendant (real estate seller), and therefore, one can only speculate about the reasons for this situation. I will briefly describe the plot of the case.

On May 12, 2017, the parties signed a contract.

Payments under the agreement: personal funds (cash) + credit (letter of credit).

Before signing the contract on 04/05/17, the seller received an advance from the buyers by issuing a receipt.

The following is an excerpt from the court decision: “After signing the Agreement, they paid the defendant another N rubles in payment for the real estate according to a receipt dated May 17, 2021. They were forced to agree to such conditions of the defendant, since if the Seller refused to conclude the transaction, Rosselkhozbank JSC would refuse to provide them with a loan.” Taking into account that the defendant’s arguments were not heard in court, we can only assume the purpose of this amount.

On May 25, 2017, the bank transferred credit funds to the seller, which is confirmed by the payment order.

Next, the buyers filed a claim against the seller for unjust enrichment. The claim was satisfied. Excerpt from the court decision: “The totality of the evidence presented in the case, which was the subject of research and assessment at the court hearing, confirmed that, despite the determination by the parties in accordance with the requirements of Art. 555 of the Civil Code of the Russian Federation, the price in the real estate sale agreement is N rubles, for the above-mentioned real estate objects sold under the purchase and sale agreement dated May 12, 2021, defendant V.A. Kalashnikov. received from the plaintiffs Baranov D.S. and Baranova S.B. N rubles, the overpayment amounted to N rubles, of which: according to the receipt dated April 5, 2021 - N rubles, according to the receipt dated May 17, 2021 - N rubles. Based on the foregoing, the court comes to the conclusion that the excess received by the defendant Kalashnikov V.A. for the real estate objects he sold to the plaintiffs, funds in the amount of N rubles became the property of the defendant without proper legal grounds, and were not returned to the plaintiffs, and therefore the specified funds in the amount of N rubles are subject to recovery from the defendant in favor of the plaintiffs in equal shares as unfounded enrichment." (Decision of the Ust-Kamchatsky District Court of the Kamchatka Territory dated November 30, 2021 in case No. 2-117/2017).

As we can see, the court simply added up all the amounts on the receipts and the amount on the payment order. The total amount did not match the price of the real estate under the purchase and sale agreement. Conclusion: he unjustifiably received more than he was due.

Another situation.

The parties entered into a preliminary agreement for the purchase and sale of the room. As part of this agreement, upon the buyer’s approval, she transferred N the amount to the seller’s bank account and transferred the same amount in cash, which was confirmed by the seller’s receipt. Due to the fact that the subsequent purchase and sale agreement was not concluded, the buyer filed a lawsuit to recover the amount of unjust enrichment. The amount of unjust enrichment in her opinion amounted to the sum of non-cash and cash funds. The claim was partially satisfied. “The panel of judges takes into account the consistency and consistency of the defendant’s position, which explained that this amount is 15% of the cost of the room, the amount was transferred only for the reason that the bank issues a loan upon confirmation of payment of 15% of the cost of housing by the borrower, for which a receipt was drawn up. Considering that the amount indicated in the receipt and transferred by bank transfer is the same, the circumstances of writing the receipt and transferring funds took place on the same day, according to the consistent and consistent testimony of witnesses when drawing up the receipt, cash was not transferred, the receipt was transferred to the plaintiff after the bank transfer amount, the court came to the correct conclusion that the receipt did not confirm the fact of the repeated (in addition to the non-cash transferred amount) transfer by the plaintiff to the defendant ( / / ) rubles. The plaintiff argued the claim for transfer twice (//) rub. not proven” (Appeal ruling of the Investigative Committee for civil cases of the Sverdlovsk Regional Court dated March 12, 2015 in case No. 33-3644/2015).

Conclusion:

The parties to the transaction must pay close attention to the financial documents confirming mutual settlements, and realtors, in turn, must give legally competent advice, guided not only by the principle “that’s how everyone does it,” but also by the rules of law.

Nuances of the procedure

The standard procedure for transferring money and drawing up a receipt may differ depending on who the seller is. Familiarize yourself with the nuances of the procedure.

If the seller is a minor

Sometimes, despite their age, a minor can manage an apartment if a share or the entire property is allocated to him. In this case, the transaction acquires some features that are best familiarized with before transferring money and receiving a receipt:

- If the seller is under 14 years of age. Under such conditions, the child does not have the right to sign and, accordingly, cannot participate in the transaction in any way. The sale of property is carried out by his legal representative - parents or guardians. You will also additionally need permission from the guardianship and trusteeship authorities in order to confirm that the interests of the child are not violated. And in the receipt itself, add a line in which to indicate “The interests of the minor are represented by the legal representative...”.

- If the minor has already reached 14 years of age. Upon reaching the age of 14, a minor may already have a passport, but is still considered incompetent. Therefore, he must be present when transferring money, drawing up a receipt and give his consent to this action, but the receipt itself is drawn up by his legal representative, including signing with his data and the corresponding mark on the receipt.

If there are several sellers

If several sellers are involved in the purchase of an apartment, who own the property in equal or different shares (for example, a husband and wife), then a receipt is drawn up by each individual seller indicating the amount of money due to him. At the same time, it is very important that everyone writes a receipt with their own hands, and does not entrust this matter to someone alone and only put their signature at the end.

Under no circumstances should you succumb to the persuasion of sellers that you can draw up one receipt in which you will list all the participants and the amount of money they are entitled to for their share in the apartment. This can lead to disastrous consequences.

If the seller has a representative

For many reasons, the owner of the apartment cannot always participate in the transaction - drawing up a receipt and transferring money, so his interests are represented by a trustee. Only the person who acts and represents interests on the basis of a concluded notarized power of attorney can be called a proxy. In this case, the legal representative must provide you with his passport and the original certified power of attorney from a notary (no photocopies). The power of attorney is issued for one year and the expiration date of the document must be indicated.

Before you draw up a receipt and transfer funds to him, carefully read the text of the power of attorney. Study the information about who trusts whom and what - representation of what interests (specifically, the disposal of property) and whether the authorized person has the right to sign when carrying out financial transactions. If the legal representative has a general power of attorney, then it implies the implementation of any actions on behalf of the owner of the apartment. If the text of the power of attorney or its authenticity confuses you, then before transferring funds, it is better to check it in the EIS register of notarial affairs.

Receipt validity period

The validity period of the receipt is three years. This is exactly how long the statute of limitations is for a claim in civil cases. The limitation period for claims begins to run from the moment a citizen learns that his rights are being violated.

If the receipt indicates a specific date when the amount must be transferred, then the period begins to operate and count from this date. If such a date is not specified, then it begins to count from the date when demands are sent to the buyer to transfer the required amount to the seller.

For example, if we have made a deposit payment and undertake to pay the balance of money in a certain amount, then the validity period of such a receipt has not yet come. If such a date is not specified in the text, then it is considered that the money will be given at the first request of the seller. The claim period begins from the moment the seller receives notice of the transfer of money. If the money is not transferred within three years, it will expire.