If a person moves to another apartment, he must register at this address. Registration can be permanent or temporary. But do you need to change other documents when moving? For example, is there a need to change the TIN when changing registration or can this procedure be neglected? People have an ingrained opinion that when moving to another place of residence, they may need to contact the Federal Tax Service. However, the statement is not entirely true.

In what cases is it necessary to replace the TIN?

The TIN number is unique and is issued once and for life. The twelve-digit number itself cannot be changed; it will remain the same. However, in some cases it is possible to replace the form of the Certificate of Registration.

Cases when it is necessary to change the TIN certificate:

- its loss or damage;

- change of surname, first name or patronymic.

Replacement is not required if you change your place of registration.

Remember, even the slightest mistake when filling out will either lead to you being immediately asked to fill out the form again, or the documents will be accepted, and later a refusal to assign a TIN will come.

What is a TIN?

A taxpayer identification number is a unique 12-digit code assigned to each individual - citizen or non-resident of the Russian Federation. An individual entrepreneur or legal entity must also have a TIN for the same purposes - taxation of income in favor of the state. The TIN is required to identify (recognize) the taxpayer and conduct any financial transactions involving the deduction of part of the profit in favor of the state:

- wages;

- income from real estate transactions (sale of an apartment or car);

- entry into inheritance.

The identification code is used for tax deductions and opening a bank account and other financial transactions. Most taxpayers know what the TIN of an individual looks like. When it comes to TIN, it usually means a certificate of assignment of an identification code to a citizen. A document is a kind of certificate that a person is in the Unified State Register of Real Estate and can conduct financial transactions on his own behalf.

How to change TIN: instructions

TIN - where is it changed?

To change, you can contact the tax office directly (at your place of registration), or the department of the multifunctional center ( MFC ) (this is just the answer to a frequent question from our readers: is it possible to change the tax identification number in the MFC?), which performs the functions of the tax service.

What documents are needed?

To replace, you must provide the following package of documents to the inspection officer:

- passport with registration mark,

- a document confirming permanent registration, if such a mark is not in the passport;

- marriage certificate or a copy thereof (in case of changing the TIN due to a change of surname);

- old Inn certificate to be replaced;

- receipt of payment of the fee (payment must be made only in case of loss or damage to the certificate!);

- statement (more details below).

Do I need to write any statements?

To replace the TIN certificate, you must write an application in the established state form (Form No. 2-2-Accounting). A sample application can be taken from tax service or MFC employees and filled out on the spot.

The application must indicate the full name. And. o., date of birth, gender, passport details, place of residence, information about changing the last name, first name or patronymic (if any).

Application for change of TIN - form.

Cost and state duties

Re-obtaining a certificate is subject to a fee only if it is lost or damaged. The state duty in this case is 300 rubles.

When changing your last name, first name or patronymic, obtaining a duplicate is not subject to state duty.

Replacement timing

The legislation does not regulate the period during which it is necessary to change the TIN. The TIN certificate itself is almost never required to be presented.

An individual also has the right not to distribute information about the TIN anywhere. The only exception is the situation when an individual gets a job in government agencies.

In this case, the new certificate must be in hand and the information in it must match the passport data, which should be taken into account when replacing. A new form with the TIN is made within 5 calendar days , that is, during this period after submitting the application, the citizen is obliged to appear at the tax authority to receive a new TIN certificate.

What documents need to be changed when moving?

People often create non-existent problems for themselves, including when changing their registration, without even understanding why, why and whether the TIN is changed at all in such a situation. However, delving into the question, the person will find out that there is no need to carry out the action at all. Correction of a number of papers will still be required. If a person moves, this does not impose special obligations on him to the state. All you need to do is register.

Registration can be temporary or permanent. If a person has purchased real estate, he receives the full right to register on the premises. When staying in another place is temporary, permanent registration is not required. However, you will still have to notify the migration service department. As a general rule, the procedure is completed within 7 days from the date of arrival.

During the manipulation you will not have to collect a large package of documentation. You just need to provide your passport. For permanent registration, a stamp is affixed to it. In order for the manipulation to be carried out, you will need to personally visit the territorial department of the Ministry of Internal Affairs dealing with migration issues.

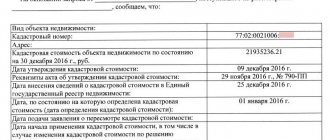

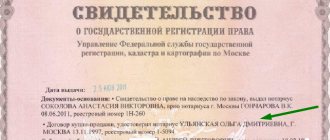

However, it is important to confirm the fact of ownership of the apartment. Documentation will be required that the person owns the property.

If there is a change of residence, some of the papers must be updated. The citizen is required to replace the following documentation:

- STS auto;

- pension certificate, if it was previously received;

- military ID if a man is moving.

If there are other documents that reflect registration, they will also have to be adjusted. If a person seeks medical help, a new card will be created for him.

When a person moves, there is no need to adjust SNILS. Licenses, bank cards, insurance and a number of other documents provided at the national level do not change either.

Is it possible to make a replacement online? How to do it?

The TIN certificate can be replaced without contacting the tax office. The change can be made online on two websites:

- official website of the Tax Service of the Russian Federation - www.nalog.ru;

- official website of the Public Services Portal - www.gosuslugi.ru.

Change on the tax service website:

- Go to the website https://www.nalog.ru and find the “Individuals” section. The website must have a registered personal account. If the site does not have a personal account, then on the page that opens, select “Registration”, enter personal data, indicate your email address and create a password. After this, you need to confirm your registration via an email sent to the specified address and log into your personal account.

- On the right, in the “Electronic Services” section, select “Submission of an application for registration” and click on it.

- If payment of a state duty is required (in case of loss or damage), then you must additionally go to the “Payment of state duty” section and make a payment of 300 rubles.

- Fill out the online registration application form, click “Save” and send it to the tax service. If the online application is successfully submitted, a confirmation email will be sent to your email address.

- If an individual does not have an electronic signature, then after some time an email will be sent with information about when and where you can receive a new document.

After this, within the specified period, you must appear in person at the tax office with an identity document and pick up a new document. - If the taxpayer has an electronic signature, then the certificate can be received electronically (download it from the website) or by registered mail with an inventory.

Replacing TIN through State Services:

- Open the official website https://www.gosuslugi.ru. You must also have a registered personal account. Log in to your personal account.

- In the “Public Services” section, select the “Registration of an individual” item and click on it.

- In the window that opens on the right, select the “electronic” option from two options for submitting an application.

- Complete the online application form and submit.

Wait for a response about the place and time of receiving the new document. After receiving the response letter, you must personally go to the tax department within the specified time frame with your passport.

How to obtain a TIN for a foreign citizen through State Services - read here.

Do I need to contact funds and statistical authorities?

The same automatic procedure for reporting the new place of residence of an entrepreneur is provided for extra-budgetary funds and statistical bodies. According to paragraph 9 of the Rules for the Submission of Information (Resolution of the Government of the Russian Federation of December 22, 2011 No. 1092), the necessary information is transferred to these authorities by the tax service within five working days after making an entry in the Unified State Register of Individual Entrepreneurs.

In total, within twenty working days after the change of address of the individual entrepreneur, all government agencies where he is registered must be automatically notified about this. However, this applies only to citizens of the Russian Federation; foreigners must submit an application to the Federal Tax Service in the form P24001.

In addition, individual entrepreneurs and employees must send a notification to the Social Insurance Fund about a change of registration in the form from Order No. 215 dated April 22, 2019. The same obligation is established for entrepreneurs who voluntarily pay social insurance contributions for themselves.

How can you change your TIN if you are not at your place of registration?

Replacing the TIN certificate form in person is only possible at the place of registration. If an individual is in another city and does not have the opportunity to personally come to the tax authority, then a new form can be issued by mail.

To do this, you must send an application in the prescribed form by registered mail with acknowledgment of receipt and attach to it a notarized copy of your passport, a copy of the document confirming registration and a receipt for payment of the fee (only if the TIN is issued due to damage or loss of the old one).

After receiving the letter by the tax authority, a completed duplicate of the TIN certificate is also sent to the individual by registered mail with acknowledgment of receipt.

If an individual has his own legal representative, who has the opportunity to contact the tax service (at the place of registration of the individual), then he can submit all the necessary documents in his place. A representative of an individual also has the right to pick up a new TIN certificate.

To do this, the legal representative must contact the tax office with a written application for registration, a document confirming registration and a passport of the individual being registered.

The legal representative must have a document with him that confirms his authority.

conclusions

Do I need to change my TIN when changing my registration? No. Remember, this document is issued once and for life. Even changing your place of residence does not affect this. With only rare exceptions.

Obtaining a TIN certificate also does not cause any hassle. Nevertheless, you can live without a document for the time being. There is no need to rush to receive it. As a rule, you need to obtain a TIN by the time of your first official employment. And nothing more. There are no penalties for missing a document. After all, you have the right to receive it when you consider it necessary, if you do not officially get a job.

What is a TIN and how to find it out

TIN is a kind of code, which is a sequence of twelve digits for individuals. persons and out of ten for legal entities. persons It is necessary in order to ensure control of taxes on a citizen’s income. You can obtain such a document from the Federal Tax Service, according to the place of registration.

At the moment, there are several types of digital codes:

- For physical faces. The code consists of twelve digits:

- the two digits in front indicate the region code;

- the next two are the Federal Tax Service number;

- the next 6 digits are considered the tax record number;

- the remaining value is a digit for input control.

- For individual entrepreneurs. Its assignment is carried out after an individual registers himself as an individual entrepreneur.

- For a legal entity.

- For a foreign legal entity.

How to find out your TIN and assigned digital code:

- Contact the Federal Tax Service.

- Use the unified portal of State Services or other online service.

The first method has a significant drawback - the need to pay a state fee. If you use the online service, you just need to enter your passport data in the fields provided for this purpose.

Interesting! In addition, any citizen of the Russian Federation can contact the Federal Tax Service to have a mark with a digital code put in their passport. Thanks to this, you don’t have to present a certificate when carrying out any transactions. This is done solely at will.

The presence of this document is necessary for official employment, for civil servants, as well as individual entrepreneurs. Also, without it you cannot purchase real estate. This number is used for any and all taxes or fees.

Urgent replacement

When changing place of residence, the TIN remains the same. As emphasized earlier, citizens are assigned an individual number once in their life. It remains unchanged throughout life. Therefore, the TIN cannot be exchanged under any circumstances. Data about the applicant will be transferred to the Federal Tax Service at the new place of registration. Accordingly, all tax notices will still reach the real recipient.

TIN and certificate

Is there a change of TIN in Russia when changing place of residence? We have to find the answer to this question today. In fact, this topic interests many citizens. After all, moving to a new place is usually accompanied by significant paperwork for people. Therefore, it is better to find out in advance which documents will need to be changed. Is the taxpayer number subject to change? And if so, how can you get this service?

All taxpayers have this combination of numbers, but some are not even aware of it. TIN is issued at the place of registration. Or, more precisely, at the Federal Tax Service of your area. Accordingly, registration plays some role when receiving this document. What to do if you change your registration? Do I need to change my TIN? And what documents will be required in this case?