Paying taxes on time is the responsibility of every citizen of the Russian Federation. Nowadays, this process has been simplified as much as possible and has become accessible from anywhere in the world. We know 7 ways to do this.

The process of paying taxes has become extremely simple, which cannot be said about the procedure for filling out a tax return. If you have difficulty with the latter, contact an experienced tax lawyer.

Do you want to figure it out, but don’t have time to read the article? Lawyers will help

Entrust the task to professionals. Lawyers will complete the order at the cost you specify

45 lawyers on RTIGER.com can help with this issue

Solve the issue >

Responsibility for non-payment of taxes

Individuals in the Russian Federation are required to pay taxes on income, property, land, and transport. The first, in most cases, is collected from wages and paid by the employer on a monthly basis. Income deductions from other types of income are borne by the taxpayer himself; they must be paid before December 1 of the year following the expired tax period. A declaration in form 3-NDFL is submitted by a citizen who has not yet paid the tax until April 30 of the specified year. Other types of taxes must be paid within the same deadlines.

Failure to comply with the specified deadlines entails sanctions under tax, administrative and criminal legislation. All transactions with taxable property are monitored by the Federal Tax Service: Rosreestr and the State Traffic Safety Inspectorate, through interdepartmental cooperation, send there information about registration acts.

Malicious evasion of the obligation to pay taxes, due to which a debt of at least 900,000 rubles has accumulated over the course of three years, is punishable under Article 198 of the Criminal Code by a whole range of punishments, from a fine of one hundred thousand rubles or more to imprisonment for up to three years. . To end up in a colony for three years, you need to owe the state a particularly large amount - more than 9,000,000 rubles. Capable citizens over the age of 16 are held criminally liable for such a violation.

For failure to submit an income tax return on time, a fine ranging from 5–30% of the amount to be paid is imposed. Its minimum value is 1000 rubles. Delay in payment entails the accrual of penalties in the amount of three hundredth of the current refinancing rate of the Central Bank of the Russian Federation. An additional fine of 20% of the debt amount is imposed if the delay was unintentional - for example, there were errors in the calculations. In this case, the way to avoid a fine would be to pay additionally the missing amount, after which you need to submit a clarifying declaration. If payment is not made intentionally, the fine increases to 40% of the debt amount.

Who is this service available to?

Payment of land tax online is available to all categories of taxpayers:

- individuals;

- individual entrepreneurs;

- legal entities (companies).

It is worth considering that they must pay from their own funds.

So, if the tax is supposed to be paid from a card, then it must belong to the owner of the land plot. Payment from the money of the tenant of the land instead of its legal owner is not allowed.

Often, owners of a land plot who own real estate as common shared ownership are interested in how to divide the land plot into two plots. What is a predial easement and when is it established? Find out about this from our article.

Is it possible to legally sell land without land surveying? We talked about it here.

Pay taxes offline

To pay tax without access to the Internet, you must receive a notification receipt with a fifteen-digit identification number. Until the time for payment has expired, it can be collected from the tax office at the place of registration of the taxable object. After this, you have several options.

- Payment at bank branches: this can be Sberbank, Tinkoff, VTB, Promsvyazbank and others. Instead of a receipt, you can submit a completed declaration to the cashier, and pay using a card or cash.

- Payment through the Federal payment system "City". It does not operate in all cities. System points can be found, for example, in Forbank branches in the Altai Territory, Chelyabinsk Region and other regions.

- Depositing funds into bank terminals. A barcode printed on the receipt is used, so the procedure can only be carried out at ATMs that have special reading devices.

- Payment through self-service devices at tax offices. These are the same terminals as those that accept money to top up a mobile phone account.

These methods are the most accurate - you receive a payment receipt immediately at the checkout, you do not need to wait until the payment status is confirmed (and in the case of online methods, the waiting period reaches 10 days). You will know for sure that the payment has gone through.

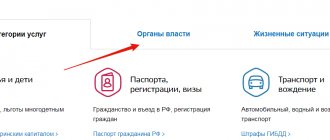

We pay taxes without a receipt from the Federal Tax Service on the State Services portal

After entering all the information into your personal profile, check your tax information and pay without a receipt. Just follow the instructions:

- Follow the link https://esia.gosuslugi.ru.

- Log in to the system by entering your login information.

- Open the main page of the portal.

- At the top, find the “Services” section.

- Go to the "Authorities" category.

- In the list of departments that appears, select “Federal Tax Service of Russia”.

- A list of popular services will open.

- Click on the item where tax debt is checked.

- Familiarize yourself with the procedure for providing the service. On the right side, click on the “Check” button.

- The system will begin automatically checking the debt using the TIN that you previously indicated in your profile.

- After processing the request, information about the tax debt will appear in the “Payment” block. Here you will see what the tax was charged for.

- To go to the payment page, click “Pay” next to the required charge.

- Select a Payment Method.

- Please provide your details. If you want to pay by credit card, enter the number, expiration date and three-digit code on the back.

- Check all the data, read the information about the commission.

- Click "Pay".

- Confirm the payment.

Paying taxes online

The most modern payment methods are online. Advantages: ability to pay tax at any time of the day and simplicity. To make a payment, you only need your Taxpayer Identification Number (TIN). Online payment methods include payment through:

- online banking;

- taxpayer’s personal account on the “Pay Taxes” website;

- single portal “State Services”.

The first method involves the ability to pay, for example, through Sberbank Online. The other two require a relatively lengthy authorization process. We will tell you more about each of the methods.

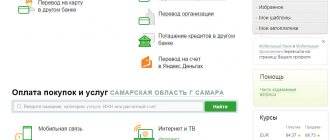

Payment via Sberbank Online

You can pay taxes in the Internet version of Sberbank via a computer or smartphone application. Funds are debited from the Sberbank card to which your personal account is linked, or from another card of your choice. If you do not yet have a personal account in Sberbank Online, connecting to the service will not take much time and effort - registration only requires entering card details without a waiting period.

The payment methods in the computer and mobile versions are somewhat different, although, in general, the order is as follows: find the service you are interested in, fill out the details and confirm. To pay tax using the first method, you need to find the item “Payment for purchases and” on the website in the “Payments and Transfers” section. Then “Search and pay taxes to the Federal Tax Service.” The system will then ask you to enter the required data.

After you have downloaded the Sberbank Online application, in the “Payments” section find “Taxes, fines, traffic police”, and there in the list - so that you can pay, the system will offer 3 search methods: by TIN, by receipt-notification index, by arbitrary details. By entering your TIN, you will receive information on payments, overdue payments and will be able to pay the latter.

To pay using a tax notice, you must either enter the identification number yourself or scan the barcode on the document. The third option requires entering the recipient's bank identification code (BIC), his account number, budget classification code and TIN. Then you need to enter your details and payment details:

- All-Russian classifier of municipal territories - if you don’t know, you can, for example, find out in the “Find out OKTMO” service on the Federal Tax Service Inspectorate website;

- TIN - consists of 12 digits;

- the tax period for which you intend to pay tax;

- payer status - there are 26 statuses in total, including “another individual - bank account holder” under number 13, “entrepreneur” under number 09 and others.

You will also need to enter the basis of the payment - two-digit letter codes. For example, TP, ZD, BF for paying current year bills, repaying debts and making current payments through a bank account. Moreover, to pay for the TP you need to put “0” in the column;

Service fee

Land tax refers to payments that are not subject to Sberbank commission upon payment. This is the advantage of such payments through this banking institution. The speed of the procedure is minimal.

You might be interested in:

How to pay taxes

The ability to pay various payments online allows customers not to waste time and effort on completing these transactions. Each person at any time convenient for him via telephone or computer can make a payment using the details. To do this, it is enough to have a bank card and a personal account in the bank’s online service.

Autopay and how to use it

But there is an even more convenient system called “autopayment”. You independently choose the required amount, which the bank will write off monthly in favor of the tax service. This way, you no longer have to set reminders for yourself, be afraid of late payments and waste time on it.

Using a free banking service, you can control the process of paying out money at any time, change time intervals, or completely stop using autopayment. After selecting the “connect auto payment” option, you need to re-enter your TIN and select a card for payment, then click “connect” and wait for the notification. Soon the message “Accepted for execution” will appear on the screen, and an SMS about the first payment will be sent to your phone. Don’t worry, every month before making a payment, the bank will send you an SMS from number 900. This system is valid for absolutely all transactions through the online service, be it paying land tax or replenishing a mobile account.

For many, renting land used to seem like a heavy burden, since in addition to dozens of documents to complete, it was necessary to monitor the amount of debt on a monthly basis and try as hard as possible not to fall behind on the next payment. Long queues at the cash register have always only complicated this process, preventing you from quickly performing the necessary operation, but now you can forget about all the inconveniences and pay for any services at your workplace or at home on the sofa. It's really convenient, try it!

Land tax benefits for pensioners

In 2021, the President of the Russian Federation signed Federal Law No. 436-FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation.” In accordance with this law, a tax deduction is introduced that reduces land tax by the cadastral value of 600 square meters of land area. In fact, we are talking about the so-called 6 acres. All pensioners are eligible for this benefit.

, as well as the following categories of citizens: Heroes of the Soviet Union, the Russian Federation, disabled people of groups I and II, disabled people since childhood, veterans of the Great Patriotic War and military operations, etc. The tax for 2021, which will need to be paid in 2021, will be calculated based on this benefit.

Tax deduction is provided only for the cadastral value of 6 acres. If the area of the land plot is larger, then the tax will be calculated for the remaining area. For example, if the area of a land plot owned by a pensioner is 20 acres, then the tax will be charged only for 14 acres. Another feature of this law is that the deduction will be applied only to one plot of land

at the choice of the “beneficiary”, regardless of the category of land, type of permitted use and location of the land plot. In order to independently select a land plot to which the benefit will be applied, you must contact any Federal Tax Service Inspectorate with a Notification of the selected plot. If the notification is not received from the taxpayer, the deduction will be automatically applied to one plot of land with the maximum calculated tax amount.

How to find out the cadastral value of a land plot?

You can find out the cadastral value of a land plot using the online service of Rosreestr called “Public Cadastral Map”. This site contains an interactive map of all subjects of the Russian Federation. After selecting the plot of land you are interested in, detailed information on it will be shown: type, cadastral number, status, address, category of land, form of ownership, cadastral value, area, etc. Searching for a site is possible using GPS coordinates, but this functionality does not always work correctly. All information about the land plot is available free of charge and without registration.

What is land tax for individuals?

Land tax is a tax levied on individuals who own land plots on the right of ownership, the right of permanent (perpetual) use or the right of lifelong inheritable possession.

The tax is not levied on individuals in relation to land plots held by them under the right of free use or transferred to them under a lease agreement.

Land plots of the following categories are not subject to taxation:

- included in the common property of an apartment building

- limited in circulation in accordance with the legislation of the Russian Federation, which are occupied by especially valuable objects of cultural heritage of the peoples of the Russian Federation, objects included in the World Heritage List, historical and cultural reserves, objects of archaeological heritage, museum-reserves

Land tax belongs to the category of local taxes and, as a result, rates are established by regulatory legal acts of representative bodies of municipalities.

Deadlines for payment and crediting to budget accounts

The taxpayer's time spent on transactions to pay off tax debts through Sberbank Online is minimal.

In this case, funds are credited to budget accounts within the next working day. It must be remembered that when making a payment on weekends and non-working days, the payment will be “accepted” for its intended purpose only on the next banking day.

As for the liability in relation to unscrupulous taxpayers, it is quite serious:

- in case of evasion of the obligation to report the availability of the object at the payer, he will be held accountable and obligated to pay fines in the amount of 20% of the amount of the unpaid fee;

- In addition to a fine, a penalty may be charged. Its accumulation occurs daily, when debts on land taxes are overdue. The amount of penalties is set in accordance with the amount of debt, and depends on the refinancing rate at the time of calculation.

Paying taxes through the Sberbank Online service allows you to significantly save time and money. A user-friendly interface and free application allows you to successfully pay tax debts, even while on the road, provided you have access to the Internet. Timely payment of tax debts will avoid liability to the state.

Step-by-step instructions for making payments through the Sberbank mobile application are presented below.

about the author

Grigory Znayko Journalist, entrepreneur. I run my own business and know first-hand the problems and difficulties that individual entrepreneurs and LLCs face.

Calculation and rates of land tax

The land tax can be calculated using the formula: Land tax = KST * D * ST * KV KST - cadastral value of the land plot; D – size of the share in the right to the land plot; ST – tax rate; KV – land ownership coefficient (applies only in case of ownership of a land plot for less than a full year).

The cadastral value of a land plot is calculated by Rosreestr (Federal Service for State Registration, Cadastre and Cartography). The tax rate is established by regulations of the representative bodies of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol). Thus, the tax rate differs in different localities (municipalities). For example, the land tax rate in Moscow is 0.025% for the so-called “dacha land”, while in the Moscow region the prevailing rate is 0.3%. In addition to the differences in the rate depending on the municipality of the site, the rate varies depending on the category of land. There is an upper limit on the tax rate fixed at the federal level. 0.3% for land plots:

- classified as agricultural lands or lands within agricultural use zones in populated areas and used for agricultural production;

- occupied by the housing stock and objects of engineering infrastructure of the housing and communal complex (except for the share in the right to a land plot attributable to an object not related to the housing stock and objects of engineering infrastructure of the housing and communal complex) or acquired (provided) for housing construction;

- purchased (provided) for personal subsidiary plots, gardening, market gardening or livestock farming, as well as summer cottage farming;

- limited in circulation in accordance with the legislation of the Russian Federation, provided to ensure defense, security and customs needs (Article 27 of the Land Code of the Russian Federation);

Calculation of land tax when selling/purchasing a plot

In a situation where ownership of a land plot was for less than a full year, for example, when selling or buying a plot, the ownership coefficient is used to calculate the tax. The land plot ownership coefficient is the ratio of the number of full months during which this land plot was owned (permanent (perpetual) use, lifelong inheritable ownership) by the taxpayer to the number of calendar months in the tax (reporting) period - 12 months. When purchasing a plot of land

, the month is considered complete if ownership arose before the 15th (inclusive) of the month of purchase.

In the case of a sale

, a month is considered complete if ownership is terminated after the 15th of the relevant month. In other cases, the month is considered incomplete and is not taken into account when determining the ownership ratio.

Payment in the Sberbank application

In the program for smartphones, you can pay property tax according to the standard scheme, it is similar to the actions in the personal account on the website. But another method is available in the application - payment using a QR code:

- Log in to the application.

- Go to payments.

- Click “Payment by QR”.

- Point your mobile camera at the QR code from the payment card.

- After scanning, the system will fill in the details - all you have to do is confirm.

Money is credited to the budget only on business days; in order to avoid delays, the transaction should be completed in advance. Processing usually takes up to 3 days.