Step 1. Select "Payments in our region"

Step 2. Search by name or TIN,

Enter the TIN or the name of the individual entrepreneur (LLC)

Attention! In ATMs, you can only search by TIN, since there is only a numeric keypad.

Press the “ENTER” button.

Step 3: Enter ID

Identifier (L/C, Contract N) is the number of your purchase order and

Press ENTER.

Step 4. Full name value (in terminals and ATMs, by default, the full name of the card owner, i.e. yours). Do not change this value!

Press ENTER.

Step 5. Next, the terminal or ATM will prompt you to enter the payment amount (Bill Payment). Enter the order amount.

Press the "PAY"

The ATM or terminal will issue two checks: “Cash transfer” and “Check order” (this is a document confirming your payment to the company’s bank account)

Attention! Be sure to keep payment receipts until you receive your order.

Popular money transfers:

| Rating | Translation option | Details |

| 1 | Sberbank card is the most popular | 0% for transfers in one region 1% for transfers to another region |

| 2 | Yandex Money quickly and conveniently | 0.5% for transfers between wallets from 0-3% for other transfers and payments |

| 3 | Zolotaya Korona cannot do without commissions | On average 1% per transfer |

| 4 | Russian Post queues and queues again | From 1% to 5% depending on the type of transfer |

You can find information about other translations here

Do you need to pay a bill at Sberbank, but you don’t know how to do it correctly? Today we will tell you about what opportunities this banking company offers for its clients, what is the most convenient way to complete the transaction?

We offer you a choice of several methods that are quite simple to use in practice. Please note that many clients are confused about the details, so once again we draw your attention to the following information: the card number consists of 16 or 18 digits, the account number consists of 20, and these are completely different data from a company or an individual’s card!

Read more: The bank refused to refinance the loan, what to do

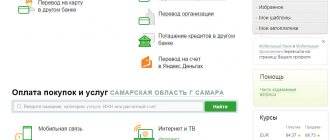

If you are registered in the Sberbank Online system and have experience in money transfers, you can make payments using it. For this:

- go to your personal account,

- At the top, click on the “Payments and transfers” link,

- then select the type of transfer you need to make - an individual or an organization.

- then indicate the card from which you will send money,

- Enter the required amount and recipient details.

Please note that if you make a transfer to another region, you will need to pay a commission, its amount is indicated here. If you make a transfer in your region or between your Sberbank accounts, then it will take place without commission.

How to register in the system is described in this article. The same procedure is followed if you want to make a payment in the mobile application.

Via an ATM or Sberbank payment terminal

If you have a valid Sberbank debit card, you can pay various bills, in particular utility bills and for mobile communications without commission. Instructions are given in this article.

In order to pay a bill at Sberbank, you do not need to know all the details - you only need the details and the exact amount of the transfer. It is advisable to have them printed out on paper with you and simply present them to the department employee

Since utility payments must be made monthly, you need to know different ways to do this, for example, how to pay utilities through an ATM or terminal. It would probably not be an exaggeration to say that the services of this bank are used by the majority of the country's population. It is very convenient to do this, since bank branches are available in almost all localities, and ATMs are even more common. In addition, many users and mainly the younger generation prefer to make payments via the Internet. There is a special service for this. But if you want to make a payment in cash, then do it through an ATM quickly, conveniently and profitably.

Read more: Lease agreement with trustee sample

How to pay a Sberbank bill in cash

Paying in cash is now easy. A person will need to come to the financial department and declare his desire to transfer funds using the details. You will need to fill out a special application indicating your account details.

All that remains is to confirm your identity using your passport, submit the application and the required amount, taking into account the percentage. The remaining steps will need to be performed by a Sberbank employee. If a person does not want to go to a branch, then he can use an ATM. This option has already been described above, but in this case you will need to transfer funds not from the card, but use cash.

Through bank branches

You can make the appropriate payment through bank branches anywhere in the country. This method is implemented in cash, or using a card account from which the debit is made. To pay through the cash register, you must provide the following information:

- FULL NAME.;

- payer's address to which payment is made;

- details of the organization receiving the money;

- amount to be paid;

- date and signature of the payer.

This method has many advantages. So, thanks to the huge network of branches, in fact, all regions have their own branches where these actions can be performed. Anyone can get advice from a specialist on site who can tell you how to use the ATM and show it. If a citizen wants to make a payment “the old fashioned way,” he can do it through a cashier.

Other ways to deposit cash to a card

To deposit funds, you can contact a bank branch. For this you will need:

- identification document;

- card or personal account number.

You need to contact a Sberbank employee and provide him with the data to complete the transfer. Then give the cash to be deposited into the cash register.

If there is no Sberbank branch nearby, you can contact any other bank. However, it will charge a fee for depositing or withdrawing cash. The commission for replenishing a debit card is 1.2% (but not less than 30 rubles).

On a note! There are no fees for credit cards.

Through the Internet

Internet users can pay for housing and communal services through the Sberbank Online service. But this is only possible if the person is a client of this bank, he has a corresponding card with a positive balance, and, finally, the user has connected, through which information is provided by receiving SMS.

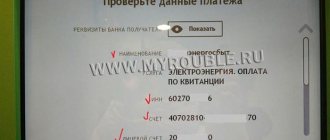

The step-by-step payment algorithm will be as follows:

- You must log in to the system by entering your username and password.

- Find the “Payments and Transactions” section, then – “Housing and Public Utilities”, then – a specific payment, for example, electricity.

- From the drop-down list, select the appropriate service provider (in this case, light).

- Next, indicate the card number, payment amount and click on the “Continue” button.

- After checking all the data, the operation is confirmed by indicating the password from the received message.

In the “Payment History” section, you can track at any time what stage the transaction is at. If the data was entered incorrectly and the transaction did not go through, the money will be returned to the account, and the section will indicate that it was “Not accepted by the bank.”

When making a utility payment for the first time, it makes sense to create a template. Then there will be no need to enter all the information again. It is enough just to indicate the amount, and then only if it is different, and confirm the operation.

Device functionality

Despite all their simplicity, terminals perform many useful functions:

- They accept cash into Sberbank accounts and make transfers between them.

- They pay for the following services: cellular communications, television, Internet providers, utilities, taxes, fines, and other budget payments.

- They make transfers to plastic cards or using bank details to other banks.

- Repaying loans.

- Help Sberbank clients: manage their services (connect, disconnect, change data, switch packages); receive information about: your accounts and transactions, promotions and offers; generate and print one-time passwords for their further use by cardholders who do not have the Mobile Bank service; create templates for fast payments; open deposits.

Payment for services by bank clients through a card terminal is interest-free or with a small commission, in contrast to cash payments, which can be made by non-customers of Sberbank.

Instructions for paying utility bills through a Sberbank ATM

Sometimes the most convenient way is to be able to pay on time through an ATM. This is a better option than standing in line at the checkout counter. Instructions on how to pay a receipt through any Sberbank ATM, in this case, are as follows:

- In the ATM menu, look for the “Utility payment” section and click on it.

- Next, choose your full name. and the address of the person for whom the payment is made.

- In the form that appears, you need to indicate the payment period, its name, specific amount and code.

- At the end, click “Pay” and deposit cash or pay via bank card.

Read more: Can’t find enforcement proceedings by number

After the operation, you must remember to take a receipt, with which you can confirm the payment, if necessary.

Deadline for crediting funds and commission

If you deposit money into your Sberbank personal account in Russian rubles, the term for crediting the amount will be 1 business day. There are no restrictions on the maximum amount.

The commission for replenishing another person’s account will be as follows:

| Where | Pay in cash | Credit to account | Credit to recipient's card |

| Within the same city | – | – | – |

| Outside of one city | 1.75% (but not less than 50 rubles), commission does not exceed 2000 rubles. | 1.75% (but not less than 50 rubles), commission does not exceed 2000 rubles. | 1.5% (not less than 50 rubles), but not more than 1000 rubles. |

Cash withdrawals and deposits without commission can be made at partner banks:

- VTB 24;

- Rosselkhozbank;

- Investment Bank;

- MTS Bank;

- Promsvyazbank.

If the amount of cash withdrawal or deposit is more than 50 thousand rubles, Sberbank charges 1% of the amount. To carry out transactions with a large amount, the branch will require a document. If money is withdrawn from an ATM of any other bank, the commission is 1%, but not less than 100 rubles.

Via terminal

A similar method to using an ATM is a terminal where rent or other payments are also made. The instructions in this case may be as follows:

- The bank card is inserted into a special window, after which the corresponding PIN code is entered.

- Next, select the “Payments in the region” section.

- You can search for a specific organization.

- Then a receipt is brought to the scanner, where the barcode is indicated.

- The receipt will appear on the screen. Then you need to check all the data and confirm the payment by clicking on the “Pay” button.

After making the payment, click on the appropriate button to print the receipt.

What should the client remember?

If you are a Sberbank client relatively recently and are not sure that you can handle the self-service device on your own, then step-by-step instructions will help you complete the operation as quickly and correctly as possible. This can be done by card or cash.

Best credit cards:

| Bank | % and limits | Application |

| Bank Otkritie credit card | 0% for 120 days + Cashback up to 11% Limit up to 500,000 rubles | Application |

| Alfa Bank credit card | 0% for 100 days + Cashback up to 10% Limit up to 700,000 rubles | Application |

| Tinkoff Drive credit card | 0% for 55 days + 10% for purchases at gas stations Limit up to 700,000 rubles | Application |

| Rosbank credit card | 0% for 120 days Limit up to 1 million rubles | Application |

| Halva Installment card | 10% for overdue payments up to RUB 350,000. + installments up to 18 months + 10% yearly | Application |

| Ekapusta Or maybe a loan at 0% would be better? | up to RUB 30,000 0% first loan for 21 days | Application |

You can always see all the banks we work with here ⇒

Loan without refusal Loan with overdue Urgent with your passport Loans at 0% Work in Yandex.TaxiYandex.Food courier up to 3,400 rubles/day!

Offers from Sberbank:

| Bank | % and amount | Application |

| Debit Gold many privileges | Thank you 5% + 30% of the purchase amount from partners 3000 rubles/year | Apply now |

| Premium card with big bonuses | Thank you up to 10% + a lot of privileges 4900 rub/year | Apply now |

| Simple debit if you just need a Sbercard | Standard tariffs, you can order your own design 750 rubles/first year, then 450 rubles | Apply now |

Let us immediately make a reservation that most payment transactions are made without commission, but this issue should always be clarified with a bank employee, or with an employee of the company whose services you want to pay for. In addition, if we are talking about paying for housing and communal services, then it is usually written on the receipt that the commission is 0%.

Important: You can make transactions with debit cards without additional fees. If you want to make a debit transaction with a credit card, it will be regarded as cashing out, which means an additional commission of 3% of the amount will be charged (but not less than 390 rubles), and the grace period will not apply.

Loan without refusal Loan with arrearsUrgently with your passportLoans at 0%Work in Yandex.TaxiYandex.Food courier up to 3,400 rubles/day!

If you are carrying out an operation at a Sberbank branch, you can contact a consultant for help. They will definitely help you and tell you what to do; when you enter your PIN code, the employee turns away for your safety.

Important: cover the keyboard when entering confidential information, try not to give your papers and documents into the hands of strangers. And always take your receipts: they will help in case of controversial issues.

Commission fee

Important! Regardless of whether the citizen is going to pay for the use of light or another utility is subject to payment, each operation is carried out with the collection of a commission.

It can be different. The smallest amount for housing and communal services when paying through a Sberbank terminal will be charged if the Sberbank Online service is connected, or the payment is made through bank terminals and ATMs. Then it will be 0.5 percent. If the operation is carried out through the cash register, then the amount will be from 1.5 to 3 percent.

Thus, through terminals, ATMs and the Sberbank Online service, the apartment will be paid for with a minimum commission fee. Similar tariffs are set at VTB and other banks.

Auto payment

This service allows you to top up your account and make a payment in the same amount at a given time automatically. It is very convenient, which is why it is becoming increasingly popular among users. You can connect it directly by visiting the bank and contacting a specialist, in the terminal or using the Sberbank Online service.