On March 18, 2021, changes to the Federal Law “On additional measures of state support for families with children” came into force, tightening the requirements for organizations that have the right to work with maternity capital. The amendments prohibited other organizations from working with maternity capital, except for:

- Credit institutions that have a license to carry out banking activities;

- Consumer credit cooperatives (CCCs), which are members of an existing SRO and have been operating on the market for more than 3 years;

- JSC "DOM.RF" (formerly JSC "Agency for Housing Mortgage Lending").

These measures made it possible to exclude organizations whose activities are not controlled by the Central Bank of the Russian Federation. According to legislators, the changes will clear the market of unscrupulous players and various fraudulent schemes for cashing out government support funds.

What can M(s)K funds be spent on?

According to the state support program, funds from the maternal (family) certificate can be used:

- To improve living conditions - purchase housing suitable for living with children, pay a mortgage loan, spend funds on housing construction;

- For the education of children - payment for the services of preschool and school institutions, payment for secondary vocational and higher education, funds can be spent, including on paying for private kindergartens;

- For families with low incomes, they have provided the opportunity to receive payments and maternity capital in the amount of 1 minimum wage;

- For the purchase of goods and services for the social adaptation and integration of disabled children;

- To form the funded part of the mother’s future pension.

According to the Pension Fund of the Russian Federation, statistics on the use of maternity capital funds are as follows:

- To improve living conditions - 59.23%;

- For monthly payments – 30.23%;

- For education of children - 10.44%;

- For mother’s funded pension – 0.08%;

- Social adaptation and integration of disabled children – 0.02%.

When do you need to start issuing a certificate?

The current Russian legislation does not provide for a time limit for registering maternity capital at the birth of a second child. This can be done either immediately after discharge from the hospital or much later. In this regard, there are simply no restrictions for young parents.

Thus, citizens can apply for a certificate at any time convenient for them.

The document itself, in addition to the personal data of its owner, contains information about the amount of maternity capital. At the same time, the MK itself is periodically subject to indexation. In this case, many believe that it is necessary to change the certificate itself after each increase.

In practice this is not the case. Indexation occurs automatically for all persons entitled to maternity capital, including if part of the funds has already been spent previously. Information about the balance of funds can be obtained by ordering a certificate from the Pension Fund of the Russian Federation or by going to the personal account of the insured person on the fund’s website.

Loans for maternity capital in KPK

Tighter requirements for organizations working with maternity capital have further contributed to the popularization of services provided by credit consumer cooperatives - loans against maternity capital. There are several reasons for this:

- Firstly, not all citizens have access to banking services;

- Secondly, lower requirements for the candidacy of the borrower and the objects for the purchase of which maternity capital funds are planned to be used;

- Thirdly, the application processing speed is higher, since assessment and insurance of the object is not required; some cooperatives in promotional materials claim that if all documents are available, they can transfer money on the day of application.

- Fourthly, there is the possibility of purchasing housing, the cost of which does not exceed the amount of the remaining maternity capital.

Scheme of work of a cooperative with maternity capital

Since until the child reaches 3 years of age, with whose birth the family has the right to maternity capital, the funds can only be used to repay a loan or a loan for the purchase/construction of housing, cooperatives operate according to the following scheme:

- The owner of the certificate becomes a member of the CCP;

- Selects an object that he plans to purchase using maternity capital funds;

- Fills out an application for a targeted loan for the purchase of finished or construction of new housing;

- The credit committee of the cooperative makes a decision on the application; if approved, the funds are transferred to the borrower’s account;

- The borrower enters into a transaction and, after the transaction, submits an application to the Pension Fund of the Russian Federation for the disposal of maternity capital funds, in which he asks to send funds to repay the targeted loan to the cooperative;

- The pension fund considers the application, if approved, sends MSK funds to the cooperative - if the debt under the loan agreement is equal to the balance of MSK funds, then the agreement will be fulfilled;

- The cooperative removes encumbrances from the facility;

- The borrower-shareholder submits an application to leave the cooperative.

Let's look at each stage of work in more detail:

Joining a cooperative

When joining a cooperative, an application is written addressed to the chairman of the board, usually on KPK letterhead, and entrance and share fees are paid. The amount of contributions is set by the cooperative itself; these can be symbolic amounts of 100 or 200 rubles, or more tangible ones. The voluntary share contribution will be returned after the shareholder leaves the cooperative. Some cooperatives accept shareholders only after prior approval of a loan application.

Selection of object

The object can be selected by the borrower independently, but some cooperatives offer this stage as an additional service, or refer them to a realtor with whom KPK cooperates.

The object can be a share in an apartment (the room must be isolated and the purchase and sale agreement defines the procedure for using common areas), a room in a communal apartment, a communal apartment, a house, or part of a house. The property should not be included in the register of dilapidated and emergency housing. If a house is purchased, the cooperative may additionally request a certificate from the administration about the suitability of the house for habitation.

If a loan is issued for construction, then the land plot must be owned or under long-term lease and the borrower must have a construction permit in hand.

Loan application

As a rule, it is issued at the cooperative office. Attached to the application are documents confirming the right to government support for the borrower and his family members, and documents for the purchased object. The list in different PDAs may differ, so it is worth checking the list in advance.

Application decision

The application approval stage can take from one hour to several days. It depends on how the work is set up within the cooperative itself and on the completeness of the documents submitted by the borrower. During the consideration of the application, the cooperative may request additional documents, ask to replace the object, or additionally provide 1-2 guarantors if the borrower’s solvency is in doubt.

If the application is approved, after signing the loan agreement, funds can be transferred to the borrower’s account immediately or after registering the transaction. This point should be clarified immediately in the CCP, since it determines at what stage the real estate seller will receive the funds. Cash can be issued only if the loan amount does not exceed 100,000 rubles.

Submitting an application to the Pension Fund of the Russian Federation

An application for disposal of maternity capital funds can be submitted to the territorial division of the Pension Fund, through a multifunctional center, or through the State Services portal. It is preferable to submit documents through the MFC, since when applying through State Services, you will in any case have to take copies and originals of documents to the Pension Fund.

List of required documents for consideration of an application for disposal of maternity capital:

- Identification documents of the applicant;

- Application and information about the application (on PF form);

- Loan agreement;

- An account statement confirming receipt of the cash account from the CCP;

- Contract of sale;

- Extract from the Unified State Register.

In some regions, they are asked to provide an extract from the protocol on the borrower’s acceptance as a member of the CPC, as well as a payment order for the transfer of funds by the Cooperative.

Consideration of the application by the Pension Fund

Within 10 days, the Pension Fund makes a decision on whether to satisfy or refuse the application for disposal of maternity capital funds. If approved, the funds will be transferred to the PDA within 10 days.

The result of the application arrives at the address specified in the application; the result can also be viewed on the State Services portal in the corresponding section of the site.

Thus, the maximum period for transferring funds by the Pension Fund to the cooperative is 20 days from the date of filing an application for disposal of maternal (family) capital funds.

Removal of encumbrances from real estate

Since real estate is purchased with borrowed funds, Rosreestr automatically imposes a “mortgage by force of law” encumbrance on the object. After the loan agreement is executed, the borrower will need to contact the cooperative to remove this encumbrance. The cooperative cannot remove the encumbrance on its own, since this stage requires the participation of both parties (Updated: The cooperative independently removes the encumbrance by submitting the appropriate application).

Leaving the cooperative

Cooperatives do not like to “inflate” the number of shareholders, since this complicates the process of holding general meetings and requires the formation of additional management bodies. And, despite the SRO’s comments about unfair practices, shareholders are excluded immediately after the loan is repaid. There are cases when cooperatives are asked to write an application for joining and leaving with an open date even before submitting an application for a loan. When leaving the cooperative, the shareholder's share contributions are returned.

Answers to the most popular questions

How to use maternity capital funds for construction without a loan from the CCP?

There are two options, the first is when you involve a construction organization. In this case, the Pension Fund will need to provide documents for the land plot, a construction permit and a contract.

Second, if you are planning construction on your own. In this case, the Pension Fund will transfer funds to MK in two tranches - 50% before the start of construction, and 50% 6 months after completion of preliminary work. Simultaneously with submitting the application, you must provide documents for the land plot, a building permit and the recipient’s details.

How long does it take for maternity capital to be transferred to the CPC?

If an application for disposal of maternal (family) capital funds is submitted to the Pension Fund of the Russian Federation, then the maximum period is 20 days.

If the application is submitted through the MFC, then the period for transferring funds, taking into account the delivery of documents, increases by 4 days and is 24 days.

If one of the parents has a bad credit history, will the cooperative issue a loan to improve housing conditions using maternity capital funds?

Cooperatives are loyal to the credit history of borrowers. If the loan amount is equal to or slightly more than the remaining maternity capital, then there will be no problems.

Is it legal to cash out maternity capital through a cooperative?

Any scheme for cashing out maternity capital funds is illegal; these actions are subject to liability under Art. 159.2 of the Criminal Code of the Russian Federation and it does not matter whose funds you use in this scheme: a loan from a bank or a loan from a cooperative. However, if your actions are truly aimed at improving the living conditions of your family, then there is nothing to fear.

How to remove the encumbrance from housing after paying maternity capital to the CCP?

After repaying the loan, the Cooperative can independently remove the encumbrance (as a rule, there are no problems with this), but it will not be superfluous if you remind about this. This can be done either verbally or by submitting a written application. If the cooperative ignores your requests, then the encumbrance can be removed through the court, and all expenses will be recovered from the cooperative.

What is the commission fee in a cooperative for a loan against maternity capital?

As a rule, the cooperative's remuneration consists of two parts: interest on the use of the loan amount (as of 09/06/2021 no more than 17%) and membership fees. On average, 35,000 rubles from an MK amount of 483,882 rubles, and 40,000 rubles from an amount of 639,432 rubles.

If the commission amount significantly exceeds the market average, then you should familiarize yourself with the conditions in more detail or look for another cooperative.

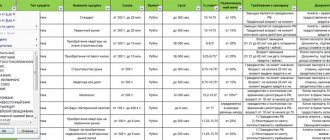

Which credit cooperatives can work with maternity capital?

Firstly, the cooperative must have been operating for at least 3 years. Secondly, the cooperative must be a member of the SRO and, thirdly, it must be included in the register of the Central Bank (the current list can be downloaded on the website of the Central Bank of the Russian Federation at the link ).

I know that many questions arise, since I have been working closely with maternity capital for 4 years now. Therefore, if you have not found the answer to your question, then ask it in the comments to this article. I’ll answer, discuss and add the most interesting ones to the body of the article!

How long does the review process take?

After a citizen contacts the Pension Fund with the relevant application and documents, its employees review the documents within 15 days, after which they issue a certificate in hand or provide a motivational refusal to do so. It should be noted that previously this period was 30 days.

It is also possible to refuse to provide a certificate . In practice, such cases are extremely rare and are associated, for the most part, with incorrectly executed documents. A citizen has the right to appeal a decision to refuse in court.

Attention! There are no clear deadlines for using funds from maternity capital. The family can use it at any time, at its discretion, for any available purposes.