Giving is a very common phenomenon in everyday life of society. Citizens often have questions about how to issue a deed of gift for a house and land to their relatives or friends while spending minimal financial resources and at the same time protecting themselves as much as possible from various kinds of legal conflicts.

The donation agreement for a house and land does not require significant material costs and time. At the same time, a well-drafted deed of gift fully protects the rights of all participants in the transaction. This applies to cases when one of them will be a participant in divorce proceedings, or will die suddenly, which is a significant factor in favor of this document.

To formalize the donation of a residential building with a personal plot, you need to know a number of important points during its legal registration. We'll talk about this in this article.

Features of donating a residential building

According to the law, a residential building is an individual structure consisting of rooms, utility and other premises. It will not be possible to give a high-rise building as a gift - it is owned by several citizens, and alienation in favor of one person will require the will of all owners.

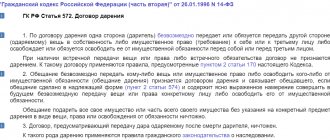

The owner of a residential individual house has the right to give it to any person, but it is important to observe several features. According to Art. 572 of the Civil Code of the Russian Federation, a gift agreement (hereinafter referred to as DD) implies a gratuitous transaction, because the donor has no right to demand money or services from the recipient.

There are other conditions:

- real estate cannot be donated by actual transfer - the right of ownership to it is given;

- the house is alienated only with the land plot on which it is located (donation separately is prohibited (Article 35 of the Land Code of the Russian Federation);

- household appliances, tools, furniture and various devices located in the house will not be transferred to the donee unless they are indicated in the deed of gift;

- the donee's right of ownership arises not from the moment of signing the DD, but from the date of registration of such right in Rosreestr;

- If the house is mortgaged, the written consent of the mortgagee will be required for alienation.

Important! If the house was purchased by the donor during marriage, the consent of the spouse must be obtained. Real estate transactions made without consent can be challenged by the spouse within 1 year from the moment it became known about the alienation of property (Article 35 of the RF IC).

Donation of a house on a rented plot

If a house is built by a donor on a rented plot of land, the building itself can be donated, but the transaction must be agreed upon with the owner of the land, because the rental agreement will need to be renegotiated.

If the plot with the house belongs to the donor and is rented out under a lease agreement, before drawing up the deed of gift, you need to negotiate the terms of the transaction with the tenants. You should also look at the rental agreement itself regarding early termination.

There are two options here:

- real estate is donated, the donee continues to rent it out to tenants;

- The lease agreement is terminated and a deed of gift is drawn up.

It is important to consider that if employers do not agree to early termination, they will be able to go to court to resolve the issue.

Donating a house for different forms of ownership

Property can be joint or shared. In the first case, the house belongs to several citizens on equal rights, in the second, shares determined by them are allocated by agreement.

If the house is jointly owned, the consent of the other owners will be required for the donation. You can also agree on the allocation of shares: in this case, you will not have to obtain permission, but the DD will be notarized.

Where to submit?

The deed of gift is issued at the MFC or Rosreestr. The website allows you to pre-register for an appointment. When contacting the MFC, the Center accepts documents, helps fill them out (if necessary) and independently submits them to Rosreestr for registration.

Reference! The registration authority must be located at the location of the object of the donation or the registration of the participant in the transaction. Otherwise, the procedure will take longer.

Form of gift agreement

Donation is made in two ways - orally or in writing. To transfer a house as a gift, only written form is used, because... a completed contract form will be needed to register the transfer of ownership in Rosreestr.

Another condition is the presence of signatures of the donor and the recipient. If they cannot sign in person, it is allowed to issue a deed of gift with qualified electronic signatures (Article 6 of the Federal Law dated 04/06/2011 No. 63-FZ). An alternative option is to draw up a notarized power of attorney for another person who will represent the interests.

Features and procedure for donating a land share for agricultural purposes

What is more profitable: an exchange agreement or a gift agreement?

Possible difficulties

Ideally, both the plot and the house are accounted for and registered in the Unified State Register of Real Estate. The register contains information about objects since 1998. The right to real estate acquired earlier must be confirmed in Rosreestr . This can be done before registering the donation or at the same time with an additional statement.

Attention! It is impossible to give a plot and a house that are not officially registered with the owner, even if they are de facto his.

If there are no paper confirmations of ownership rights (in fact, the land is used illegally, and the house is a self-construction), they need to be legalized through a “dacha amnesty” or in court before the deed of gift is issued. But the absence of exact boundaries of the plot, which is registered in the cadastral register and recorded in the Unified State Register of Real Estate, will not become a basis for refusal of registration.

Who can you give a house to?

The owner of a residential premises has the right to give it to any person:

- close relative: mother, father, children, sister, brother, spouse;

- to a third party (acquaintances, friends, etc.).

Note! After signing the deed of gift and registering with Rosreestr, the donor loses ownership rights, so the identity of the donee must be approached as responsibly as possible if you want to continue living in the house in the future.

Donating a house to children as a maternity capital obligation

According to Art. 10 Federal Law dated December 29, 2006 No. 256-FZ, parents who have used funds under the maternity capital program to build or buy a house sign a notarial obligation to allocate shares to all family members, incl. and children.

Shares can be allocated by drawing up an agreement of the same name, or through the execution of a deed of gift.

This must be done within six months after the Pension Fund transfers money to the seller, pays the last installment under the purchase and sale agreement, fully repays the mortgage or settles with the organization that built the housing.

Gift between spouses

According to the law, property purchased during marriage belongs to the spouses in equal shares and is jointly owned without actual separation (50/50). In order for a wife to give a house to her husband, the shares must be allocated by agreement, after which she will be able to draw up a deed of gift for it.

If the real estate belongs to the donor solely on the basis of a marriage contract, shares are not allocated, and the consent of the second spouse is not required.

Property received during marriage by the donor as a gift, inheritance or before marriage belongs only to him. He has the right to give housing to his wife without obtaining her consent.

Important! If the donor intends to give the house to a third party, in the absence of a marriage contract or agreement on the allocation of shares, the consent of the spouse must be obtained.

Donating a house to the state

Donations to state or municipal institutions are allowed, but with some restrictions:

- You cannot make gifts to employees of such organizations if the transaction is related to their official position and the value of the gift exceeds 3,000 rubles;

- if the donor is a legal entity, the transaction is carried out in agreement with other owners, if this is provided for by the terms of the charter.

Legal advice: if the house is planned to be used for socially beneficial purposes, and the role of the donee is a non-profit organization (hospital, school, social institution, etc.), instead of a standard deed of gift, it is better to draw up a donation agreement and indicate exactly how it should be used. If these conditions are not met, the donor will be able to cancel the transaction (Article 582 of the Civil Code of the Russian Federation).

Do I need to certify?

The deed of gift can be drawn up independently or with the help of a notary. In the first case, notarization is not necessary.

But his participation will guarantee the fulfillment of obligations. According to Federal Law No. 218 (Article 54) of July 13, 2015, the deed of gift must be certified by a notary if the donor is a minor or incapacitated citizen.

Certification of the deed of gift will also be required when donating a share of property (if one of the owners is involved).

Is notarization required?

Despite the mandatory written form, the signature and seal of a notary will only be required if a share in the property right is alienated.

Cost of notary services when donating a house

If the DD is subject to mandatory notarization, a state fee is paid in accordance with Art. 333.24 Tax Code of the Russian Federation. It is calculated from the cadastral value of the house and land and is 0.5% (not less than 300 and not more than 20,000 rubles).

Calculation example:

A house and a plot of land with a total value of 5 million rubles are donated. The notary fee will be:

5,000,000 x 0.5% = 25,000 rub.

Due to the restrictions established by the Tax Code of the Russian Federation, the maximum amount applied to payment is 20,000 rubles.

If notarization is not necessary, the parties can turn to a notary for their own protection: a deed of gift with his signature is more difficult to challenge.

In this case, the notary fee is paid in accordance with Art. 22.1 “Fundamentals of legislation on notaries” - it depends on the value of the object and the family ties of the donor and the donee:

- Alienation in favor of a relative: child, spouse, mother, father, brother, sister with a real estate value of up to 10 million rubles. 0.2% +3,000. If housing costs from 10 million - 0.1% of the amount over 10,000, plus 23,000.

- Donation to other persons with a value of up to 1 million – 3,000 + 0.4%; from 1 to 10 million – 0.2% + 7,000; from 10 million – 0.1% + 25,000.

The maximum tariff cannot exceed RUB 100,000. If the payment is calculated to be 200,000, the maximum allowable amount is actually transferred.

Is it possible to challenge?

A contract can be declared invalid for several reasons, some of which are specific only to gift transactions.

The following are common:

Giving is against the law. This is recognized as a transaction, the purpose of which is to protect property from foreclosure or to deprive someone of the right to buy out a share before others. It is also a gift made under duress, as a result of deception, etc.- The agreement was concluded contrary to prohibitions. Art. 575 of the Civil Code of the Russian Federation defines them: it is impossible to give on behalf of minors and incompetents; teachers, educators and doctors, their relatives on behalf of students and patients, their relatives; work officials; between commercial organizations (LLC, PJSC, individual entrepreneur, etc.).

- The agreement was concluded contrary to prohibitions. It is impossible to give property acquired during marriage, etc., on behalf of the husband without the consent of the wife and vice versa.

- The contract involves some kind of payment or reward for the land and house (money, property, right). Such sham transactions often disguise the purchase and sale.

In most cases, the registrar will simply refuse to finalize the deed of gift. But if it is still committed, it is challenged in court. To do this, the participant in the transaction or another person has from 1 to 3 years, depending on the basis (Article 181 of the Civil Code).

A person not participating in the transaction (for example, an heir) is obliged to justify how the donation violated his right, interest, or what negative consequences it entailed. And prove that he cannot defend himself in any other way other than judicial intervention.

If the court declares the transaction invalid, the recipient must return the property to the property of the previous owner. If the donation disguises the purchase and sale, it will be reclassified with all the ensuing consequences.

How to draw up a donation agreement for a house and land: step-by-step instructions

If the deed of gift is certified by a notary, you can submit documents for registration through him - in any case, he transmits information about the transaction to Rosreestr and the tax service.

The service is provided free of charge; the recipient will only have to receive a new extract from the Unified State Register of Real Estate.

When concluding a transaction yourself, you need to complete several steps:

- Notify the donee of the intention to donate property.

- Draw up and sign the DD.

- Submit documents for registration to Rosreestr or MFC.

- The recipient - receive an extract from the Unified State Register of Real Estate.

Let's look at the stages in detail.

Step 1: agreeing on the transaction with the donee

First, you need to agree on the donation with the recipient of the property - he has the right to refuse the transaction until the ownership is re-registered.

Step 2: signing the deed of gift

When the terms are agreed upon, a contract is drawn up and signed.

The following documents will be needed:

- passports;

- cadastral passport;

- certificate of ownership or extract from the Unified State Register of Real Estate;

- a document on the basis of which the donor’s ownership arose: certificate of inheritance, deed of gift, purchase and sale agreement, etc.

Important! If a representative acts on behalf of the donor or recipient, a power of attorney is required. Without it, a stranger has no right to sign on behalf of the owner, and besides, its details are included in the contract.

Contents of the gift agreement

To prevent the registrar from refusing to re-register ownership rights, the deed of gift must include detailed information about:

- donee and donor: full name, registration addresses, passport details;

- property: address, year of construction, area, number of rooms, details of title documents, etc.;

- the date of commencement of execution of the transaction: after signing, on a specific day or upon the occurrence of an event (if a contract of promise of gift is drawn up);

- responsibilities, rights and obligations of the parties;

- conditions for termination of the DD.

At the end, the donor and recipient sign. Each person receives one copy of the agreement, the third is drawn up for the registrar.

Sample agreement for the donation of a residential building and land: alt: Agreement for the donation of a residential building and land

Sample agreement for donation of a share of a house and land: alt: Agreement for donation of a share of a house and land

Step 3: registration with Rosreestr

The parties need to submit documents for re-registration of the house to the new owner to Rosreestr, or through the one-stop service - MFC. Both must be present.

If the property is given to a child under 14 years of age, he does not come - his interests are represented by his mother or father. You should contact the agency at the location of the property.

Documentation

For registration, documents used to formalize the deed of gift are provided.

Additionally, you will need the contract itself: on its basis, ownership is re-registered, then it is returned to the donee with the registrar’s notes upon receipt of the extract.

State duty

The donee pays the duty. For individuals the amount is 2,000 rubles, for organizations - 22,000 rubles.

Step 4: obtaining an extract from the Unified State Register of Real Estate

10 days after submitting the documents, the new home owner needs to come to Rosreestr or the MFC for an extract, where he will be indicated as the owner.

Note! Some MFCs provide home delivery of documents for a small fee - about 300-500 rubles. If you wish, you can use this service by paying separately from the state fee.

Content

The agreement is prepared in writing. After signing, it, along with other documents, is handed over to the Rosreestr office.

The deed of gift includes:

| Paragraph | Content |

| Transaction participants or representatives | Last name, first name and patronymic, passport details, permanent residence address in exact accordance with the identity card, including abbreviations. There can be several donors, as well as recipients. Depending on the number of participants, sign the required number of copies of contracts: for 3 - 4, for 4 - 5, etc. One person cannot simultaneously be a participant in a transaction and a representative of the other party. If a mother wants to give land and a house to her young son, the father or a guardianship official signs for him |

| Subject of the transaction | Cadastral number, location, area, category and purpose of the land. Cadastral number, address, square footage, number of storeys for the house. Data is taken from an extract from the Unified State Register of Real Estate |

| Proof of ownership | Details of the extract or other document, date and reasons for receipt |

| Price | Optional item. As a rule, they use the estimated or cadastral value at the choice of the parties to calculate personal income tax |

| Restrictions and encumbrances | Arrests, easements, pledges, etc. |

| Persons retaining rights of use | Optional item. Moreover, some courts perceive this as a reciprocal favor on the part of the donee, which violates the conditions of gratuitousness and unconditionality |

| Transfer rules | They can be described in the text of the contract, but, as a rule, a separate act is drawn up for them |

| Rights and obligations of the parties, liability of the parties, force majeure, dispute resolution | Optional items |

| Final provisions | List of accompanying documents with details, signatures of the parties with transcripts |

Challenging a residential building donation agreement

You can challenge the deed of gift on the grounds specified in Art. 578 and in other provisions of the Civil Code of the Russian Federation:

- death of the donor through the fault of the donee: the heirs have the right to challenge;

- conclusion of a DD within six months after the donor is declared bankrupt, if the housing was purchased with funds from business activities;

- registration of a deed of gift under the influence of delusion, threats, blackmail;

- drawing up a DD by an incapacitated person;

- transfer of property as a gift by a citizen unable to understand the legal consequences;

- causing harm to the health and life of the donor or his close relatives by the recipient.

Donors themselves, legal representatives or third parties authorized to file a claim can go to court to challenge it.

Rules for drawing up paper

When drawing up this document, it is imperative to record items that should contain the following information:

- Information about the parties. In the first paragraph, you need to identify the parties who enter into the agreement. For example, the donor, the recipient, any third parties.

- Information about the subject of the donation. In the second paragraph you need to indicate the subject of this agreement. Indicate the cadastral number, immovable objects that are located on the land being donated. For example, private houses, the area of the entire plot as a whole, as well as the purpose of the target type of this very land.

- Price. In the third paragraph, write the price that corresponds to the standard. For example, they write the cost of the allotment indicated in the attached deed.

- Assessment of objects. In point number four, you need to indicate the ratings assigned to certain real estate objects located on this land. For example, there are two one-story houses on the land. In order for everything to be formalized correctly, it is necessary to evaluate each of them and enter the figures into the donation agreement, provided that this property is transferred to the donee along with the land.

- Existing disputes regarding the subject of the deed of gift. In the fifth paragraph, it is necessary to specify all the disputes that currently exist regarding the subject of the donation.

For example, a donor inherited a plot of land and decided to give it to the donee, but a third party appeared who also has rights to this land thanks to the inheritance law. It turns out that a dispute arises between the donor and a third party, which must be recorded in the deed of gift. - Encumbrances. In the next paragraph, number six, all the encumbrances that lie on this land should be spelled out. For example, various easements, transfer of land for rent, land being pledged to a bank, land transferred for temporary use, etc.

- Are there any restrictions? In the seventh paragraph, you need to indicate the restrictions that are imposed on the site regarding its use. We are talking about restrictions that are due to the fact that a technological or sanitary-protective type zone is installed.

Restrictions may also be imposed due to the fact that the entire land or its fragment is on the list of recreational, environmental sites or those that have cultural and historical significance.For example, certain construction or performance of any work may be prohibited on this land.

- Duties of the parties. Point number eight states the obligations that the parties will be required to fulfill. For example, the donor undertakes to donate a plot of land, and the donee must accept it. All this must be officially recorded.

- Final provisions. In the last paragraph, number nine, you need to write down certain final provisions. For example, the moment from which the agreement fully comes into force, the number of copies of this document, the amount that will be spent on paying the costs associated with its execution, as well as a list of integral annexes.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 350-29-87Moscow

When drawing up such documents, many experts advise taking into account all possible scenarios . First of all, you need to provide for the worst options. For example, if the donor, after completing the entire procedure, suddenly wanted to return his land back. The motivation for such an act can be very different, but most often such a citizen claims that at the time of concluding the contract he was misled by the second party.

To avoid such situations, the contract must initially record the results of a psychological examination, which will confirm the legal capacity of all parties.

It would also be useful to state the fact that the agreement was not concluded due to a combination of certain life circumstances of a difficult type.

Further, it is better to point out that this agreement does not constitute a hard bargain. In addition, you can also have the document certified by a notary. This can also play a certain role if the situation turns out unexpectedly.

In addition to complying with the formal conditions of drawing up an agreement, it is also necessary to pay attention to what documents are needed to donate a plot of land or a house.

Arbitrage practice

It is difficult to invalidate a deed of gift, but it is quite possible if you present the court with maximum evidence and justify your claims.

This is confirmed by real decisions made by courts in different regions:

- Decision No. 2-4547/2018 2-4547/2018~M-3264/2018 M-3264/2018 dated October 10, 2021 in case No. 2-4547/2018;

- Decision No. 2-1337/2018 2-1337/2018 ~ M-1515/2018 M-1515/2018 dated June 8, 2021 in case No. 2-1337/2018;

- Decision No. 2-94/2017 2-94/2017~M-752/2016 M-752/2016 dated May 16, 2017 in case No. 2-94/2017.

Lawyer's answers to frequently asked questions

Is it possible to draw up a deed of gift for a house using a power of attorney?

It is possible, but the deed of gift must be certified by a notary.

What happens to the donated house after the donor dies?

If a real DD is drawn up and the donee is listed as the new owner, the house is not included in the inheritance estate. If a promise of gift agreement is drawn up and the donor dies, his obligations pass to his heirs (Article 581 of the Civil Code of the Russian Federation).

Is it possible to donate a house that is pledged to a bank?

If a house is purchased with a mortgage or pledged to a bank when applying for another loan, transactions with it are carried out only with the consent of the lender.

Is consent required for the donation of a house from the people registered in it?

No, consent is not required. The owner has the right to dispose of the property at his own discretion, but before signing the DD, everyone must be signed out.

Is it necessary to draw up a transfer and acceptance certificate when donating a residential building?

It is not necessary, but the parties can arrange it if they wish. It confirms the actual transfer of the gift, and it can reflect possible shortcomings.

Who can apply?

The owner has the right to donate property to any citizen at his own discretion. But only in the case of close relatives, along with the rights to the house and land, they will not be required to pay tax on the income received. Who does the law classify as close relatives? To answer this question, you should turn to family law (Article 14 of the Family Code).

Close relatives include:

- in a straight line: children, grandchildren, parents, grandparents;

- blood: sisters and brothers with whom only a father or mother is common;

- adopted children.