In our article, we talk in detail about what a TIN is and whether foreigners need a TIN, as well as how a foreign citizen is registered with the tax authorities of the Russian Federation. In the article you will find a sample application for a TIN for a foreign citizen and official instructions for filling them out.

To move around the page more conveniently, you can use the navigation:

- What is the TIN of a foreign citizen?

- Does a foreigner need a TIN and why?

- TIN and patent for work (without TIN the patent cannot be renewed)

- Where can a foreigner get a TIN?

- How to get a TIN for a foreigner

- What does a foreign citizen need to obtain a TIN?

- List of documents for obtaining a TIN for a foreign citizen in Russia

- Application for obtaining a TIN for a foreign citizen (sample)

- How to fill out an application form for tax registration of a foreign citizen in the Russian Federation

- What does the TIN of a foreign citizen look like?

- What does a certificate of registration of an individual (foreign citizen) with the tax authority look like?

- How to find out the TIN of a foreign citizen

- Is it possible to find out the TIN of a foreign citizen from a passport online?

- How to find out the TIN of a foreign citizen using a patent

What is the TIN of a foreign citizen?

TIN of a foreign citizen (taxpayer identification number) is the personal number of each foreign citizen registered with the tax authorities of the Russian Federation.

The assignment of a TIN to a foreign citizen in the Russian Federation, as well as to citizens of the Russian Federation, occurs only once and is forever assigned to an individual, becoming his personal identifier in the tax authorities.

The fact that a foreign citizen has received a TIN is confirmed by the issuance of a certificate of registration of an individual (foreign citizen) with the tax authority. The certificate must include the following information:

- Full name of the foreigner registered with the tax office;

- number of the tax authority that issued the TIN to the foreigner;

- series and document number.

Description

What kind of paper are we talking about? And why is it needed?

TIN is an individual taxpayer number. The document is represented by paper on which information about its owner is written, as well as the corresponding number. The latter is assigned at birth and for life. It does not change under any circumstances.

TIN is needed:

- during employment;

- to open an individual entrepreneur;

- to quickly search for taxpayer information.

Without this document, a citizen will not be able to use a number of state and municipal services. Everyone has a TIN, but not everyone has a certificate. Where and how to get it? Can this be done at the MFC?

Does a foreign citizen need a TIN and why does a foreigner need a TIN?

Many people wonder whether foreign citizens receive a TIN in Russia and, if so, which foreign citizens are assigned a TIN in the Russian Federation?

A TIN is needed to record income and taxes paid by a foreign citizen.

In accordance with clause 7 of Article 83 of the Tax Code of the Russian Federation, as well as with clause 7 of Article 13 of Federal Law No. 115 “On the Legal Status of Foreign Citizens in the Russian Federation”, foreign citizens - individuals must register with the tax authorities according to place of residence, at the location of their real estate and vehicle, as well as on other grounds provided for by the legislation of the Russian Federation.

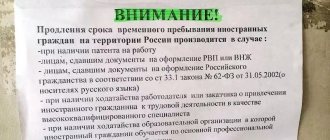

Thus, registration of a foreign citizen with the tax office and obtaining a TIN by a foreigner in the Russian Federation are mandatory if:

- A foreign citizen intends to live and work in the Russian Federation and earn income, and he needs to obtain a work permit or a labor patent to work in the Russian Federation.

- A foreign citizen received a temporary residence permit in the Russian Federation.

- A foreign citizen in Russia owns property that is subject to taxation, including a car or real estate.

- A foreign citizen carries out transactions in the Russian Federation that are subject to taxation.

Issuing authorities

Answering this question is not so difficult. To do this, it is enough to understand how organizations in Russia produce and issue the relevant paper.

Is it possible to obtain a TIN at the MFC? This document can be issued:

- to the Federal Tax Service;

- through “State Services”;

- by contacting intermediary companies;

- in multifunctional centers.

It follows that a TIN can be issued at the MFC. Both initially and repeatedly. Today, multifunctional centers in different regions are endowed with a variety of capabilities. But we can say with confidence that they issue TINs in all cities of the country.

How can a foreign citizen obtain a TIN and register for tax purposes in Russia?

In order to obtain a certificate of registration with a tax authority (TIN) in Russia, a foreign citizen must contact the tax authority at his place of residence with an application to register an individual in the prescribed form.

The list of documents for obtaining a TIN by a foreign citizen depends on the reason for which the foreigner is in Russia.

In addition to the application, you must provide one of the following documents:

- RVP in Russia with a mark of registration in the Russian Federation;

- an identity document of a foreigner with a mark of registration at the place of residence in Russia;

- an identification document of a foreign citizen and a detachable part of the Notification of Arrival form with a mark or a migration card with a mark of registration at the place of temporary stay.

In what cases is the TIN changed?

Replacing a TIN usually occurs as a result of a change in passport data. Here are the most common cases requiring a TIN change:

- the woman got married and took her husband’s surname;

- the person has changed his name or patronymic;

- the person changed his place of birth in his passport;

- errors and inconsistencies were discovered in the current certificate.

When getting married, not only women, but also men can change their surname, so this applies to them too. The opposite situation also applies: if, during a divorce, a woman returns her maiden name, she will also need to take a new original. Those who have received a new birth certificate also change their TIN when changing their last name, for example, when establishing paternity in themselves.

Documents required for obtaining a TIN for a foreign citizen

Thus, a foreign citizen needs the following documents to obtain a TIN:

- application form for registration of an individual with the tax authority;

- passport (identity document);

- notarized translation of the passport;

- migration registration form with registration at the place of stay;

- migration card.

Documents for TIN for a foreign citizen with a temporary residence permit

- Applications for registration of an individual (foreigner) with the tax authorities.

- Residence permit in the Russian Federation with a mark of registration at the place of residence in Russia.

The role of registration

Some believe that the preparation of the paper being studied is possible only in organizations located at the place of registration. It is the institutions that register a person who are often involved in processing the relevant civil documents.

But is this true in the case of TIN? Or is the population given some freedom of choice? Is it possible to obtain a TIN at the MFC not at the place of registration?

Yes. Until 2012, citizens had to apply only to institutions at their place of registration. But after this period, people were allowed to come to the authorities at their actual place of residence to complete some documents. This fact made life much easier.

Application for registration of a TIN for a foreign citizen

An application for obtaining a TIN for a foreigner (application for registration with the tax authority of an individual - a foreign citizen) contains 3 pages, which look like this:

applications for registration of a foreign citizen with the tax authority for obtaining a TIN for a foreigner can be found here.

Price

The next very important question concerns the cost of producing the document. Is it possible to get a TIN at the MFC? Yes. This service is offered in all regions of the country. How much will it cost to produce a certificate with an individual taxpayer number?

The initial issuance of paper does not require any costs. The service is provided free of charge in all previously listed registration authorities.

Making a duplicate TIN requires a citizen to pay certain costs. The state duty today is 300 rubles. This is how much a duplicate with an individual taxpayer number costs. There are no more special expenses. The exception is when a TIN is issued through intermediaries. Then you will have to pay for the services of the relevant company. The price tag is different everywhere. On average, you will have to pay from 1,000 to 3,000 rubles.

Why is this necessary?

According to the compulsory pension insurance system (SOPS), which has been operating in Russia since 2002, every able-bodied member of society must be registered in it. On the basis of Federal Law No. 27 (04/01/96), everyone who registers in the SOPS opens a personal account, and accordingly, is assigned an individual personal account insurance number (SNILS).

The citizen is given an insurance certificate in the form of a green plastic card with personal data, where the following must be entered:

- individual SNILS number;

- FULL NAME.;

- floor;

- Date and place of birth;

- date of registration in SOPS.

As you can see, data is entered into the system based on passport data. The employer or the employee himself is obliged to transfer monthly contributions to the account opened in the SOPS, which will be taken into account when calculating the retirement pension.

In addition to citizens who have reached the working age of 14 years, minor children can also register in the system. Their legal representatives must complete the registration procedure. Foreigners and stateless persons living on the territory of the Russian Federation are also allowed to register with SOPS.

Do citizens applying for a job need to provide a “green card” to their employer? Mandatory if the employment is official.

In addition to the fact that an insurance number is needed to transfer labor pension contributions, it must be provided when a citizen needs to:

- receive state or municipal services for which he wishes to submit an application through the State Services portal;

- visit the official website of the Pension Fund as an insured person and find out information about yourself, for example, what is the length of his work experience, how many pension points he already has, etc.;

- apply for government benefits or social services provided free of charge, such as receiving vouchers, medications, etc.

When replacing SNILS, it is assumed that only the plastic card will be replaced, where the citizen’s new personal data will be entered if, for example, his last name changes, but the insurance number itself will remain unchanged. After replacing the certificate, it can be provided upon request along with a passport and other documents, since the citizen’s personal data will match in them.

How long will the replacement take?

The time frame for issuing a new certificate is no more than 5 days (usually 2-3 days). If the Tax Inspectorate delays in preparing a new certificate, then its actions can be appealed. The procedure may be delayed when sending documents by mail (during the delivery of postal correspondence) or through the MFC (during courier delivery).

There are no regulated deadlines for replacing a certificate after receiving a new passport. You can issue a document at any time . This is due to the fact that the procedure for replacing the TIN is voluntary.

You will learn how to calculate your average daily earnings in this article. Are you not getting unemployment benefits this year? Find out why!

Read about the benefits and benefits for a labor veteran by following the link.

Documentation

Is it possible to obtain a TIN at the MFC? Yes, this is a fairly common service offered in multifunctional centers. Exactly how to proceed will be discussed later. First, you need to understand which papers will be useful for the implementation of the task.

All citizens who need a TIN must prepare:

- passport (or other identification document);

- registration certificate (if a passport is presented, the document is not necessary);

- application for issuing a TIN.

Nothing more is needed. The application is usually filled out directly at the registration authority.

Replacement costs

The procedure for obtaining a TIN certificate does not involve paying a state fee. The number is also assigned to the taxpayer free of charge.

Payment of the state fee is provided only if a duplicate certificate is issued to replace the old one.

If you submit all documents in person, you will avoid costs.

Otherwise, you must pay for the services of a notary for certification of the submitted documents (about 100-500 rubles for one document).

If you send documentation by mail, you must bear the cost of sending a registered letter. The standard tariff of the Russian Post starts from 100 rubles.

Price issue

The cost of replacing the TIN is 300 rubles. But you only need to pay for re-registration in certain cases:

- loss of certificate;

- its damage.

Changing a citizen's surname does not belong to the specified list and does not imply re-issuance of the document. Therefore, no state duty is charged for its replacement. A new certificate with changed personal data is issued free of charge.

Note : If there was a change of surname and at the same time the TIN was lost, the certificate will be issued in the new surname. But you will have to pay a state fee due to the loss of the document. It will not be possible to hide this fact - the previous TIN must be surrendered.

Procedure

Is it possible to obtain a TIN at the MFC St. Petersburg? No problem. The main thing is to collect certain documents and adhere to certain instructions. In general, registration of a TIN does not require any significant knowledge and skills from a citizen.

To obtain the document you are studying, you need:

- Collect a package of papers necessary for a particular case.

- Get in line at the MFC. To make the operation easier, you can sign up for an example online.

- Write an application for the issuance of an individual taxpayer number (or its duplicate). Present the prepared documents.

- Receive a receipt indicating acceptance of the documents.

- Wait. After notification that the TIN is ready, you can come to the MFC and pick up the document by presenting your ID.

Contacting multifunctional centers has a number of advantages. For example, you can issue other documents along with the TIN. Also, MFC employees work faster, and departments of institutions are more comfortable.

Registration period

Is it possible to get a copy of the TIN at the MFC? Easily! It is enough to follow the proposed instructions. It is recommended to pay the state fee immediately before your visit to the MFC. This will reduce the likelihood of a repeat visit to the institution to a minimum.

How long will it take to produce an individual taxpayer number? It is difficult to give an exact date. But we can say with confidence that production will not take much time.

MFC employees say that the TIN takes about 7-10 days to produce. But most often it is recommended to focus on 5 days. The same amount is issued by the Federal Tax Service with a certificate with an individual taxpayer number. In any case, as soon as the document is ready, employees will quickly notify the citizen of the need to obtain a TIN.

The processing time for an application may increase. This is possible if a citizen applies to an organization at the place of actual residence, and not according to registration. Sometimes you have to wait 30 days for a TIN. Fortunately, this is a fairly rare occurrence.