Who pays land tax

Land tax is paid by entrepreneurs, legal entities and individuals who have land plots recognized as objects of taxation (Article 389 of the Tax Code of the Russian Federation). The tax is paid if the plot is owned, in perpetual use or inherited possession. There is no need to pay tax on the plots that you rent, since it is paid by the lessor himself.

Working under special tax regimes does not exempt you from land tax. Therefore, organizations and entrepreneurs using the simplified tax system, unified agricultural tax or patent pay tax in the standard manner.

You will become a tax payer as soon as a record of your rights to the plot is made in the Unified State Register, and you will cease to be one when a record is made in the Unified State Register of the transfer of the right to another person or the liquidation (reorganization) of your legal entity.

There are three exceptions when tax will have to be paid according to different rules:

- The right to the plot is confirmed by documents, but is not registered in the Unified State Register of Real Estate, since at the time of acquisition of the plot, Law No. 122-FZ had not yet been adopted.

- The organization received the right to the site as the legal successor of the reorganized organization (except for the allocation). Then the tax must be paid from the date of entry into the Unified State Register of Legal Entities about the termination of the reorganized company.

- An individual or entrepreneur received a plot by inheritance. The tax must be paid from the day the inheritance is opened.

What is Chapter 31 “Land Tax” of the Tax Code about?

The rules regarding the calculation and payment of tax are reflected in Chapter. 31 “Land tax ”, in which the Tax Code of the Russian Federation prescribes the following components of land tax:

- an object;

- rate;

- tax base;

- taxable period;

- tax benefits;

- procedure for calculating and paying land tax.

However, since land tax is a local tax, it is also regulated by acts of local authorities. In particular, they determine what the land tax rate is in force in a particular locality, since the Tax Code of the Russian Federation establishes only the boundaries of these rates.

more about land tax rates in this publication.

The Tax Code of the Russian Federation for legal entities determines the deadline for submitting a land tax return until February 1 of the year following the tax period. The local legislator will specify the exact date for filing the report. Our article “Submitting a tax return for land tax (form)” .

Find out about the current land tax declaration and plans to change it by following the link.

Our material will introduce you to the nuances of calculating land tax.

You can submit a declaration to the Federal Tax Service both on paper and by TKS or through the Federal Tax Service website. You can find current recommendations for submitting a report in the following articles:

- “The power of attorney for the representative must be submitted to the Federal Tax Service before sending the electronic declaration”;

- “Federal Tax Service of the Russian Federation: almost all reports can be submitted via the website”.

Local laws may also provide for interim tax periods, payment deadlines, and benefits (details here).

IMPORTANT! The deadline allocated for payment of land tax by individuals has changed. Please see the article for updated dates.

Object of taxation

In order for a land plot to be recognized as an object of taxation, a land tax must be introduced at its location, and the cadastral value for the plot must be determined.

Not subject to land tax (Articles 388, 389 of the Tax Code of the Russian Federation):

- lands that are withdrawn from circulation;

- lands under especially valuable objects of cultural heritage of the peoples of Russia, objects from the World Heritage List, nature reserves, etc.

- forest fund lands;

- lands occupied by water bodies as part of the water fund, which are in state ownership;

- plots as part of the common property of apartment buildings.

There are also benefits that exempt plots from taxation.

Municipalities

This type of tax falls under the category of local taxes. The state only establishes the general collection procedure, the maximum tax rate, and the list of federal beneficiaries.

We must remember that this type of tax is not levied on the owners of the land, but on the land itself . The tax is calculated based on the cadastral value existing at a given time in a particular territorial entity. That is, the cost of land in the regions of the country may be different. Somewhere more, somewhere less.

The tax is paid on all plots that are in circulation, have a cadastral number, belong to a legal entity, individual and are located on the territory of the municipality. Unless, of course, the owner has benefits.

The right of the municipal body

Local taxes, including land taxes, are put into effect directly by a regulatory act of the municipal body. The legislation gives the right to municipalities to determine categories of land, set their own tax rates, which should not exceed the values established by the state, and determine the cadastral value of the site, based on this and the amount of land tax.

The municipality puts into effect benefits provided by the state to certain categories of persons, individuals and legal entities .

Local authorities may supplement the federal list of beneficiaries. But they are not allowed to reduce it.

How to determine the base for calculating land tax

The tax base is the cadastral value of the land recorded in the Unified State Register at the beginning of the year. It is determined by each region during the state cadastral assessment, which is carried out at least once every five years.

Organizations must find the cadastral value and calculate the base themselves; the tax office only controls the process. But for individuals and individual entrepreneurs, inspectors calculate the tax themselves based on the data they receive from Rosreestr.

You can find out the cadastral value in the taxpayer’s personal account, on the public cadastral map of Rosreestr or in an extract from the Unified State Register of Real Estate.

If you have a standard situation, then to calculate tax and advance payments it is enough to take the cadastral value. But sometimes a special procedure is used, for example, if the cadastral value of a plot has changed during the year, the plot is owned by several persons or is subject to deduction.

How and when to pay

Entrepreneurs do not have to calculate the land tax themselves - the tax authorities do this, and then send a corresponding notification and a completed receipt to the individual entrepreneur's registration address or electronically.

You can pay in any convenient way:

- at the post office;

- through State Services;

- in the taxpayer’s personal account on the Federal Tax Service website;

- from a mobile phone or electronic wallet.

The main thing is to pay no later than December 1 of the year following the reporting year. Thus, the deadline for payment for 2021 is December 1, 2022.

It happens that deadlines are approaching, but there is still no notification. Then the individual entrepreneur himself will have to provide the inspection with information about the land plots in his ownership or permanent use. To do this, you need to fill out a special form and submit it to the Federal Tax Service - in person, by registered mail, through TKS or the taxpayer’s personal account.

Land tax rate

Subjects of the Russian Federation independently set land tax rates. You can find out what rates apply in your region on the Federal Tax Service website.

The maximum bet size is limited and fixed in the Tax Code of the Russian Federation:

- 0.3% - for agricultural land, housing funds, engineering infrastructure, housing construction, personal subsidiary plots and others provided for in paragraphs. 1 clause 1 art. 394 Tax Code of the Russian Federation.

- 1.5% for all other lands.

In regions there may be not two types of rates, but more, since they have the right to come up with separate rates for lands of different categories and types of permitted use.

If tax rates are not established in regional legislation, it must be paid at the maximum rates in accordance with the Tax Code of the Russian Federation.

Regional taxes

Mandatory for payment in the territories of the constituent entities of the federation. The general part is described by the Tax Code of the Russian Federation, individual elements of taxation are described by regional laws. Moscow has entrusted the regions with determining tax rates within the established corridor, the procedure and deadlines for paying taxes. Therefore, for example, the transport tax in the Chelyabinsk region can be twice as high as in the Chechen Republic. All regional taxes go entirely to the regional budget and are paid only by those who have certain property or are engaged in a certain type of activity. These taxes are:

- transport tax;

- gambling tax;

- corporate property tax.

How to reduce land tax

To reduce land tax, you can take advantage of benefits and deductions or revise the tax base (cadastral value).

Land tax benefits

All land tax benefits are divided into federal and local. Federal benefits are valid throughout Russia. They are established in the Tax Code of the Russian Federation and exempt from paying tax the persons listed in paragraph 1 of Art. 395 of the Tax Code of the Russian Federation, in particular:

- religious organizations;

- SEZ residents;

- institutions and bodies of the penal system;

- individuals belonging to indigenous peoples;

- Skolkovo residents.

Entrepreneurs and ordinary individuals additionally have the right to the benefit provided for in paragraph 5 of Art. 391 Tax Code of the Russian Federation. It assumes that the tax base is reduced by the cadastral value of 600 m² of land area, so that many will not have to pay tax at all. Parents of three or more minor children, pensioners, disabled people of groups I and II, disabled since childhood, veterans, etc. have the right to this.

Example. How to calculate land tax with deduction

Boris Loktev owns a plot of 1,000 m², the cost of which is 3,000,000 rubles. Boris has three small children, so he is entitled to a deduction in the amount of the cadastral value of 600 m² of his plot.

Let's calculate the base for calculating land tax: 3,000,000 rubles - (3,000,000 rubles / 1,000 m² × 600 m²) = 3,000,000 rubles - 1,800,000 rubles = 1,200,000 rubles.

Tax is paid at a standard rate of 1.5%. This means the amount of land tax payable will be: 1,200,000 × 1.5% = 18,000 rubles. If there had been no deduction, Boris would have paid 45,000 rubles.

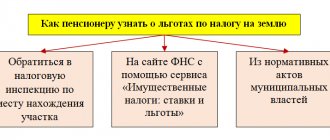

Regions set local benefits independently; they can be provided in the form of reduced rates, deductions, a reduction in the tax base, or complete exemption from payment. You can find out your benefits on the Federal Tax Service website.

Organizations in 2021 will need to submit a tax application to receive the benefit. The form and procedure for filling out are approved by Order of the Federal Tax Service of Russia dated July 25, 2019 N ММВ-7-21/ [email protected] Take benefit codes from Appendix 2 to the Procedure.

How to calculate land tax in 2018-2019

The company determines land tax in 2016-2017 (as well as in 2021) either for the year as a whole or quarterly (if there is a reporting period in the region). The procedure for calculating land tax is regulated by Art. 396 of the Tax Code of the Russian Federation, the tax amount is found by multiplying the tax base and the land tax rate.

Calculation of land tax often requires taking into account adjustments to coefficients that arise for land:

- for construction;

- in use for less than a year;

- preferential.

For options for calculating land tax using coefficients, see the publication.

with an example of calculating land tax in this material.

As for entrepreneurs, they do not independently calculate the tax and file a declaration on it: they pay land tax upon notification from the tax authorities. That is, in relation to this payment, individual entrepreneurs are treated as individuals as subjects of land tax (details here).

Land tax is levied on land plots that are in your property or belong to you on the right of permanent (perpetual) use, the right of lifelong inheritable possession. Land tax is a local tax, therefore the procedure for its payment, rates, benefits are established by regulations of the representative bodies of municipalities.

Land tax for individuals is calculated by the tax office, which sends a tax notice to the payer. It indicates the amount of tax and the data on the basis of which it was calculated. The notification, in particular, reflects: - the year for which the tax is calculated; — information about the land plot (cadastral number, location); — size of the tax base (cadastral value of the site); — tax rate; — tax benefits; - tax amount. To check whether the tax office has calculated the land tax correctly, we recommend following the following algorithm. Step 1: Find out if you are eligible for tax relief. You can find out about the benefits that apply in your municipality in the regulatory legal act of the representative body of government of the municipality. To receive the benefit, you must submit an application and supporting documents to the tax office. You can also check information about existing benefits at the tax office at the location of the land plot. Step 2. Determine whether the tax base is correctly determined (if you are not exempt from paying tax). The tax base for land tax is the cadastral value of the land plot as of January 1 of each year. Tax authorities receive data on this value from the Federal Service for State Registration, Cadastre and Cartography - Rosreestr. You can find out the cadastral value by writing a request to the Rosreestr Office or the land cadastral chamber at the location of your land plot. In your request, indicate on what date you are requesting the cadastral value of the land, otherwise the cadastral certificate will indicate the value as of the date of submission of the application. You should be given a certificate of cadastral value free of charge. Note. Changes in the cadastral value of a land plot in the current calendar year are not taken into account when determining the tax base for the current and previous years. A change in the cadastral value of a land plot due to the correction of a technical error made by the body carrying out cadastral registration is taken into account when determining the tax base starting from the year in which the error was made. In the event of a change in the cadastral value of a land plot by decision of the commission for resolving disputes about the results of determining the cadastral value or by a court decision, the changes are taken into account from the year in which the corresponding application for revision of the cadastral value was submitted, but not earlier than the date of entry of the cadastral value into the state real estate cadastre, which has been the subject of dispute. If the land plot is in shared ownership of several persons, then the tax base of the owner must be calculated in proportion to his share. If the plot belongs to individuals on the basis of common joint ownership without allocation of shares, then the tax base is distributed to each owner in equal shares. Some individuals can reduce the tax base (cadastral value) by 10,000 rubles. in relation to one plot of land within one municipality. These are disabled people of groups I and II, disabled since childhood, veterans and disabled combatants, etc. However, for this, supporting documents must be submitted to the tax office. They must be submitted within the deadline established in local legislation, but no later than February 1 of the year following the year in which the tax is calculated. Step 3: Check if the tax rate is applied correctly. Tax rates are set by local legislation depending on the category of land. To find out the land tax rates, read the regulatory legal act that introduced the land tax on the official website of the municipality. The rates that are established in local regulations are limited to the maximum amount in accordance with clause 1 of Art. 394 Tax Code of the Russian Federation. For example, the land tax rate cannot exceed 0.3 percent for agricultural land, plots for personal subsidiary plots and summer cottages, gardening and vegetable gardening, etc. A maximum of 1.5 percent is established for other plots. If land tax rates are not established by the regulatory legal acts of municipalities, then the tax is calculated at the rates provided for in paragraph 1 of Art. 394 Tax Code of the Russian Federation. Step 4. Calculate the amount of land tax. The tax amount is equal to the product of the tax base and the tax rate. If you are entitled to a tax-free amount or benefits, apply these to the calculation as well. When acquiring or losing the right to a land plot during the year (for example, in the case of purchase or sale of a land plot), the tax for this year is calculated based on the number of full months of ownership of the plot. Moreover, if the emergence of these rights occurred before the 15th day of the corresponding month inclusive, or their termination occurred after the 15th day of the corresponding month, then the month of their occurrence (termination) is taken as a full month. If these rights arise after the 15th day of the corresponding month or their termination occurs before the 15th day of the corresponding month inclusive, then the month of occurrence (termination) of these rights is not taken into account. When receiving a land plot by inheritance, the tax is calculated from the month of opening of the inheritance. If the result of your tax calculation does not coincide with the calculation of the inspectorate, an error was made in the tax notice or benefits were not applied, contact the tax office with a statement about this. Please attach copies of documents that support your position to your application. Complete the application in two copies. The inspection will mark the second copy with the date of acceptance and return it to you. Example. Calculation of land tax Let's calculate the tax on a land plot that is owned by an individual - a pensioner and located in Moscow. Initial data: 1. The purpose of the land plot is for running a personal subsidiary plot. 2. The cadastral value of the plot is 1,000,000 rubles. 3. There is only one owner. 4. Tax rate - 0.025%. 5. Ownership of the plot was registered on October 10, 2014 (the plot was owned for three full months). Formula for calculating land tax for 2014: 1,000,000 rubles. x 0.025% x 3/12 = 63 rub.

When taxpayers' rights to benefits are recognized

The list of benefits for land tax is established by Art. 395 Tax Code of the Russian Federation. The main conditions for their use are:

- provision of a site for certain purposes and its use for these purposes;

- documentary evidence of entitlement to benefits.

Organizations that are payers of land tax are exempt from paying tax on plots intended for the purpose of locating:

- institutions of the penal system;

- public roads;

- religious buildings;

- public organizations of disabled people;

- folk arts and crafts;

- special and free economic zones;

- innovative.

There are additional restrictions for public organizations of people with disabilities and organizations with their participation. Benefits apply to them if:

- in all-Russian public organizations the number of disabled people exceeds 80%;

- in organizations with authorized capital formed by contributions from all-Russian organizations of disabled people, the number of disabled workers is more than 50%, and the share of their salaries in the wage fund exceeds 25%, while the site is used for the production and sale of goods, work, services, but not for excisable or subject to mineral extraction tax goods, not for brokerage or other intermediary services;

- institutions, the property of which is fully owned by all-Russian public organizations of disabled people, are engaged in activities aimed at providing assistance to disabled people, their social protection and rehabilitation.

The terms of tax exemption for special and free economic zones are limited:

- 10 years from the date of registration as a resident - for shipbuilding organizations of a special zone;

- 5 years from the month of the emergence of the right to a land plot - for other residents of the special zone;

- 3 years from the month of the emergence of the right to a land plot - for participants in the free economic zone.

There is only one benefit for individuals. It can be used by the indigenous peoples of the Russian Federation who continue to lead a traditional way of life for them.

Regional laws may establish additional tax benefits for both organizations and individuals.

about the nuances of paying land tax for summer cottages here.

Results

Payers of land tax are individuals and legal entities using land plots on the basis of ownership, the right of perpetual use or the right of inheritance of land. Tax legislation establishes a number of persons who have preferential conditions when calculating tax. At the same time, the laws of the constituent entities may expand the list of beneficiaries.

To understand all the nuances of calculating land tax, read our “Land Tax” section.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation of transport tax

Transport tax is also calculated by specialists of the Federal Tax Service, but if you want to check the figure in the notification, a citizen can calculate the contribution yourself.

What you need to know before calculating:

- Rates. They are different for each region, but the general picture is this: for cars with a power of up to 100 horsepower, the calculated index is 2.5 rubles per hp, and for vehicles more powerful than 250 horsepower, you will have to pay 15 rubles per hp. (Article 361 of the Tax Code of the Russian Federation).

- Deadlines. The fee is paid by citizens who own vehicles (Article 357 of the Tax Code of the Russian Federation). The deadline for transfers is December 1 (Article 363 of the Tax Code of the Russian Federation).

- Increasing factor. Owners of expensive cars (price - over three million rubles) when calculating the contribution must take into account the index exceeding the amount of payment (Article 362 of the Tax Code of the Russian Federation).

Let's calculate the fee using an example. Viktorov V.V. owns a BMW X3 xDrive20d xLine, 3 years have passed since the car was released. Approximate cost - 3,500,000. Engine capacity - 1,995 liters, power - 190 horsepower. Diesel fuel is used. The increasing factor for this category is 1.1.

The annual contribution is: 190 hp. * 5 (rate) * 1.1 = 1,045 rubles.

Owners can substitute the indicators of their car and calculate the value. In this way, you can detect errors in tax notices and warn the inspectorate in advance, before the payment deadline.