Who can receive a deduction when donating real estate?

Any tax deduction is provided to a citizen on the basis that at a certain point in time (which is significant from the point of view of issuing a specific deduction) he paid personal income tax at a rate of 13% to the budget of the Russian Federation. If personal income tax was not paid by a person (was not calculated from his income), then no tax deduction can be issued by him. Another condition for receiving a deduction is that the taxpayer has made certain expenses that give the right to a refund of personal income tax paid to the state budget, or the right to legal non-payment of calculated personal income tax.

Are these conditions for registering a deduction observed when concluding an apartment donation agreement?

The gift of real estate, as well as most other types of valuable property, is a process that is regulated by civil and tax laws. It involves 2 parties - the donor and the recipient.

If they are close relatives of each other , then the property presented in monetary terms (as reflected in the gift agreement) is not subject to any tax. In this regard, the recipient, the new owner of the property, does not have the right, for example, to issue a property deduction for the housing received, since he received it without making any expenses. The donor, the previous owner of the property, will not be required to pay income tax calculated on the value of the donated apartment, since he did not receive the corresponding income.

In turn, if the donor and the recipient are not close relatives of each other , then in this case:

- The recipient becomes obligated to pay personal income tax calculated on the cost of the apartment under the contract. This tax is calculated at a rate of 13%, like personal income tax on any other income.

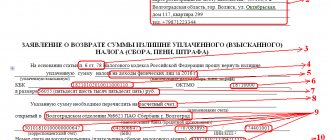

- The recipient becomes obligated to submit to the Tax Inspectorate (FTS) a declaration in form 3-NDFL, which will reflect the income represented by the monetary value of the apartment donated to the person.

- The recipient acquires the right to reduce or compensate the calculated personal income tax if there are legal grounds for doing so. For example, when purchasing another apartment at your own expense, as well as when applying for a mortgage loan.

Let us consider in more detail how the recipient citizen can exercise these privileges.

When is a gift deed needed?

A donation involves the gratuitous transfer of any thing or benefit from one person to another (Clause 1 of Article 572 of the Civil Code of the Russian Federation). According to the Civil Code of the Russian Federation, money is classified as movable property (clause 2 of Article 130 of the Civil Code of the Russian Federation), therefore it has the right to act as the subject of a deed of gift. Usually the transaction is made orally by directly transferring funds to the donee, but there are several reasons when the parties are required to comply with a simple written form: the amount of the gift is more than 10,000 rubles. (Article 161 of the Civil Code of the Russian Federation); money over 3000 rub. donated by an organization (Article 574 of the Civil Code of the Russian Federation); the transaction implies a promise of a gift in the future. IMPORTANT!

If real estate is intended as a gift, the agreement is drawn up in writing, and the transfer of rights is subject to state registration in Rosreestr.

Cases when funds exceed RUB 3,000. It is not allowed to give (Article 575 of the Civil Code of the Russian Federation):

- on behalf of minors and incapacitated citizens;

- employees of educational, medical and social organizations;

- state and municipal employees in connection with their official position or performance of official duties;

- between commercial organizations.

Deduction for the recipient party: nuances

So, when receiving an apartment as a gift, a person who is the recipient of the contract, in general, has not a privilege, but an obligation to the state - to pay 13% of the cost of the received housing to the Russian budget.

But there may be cases in which this cost can be reduced by certain tax deductions. Among those in which such a discount will be the most significant is a property deduction.

In order to receive it, the recipient, as we noted above, needs to buy some other housing, and always at his own expense or using credit funds. It is noteworthy that a person can partly solve this problem by using an existing apartment as an asset.

Example.

Ivanov A.S. in January 2015 received a gift from V.S. Petrov. an apartment worth 2,000,000 rubles. He had an obligation to pay a tax on this amount to the Russian budget - 260,000 rubles (13% of 2,000,000).

In 2015, Ivanov A.S., taking advantage of the opportunity to rent out a donated apartment for 30,000 rubles a month, accumulated 240,000 rubles (30,000 *) in 8 months and used them for a down payment for a mortgage on a new apartment worth 1,800,000 rubles. In this case, Ivanov made mortgage payments from the income received from further renting out the apartment.

During 2015, A.S. Ivanov, on the one hand, accumulated significant debts to the state:

- 260,000 rubles - in the form of personal income tax for an apartment received as a gift;

- 31,200 rubles - in the form of personal income tax for income received from renting out an apartment.

On the other hand, Ivanov A.S., having bought an apartment for 1,800,000 rubles with a mortgage, received the right to issue a deduction for it:

- in the amount of 234,000 rubles (13% of 1,800,000) directly for the purchase of the corresponding property;

- in an amount equal to 13% of the mortgage interest paid for the apartment (let’s agree that in September-December their value was 30,000 rubles, and the actual amount of the deduction will therefore be 3,900 rubles).

Having contacted the Federal Tax Service in 2021, Ivanov A.S. will be able to offset existing debts to the state for 2015 against a property deduction. As a result, his actual debt will decrease significantly and amount to 53,300 rubles ((260,000 + 31,200) - (234 + 3900)).

He can pay this tax in the future, for example, from the same income from renting out the apartment received as a gift.

The specific procedure that needs to be carried out to formalize the mutual offset of the personal income tax accrued on the donated apartment and the deduction for the one purchased by A.S. Ivanov will be advised by Federal Tax Service specialists when a citizen contacts the representative office of this department.

How to register a deed of gift for real estate in the name of a spouse: step-by-step instructions

Before drawing up an agreement, you need to agree on the transaction with the donee spouse, then draw up a deed of gift and, if necessary, have it certified by a notary. If real estate is donated, the re-registration of the right is registered in Rosreestr.

Note! You need to decide in advance who will bear the costs of the DD certificate. This is true when spouses have separate budgets. Usually the donor pays for everything, but other terms can be negotiated

Step 1: approval of the deal

During the approval process, you need to find out what will be donated, in what share (size), and whether notarization is required. Also at this stage, expenses are distributed as agreed.

Step 2: drawing up a gift agreement

You can draw up a DD yourself, contact a lawyer or a notary. Lawyer services will cost approximately 2,000-3,000 rubles, notaries charge more - from 5,000 rubles.

Sample contract

It is important to reflect the following points in the deed of gift:

- Full name, registration addresses, passport details of the parties;

- the property regime in force in the family: general or contractual;

- the size of the part alienated in favor of the donee under the DD;

- address, location of the apartment, area, floor, year of completion of the house, technical data;

- details of the certificate of ownership;

- when alienating a car - make, model, color, license plate number, VIN, STS and PTS details;

- date of entry into force of the transaction – from the moment of signing or in the future.

Note! The contract for the promise of a gift in the future must contain a specific date from which the donee will be able to use the gift.

Sample gift agreement between spouses: alt: Gift agreement between spouses

Documentation

The list of documents depends on the item of donation transferred under the DD.

You will definitely need:

- passports;

- marriage contract (if any);

- agreement on the allocation of shares.

Additionally, depending on the availability:

| Automobile |

|

| Share in an apartment |

|

| The apartment is the sole property of the donor. | |

| House |

|

| Land plot |

|

Step 3: Notarization

If the transaction requires certification by a notary, you need to come with a ready-made package of documents and sign everything in his presence. You can order the registration of a deed of gift at a notary office, but the service is paid separately from the tariff and state duty. The amount of the fee depends on the prices established by the regional notary chamber.

Step 4: visit Rosreestr

You only need to go to Rosreestr to register the right to the donee when transferring real estate as a gift. Instead of Rosreestr, you can submit everything through the MFC, having previously made an appointment. Both must be present.

Documentation

When visiting Rosreestr or the MFC, you need to take with you the same written information as for drawing up the DD. The deed of gift for registration is provided to an employee of the institution and is returned after the procedure to the donee with the appropriate note.

State duty

Re-registration of rights to real estate in Rosreestr costs 2,000 rubles.

Step 5: obtaining a new extract from the Unified State Register of Real Estate

After 10 working days, the recipient must come to the MFC or Rosreestr for a new extract, where he will be indicated as the new owner.

What can the donor expect?

What, in turn, rights and obligations may arise for the donor of the apartment?

In general, the fact of a person donating real estate does not imply the emergence of any special rights and obligations, at least from the point of view of tax legislation. But this rule has an exception: if the donor previously bought an apartment donated to another at his own expense, then his right to receive a property deduction for this apartment does not disappear.

It is worth noting that, in principle, it does not matter through what mechanism the donor freed himself from ownership of the apartment - he sold it or, as in the scenario under consideration, donated it. It does not matter whether the recipient was a close relative. The right to a property deduction is given to a person once the expenses for the purchase of a property are made. This right is not canceled in subsequent transactions with the apartment.

When applying for a deduction for a donated apartment, the donor will, however, need to take time to collect documents that certify the fact that:

- he bought the corresponding apartment at his own expense;

- he was the full owner of this apartment.

Otherwise, the documents for registration of the deduction, in principle, do not differ from those that characterize the process of using the corresponding privilege in the event that the citizen has valid ownership of housing.

Which is better: an oral transfer of a gift or a written transaction?

The law allows you to give movable things without a written document. For example, to alienate a car in favor of a spouse, it is enough to indicate her as the new owner in the title and hand over the keys. However, it is better to draw up a deed of gift: this will allow you to confirm the fact of the transaction if problems arise.

Another argument in favor of a written contract is that it is difficult to challenge. If the donor or a third party decides to take back the gift, he will have to go to court, and only if there are grounds. DD will not be canceled without reason.

Summary “Q&A”

Does the recipient have the right to a deduction - as a new owner under a housing donation agreement?

No. Moreover, he has an obligation under tax law to pay 13% of the cost of the apartment given to him under the contract.

Who has the right to deduction under a gift agreement?

In general, this right does not arise for any of the parties to the transaction of donating a property.

But it may appear to the recipient if he purchases another piece of real estate (and through this transaction he will be able, like Ivanov A.S., to reduce the tax on the donated apartment). It is not lost by the donor if the apartment was purchased by him at the expense of personal expenses, and the deduction for them was not issued or was exhausted earlier, before donating the apartment.

Is the consent of the second spouse required?

According to Art. 35 of the RF IC, alienation of common property in favor of third parties is carried out with the consent of the spouse. If the transaction is subject to state registration, the consent is certified by a notary. As mentioned earlier, it will not be possible to donate common valuables purchased during marriage - they already belong to both parties in equal proportions, although without the actual allocation of shares in the right.

Everything is different if the apartment is in shared ownership, or belongs to a person solely on the basis of a marriage contract, and the alienation is made in favor of the second spouse. In this case, his consent will not be required. In addition, this spouse also acts as a donee, which already confirms the fact that there are no disagreements regarding the transaction - this is confirmed by his signature.

Briefly: a notarized consent of the spouse for a gift to him will not be required. You can donate both movable things and real estate, having previously allocated shares, concluding a marriage contract or a division agreement.

Responsibilities of the donor: does he pay tax?

Sometimes, by analogy with a purchase and sale agreement, the question arises whether the donor has tax obligations. Since donation is a gratuitous transfer of property, the former owner of the living space does not receive any financial benefit from the transaction.

Accordingly, he does not have to fill out a declaration and pay tax , since there was no profit.

The former owner should not be alarmed if he receives a letter demanding payment of tax on the transfer of real estate. The fact is that the tax service receives information about a change in the ownership of real estate, but it does not always indicate on what basis it occurred. By default, employees assume that the owner has changed as a result of a purchase and sale agreement, which means that the former owner of the property received income subject to taxation.

This misunderstanding can be resolved simply: an explanatory note is written to the tax service, to which a gift agreement is attached. After this, questions to the donor from government agencies will be removed.

Close relatives according to the Family Code of the Russian Federation

The concept of family relations from a legal point of view has a complex interpretation. As such, there is no general definition in legislation, so controversial situations often arise. Depending on the area of law, different citizens who have both blood and non-blood ties can be considered relatives.

- New offers for remote work during quarantine

- Aromatherapy treatment of varicose veins

- Bulk pie - step-by-step recipes for preparing dough and filling with photos

A more complete concept is given in Article 14 of the Family Code. It is based on blood ties along descending and ascending lines:

- parents;

- children;

- grandmother;

- grandfather;

- grandchildren;

- brothers;

- sisters.

Brothers and (or) sisters are the closest relatives according to the Family Code, regardless of whether they are full-blooded (have common parents) or half-bred (step-fathers who have only a father or mother in common). Spouses are not considered either close or distant relatives. They belong to the category of persons who are in a legal union, and when giving or inheriting, this connection is paramount.

- Classic massage - a description of the technique and techniques of general, medical or wellness

- Average life expectancy of women in Russia in 2019

- 5 questions about carotid artery stenosis

Joint property of spouses

The law defines common property belonging to both spouses as property acquired by them during the years of their legal marriage. This refers to both financial assets and property acquired with them, as well as bank papers, shares in business and other material goods.

The regime of joint ownership arises regardless of the contribution of each spouse to the common treasury. The limiter of joint rights is a marriage contract, according to which the property rights of each spouse are regulated in strict accordance with the specified contract. The following property also cannot be considered jointly acquired:

- existing before the marriage;

- received in the form of gifts;

- acquired by inheritance;

- products of intellectual work;

- personal property for personal use.

The disposition of joint property by spouses is subject to the following rules:

- without the mutual consent of the spouses, alienation of their joint property is impossible;

- In relation to real estate, such consent must be notarized.

Tax rate calculation

An important question for the new owner: what gift tax must be paid. The final amount of payments for individuals is influenced by two factors:

- Status of the recipient.

The rate for residents of the Russian Federation is 13% of the value of the gift . These include citizens living in the country for more than 183 days during a calendar year, as well as stateless persons permanently residing in our country, and foreign citizens who have received a residence permit. Russians living in the Russian Federation for less than 183 days during a calendar year lose their resident status, for them the tax rate is 30% .

There are no benefits, including for pensioners and minors, when donating. If the donor is a minor and does not have his own funds, his legal representatives contribute the required amount to the treasury. It does not provide for such taxation and tax deductions.

- The cost of the donated apartment.

There are no clear instructions in the legislation as to what exact amount should be the basis for calculating payments. This can be either the market or cadastral value of the property. If the deed of gift contains a figure that differs significantly from the cost of similar objects, reasonable questions may arise for the parties to the agreement. It is possible that you will have to defend your view on the cost of living space under a deed of gift in court.

By law, it is prohibited to indicate in the contract the cost of an apartment that is less than 70% of its cadastral valuation and less than 80% of the market price . If the contract does not specify the cost of housing, the tax service is guided by its cadastral value or, in rare cases, the average market value. If not the entire apartment, but a share in it, is transferred as a gift, the calculation of the required amount is based on the value of this share.