In the Moscow region there is a regional program “Housing”, the implementation period of which will end in 2027. One of its parts is a subprogram to provide young spouses and single parents with their own housing. The “Young Family” program in the Moscow Region (MO) was launched to help family citizens under 36 years of age purchase their own housing. It is financed from three sources: the federal treasury, the regional budget of the Moscow Region and the budgets of municipalities. Let's look at what is offered in the Moscow region under the Young Family program.

About the program

The “Young Family” program is approved by the current Decree of the Government of the Russian Federation No. 1050 and is valid from 2015 to 2027. It is designed to help young families and is aimed at improving their living conditions. Families with or without children, as well as parents raising a child alone, can apply for the program. The main condition is the lack of your own housing.

The state provides young families with a free subsidy, which can help pay part of the cost of an apartment. That is, there is no need to return anything. Program participants do not receive cash: it goes only to the bank account.

Programs in different regions may differ, since all constituent entities of the Russian Federation are developing their own projects. Please check the conditions in your city carefully before applying for a subsidy.

Not every young family can take advantage of government support in purchasing real estate. Let's look at the selection criteria below.

Subsidy amount

Housing is paid to young families in the amount of 30 or 35 percent of its cost. How to find out what specific percentage is due:

- childless couples – 30%;

- spouses with one child or more – 35%.

The indicated percentages are not calculated from the cost of the house or apartment, but from a separate value, which is called the estimated cost. It is defined like this:

RS = price per square meter (fixed norm) x area.

The standard price per square meter differs in different regions of Russia. And the estimated area is fixed at the federal level. 42 meters when calculating for a childless couple. If there are children - 18 meters for each family member.

After the family is checked for compliance with the requirements, a specialized document will be issued - a certificate. It indicates the exact amount of subsidies.

Cash is not issued, only to the bank account of the real estate seller.

Requirements for borrowers

Standard points for obtaining a loan:

- Officially registered marriage. Only married couples can participate in the program; living together in the same territory without a stamp in the passport does not give the right to apply. The presence or absence of children does not matter, but does affect the size of the subsidy.

- Single-parent family. A parent who is raising a child alone can apply to participate. This could be either the mother or the father.

- The age of each spouse must not exceed 35 years. If, while waiting for a subsidy, one of them turns 36 years old, the family is removed from the queue. To increase your chances of receiving money, you should not delay submitting your application: you can wait several years.

- Proof of official income or savings. To receive a subsidy, you must provide documents that guarantee the family has the funds to repay the loan or pay the balance. Proof can be a salary certificate or a statement of savings.

- The need to improve living conditions. Only those families who really need it receive subsidies. Having your own apartment or living in a large house with your parents does not qualify you for participation in the program.

To apply, the family must contact the local administration. The executive body must confirm that the family needs improved living conditions. These include not having your own home, living in a dilapidated house or in an area that does not meet registration standards. They are set by the municipality and may vary depending on the locality.

Important ! Each region of the Russian Federation has its own rules for determining the need to improve housing conditions. You can find out the exact information at the MFC, social security or administration.

Who can receive assistance within the project?

Firstly, you immediately need to define the concept of “young”. The law has a specific age - 35 years. It is up to this age that spouses can apply. It is important that both husband and wife must be under 35. If one is 33 and the other is 37, then subsidies will not be paid.

Secondly, the marriage must be registered. It does not matter when the registration took place. It is acceptable to have a certificate dated one week before applying for subsidies. Single-parent families with children - father or mother with a child - can take part in the program.

Thirdly, the family must be solvent. This is easily explained: if spouses do not have money for housing, subsidies will not save them, because they do not even cover half the cost of real estate. It is not necessary that the family have the required amount. You can take out a mortgage, but your monthly income must be enough to pay it off.

What evidence of solvency can be provided. This may be a 2-NDFL certificate or an extract from a deposit account.

Another important requirement is that a young family must be in line to expand their housing meters (they don’t have enough square meters). To register the status of those in need, you need to contact the MFC or local administration. Who can apply? Families who do not own housing or it is too small. The concept of “small” is defined differently in each region. For example, in Moscow it is ten square meters for each family member, in Volgograd it is eleven.

Let's summarize the requirements:

- the age of both spouses is no more than 35 years;

- it is important that the marriage be registered;

- solvency;

- do not own housing or own a small apartment or house.

Program conditions

The Young Family program provides the following benefits to solve the housing problem:

- low interest rate on the loan;

- small down payment or no down payment;

- deferment of payments due to job loss, birth of a child, illness, military service;

- loan repayment period - up to 30 years;

- the ability to attract up to four co-borrowers;

- the possibility of repaying debt with maternity capital.

To participate in the state program, you must confirm your financial security and provide certificates of wages, savings, availability of maternity capital, etc.

The size of the subsidy largely depends on the composition of the family:

- childless couple - 30% of the cost of housing;

- family with one child - 35%;

- family with two children - 40%;

- family with three or more children - 50%.

Important! You can only participate in the program once.

Help with obtaining a mortgage

More details

200-60-91

Deadlines

The Young Family program is valid from 2015 to 2027, but it may be extended.

Types of loan

The subsidy certificate allows you to:

- buy an apartment in a new building;

- purchase ready-made housing;

- build a new house;

- make a down payment on a mortgage;

- pay off mortgage debt;

- buy housing through a cooperative and make a share contribution.

Requirements for purchased housing:

- It must be located in the region that paid the subsidy.

- Should not belong to close relatives.

Banks

Most large banks participate in the program, which issue mortgages for young families under certain conditions. As a rule, credit institutions offer one of two options.

A family without children or with one child can expect a slightly lower interest rate. If a second or subsequent child was born in the family after January 1, 2021, she has the right to receive a loan at a low rate: from 4.7 to 6.5%.

Each bank may have different requirements, so check them in advance.

Do banks have strict age restrictions?

As already noted, each bank independently determines the age restrictions it sets when issuing a mortgage. The requirements of the largest banks are as follows:

- Sberbank

. The mortgage lending conditions offered by the leader of the Russian financial sector can be considered standard. The minimum age for obtaining a loan is 21 years, and the maximum age at the time of closing the mortgage cannot exceed 75 years. Thus, if the borrower is 55 years old, he cannot take out a loan for more than 20 years; - VTB

. The country's second largest bank has established age restrictions on mortgages, completely similar to those described above for Sberbank; - Gazprombank

. The requirements for mortgage borrowers set by Gazprombank are somewhat different from those established by VTB and Sberbank. The minimum client age is 20 years, and the maximum value of this parameter is 65 years on the date of completion of mortgage payments; - Rosselkhozbank

. The minimum age of a mortgage borrower at RSHB is set at 21 years. The maximum is either 65 years at the time of repayment of the loan, or 75 years if there is a co-borrower who meets the first requirement; - Alfa Bank

. Alfa-Bank's age restrictions are as follows: the minimum age at the time of concluding a mortgage is 20 years, the maximum at the date of full repayment of the loan is 64 years; - Credit Bank of Moscow

. One of the banks that does not have an upper age limit for potential clients. Moreover, the lower threshold for obtaining a mortgage is 18 years old; - UniCredit Bank

. Another credit institution that issues mortgages when a potential client reaches 18 years of age. There are no restrictions on the maximum age of borrowers; - Raiffeisen Bank

. A mortgage from this bank can be obtained by a client who has reached the age of 21 at the time of signing the loan and who will be no more than 65 years old at the time of full repayment of the loan. Moreover, the last figure can be reduced to 60 years if a combined insurance contract is not concluded.

How to participate in the program

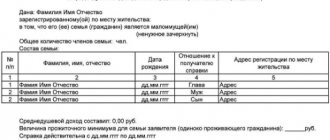

To receive a subsidy, you must provide the following package of documents to local governments:

- application for participation in the program;

- copies of spouses' passports;

- copies of children's birth certificates (if any);

- a copy of the marriage registration certificate (for two-parent families);

- confirmation of savings and income;

- SNILS numbers;

- 2-NDFL certificates;

- work books or extracts from the employment order;

- confirmation of the solvency of the spouses;

- confirmation of the need for housing;

- information about credit history (if available);

- extract from the house register.

If a young family plans to spend the subsidy on an existing mortgage, additional information will be needed:

- a copy of the loan agreement;

- an extract from the Unified State Register for an apartment or a contract for a house;

- certificate of debt balance.

Fill out the documents carefully and check the validity periods of all certificates.

The application is submitted to the local executive authority. The administration checks the documents within 10 days, after which it makes a decision on the subsidy. If it is positive, the young family is added to the list to receive financial assistance. When it’s their turn, the spouses receive a certificate for a government subsidy. After this, the family can contact the bank to apply for a loan.

Important ! The certificate is provided to a young family only once and cannot be exchanged or resold.

Renting housing on preferential terms for participants of all groups

As already mentioned, program participants can improve their living conditions by becoming tenants of an apartment in one of the non-subsidized buildings of the Moscow city housing stock. At the same time, the monthly payment for utilities, maintenance and repair of housing is charged at the actual cost, and as for the cost of renting in non-subsidized houses, the payment rate per square meter is established and approved by the Moscow Government every year.

Let's talk about renting apartments within the program. What are the hiring considerations for program participants in the first, second, or third cohorts?

Let's start with the first group.

Its participants can receive premises for rent and at the same time either be removed from the register as those in need of improved housing, or remain on the register.

In the first case, a young family is given an apartment for rent in a non-subsidized building. An agreement is concluded for a period of up to 5 years and the employer is guaranteed the opportunity to extend the agreement in the future. The program participant is removed from the register of those in need of improved housing conditions, but this is justified, since he is given the opportunity to virtually use the apartment indefinitely and to extend the contract multiple times. Moreover, if the family’s need for housing has changed (say, more children have been born), then after the expiration of the contract, you can conclude a new one for the apartment from the non-subsidized fund, which will be better suited in size to the changed composition of the family. At the same time, let us remind you that premises received for rent cannot be privatized - they remain the property of Moscow.

In the second case, we are talking about young families who are entitled to social payments from the Moscow budget for the purchase of their own housing. Since there is a shortage of social housing, program participants have to wait to purchase an apartment. To make this wait less painful, the Moscow authorities provide such a family with an apartment in one of the subsidized buildings. The contract is also concluded for 5 years with the possibility of further extension. But the contract is extended only until the family has the opportunity to receive the maximum social benefit and purchase an apartment. During the duration of the contract, the program participant is not removed from the housing queue, and after the contract is terminated, the apartment rented by the young family is vacated; it cannot be privatized; it remains the property of Moscow. After purchasing an apartment, the program participant is removed from the housing queue.

Program participants belonging to the second group

(young specialists in the social sphere of Moscow, government officials), at the request of their organizations, also have the opportunity to receive an apartment for rent in a non-subsidized building. During the term of the contract, they pay utility bills, fees for maintenance and repairs of housing at their actual cost.

Moreover, among the participants in the second group, some categories have an advantage in obtaining housing for rent. We are talking about those young families in which at least one of the spouses at their place of residence is recognized as in need of improved housing conditions. Families of young professionals also have an advantage, in which both husband and wife work in budget-funded social organizations in Moscow. Having children in the family is also an advantage.

While the young specialist continues to work in budgetary organizations of the social complex of the capital or in government bodies of Moscow, he has the right to renew the employment contract for a new term. When, over time, a family no longer meets the spousal age requirements of the program, this does not mean that people will be evicted from their rental housing. They have the opportunity to extend the employment contract further, provided that the program participant continues to work in the above-mentioned budgetary government agencies. If the family composition of a young specialist changes (up or down), then a new rental agreement can be concluded - for an apartment of a larger or smaller area.

In some cases, the tenancy agreement may be terminated. There are a number of reasons for this: if the tenant has improved housing conditions to the standards for the provision of living space established by Moscow legislation; if the tenant and his family members violate their obligations under the rental agreement; if a person lives in the apartment who does not have the right to reside in this premises; if the tenant of the apartment stops working in budgetary social organizations or government bodies of Moscow, etc.

After termination of the contract, the apartment is vacated and transferred to the family of another program participant. The next family has three months to move in. If the apartment is not occupied during this time, it is transferred to other program participants.

Program participants belonging to the third group

(young teachers, scientists, graduate students of state universities in Moscow), in order to get an apartment under a rental agreement, you first need to apply to your rector’s office. The management of the university will determine the candidates most suitable for the terms of the program and will send their petition according to the list of candidates to the Council of Rectors of Universities in Moscow and the Moscow Region. In turn, the Council will select the candidates most suitable for the conditions of the program and transmit the list to the Moscow Department of Housing Policy and Housing Fund. After this, a rental agreement for a period of 5 years will be concluded with the program participants. If, after this period, the program participant retains the grounds to continue renting city housing (with the exception of age restrictions), then the contract can be extended at the request of the Council of Rectors.

As is expected in the case of renting non-subsidized housing, the program participant makes all payments for it in full at the actual cost of services, and also pays for renting an apartment.

If a young family belonging to the third group continues to meet the requirements of the program and fulfills all the terms of the contract without violations, it has an advantage over other program participants in renewing the rental contract. To do this, you must notify the Moscow Department of Housing Policy and Housing Fund in writing of your desire to extend the contract. This must be done no later than three months before the termination of the contract.

If during the validity of the contract the composition of the tenant’s family has changed, then a new contract for renting an apartment of a larger or smaller area can be concluded with him.

The conditions for terminating the contract for participants of the 3rd group are the same as for representatives of other groups. In addition, the agreement may be terminated upon the recommendation of the Council of Rectors of Universities in Moscow and the Moscow Region. After termination of the tenancy agreement, the program participant is required to vacate the property.