When purchasing housing under construction, as a rule, they enter into equity participation agreements in construction or share accumulation agreements with a housing construction cooperative (HBC). But between the moment of concluding the contract and receiving an extract from the Unified State Register of Real Estate (certificate of registration of property rights), quite a lot of time can pass, sometimes even several years.

So when can you apply for a property deduction when purchasing an apartment in a building under construction? Immediately after concluding an agreement to purchase an apartment or after paying the full cost of the apartment? Or maybe after concluding the Acceptance and Transfer Certificate of the apartment or receiving an extract from the Unified State Register of Real Estate?

Below we will answer these questions in detail.

Conditions for returning personal income tax when purchasing an apartment in a building under construction

One of the ways to improve living conditions is to purchase housing in a house under construction under a DDU (share participation agreement).

The future owner of the apartment has the right to receive a property tax deduction, but under special conditions. Conditions for personal income tax return:

- The property must be located on the territory of the Russian Federation.

- The applicant must be a tax resident of the Russian Federation and pay income tax in the amount of 13%.

- The housing contract must indicate the cost of housing. The amount of tax deduction will be determined from this amount.

- It is necessary to have an apartment acceptance certificate

. Until this document is in the hands of the owner, he will not be able to exercise his right to a personal income tax refund.

Content:

- Calculation of the deduction amount

- When and where to apply for a deduction

- What documents to prepare

- Acquisition by assignment

- Purchasing through housing cooperatives

- Acquisition by transfer and acceptance certificate

- DDU + mortgage

- Benefits for pensioners

- When they can refuse

What is DDU

You can purchase an apartment by choosing different ways - buy it on the secondary market, take a ready-made new apartment, or use an equity participation agreement (DPA). The latter involves participation in the construction of a house in which you buy a share. According to it, you will be provided with an apartment in the future.

The parties to such an agreement are us and the developer, who has the rights to the house and land. Typically, the developer is a legal entity that owns the land and is engaged in construction, but there are exceptions. The contract looks something like this:

- we undertake to pay the developer a certain amount of money;

- the developer undertakes to use this money for construction;

- the developer undertakes to transfer to us the rights to the finished property in the future.

The real estate in such an agreement can be not only an apartment, but also a room in it or some kind of non-residential premises. Only one thing is important - the property must be part of the house in which we are buying a share.

Previously, we gave the developer money, and he immediately used it, investing in construction. Now we also transfer money to the developer, but he cannot use it until his obligations are fulfilled. Not every house construction under DDU ends successfully; the situation was especially sad before the adoption of the 2021 law.

In fact, the DDU did not give us practically any guarantees, because in the event of a banal bankruptcy of the developer, money was lost. It was not possible to return them, because the share participation agreement itself provided for such risks.

Now everything has changed - the developer is obliged to deposit the money received into a bank account, where it will be stored until the house is put into operation. That is, now the developer receives money only after he allocates the property due to us. In case of bankruptcy and other problems, our investments will simply be returned to us from this same bank account. In general, the new law has made DDU much more attractive for ordinary citizens, because the transaction itself has become more reliable.

How to get a tax deduction for an apartment

Calculation of the deduction amount

The amount of property deduction when purchasing a home is 2 million rubles (Article 220 of the Tax Code of the Russian Federation). If the purchased apartment is more expensive, a person can only return tax on this amount. The maximum amount of tax that can be refunded when purchasing a home is 260,000 rubles. This is 13% of 2 million rubles.

If an apartment under the DDU was purchased in equal shares by spouses who are taxpayers, each of them has the right to receive a tax deduction in the standard amount. For example, if the cost of an apartment is 4 million rubles or more

, each spouse can return the maximum deduction amount -

260,000 rubles

.

If the apartment costs less, the total amount spent on the purchase is divided in half and a 13% deduction is deducted from it for each spouse

.

Tax deduction for the act of accepting the transfer of an apartment in 2020

Purchasing an apartment that is still under construction gives its owner the right to receive a personal income tax refund. The act of acceptance of the apartment is the most important aspect of any transaction of this kind, and its signing gives the taxpayer the right to begin processing the deduction starting from this tax period and, what is very important, there is no need to wait for registration of ownership of the property to receive the deduction.

Example

In 2021 Komlichenko O.A. DDU was concluded. At the same time, he made the full payment for the purchased apartment, but the completion of construction and the signing of the acceptance certificate took place in December 2021, January 2021 came and the apartment of Komlichenko O.A. have not yet been registered as property. Despite this, he filed a tax refund and received it for the entire 2021, and not just for December.

When and where to apply for a property deduction under DDU

To receive a personal income tax refund under the DDU, you need to collect a list of documents according to the list together and submit them along with the 3NDFL declaration to the Federal Tax Service at your place of residence

or

online at nalog.gov.ru

To receive a deduction from your employer

, you must submit an application to the tax office, receive a Notification and submit it to the accounting department at your place of employment. An application for a deduction from the employer can be submitted to the tax office immediately after receiving the apartment acceptance certificate. No income taxes will be withheld from the employee's salary until the end of the calendar year.

But if during this period the entire amount of the tax deduction is not used, in the new year the employee will have to contact the tax service again to receive a Notification of the right to deduct. This document is submitted to the employer to extend the period during which he will not withhold income tax from the employee until he returns the full amount of the tax deduction due to him.

The right to apply for a deduction through the Federal Tax Service appears only the next year after purchasing a home. That is, if a person receives a transfer and acceptance certificate in 2021, he will be able to submit documents to the Federal Tax Service for a property deduction only in 2021.

Nuances of the procedure

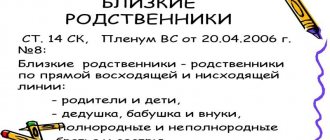

There are no particular difficulties in this procedure. We collect the necessary documents, submit them to the tax office, complete the investigation, complete it, and contact the tax office again. The only thing is that the developer should not be your close relative. This is because the state does not provide a tax deduction for property transactions between related parties. This applies only to relatives of the first category - father-in-law, mother-in-law, wife's brother and similar persons are not included in this list.

It is also worth remembering that the tax deduction is provided from the taxes that you paid in the year the trace was issued. In our case, we are talking about the act of transferring an apartment into your ownership.

What documents need to be prepared

Taxpayers who provide a complete set of documents according to the list to the tax service can receive a personal income tax refund when purchasing housing under the DDU.

What you need to prepare:

- Personal documents – passport, TIN;

- Certificate of employment in form 2-NDFL;

- Personal application for a tax refund indicating the bank details where the money for the deduction will be transferred;

- Agreement on shared participation in the construction of a house;

- Apartment acceptance certificate;

- Payment documents confirming all expenses for the purchase of real estate. If an apartment was purchased with a mortgage and a person claims to receive a deduction for interest paid, he also needs to provide a bank certificate about the interest paid and a mortgage agreement;

- 3-NDFL (tax return).

Documents are submitted in copies. You must have all originals with you.

Is it possible to get a tax deduction if the apartment is still under construction?

The exciting question is whether it is possible to get a tax deduction if the house has not yet been completed, which is asked by many citizens who buy housing in a house that is still under construction. An important aspect of receiving this benefit is the mandatory presence of a signed act of acceptance and transfer of this property into your ownership.

- Therefore, you can take advantage of such a benefit from the state, but you must have a signed acceptance certificate in hand.

Along with the basic cost of housing specified in the sales agreement, you can receive benefits for some other types of taxpayer expenses, which include:

- costs for finishing materials;

- costs of finishing work, development of design and estimate documentation for these works.

Important! To receive compensation for finishing costs, you need to make sure that the contract stipulates that the property is sold without the necessary finishing. This is a prerequisite for reimbursement of costs of this kind. Read more about this in the article “Deduction for apartment renovation in a new building and secondary housing”

Example

Zakharova M.Z. in 2021, I entered into an agreement to purchase an apartment in a building under construction and immediately paid its cost, which amounted to 1,800,000 rubles. The transfer and acceptance certificate was issued in July 2017. Considering that the agreement contains information about the purchase of housing without finishing, Zakharova M.Z. has the right, after signing the transfer deed, to receive a tax deduction of 13% from 1,800,000 rubles, and at the same time from 200 thousand rubles spent on finishing and repairs.

Features of obtaining a deduction for shared construction

In general, the procedure for obtaining a property deduction for shared construction does not differ from the standard one. But there is one caveat.

If you purchase an apartment with participation in shared construction, the right to a deduction appears only after the house is put into operation and a housing acceptance certificate is received.

Purchasing an apartment by transfer

The buyer retains the right to receive a deduction if the apartment is purchased under an agreement for the assignment of the right of claim. The registration procedure does not differ from the standard one, but the set of basic documents should include an assignment agreement with the previous buyer, a copy of the original DDU, receipts for payment for the property and an apartment acceptance certificate.

Purchasing an apartment through a housing cooperative

When purchasing an apartment through a housing cooperative, the right to receive a tax deduction appears from the moment the share is paid in full. When submitting documents, the main package is accompanied by a certificate confirming full payment of the share, as well as an act of acceptance and transfer of housing.

According to the acceptance certificate

The transfer deed is the main document when filing a tax deduction. In this case, the buyer does not need to wait for the procedure for registering property rights. To register a deduction to the tax office, it is enough to present the acceptance certificate.

Limitations and reasons for refusal

There are some situations in which you may not be able to get a deduction. Is it possible to get a tax deduction for DDU? Let’s look at them in more detail.

Documents not provided or information contains errors

In this case, the tax authority notifies the applicant that it is impossible to carry out the operation. For example, if a tax deduction for shared ownership is claimed by one owner in the amount of 100%. In this situation, you need to eliminate errors and fill out the documents correctly.

The applicant has previously received a deduction

For apartments received before 2014, there is a strict one-time rule - the buyer has the right to receive payment only once in his life and only in the amount of money spent on housing. In such a situation, it will not be possible to “get” the amount to the maximum two million later, since the rules in the old version will apply.

After 2014, the payment can be received again if it has not been exhausted in the maximum amount.

State aid funds were spent on the purchase, not their own (borrowed)

It will not be possible to receive a refund for the amount of maternity capital, regional family capital or a state housing certificate, as well as other types of assistance. These funds did not belong to the applicant and therefore the return would be unjustified.

Tax refund when buying an apartment under DDU and with a mortgage

When purchasing a home with a mortgage, the taxpayer can also recoup 13% of the amount spent on mortgage interest. This right appears immediately after the closing of a real estate purchase and sale transaction. The applicant must present a title document confirming ownership of the property, payment documents from the bank (receipts, checks, receipts), copies of the mortgage loan agreement with the bank indicating the intended purpose.

If the housing was purchased with a mortgage, the refund of the deduction will be 13% of the amount of interest on the mortgage loan paid annually by the applicant. The maximum amount of interest from which tax can be returned is 3 million rubles, that is, the maximum deduction amount will be 390 thousand rubles.

When purchasing an apartment under the DDU, the right to a tax deduction appears only after receiving the housing acceptance certificate. It is impossible to receive a deduction if the construction of a multi-story building has not yet been completed.

Legislative framework

Receiving a deduction for the purchase of housing is regulated by several legislative acts. First of all, Article 220 of the Tax Code, which establishes details of the procedure and conditions for receiving deductions, including the acquisition of real estate under the DDU (clause 1.3).

As this article indicates, the right to receive a deduction is given by signing the DDU and the acceptance certificate (clause 3.6), and it is not necessary to wait until the state registration of the purchased apartment is completed to obtain the deduction.

Also, the issue was considered and resolved in letter of the Federal Tax Service No. 3-5-04/647, in particular, it established the maximum amount of the deduction, and letters of the Ministry of Finance - No. 03-04-05/13862 and others - they clarify the details of the provision of the deduction.

Benefits for pensioners

Unemployed citizens who receive only a pension, which is known to be tax-free, cannot receive a deduction when purchasing real estate. But there are some nuances.

If a pensioner, for example, has an additional source of income from which income tax is withheld, he can receive a deduction on a general basis.

If housing was purchased after retirement, the citizen can receive a personal income tax refund for previous years. For example, a person retired in 2021, and bought an apartment in 2021, then in 2022 he can submit 3NDFL returns for 2021, 2021, 2021 and return the tax for this period.

Term

When registering through the tax office, you can receive your funds back only at the beginning of the next calendar year after receiving the right to deduct.

A month is given for tax calculations and payments, but it is counted from the time after the completion of the desk audit, and taking this into account, the money will be received only after 3-4 months, around April.

When registering through an employer, you will also first have to wait for approval from the tax authorities, and this process will most likely take more than one month. However, it will not be necessary to wait until the end of the calendar year, and therefore you can start receiving the deduction earlier - but it will not be paid in a single amount, but gradually.

Let's give an example, taking data from the previous one with citizen R.A. Borisov. Then his housing was rented out in April 2021, he submitted an application in January 2021, and received his money in full - 332,800 rubles, by April. If he had resorted to receiving it through his employer, the transfer of funds would have begun earlier - for example, in June 2021.

Let's assume that he paid 10 thousand rubles monthly as personal income tax - in this case, the payment would stretch for: 332,800 / 10,000 = 33.28 months, and would end by the beginning of 2021. Therefore, you can combine these options: receive payments through your employer until the end of the year, and then contact the tax office for payment of the balance.

From 2021, an important addition has also been made: taxes can be returned through the employer from the beginning of the year, regardless of when everything was processed. Returning to our example: if previously citizen Borisov could buy an apartment and receive a deduction through his employer only starting in June 2021, now, having also completed everything by June, he receives money for the period starting from the delivery of housing, from April.

Where to receive

There are two options for receiving:

- at the employer;

- through the Federal Tax Service.

The difference is:

- from your employer you will be able to receive a monthly personal income tax refund based on a tax notice received from the tax authority within a month from the date of your application;

- through the Federal Tax Service in a single payment for the whole year within a month after the end of a desk audit lasting up to 3 months.

In cases where you apply for a benefit from your employer, there is no need to fill out a declaration of your income, but you must submit a notification from the tax office about the right to a deduction; for more information about how to obtain it, read the article “What is the best way to get a deduction through your employer or the tax office”

Procedure

To receive a deduction, you need to write an application and fill out a declaration. Additionally, you will need to attach a package of documents confirming the fact of purchasing the apartment (DDU, deed, payment receipts, etc.), as well as obtaining a loan (if a mortgage was taken out). The buyer of an apartment under the DDU must:

- Take a certificate from work about income and the amount of tax paid for the reporting period (form 2-NDFL).

- Prepare a package of documents and write an application for a deduction.

- Submit documents for deduction (at your place of work or to the tax office).

You can receive a deduction in two ways: by submitting documents to the tax office or at your place of work. In the second case, you will need to first receive a notification from the Federal Tax Service that the payer has the right to a deduction. The order of future payments will differ depending on the chosen application method.

If you submit it immediately to the tax office, the funds are credited to the payer’s bank account after 3-5 months. If at the place of work, then the deduction amount is divided into monthly payments. For a real estate buyer, this means the opportunity to receive wages for a certain period without withholding the 13% income tax.

Where to go?

You can apply for a deduction at the tax office at your place of residence or at the accounting department of your company. The employer's monthly compensation is calculated based on the tax notice.

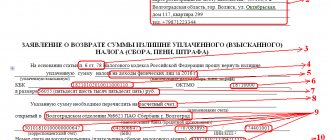

How to fill out an application?

On a note. A sample application for a refund of overpaid tax can be found on the website of the Federal Tax Service of the Russian Federation.

It is an approved form in which you simply need to fill in the blanks.

The statement states:

- FULL NAME. applicant.

- Amount to be refunded.

- Tax calculation period.

- Budget classification code.

- Applicant's contacts (in particular telephone number).

- Bank account number.

- Bank identification code.

- Passport details.

To calculate the amount of tax, you can use a tax calculator or ask a tax inspector to help with the calculations. Before filling out the application, a current (not card) account must already be opened in any bank, where the amount of overpaid tax will then be transferred. You can calculate the amount of deduction yourself.

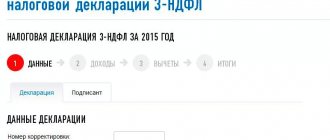

When filling out the declaration, you will need to calculate the tax base and indicate all income received during the reporting year. Sheet D1 of the declaration also indicates expenses, including those for the purchase and decoration of the apartment, and also the final calculation of the deduction amount.

List of required documents

When filing a deduction, the list of documents includes, first of all, an application for deduction.

Reference. If documents are submitted at the place of work, then you do not need to fill out a declaration, but you will have to receive a notification from the tax office.

In order to receive this document, you need to submit a complete package of documents for deduction. To receive a deduction you must present:

- copy of passport;

- 3-NDFL;

- income certificate;

- copies of the DDU and the act of acceptance and transfer of housing;

- a copy of the loan agreement (if drawn up);

- DDU payment receipts;

- agreement on the assignment of rights of claims under the DDU (if executed);

- receipts for payment of interest on the loan (if issued).

When applying for a mortgage, the buyer of the property will need a copy of the agreement with the bank and a certificate of the amount of interest paid for the reporting year. Additionally, they will ask for receipts that confirm that mortgage payments have been made.

When purchasing as joint property, you will also need a copy of the marriage certificate and a statement on the distribution of the amount of the deduction between the spouses.

If there were expenses for finishing or preparation of project documentation, then it will be necessary to confirm them with documents (contracts, checks, etc.). However, please note that the apartment building must provide for the rental of the apartment without finishing (this will be checked).

Terms of consideration

The period for reviewing documents is three months. But in practice, the procedure often drags on for up to 4-5 months, for example, if not all papers have been submitted and the tax office asks to redo the package. If all formalities are met, then refusals to provide a deduction are impossible.

The application must be submitted to the tax office at the end of the year in which the acceptance certificate was signed. You can submit documents throughout the year, and not before the end date of the declaration campaign.

Important! You can only return personal income tax paid for the previous three years. If the price of real estate is below the limit amount of 2 million rubles, then the taxpayer has the right to take advantage of the benefit until it is completely exhausted upon the next purchase of real estate.

How much can I get back?

You can return no more than 260 thousand rubles under the property deduction for the purchase of an apartment under the DDU. Plus, when applying for a mortgage, you can return part of the funds spent on interest payments - up to 390 thousand rubles. The amount to be refunded depends on the cost of the apartment, expenses incurred and the amount of personal income tax paid from salary or other income.