Limitation period for housing and communal services payments

Utilities provide their services to consumers in the form of water, electricity or gas services. In return, they require timely payment of payment into their bank account. Various situations occur when the consumer did not manage to pay for utilities on time, and a debt arose at a specific address. The onset of the debt period is marked by the accrual of penalties until the debt is repaid. If this debt is quickly liquidated, then utility services meet their consumers halfway and do not take radical measures.

But not all consumers are good citizens. For some, the debt accumulates for months, and then the utility provider can impose penalties on them, even stopping the supply of services until the arrears are fully paid.

When no methods work for the consumer, the utility company can seek help from the court. If the statute of limitations has not expired, the court will accept the statement of claim from the enterprise and begin to consider the case.

The limitation period begins on the next day after the due date for payment of utilities, or according to the deadline established by the contract. The general limitation period lasts for three years. If during these three years at least some part of the debt was paid, then the limitation period begins anew from that very day. Also, the limitation period can be extended by agreement of both parties, as specified in the articles of the Civil Code. The Supplier has the right to set its own limitation periods.

Judicial review of a debt case

At the initial stage of debt formation (up to 3-6 months), housing and communal services representatives use their own methods of influencing premises owners: sending notifications, calling or even visiting. If the measures do not bring results, the housing and communal services organization goes to court.

However, often the statement of claim is sent after a period of time significantly exceeding the statute of limitations. At the same time, the lawyer from the housing and communal services will not report the end of the period, since he has the right to withhold this information.

To reduce the amount of payments or cancel them completely, the defendant is required to declare the application of the statute of limitations. According to paragraph 11 of the Resolution of the PVS No. 43 of September 29, 2015, this can be done in free form, in writing or orally. It is important to inform about your right before the court decision is announced, otherwise the entire amount of the obligation will be collected from the debtor. Mostly, an application for the application of a limitation period is drawn up in writing (clause 2 of Article 199 of the Civil Code of the Russian Federation).

Article 199. Application of the limitation period (Federal Law No. 51)

Sample application for application of limitation period

The document is filled out in free form indicating the defendant’s personal data and contact information. Address the paper to the court where the debt case was filed. Usually this is the district authority at the citizen’s place of residence or a justice of the peace (based on the amount of obligations). The text describes the current situation and asks to use the statute of limitations. It is recommended to refer to the articles that are the basis for the implementation of the right (Articles 199, 196, 200 of the Civil Code of the Russian Federation). If additional documentation is attached to the application, it is indicated at the end. Next, they sign and set the date.

Example of a statement on the use of a limitation period

The paper is sent to the court at any stage of the process, but always before the final decision is announced.

List of documents

The application is accompanied by documents confirming the information stated in the text or during the hearing of the case:

- housing and communal services receipts for the previous 3 years;

- if the debtor does not agree with the assigned amount, he provides his own calculations;

- in case of difficult financial condition, indicate its reasons by attaching certificates from work, disability, credit obligations, and so on;

- other clarifying documents involved in the case.

Regular non-payment of housing and communal services receipts in just a few months creates an impressive amount of the amount to be collected. The longer a property owner does not pay for utility bills, the more difficult it becomes to get out of the debt hole. Using the statute of limitations, which is 3 years for utility payments, allows you to reduce or cancel the accrued amount. However, to do this, it is important to notify the court of your right and not take actions indicating recognition of your debt.

Payment deadline for housing and communal services for the previous month

It would seem that there is nothing simpler than the procedure for paying housing and utility bills. However, many payers often cannot figure out by what date and for what month it is advisable to pay all utility bills. Sometimes, a delay of several days can spoil the reputation of a conscientious payer for the worse.

When paying for utilities, you should definitely consider how long it will take for your money to reach the supplier's bank account. It all depends on the specific method of payment for receipts. Even if you pay the receipts on the last day of the due date, a debt may arise.

Utility workers advise their customers to make all payments on time. Therefore, every 20th day of the current month is the deadline for paying utility bills for the previous month. Even if the utility workers did not bring you a receipt, this does not exempt you from paying for the current month. All you have to do is go to the Housing Office at your address, and you will be provided with a current receipt for payment, taking into account any outstanding debts.

Voidable transaction

Voidable transactions can only be declared invalid in court proceedings. Here are examples of voidable transactions:

- One of the parties entered into the transaction as a result of fraud, coercion, or threat from the other party.

- The victim entered into a transaction as a result of being materially misled. For example, when instead of a two-story country house, the buyer received a dilapidated two-story barn.

- The transaction was concluded by a person with limited legal capacity. This includes people who are addicted to alcohol or drugs.

- The transaction was concluded with a child between 14 and 18 years of age without the consent of parents, guardians or trustees.

- The deal was concluded for an apartment, not all of whose owners gave their consent.

After the transaction is declared invalid, both parties must return to the original owners everything they received under the transaction. The buyer returns the property, and the seller returns the money. If something happens to the property and there is no way to return it, it is necessary to reimburse the cost.

Storage period for housing and communal services payment receipts

Sometimes unforeseen situations happen when money does not arrive in the supplier’s bank account. The consumer conscientiously pays invoices for all services received, but somehow a debt appears on his personal account. In this case, the consumer will have to contact the housing and communal services office to reconcile the payments made. But for this you need to have payment receipts for a certain period.

Then the question arises, for how long should you keep receipts for payment of utility services? If you are aware of this issue, you will be able to avoid unfounded claims from utility services and prove that you are right.

Currently, many consumers use more convenient services to pay for utilities than paying through a bank. Therefore, if you decide to pay receipts using the Internet, then you should definitely print out a payment receipt. After all, in the event of a computer failure or the liquidation of the site, the check will be the only confirmation of payment.

Utility providers advise their customers to keep all receipts for three years. In this case, you can make a reconciliation with utility services every year with a printout of payment statements for the entire period. This document should also be placed in the folder with paid receipts, and provided to the supplier’s employees if a debt is discovered.

State duty amount

According to Article 132 of the Code of Civil Procedure of the Russian Federation, along with the statement of claim, it is required to attach, in addition to the necessary materials, a receipt for the transfer of state duty.

In its absence, the court will return the claim to the plaintiff (Article 135 of the Code of Civil Procedure of the Russian Federation). The plaintiff in legal proceedings regarding utility payments can be not only the housing and communal services, but also the owner of the house. If the charges for housing and communal services were inflated, for example, water or heating was supplied intermittently, the owner of the apartment may demand a recalculation of payments. If the CP refuses to recalculate the payment for services on a voluntary basis, the owner of the property may file a claim in court.

The owner of the apartment is considered by the court as a consumer who is not associated with the business and acts in personal interests. In this option, the consumer’s claim for an amount of up to 1 million rubles is not subject to state duty (clauses 2 and 3 of Article 333.36 of the Tax Code). Therefore, when a consumer submits a claim to housing and communal services, a receipt for state fees is not attached. Instead, the application provides a reference to the legislative provision on exemption from state duty.

If the plaintiff is the housing and communal services sector, then in this case the management company or the management company are obliged to transfer the state duty. The amount of the state fee depends on the amount of the claim. The state duty is transferred according to the details of the magistrate at the defendant’s residence address.

Below is a table for determining the amount of state duty.

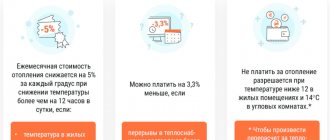

Penalties for late payment of housing and communal services

There are cases when a person is not in the city, or does not have time to contact the bank to pay for all consumed utilities. In this case, a fine in the form of a penalty will be applied to him for the delay in payment of payments. Penalty is the initial method of influencing defaulters. With its help, utility services try to reason with their customers and not drag the matter into litigation.

The consumer is given 30 days from the date indicated on the receipt to pay for housing and communal services. If a person does not make a payment within these required 30 days, then from the 31st day a penalty will be charged at a rate of 1/300 of the refinancing rate. 90 days are allotted for accrual of penalties.

During all this time, penalties will accumulate, creating even greater debt. Therefore, the consumer is advised not to delay the process of paying debts, and be sure to come to the bank to repay the debt. At the end of the penalty period, utility services will be forced to disconnect the consumer from receiving their services or go to court to resolve this issue.

What does the law on writing off debts for housing and communal services say in 2021?

Content

On October 1, 2019, new procedural rules came into force, as a result of which new courts were created, amendments were made to the requirements for claims, and only lawyers will be able to attend meetings. In total, more than 500 amendments were made, which are reflected in Law No. 451-FZ of November 28, 2018 “On Amendments to Certain ...”. Also, the State Duma proposed a new procedure for writing off bad debts for housing and communal services. These changes were proposed to introduce amendments to the Housing Code of the Russian Federation. The law on writing off debt for housing and communal services proposes writing off accumulated debts that have no prospect of being repaid.

The criteria within which debts will be recognized as bad are as follows:

- Debt on housing and communal services payments.

- The presence of debt registered with citizens and individuals.

- Collection of arrears is impossible due to the corresponding court decision:

- Refusal of the claim.

- Determination of refusal to renew an expired LED.

That is, debts for individuals with expired IDs, which are unrealistic for collection, will be written off. According to Art. 196 of the Civil Code of the Russian Federation - requirements for the collection of overdue debts for housing and communal services are permissible within the limits of the LED, which is 3 years.

In reality, debt write-off in 2021 will be carried out in the following circumstances:

- Death of a homeowner who is in arrears.

- Liquidation of the institution that owns the building.

- Bankruptcy of an individual who owns the property.

- End of the SID for utility payments accounted for by the owner of the property.

- Declaration of an individual as insolvent.

How to protect yourself from scammers and lawsuits

Before concluding any real estate transaction, especially on the secondary market, carefully study all documents and owners. Errors, forgeries, lack of consent of one of the owners - all this can lead to the transaction being declared invalid.

The main step when checking real estate is obtaining an extract from the Unified State Register of Real Estate. In it you can see all the main characteristics of the property, information about the owners, sales history, the presence of encumbrances and many other factors that may be a warning sign. If you see that the seller has owned the property for more than three years, then there is much less risk.

Order an extract from the USRN right now!