When a citizen buys an apartment or other residential premises (no matter with a mortgage or with his own money), he has the right to receive a tax deduction - this is an opportunity to return the income tax he has paid. The principle is as follows: those who work under an employment contract and receive a salary pay personal income tax (NDFL) - usually 13%. The state recognizes that a person worked, paid taxes and bought something useful for himself, and allows a certain amount to be deducted from taxable income. As a result, the tax base becomes smaller and the employee may not pay tax for some time or return the overpaid amount to his bank account.

In this article we tell you how to apply for a tax deduction for the purchase of an apartment through State Services or the taxpayer’s personal account, as well as what documents are needed for this and how much money you can get.

Photo pixabay.com

Who is entitled to an income tax refund on the purchase of an apartment in 2021?

In general, there are several types of tax deductions - standard, social, investment and property. When purchasing an apartment, a citizen has the right to take advantage of a property deduction .

You can apply for a property deduction if the following conditions are met:

- You need to be a tax resident of the Russian Federation , that is, live in the country for at least 183 days during the year and pay taxes here.

- Receive wages and pay income tax at a rate of 13% .

- Buy a home with your own funds or with a mortgage.

- Have title property document.

For housing purchased on the secondary market, an extract from the Unified State Register of Real Estate (USRN) is suitable. For an apartment purchased in a new building - a transfer and acceptance certificate.

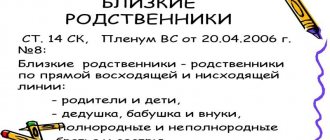

- The seller is not a close relative or family member of the buyer. For example, you can buy an apartment from your mother or brother, but there is no deduction for this. You can make a deal with your wife’s mother-in-law or brother, then the right to deduction remains.

- The property must be located in Russia .

Tax can be returned only for 3 years preceding the year of filing the declaration. So, if an apartment was bought in 2016, but the declaration was submitted only in 2021, then the money will be transferred only for 2021, 2021 and 2021. Personal income tax paid to the budget for 2021 and 2021 cannot be returned.

Check and pay taxes online

By INN and SNILS

By Tax document number

To search for taxes, enter your INN and/or SNILS.

We recommend checking both documents simultaneously. ?

To search for taxes and penalties in the GIS GMP system

?

To search for taxes and penalties in the GIS GMP system

To search for a tax, enter the Tax Document number or unique accrual identifier (UIN).

?

To check taxes and penalties on already issued Tax documents

* The search is carried out in the GIS GMP (taxes issued throughout Russia).

By clicking the “Search taxes” button, you consent to the processing of personal data, in accordance with the Federal Law of July 27, 2006 N152-F3 “On Personal Data”

How much tax paid can be refunded?

The tax deduction is equal to 13% of the amount of expenses incurred when purchasing an apartment. But the state is not ready to return money from any amount, so the property deduction has limits :

- 2 million rubles. — for the construction or purchase of housing (clause 1. part 3 of article 220 of the Tax Code);

- 3 million rub. - when paying off interest on a mortgage (Part 4 of Article 220 of the Tax Code of the Russian Federation).

Thus, the amount of property tax deduction can be up to 650 thousand rubles : 260 thousand rubles. (13% of 2 million rubles) - for the purchase of an apartment and 390 thousand rubles. (13% of 3 million rubles) - for mortgage interest.

You can receive a deduction in the amount of the established limits only once in your life . If the limit has been exhausted and the citizen has purchased a new apartment, then it is no longer possible .

It will not be possible to return more than the established limit. If the apartment costs more than 2 million rubles, the maximum refund amount will still be 260 thousand rubles. It's the same with mortgages. The unused balance can be transferred to other objects only for the purchase - this cannot be done with mortgage interest; the money is returned only for one object.

You can apply for a deduction no earlier than the year in which the right to it became available .

For example, a citizen bought an apartment in a building under construction in 2018, but he registered ownership only in 2021. This means that the right to deduction appeared in 2021. If the owner files a declaration in 2022, he will receive back the personal income tax paid only for 2021 and 2021, but not for 2021, because then he did not yet have the right to deduct, although there were already expenses.

If real estate was purchased using maternity capital or a housing subsidy, then you can receive a tax refund only on the amount that was paid using your own or mortgage funds .

For example, a young family received a housing certificate in the amount of 600 thousand rubles and bought an apartment in a new building for 2 million rubles. Spouses can receive a tax deduction only with 1.4 million rubles, that is, they can return 182 thousand rubles.

Application consideration period

It does not matter how documents are submitted to receive a social deduction - in person or via the Internet, everyone has the same review period. It is approved by the Tax Code of the Russian Federation, Article 88:

- 90 days are given to document verification;

- 10 days are allotted to convey to the taxpayer information about the decision made;

- 30 days – the period during which funds are transferred to the applicant’s account.

In order to receive funds, you must separately indicate your bank account details in the electronic tax service system.

Thus, obtaining a tax deduction through State Services is quite simple: you just need to go through the entire registration procedure once, get a signature and send applications without leaving your home.

How to apply for a tax deduction when purchasing an apartment through State Services (step-by-step instructions)

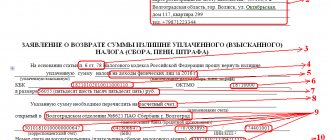

a declaration in form 3-NDFL in the next or any other year after purchasing an apartment and send it to the tax office. Here's how to do it on the State Services portal:

Step 1. Go to your profile on the website and in the “Life situations” section, select the “Purchase of residential real estate” item.

Step 2. Next you need to select “Property tax deduction”.

Step 3. Then instructions for providing a deduction will appear, you need to scroll down the page and find the button “Submit a 3-NDFL declaration”

Step 4. In the tab that opens, you need to select the type of receipt and click on the “Receive service” button.

Step 5. Next, a description of the service will appear; you need to click on “Fill out a new declaration.”

Please note that at the time of writing this article, it is possible to submit a declaration on State Services only for the period from 2021 to 2021. Data on citizens’ incomes is received on the portal later than in the taxpayer’s personal account on the Federal Tax Service website. Therefore, if you need to file a return for 2021, it is better to do this through the tax website.

Step 6. The service will ask for consent to process data. You need to check the appropriate box and click on the “Continue” button.

Step 7. Next, following the prompts on the portal, you need to fill out the electronic declaration form. Some of the information will be pulled from the applicant’s personal profile, and at the end the service will offer to add photographs of documents confirming the right to receive a deduction.

A declaration for deduction can be submitted on any day : there are no deadlines during the year. The tax must be returned within 30 days after filing the return. But this period will begin to count only when the desk audit is completed. This period may last up to 3 months .

If the tax office finds an error in the declaration or it turns out that some document is missing, an employee of the department will contact the applicant and ask him to send the missing information.

How long should I wait for funds to be credited?

The Tax Code of the Russian Federation states that the deduction by the representative office of the Federal Tax Service is transferred in favor of the citizen within 1 month from the adoption of such a decision. But there is a nuance: consideration of a 3-NDFL or 2-NDFL declaration can take up to 3 months (and in exceptional cases – longer). Accordingly, from the moment of submitting an application to the Federal Tax Service along with documentary confirmation of the right to receive a tax deduction, up to 4 months can pass until the actual accrual of funds. It is impossible to speed up this procedure in any way. But in practice, the Federal Tax Service verifies declarations much faster, on average up to 4 – 6 weeks. This already depends directly on the regional tax office. Additional delay may occur on the bank's side as it may take up to 5 business days for funds to be transferred to the bank account.

How to get a tax deduction for an apartment through the taxpayer’s personal account in 2021

You can also submit a tax return online through the taxpayer’s personal account on the Federal Tax Service website. To authorize on the site, you will need an account from the State Services portal. The procedure is as follows:

- In your personal account, you need to select the “Life Situations” section.

- Next in the menu you need to click on “Submit an application for tax deductions”.

- Then the type of tax deduction is indicated - when purchasing real estate.

- After this, you will need to indicate the reporting period for which the declaration is being submitted.

- Next, the value of the property and the amount of interest paid on loans are indicated.

- After this, the program itself will calculate the amount to be refunded and offer the applicant to manage the payment - to transfer the money, you will need to provide the taxpayer’s bank card details.

- Then you need to upload copies of the necessary documents to the website and send the declaration.

Please note the size restrictions before sending documents. Regular phone photos of contracts and receipts can take up too much space.

Can they refuse to provide a deduction and why?

A tax deduction may be refused only in the following cases:

- Incorrect completion of 3-NDFL (if submitted through State Services). To check the correctness of filling out the declaration, you can use special online services. It's free.

- Incorrect information provided. Moreover, even a spelling error in the application can be regarded as unreliable data. But the form for applying for a tax deduction can be downloaded from the State Services website and filled out at home. The tax office will only sign to accept the document for consideration.

- A citizen does not belong to the category of taxpayers who have the right to receive a deduction. In this case, you can request a written explanation of why the authorized representative of the Federal Tax Service made such a decision. It is not prohibited to re-submit an application.

- The citizen is a non-resident of the Russian Federation. Even if he pays taxes, this does not mean that he can demand payment.

- Application not at the place of registration. That is, submitting an application to the representative office of the Federal Tax Service, which does not maintain fiscal data about the citizen. This often happens when applying through State Services, since many taxpayers simply do not know which branch they need to contact.

- More than 3 years have passed since the event giving the right to accrue the deduction. A citizen has the right to apply for payments for income and expenses that were made earlier (and even last year). But if more than 3 years have passed, then the right to claim is lost.

In all of the above cases, the taxpayer may require clarification. For individual consultations, he can contact any of the branches of the Federal Tax Service or use the services of social lawyers (provided by the state).

Now documents for deduction assignment can be submitted to the MFC

What to do if refused?

There are only two options: correct the mistakes made or assert your rights through the court.

Table. Actions recommended by lawyers when receiving a refusal

| Cause | Recommended Action |

| Unreasonable refusal (no explanation) | Going to court |

| Illegal refusal (for example, insufficient circumstances to qualify for a tax deduction) | Contacting the Federal Tax Service for the region |

| The submitted package of documents is not sufficient | Request in writing a list of required documents, resubmit the application |

| They charged less than they should have | Submit an application to initiate an internal audit, and then contact the regional Federal Tax Service department |

In total, a tax deduction is a partial refund of taxes paid for personal income tax. Only citizens of the Russian Federation with a valid passport who pay personal income tax for individuals can receive it. You can submit a declaration, as well as make an appointment with the Federal Tax Service, through “State Services” - this is the most convenient and fastest option for processing a tax deduction.

Documents for tax deduction for an apartment

To receive a deduction, you will need to collect the following package of documents:

- completed tax return in form 3-NDFL;

- income certificate in form 2-NDFL (the document can be obtained from the accounting department at work);

- copy of the passport;

- extract from the Unified State Register of Real Estate;

- a transfer and acceptance certificate or an agreement for participation in shared construction, if the apartment was purchased during the construction stage;

- application for distribution of deductions between spouses if the apartment was purchased during marriage;

- documents confirming payment for real estate (checks, payment orders, receipts or payment receipts).

Please note that from 2021, a tax refund application indicating the details of the bank account to which the money should be transferred is included in the tax return!

To receive a deduction for interest paid on a mortgage loan , you must additionally attach copies of the following documents:

- mortgage agreements;

- a certificate from the bank confirming payment of interest on the loan.

On January 26, 2021, the State Duma in the first reading adopted a bill on registering deductions online, without filling out a declaration and collecting supporting documents. According to the new rules, the taxpayer only needs to submit an application with the bank details to which the funds will be transferred. The tax service will independently request supporting information from the bank where the mortgage was issued or the payment was made when purchasing a home. When the amendments are adopted, the new simplified rules will apply to tax deductions, the right to which became available on January 1, 2021 .

Receiving income:

In accordance with Art. 226 of the Tax Code, the obligation to calculate, withhold and pay the amount of tax in respect of income paid to an individual is assigned to the tax agent, usually the employer. However, in some cases, individuals need to independently calculate the amount of tax by submitting a tax return on personal income tax to the tax authority, in which the amount of tax payable to the budget is calculated. A declaration regarding income received from the sale of property owned for less than 3 years is submitted by the taxpayer no later than April 30 of the year following the year in which the relevant income was received.

2.1. Sale of property

Sale of property, for example, an apartment, house, land, car, etc., owned for less than 3 or 5 years.

Income of an individual from the sale of real estate is exempt from personal income tax if the property has been owned for more than 5 years, and for more than 3 years, provided that the ownership is registered before 2021.

The exemption conditions will remain the same for the following types of housing:

- Acquired through an inheritance agreement or gift from a close relative;

- Received as a result of privatization;

- The right of ownership that arose after the conclusion of a lifelong maintenance agreement with a dependent.

Documents required for filing a tax deduction:

- Passport (passport translation if necessary)

- TIN

- Agreement for the sale of property, shares, rooms. Car, garage, boat, etc.

- Certificate of ownership, PTS (when a car)

- Contract for the purchase of sold property (confirmed expenses)

Instead of applying a property deduction, the taxpayer has the right to reduce the amount of income received from the sale of property by actually incurred and documented expenses directly related to the acquisition of this property. In certain situations, this may be more profitable than using a property deduction.

- Receipt cash orders, sales and cash receipts, bank statements, payment orders, receipts from the seller for receipt of funds, etc.)

- Birth certificate of children (up to 14 years of age, the responsibility for paying tax is assumed by the parent or legal representative)

- Child’s passport (tax applies from the age of 14, a declaration must be filled out separately for the child)

IMPORTANT! If the taxpayer sold several pieces of property in one year, the specified limits are applied in the aggregate for all sold objects, and not for each object separately.

2.2. Rental

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Lease agreement for residential and non-residential premises

- Confirmation of payment of personal income tax of 13%, when leasing to organizations that pay tax for the lessor (certificate 2NDFL)

2.3. Agreements for the provision of services, others (with foreign companies), work abroad

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Treaty

- Confirmation of payment of personal income tax of 13%, when leasing to organizations that pay tax for the lessor (certificate 2NDFL)

2.4. Gift agreements

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Gift agreements

- Degree of relationship – birth certificate of the donor, recipient, passport, marriage certificate, etc.

2.5. In the form of various kinds of winnings

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Agreements, documents confirming winnings

- Confirmation of personal income tax payment when paying tax

2.6. Sales in authorized capital, securities

From 2021, funds received by the founder or participant of the company when reducing the authorized capital will be income subject to personal income tax. The taxpayer has the right to receive a property tax deduction not only upon the sale of a share (part thereof) in the authorized capital of the company, but also:

- upon leaving the company's membership;

- when transferring funds (property) to a company participant in the event of liquidation of the company;

- when the nominal value of a share in the authorized capital of the company decreases.

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Agreements for the sale of management companies, shares, securities, etc.

- Account statement when identifying income, documents confirming receipt of income, checks, receipt orders, receipts, acts, etc.

- Confirmation of personal income tax payment when paying tax

- Documents confirming actual expenses incurred

2.7. Income upon assignment of the right of claim

(other income during the construction of a house, apartment, during the assignment of the right of claim, before receiving ownership of the apartment, is subject to a rate of 13%)

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Treaty

- Account statement when identifying income, documents confirming receipt of income, checks, receipt orders, receipts, acts, etc.

- Confirmation of personal income tax payment when paying tax

2.8. Income from the exchange of real estate, exchange agreement

When exchanging apartments, “there is a paid transfer of ownership,” therefore this operation is recognized as a sale of property.

Documents required for filing a tax deduction:

- Passport of a citizen of the Russian Federation

- TIN

- Contracts of exchange, purchase and sale

- Account statement when identifying income, documents confirming receipt of income, checks, receipt orders, receipts, acts, etc.

- Confirmation of personal income tax payment when paying tax

Refund of income tax for an apartment through an employer

You can also receive a property deduction through your employer . In this case, documents can be sent immediately, without waiting for next year. There is no need to fill out a declaration; it is enough to obtain a special document - a tax notice , and provide it to the employer.

Receiving a notification is simple: you can personally contact the Federal Tax Service office or send a request electronically (the application form is available in the taxpayer’s personal account on the tax.ru website). After 30 days , the tax office will issue a notice, it will need to be submitted to the accounting department at work - and that’s it, the employer will reduce the taxable income for the year by the amount of the deduction and will not withhold personal income tax. The employee will receive a tax deduction in parts along with his salary.

The notice of the right to deduction is valid only until the end of the year, then you need to receive a new one. If a citizen changes his place of work during the year, the notification will also need to be issued again.

How to get an appointment with the Federal Tax Service?

If you want to submit an application in person, this can also be done through the State Services portal. The only difference in the actions is that before starting to work with the form, change the type of service received from an electronic application to another directly independent visit to the Federal Tax Service.

Next, you choose to receive the service and all that remains is to choose the most suitable geographical location for you to complete the application. In this case, you will need to bring with you all the necessary documents on income, the list of which will be indicated on the website.