If a pensioner bought an apartment (or other housing) while he was still working (at least for 3 years before the purchase), he has the right to return the personal income tax paid.

The advantage of a property tax deduction when purchasing an apartment by a pensioner is the ability to reimburse the tax paid for the previous 4 years.

But not everyone can count on this. The deduction is not available to those who did not work for 3 years before purchasing a home (did not have taxable income) and will not work in the future. There will simply be nothing to return from the budget.

Which pensioners are we talking about?

Any type of pension (insurance, disability, survivor's) is deductible. The reason for leaving can also be any: preferential (early) or ordinary (upon reaching the required age and length of service, etc.).

Moreover, any pensioner has the right to count on such a deduction period, regardless of whether he works or not.

It happens that real estate is purchased first, and retirement follows later. And there are no obstacles to an extended deduction period. If only you had a pension status at the time of applying for a personal income tax refund.

What about pre-retirees

Deduction privileges do not apply to persons of pre-retirement age. That is, pensioner status is required. Otherwise there will be no benefits.

Let's sum it up

So, we figured out whether a pensioner can become self-employed, and what consequences this may entail for him. From the above we can draw the following conclusions:

- A pensioner can become self-employed, pay NAP and not fear sanctions from the tax authorities.

- He will not lose the right to index his pension and receive a regional supplement up to the subsistence level if he does not voluntarily pay pension contributions. But certain benefits, the right to which is based on the amount of average monthly earnings, may become unavailable.

- You will have to pay a small part of your income to the budget. However, it is at least 2 times less compared to personal income tax, the risk of payment of which exists for unregistered entrepreneurs.

What amounts are refundable?

The amounts from which deductions are made are standard:

- up to 2 million rubles paid to the seller under a housing purchase and sale transaction. That is, the maximum personal income tax refund amount will be 260 thousand rubles. If the contract price is below 2 million, then the contract amount is taken into account, if above 2 million, then exactly 2 million rubles;

- up to 3 million rubles in interest for loans and credits issued for residential real estate. It is possible to receive no more than 390 thousand rubles from the budget.

There are incomes that are not taxed. Budget funds cannot be returned from them:

- pensions;

- alimony;

- one-time federal/municipal financial assistance to vulnerable social groups;

- proceeds from the sale of vegetables/fruits and domestic animals grown on a private farm.

It is possible to apply a property deduction if there was income taxed at tax rate 13 (that is, labor earnings, sale of property, rental of housing, receipt of lottery winnings, etc.).

The fact of paying other taxes (transport, property, land, etc.) is not related to personal income tax, and therefore does not affect the tax deduction.

For what period is the deduction received?

Tax refunds are made up to four years in advance. In this chronology.

For the year the property was purchased

When the property is registered, or the transfer and acceptance certificate is signed (with shared participation in the construction);

Plus three years (consecutive) from the year of purchase of the property

Example: a citizen bought an apartment in 2021. Accordingly, in 2021, you can submit a declaration for 2021, 2021, 2017 and 2015.

The pensioner decides for himself how to use the 3 previous years for deduction. You can take not all three, but 1 or 2 years - this is optional. But in compliance with order.

It is not always possible to get all the money from the budget in one year (often the previously paid personal income tax is not enough). Accordingly, a balance is formed that can be carried forward to other years.

So, if a deduction for the year in which the housing was purchased is not selected, then within the 3 previous years the balance is transferred from one year to another in a clear chronological order. Namely, from the nearest year to the later one.

An example of how not to act. A residential building was purchased in 2021. In 2021, a declaration is submitted and the deduction right for 2021 is confirmed. But the individual does not receive it in the full limit. Despite the fact that it must declare its income for 2018-2016, the taxpayer, ignoring the reporting for 2018, submits a declaration for 2021, since this year he received sufficient income to exhaust the limit on deduction. It's not supposed to be like that.

The three-year period is counted from the year in which the deduction is first claimed, but not when the property was purchased or payment for housing was made or during other periods.

Let's say a citizen purchased an apartment in 2021 and, if he applied in 2021 with a full package of documents, he could receive a refund for 2021 - 2015. However, he delayed and only converted in 2021. Accordingly, he will be entitled to compensation for the years 2021, 2021, 2021, and 2021. As you can see, the two-year delay led to the burning of two years.

Transfer to later periods

If the deduction limit has not been exhausted for the main year and the three preceding years, then the pensioner has the right to additional tax in future years.

Can a non-working pensioner receive a tax deduction when buying an apartment?

There is a fairly well-established opinion that only those citizens who are officially engaged in working activities can claim tax benefits for the payment and return of personal income tax. However, this is not the case, despite the fact that, indeed, for the most part, personal income tax payers. persons are employees employed in various organizations.

The fact is that the deduction is provided to all eligible citizens who had taxable income for a certain period and, accordingly, fulfilled their obligations to the Federal Tax Service.

Attention! Non-working people may also qualify for a tax break on real estate purchases if they received income and then paid tax.

In addition, pensioners have the right to the so-called transfer of deductions. He assumes that it is possible to return tax for three tax periods preceding the purchase of an apartment. Therefore, if the pensioner was working at this time, he will receive a refund even though at the time of filing the application he is not working and has no income other than a pension.

Both working and non-working pensioners can count on the benefit, but only those who are not working at the time of submitting the relevant documents to the tax service have the right to transfer.

Retirement after purchasing an apartment

When an apartment (house, room) is bought by an ordinary working person, and later he retires, there are no special difficulties in obtaining a deduction for a pensioner when buying an apartment. Such an owner can refer to the current pension status and return personal income tax, as provided for pensioners.

Example, an apartment was purchased in 2021. The owner finished his working career in 2021. In 2021, he submitted documents for a refund for 2021, as well as the previous 3 years (2019, 2021, 2017). That is, the countdown will start from 2021 - from the moment of retirement, and not from the moment when the “deduction right” arises (2018).

But the more time passes between buying a home and retirement, the less opportunity there is to capture the past three years as a refund. And when the time gap becomes more than 3 years, the pension benefits disappear altogether.

Let's assume that the property was purchased in 2014 and deduction returns have been filed since 2015. Retirement occurred in 2018. By claiming the balance in 2021, the applicant will not be able to claim the balance before 2014, only for 2021, 2021, 2021, 2015. And personal income tax was already returned on them.

If there are other deductions

In the same year, you can claim several types of deductions (property, social, and standard).

Housing (property) and treatment (social) are often combined. In the end, they add up.

Example : in 2021 an apartment was purchased for 1.2 million rubles. A retired citizen has his only income from renting out his property. In the same year there was a paid surgical operation, the costs of which amounted to 18 thousand rubles. At the end of 2018, a citizen received income subject to personal income tax in the amount of 300 thousand rubles, that is, he is obliged to pay a tax in the amount of 39,000 rubles. The declaration for 2018 indicates taxable income, the tax payable is 39,000 rubles. You can get a deduction for an apartment and treatment, but not more than the amount of tax payable (39 thousand). Taking into account the deduction for the purchase of housing, there will be no tax to pay (2,300 rubles (13% deduction for treatment) and 36,700 rubles - the remaining property deduction this year). The declaration is submitted with a tax amount equal to zero.

Deductible amounts can be distributed in different proportions, at the discretion of the citizen.

It is rational (in most cases) to claim a social deduction. Since its balance, unlike property, is not carried over to subsequent years, but burns out.

Where and when can you get money

After completing the audit, the tax office transfers the entire amount of the deduction to the personal account number specified in the application. You can receive money from a bank on the terms and conditions of a financial institution.

When returning the deduction through the employer, the process will take several months, and in some cases years, because... the refund will be made in installments equal to the amount of accrued income tax.

In conclusion, in the above article, the editors of the VKreditBe.ru website tried to fully explain in an accessible language whether a pensioner can receive a tax deduction. The process requires a lot of time to collect various pieces of paper, but at the end there is a pleasant prize in the form of a refund of part of the taxes paid, in some cases, expressed in large sums.

Where to contact

To the Federal Tax Service:

- If you have a permanent residence permit, go to the territorial inspectorate at your place of residence;

- There is no permanent registration, only temporary - at the Federal Tax Service at the temporary registration address;

- There is no registration at all, then at the location of the purchased housing. And if at the time of your visit to the Federal Tax Service the property has already been sold, then you can contact any inspectorate of the citizen’s choice. But first you need to write an application for registration (assignment) of a citizen to the Federal Tax Service.

When you change your residential address, the place of registration also changes (link to the inspection). For a refund, you should contact the new Federal Tax Service, where the taxpayer will be registered.

To the employer:

It is allowed to receive a deduction and submit documentation in the current year (in which the property right was registered) through the employer (this does not apply to non-working pensioners). The employer can pay wages without withholding personal income tax only in the current year.

The employer will not be able to return tax from the budget for the previous three years. You must apply for these amounts yourself to the inspectorate in the usual manner.

At the MFC:

Documents can be transferred (both submitted and received) through specialists of the multifunctional center, and to any unit in the territory of the locality and even the region. All the same rules apply here as for the Federal Tax Service regarding deadlines for submission, consideration, decision-making, appealing refusals, etc.

There is one condition at the regional level: the authorities must enter into an agreement on such transfer of documents between the MFC and the tax authority. Whether the agreement has been concluded or not will be reported to the MFC.

How to file a tax return

There are three options for submitting deduction documentation.

“Live” appearance at the tax office or MFC.

The owner or his representative (using a notarized power of attorney) only needs to visit the territorial Federal Tax Service Inspectorate (MFC). The return package is handed over to the specialist at the appropriate window (the administrator or any other employee of the Federal Tax Service (MFC) will tell you the number/location of the window). You need to bring with you both copies (which you submit to the tax office) and originals (which you simply show to a specialist to verify copies). The inspector must put a mark (position, full name of the inspector, his signature, date) on the acceptance of the declaration on its copy. Therefore, you should immediately submit two copies of 3-NDFL (one to the Federal Tax Service (MFC), the other to mark yourself). It is advisable to provide an inventory of the package of documents, which the specialist will sign. This method is convenient because upon delivery, they immediately point out shortcomings that can be quickly corrected.

Mailing.

The deduction package can be sent by registered mail with a list of attachments. In this case, delivery is carried out by any postal institution (Russian Post, courier services, etc.). The date of presentation to the Federal Tax Service will be the date on the postal receipt. The sent package should be submitted in notarized copies (this will ensure the authenticity of the documents and will remove many questions from the Federal Tax Service). In this case, copies of documents for the apartment are submitted at a time on the first application, minus the deduction.

Through the Internet

Sending is possible electronically from the “personal account” on the Federal Tax Service website. You can send not only a 3-NDFL declaration, but also an application to confirm the deduction, an application for a tax refund and attach copies of electronic documents. To do this, you need an electronic signature (if the taxpayer does not have his own electronic signature verification key certificate, then on the tax service website you can order an electronic signature for tax document flow).

Recently, deductions can be claimed through the State Services portal.

When?

You can submit documentation to the Federal Tax Service the following year after registering your property in Rosreestr.

Start of application period:

- if submitted by mail, then from the first calendar day of the year,

- if personally, then from the first working day of the new year.

If, in addition to receiving a deduction, you also need to report for income received in the past year, then the declaration must be submitted before April 30.

The declaration is submitted only to return the tax paid by the employer (i.e. there is no other taxable income), then there is no need to rush to April 30th. Documents can be submitted any day throughout the year.

The tax office has the right to check the declaration and documents within 3 months . Then, within 4 weeks, the tax must be returned to the pensioner’s bank account.

Which documents

The set of documentation for returning a tax deduction is standard:

- Declaration 3-NDFL (main, if it was not submitted for the reporting year, or clarifying);

- Application for deduction. Its form is approved by the tax service, so a certain clarity and compliance with the rules is required when filling it out.

- Help 2-NDFL. It can be obtained either from the employer or in the personal account of the Federal Tax Service website (in the “Tax on personal income and insurance contributions” section, subsection “Information on certificates in form 2-NDFL”) or from the tax office (if it is difficult to obtain from the employer, for example , the company was liquidated). The certificate is issued annually for the reporting period.

- Certificate of pensioner status. Persons who retired before 2015 had a certificate. Afterwards it was replaced with a certificate, which is issued upon request by the territorial pension fund.

- Basis agreement: purchase and sale of an apartment (room, house), exchange, equity participation in the construction of a new building with an act of acceptance and transfer of housing in this apartment building. Such agreements must have a state registration mark from Rosreestr.

- Payment document. Receipts, orders, receipts, bank statements, etc.

- Certificate/extract of ownership.

- Copy of the passport.

- Application for transfer indicating bank account details. It can be submitted with the main package of documents.

Since when purchasing real estate in a new building, property registration is not required - it is enough to register a share participation agreement and receive an act of transfer of the apartment . Accordingly, an extract certifying the property is not needed.

Read more about documents for deduction here.

Pensioners as a category of citizens

Pensioners, like any other categories of individuals, remain citizens of Russia and count on similar rights and freedoms, regardless of whether they have stopped working or not.

Despite this, there are certain specific features inherent in older people as a category of citizens:

- The main income of most pensioners is state pension payments;

- Taxes are not paid to the treasury from this source of income, which is why the right of citizens to receive a tax deduction is called into question;

- They incur certain expenses for treatment, training, purchase of real estate and its sale.

Separately, it is worth noting that all pensioners are divided into two large categories - non-working persons and persons engaged in full-time work.

The lack of pension funds to cover current expenses forces retirees to look for work and find third-party sources of income. Many of them buy securities, rent out real estate, and place funds in time deposits in commercial banks. Receiving additional income forces pensioners to fill out a 3-NDFL declaration.

Features of filling out declarations and applications

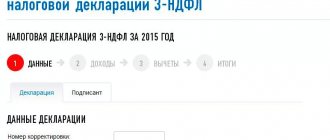

Declaration 3-NDFL

There are two ways to fill out a declaration: on a paper form or using a special program, followed by printing on paper (or sent electronically to the Federal Tax Service).

In general, it is easier to produce 3-NDFL using the program. Therefore, below we will talk about the program declaration.

First you need to download the program. This can be done without any difficulty on the Federal Tax Service website.

You need to download not the latest version of the program, but versions of declarations for the years for which the report will be submitted. That is, if funds are reimbursed for 2021, then you need to download and fill out the “Declaration 2020”, if we take into account income and form the remaining deductions for 2021, download the “Declaration 2019”, etc.

Since older persons submit several declarations at once (for the year in which the right arose and the previous three), the sequence of transferring the deductible balance from year to year should be followed. The compilation of 3-NDFL begins from a later time and when transferring the balance, proceeds to earlier years.

For example, a transaction was completed in 2021. First, a declaration is drawn up for 2021, if there is a balance (the entire tax amount has not been collected), then it is drawn up for 2021, then for 2017, etc.

Data in the declaration is entered on the basis of transaction documents (purchase agreement, transfer and acceptance certificate), information about real estate from Rosreestr, a citizen’s personal passport, certificates from the employer (certificate 2-NDFL). That is, from those documents that will be submitted to the tax office.

Usually there are no difficulties filling out 3-NDFL. The main thing is not to get confused with the transfer of deduction balances. The tax paid in the year in which the right to compensation arose (registration of property) is deducted from the total refund amount. The tax paid in the next descending year is subtracted from the result obtained. Next is the tax amount for the next year. And so on the chain for 4 years.

The total amount of the deduction is reflected in line “1.12” of sheet “D1”. And the balances are indicated in lines “2.10” (if deductions are made and/or for interest on loan agreements - “2.11”) of sheet “D1” of the declaration.

A pensioner-taxpayer forms the balance for 4 years at a time, while simultaneously submitting 4 corresponding declarations to the tax office. If the balance is not reduced to zero, then you can continue to choose in future years.

Example: an apartment was purchased in 2021 for 1.5 million rubles. The person received income and paid taxes in the following amounts: in 2021, personal income tax was 35,000 rubles, in 2021 - 39,000 rubles, in 2021 - 34,000 rubles, in 2021 - 42,000 rubles. It has the right to receive a deduction in the amount of 195,000 rubles from the purchase amount. (1.5 million X13%). For the specified periods (2017-2021), the owner received compensation in the amount of 150,000 rubles. (35 thousand + 39 thousand + 34 thousand + 42 thousand). The balance is 45 thousand rubles. (195 thousand - 150 thousand) the pensioner will be able to receive in the next financial year, starting from 2021 onwards. Let’s say that in 2021 the personal income tax was equal to 30 thousand rubles, and in 2022 – 33,000 rubles. Accordingly, over these two years the remainder will be selected.

If there was no income in a certain year, then the taxpayer may not file a “zero” return, but skip from year to year. Thus, instead of 4 declarations, a smaller number can be provided.

When other personal income tax deductions (social, standard) are declared at the same time, they are reflected in one declaration. To do this, on the “Deductions” page, in addition to property, select the corresponding sheets “Standard” and/or “Social” and fill in the necessary details.

It happens that some deductions have already been declared earlier and refunds have been received from the budget. Then you will have to declare the “housing” compensation in the clarifying 3-NDFL. The fact that it is clarifying can be judged by the numbers in the column “Adjustment number” on the title page (the initial declaration has the number “0”, all other numbers indicate the number of clarifications, for example, we put 1 means there is only one adjustment, if we put 2 it means a report is corrected for the second time, etc.).

When filling out an updated declaration, we first transfer the data from the original one and then supplement it with new information (which we correct).

If the allowable annual amount of compensation has already been exhausted by the previous deduction (a decision has been made and money has been received), then the funds received cannot be redistributed.

For example: in 2015, an individual received 15 thousand rubles from the budget as a social deduction, and in 2021 - 20 thousand rubles. In 2021, I bought a residential building for 2 million rubles. The taxpayer has a constant, identical income for the indicated periods and paid personal income tax of 45 thousand rubles. annually. Having intentions to reimburse funds for property deduction, an individual can receive 45 thousand rubles for 2021, 25 thousand rubles for 2021. (45 tr. - 20 tr.), for 2015 - 30 tr. (45 tr. – 15 tr.).

Instructions for using the program for filling out 3-NDFL are here.

Application for deduction

Officially, this application is called “On the return of the amount of overpaid tax.” It has a strict form - Appendix No. 8 to the order of the Federal Tax Service of Russia No. ММВ-7-8 / [email protected] dated March 30, 2015.

The application is simple to complete. It is enough to fill out the details of the form, where all the columns are clear. You need to have your passport, your bank account details, a completed declaration and know several other meanings (KBK, tax code article numbers, etc.).

A separate application is filled out for each year, that is, the application is not general (not single) for the entire time. Thus, if the applicant immediately submits 4 declarations (the main one and for the 3 previous years), then there should also be 4 applications.

Instructions for filling out the application

- Territorial tax office, to which a package of documents is submitted for deduction;

- Full name, INN, address (according to registration), contact telephone number of the taxpayer;

- This rule of law is always indicated;

- The year for which the tax is being reimbursed is indicated;

- An unchangeable indicator for any taxpayer, regardless of region;

- Same as in the declaration;

- Same as in the declaration;

- In the vast majority of cases, this is the name of the taxpayer's bank account;

- Details can be ordered from the servicing bank;

- In addition to your full name, it is necessary to indicate the full details of your passport;

- It is better to put the date the same as in the declaration.

Features of personal income tax return for pensioners

Without any special features, while maintaining standard technology, a tax deduction is provided for pensioners in 2021 if they do not quit their jobs, but continue to work as before. The situation is the same when they go to work under an agreement or contract. A special option for compensation payments from the state is the transfer of deductions from previous periods.

Property tax deductions are issued for purchased property in parts or the entire amount without differentiation into periods. The latter scheme may be used if the maximum amount of compensation allows it. You are allowed to receive money for a newly purchased house, for residential square meters that became property several years ago. At the same time, a specific period for registering property is not specified, but there is a maximum maximum for filing an application for reverse payments.

The main condition is that taxes be paid. Money in the form of compensation for funds spent on a purchase is issued by the fiscal service even when the citizen is not actively working at the enterprise. If the deadline for the implementation of compensation payments has not passed, the pensioner has the same grounds for this assistance from the state as an ordinary employee of a company or state-owned enterprise.

The applicant calculates compensation and indicates the current year 2021 as the starting year for recalculating obligations to the state.

The law allows the return of personal income tax money no more than three years from the date the applicant ceases paying fiscal contributions. In this case, this means retirement or transition to unemployed status after retirement.

It is not necessary to receive payment for going to work every day. Money is also declared from indirect profits. Any person who has rented out a garage, part of a house, or land can use the system of budget discounts and receives money drawn up under an agreement and with the payment of deductions.

In addition to rental relations, the same list includes resources that a citizen receives in the form of income to an account or in cash for a transaction for the sale of housing. This may also be the sale of other objects that are subject to personal income tax.

If the calculation of the refund is made by the enterprise or company where the pensioner works, then they can independently recalculate the application and coordinate all further actions to reduce the citizen’s taxation directly. That is, the fiscal service and accounting department of the enterprise then operate.

The only action required from the applicant is to submit information in the form of an application and calculation. It requires you to indicate your amount of compensation, according to the amounts submitted to the tax office for the purchase/sale transaction. There may be other cost options:

- repair estimate;

- estimate for the design and reconstruction of the building with mandatory transfer to the status of premises suitable for living.

How to get a deduction when buying an apartment for a working pensioner

How to get a tax deduction when a person has already earned a pension, but is in no hurry to stay at home and continues to work?

The law establishes that the main criterion for processing payments is the availability of deductions. The social status of the applicant in this case does not matter. That is, working pensioners undergo the same usual recalculation of income tax when buying an apartment as working people. The legislation does not differentiate between recipients of reverse payments by belonging to the category of working or non-working.

The norm prescribed in the legislation is addressed to all categories of residents (permanently residing in the Russian Federation) and paying a thirteen percent rate of personal income tax.

The refund accrual is carried out by the fiscal service upon personal application and after registration of such paper (electronic version) with the fiscal authority. After this, you will need to contact the company. There, a deduction is made in the form of salary growth and mutual settlement between the employer and the state.

You can receive compensation yourself after the tax service has decided to grant a discount.

How to get a tax deduction when buying an apartment for non-working pensioners in 2021

Let's look at how to return 13 percent from taxes for a non-working individual. And at the same time, the applicant made a significant purchase with accumulated funds? Two possible situations should be distinguished:

- the applicant has only the money that the state gives him as pension social security, and the recipient does not have a job in public or private commercial structures;

- There is money from the state (pension), and indirect income or salary from a registered place of work.

A non-working citizen must determine the payment period - it should be no more than three years. In this case, the period of acquisition of real estate is not taken into account and should be a reasonable limit. The property is registered only in the name of the person submitting the documents, that is, the applicant, for a reverse amount from the budget.

In practice, this would look like this for those retiring in 2019:

- payment period is no more than three years from the date of filing the declaration in 2020 - for 2019–2017 inclusive;

- money is withdrawn from the current accounts of treasury services and transferred to a specific applicant;

- Data verification can take from one to several months.

Can a non-working pensioner count on a reverse payment if he became the owner of real estate five years ago? Yes, he can, but only if he remained a tax payer no later than three years ago.

A working citizen who has reached the age at which he has the right to go on vacation based on his length of service and insurance payments, his status does not differ from that of an ordinary worker. His employment relationship must be formalized, and both wages and the amount of tax deductions established by law must be accrued for the work.

What is paid in the form of pension proceeds will not be included in compensation calculations. This money is issued directly by the state, without deductions on income from individuals. Let us remember the previously stated rule - deductions go only with personal income tax. Therefore, a pensioner or other recipient of social assistance should not count on such a refund.

The exception would be when a citizen has another way to earn money, and it is officially registered.

Receiving a property deduction if you have additional income

Let us clarify the position on the situation when a property deduction when purchasing land or an apartment can be carried out from indirect income:

- leasing, with the execution of an agreement and payment of taxes, a garage, summer house, other property, for example, cars, equipment and commercial premises;

- there is an officially registered receipt of income in the form of payment for a real estate asset provided in installments;

- funds from the fulfillment by the parties of the agreement with the full implementation of all tax deductions.

When a pensioner who combines work and pension status buys an apartment, he receives a full standard compensation rate of 13% with personal income tax.

As in other circumstances, the applicant must contact the fiscal service and the employer (if there is one) to implement the payment mechanism.

A working pensioner stopped working

Can a pensioner receive tax benefits if he is not registered as working? Or, if his work contract is terminated at the time of filing the declaration? Or if he retired not in February, but, say, in June? And one more important question: can ex-employees receive a tax deduction not partially, but completely?

For the legislation, such nuances do not matter, since two conditions remain fundamental - the availability of payments in the previous period, and the opportunity to take advantage of personal income tax benefits.

That is, if there is an acquisition this year, it is necessary to systematically prepare for filling out the declaration in 2021. This is when the period begins when it is possible to reserve a reverse payment.

The right to receive reverse payments always works if there were payments in the previous period for tax obligations. A non-working person receives a tax discount on the purchase of an apartment after verification of data by the fiscal service and submission of a declaration. It is necessary to justify the fairness of the deduction. If there are no gaps in the length of service and personal income tax payment, then the payment can be postponed for no more than three years. That is, in the fourth year from the date of the last payments, the pensioner can receive compensation.

Typical life situation: the applicant retires three years ago, and does not mind receiving reverse additional payments. The first requirement has been met - the time limit has not been exceeded. The second requirement is maintaining resident status (non-residents pay a different rate). That is, the applicant must reside in Russia for at least ½ year.

The third important point is that it is necessary to submit three declarations based on the results of previous periods. This allows the fiscal service to assess the financial situation and the legality of charges for such a transfer from the budget.

Deduction for the purchase of housing in common ownership of retired spouses

Is housing compensation due if one of the spouses has the opportunity to receive limited compensation, but the other does not? Yes, the law provides such a right. Actually, this is one of the options when a male or female pensioner cannot show official earnings in full before retirement.

Either spouse has the full right to a tax deduction. Family relationships must be officially recorded. The applicants have marriage certificates and maintain common affairs and a common household.

This gives the right to receive benefits from the state, since, in fact, such discounts are provided not to a specific citizen, but in his person - to the family of a pensioner.

Tax deduction for military pensioners

In fact, it is not provided to this category of citizens. A tax refund when purchasing an apartment is possible only when the personal funds of a military person or a person equivalent to a military personnel were invested in the purchase of housing.

In this case, the deduction for the apartment is the same 13% of the contract price, but in this case the amount of costs is determined based on the citizen’s personal investment. That is, if the apartment cost 1 million rubles, and 300 thousand of them were paid by the applicant, then it is from this amount that he has the right to count on compensation. As in other cases, a declaration is submitted, a package of documents confirming ownership is drawn up, which must specifically indicate the share of investment of personal funds, as well as obtaining the right of personal ownership of housing.

These payments, if verified by the tax service, are paid from the next year after filing the application.

Problems with document transfer

It is better to submit documents “live”. Upon delivery, a Federal Tax Service specialist will first check the documentation. Defects can be corrected on the spot. If the mistake is serious, then reschedule the delivery to another nearest appointment day, after putting the documents in order.

The deadlines for approval and payment of property deductions may be violated. Therefore, it is necessary to record the moment of submission of documentation to the inspection and the composition of the documents (so that the Federal Tax Service cannot deny the fact of submission). The inspector must be required to mark the submission of documentation. It is placed on the copy of the declaration. But it is better to prepare a cover letter that reflects the entire list of documents. You should write a separate cover letter for each package (annual). Recently, specialists have been handing over a receipt for accepting documents, which completely simplifies this procedure.

Tax authorities have few reasons for refusing to accept a package of documents (submission of documentation by an unauthorized person, lack of signature in 3-NDFL, etc.), but if questions arise, then you should not zealously insist on accepting the documentation, since the very fact of delivery and acceptance is not means approval of the deduction itself. A decision on the merits is made after studying the documentation and conducting a desk audit.

Approval and payment

You should be aware that the requested amount for payment can be paid in the absence of debts on any taxes. But this applies to cases where the declaration is not submitted for the current period, but corrective declarations for the missing years (within the three previous years). And until the debt is repaid, payment will not be received. By the way, the debt can be paid off with a deduction, even for other types of tax.

Links to legislative acts

- Article 78 of the Tax Code of the Russian Federation. Offset or refund of amounts of overpaid tax, fee, insurance premiums, penalties, fines

- Article 220 of the Tax Code of the Russian Federation. Property tax deductions

- Article 229 of the Tax Code of the Russian Federation. Tax return

- Letter of the Ministry of Finance of the Russian Federation No. 03-04-07/40091 dated July 13, 2015

- Letter of the Ministry of Finance of the Russian Federation No. 03-04-07/17776 dated April 17, 2014

- Appendix No. 8 to the Order of the Federal Tax Service of Russia No. ММВ-7-8/ [email protected] dated 02.14.2017

- Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated 10/03/2018 “On approval of the tax return form for personal income tax (form 3-NDFL), the procedure for filling it out, as well as the format for submitting the tax return on the income of individuals in electronic form"

Can they refuse payment?

In some cases, tax authorities may refuse to pay a tax deduction.

Among them it should be noted:

- lack of grounds for providing benefits;

- factual errors when filling out the declaration;

- existing debts to the Federal Tax Service;

- expiration of the deadline for providing a deduction.

Reference! The refusal of the tax authorities to pay can be appealed in court.

In accordance with the law, a number of citizens, if there are grounds for this, are provided with benefits for paying fiscal fees in the form of a tax deduction. At the same time, even non-working pensioners who in fact do not have any taxable income have the right to receive it. This is possible due to the mechanism of transferring tax deductions, when they are returned the funds paid for the 3 years preceding the year of acquisition of real estate.