Tracking the progress of tax return verification in your personal account

From this article you will learn how to check the progress of the audit of your submitted return in your personal tax office account.

Very often my readers ask the question: “I have an overpayment in my personal account!” Does this mean that the deduction amount has been confirmed to me and will be paid tomorrow?”

Not certainly in that way. If an overpayment amount appears, this only means that your declaration has been entered into the inspection database. That is, the operator entered it into your personal card. But the check is not finished yet; it may not even have begun. The tax office has 3 months from the date of submission of documents to verify the declaration.

Let's figure out where and how to look at the dates.

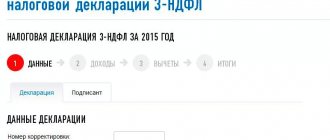

Open the “Income Tax” menu, then “3-NDFL”. The 3-NDFL verification status will appear.

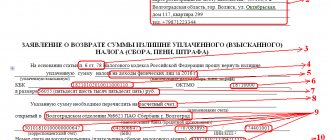

You will see the number assigned to your declaration, the date of submission, and the date of registration. We are interested in the “Progress of the desk audit.” When the status becomes COMPLETED, then from this completion date we count one month for transferring money. The date, as you can see in the picture, appears next to the status.

You can also see the result of the check, whether all deductions are confirmed, as well as the amount to be refunded. You can also submit a return request here.

The second most frequently asked question: “The verification is completed and the declaration is fully approved! What are my next steps?

When the audit status changes to “completed”, the tax office has 1 month to transfer the money, provided that you have already submitted an application for a refund.

- How to reset personal income tax declaration 3, sample form 2019

If you have not submitted it before (or submitted it, but if the amount to be refunded has changed after verification), you will have to generate it again. Read more instructions on “How to form a return application.”

How to track the status of a 3-NDFL tax audit

You can find out what status is assigned to the 3-NDFL declaration by phone, indicating your TIN. When you call you will receive the following information:

- document verification stage;

- whether any difficulties arose (for example, a counter check);

- are there any errors in the paperwork, etc.

On the Federal Tax Service hotline, the call is redirected to the required department of the tax office, which accepted the documents from the applicant.

You can send an official written request, but this will take even more time - it will last a month at best. The fastest way is to go to the Federal Tax Service portal in the Personal Account to the tab with personal messages, where information about the progress of the desk tax audit of the declaration has been received. The method is considered convenient for the user; he can independently monitor the progress of execution.

At the first stage, the status of the desk audit is “registered,” which means the documents have been accepted for consideration. From this moment the countdown of the time required for document inspection begins.

The desktop audit status “In Progress” is displayed after the “Started” status. In your personal account you can see the completion percentage. In reality, this indicator does not characterize the state of the inspection by the authorities; only the amount of time until its results is traced as a percentage.

When a review is completed, it is assigned the status “Completed.” If there is no audit status, the tax inspector should answer the questions; the reasons must be found out individually.

Where can I find out about tax deductions?

Citizens often forget about this nuance, so they begin to worry if deductions are not made. Moreover, many individuals monitor this in order to navigate the amount that needs to be paid for a mortgage loan. In addition, they are concerned about whether social taxes already apply to them.

With such questions, you can contact several departments, where they will help you find out whether there was a deduction. Such structures include:

- Inspectorate of the Federal Tax Service;

- Federal Tax Service;

- Federal Bailiff Service.

How to find out about tax deductions from the tax office? Most often, those who pay taxes on social benefits try to track information by phone. Usually they call the tax authorities and ask for all the necessary information.

This method is already somewhat outdated, so these organizations have developed special electronic versions of their services. They have created online services, thanks to which each borrower can freely obtain all the information he needs.

How to find out when the tax deduction for an apartment will be transferred

After filling out the 3-NDFL declaration and submitting it to the Federal Tax Service, the question immediately arises: how long to wait for a tax deduction for an apartment?

- How to send an adjusted personal income tax return 3 through your personal account

How long do you need to wait and is it possible to demand that the inspector transfer money if these deadlines are not met? How to check tax refund using TIN?

When should the Federal Tax Service return the tax?

The deadlines for transferring tax deductions are specified in paragraph 2 of Article 88 of the Tax Code of the Russian Federation. The Federal Tax Service has three months from the date of submission of documents for a desk audit. After the end of the desk audit, the tax service is obliged to make its decision: to approve the tax refund or refuse. The taxpayer must be notified in writing of the results of the audit. Let's look at how to track your tax deduction below.

If the Federal Tax Service makes a positive decision, the citizen additionally submits an application for a refund of 13%. It contains his personal account and bank details. The tax office has one month to transfer the money. Thus, the maximum time for checking and transferring a refund takes four calendar months.

How to find out when the tax deduction will arrive? The easiest and most convenient way is to open a personal taxpayer account. To do this, you need to contact the nearest tax office with your original passport and TIN. It is not necessary to come to your place of registration; you can open a personal account at any tax office.

The taxpayer will be given a personal login and password. Using your personal account, you can check the status of your tax deduction. To do this, you need to go to the Federal Tax Service website using your username and password. It takes three days to create a taxpayer’s account. After that, it displays the status of the tax deduction refund.

If it is not possible to create a personal account, there is still a way to find out when the tax deduction for the apartment will be paid. The taxpayer has the right to call his tax office, give the TIN and receive verbally the result of the audit process of his tax return.

Procedure for returning a tax deduction

Let us remind you that in order to return 13% of the purchased property, you need to collect documents, fill out 3-NDFL and submit the finished package to the tax authority.

To receive a deduction for an apartment, prepare the following documents:

- certificate from work 2-NDFL;

- agreement for purchase or participation in shared construction;

- deed of transfer;

- certificate or extract of ownership;

- payment documents;

- loan agreement if there is a mortgage;

- application with bank details and personal account.

Based on the documents, the 3-NDFL declaration is filled out. You can compile it in two ways: on tax office forms or in a special Declaration program. With documents and a completed declaration, the taxpayer goes to the Federal Tax Service for registration and hands over the package.

- Tax deduction through State Services: features of obtaining a deduction and assistance in registration

According to the law, you will have to wait three months for a desk audit. If the declaration is drawn up correctly, there will be a receipt in the fourth month. But it happens that after a full four months the money is not transferred.

Delay in payment of tax deduction

If the money has not been received and the deadline for the desk audit has long passed, the taxpayer can contact the tax service for clarification.

A delay in payment means some kind of error in the declaration or in the documents provided. The tax service is obliged to notify about the presence of shortcomings during the desk audit. In practice, district tax inspectorates may not send notifications if there are errors. The taxpayer needs to independently control the progress of his business.

If a delay occurs, you should immediately contact the office department and find out when the money for the tax deduction will arrive. It is possible that not all documents were attached to the declaration. After eliminating the shortcomings, the tax inspector sends an order to transfer the refund. The taxpayer has the right to collect interest for violation of the return deadlines. All requests to the tax service should be submitted in writing to the head of the inspectorate.

The deadline for a desk audit cannot be accelerated. If the taxpayer wants to receive compensation faster, he is required to have a correctly completed declaration and a complete package of documents. This will avoid delays during the verification process.

How to find out about an overpayment

Most often, the reason for overpayment is errors in the payment order or declaration, double write-off of tax at the request of the Federal Tax Service, previously paid advance payments exceeding the total tax amount for the year.

In 2021, an additional reason may be exemption from paying taxes and fees for the second quarter on the basis of Federal Law No. 172-FZ dated 06/08/2020. Previously, it was possible to find out about an overpayment only after reconciliation with the tax office or from a certificate in the KND form 1160081. Starting from October 1, 2021, the Federal Tax Service is obliged to always notify the taxpayer that there is an overpaid amount of tax on his personal account within 10 days period from the moment of its detection (clause 3 of Art. Tax Code of the Russian Federation).

How to check the status of an application at the tax office

The flow of requests and applications to the tax office is huge. Someone submitted another declaration, someone filed a complaint or an application for a property deduction. Each applicant wants to quickly find out the verdict on his application, so there are certain ways to check the status of the application with the tax service.

Tax system of the Russian Federation

The taxation system is an integral part of the functioning and development of the economy of the Russian Federation. Taxpayers making mandatory contributions to the state budget of the country are:

- working-age population - ordinary citizens make contributions from wages, property, financial transactions, etc.;

- legal entities - organizations and enterprises of various levels are required to pay taxes on profits, property, value added, excise taxes, etc.;

- individual entrepreneurs - representatives of small and medium-sized businesses also make a feasible contribution to the state budget through deductions from profits, etc.

In addition to monitoring the accuracy and completeness of the calculation of taxes, fees and other payments, the Federal Tax Service of the Russian Federation also performs other functions:

- Control over the circulation and production of tobacco products.

- Reception of applications and complaints from citizens.

- Registration and issuance of TIN.

- Registration of legal entities and individual entrepreneurs.

- Reception and verification of tax returns.

- Monitoring compliance with currency legislation.

- Registration and issuance of permits for certain operations.

- Registration of cash register equipment and much more.

How to check the registration status of incoming documents

Obviously, the high workload of the department does not allow ordinary visitors to obtain the necessary information about the progress of an application or complaint during a personal visit. In addition, taxpayers know how to value their time and money, so they choose remote ways to track the stages of document registration.

Types of property for which a tax deduction can be returned

The legislation defines a list of real estate, upon purchase of which a taxpayer can obtain approval for the return of property benefits:

- Apartments, houses, rooms that were purchased with the taxpayer’s own funds. In case of a shared purchase, an individual can return the overpaid tax only on his part of the property.

- Land plots for development, which have been assigned the status of individual housing construction.

- Plots on which any residential building is already located.

How can you manage your money?

You can dispose of the overpayment in three ways (clause 5, clause 1, article 1 of the Tax Code of the Russian Federation):

- return to your current account;

- offset against future payments;

- pay off debts on other taxes, pay penalties or fines.

Until October 1, 2021, overpayments of taxes can only be offset against taxes of the same level. Thus, by overpaying federal income tax, you can cover arrears and upcoming payments from federal taxes: VAT, income tax, mineral extraction tax.

Another rule that will soon be changed: money is returned to the account for those taxpayers who do not have debts to the budget for taxes of the same type.

From October 1, 2021, the provisions of Federal Law dated September 29, 2019 No. 325-FZ will come into force, and the rules will change:

- You can offset the overpayment against future payments or pay off the debt for various taxes. Regardless of which budget of the Russian Federation they are credited to. For example, due to overpaid income tax (federal budget), you can pay off arrears or a fine on property or transport taxes (regional budget).

- If you have tax debts of any type (federal, regional or local), you cannot return the overpayment of taxes in cash. Debtors, due to overpayment, are obliged to first pay off their obligations for taxes, fines and penalties (Clause 6 of Article 78 of the Tax Code of the Russian Federation).

How to monitor the progress of a desk audit

By registering in your personal account on the website of the State Tax Service, you can see whether the application for a deduction has been approved, whether the citizen has used a tax deduction before, check at what stage the verification of the tax deduction for the purchase of an apartment is, and so on.

To use the online service, you need to log into your personal account and select the “Individual Income Tax” tab. Next, you need to select “3 personal income tax”. The window that opens will reflect the moment of receipt of the application for property return and the status of its verification. Tracking the processing of the declaration in your personal account is a very convenient procedure that does not require a personal visit to the inspection. When the verification status “Completed” appears, you can count one month from the date of filing the tax refund application to transfer funds to your personal account.

Status of verification 3 personal income tax information missing

If there is no data on the result of the desk audit, what this means, the tax inspector will tell you at the place where the declaration was registered or by telephone. The main reason is the lack of necessary information from the taxpayer. If the inspector detects a violation, he draws up a report and recalculates the amount of tax.

The inspector does not have the right to extend the three-month inspection period allocated by law. The taxpayer is notified of a pause in inspection by sending the following to his address:

- notification add clarifying documents;

- notice to appear at the tax office.

The inspector can contact the applicant using the phone number that is filled in during the paperwork process. If the period allocated for verification has expired, the payer has not received instructions, there is a reason to personally contact the tax office.

Three months is the final inspection period and if it is violated, the inspection cannot impose a fine on the client. The taxpayer must personally monitor the receipt of funds into his own current account. They are accrued within a month after the last day of verification. If the period established by law is exceeded, interest will be charged on the amount of the tax deduction for each day of delay.

How to find out about the status of checking the 3-NDFL declaration and tax refund online via the Internet

To facilitate informing taxpayers, the Federal Tax Service has developed a special Internet service “Taxpayer Personal Account for Individuals.”

Using your “personal account” you can find out about the amounts of taxes accrued and paid by you, pay tax debts via the Internet, contact the tax office and track the status of the desk audit of your tax return using Form No. 3-NDFL.

The online service allows taxpayers who have filled out a declaration for receiving property or social tax deductions to learn about the results of a desk tax audit of the submitted 3-NDFL declaration, as well as find out online the status of consideration of an application for a tax refund. The section contains information about the registration number of the submitted declaration, the date of registration with the Federal Tax Service, the start and completion date of the desk audit, the stage of the desk audit “Started” or “Completed”.

To gain access to your “personal account,” you need to contact any tax office, not necessarily the one with which you are registered. You must have a passport or other identification document and a copy of the registration certificate (certificate of receipt of TIN). The need for a copy of the TIN is due to the fact that connection to the “Personal Account” is possible not only at the tax office at your place of residence, where data is available about you, but also at other inspections; in this case, it is necessary to exclude an error in the TIN number.

You can fill out the 3-NDFL declaration, for example, using the free computer program “Declaration” developed by the State Research Center of the Federal Tax Service of Russia.

How to get a personal income tax deduction

Individuals have the right to receive standard, social, property and investment deductions when calculating and paying personal income tax (clause 3 of Article 210 of the Tax Code of the Russian Federation).

Some types of deductions can be provided by the employer, that is, when deducting personal income tax from the salary, the accountant will immediately take into account the deduction and reduce the tax base for it. He will do this if the employee submits the appropriate application and documents, that is, receiving a deduction at work is of a declarative nature. The main document for issuing a standard deduction is the employee’s application; in other cases, it is a notice of the right to deduction, which is issued by the Federal Tax Service after checking the supporting documents submitted by the taxpayer to the regulatory authority. How to fill out the 3-NDFL declaration for investment deduction, we wrote here

That is, the deduction when calculating wages is not always applied. In this case, you can independently declare your right to deduction and return the overpaid personal income tax from the budget by sending a 3-personal income tax declaration at the end of the year to the tax office. This can be done either in person at the inspectorate or through the taxpayer’s personal account () by registering on the official website of the tax office. The second option saves a lot of effort and time, and also provides undeniable advantages, which we will discuss below.

Filing for a tax deduction online through State Services: step-by-step instructions

The application for a tax deduction can be filled out by portal users who have a verified account. The document will need to be signed with an electronic signature: enhanced qualified or enhanced unqualified.

The declaration can be checked by the Federal Tax Service within three months.

How to check your tax deduction status online?

The State Services Portal does not provide a function for clarifying the status of the declaration verification. This can be done on the website nalog.ru (portal of the Federal Tax Service). You can register on it through State Services (for this you need to indicate your TIN number on the State Services portal).

- On the main page of the nalog.ru website in the section “

Individuals " click the " Login to your personal account " button. Select the function “ Log in/register using a government services portal account .” A window will appear to log into your personal account on State Services. Enter your details. Click on the “ Provide ” button, allowing the site to view your account information on State Services. Check the box to accept the Agreement. Click on the “ Register ” button. A warning will appear that the data in your personal account will be generated within three days. You may not be able to immediately find out the status of your tax return review. You have entered your personal account on the Federal Tax Service portal. Open the section “ Personal Income Tax and Insurance Contributions ” and click “ Declaration on Form 3-NDFL ”. View information about the status of the 3-NDFL check. Upon completion of the audit, you will receive a notification informing you of approval or denial of the tax deduction.

Deadlines for tax payments

After submitting the declaration to the inspectorate, many people ask the question: how to find out when the tax deduction for the apartment will be transferred? The deadlines for payments are determined by law and for violation of them, a citizen can demand material compensation from the tax authority.

From the moment of filing the declaration, the government agency is given three months for a desk check of the attached papers. After this period, the inspection is obliged to make a decision on granting a property deduction for the purchase of housing or refuse to provide the benefit. Whatever the decision of the government body, the taxpayer receives a notification.

If the decision is positive, then the individual must provide the inspectorate with data to transfer the amount in excess of the tax paid. Within the time period established by law (one month), the treasury is obliged to transfer the accrued amount of money to the citizen’s current account. Thus, the maximum time for paying a tax deduction when purchasing an apartment or other real estate is 4 months. If the deadline for tax refund is not met, the taxpayer can write a complaint to a higher authority, which must be considered within one month. For each day of delay, a citizen has the right to demand compensation from the inspectorate as a percentage of the deduction amount.

If the declaration is incorrectly completed or the package of collected papers is incomplete, the inspector has the right to demand an adjusted Form 3 of personal income tax.

How to calculate property deduction

You can calculate the amount of overpaid tax without contacting the inspectorate.

The legislation determines the maximum amount of the value of a property from which a tax deduction can be obtained - 2 million rubles. If the cost of the purchased housing exceeds this figure, 2 million is still taken as the calculation base.

When purchasing a home with a mortgage, you can also receive compensation from the amount of interest paid to the bank. The maximum amount of mortgage interest to return the property benefit should not exceed 1 million rubles. Thus, the estimated base of mortgage housing for income tax refund is 3 million rubles.

Let's give an example of a standard purchase of an apartment without equity participation by an owner who has an official salary of 40 thousand rubles. Ivanov A.P purchased an apartment for 3.5 million rubles. Since the law establishes a maximum amount for the return of property benefits of 2 million, with a salary of 40,000 per month, A.P. Ivanov can return the overpaid tax of 260,000 rubles. Every month A.P. Ivanov pays 5,200 rubles in income tax. In a year, a citizen can return 62,400 rubles. This means that in subsequent periods A.P. Ivanov will return income tax until he has collected all 260,000 rubles.

Unfortunately, not all citizens know that after purchasing a home, they can return a small part of its cost in the form of a property benefit. To receive it, you must have official earnings, deduct 13% income tax from it, fill out a declaration and take it to the tax office with a package of necessary documents. The desk audit lasts no more than 3 months, after which the treasury transfers the amount of the property deduction to the individual’s current account within a month. If the declaration verification procedure exceeds three months, the taxpayer has the right to demand interest from the inspectorate for each day of delay.

How to check the status of tax deductions for government services

How can I find out my tax deduction status?

The most proven way to find out the status of a tax deduction was to call the branch of the Federal Tax Service. Inspectorate employees have the right to provide information to the applicant by phone if he gives his last name, first name and patronymic. Although sometimes additional information is required for clarification:

How to find out your tax deduction status

First, enter the login and password that are in the registration card issued by the Federal Tax Service. To get a card, you need to come to the tax authorities with your passport and the original certificate with TIN. If a taxpayer has lost his login and password, it is easy to restore them by contacting the Federal Tax Service office again with the same documents as during registration.

How to apply for a tax deduction through the State Services portal

It often happens that due to the lack of proper financial education in our country, some citizens miss the opportunity to exercise their rights in certain areas of life. In this article we will talk about ways to return part of the taxes paid to the state from your official salary.

How to find out when the tax deduction for an apartment will be transferred

From the moment of filing the declaration, the government agency is given three months for a desk check of the attached papers. After this period, the inspection is obliged to make a decision on granting a property deduction for the purchase of housing or refuse to provide the benefit. Whatever the decision of the government body, the taxpayer receives a notification.

Find out the tax deduction status

Secondly, you can enter your “Personal Account” using a Universal Electronic Card (more precisely, an electronic signature attached to it). You can obtain a key with an electronic digital signature at one of the certification centers (as a rule, their functions are performed by regional branches of Sberbank). One of the advantages of the second method is that you can set and change the password yourself.

The procedure for filing a tax deduction through State Services

Since 2015, users of the State Service can submit reports to the Federal Tax Service directly through the portal. All information will be transferred directly to the Federal Tax Service of Russia. Moreover, this service can be used not only by residents of large cities and regional centers, but also by people living in small towns remote from the capital. The opportunity to receive a tax deduction electronically through gosuslugi.ru will be appreciated by those who cannot contact the department in person, for example, people who often leave the city or have a busy work schedule.

[1]

How to apply for a tax deduction and submit a 3rd personal income tax return through the taxpayer’s personal account

If you want to control what is happening with your declaration, in what form it has reached the Internal Revenue Service, then you need to go to the section: Declaration in form 3-NDFL (see step 8-9). Below you see the section my declarations. Once there is a status with a green checkmark and the phrase: “receipt of acceptance received,” you can be sure that the set of documents has reached the Federal Tax Service.

We issue tax deductions through government services

- Go to the website gosuslugi.ru and log in;

- Go to the “Service Catalog” section;

- Select the “Taxes and Finance” category;

- Select the item “Acceptance of tax returns”;

- Select ;

- Read the terms of service and click on the “Get service” button;

- Fill out the declaration, confirm the application with an electronic signature and send it to the tax office for consideration.

How to get a tax deduction through the MFC or the taxpayer’s personal account on State Services

The state also removes part of the tax burden if the taxpayer spent his funds on the purchase of an apartment, a house for the whole family, invested money in housing construction, or took out a mortgage loan to purchase an apartment or land plot for the construction of a house. The benefit also applies to the purchase of part of a residential premises in an apartment building or private building.

[3]

How to find out when the tax deduction for an apartment will be transferred

The maximum period for paying a tax deduction for an apartment and other purchased property is 3 calendar months, after this period the money should arrive in your account from the tax service. You can control this process by registering in your personal account on the website of the Russian tax service.

Main features of the service

- Contains information from citizens.

- taxpayer's property: land, real estate, vehicle and their value, date of registration of property, etc.;

- benefits to which the applicant is entitled;

- the conditions of settlements with the state budget: the amount of accrued taxes, payment deadlines, information about debt.

- Communication with a tax inspector via the Internet.

- Tracking the progress and status of the desk audit using Form 3-NDFL.

- Reception of notices and receipts with the specified tax amount.

- Online payment or printing a receipt for tax payment.

- Obtaining the necessary information without a personal visit.

Deadlines and how to find out the results of the verification of reports and documents for tax refunds? You can submit documents for a tax refund on the day you submit your 3-NDFL declaration. It is allowed to submit a declaration without filling out an application for a refund, but not on the contrary. The reason is that the surplus is calculated based on paid tax receipts. If your personal account indicates that there is no data on the result of the desk audit, then the details must be clarified with the tax office.

The Tax Code sets a period of one month for payment and three for verification. This means that after three months the taxpayer will receive a decision:

- providing a tax deduction;

- refusal of payments and its reason.

If the tax office has decided to pay the funds, they will be credited to the account within a month from the date of registration. The period may differ if the application for a deduction is submitted after the completion of the inspection, which acquires the status “Completed”.

The results of checking reports and documents for tax refunds are tracked in the taxpayer’s personal account on the official website of the Federal Tax Service on the “3-NDFL” tab. This electronic service contains all the necessary information about registration, progress and confirmation or refusal of property deduction payments.

You can find out the details in person by contacting the tax authority by presenting your Taxpayer Identification Number (TIN) and your passport. If on the day of filing the tax return the current account for transferring the refund amount was not indicated, an application for its assignment is submitted after the completion of the desk audit.

The verification period may increase if an error is found in the submitted documents. You can track this in your personal account. If there are no errors, then the audit and its result can only be delayed by the demand for clarification from the taxpayer.

On-site inspection

The Tax Code of the Russian Federation does not prohibit inspection of “physicists”. There is just a small twist: according to the Constitution, the home is inviolable, so you can refuse a home inspection. In this case, the inspectors will work at the location of the Federal Tax Service, but you will have to take them all the requested documents.

If you operated as an individual entrepreneur and did not pay all taxes, then closing an individual entrepreneur will not save you from sanctions. The Federal Tax Service will check the former businessman and impose fines on the individual.

Features of logging into your personal account in the updated version

If a taxpayer does not know how to view the progress of a desk audit on the updated website, there are several tips below. The user needs to go to the Federal Tax Service website and fill out the fields in the form: “login”, “password”. To change the login parameters, select the appropriate section to the right of the login button: Digital signature, State services. Further details.

The updated version of the Personal Account became available to all citizens in August 2018. From now on, it is no longer possible to use the old version. The login algorithm is not complicated, the main thing is to obtain and save authorization data for the tax.ru website. The list contains three methods for obtaining a secret character set:

- Registration in person at the tax office. Personal appeal to the inspectorate. Upon presentation of your passport and Taxpayer Identification Number, an employee of the Federal Tax Service fills out an application and provides a login and password. They provide access to the taxpayer’s new personal account. If you lose your authorization data, you must contact the INFS and get it again.

- EDS stands for electronic digital signature. There is a condition for this option. The organization that issues the key certificate to confirm the digital signature must be accredited by the Ministry of Telecom and Mass Communications of the Russian Federation. Any electronic media will do, but for accurate operation you need to use the CryptoPro CSP software, version 3.6 or later.

- Profile on the State Services portal. If the taxpayer registered earlier and received the password by mail or at the MFC, then from the personal page on the State Services website you can go to the tax inspectorate’s personal account. Access to your personal account opens in one or two days.

To enter the updated account on the nalog.ru portal, you must select the “Individuals” section and go to the “Login to your personal account” tab. These actions will lead to a form for entering your login and password. A distinctive feature of the new version is a dark blue background and an updated interface. The process of the inspection itself has also changed. Now you can find out about the status only by contacting the LC message service, or wait until the tax authorities themselves send a notice. Federal Tax Service employees warn you about each step in messages.

Necessary certificates for property return

To obtain the right to a deduction, the taxpayer must provide the tax office with a complete package of documents.

List of documents for returning tax benefits:

- Application for refund of over-withheld tax. Such a certificate can be downloaded on the website of the State Tax Service or purchased at any inspection office. The certificate contains information about the owner of the property (registration, passport data), address of the property, Taxpayer Identification Number, deduction amount. If a citizen previously received a property return from the purchase of an apartment, then the calculation base will gradually decrease.

- Declaration of form 3 personal income tax. This certificate can be submitted no more than three years from the date of purchase of the property. You can fill out the declaration yourself or seek the help of tax specialists. If the document contains incorrect data, the declaration will be returned to the taxpayer for revision.

- Certificate from the employer, Form 2 Personal Income Tax. It contains data on the income of an individual on which 13% income tax was paid.

- Documents establishing the right of ownership of a property.

- If housing was purchased with shared participation, documents confirming this fact are also required.

- Financial documents: bank statements, checks, bills.

- If part of the cost of the apartment was repaid with the help of maternity capital or other subsidies, you must attach copies of these documents.

certificate in form 3-NDFL Maternity capital certificate Certificate of income Document establishing the right of ownership of the property Application for refund of over-withheld tax Equity agreement

Who can take advantage of the property deduction

Not every person can take advantage of the tax benefit; in order to receive it, certain conditions must be met.

To whom can the property deduction be returned:

- Individuals who have official income and pay 13% income tax on it.

- Pensioners can also count on a property deduction.

The following categories of citizens cannot receive a tax refund:

- Individuals who have completed a purchase and sale transaction with a husband or wife, parents, brothers and sisters.

- Citizens who received real estate as a gift or inheritance.

- Taxpayers who filled out the declaration incorrectly or provided an incomplete package of documents.