Law on deductions

According to the Tax Code, property tax refunds are provided to:

- To sellers when selling property. The seller reduces the amount of income transferred to him by the buyer for the home. A fixed or expense amount is deducted. The tax payable is thus reduced. Read more about tax deductions when selling real estate at this link.

- Buyers when purchasing real estate. The buyer requests a return of a maximum of 2 million rubles and receives 13% of the cost of purchasing living space from the budget. The refund is made from previously paid personal income tax. We previously published material on compensation for purchases here.

IMPORTANT! A tax refund when donating housing is not provided to either the donor or the recipient. This type of deduction is not provided for by tax law, and rules cannot be applied by analogy with purchase and sale.

In this case, the parties to the transaction can take advantage of the deductions that arise for them in connection with the purchase and sale of this apartment under the DCT. Let's consider these situations in more detail.

Legislative framework for gift taxation

If housing is the object of the gift agreement, gift tax is calculated based on its actual inventory value. However, in recent years, for calculations, as a rule, the market value of an apartment or house transferred from the donor to the donee is taken.

After confirmation of the cadastral value of real estate, the actual amount of tax paid is determined. At the same time, only privatized housing is subject to donation, and if the owner took out a mortgage to purchase an apartment or house, the living space can be donated if the banking organization acting as a creditor allows it.

Consider your gift tax situation?

Get a free consultation from the best lawyers in Moscow and St. Petersburg, considering only your situation! Save with us!

In the case of alienation of a land plot in this way, the amount of taxation is also determined using the cadastral value.

Donor's rights

The donor is the former owner of the apartment, who transferred it under a deed of gift to the next owner. Based on the donation, there are no tax consequences:

- there is no need to calculate and pay 13% personal income tax to the budget;

- no tax refund is provided;

- Property tax (annual) ceases from the moment of the donation transaction.

In this case, it is impossible to apply the rules on deductions by analogy with the buyer during the purchase and sale. The buyer purchases the property and incurs expenses, from which he can return 13%. The donor simply voluntarily transfers the property without acquiring anything. The price of this property cannot be deducted. This is a false comparison.

However, by donating an apartment, the donor does not lose the right to claim a deduction under the policy under which he once bought it.

Example. In 2021, Mikhail Sviridenko bought an apartment for 2 million rubles. He did not submit any documents for the deduction and did not receive any money from the budget. In 2021, he gave this apartment to his daughter. At the same time, after the housing was re-registered in his daughter’s name, Mikhail’s right to a deduction for the 2021 purchase and sale transaction did not disappear. He has the right to submit documents to the tax office or to work - and receive money from the treasury.

The law does not provide for other deductions related to the gift of an apartment.

Required documents

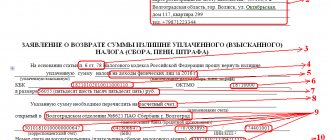

What documents need to be prepared to take advantage of the tax deduction? The list of documents is standard and includes the following papers:

- application for a property deduction;

- passport;

- certificate of income from the official place of work, filled out in Form 2-NDFL;

- a notarized contract of purchase and sale or shared ownership of real estate;

- completed tax return in form 3-NDFL;

- extract from the Unified State Register of Real Estate;

- documents - checks, receipts, bank statements confirming the fact of payment for the apartment;

- acceptance certificate (optional for DCT);

- marriage certificate (if available);

- bank account details for depositing funds;

- loan agreement and a certificate of accrued interest on the mortgage for the year (if the property is purchased on credit).

All listed documents for obtaining a property deduction are submitted both in originals and copies. Each copy will need to be personally certified.

When the package of documents is prepared, you go to the Tax Inspectorate office at the place of your registration or apartment registration. It is very important to write the application correctly on the spot, as well as fill out the tax return. If the inspector finds errors, your application will be returned to the Tax Office. Therefore, if you doubt the correctness of drawing up documents for deduction, it is better to use the help of a specialist. Once you are done with this question, all that remains is to wait for the answer and the money. If you are in another city, then the documents can be sent by mail, but you must send the parcel in a valuable letter with an inventory included inside.

Rights of the donee

The following tax consequences occur on the donee’s side:

- according to the gift deed itself;

- after the sale of the donated real estate;

- after buying a new apartment with money from the sale.

Let's consider all these situations in more detail.

After the donation transaction

Immediately after receiving the apartment, the recipient has income that is subject to personal income tax. Income is measured by the price of living space, which the parties indicate in the contract, cadastral or inventory value. From this price you need to calculate 13%. The resulting number will be the amount of tax that must be declared by April 30 and paid to the budget by transfer by April 15.

At the same time, tax deductions by analogy with the seller are not provided for under the DCT. If the seller can reduce the income from the sale by a fixed or expense amount, then the donee does not have such an opportunity. He will definitely have to pay personal income tax on the full cost of housing.

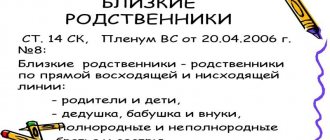

IMPORTANT! When making a gift, a recipient who is closely related to the donor is exempt from personal income tax. This is a spouse, parent, child, grandparent, grandchild, grandchild, brother or sister. Relatives with a greater degree of kinship are not included in this list.

Example. Alexander Petrenko gave his nephew real estate worth 1,200,000 rubles. The nephew calculated the amount of tax: 1,200,000 * 0.13 = 156,000 rubles. The tax amount is large, but it cannot be reduced, since deductions are not provided.

After the sale of the donated living space

Personal income tax of 13% will have to be paid if the property is sold before the expiration of the statute of limitations for ownership.

- 3 years – for premises donated by people from a circle of close relatives.

- If the housing was donated by a person who is not a close relative, then 5 years.

To reduce the tax amount, the seller has the right to apply a deduction. To do this, you need to subtract 1,000,000 rubles from the amount received under the monetary policy - a fixed amount. The expense option is not applicable, since the seller had previously not purchased the apartment, but received it by gift.

Example. Lyudmila Ivashutina received an apartment from her grandmother under a gift agreement in 2021. In 2021, she decided to sell it for 1,750,000 rubles. The statute of limitations for possession of Lyudmila is 3 years. It has not expired by the time the policy agreement is concluded, so you will have to calculate and pay the tax. For this, Lyudmila has the right to use a fixed legal deduction of 1 million rubles. The personal income tax calculation will be as follows: (1,750,000 – 1,000,000) * 0.13 = 750,000 * 0.13 = 97,500 rubles.

After purchasing a new property with money from a gift

If, after selling the donated housing, a citizen buys another, he will be able to return 13% of the expenses from the budget. The maximum you can claim is a deduction of 2 million, and return 260 thousand.

Additionally, if the purchase is made with credit money, you can receive a deduction for mortgage interest. Maximum 3,000,000 rubles deductible and 360,000 rubles refundable.

IMPORTANT! It makes no difference what money was invested in the purchase of living space - from donated property or from any other property, and whether tax was paid on it or not. It is the fact of purchasing housing that has legal significance. An additional condition is that the tax refund must not be exhausted. It is provided to everyone once until the maximum amount is exhausted.

Example. Maxim Vasilenko’s parents gave him an apartment in 2016. In 2021 he sold it for 2 million rubles. He was exempt from personal income tax on the sale, since the period of ownership was 4 years; he did not need to submit a declaration. In the same year, he invested the proceeds from the sale into the purchase of a new apartment for 3,000,000 rubles, taking out 1 million as a mortgage. Starting in 2021, Maxim will be able to submit documents for a tax refund from the purchase of a home. He will return 260 thousand (13% of the maximum amount of 2 million) directly from the DCT, and will additionally be able to receive compensation for the mortgage interest paid.

Is a gift taxable?

You need to pay taxes on gifts, but not everyone.

According to paragraphs. 18.1 Art. 217 of the Tax Code of the Russian Federation, close relatives of the donor are exempt from taxation:

- spouses;

- parents;

- children;

- grandfathers;

- grandmothers;

- grandchildren;

- full and half brothers and sisters.

A gift is a gratuitous transaction from which the donor does not receive profit, so he also does not need to transfer personal income tax. Other citizens who are not related to the donors will have to pay personal income tax.

Tax rates

The rates are set by Art. 224 Tax Code of the Russian Federation. For residents, the amount is 13% of the value of the gift, for non-residents – 30%.

Non-residents are people who have been absent from the territory of the Russian Federation for more than 183 days during the last 12 calendar months. Even if a person has Russian citizenship, but left the country for a long time, he will have to pay 30%.

Practice of calculating tax deductions

Above, we separately examined the rights of the donor and the donee in transactions related to donated real estate. Next, we will take a comprehensive look at who pays what taxes and what compensation they claim for refund.

Gift to a close relative

Their tax rights are as follows:

| Deal | Donor (the one who donated the housing) | The donee (the one who received housing) |

| Gift deed | Does not pay gift tax. There are also no tax refunds on gifts. Doesn't file a tax return. | Don't pay gift tax. Does not receive tax refunds. Doesn't file a tax return. |

| DCT (before or after deed of gift) | Can apply for a tax deduction on the purchase of an apartment, which he subsequently donated. To do this, submit 3-NDFL at any time after purchase | If you decide to sell your apartment, you will need to calculate personal income tax on the DCT amount. Tax can be avoided due to the length of ownership (3 years). 3-NDFL is not necessary. If the deadline has not passed, you can reduce the tax using a fixed deduction of 1 million rubles - it is declared when filling out 3-NDFL |

Gift to non-relative

This category of recipients includes everyone who is not part of the circle of close relatives - including great-aunts, great-nephews, aunts, uncles, fathers-in-law, daughters-in-law, sisters-in-law, brothers-in-law, and so on.

When donating, compensation is distributed as follows:

| Deal | Donor (the one who donated the housing) | The donee (the one who received housing) |

| Gift deed | Does not pay gift tax. There are also no tax refunds on gifts. Doesn't file a tax return. | Pays 13% of the apartment price. Does not receive tax refunds. Submits 3-NDFL by April 30 of the following year. Until July 15, pays the received personal income tax |

| DCT (before or after deed of gift) | Can issue a tax refund from the purchase of an apartment, which he subsequently donated. To do this, submit 3-NDFL at any time after purchase | If you decide to sell your apartment, you will need to calculate personal income tax on the DCT amount. You can avoid tax due to the length of ownership (5 years), then you do not need to file 3-NDFL. If the deadline has not passed, you can reduce the tax using a fixed deduction of 1 million rubles - it is declared when filling out 3-NDFL |

This situation is very unfavorable for the donee, because he is subject to taxation twice - in the transaction with a gift and when selling the donated apartment. The state deduction upon sale rarely exceeds the price of the policy. You can avoid this situation by using step-by-step donations through a relative.

Who can receive a deduction when donating real estate?

Any tax deduction is provided to a citizen on the basis that at a certain point in time (which is significant from the point of view of issuing a specific deduction) he paid personal income tax at a rate of 13% to the budget of the Russian Federation. If personal income tax was not paid by a person (was not calculated from his income), then no tax deduction can be issued by him. Another condition for receiving a deduction is that the taxpayer has made certain expenses that give the right to a refund of personal income tax paid to the state budget, or the right to legal non-payment of calculated personal income tax.

Are these conditions for registering a deduction observed when concluding an apartment donation agreement?

The gift of real estate, as well as most other types of valuable property, is a process that is regulated by civil and tax laws. It involves 2 parties - the donor and the recipient.

If they are close relatives of each other , then the property presented in monetary terms (as reflected in the gift agreement) is not subject to any tax. In this regard, the recipient, the new owner of the property, does not have the right, for example, to issue a property deduction for the housing received, since he received it without making any expenses. The donor, the previous owner of the property, will not be required to pay income tax calculated on the value of the donated apartment, since he did not receive the corresponding income.

In turn, if the donor and the recipient are not close relatives of each other , then in this case:

- The recipient becomes obligated to pay personal income tax calculated on the cost of the apartment under the contract. This tax is calculated at a rate of 13%, like personal income tax on any other income.

- The recipient becomes obligated to submit to the Tax Inspectorate (FTS) a declaration in form 3-NDFL, which will reflect the income represented by the monetary value of the apartment donated to the person.

- The recipient acquires the right to reduce or compensate the calculated personal income tax if there are legal grounds for doing so. For example, when purchasing another apartment at your own expense, as well as when applying for a mortgage loan.

Let us consider in more detail how the recipient citizen can exercise these privileges.

What real estate can be donated to another person?

The object of taxation in this case will be the following types of real estate:

- An apartment or a share in it.

- Private home ownership along with a plot of land.

- A plot of land, if there are no buildings on it. Or the buildings do not belong to the donor. Here we must keep in mind that if the building still exists, but it is not completed and not registered in the cadastral register, then, from the point of view of the Land Code, it does not exist. You can also donate part of the land plot on which there are no buildings.

- Country house with plot.

Terms of the gift agreement

The subject of a gift agreement is most often property or vehicles. Among the items of donation, there are ordinary gifts with a value that does not exceed 5 minimum wages and ordinary gifts of small value. Agreements for the donation of such gifts do not provide for the registration of deeds of gift and are not subject to tax.

The subject of the gift agreement must be specified and drawn up in accordance with the legislation of the Russian Federation. All fictitious transactions may entail administrative liability.

In most cases, a donation can be formalized orally if it is a transfer of inexpensive items, documents and other valuables.

In simple written form, a gift agreement is concluded if the donor is a legal entity and the object of the gift does not exceed 5 minimum wages.

If an agreement is concluded orally and contains only a promising nature, then this agreement cannot be considered valid and it does not contain any executive nature.

All donation transactions must be concluded in accordance with the legislation of the Russian Federation, certified by a notary, and only then will they be valid and of an executive nature.

Instead of an afterword

As you can see, among the existing gift taxes in our country in 2021, it is worth including only personal income tax, which is the only tax when concluding a gratuitous gift transaction, which is characterized by the recipient receiving a profit without spending his own funds.

At the same time, personal income tax is included in the category of national taxes with a single rate throughout the entire territory of the Russian Federation, amounting to 13% of the total value of the transaction object for residents of Russia.

This tax is paid once a year, namely, its payment must occur next year, that is, after the actual receipt of the gift. The recipient is obliged to do the calculations and reporting himself.

We understand that it is quite difficult for an ordinary citizen to fully understand such a complex issue. And, therefore, we invite you to quickly get free help from our on-duty lawyer! To do this, simply formulate a question and click the “Submit Question” button! Previous

Deed of GiftIs it possible to cancel a deed of gift for an apartment?

Next

Gift deedGarage donation agreement: sample, how to draw up and deadlines

What happens if you don’t declare or pay your gift tax on time?

If the established deadlines for filing a tax return with the Federal Tax Service are ignored, the agency’s specialists will be forced to send the taxpayer a corresponding notice. It is worth noting that information on all transactions related to real estate is submitted to the tax registration chamber.

Experienced lawyers of the Legal Ambulance website recommend filing a declaration as soon as possible, because the more time passes from the date of the deadline established by law, the more the fine you will have to pay in the end!

In 2021, the fines for failure to meet deadlines remain as follows:

- Ignoring the obligation to submit a tax return is a fixed fine of 1,000 Russian rubles, as well as 5% of the total tax for each month of delay (the period begins in May).

- Refusal to pay tax - 20% of the total amount of personal income tax in case of the first non-payment, as well as 40% for each subsequent non-payment (according to current legislation, each subsequent non-payment is considered intentional).

- The penalty for late payment of the tax established by law is calculated daily from the moment of delay, that is, the next day after July 15, according to the following formula:

amount of tax debt * refinancing rate (8.25%) * 1/300 * number of days overdue

All fines are collected by tax authorities both voluntarily (at the first request of tax officials) and through the courts.

How can you reduce your personal income tax?

It is also important that after the transaction, the recipient must personally calculate the amount of the tax contribution, enter it into the declaration and submit this document to the tax authorities. It is on the basis of the declared declaration that tax specialists will calculate the final contribution, that is, check the accuracy of the stated facts.

ARTICLE RECOMMENDED FOR YOU:

How to draw up a debt gift agreement?

The most profitable option, which unscrupulous payers constantly try to take advantage of, is the deliberate underestimation of the actual cost of the transaction object. Moreover, if such value is not less than 70% of the amount of the cadastral value of the property, the amount will be calculated from the lesser one.

Case Study:

The deed of gift states that the value of the object of donation is 2 million Russian rubles. However, its real market value is 2,500,000 Russian rubles. At the same time, the cadastral value of this property is also 2 and a half million rubles.

Since the amount of 2 million is 20% less than the cost of 2 and a half million, the tax will be calculated by tax specialists from 2 million, which will save the payer a lot of money.

At the same time, such an underestimation of the real value of an apartment or other real estate can have certain negative consequences for the recipient, because tax officials check the compliance of the declared data. However, this method can be useful when an object is overvalued. You can conduct an independent examination yourself and challenge the value, reducing the amount of gift tax.