What is the fee and is it possible to make a payment without it?

When paying for utilities, many financial institutions charge a commission for the action performed. It is expressed as a percentage of the amount paid. VTB is no exception to the general rule, but offers special conditions to its clients.

VTB bank card holders can pay for all utilities via the Internet for free. When making online payments from cards of other financial institutions, the commission will be 1.5%. In other cases, a commission percentage is charged on each payment made.

The commission amount is:

- 0.9% if non-customer money is credited through the terminal. Free for VTB plastic card holders.

- For everyone 1.5% when depositing funds at a bank branch.

In VTB branches, commissions are not charged only to pensioners.

How does it work?

The conditions of the VTB Multicard are quite standard. For payments with your own or borrowed funds, cashback or miles are awarded every month:

- 1% – standard, for purchases up to 30,000 rubles;

- up to 20% for purchases from partners of the Multibonus program.

You can connect extended reward levels:

- Cashback, Collection or Travel – up to 1.5% on tatas up to 75,000 rubles.

- Savings – additional income of 3% on a current account for an amount up to 100 thousand rubles and an additional 1% on a savings account or deposit up to 1.5 million rubles.

- Borrower - the loan available from the same bank is reduced in interest by 0.3% for a mortgage or by 1% for a cash loan.

- Investments – a reward of up to 1.5% for purchases is credited to a brokerage account, which can be used to purchase securities.

VTB Bank, Lit. No. 1000

Multicard up to 7.00% on balance, Cashback

VTB Bank, Lit. No. 1000

Apply for a card

To use the extended levels and the card service is free, the owner needs to use the card for an amount of at least 10,000 rubles per month. If you do not reach this amount, then you need to pay 249 rubles per month.

Screenshot: vtb.ru

It is possible to connect several additional cards to the main one. This is very convenient when the family is large and the bill is one. Now let's study the VTB Multicard in more detail, consider its advantages and disadvantages.

How can I deposit money for utilities?

VTB Bank offers several ways to pay housing and communal services payments:

- In person at any VTB Bank branch.

- At ATMs of this financial institution.

- Through your personal account in online banking or mobile application.

Each option has its own sequence of actions.

Via an ATM or bank branch

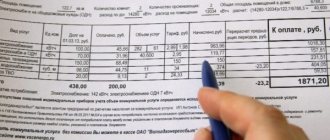

The easiest way to pay for housing and communal services is to visit a bank branch. This is a familiar option that does not require any action on the part of the client, but takes a lot of time waiting in line at the cashier. To deposit funds for utilities at a VTB branch, you must prepare:

- identification;

- payment receipt;

- money or card.

All actions for entering data and posting amounts are performed by the cashier-operator.

At an ATM, you can pay for utilities using a credit or debit card. Payments from cards of third-party financial institutions can only be made subject to an additional fee for interbank transfers.

When using ATMs, you should do the following:

- Insert the card and in the window that opens, select the “Payment” option.

- Find the desired organization and enter the amount.

- In the “Payment Purpose” window, enter your full name, address, payment period, and personal account number.

- Confirm the operation using the code from the SMS message.

After posting the amount, a check is issued with information about the transaction.

Online from the official website

There are two ways to pay for housing and communal services online:

- directly on the bank’s website;

- through your personal account.

Both options have their own step-by-step instructions for posting amounts.

On the VTB website online payments are made as follows:

- Log in to the VTB website – https://www.vtb.ru/.

- In the upper right corner, activate the red “VTB Online” window.

- To enter your personal account you will need to enter your username and password.

- In order for the account to open, you will need to additionally enter a one-time code, which is automatically sent to the owner’s phone.

- In the personal account that opens, select the “Payment for services” option, which is located at the top.

- In the new window you need to select the “Utility payments” item. It is located lower, so you will have to scroll the wheel down a little.

- From the list that opens, you must select the organization to which you intend to make payments for the services consumed.

- Enter the amount to be written off.

- In the “Purpose of payment” section, enter the full name of the payer, the address of the property and the payment period.

- Activate the "Pay" button.

- Enter the one-time code from the SMS message.

- Click the “Submit” box.

All entered data can be saved and you will not have to re-enter it.

Via the application: by QR code and barcode

VTB is introducing a new version of online payment via QR code and barcode in the mobile application. You can take advantage of the innovation as follows:

- Go to the “Payment” tab.

- Select a service provider.

- If the QR code payment option is available, the Scan Barcode field will appear.

- Using a pre-installed scanner, information is read from the barcode printed on the payment receipt.

- All data is entered automatically. You do not have to fill out information about your name, address and payment period.

- Activate the "Pay" button.

This method is not yet available everywhere. At the moment, residents of Moscow can use the simplified procedure, but not for all housing and communal services providers. VTB is actively developing this option. Very soon, residents throughout the Russian Federation will be able to take advantage of this opportunity.

Why do you need a receipt for payment?

A transaction receipt confirms the fact of transfer of money for housing and communal services. Disputes about making payments arise due to failures in banking systems, communication channels, human brains, etc. A check is an official document confirming the amount, date and direction of payment.

If the check is received electronically using VTB online or a mobile application, then in order to increase the impact on the party disputing the payment, it should be printed and certified by the bank operator.

How long does it take to transfer funds?

When crediting funds, utility organizations must comply with established deadlines. Bank transfers go:

- From 1 to 5 days when paying at a branch of a financial institution.

- Up to 24 hours if we are talking about online payment.

Payment through your personal account takes place within a few hours, but there may be exceptions. To avoid delays, it is better to pay housing and communal services a few days before the end of the established period.

What's the catch with the card?

This card has several of them. This does not mean that the card is bad, it just wasn’t worth calling it a “Multi-Card”. Let's take a closer look at what's wrong with it:

- Name. Most review sites reflect that people perceive Multicard as multicurrency, that is, one on which you can store rubles, dollars and euros or other currencies at the same time. Meanwhile, this particular product can be issued only in one of the currencies.

- Advanced reward tiers are not free. In order for the card to remain free when connecting to advanced levels, you will have to maintain a turnover of at least 10,000 rubles on it every month. If this is not done, you will have to pay the bank 249 rubles monthly. And in terms of annual maintenance, this will amount to almost 3,000 rubles. Many other banks have more favorable conditions in this case. One more nuance - additional remuneration will also be accrued only if a monthly turnover of 10,000 rubles is maintained.

- You have to spend a lot. For the greatest benefit, you will have to maintain a turnover of 75,000 rubles. If this amount is not achieved, then the reward is not so great. But like many banks, earning cashback on spending across most categories has limitations. For example, it is possible to return only 3 thousand rubles in the “Restaurants” or “Auto” category. For any purchases this is only 5 thousand rubles. If you do the math, it turns out to be only 4% and almost 7% of the 75,000 rubles spent. If spending exceeds this amount, the interest ratio will become even lower. Some banks offer similar conditions and do not set restrictions, or allow a much larger amount to be returned.

- Bonuses. VTB awards not only bonus rubles, which are exchanged for regular rubles, but also bonuses and miles. Now you can’t change them for anything, and in a year the bonuses may expire. In addition, there are no guarantees that the bank will not change the conditions and make the bonus rubles combustible.

- Commission. 1% for withdrawing your own funds from ATMs of other banks, the same amount for online payments to other banks. The limit for transfers from the card per month is 100 thousand rubles. Further, all transfers will be subject to a commission of 0.5%, but if the amount is small, then at least 20 rubles per transfer will still be charged.

- Currency cards. If you open a VTB card in dollars or euros, then be prepared for the fact that there will be practically no advantages of such a card. No interest is charged on the balance.

These are the main pitfalls of the VTB Multicard, but this does not mean that using it is not profitable. It just doesn't suit all categories of people. For example, it will be very useful for existing VTB clients whose loan interest rate is reduced due to the use of such a card.

Pros and cons of VTB multicard

There is one feature that is difficult to categorize as a plus or minus.

You can withdraw your own money from the card at any ATM, but please take into account a commission of 1% of the withdrawal amount, but a minimum of 300 rubles. True, this amount can be returned in the form of cashback if you meet the monthly spending requirement. Borrowed funds cannot be withdrawn this way. Advantages and disadvantages of VTB Multicard

| Advantages | Flaws |

| Interest on a loan or mortgage is reduced when using the card | Commission for withdrawals from ATMs of other banks |

| You can activate increased cashback for your balance and just save | Bonuses that are difficult to spend |

| The map can be customized to suit your lifestyle, customize the options you need | Inconvenient currency cards |

| You can choose for yourself what to receive cashback for | Misleading name |

| You can withdraw up to 350,000 rubles per day or 2,000,000 rubles per month from your own ATM | You have to spend a lot to get increased cashback |

| You can activate a free SMS package and email notifications | Interest for transfers to other banks over 100,000 rubles |

| To open a minimum number of documents is enough, and you can close it in 10 minutes |

Review analysis

Holders of salary multicards write very few reviews on the Internet. It can be assumed that plastic suits workers as a free means of payment.

The network is filled with negative impressions about debit plastic cards issued on personal initiative. Let us summarize the most common theses:

- actual use of the card differs significantly from the information in advertising;

- a large number of pitfalls;

- constant errors in paperwork and bonus calculations that are not in favor of clients;

- changing the terms of service without informing via SMS, including revision of interest on bonus programs;

- complex structure of the contract, general wording, numerous references to regulations that the client must find himself and monitor changes.

Answers on questions

Let's look at the problematic situations faced by participants in VTB salary projects.

What to do if your salary doesn't arrive?

Before starting a search in the accounting department or bank:

- make sure the card is working properly (expiration date, no damage);

- visit your VTB online account, there may be an important notice;

- if SMS does not arrive, and another way to check receipt is temporarily unavailable, reboot your phone, sometimes messages freeze;

- If time permits, wait a few hours to rule out minor technical problems.

What days should I arrive?

Payments are processed during bank business hours. The working days coincide with the production calendar in force in the Russian Federation.

Where to go if it doesn’t come?

Tell the accountant that the salary did not arrive on the card. In most cases, this is enough to find out the cause. If a mistake is made, the accountant will correct it. Perhaps they will explain to you why there is no enrollment (for example, financial difficulties, a software failure, the payment card was filled during non-working hours, deprivation of a bonus, etc.).

Sometimes the accounting department insists that all obligations on the part of the enterprise have been fulfilled. You will have to contact the bank in a way convenient for you - telephone, Internet, in person.

After leaving my job, do I need to hand over my card?

Upon dismissal, an employee is excluded from the salary project. He independently decides to refuse to use the card or to keep it as a personal debit card. Find out the terms of service taking into account changes in cash flow. If there is insufficient turnover, the bank charges 249 rubles monthly. Annual maintenance will cost up to 2988 rubles.

Overdraft

On a salary multicard, the overdraft is 10,000 rubles. Its connection is optional. You can communicate your intention when concluding an agreement for issuing and servicing the card. By personal request, you can start or stop using the service later.

The loan rate is 12% per annum. Unlike a regular credit card, when overdrafting on a VTB Bank salary card, there is no grace period; interest is accrued from the first day of use.

VTB announces a loan term of 360 months. The repayment schedule automatically calculates the required payment of 5% of the debt plus interest on the use of money.