Regional social mortgage programs

A social mortgage can be issued under a federal or regional subsidy program. And if federal ones are general for the whole country, then regional ones are relevant only for a specific region.

The government of each constituent entity of the Russian Federation has the right to create its own social mortgage lending programs for certain categories of citizens. That is, in one region there may be one preferential category, in another several, and in a third no benefits are provided at all.

Who can benefit from benefits in different regions:

- military personnel;

- state employees;

- teachers;

- doctors;

- scientists;

- large families.

Which social mortgage options are available in your region - check with your local administration. If you meet the conditions of a program, you can apply for a preferential housing loan at any bank in the region.

Credit criteria

All government spending is strictly controlled. Laws prohibit the provision of assistance to Russians who have a sufficient number of square meters. Accordingly, you will have to meet a number of criteria in order to qualify for affordable housing.

There are common features that can guarantee a positive decision from the lender:

- people living in apartment 1 with other families;

- couples who do not have square meters in personal property;

- registered persons in a communal apartment or hostel (but this does not take into account Russians who are in the city for training or seasonal work);

- living in premises that do not comply with area standards and SNiPs (the list is specified in the Housing Code of the Russian Federation).

Each banking program also has its own individual conditions. But if a loan applicant applies for state assistance, then the above requirements must be met.

Social mortgage in Moscow

A separate social mortgage lending program has been created for residents of the capital, information about which can be found on the website of the Moscow Mayor. Citizens who registered as needing improved housing conditions before March 1, 2005 can receive special conditions.

The essence of the benefit is that the city government creates a list of municipal housing that it sells under the program at a discounted price. A formula for determining the price has been derived; the exact cost depends on the number of rooms, area of the apartment, area, etc.

The longer a Muscovite is registered as needing housing, the cheaper the apartment costs.

Decree of the Moscow Government on approval of the calculation methodology →

The real price of an apartment turns out to be 3-5 times lower than the market average. In addition, a 30% discount is given if the family has three or more children or a disabled child. If a third or subsequent child appears in the family with an existing mortgage, you can also get a 30% discount (the money will be used for partial early repayment).

Last changes

Changes at the end of 2021 - beginning of 2021 on mortgages at Sberbank occurred mainly for families with children. They are connected with the explanations of the provisions of the presidential decree given by V.V. Putin. First of all, the inaccuracy regarding the number of minors has been eliminated. Previously, the text of the legal acts contained a condition on the presence of two or three children in the family. Lenders, based on literal interpretation, did not consider the parents of four children as applicants.

The President explained that everyone who had two or more children during the established period will automatically be included in the list of beneficiaries.

The clause on the urgency of applying the 6% rate has been cancelled. Previously, spouses with two children received the benefit for three years, and families with three children enjoyed it for five years. After the amendments were made, a provision was approved that the reduced interest rate should be accrued for the entire term of the loan.

Another clarification concerned the Far East (rural areas of the region). For people living in remote areas, the head provided the possibility of issuing a loan for the purchase of secondary housing.

How to get a social mortgage in Moscow

If you meet the conditions of the program, that is, you registered as in need of improved housing conditions before March 1, 2005, you can initiate the registration of a social mortgage.

How it goes:

- You contact the Moscow Property Department directly or through the MFC and submit an application to make changes to your personal file. You also indicate there that you intend to take out a social mortgage. The application is signed by all family members.

- The department verifies and confirms your eligibility, after which you are given a choice of three family-friendly accommodations. If after inspection none of them are satisfactory, inspection of the next ones will be possible only next year.

- Choose any bank that issues mortgage loans. Go through the standard mortgage application process.

- If the bank has given approval, you enter into a purchase and sale agreement with the Department and register ownership.

Despite the fact that this is a social mortgage, an encumbrance is still placed on the purchased apartment. It becomes the property of the family: and if you do not fulfill your loan obligations, you can lose the roof over your head.

How is status assigned?

Low-income families are those families whose income does not reach the subsistence level established in the region. This indicator is calculated in this way: all family income for three months is summed up, divided by 3 (by the number of months) and then the result must be divided by the number of family members.

As a result, the average per capita income is determined, which is compared with the subsistence level established for a given period. If the cost of living exceeds the average per capita income, then the family has the right to receive the corresponding status.

Important! Only those families that find themselves in a difficult life situation (problematic financial situation) through no fault of their own, but due to unforeseen circumstances that are impossible to influence independently, can be recognized as poor.

Federal social programs

These social mortgage offers are already available throughout the country. No matter what city or region you live in, preferential housing loans are available everywhere under special programs.

The most common benefit is maternity capital. If you have the right to receive it, you can take out any mortgage for the purchase of residential property and use government subsidies. Matkapital works together with other social programs without exception.

What social programs for mortgages exist:

- Family mortgage for families with children;

- Rural mortgage;

- Mortgages with state support for new buildings.

Social programs are temporary, they have an expiration date. Upon completion, the program is either terminated completely or extended. And the list of social mortgages itself can be updated regularly.

Social lending has acquired characteristic features

- Buying a home with borrowed money.

- The funds are accumulated in an account or in a safe deposit box for transfer to the seller; the buyer himself does not touch the rubles.

- Property passes to the buyer upon execution of the purchase agreement.

- The property acts as collateral for the transaction.

- The encumbrance will be lifted only after full fulfillment of obligations to the bank.

- While repaying the loan, a person will not be able to donate the apartment, exchange it or sell it; even renting it out must be agreed upon with the lender.

- If there are systematic delays, the financial institution has the right to demand early repayment of the debt.

- State assistance does not cancel the client’s obligation to cover his part of the payment.

- When the payer refuses to pay off the debt, the creditor has the right to sell the property against the loan.

Loan without refusal Loan with arrearsUrgently with your passportLoans at 0%Work in Yandex.TaxiYandex.Food courier up to 3,400 rubles/day!

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

It is important to understand that for the entire period of debt servicing, the payer does not have the right to reduce the value of the collateral. This means that any long-term repairs will also need to be agreed upon with the bank.

Buying housing in new buildings

The most popular social mortgage today is with state support for the purchase of housing from developers. This could be an apartment or a house, a finished or under construction project. Its location does not matter - anywhere in the Russian Federation.

The social program was created in anticipation of the peak of the coronavirus pandemic. This is a special government support measure for people who were planning to take out a mortgage.

The pandemic caused a reduction in household incomes, and many were forced to abandon the idea of purchasing a home on credit. To support the construction industry and Russians, the government introduced social mortgages for new buildings.

Terms of a transaction:

- purchasing real estate from a developer;

- loan amount for Moscow and St. Petersburg and their regions - up to 12 million, for other cities - 6 million;

- down payment - from 15%;

- a preferential rate of 6.5% is established.

There are no more requirements. There are no criteria for the borrower or the type of property. Anyone can take advantage of a social mortgage for new buildings. The program is valid until July 1, 2021

Some banks give even better conditions. We recommend considering the offers of Alfa-Bank, Sberbank, VTB. The same Sber generally offers a rate of 0.1 or 2.05 for the first 1 or 2 years. So, you can make a deal even cheaper than 6.5% from the state.

What is this

Families with low earnings are unlikely to be able to afford a regular mortgage on a general basis. The amount of accrued interest for the use of borrowed funds can become simply unaffordable. An alternative to solving the housing problem for low-income citizens may be to obtain a social mortgage with state support.

Low-income citizens include those whose income does not exceed or equal to the subsistence level in the region of residence. As of the current date (beginning of 2022), it fluctuates on average around 10 thousand rubles. It is quite natural that a person with such earnings will not be able to get any loan, much less a mortgage.

Today in the Russian Federation there are 2 main programs being implemented, the main goal of which is to provide socially vulnerable and unprotected segments of the population with affordable housing - the Federal Target Program “Housing” and the subprogram “Providing housing for young families”. These programs are tentatively valid until 2022, but there is a high probability of their extension.

Assistance to the poor can be provided in the form of a reduction in the base interest rate, the allocation of a targeted subsidy from the budget, or a mortgage for housing built with the participation of regional authorities at a low price. In most cases, mortgages for low-income families are issued at AHML or a regular Russian bank, in favor of which, after some time, a social benefit (subsidy) will be transferred. Its average value is approximately 30-35% of the price of the purchased apartment.

Rural social mortgage

The program was created for citizens who want to buy real estate in rural areas. This could be a house or apartment, a primary or secondary market property, or you can take out a mortgage for the construction of your home.

Conditions:

- loan amount - up to 3-5 million rubles depending on the region;

- down payment - from 10%;

- term - up to 25 years.

Under the terms of a rural social mortgage, the state subsidizes the interest rate; as a result, the borrower enters into an agreement at only 2.7-3% per annum.

Banks receive limited subsidies under this program. So, at Sberbank the volume has already been completed; applications for this mortgage are not accepted. The situation is similar in many large banks.

Do they give loans and what programs can I take part in?

For some categories of citizens, it is possible to obtain a mortgage on preferential terms , that is, social (read about social and preferential mortgages here). Low-income families also have this opportunity, but this status must be obtained officially.

Low-income citizens can take part in the following programs to obtain a mortgage.

Social mortgage for young families

To implement this program, subsidies are allocated to those young people who are under 35 years old and must stand in line for an apartment. At the same time, young families with children can receive 40% of state support , and childless families - 35%. Read more about mortgages for a young family here, and you will find out what benefits there are for this loan upon the birth of a child in this article.

Military mortgage

The purpose of this program is to help provide housing for military families. Funds (budget) are periodically transferred to special accounts and accumulated there. They can only be spent on the purchase of housing, which can be purchased in any locality in the country. You will learn all the details about military mortgages in a separate material.

Lending to young professionals

The mortgage program for young professionals does not yet work in all regions of Russia. According to its terms, the following can take advantage of the offer:

- Scientists.

- Persons who agree to move to rural areas.

- Those who have worked in construction teams for a certain number of hours (150 or more).

The following program only works in those regions that have their own housing stock.

Support for citizens queuing for an apartment

This program provides assistance in the form of:

- Providing subsidies to repay a mortgage loan.

- Issuing a loan for social housing, which the municipality sells at reduced prices.

Program for families with children

Another popular social mortgage among Russians, which has already been used by thousands of families. If a second or subsequent child is born in a family after January 1, 2018 or later, the right to obtain a mortgage at 6% per annum arises.

Under the terms of the program, you can purchase a property only from the developer, with a down payment of 15%. If the family already has an existing mortgage, then when the right to the benefit arises, it can refinance.

All banks whose offers are available on Brobank.ru issue social mortgages. Everyone is authorized by the state to work with social programs. So, you can choose any one and apply immediately.

Underwater rocks

It is worth paying attention to the following points:

- If payments are not made, government funds will be confiscated and cannot be recovered again.

- It is very important to initially calculate the real possibility of making monthly payments in order to avoid negative consequences in the future.

- There should be no insurance commissions in the contract, since the state acts as a guarantor.

As a result, we can conclude that families who do not have the opportunity to buy housing on their own can successfully take advantage of government support (you can read about how to use a mortgage with government support, including for young families, here). For low-income families, special conditions are provided, that is, various forms of providing benefits from the state and from the bank. Due to their social status, they can repay the loan on special terms.

If you find an error, please select a piece of text and press Ctrl+Enter.

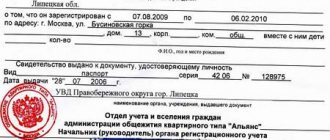

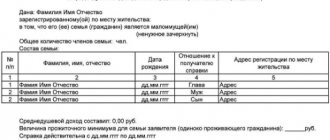

List of documents

To apply for a preferential mortgage in 2021, the borrower will need the following documents:

- statement;

- passports of all family members;

- children's birth certificates;

- tax registration document;

- extract from the house register;

- certificate of family composition;

- document from the place of work about length of service and salary;

- a copy of the work book;

- extract from the Unified State Register for the purchased housing;

- title documents for the apartment;

- certificate of registration of ownership of real estate;

- bank account details.

You can count on a social mortgage if the applicant does not have his own home, lives in a hostel or communal apartment, or rents an apartment. State employees living in the same area with relatives or in cramped conditions (less than 14 square meters per family member) are also entitled to preferential mortgages.