According to Russian legislation, several types of land plots are distinguished according to their purpose - for example, agricultural land, settlement land, land intended for the location of industrial facilities. The category of a lot determines in what ways the owner is allowed to use it.

If you are planning to buy a plot outside the city, most often it is agricultural land. The land tax on it is lower than on plots for individual residential construction. However, such areas often have infrastructure difficulties, and it is not always possible to register in them either. Therefore, before investing money in buying land, you need to find out the features of a particular site.

Various organizational structures may exist on agricultural land. Often these are DNT (dacha non-profit partnerships) or SNT (gardening non-profit partnerships).

What is SNT: definition of the term

SNT is an abbreviated name for a form of association of citizens created to solve current problems in the horticultural process.

Such an organization must be registered with the tax authorities. It is imperative to develop a Charter as a tool for resolving controversial situations.

The members of the association are the owners of individual plots who make voluntary contributions to the general goals of the organization.

SNT has its own land and the necessary infrastructure (roads, water supply, communications for various purposes).

How is it deciphered?

SNT literally stands for “horticultural non-profit partnership.”

In other words, this is a voluntary association of summer residents, the purpose of which is to jointly resolve issues related to the exploitation of land plots legally.

SNT members use the land in accordance with the association's charter: plant trees, grow fruits and vegetables.

The construction of a house and adjacent outbuildings is allowed. The law provides for registration at the location of the dacha, but only if the constructed structure is suitable for habitation.

Legal entity or not?

SNT is a non-profit organization. The purpose of the creation is to jointly solve the problems of proper gardening. According to the Federal Law on Dacha Associations of Citizens, such organizations are subject to mandatory state registration in the manner prescribed for legal entities.

What is the difference between SNT and ST?

Historically, the creation of SNT was preceded by another form of association of gardeners - ST. They entered into such partnerships in order to receive from the state a plot of land (no more than 8 acres) with a country house located on it. There was no other option to acquire country real estate. ST members were responsible for making contributions, and the board of the partnership collected utility bills.

The concept of “SNT” appeared in 1998 as a new form of legal entity. According to regulatory act No. 66-FZ, the previously existing STs were to be reorganized into non-profit associations.

Concept of NTD

One of the forms of non-profit association of people can be DNT, which involves representing the interests of dacha owners. The partnership greatly simplifies the conduct of business activities on dacha plots, since it can provide certain benefits in exchange for membership fees.

An established legal entity can acquire property, enter into contracts with sales companies, order security services for the territory of a dacha community, and organize centralized collection and removal of garbage and household waste. At the same time, a dacha non-profit partnership has the right to conduct certain commercial activities, provided that all profits from this will go to meet the needs of the association of dacha residents.

The property of the partnership is divided into that belonging to the participants and that belonging to the legal entity itself. The first is paid from targeted contributions and allows each member of the partnership to use them. The property of a legal entity is acquired from membership fees and income of the legal entity. The right to use it is lost by the summer resident upon leaving the DNT. By the way, it is precisely the ownership of property that makes the difference between a DNT and a DPP (partnership and partnership).

How to open SNT?

To open an SNT, you must first submit an application to government agencies.

Land for such purposes is allocated in accordance with the zoning criteria of the territory. As a legal entity, a gardening partnership must be registered with the appropriate authorities. Without this procedure, the organization will not be granted any rights.

True, the process may drag on for a long time due to the need to comply with a number of formalities: approval of a development project, transfer of land into the ownership of SNT, selection of founders.

Advantages

Purchasing a plot of land in DNT has its advantages:

- Buying land in DNT for permanent residence can be a profitable investment, since it is cheaper than in the city;

- At the same time, the plots themselves are cheaper due to their location on less fertile soils;

- There is an opportunity to purchase several plots located next to each other;

- The organization represents the interests of all participants, so issues do not need to be resolved independently.

Charter of the partnership

The creation of a gardening partnership involves the development and approval of a Charter regulating the actions of the society and its members. This document sets out the rules and principles of SNT activities. The charter must contain the following information:

- name of the association;

- location address;

- legal form;

- actual and maximum allowed number of members, their rights and obligations;

- amounts and procedure for making mandatory contributions;

- management structure;

- the total area occupied by land plots.

What to pay attention to

You can find a house that suits your pocket in SNT. The price is affected by:

- Distance from the city.

- Transport connection.

- Condition of access roads to gardening.

- Sewerage and running water (not available everywhere).

- Electricity.

- Gas.

- Condition of the building.

- Condition of the garden.

- Proximity of the forest.

- Proximity of lake, river.

Before you buy real estate, you need to check the documents . You should pay attention to whether there are “third parties” among the owners, whether the property is pledged, whether there are debts on taxes and utility bills. It is necessary to compare the house plan with the actual structure. Often, owners make extensions without registering them. The new owner will have to do this, which is expensive in terms of money and time.

It is advisable that land surveying be carried out, or done immediately after the purchase and sale transaction. It is more profitable to carry out land surveying with neighbors, because the cost of surveyors’ services is automatically reduced. Joint land surveying is also beneficial because it will avoid quarrels and litigation with neighbors.

Controls

The management of the partnership is carried out by a chairman elected at a meeting of all members.

The “first person of SNT” is subject to certain requirements: experience in gardening, knowledge of all the intricacies of office work, legal literacy, and the ability to ensure fire safety. The direct responsibilities of the chairman include:

- monitoring the work performed by other employees;

- conclusion of contracts;

- opening accounts in financial institutions;

- timely notification of SNT members about current events.

At the first meeting, authorized persons are also elected who, along with the chairman, are responsible for the safety and maintenance of the partnership’s property and land in proper condition.

SNT registration procedure

- It is necessary to decide on the founders of SNT (for registration of SNT a minimum of 7 (seven) founders )

- It is necessary to form the governing bodies of SNT: the sole executive body is the chairman of SNT; SNT board; auditor

- It is necessary to determine the legal address of SNT

- It is necessary to decide on the types of activities and goals of creating a partnership

- Once all the main points have been determined, it is necessary to collect a set of documents and submit them to the tax office for registration.

The applicants are all the founders and, accordingly, they submit documents to the Federal Tax Service in person, or they all certify the application in form P11001 with a notary.

SNT registration address

As a legal address, you can use the real location of the partnership, or the home address of the Chairman (the founder’s residential premises-apartment can be the legal address of the organization, but the apartment must be owned by the founder (shared ownership is also allowed). It is desirable for the founder to have registration (registration) at this address).

Based on the Law, there may be different SNT on different streets.

The Federal Law on the conduct by citizens of gardening and vegetable gardening for their own needs and on amendments to certain legislative acts of the Russian Federation dated July 29, 2017 N 217-FZ defines the provisions of members and the procedure for interaction with owners who are not members of SNT, who are also required to make contributions for use of partnership property (Chapter 3).

Registration of SNT documents

To prepare documents you will need the following documents:

- letter of guarantee + copy of the certificate of ownership (please note that the letter of guarantee must indicate the full address of the premises in accordance with the certificate of ownership (if any: building, building, floor, office/premises number, etc. If the legal address coincides with the place of registration of the manager, then it is necessary to provide a copy of the certificate of ownership and the consent of all owners;

- passports of the founders and director;

- TIN numbers of founders and managers.

You also need to decide on the following questions:

- full and abbreviated name (+ in a foreign language, if required)

- Contact phone number and email for the Federal Tax Service

- taxation system (OSNO, simplified tax system (6 or 15%))

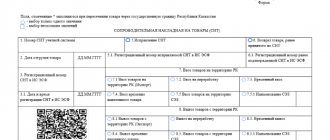

The list of documents for submission to the Federal Tax Service includes:

- charter (original and archival copy);

- a protocol containing comprehensive information about the organization: goals, information about the founders, governing body, etc.;

- application in form P11001;

- application in form 26.2-1 (if it is planned to switch to a simplified taxation system);

- receipt of payment of state duty;

- documents at the legal address.

The decision to establish a partnership is made by citizens (founders) unanimously at their general meeting through in-person voting.

The decision on the establishment of a partnership shall contain information on the establishment of the partnership, approval of its charter, on the procedure, size, methods and timing of the formation of the property of the partnership, on the election (appointment) of the sole executive body of the partnership (chairman of the partnership), the permanent collegial executive body of the partnership (board) and the audit commission (auditor).

The board of the partnership is accountable to the general meeting of members of the partnership.

Accounting support

Zero 1500 rub. Activity 3500 rub. Activities + Salary 5000 rub.

• Personal accountant • Possibly remotely • 12 years of experience • 1000+ NGOs • All forms • Grants

Call your accountant right away

*The cost in Moscow and Moscow Region, St. Petersburg and Leningrad region is respectively: 2000, 5000, 7000 rubles

Call

Contributions

Members of the gardening partnership are responsible for paying the following types of mandatory contributions:

- share - upon joining SNT, for the acquisition of material assets for the entire organization (in value equal to five membership fees);

- membership - for remuneration of employees of the partnership, making utility payments and current expenses, the amount depends on the number of land plots;

- targeted - based on a decision made at a meeting to solve a specific problem;

- additional - in force majeure situations.

Category (purpose) of SNT lands

The category is the main criterion for determining the intended purpose of land and the parameters of its use. The division of lands into categories is a consequence of the zoning of territories, for each of which its own use strategy and characteristics are established, as well as the legal regime of use. For example, agricultural lands include areas with fertile soils suitable for growing crops, forest lands must be covered with forest vegetation, and specially protected natural areas are essential for preserving the ecological environment, flora and fauna, etc.

Alexander Vasiliev

Lawyer

The intended purpose and types of permitted use of land in the SNT are determined in the documents for the land plot on the basis of more general cadastral (and sometimes town planning) documentation. During the formation and cadastral registration of a newly created land plot, it “inherits” these characteristics from the land on which it is located.

The Land Code of the Russian Federation defines 7 categories of land: lands for agricultural purposes, settlements, special use (industry, energy, transport), forest and water funds, specially protected areas and objects (SPNA), reserve reserve lands.

Owners and buyers of land most often encounter agricultural land or land in populated areas. Less common are lands transferred from the forest fund, defense lands (former sites of the Ministry of Defense), water fund and others. If there is a change in land category in the history of the site (especially recent), you need to be more careful when checking the purchase. An illegal change in the category of land may be challenged, which entails the risk of losing money invested in it.

Member Rights

Members of the SNT have the fundamental right to build residential buildings on their plots with subsequent registration at their location.

As for participation in solving the problems of society, each member has the right to only one vote, regardless of the number of plots occupied. In addition, gardeners can:

- take part in meetings;

- elect a chairman and nominate oneself for the role of manager;

- require reporting on the work done by employees of the partnership;

- carry out activities on your property that are not prohibited by law;

- dispose of owned property at its own discretion;

- freely use the infrastructure and communications of SNT;

- have free access to your site;

- leave the association of gardeners;

- become an employee of the partnership if there is a vacancy.

Purpose of the land

The allotment in DNT can be used in the following ways:

- for personal farming;

- for growing fruit trees and shrubs

- for the construction of a cottage on it, including as the main residence;

- for the construction of structures for various purposes.

Building a house on DNT lands is not mandatory. Russian citizens can register for them at their place of residence. But stateless persons or foreign citizens cannot have ownership rights to such lands.

Leaving the gardening partnership

Any member of the SNT can withdraw from its membership. At the same time, the right to land allotment is retained. You can also continue to use the infrastructure and communications of SNT for the purpose of carrying out gardening activities.

The obligations to attend meetings, obey the decisions of the association, participate in socially significant events, and pay dues disappear.

The following obligations arise. An individual gardener must:

- pay for utilities in accordance with the current agreement with SNT;

- make payments for the use of the partnership’s infrastructure;

- demand a share in the property of the association commensurate with the contributions previously made.

Flaws

Using a site as a place of permanent residence also has disadvantages:

- Often, DNT lands are located far from infrastructure and it takes a long time to get to schools, shops, cultural and healthcare institutions;

- Communications will need to be connected to the building on the site, which is often more expensive than the site itself, and is also accompanied by administrative obstacles;

- It is impossible to take out a loan secured by a house or land in DNT;

- It is possible to register in a house built on land in the DNT, but in practice there are often difficulties with obtaining registration;

- Joint resolution of issues can also be a disadvantage in case of disagreements with neighbors;

- The need to pay membership fees or pay for the use of the partnership’s infrastructure.

Pros and cons of such areas

The success of any organization depends on the abilities of its leader. If SNT is headed by an intelligent chairman, there will be only positive reviews about the partnership. The advantages of an association of gardeners include:

- presence of security;

- well-groomed territory;

- high quality access roads;

- the possibility of building a residential building on your own site with the prospect of further registration.

Along with the advantages, there are also disadvantages:

- a large number of additional fees;

- not always developed infrastructure;

- the occurrence of obstacles during the registration of property rights.

What should you choose?

Based on the presented characteristics, you should focus on the needs of memory buyers.

It is clear that the priority for a residential building is a plot for individual housing construction , and for running a subsidiary farm, which involves not only planting a garden and vegetable garden, but also raising livestock, a plot for private household plots. If you chose the wrong one, then our instructions will help you transfer the category of land from one to another.

When buying a summer house, you should weigh the priorities that relate to the possibility of erecting a building , the desire to express yourself in an architectural design, or abandon the building altogether. Much depends on the financial capabilities of the family and its provision of transport.

Any of the acquired plots can be used with maximum benefit for the owner. However, it is advisable to deliberately choose the type of plot that best meets the needs of the family.

Own house on the territory of SNT

Before building a comfortable house in an area where there is no water supply and sewerage, geological surveys . Find out at what level the groundwater is. The house can be provided with water by drilling a well and installing a pump.

We are also solving the sewerage issue; we need to dig a septic tank . It will have to be constantly pumped out as it becomes full. But the plus is that sewage can be used as fertilizer. The price of work on installing water supply and sewerage together with equipment is 80-150 thousand rubles . The costs are one-time, but there is complete independence from public utilities.

If the owner decides to build a house, he must ask the neighbors for written permission. Without permission, you can build a house no higher than 3 floors . When laying the foundation, you should calculate the distance to neighboring houses; it should not be closer than 3 meters. After completion of construction, the object must be registered.

Cunning summer residents are delaying the registration of their buildings so as not to pay taxes. Now such a position will hit the summer resident himself. The new law gives an incentive to owners to register buildings. The official registration of the house indicates the presence of people living in the garden, which means:

- The municipality will be required to finance the repair of roads to holiday villages.

- Starting this year, it became possible to transfer roads, power grid facilities, and water supply to the balance of the municipality.

To do this, you need to write an application to the municipality and justify the requirements of SNT. You may have to hire a lawyer, but it will be worth it. Because after the transfer of property to the balance of the municipality, the amount of contributions from owners for the maintenance of the territory will noticeably decrease.

Nuances of construction on lands for various purposes

Areas used for construction work may not be connected to electrical power, which will make it difficult to carry out operations involving the use of electrical equipment.

Areas within populated areas do not have this disadvantage.

If you intend to electrify a future construction site, you will have to obtain the consent of the remaining members of the association of which you are a member.

The work will be carried out at your expense.

A non-residential building on SNT or individual housing construction lands that is not intended for private economic activity cannot be built. An exception may be buildings necessary to support the activities of SNT.

The construction of a house in a holiday village is a prerequisite , since the construction of a vegetable garden is not the only purpose for providing a land plot.

Innovations in legislation exclude from the law such concepts as dacha cooperatives and partnerships. From 2021, the development of land occupied by these associations will take place according to new rules.

The problem is supposed to be solved by re-registering dacha associations as horticultural associations and acquiring horticultural status for the constructed real estate.