The legislation provides for the possibility of returning part of the income tax paid to the budget when purchasing real estate - an apartment or a house. Until 2012, this could only be done by working citizens, from whose income personal income tax was withheld. On January 1, 2012, amendments were made to the Tax Code of the Russian Federation, which made it possible to obtain a tax deduction when purchasing an apartment by pensioners who have no other income other than pension payments.

Transfer of property deduction for non-working pensioners

The situation when a non-working pensioner purchases housing is somewhat more complicated in terms of the application of tax benefits. Pensions as a source of income are not taxed, according to clause 2 of Article 217 of the Tax Code of the Russian Federation, therefore there is simply no amount of personal income tax that the budget can compensate for.

However, if there is additional income that is subject to taxation, a tax deduction for the purchase of an apartment for pensioners is applied on a general basis. Such income includes:

- income from the rental of apartments, non-residential premises, land plots, etc.;

- income from the sale of housing (subject to personal income tax if the transaction value exceeded 1 million rubles and the tenure was less than 3 years);

- transfers from non-state pension funds in the form of monthly payments or lump sum payments;

- dividends from the placement of securities, participation as a founder of enterprises.

In situations where there is no income subject to personal income tax, a “reverse calculation” scheme is used. The Federal Tax Service considers the last three years before the applicant’s retirement as the basis for applying the benefit and transfers the unused benefit to an earlier date (but not longer than a three-year period).

Simply put, if you retired in 2021, and bought an apartment in 2021, then to apply the property deduction to the calculation, you can only take income for 2021, 2021 and 2021. The tax base will be reduced by the amount paid for the purchased housing (with a restrictive ceiling of 2 million rubles).

Registration of a property benefit when purchasing an apartment for pensioners who are not working and do not have additional sources of income implies the transfer of the full amount of compensation to previous tax periods if they worked for three years before the formation of the right to deduction.

Situation 1 – the apartment was purchased after retirement. Retirement age came in 2021, and housing was purchased in 2021. In the absence of taxable income, the transfer of property deductions to the three years preceding retirement is applied - 2021, 2021 and 2021 (but not more than the established maximum amount of 2 million rubles. ).

Situation 2 – housing was purchased in the year of retirement. Both the purchase of an apartment and retirement occurred in the same year - 2021. According to the declaration, a property deduction is drawn up from income in 2014, and the balance is transferred to the three previous periods - 2019, 2021, 2021.

Situation 3 – housing was purchased several years before retirement. The apartment was purchased and registered in 2020, and the moment of retirement occurred in 2014. By law, it is possible to issue a deduction only for three years - 2021, 2021 and 2021, during which the owner did not work and did not have income to which the benefit can be applied . Accordingly, he will not be able to exercise his right.

Alternatively, in such a situation, a working or recently retired spouse may receive a deduction. In this case, the apartment must be purchased in an official marriage , or the property must be registered as joint ownership.

How to get tax benefits in the Moscow region

According to paragraph 1 of Article 56 of the Tax Code of the Russian Federation, tax and fee benefits are those provided for certain categories of taxpayers and fee payers provided for by the legislation on taxes and fees compared to other taxpayers or fee payers, including the opportunity not to pay a tax or fee or to pay them in smaller size. An application for property tax benefits can be submitted to any tax authority of the Moscow region of your choice. Information on the application of tax rates and benefits for property taxes can be obtained on the website of the Federal Tax Service of Russia (www.nalog.ru) in the section “Reference information on rates and benefits for property taxes.” Read about what tax benefits individuals in the Moscow region can receive in the material of the mosreg.ru portal.

Transport tax benefits

Residential building in Solnechnogorsk district.

Source: Photobank of the Moscow region, Alexander Kozhokhin

Transport tax is a regional tax and is regulated by Chapter 28 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), as well as the laws of the constituent entities of the Russian Federation - they define the main elements of the tax, rates, procedure and deadlines for payment, reporting form, tax benefits and grounds for their use. According to Article 3 of the Law of the Moscow Region dated November 16, 2002 No. 129/2002-OZ “On transport tax in the Moscow Region”, tax benefits for transport tax are provided in accordance with the Law of the Moscow Region dated November 24, 2004 No. 151/2004-OZ “On preferential taxation in the Moscow region" (hereinafter referred to as the Law).

Tax benefits provided for in Article 25 of the Law are established for persons who are subject to the Law of the Russian Federation of January 15, 1993 N 4301-1 “On the status of Heroes of the Soviet Union, Heroes of the Russian Federation and Full Knights of the Order of Glory”, Federal Law of January 12 1995 N 5-FZ “On Veterans”, Federal Law of November 24, 1995 N 181-FZ “On Social Protection of Disabled Persons in the Russian Federation”, Law of the Russian Federation of May 15, 1991 N 1244-1 “On Social Protection of Citizens, exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant."

The tax benefit does not apply to persons who, in accordance with the legislation of the Russian Federation, have registered vehicles received (purchased) by them through the social protection authorities in the manner prescribed by law.

Persons who are subject to the Law of the Russian Federation “On the status of Heroes of the Soviet Union, Heroes of the Russian Federation and full holders of the Order of Glory”, the Law of the Russian Federation “On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant”, persons recognized as participants in the Great Patriotic War in accordance with the Federal Law “On Veterans”, persons recognized as disabled people of groups I and II, disabled since childhood (regardless of the disability group) in accordance with the Federal Law “On Social Protection of Disabled Persons in the Russian Federation” are exempt from paying transport tax , but no more than one vehicle per tax period.

For persons recognized as disabled people of group III in accordance with the Federal Law “On Social Protection of Disabled Persons in the Russian Federation” and persons covered by the Federal Law “On Veterans” (with the exception of persons specified in paragraph 3 of Article 25 of the Code), transport rates tax is reduced by 50 percent, but not more than for one vehicle per tax period.

Based on Article 25 of the Law, vehicles are recognized as passenger cars with an engine power of up to 150 horsepower (up to 110.33 kW), inclusive, motorcycles and scooters with an engine power of up to 50 horsepower (up to 36.8 kW), inclusive (hereinafter in this article - vehicles) that are objects of taxation in accordance with the legislation of the Russian Federation on taxes and fees.

In accordance with Article 26.8 of the Law, large families are exempt from paying transport tax, but no more than one vehicle per tax period, in relation to vehicles with an engine power of up to 250 hp. (up to 183.9 kW) inclusive, which are objects of taxation in accordance with the legislation of the Russian Federation on taxes and fees: cars, motorcycles, scooters, buses, tractors.

Based on paragraph 4 of Article 26.8 of Law No. 151/2004-OZ, the right to apply the tax benefits established by this article begins from the date the status of a large family arises (birth (adoption, establishment of guardianship and trusteeship) of the third and subsequent children). The benefits established by this article are provided upon application of the taxpayer on the basis of a document confirming the applicant’s status in accordance with the legislation of the Moscow Region in the amount of 100% for one vehicle with an engine power of up to 250 hp. With. inclusive, which apply to one of the parents in a large family.

Additionally, we inform you that the benefit is not provided for expensive cars specified in the list of the Ministry of Industry and Trade.

How to obtain: citizens entitled to the benefit independently submit an application and documents confirming receipt of the transport tax benefit to any tax authority of their choice.

Read how to apply for an old-age pension in the Moscow region >>

Property tax benefits

Source: Photobank of the Moscow region, Ksenia Sidorova

The list of persons entitled to tax benefits is established by Article 407 of the Code. Thus, the following categories of taxpayers have the right to tax benefits:

- Heroes of the Soviet Union and Heroes of the Russian Federation, as well as persons awarded the Order of Glory of three degrees;

— disabled people of disability groups I and II;

— disabled people since childhood, disabled children;

- participants in the Civil War, the Great Patriotic War, and other military operations to defend the USSR from among military personnel who served in military units, headquarters and institutions that were part of the active army, and former partisans, as well as combat veterans;

- persons of civilian personnel of the Soviet Army, Navy, internal affairs and state security bodies who held regular positions in military units, headquarters and institutions that were part of the active army during the Great Patriotic War, or persons who were in cities during this period , participation in the defense of which is counted towards these persons’ length of service for the purpose of granting a pension on preferential terms established for military personnel of active army units;

- persons entitled to receive social support in accordance with the Law of the Russian Federation of May 15, 1991 N 1244-1 “On the social protection of citizens exposed to radiation as a result of the Chernobyl nuclear power plant disaster”, in accordance with the Federal Law of November 26, 1998 N 175-FZ “On the social protection of citizens of the Russian Federation exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River” and Federal Law of January 10, 2002 N 2-FZ “On social guarantees” citizens exposed to radiation as a result of nuclear tests at the Semipalatinsk test site";

- military personnel, as well as citizens discharged from military service upon reaching the age limit for military service, health conditions or in connection with organizational and staffing events, having a total duration of military service of 20 years or more;

- persons who took direct part in special risk units in testing nuclear and thermonuclear weapons, eliminating accidents at nuclear installations at weapons and military facilities;

- family members of military personnel who have lost their breadwinner, recognized as such in accordance with Federal Law No. 76-FZ of May 27, 1998 “On the status of military personnel”;

- pensioners receiving pensions assigned in the manner established by pension legislation, as well as persons who have reached the ages of 60 and 55 years (men and women, respectively), who, in accordance with the legislation of the Russian Federation, are paid a monthly lifelong allowance;

- citizens discharged from military service or called up for military training who performed international duty in Afghanistan and other countries in which hostilities took place;

- individuals who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology;

— parents and spouses of military personnel and government employees who died in the line of duty;

- individuals engaged in professional creative activities - in relation to specially equipped premises, structures used by them exclusively as creative workshops, ateliers, studios, as well as residential buildings, apartments, rooms used to organize non-state museums and galleries open to the public, libraries - for the period of such use;

- individuals - in relation to economic buildings or structures, the area of each of which does not exceed 50 square meters and which are located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction.

The list of persons entitled to privileges regarding the amount of the fee has remained virtually unchanged this year. The main group consists of citizens with disabilities of categories 1 and 2, or those disabled since childhood, as well as people of retirement age.

Federal Law No. 334-FZ dated August 3, 2018, added the list of beneficiaries to the category of taxpayers such as disabled children. The benefit for this category of taxpayers has been applied since 01/01/2015.

A tax benefit is provided in the amount of the amount of tax payable by the taxpayer in relation to an object of taxation that is owned by the taxpayer and is not used by the taxpayer in business activities.

The benefit is provided in respect of one taxable item of each type at the taxpayer's choice, regardless of the number of grounds for applying tax benefits.

Tax benefits are provided for the following types of taxable items:

- apartment, part of an apartment or room;

- residential building or part of a residential building;

- premises or structures specified in subparagraph 14 of paragraph 1 of this article;

- economic building or structure specified in subparagraph 15 of paragraph 1 of this article;

- garage or parking space.

Article 407 is supplemented by such taxation objects as part of an apartment and part of a residential building (Federal Law of 08/03/2018 N 334-F).

A citizen has the right to independently decide which object he wants to completely exempt from tax: an apartment or a room; House; premises or structure; garage or parking space. Moreover, if a taxpayer has an apartment, a room, a residential building and a garage, then he can apply for a benefit for one object of one type of choice - an apartment or a room, as well as a residential building and, for example, a garage.

Municipal administrations have the right to introduce additional benefits.

Additionally, we inform you that in addition to tax benefits at the federal level for personal property tax, tax deductions are provided for residential properties: for example, for a room or part of an apartment, the tax deduction is set in the amount of the cadastral value of 10 square meters of total area, apartment or part of a residential property. houses - in the amount of the cadastral value of 20 square meters of the total area of this apartment, and in relation to a residential building - 50 square meters of the total area of this house.

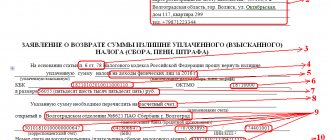

How to obtain: the taxpayer must submit to the tax authority of his choice an application for a tax benefit (if a tax benefit has not been issued previously) and documents confirming the taxpayer’s right to a tax benefit, as well as a notice of the selected taxable item in respect of which a tax benefit is provided (if the presence of several real estate objects of the same type). The application and documents must be submitted before November 1 of the current year, that is, before the start of the new tax period.

Find out how to get land for free in the Moscow region >>

Land tax benefits

Suburban village

Source: Photobank of the Moscow region, Alexander Kozhokhin

According to paragraph 5 of Art. 391 of the Code, the tax base for land tax is reduced by the cadastral value of 600 square meters of land area owned, permanent (perpetual) use or lifetime inheritable possession of taxpayers belonging to one of the defined paragraph 5 of Art. 391 of the Code of Categories, in particular pensioners receiving pensions assigned in the manner established by pension legislation.

This provision was included in Chapter 31 “Land Tax” of the Code by Federal Law of December 28, 2017 N 436-FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation” and in accordance with Part 13 of Art. 14 of this Federal Law applies to the procedure for calculating land tax for tax periods starting from 2017.

The tax base is reduced by the cadastral value of 600 square meters of land area owned, permanent (perpetual) use or lifetime inheritable possession of taxpayers belonging to one of the following categories:

- Heroes of the Soviet Union, Heroes of the Russian Federation, full holders of the Order of Glory;

— disabled people of I and II disability groups;

— disabled people since childhood, disabled children;

— veterans and disabled people of the Great Patriotic War, as well as veterans and disabled people of combat operations;

- individuals entitled to receive social support in accordance with the Law of the Russian Federation “On social protection of citizens exposed to radiation as a result of the Chernobyl nuclear power plant disaster” (as amended by the Law of the Russian Federation of June 18, 1992 N 3061-1), in accordance with the Federal Law of November 26, 1998 N 175-FZ “On the social protection of citizens of the Russian Federation exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River” and in accordance with the Federal Law of 10 January 2002 N 2-FZ “On social guarantees for citizens exposed to radiation as a result of nuclear tests at the Semipalatinsk test site”;

— individuals who, as part of special-risk units, took direct part in testing nuclear and thermonuclear weapons, eliminating accidents at nuclear installations at weapons and military facilities;

- individuals who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology;

- pensioners receiving pensions assigned in the manner established by pension legislation, as well as persons who have reached the ages of 60 and 55 years (men and women, respectively), who, in accordance with the legislation of the Russian Federation, are paid a monthly lifelong allowance.

The reduction of the tax base in accordance with paragraph 5 of this article (tax deduction) is carried out in relation to one land plot at the choice of the taxpayer.

A notification about the selected land plot in respect of which a tax deduction is applied is submitted by the taxpayer to the tax authority of his choice before November 1 of the year, which is the tax period from which the tax deduction is applied in respect of the specified land plot.

A taxpayer who has submitted a notification to the tax authority about the selected land plot does not have the right, after November 1 of the year, which is the tax period from which a tax deduction is applied to the specified land plot, to submit an updated notification with a change in the land plot in respect of which in the specified tax period a tax deduction is applied (clause 6.1 of Article 391 of the Code).

If a taxpayer entitled to apply a tax deduction fails to provide notice of the selected land plot, the tax deduction is provided in respect of one land plot with the maximum calculated amount of tax (if information about the benefit is available in the information resource of the tax authorities).

To apply for the benefit you need:

— submit an application of the established form (the application indicates the personal data of the taxpayer, the cadastral number of the land plot and other information);

— confirm the right to receive benefits (for pensioners - a pension certificate).

If a document confirming the benefit is not provided, tax authorities independently request the necessary information from the authorized bodies, and then inform the taxpayer about the results.

You can apply for benefits in different ways:

- contact any tax office of the Moscow region and fill out an application form on the spot and provide documents confirming your right to the benefit;

— fill out an application at any MFC in the Moscow region;

— send by Russian Post by downloading and filling out the application form from the website of the Federal Tax Service of Russia;

— through the State Services website or through the taxpayer’s personal account.

Tax authorities call the latest options the most convenient, and a personal account must be created in advance. Assistance in opening offices can be provided by the MFC and the tax office.

The application review period is 30 days. It is convenient to track the status of the application in your personal account on the State Services website or in the taxpayer’s personal account.

Until 01/01/2017, the old procedure for providing benefits is in effect.

Since 2021, Article 395 of the Code has established a list of categories of taxpayers exempt from paying land tax. Categories of citizens such as pensioners, disabled people, labor veterans, large families, etc. are not included in the list.

At the same time, in accordance with paragraph 5 of Article 391 of the Code, for the categories of taxpayers specified in this paragraph, the tax base when calculating land tax is reduced by a tax-free amount of 10,000 rubles per taxpayer in the territory of one municipality in relation to a land plot, owned, permanent (perpetual) use or lifetime inheritable possession.

How to obtain: citizens need to submit supporting documents to any tax office and write an application (the form will be provided at the tax authority’s office).

Read how to build a dacha in the Moscow region: site selection and permission >>

Personal income tax benefits for working pensioners

When buying an apartment or house, all citizens who receive income and pay 13% personal income tax have a legally confirmed right to a property deduction and a refund of part of the previously paid tax. The only limitation concerns the maximum amount from which compensation is calculated:

- 2,000,000 rubles when purchasing real estate under a sales contract. Accordingly, the ceiling for tax refunds is 260,000 thousand, and this is the maximum that the budget is ready to compensate;

- 3,000,000 rubles when repaying interest on loans aimed at purchasing housing. The amount of refundable tax is no more than 390 thousand rubles.

For pensioners who purchased housing after retirement but continue to work, there are no problems with applying personal income tax benefits. They can claim a tax refund on a general basis, subject to established restrictions on the amount of the refund.

Before applying to the Federal Tax Service for the required benefit, you need to collect a package of documents:

- confirmation of ownership of an apartment or house - purchase and sale agreement, extract from the Unified State Register of Real Estate;

- a certificate of income from the main place of work (if a person works somewhere else part-time, then from each enterprise);

- fill out a declaration in form 3-NDFL with all supporting documents attached and submit it to the Federal Tax Service at the place of registration.

If the annual income is less than the maximum established for calculating the benefit of 2 million rubles. and less than the cost of purchased housing, personal income tax will be compensated over several tax periods.

The pensioner continues to work, he can receive a deduction from his employer by writing an application to the Federal Tax Service. The disadvantage of this solution is that it will not be possible to use the balance carryover to previous periods - you will have to apply to the tax office yourself for this compensation. In cases where a pensioner is listed as a part-time employee in several organizations, he will be able to receive the benefit from several employers, but the Federal Tax Service will determine the priority of its application.

Important! The amount to be compensated can include the costs of repairs and finishing of an apartment or house (attaching supporting documents - checks, contracts with companies for work). But in this case, you need to make sure that the purchase agreement indicates the rough condition of the property.

The use of “reverse calculation” and transfer of the balance of the property deduction to previous years is also possible for working pensioners. But there are certain limitations here. Let's consider the options.

Situation 1 – housing is purchased after retirement. A working pensioner purchased an apartment and received ownership of it in 2021. The pension registration year is 2021. He has the right:

- receive benefits for 2021 (in 2016) based on available income (salary for the current period);

- transfer the balance of the property deduction (if any) to the three years preceding retirement - 2021, 2021, 2021.

If the entire possible deduction is not used, it can continue to be applied for the entire period while the pensioner receives income.

Situation 2 – an apartment or house was purchased before retirement. The certificate of ownership was received in 2019, and the right to pension came during 2021:

- the deduction for 2021 is issued in 2021 (according to the declaration);

- deduction for 2021 – in 2020;

- in addition, the pensioner has the right to transfer the balance of the deduction for three years preceding retirement - 2021, 2021, 2021. The benefit for 2021 has already been used by him, which means that the balance is transferred only to two periods - 2021 and 2021.

Important! The right to a property deduction must be applied for no later than the year following the year of its formation. Otherwise, the transfer will be processed in two years, not three.

That is, the deduction for 2021 must be issued in 2021. If the declaration is filed late, in 2021, then the benefit will be issued only for 2021 and 2021.

Can a pensioner count on a mortgage?

Tatyana Reshetnikova says that currently non-working pensioners have the opportunity to obtain a mortgage loan in only two banks. In this case, the income is confirmed either by a certificate from the Pension Fund of the Russian Federation, which will be provided by the potential borrower himself, or bank representatives independently request the required information from the relevant authorities. In theory, the age of the borrower at the time of repayment of the mortgage should not exceed 75-85 years. In addition, there are cases when banks take into account non-working pensioners as co-borrowers with younger clients. For example, in this way, adult children can help elderly relatives buy their own home or a country house.

If we talk about working pensioners, all banks consider such clients, but they put forward certain conditions.

“The loan term is calculated depending on the bank’s age requirements, and for most financial institutions it is up to 65 years at the time of loan repayment. In this case, the pension will be taken into account as additional income, while the main income will be income received from employment or entrepreneurial activity,” explains our expert.

Despite the fact that pensioners theoretically have the opportunity to obtain a mortgage loan, it is still worth noting that the likelihood of such applications being approved is significantly lower, and the amounts of approved loans themselves are less, all other things being equal, with younger borrowers.

pixabay.com/

Nuances when applying tax benefits

When there are no benefits. There are a couple of situations in which a tax deduction cannot be applied to pensioners when purchasing an apartment:

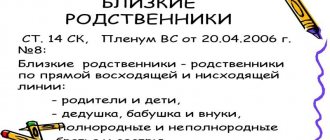

- if the transaction is concluded with a related party. The law includes such persons as close relatives - spouses, children, parents, brothers or sisters, or guardians;

- when payment for the construction of a house or the purchase of an apartment is made at the expense of other persons or organizations (employer, budget), as well as when using maternity capital.

If there are several owners. When purchasing a home in shared ownership, the amount of the property deduction must be distributed between them:

- in proportion to the acquired shares, if the property was registered before 01/01/2014;

- according to actual expenses incurred by each owner (but not more than the maximum statutory maximum of 2 million rubles), if the apartment was purchased after 01/01/2014.

Exchange deal with additional payment. When making a transaction that involves the exchange of existing living space with a monetary surcharge, the party that incurred financial expenses also has the right to apply to the Federal Tax Service for a property deduction.

Joint ownership. When purchasing an apartment, plot, house by persons who are officially married, the property will be considered joint. In this case, both spouses have the right to a property deduction, but if they wish, they can redistribute it in favor of one of them.

Refund amount. The Federal Tax Service has the right to transfer not the entire amount calculated in the declaration as a personal income tax refund. Such situations arise when the applicant has overdue debts on other budget payments, which the tax authorities compensate from the tax accrued for reimbursement.