An insurance policy plays an important role in financial protection of the insured and his family from unforeseen situations and accidents. According to the Tax Code of the Russian Federation, citizens who are taxpayers and have entered into a life insurance contract on a voluntary basis can return part of the funds they paid in the form of taxes on insurance premiums through a personal income tax deduction, provided that the insurance policy is issued for a period of five years or more. For persons who entered into a contract before 2015, there is also the possibility of an income tax refund if the contract has not yet expired.

Policyholders have the right to return up to 13% of the amount of insurance premiums they paid. Since the maximum deductible contribution amount is RUB 120,000 per calendar year, the maximum allowable deduction is RUB 15,600 per year. If the amount of insurance premiums paid by the policyholder exceeds RUB 120,000 per year, the balance cannot be carried forward to the next year.

Documents required to obtain a tax deduction

To receive a deduction, a policyholder using the services of Sovcombank Life should contact the tax office and provide the following documents:

- a document confirming payment of insurance premiums;

- application for a deduction;

- a copy of the license of JSC IC "Sovcombank Life";

- a copy of the voluntary life insurance agreement;

- copy of passport and details for transferring deductions;

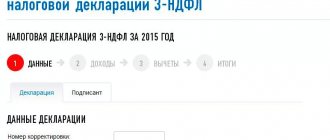

- tax return in form 3-NDFL;

- certificate of relationship (to pictures) if the insurance contract is concluded in favor of a spouse, child or parent);

- certificate from place of work 2-NDFL.

Documents confirming payment can be a receipt for payment of the first installment (with pictures) in form A7), as well as a bank statement indicating:

- FULL NAME. the policyholder;

- numbers of his policy/insurance contract;

- the amount of the contribution paid;

- name of the insurance company (to pictures) JSC IC "Sovcombank Life").

Where can I get a tax deduction?

At the tax office

The policyholder can apply for a deduction to the tax office, where he will have to submit a 3-NDFL tax return, an application for a personal income tax refund and an application for a tax deduction.

At the employer's

From January 1, 2021, policyholders can return part of the premiums paid through their employer, provided that they purchased the policy at their own expense and the insurance premiums were withheld from their salaries. The policyholder must receive a tax notice confirming the right to a deduction, and then provide it along with an application for a deduction to the employer.

How to calculate how many tax deductions a person is entitled to?

You already know what a tax deduction is and who can use it. However, the amount of the benefit is not fixed: it has features for different categories of returns and a maximum amount. Let's look at the main types of tax deductions and learn how to calculate them correctly.

Standard deductions

Every officially working adult can receive a tax benefit for their children. The deduction is considered until the month in which the employee’s total income exceeds 350,000 rubles, and its amount is:

- for the first and second child – 1400 rubles;

- for the third and each subsequent – 3000 rubles;

- for a disabled child – 12,000 rubles.

Let’s take for example a family with three children, in which the father receives a salary of 35,000 rubles. How much tax does he need to pay and how much can he get if he takes advantage of the benefit?

- The total amount of deduction for three children: 1400+1400+3000=5800 rubles.

- The amount of the deduction must be subtracted from the salary: 35,000-5800 = 29,200 rubles. This is the amount on which tax will be charged each month.

- Tax amount: 29200*13%=3,796 rubles.

That is, the father will receive: 31,204 rubles. And without filing a deduction, he would have received:

35,000-(35,000*13%)=30,450 rubles.

That is, by taking advantage of the tax benefit, a father with many children will be able to save 754 rubles monthly, but only until his total income reaches 350,000 rubles, that is, after 10 months. In general, for a calendar year, a family can claim a tax discount in the amount of:

754 rubles * 10 months = 7540 rubles.

Social deductions

Such payments are due to people who paid for education for themselves, children and even sisters or brothers, treatment (again, for themselves, children or close relatives) or decided to make a charitable contribution.

It is worth noting that the amount from which the social deduction will be calculated for all categories should not exceed 120,000 rubles, and the amount of the deduction received cannot be more than 15,600 rubles. For educational expenses for children or relatives, a deduction is provided in the amount of no more than 50,000 rubles per child - that is, you can get 6,500 rubles in your hands.

For example, Alexey spent 100,000 rubles on medicines, and his annual income was 420,000 rubles (with a salary of 35,000 rubles per month). Of this, the employee paid 54,600 rubles in income tax. And since he spent 100,000 on treatment, he will be able to reduce tax payments by the amount:

100,000*13%=13,000 rubles.

This amount is less than the maximum (15,600 rubles) that the state returns, which means that the employee will receive a deduction in full: 13,000 rubles.

Property payments

The peculiarity of this deduction is that you can receive compensation when purchasing a home in the amount of no more than 260,000 rubles (that is, for the amount spent of 2 million rubles). When reimbursing expenses for the purchase or construction of housing on credit, you can also receive a tax deduction for mortgage interest. In this case, the amount of 3 million rubles is taken into account. That is, the refund amount should not exceed:

3 million rubles * 13% = 390,000 rubles.

There is also provision for the transfer of payments to subsequent years if the amount of taxes paid in the current year is less than the total amount of tax benefits.

A simple example: Anna bought an apartment for 3.2 million rubles, and her total income for the last year was 600,000 rubles. Of this, she paid 600,000*13% = 78,000 rubles in income tax.

The maximum amount she can return for purchasing an apartment is 260,000 rubles. Since the amount of tax paid was 78,000 rubles, she will be able to return the remaining 182,000 rubles in the following years.

As can be seen from the calculations, a tax deduction is a very fair tax instrument that helps save significant amounts.

Find out more about the types of tax deductions on Vashifinansy.rf Prepared by order of the Ministry of Finance of the Russian Federation during the implementation of the joint Project of the Russian Federation and the International Bank for Reconstruction and Development “Promotion of increasing the level of financial literacy of the population and the development of financial education in the Russian Federation” within the framework of “Competitive support initiatives in the field of development of financial literacy and consumer protection"

Sovcombank Life programs, within which you can get a tax deduction

- Life insurance: “Prestige +”, “Life Protection +”, “Life +”. Life insurance programs from Sovcombank Life provide insurance compensation in the event of the death of the insured or the diagnosis of a critical illness, as well as loss of ability to work. In addition, in the event of death or disability, Sovcombank Life will assume the obligation to pay further contributions under the program.

- Savings programs: “Prestige +”, “Guarantee +”. The “Prestige +” program guarantees payments in the event of the death of the insured or his loss of ability to work, while the “Guarantee +” program provides payments in cases of death of the insured, loss of his ability to work, as well as the return of contributions in the event of the death of the insured as a result of illness. Moreover, the programs will be continued at the expense of Sovcombank Life in the event of the death of the insured person or his loss of ability to work, regardless of the reason.

- Pension insurance. Under the “For Life” program, the client independently determines the amount of insurance compensation. In the event of the death of the insured before the end of his working life, Sovcombank Life will pay the beneficiary insurance compensation and investment income, if any. In addition, if the insured person dies due to illness before retirement age, the beneficiary will receive back all contributions paid and investment income, if any, provided by the program.

When to apply for deduction

During the current year, you can apply for a deduction for the previous year. You can collect documents and upload them to the tax website at any time; there is no clear reference to dates. The main thing is to meet three years from the date of the first reporting year, because this is the official deadline for filing an income tax return.

For example, at the beginning of 2021 you can submit documents for deductions under the IIS for 2021, at the beginning of 2022 - for 2021, and so on. The deadline for filing a return for 2021 is December 31, 2023. If you decide to file a deduction for three years at once, you will need to file a separate return for each year.

How to calculate income tax taking into account deductions: example

Petrov Semyon, a sales consultant in a large chain store of electrical equipment, has three minor children. Wife on maternity leave. Semyon's salary is 45,000 rubles. Based on sales results in June 2019, in July Semyon received a bonus of 20,000 rubles and financial assistance of 5,000 rubles. The total income for the month was 70,000 rubles.

We subtract 4000 rubles from the amount of income. tax-free financial assistance and standard deductions for children, 1400 rubles for the oldest and middle, 3000 rubles for the youngest.

RUR 70,000 – (RUR 4,000 + RUR 1,400 + RUR 1,400 + RUR 3,000) = RUR 70,000 – RUR 9,800 = RUR 60,200

This means that income tax of 13% must be calculated on the amount of 60,200 rubles.

60,200 rubles X 0.13 = 7,826 rubles

Semyon's net salary for July will be equal to 70,000 rubles – 7,826 rubles = 62,174 rubles

It is worth considering that, by law, the employee must be paid in two monthly deductions: an advance and a salary. And the tax is paid only from the final calculation, and not from the preliminary one. An exception is the issuance of an advance on the last working date of the month. This case is regulated by a separate letter from the Ministry of Finance.

It explains how to close financial statements in such cases. It is necessary to calculate the personal income tax due on this amount from the advance payment. And then the remaining salary tax will be paid next month, from salary.

What to do if the deduction is not fully selected

If by the end of the year the employee does not have time to select the entire amount of social deduction, then this is his concern; the accountant has fulfilled his duties. The employee will have to apply to the Federal Tax Service independently for the remainder of the deduction at the end of the tax period (calendar year).

If filling out the declaration yourself causes you difficulties, contact SberResolutions - we will help you prepare and send documents to the tax office right from home.

Apply for a deduction

What documents to prepare

To apply for a Type A deduction online, you will need to scan and upload to the Federal Tax Service website:

- Notification of the opening of an IIS. It can be downloaded from your Gazprombank Investments personal account.

- Certificate of income and tax amounts of an individual - 2-NDFL. A certificate must be provided for each year for which the deduction is issued. If the employer has reported to the tax office for the required period, the data is already in the tax service system. You will see them in your personal account. If not, you need to request a certificate from the accounting department at your place of work.

- Confirmation of deposit of funds to the account. You need to confirm with the tax authorities that you contributed money to an IIS. Payment orders from the bank, where the transfer to the account is reflected, or confirmation of account replenishment from the broker are suitable for this.

- Brokerage report. Provided in addition to payment orders for replenishing IIS from the bank. The report can be requested in your Gazprombank Investments personal account.

From what date should the deduction be provided?

But here the accountant faces certain difficulties. Property deductions are provided from the beginning of the calendar year, provided that the employee has already worked at the enterprise during this period. The date of submission of the application with notification does not matter.

For example, an employee who has been working for the company for a long time applied for a property deduction in November. It turns out that for the period from January to October, the employer excessively withheld and transferred personal income tax from his salary to the budget. Now the employee needs to return this money.

Moreover, you need to act according to the algorithm given in paragraph 1 of Art. 231 Tax Code of the Russian Federation:

- Within 10 days from the date of receipt of the application and notification from the employee, inform him about the fact of excessively withheld personal income tax.

- Receive an application from the employee indicating his account details for transferring funds by bank transfer.

- Transfer money to the employee within three months.

The money for the refund can be taken from the total amount of personal income tax that is due to be transferred to the budget for the coming periods, both for this employee and for other employees of the enterprise. Thus, it is possible to make a refund, for example, in the case when the amount of personal income tax to be withheld from the employee is less than the amount that needs to be returned.

Please note that if an employee pays alimony for minor children under a writ of execution, the accountant must withhold alimony from it before transferring the amount of the returned personal income tax to the employee's bank account. This requirement was approved by Decree of the Government of the Russian Federation dated November 2, 2021 No. 1908 and applies from November 11, 2021.

How to register in your personal taxpayer account

To apply for a Type A deduction online, you need to go to the taxpayer’s personal account on the Federal Tax Service website. If you haven’t registered on the resource yet, you can register by choosing a convenient option:

- Log in using your State Services portal account.

- Get a login and password from the Federal Tax Service. To do this, you need to come to any branch in person with a passport of a citizen of the Russian Federation.

Make an electronic signature at any certified department of the Ministry of Communications.

You can log into your personal account in three ways: through your State Services account, with your tax office login and password, or using an electronic signature.

The easiest way is to use a State Services account. Now you can create and verify it online without going to government agencies.

If you select the login method through the Unified Identification and Login Account, the user will be redirected to the State Services page

After authorization, the main page of the taxpayer’s personal account will open. Here you need to create an electronic signature.

Calculation of income tax from salary

Every month, the employer must pay compulsory insurance contributions for each officially registered employee from its own funds. And you need to calculate and pay income tax on employee salaries. Let's look at how to do this.

The Tax Code stipulates 2 personal income tax rates. For residents this is 13%, and non-residents must give 30% of all income to the budget. A resident is recognized as a citizen of the Russian Federation or another country who stays on the territory of Russia for at least 183 days during the year.

It would seem obvious how to determine the amount of personal income tax - multiply all income by 0.13 or 0.3. But in fact, the system of tax deductions is applicable to every case. We will show you how to find a list of all these situations - they are listed in Article 217 of the Tax Code. Among the most frequently used deductions, it is worth mentioning those related to payment for education and treatment, for one’s own and certain categories of relatives, and for payment of a mortgage. The following payments to employees are not subject to the 13% rate:

- state-defined financial assistance for birth or adoption in the amount of up to 50,000 rubles;

- a lump sum payment upon the death of a family member;

- travel allowances within the country up to 700 rub. and abroad 2500 rub. per day:

- prize awards and financial assistance issued upon application in connection with certain situations in the amount of up to 4,000 for the entire year;

- some types of government bonuses, benefits and compensation;

- alimony collected by court decisions and orders.

Understanding the system of tax deductions can tell employers how to legally save on tax and insurance payments to the budget. To do this, you need to agree in advance with the employee and replace part of the salary with targeted contributions to pay off the mortgage or pay for training. With this money you will not have to pay personal income tax and compulsory insurance contributions.

What to do if the deduction is not fully selected

A property deduction is a large sum of money, and it is not always possible to return it within a year. But the notice from the tax service is valid only until the end of the year in which it is issued.

If an employee plans to receive a deduction at the enterprise next year, he needs to contact the Federal Tax Service again and request a new notification.

Thus, to resume providing the deduction next year, the accountant will need:

- New notification from the Federal Tax Service (remember that in 2022 the tax authorities will send it directly to the company).

- A new application from the employee, which must indicate the amount of the remaining deduction.