Tax deduction: how to get some money back when building a summer house

A resident of the Krasnodar Territory, Dmitry Maksimov, is building a dacha. He has many plans, but, as usual, everything comes down to finances. The young family doesn’t have enough of them, which is why construction of a house on the plot purchased two years ago is progressing slowly. This is too expensive an undertaking.

“We invested around 900 thousand rubles – this excluding the purchase of the plot. They connected the electricity, installed water, and installed a sewer system. In the future, building a house will cost around 3 million rubles,” said Dmitry.

A man plans to apply for a property tax deduction. Few people know, but not only those who bought ready-made housing, but also those who are building a house or cottage on their site can claim compensation for expenses.

“You and I collect all supporting documents, prepare a tax return and submit it to the tax office at your territorial location,” said Ravil Akhmadeev, associate professor of the department of accounting and taxation at the Plekhanov Russian Economic University.

We must include contracts with contractors, payment documents for payment for work, and receipts for the purchase of materials with the declaration. All this will serve as proof of your construction costs.

“The taxpayer has the right to exercise the right to receive a tax deduction within three years from the end of the tax period in which the corresponding expenses were incurred,” explained lawyer Tatyana Kormilitsyna.

If you purchased a property in 2021 or completed the construction of a residential building on a plot of land, then you will submit a declaration for 2021 already in 2022. If you don't file in 2022, that's okay, you have two more years.

By the way, the maximum tax deduction for the construction of a house or dacha today is 2 million rubles. But this is not the amount that you can receive in your hands, but the amount from which 13 percent will be calculated. That is, if you spend 2 million rubles on housing construction, a maximum of 260 thousand rubles will be returned to you as compensation for expenses.

Whether it is a one-time payment or the payment will last for several years depends on your income. For example, with a salary of 50 thousand rubles, you pay 6.5 thousand to the state in the form of tax every month. This amount will be 78 thousand rubles per year. That is, the entire tax deduction - 260 thousand rubles - will be paid to you over four years.

When can the costs of purchasing a summer cottage be included in the property deduction?

The costs of purchasing a garden plot of land where a residential building was built can be included in the property tax deduction. The Federal Tax Service warns taxpayers about this, referring to the letter of the Ministry of Finance dated 09/07/2020 No. 03-04-07/78389.

In its message dated September 17, 2020, the Federal Tax Service explains that from January 1, 2019, plots with the types of permitted use “garden land”, “for gardening”, “for gardening”, “dacha land”, “for dacha farming” and “for country house construction” are considered equivalent.

In all these areas it is allowed to place garden and residential buildings, outbuildings and garages. An exception is land plots with the type of permitted use “horticulture”, since they are intended for a type of agricultural production associated with the cultivation of perennial fruit and berry crops, grapes and other perennial crops.

The Tax Code of the Russian Federation allows you to receive a property tax deduction for expenses on the purchase of land plots where the residential buildings being purchased are located, or which are intended for individual housing construction. Providing a deduction for the acquisition of other plots is not provided for by tax legislation.

Thus, the costs of purchasing a garden plot can be taken into account when claiming a property tax deduction after state registration of ownership of the house.

BUKHPROSVET

A property deduction is provided in the amount of actual expenses incurred for new construction or purchase of housing, but not more than 2 million rubles (clause 3, clause 1, article 220 of the Tax Code of the Russian Federation). For a mortgage, an individual may be provided with an additional deduction in the amount of interest paid on the loan, but not more than 3 million rubles. When purchasing land plots provided for individual housing construction, a personal income tax deduction is provided only after receiving a certificate of ownership of a residential building.

Actual expenses may include costs for the development of design and estimate documentation, for the purchase of construction and materials, for the purchase of a residential building, for connection to electricity, water and gas supply and sewerage networks. These expenses of an individual can be confirmed by receipts for receipt orders, bank statements about the transfer of funds from the buyer's account to the seller's account, sales and cash receipts.

Also, expenses for the purpose of obtaining a deduction can be confirmed by acts on the purchase of materials from individuals indicating the address and passport details of the seller (clause 3 of Article 220 of the Tax Code of the Russian Federation). If an individual exercises the right to receive a deduction in an amount less than its maximum amount, the remaining amount can be taken into account when receiving a deduction in the future for new construction or purchase of housing.

How to get a property tax deduction in the Moscow region

A tax deduction is an amount that reduces the amount of income on which tax is paid. Only officially employed Russian citizens who pay personal income tax (NDFL) have the right to such deductions. Read about who can receive a property tax deduction and how to apply for it in the material of the mosreg.ru portal.

Tax regime for self-employed in the Moscow region: transition conditions and advance payment for beginners>>

Who can receive

Signing of documents

Source: RIAMO, Nikolay Koreshkov

A taxpayer who sold property, purchased housing, built housing, or purchased a plot of land for these purposes can receive a property tax deduction. A taxpayer who has purchased any property for state or municipal needs also has the right to a property tax deduction.

These deductions can be divided into two groups: property deduction when purchasing property and property deduction when selling property.

How to apply for a subsidy for utility bills online in the Moscow region>>

Acquisition of property

Suburban village

Source: Photobank of the Moscow region, Alexander Kozhokhin

A deduction for the purchase of property can be obtained in three cases:

- if the taxpayer has built or purchased a residential property or a land plot for it. In this case, the maximum amount with which you can receive a tax deduction is 2 million rubles.

- if the taxpayer pays interest on targeted loans received from Russian organizations or individual entrepreneurs. Loans must be spent on new construction or the purchase of housing or land for it. The maximum amount with which you can receive a deduction is 3 million rubles;

- if the taxpayer pays interest on loans from Russian banks to refinance loans for the construction or purchase of housing or land for it. The maximum amount with which you can receive a deduction is 3 million rubles.

When new construction or purchase of a residential building, the costs of developing design and estimate documentation, purchasing building and finishing materials, purchasing a house, construction work, as well as organizing electricity, gas and water supply are taken into account.

And when purchasing an apartment or room, the costs of purchasing an apartment or room, acquiring rights to an apartment or room, purchasing finishing materials, and finishing work are taken into account.

It is important that the costs associated with the redevelopment of the premises are not taken into account, as are the purchase of plumbing and other equipment.

A property deduction for the purchase of property cannot be obtained if maternity capital funds, budget funds or employer funds were used. And also if the deal was concluded with a spouse, parents, children or brothers and sisters.

How to change the type of permitted use of a land plot in the Moscow region>>

Documentation

Submission of documents

Source: Photobank of the Moscow region, Boris Chubatyuk

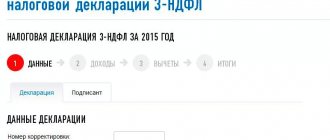

In order to apply for this deduction, you will need the following documents:

- completed tax return in form 3-NDFL;

- certificate from the accounting department in form 2-NDFL;

- copies of documents confirming the ownership of housing;

- copies of payment documents;

- a marriage certificate and a written statement (agreement) on the agreement of the parties involved in the transaction on the distribution of the amount of the property tax deduction between the spouses (if the property was acquired as joint property).

Introduction of super services in the Moscow region: what government services will be provided automatically>>

Sale of property

Signing of documents

Source: Photobank of the Moscow region, Anastasia Osipova

Income from the sale of an apartment is taxed. The exception is cases if the apartment has been owned for more than 5 years, and in some cases - more than 3 years (if the apartment was inherited, was owned under a privatization agreement, or was transferred under a lifelong maintenance agreement with dependents).

The maximum tax deduction amount is 1 million rubles, by which income can be reduced when selling apartments and residential buildings.

Tax deductions from the sale of property can be calculated in two ways. First option: if an apartment bought for 4 million rubles was sold for 5 million rubles, then from 5 million rubles we subtract 1 million rubles (the maximum tax deduction amount), from the remaining amount we find personal income tax (13%) - it turns out that 520 thousand rubles will be due pay from the sale of the apartment.

Second option: the owner declares in the declaration not a property deduction, but a deduction in the amount of documented expenses, in this case his taxable income will be 1 million rubles, and personal income tax will be 130 thousand rubles.

Mortgage holidays in the Moscow region: how to get a deferred payment>>

Documentation

Mosoblarkhitektura processed more than 200 documents for approval of general plans and PPZ in 2021

Source: Committee for Architecture and Urban Planning of the Moscow Region

- completed tax return in form 3-NDFL;

- copies of documents confirming the fact of sale of property;

- copies of documents confirming expenses (if the taxpayer claims a deduction in the amount of expenses associated with receiving income from the sale of property).

How to obtain permission to place objects on land plots in the Moscow region>>

Where to go

A girl at a computer with a calculator checks calculations

Source: , pixabay.com

In order to receive a property tax deduction, you need to contact the tax office at your place of residence at the end of the year. You will need to fill out a tax return and attach copies of documents confirming your right to deduction.

Find out how to get a social tax deduction in the Moscow region>>