Few people feel excited when thinking about paying taxes, and many systematically avoid it altogether due to financial or other circumstances. However, others are hampered by forgetfulness or not knowing how to do it easily. Paying taxes through Sberbank no longer seems complicated and unpleasant. Moreover, you can do this without leaving your cozy apartment or office.

However, if you like to use an ATM or payment terminal, then this method is also possible.

Single receipt

Recently, a single receipt has been in effect. According to it, payment for utilities is carried out using one document by mail or electronically. But this procedure applies only in certain Russian cities.

Therefore, you can write a statement by contacting the housing and communal services management to receive a single receipt. Then all bills are attached to one single account, and they can be paid, including in the terminal. In this case, the operation looks like this:

- in the terminal select the item “Single receipt”,

- then click on “Payments and transfers”,

- enter the city and your personal account,

- enter the code found on the receipt,

- the terminal will display all the information that needs to be verified,

- after confirmation of payment, money is deposited,

- take the check.

The last point that the instructions indicate is mandatory, since the check will confirm that the payment actually took place.

What should foreigners do?

The functionality of Sberbank terminals allows you to easily pay obligatory payments and tax fees to citizens of foreign countries. However, a more complex procedure is provided for them. The fact is that, as an initial stage, non-resident individuals are required to fill out a receipt form developed specifically for them, posted on the Federal Tax Service website. Then the receipt filled in accordingly is printed, after which the steps described above are performed.

Applications on the phone

It is also convenient to pay for utilities through mobile applications issued by different banks for their clients. For this purpose, you need to download the corresponding application to your phone, and then enter your username and password. This is done only once.

- Then you need to enter “Services”.

- Find the “Utilities” item and enter your personal account there.

- Next, you should select the card from which the debit will be made.

- The payment receipt will be in electronic form. If desired, it can be printed.

If the monthly amount remains the same, then it is convenient to set up “Regular payment”. Then the amount indicated in it will be debited automatically every month, but the user can also suspend such payment if the need arises.

Terms and commissions

The legislation currently in force in Russia prohibits financial organizations from establishing any commissions when providing services for transferring tax payments to the state budget. At the same time, when making other types of mandatory payments, the commission fee may well be established based on the bank’s tariffs existing at the time of payment.

Photo No. 2. No commission when paying taxes

An important condition for the timely receipt of funds as a tax payment is its implementation directly to taxpayers. Payment from another person's account or card is not allowed and can be counted as a tax payment to the budget.

It should be remembered that in the absence of timely tax payment, the Tax Code of the Russian Federation provides for the possibility of accruing penalties in the form of penalties, based on the amount of debt and the current refinancing rate established by the Central Bank of Russia. Obviously, it is much easier to pay taxes on time than to then overpay taking into account the fine imposed.

Payment via ATM

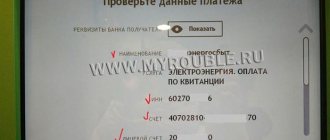

When you withdraw your salary or pension payment, it is convenient to immediately pay for utilities through an ATM. Here you can pay for water, electricity, gas and other services.

- To carry out the operation, insert a card with enough money into the ATM and enter the PIN code.

- Next, they also look for the “Payments” section, and then “Utility payments” and follow the simple steps that the system offers.

- So, you need to specify the payment period, personal account, amount and click “Next”.

- All information will appear on the screen, including the bank commission. Everything needs to be checked and payment confirmed.

- After completing this method of paying for housing and communal services through an ATM using a Sberbank card, you must remember to pick it up.

You may find it useful: Housing and communal services penalty calculator: detailed online calculation of penalties for late payment of utilities.

Procedure for paying vehicle tax

The requirements for the calculation and payment of transport tax are specified in Chapter. 28 Tax Code of the Russian Federation. This is a regional tax. Payment of transport tax is provided for vehicle owners. These include:

- cars,

- aircraft,

- boats,

- motorcycles,

- other vehicles.

The following are not subject to tax (Article 358 of the Tax Code of the Russian Federation):

- transport for disabled people;

- cars with engines up to 100 hp. pp., registered through social protection authorities;

- agricultural machinery;

- transport used by military and medical services;

- various vessels owned by organizations, individual entrepreneurs, whose main activity is passenger and (or) cargo transportation, as well as fishing vessels;

- cars listed as stolen and others.

Transport owners can be individuals and legal entities.

Since 2015, the legislator has introduced new parameters for calculating transport tax. Now the following are taken into account for the car:

- age,

- purchase price,

- engine capacity,

- environmental friendliness of the engine.

For car owners, the new parameters are taken into account when calculating the tax in 2015.

For information on innovations effective from 2021, see the material “Transport tax: changes 2016”

For legal entities, payment of transport tax is made based on the requirements of regional law. Advance payments are provided for them at the location of the vehicle. The terms for payment of advances are determined by regional authorities. To make the calculation, take 1/4 of the tax base and multiply it by the transport tax rate and an increasing coefficient, depending on the cost of the car (clause 2 of Article 362 of the Tax Code of the Russian Federation).

For details on calculating transport tax, see the article “Transport tax under the simplified tax system: calculation procedure, deadlines, etc.” .

Payment in the salon

If the owner of an apartment wants to pay for utilities through a Sberbank terminal, but there is none nearby, he can use a communication shop. They present a receipt with a barcode, and the cashier will calculate the full amount. The commission in this case, as a rule, is no more than two percent. But if it is possible to pay for utilities through the Svyaznoy terminal, then there will be no commission. If you contact the cashier, you will have to pay additional interest in any case.

Let's sum it up

Acquiring terminals are suitable for any activity - from hypermarkets to small convenience stores. These devices provide the ability to make cashless payments for goods or services. Nowadays, having an acquiring terminal is not an advantage or a competitive advantage, but an absolute necessity for business.

Terminals are different - mobile, stationary, with or without a remote pin pad, with different types of communication, and so on. You need to choose your terminal based on the traffic of the retail outlet and the needs of the business.

The main thing to remember is that not only the terminal is important, but also the bank that services it. He is the one who provides you with support, repairs equipment and deals with complex cases. It is important to choose a reliable partner who will offer the best conditions and has a truly “human” support service.

Sources:

- https://acquiring.vtb.ru/articles/pos-terminaly-ustroystvo-i-printsip-raboty-dlya-chego-on-nuzhen-i-chto-daet/

- https://www.cleverence.ru/articles/elektronnaya-kommertsiya/pos-terminaly-chto-eto-takoe-printsip-raboty-podklyuchenie-kak-polzovatsya/

- https://brobank.ru/pos-terminal/

- https://Podelu.ru/article/chto-takoe-pos-terminal-i-kak-on-rabotaet/

- https://acquiring.vtb.ru/articles/terminal-dlya-ekvayringa-raznovidnosti-printsip-raboty-kak-vybrat/

Payment via online banking

Large banks are increasingly providing these services without commission if clients use Internet banking. To do this, they gain access to their personal account. Thus, it is profitable not only to pay for housing and communal services through the Sberbank terminal, but also online, sitting at the computer. The instructions here are very close to those offered in the terminal.

Read also: How to create a personal account for paying housing and communal services.

They select a supplier, enter a personal account, indicate the amount, etc. Here you can install . Then you won’t even have to remember and think about how to pay for housing and communal services.

Although no commission is charged through Sberbank and other large financial institutions, in some cases, if the service provider does not have an agreement with the bank, the payer will still have to pay some percentage.

Device for accepting payments

To organize acquiring, you need to purchase special equipment. It differs in connection type, supported cards, and communication features. The most popular equipment are:

- Cash desks equipped with an acquiring function. Retail outlets began to actively implement them thanks to the introduction of the obligation to instantly send online receipts to the tax office. A similar rule was consolidated by innovations that were introduced into Federal Law No. 54 of May 22, 2003. The equipment automates the process and simplifies interaction with the regulatory authority. There are many types of cash registers with acquiring functions. One of the clients writes that devices from Ka Holding have proven themselves well.

- Pos terminals. This is the most common type of equipment for accepting payments. Devices may be equipped with a separate keyboard for entering a PIN code.

- Imprinter. These are the predecessors of standard terminals - the card was “rolled” over special paper, where it left its details (this is why the raised numbers on it are needed). Nowadays they are practically not used - to make a payment through an imprinter you have to authorize it over the phone. Such terminals are now used only to protect against loss of connection to the Internet, without which the terminal does not work. Imprinters can do without the Internet.

The method of communication with the bank varies. Most modern cash registers and terminals use a Wi-Fi connection

. To do this, the point of sale must have a router connected by cable to the provider’s network.

Alternative - 3G or 4G networks,

This type of connection is used if connecting to Wi-Fi fails for some reason.

In this case, the terminal is equipped with a SIM card. A 3G network is significantly slower than Wi-Fi. An even slower alternative is a connection via GPRS

, which is almost never used anymore.

In addition, you can connect the terminal directly with an Ethernet cable

.

Terminals may not support all payment systems

. Thus, most of the devices support payment with Visa, MasterCard and Mir cards - according to legal requirements, they work through the National Payment Card System (NSCP), and all transactions go through it. But some terminals may not support payments from some cards (or may not accept cards with contactless media).

What to choose

Since it became possible to pay for utilities through the terminal, and many people began to use this method, queues at the post office and in banks have practically melted away because of this. At the same time, when paying in cash at the same post office, the percentage is withdrawn even more than if you were to pay for housing and communal services through an ATM of Sberbank or another banking organization. These methods look even more unprofitable against the backdrop of the possibility of using Internet banking.

Thus, the emerging alternative methods allow you to save not only precious time, but also money. In some cases, funds are credited within two to three business days, in others – instantly. At the same time, the system is designed in such a way that the risk of making a mistake is minimized.

If a citizen receives a salary or pension on a Sberbank card, then the method of paying for utilities through a Sberbank ATM is the most reliable, safe and profitable for him.

Types of bank terminals

Based on the principle of working with client funds, ATMs are divided into 2 types:

- terminals for working with bank cards. In this case, to make payments for utilities, you must have a plastic card with a positive balance or an open credit card.

- terminals for working with cash. When working with such devices, a bank card is not required. You can pay for utilities using paper banknotes.

Finding a terminal for working with bank cards is not difficult. Many devices of this type are installed in underground passages or in front of retail store windows. Access to such terminals is provided around the clock.

It is important to know! An ATM that allows cash payments is less common. Such terminals are installed in any bank branch, in the foyers of large shopping centers, at bus and railway stations and other crowded places.

Payment terminal: monitoring equipment operation via the Internet

If you want to connect several PSs to the AUS (or AUS network) at once, you should think about developing custom software for processing.

In addition to access to all the options provided by the service that connects the AMS to the payment system (they are listed in the previous section), such a solution will give you the opportunity to:

- improve the quality of control over the operation of the payment terminal via the Internet;

- expand the range of options by constantly adding new substations;

- develop a unique interface;

- improve the software to accept certain types of payments;

- constantly increase their number;

- use a dedicated server.

It should be understood that developing custom processing is not a cheap pleasure. The cost of such services starts from 10,000 rubles/month. On average, an order for the creation and support of processing from a professional developer costs 50,000 rubles per month. for one AUS.

Development of processing for PT is offered by:

- Soft-Logic;

- "Finecosoft";

- "WHALE";

- Universal Terminal System - UTSPayTerminal;

- Proinform;

- PayPRO and others.