Declaration form for the simplified tax system in 2021

On March 20, 2021, a new declaration form and electronic format, approved by Order of the Federal Tax Service dated December 25, 2020 No. ED-7-3/958, came into force. It must be used for reporting for 2021. But the declaration for 2021 after March 20 can be submitted using any of the forms (letter of the Federal Tax Service dated 02.02.2021 No. SD-4-3/1135):

- old, approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/99;

- new, approved by order of the Federal Tax Service dated December 25, 2020 No. ED-7-3/958.

The new form takes into account that the tax rate may increase during the tax period - this is due to an increase in the tax burden after exceeding the basic limits. We also added fields to justify the preferential tax rate.

Basic requirements for filling out the report

Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated February 26, 2016 approved instructions for filling out a declaration under the simplified tax system of income for individual entrepreneurs without employees or with hired personnel. Amounts in this report are entered in whole rubles. Pennies are rounded up. If the document is filled out by hand, you must use blue, purple or black ink.

IMPORTANT!

No corrections are allowed!

Each page of the report is printed on a separate sheet (two-sided printing is prohibited). Typically, when filling out a tax return, taxpayers do not pay attention to the fact that the numbers in the fields are aligned, but this is very important. If the form is filled out by hand, the numbers are entered from the first - left - field; when filling out electronically, the numbers are aligned to the right. If there are free cells left, put a dash. All text values are written in capital block letters.

The rules for filling out reports are the same for all types of property: both for legal entities and individual entrepreneurs.

To make filling out a declaration under the simplified tax system as clear as possible, we have compiled step-by-step instructions and ready-made samples.

Basic filling rules

All cost indicators (tax, income, losses) must be written in full rubles, using mathematical rounding. For example, income of 40,600.51 rubles is rounded up to 40,601 rubles. But the income of 40,600.38 rubles is rounded down to 40,600 rubles.

The declaration must be numbered - each page is assigned a serial number, starting from the title page. The first sheet will have a number like “001”, and the eleventh sheet should be designated as “011”. Under no circumstances should corrections be made using a “stroke” (clerical putty). In the top field of each page above the section title, you must enter your Taxpayer Identification Number and Taxpayer Identification Number, if available.

Submit reports using the simplified tax system and take advantage of all the features of Kontur.Externa

Send a request

Title page

In particular, the title page must include the following information:

- Correction number. The number “0—” indicates that the declaration is primary. A clarification can be identified if the field contains a number other than zero (for the fourth clarification the number “4—” is entered, for the third — “3—”, etc.).

- Tax period code (for companies that continue to operate, you need to select code “34”, for those that are liquidating - code “50”, and for those switching to another regime - “95”).

- Tax office code (take it from the registration notice. If the notice is not at hand, the tax authority code can be found on the Federal Tax Service website).

- Code for the place of submission of the declaration (120 - for individual entrepreneurs; 210 - for organizations).

- Full name of the enterprise or full name of the businessman (Limited Liability Company "Elka", Individual Entrepreneur Artemy Stepanovich Senkin).

- OKVED code. It can be easily found in an extract from the Unified State Register of Legal Entities (USRIP) or determined using the OKVED2 classifiers. An extract from the Unified State Register of Legal Entities can be obtained by sending a request to the Federal Tax Service via the Internet or by coming in person. Persons combining several modes must indicate the OKVED code corresponding to their type of activity on the simplified tax system.

- Numerical code of the reorganization or liquidation form (leave it blank if there were no specified circumstances).

- TIN/KPP of the reorganized organization (if there were appropriate circumstances).

- Phone number.

- How many pages does the declaration have?

- How many sheets are there in supporting documents?

All possible codes involved in the declaration are included in the appendices to the filling procedure.

For signatories of the declaration, codes are assigned: “1” - if the signature is placed by a manager or individual entrepreneur, “2” - if the signature in the declaration belongs to a representative of the taxpayer.

What indicators to consider

It would seem that entrepreneurs only need to take into account business income in order to submit reports. The main thing is to indicate all amounts on an accrual basis by quarter. But the fact is that the declaration also includes data on insurance premiums and trading fees.

Insurance premiums in the declaration mean several payments at once:

- insurance premiums of individual entrepreneurs for themselves;

- sick leave benefits paid to employees;

- payments under personal insurance contracts.

You can indicate either quarterly or in a single amount for the year. It all depends on how you pay them. For example, if you make contributions every quarter, indicate the exact payment amount for each period. If you pay one time, then the declaration must also contain one amount.

A separate block of the declaration is devoted to the trade tax. This is a local payment for retail trade that is valid in Moscow. Here's who pays it:

- retail outlets without halls (for example, markets, tents, vending machines);

- non-stationary trade points (for example, coffee kiosks);

- retail outlets with trading floors;

- warehouses.

If you have never heard of a trade tax, but work in Moscow in one of the listed areas, carefully study the capital’s tax memo. It contains detailed information about accounting and benefits.

Income from trading fees is accounted for separately. Here's what it looks like in an example. Let's say entrepreneur Daniil opened a small coffee shop of 30 square meters. m in Zelenograd. He sells coffee and baked goods, and also conducts master classes and training for baristas. This is what the table of his income looks like by type of activity for the past year.

If we convert to income on an accrual basis, the table changes slightly.

All this data will be useful when we fill out the declaration.

Section 1.1

Although sections 1.1 and 1.2 of the declaration go directly after the title page, they must be completed after the data is reflected in subsequent sections. This is explained by the fact that these sections are, as it were, summary and collect the final data from the remaining sections.

Section 1.1 will only be needed by taxpayers working on the simplified tax system for “income”.

In line 010, as well as in lines 030, 060, 090, OKTMO is supposed to be indicated. The last three lines indicated are filled in only when the address changes.

OKTMO occupies eleven cells in the declaration. If there are fewer digits in the code, dashes are placed in unoccupied cells (to the right of the code).

In line 020, the accountant enters the amount of advance tax for the first three months of the year.

The payer enters the advance payment for the half-year in line 040. Do not forget that the advance payment for the first quarter must be subtracted from the amount of the advance payment for the half-year (otherwise there will be an overpayment). By the way, the advance must be paid no later than July 25th.

During a period of crisis or downtime, it is likely that the advance payment for the first quarter will be greater than that calculated for the first half of the year (due to a decrease in income). This means that the amount to be reduced will be written down in the line with code 050. For example, for the first quarter, Elka LLC sent an advance of 2,150 rubles, but at the end of the six months, the advance was only 1,900 rubles. This means that you don’t need to pay anything, and in line 050 the accountant of Elka LLC will write down 250 (2,150 - 1,900).

The algorithm for filling out line 070 is similar to the algorithm for line 040, only information is entered here for 9 months. Line 080 stores information about the tax to be reduced for 9 months.

Line 100 summarizes the year and records the amount of tax that needs to be written off from the current account in favor of the Federal Tax Service. Line 110 is useful if advances exceed the tax amount for the year.

Based on the results of 2021, Elka LLC must send a “simplified” tax in the amount of 145,000 rubles to the budget. However, during the quarters advances were made in the amounts of RUB 14,000, RUB 18,500 and RUB 42,300. This means that in total Elka LLC will have to pay an additional 70,200 rubles (145,000 - 14,000 - 18,500 - 42,300).

Form of the new simplified taxation system reporting form

Let's take a look at the new declaration form and figure out how it differs from the previous one.

The most noticeable difference is that the number of pages has increased from eight to ten. This is explained by the fact that fields were added to the new simplified taxation system declaration form to reflect increased limits.

We remind you that from 2021 standard and increased limits apply to the simplified tax system. This is 150 million rubles/100 employees and 200 million rubles/130 employees, respectively.

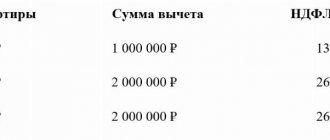

If an organization or individual entrepreneur exceeds standard limits, then they pay tax at higher rates:

- 8% instead of 6% on the “Revenue” object;

- 20% instead of 15% on the “Income minus expenses” object.

Please note: by order of the Ministry of Economic Development of Russia dated October 30, 2020 N 720, a deflator coefficient for the simplified tax system was established; its value in the current year is 1.032. However, the Ministry of Finance believes that the coefficient cannot be used to distinguish between different tax rates (letters dated January 22, 2021 No. 03-11-06/2/3505 and dated January 27, 2021 No. 03-11-06/2/4855).

Another innovation in the new simplified taxation system declaration is the justification for the use of a reduced tax rate. An organization or individual entrepreneur who worked at a reduced rate must indicate a special justification code. You will find details about this below.

The order that approved the new reporting form also contains the procedure for filling it out. You can find out more about the procedure by following the link. We'll look at this quite briefly.

Section 1.2

Fill out Section 1.2 if your object is “income minus expenses.”

The principle of filling it out completely repeats the principle of filling out section 1.1.

Lines 010, 030, 060, 090 contain OKTMO. If it has not changed during the year, it is indicated only in line 010.

Tax advances are recorded in lines 020, 040, 070. The timing of their payment does not depend on the object of taxation - it is always the 25th.

Entries are made in lines 050 and 080 if prior payments to the budget exceeded the advance for the current period.

The amount of tax subject to additional payment for the tax period is reflected in line 100. If it is calculated to be reduced, it is indicated in line 110.

The only difference between the described section and section 1.1 is line 120. In it you need to indicate the amount of the minimum tax (1% of income).

For example, with an annual income of 10,000 rubles and expenses of 9,500 rubles, the tax payable by Elka LLC will be only 75 rubles ((10,000 - 9,500) x 15%). If you calculate the minimum wage, you get 100 rubles (10,000 x 1%). Elka LLC must pay exactly the minimum tax, naturally reducing it by the amount of advances. If the company had advances in the amount of 30 rubles, then in line 120 the accountant will indicate 70 (100 - 30).

If advances based on the results of three quarters of the year exceed the minimum tax, line 120 is crossed out.

Step-by-step instructions for filling out a declaration under the simplified tax system for 2020 (object “Income minus expenses”)

Let's look at how to fill out the simplified taxation system “Income minus expenses” using the example of an LLC. The tax period is 2021, so these reports must be submitted by March 31, 2021 (this date fell on Wednesday, therefore, there are no postponements).

Step 1. Title page

The TIN and KPP are taken from the registration certificate and are written on all pages of the document (see sample certificate). In electronic form, it is enough to indicate them only once, the rest will be filled in automatically. The tax authority code is also included in the registration certificate. The remaining codes shown in the figure are the same for all LLCs. The reporting year refers to the tax period, i.e. 2020 in our case.

The name of the taxpayer is taken from the same certificate or from the charter.

IMPORTANT!

It is necessary to write both the full and short name and name in a foreign language, if they are recorded in the constituent documents.

The OKVED code is set for the main type of activity either from the charter or from statistics codes issued by Rosstat. It is customary to write the phone number in 11 digits (with an eight). If it is easier to reach you on your mobile phone, then indicate it.

Let's fill out a sample declaration.

The accuracy of the specified information has the right to certify:

- LLC director (code 1);

- in-house or outsourced accountant (code 2).

In any case, for the organization, fill out the fields Full name, signature and date. If the code is 1, then dashes are placed in the lower field “Name of document”, otherwise a power of attorney is indicated.

Step 2. Section 2.1

For each object of taxation, a special subsection is provided in the declaration under the simplified tax system. If the object of taxation is “Income minus expenses”, first fill out section 2.2.

Let’s figure out how to fill out section 2.2 of the declaration under the simplified tax system “Income minus expenses”: in lines 210–213, on a quarterly accrual basis, we enter the income received, from which the taxable base is formed. And in 220–223 there will be amounts of expenses (cumulative total) corresponding to the list from Article 346.16 of the Tax Code of the Russian Federation. As in previous cases, each line corresponds to a tax period (1st quarter, half year, 9 months, year). If a loss was incurred in the previous reporting period, it is reflected in line 230. It will reduce the tax base. In our example there is no loss.

For the total value for the reporting period, line 213 is intended in the declaration under the simplified tax system; in it we summarize the income for all four quarters. We summarize the costs in line 223.

Lines 240–243 indicate the tax base for calculating the advance payment:

- Page 240 = page 210 – page 220 if > 0.

- Page 241 = page 211 – page 221 if > 0.

- Page 242 = page 212 – page 222 if > 0.

- Page 243 = page 213 – page 223 – page 230 if > 0.

If the amount of loss on line 230 is equal to the taxable base, in line 243 we set the value 0.

Losses for the reporting year are reflected in lines 250–253 if the indicators in lines 210–213 are less than 220–223.

The next two blocks on the tax base and losses of the reporting year are mutually exclusive: if line 240 contains a numerical value (profit), then line 250 contains dashes (loss), and vice versa. Similarly for pairs of lines 241 and 251, 242 and 252, 243 and 253.

The values are determined by simply subtracting expenses from income for the required period (the first two blocks).

Lines 260–263 indicate the tax rate of 15% or another provided for by the legislation of the constituent entity of the Russian Federation where the taxpayer’s activities are registered. Tax rates vary depending on the region and type of activity of the organization and change throughout the year. But usually the same value is specified four times. The amounts of calculated tax are not the payments that the company actually paid to the budget. In our example, the organization paid the minimum tax twice. The instructions say how advance payments are taken into account in the declaration under the simplified tax system for 2021 - mathematical values are recorded in lines 270–273: the tax base multiplied by the rate and divided by 100.

Tax advances are calculated and reflected as follows:

- Page 270 = page 240 × page 260 / 100.

- Page 271 = page 241 × page 261 / 100.

- Page 272 = page 242 × page 262 / 100.

- Page 273 = page 243 × page 263 / 100.

Pay attention to line 280 - the minimum tax on the simplified tax system (income for the year on line 213, multiplied by 1%). Line 280 indicates the minimum tax to be paid. It is defined as pp. 213 × 1/100.

Step 3. Section 3

The third section of the tax return is intended to be filled out only by those organizations that received funds in accordance with paragraphs 1 and 2 of Art. 251 Tax Code of the Russian Federation. We are talking about targeted funding, targeted revenues and income received as part of charitable activities. Previously, firms using the simplified tax system, if they had such amounts, had to fill out sheet 7 of the income tax return. The procedure for filling out the new section is similar to the previous requirements. This is a specific section, so it is not common among simplifiers.

The codes for column 1 “Receipt type code” are given in Appendix No. 5 to the procedure for filling out the declaration.

Start filling out section 3 by transferring funds that were not used on time (or without a period of use), but received in the previous year. For amounts for which a period of use has been established, indicate the date of their receipt in column 2, and in column 3 - their amount. If the period of funds received in the previous reporting period has not expired, then their amount is entered in column 6.

Only after this do they fill in the data on funds received in the reporting period:

- In columns 2 and 5, for funds with a specified period, the dates of receipt and use are indicated.

- Column 3 - the amount of funds received with a specified period.

- Column 4 - funds that were fully used for their intended purpose within the prescribed period.

- Column 6 shows the amount of unused funds that have not yet expired.

- In column 7 - funds used for other purposes (they are included in non-operating income at the time of actual use).

The line “Total for the report” indicates the total amounts for the corresponding columns 3, 4, 6, 7 of section 3.

Step 4. Section 1.2

- In line 010, enter the OKTMO code (check the code on the Federal Tax Service website).

- Enter the amounts of quarterly advance payments in lines 020, 040, 070.

- In line 100 - the amount of additional payment for the year.

If there were amounts to be reduced during the year, fill in 050 instead of 040, and 080 instead of 070.

Lines 110 and 120 are for special cases. If the tax for the year is less than the advance payments, fill in 110. If you need to pay an additional amount of the minimum tax - 120.

Step 5. Registration and certification of the declaration

Signatures and dates are placed on the title page and in section 1.2 (below).

The presence of TIN and KPP on each page is checked. The page numbers are specified: 001 - title page, 002 - section 1.2, 003 - section 2.2.

The number of pages is indicated on the title page. There are no official instructions on how to do this, the main thing is that all familiar places are occupied. Please note that when signing a declaration under the simplified tax system by a representative, and not by the director of the company, there is at least one attachment - a power of attorney for the representative.

And lastly: only completed sections need to be sent to the tax office. And those organizations that, in accordance with the charter, operate without a seal, do not certify the report with a round seal.

Section 2.1.1

It is needed as part of the declaration only for those categories of payers who pay income tax.

So, it is advisable to fill out a declaration under the simplified tax system starting from this section.

Line 101 indicates the code for the application of the tax rate. If the tax was paid all year at the standard rate of 6% or at the rate established by the law of the subject, enter code “1”. If during the year you exceeded the limits on number and income and began to pay at a rate of 8%, enter code “2”.

In line 102 you must indicate one of two characteristics of the taxpayer:

- code “1” - for companies and individual entrepreneurs with employees;

- code “2” - exclusively for individual entrepreneurs without employees.

Lines 110–113 collect information about income for the first quarter, six and nine months, and the year. The main principle: all income and expenses are recorded on an accrual basis. Using the example of Elka LLC, we will show what income is on an accrual basis.

Initial income data: I quarter - 13,976 rubles, II quarter - 24,741, III quarter - 4,512 rubles, IV quarter - 23,154 rubles. To fill out lines 110–113, the accountant at Elka LLC will add the current value to the previous value. So, in line 110 the accountant will write 13,976, in line 111 - 38,717 (13,976 + 24,741), in line 112 - 43,229 (38,717 + 4,512) and in line 113 - 66,383 (43,229 + 23,154 ).

The tax rate is fixed in lines 120–123. Line 124 specifies the rationale for applying the tax rate established by the law of the constituent entity of the Russian Federation. The first part of the indicator includes the seven-digit code from Appendix 5 to the procedure for filling out the declaration, the second part - the number, paragraph and subparagraph of the article of the law of the subject.

Line 130 records the tax advance for the first quarter. Lines 131–133 reflect advances and taxes for subsequent periods. How to calculate them is indicated directly on the declaration form to the left of the corresponding line. In lines 140–143, entries are made about the amounts of insurance premiums, sick leave and payments for voluntary personal insurance. An accountant of any company must remember that the amount of tax and advances can be legally reduced by the amount of these expenses, but not more than 50%.

Elka LLC has calculated the annual tax, and it is equal to 74,140 rubles. Contributions for employees amounted to 68,324 rubles, and sick leave for director Stas Igorevich Kopeikin amounted to 17,333 rubles. Total expenses amounted to 85,657 rubles (68,324 + 17,333). The accountant of Elka LLC decided to take advantage of the legal right and reduced the tax. For this, accountant Olkina S.T. calculated half of the tax amount (74,140: 2 = 37,070). This is the maximum amount by which the tax payable can be reduced. It turned out to be significantly less than the amount of expenses that can be deducted. This means that Olkina S.T. can reduce the tax by only 37,070. Elka LLC will have to pay 37,070 (74,140 - 37,070) to the budget. In line 143, the accountant will enter the amount of 37,070.

Let us add that individual entrepreneurs in lines 140–143 reflect contributions for themselves. Single entrepreneurs have a special advantage - they can reduce taxes by 100% of contributions transferred to the budget.

Individual entrepreneur Semechkin V.O. (without employees) for the year, according to preliminary calculations, should send 36,451 rubles to the budget, the contributions paid amounted to 17,234 rubles (this is exactly the amount Semechkin paid). Individual entrepreneur Semechkin V.O. reduced the tax on contributions (by 17,234) and transferred 19,217 rubles (36,451 - 17,234) to the Federal Tax Service.

Filling using the wizard

To fill out the declaration using the wizard, use the “Fill out simplified” in the upper right corner of the page.

The following are indicated:

- Object of taxation: income or income minus expenses.

- Code of the tax rate application indicator.

- Taxpayer type.

- Payments (tax paid when applying the PSN, insurance premiums and payments or fixed payments to the Pension Fund or the Federal Compulsory Medical Insurance Fund).

Payments must be indicated, because on their basis, insurance premiums are calculated, reducing the amount of the advance payment (tax). - Location (OKTMO code) of the organization/residence of the individual entrepreneur.

- Tax rate.

If the location and/or rate changed during the year, check the appropriate box and enter the value for each quarter. - Justification for applying the tax rate (for entities applying the rate established by regional law).

- Fill in the data on income and expenses with a cumulative total .

To reflect information about the intended use of funds, click “Targeted use of property within the framework of charitable activities” and add data using the “+Receipts” (see the filling procedure here).

If the organization/individual entrepreneur pays a trade fee , check the appropriate box. In the block that opens, enter data on activities related to the established trading fee.

Insurance premiums are shown here only for employees involved in activities subject to the trade levy.

Click “Fill” and the specified data will be entered in the appropriate fields of the declaration.

Section 2.1.2

If you pay a trading fee, then this section is for you. Lines 110-143 are filled in only for the activities for which the fee is paid.

Income is noted in lines 110–113. Definitely on a cumulative basis. For which period to record income, the explanation for the line indicated in the declaration form will tell you.

Also, as in section 2.1.1, taxpayers who have ceased operations or lost the right to work on a simplified basis duplicate income for the last reporting period in line 113, and the tax is repeated in line 133.

Similar to section 2.1.1, in line 130 you need to indicate the tax advance for the first three months of the year, and in lines 131–133 - payments for the following periods. The accountant will see the calculation formula directly under the specified lines in the declaration form.

In lines 140–143 you need to indicate the amounts of payments, the list of which is presented in clause 3.1 of Art. 346.21 Tax Code of the Russian Federation. It is on these payments that the tax can be significantly reduced. But there is a limitation here: it is legal to reduce the tax by no more than 50% of the specified payments.

Elka LLC has calculated the annual tax, and it is equal to 74,140 rubles. Contributions for employees amounted to 68,324 rubles, and sick leave for director Stas Igorevich Kopeikin amounted to 17,333 rubles. Total expenses amounted to 85,657 rubles. The accountant of Elka LLC decided to take advantage of the legal right and reduced the tax. For this, accountant Olkina S.T. calculated half of the tax amount (74,140: 2 = 37,070). This means that Olkina S.T. can reduce the tax by only 37,070. Elka LLC will have to pay 37,070 (74,140 - 37,070) to the budget. In line 143, the accountant will enter the amount 37 07.

Enter the actual trading fee on an accrual basis in lines 150–153. Enter the fee here if it has already been paid. Lines 160–163 will tell you about the amount of the trade fee, which reduces the tax and advances on it. Depending on the indicators, these lines can take different values. Which ones exactly, the formula under the lines in the declaration will tell you.

Composition of the declaration

In addition to the title page, the declaration has 6 sections. Which ones need to be filled out?

- Entities who have chosen income as an object of taxation fill out sections 1.1 and 2.1.1 without fail. If at the same time they are payers of the trade tax, then they also fill out section 2.1.2.

- Section 3 is completed only by those who received targeted funding during the reporting period. As a rule, ordinary companies and individual entrepreneurs do not have this section in the declaration.

- Section 2.2 is filled out by simplified tax authorities who have chosen income minus expenses as the object of taxation.

Section 2.2

If you pay tax on the difference between income and expenses, then this section is for you. Let us briefly describe the lines to be filled in. Remember that we count and record data on an accrual basis.

Line 201 contains the code for the application of the tax rate. Put “1” if you paid tax for the entire year at a rate of 15% or the one established by the law of the subject. If you violate the limits and apply a 20% rate, enter the code “2”.

Lines with codes 210–213 are income for the reporting periods.

Lines with codes 220–223 are expenses, the list of which is given in Art. 346.16 Tax Code of the Russian Federation.

Line with code 230 - loss (part of it) for past tax periods. By declaring a loss, you can legally reduce your tax base.

Lines with codes 240–243 are the tax base. Let’s say the income of OOO “Sova” amounted to 541,200 rubles, expenses - 422,000 rubles, and the loss of the previous period - 13,400 rubles. The accountant of Sova LLC calculated the tax base: 541,200 - 422,000 - 13,400 = 105,800 rubles.

If at the end of the year the amount turned out to be a minus sign, the amount of the loss should be indicated in lines 250–253.

Let’s say the income of OOO “Sova” amounted to 422,000 rubles, expenses - 541,200 rubles. The accountant of SOVA LLC calculated the tax base: 422,000 - 541,200 = - 119,200 rubles. The result was a loss.

Lines with codes 260–263 are the tax rate (usually 15%). If you are applying a reduced rate established by the law of the subject, indicate the justification on line 264. It consists of two parts: the first is a special code from Appendix 5 to the filling procedure, the second is the number, article, paragraph and subparagraph of the law.

Lines with codes 270–273 are tax advances and additional payments based on the results of the tax period.

Line with code 280 is the amount of the minimum tax. It is not paid if it turns out to be lower than the tax itself according to the simplified tax system.

LLC "Sova" in 2021 received income of 470,000 rubles, confirmed expenses amounted to 427,300 rubles. Accountant Filina A. Yu. calculated the tax: (470,000 - 427,300) x 15% = 6,405 rubles. Next, Filina A. Yu. calculated the minimum tax: 470,000 x 1% = 4,700 rubles. As we can see from the calculations, the minimum tax is less than the accrued tax. Therefore, the accountant of Sova LLC will transfer 6,405 rubles to the Federal Tax Service account (provided that there were no advances previously).

Simplified expenses: important clarifications from officials

Simplified people with the “income minus expenses” base, when calculating the amount of the simplified tax system, have the opportunity to reduce the income received by the amount of expenses incurred during the same period. The list of such expenses is limited (Article 346.16 of the Tax Code of the Russian Federation).

It is important for a simplifier not only to check all expenses against this list, but also to take into account the explanations of officials and court decisions on certain types of expenses, which will help to accurately determine the taxable base and correctly calculate the simplified tax system.

Is it possible to take into account “coronavirus” expenses, ConsultantPlus experts explained. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Check out the set of “controversial” expenses of simplifiers and links to the Tax Code of the Russian Federation, court decisions and explanatory letters from officials:

Section 3

Most companies, and especially individual entrepreneurs, are unlikely to encounter this section. After all, the third section is filled out by those who become recipients of targeted funds (clauses 1, 2 of Article 251 of the Tax Code of the Russian Federation).

Here it is worth reflecting data on different categories of target funds: unspent money from the past period, unspent funds with an unexpired period of use, as well as funds with an unknown period of use.

All funds are divided by codes (codes are available in the appendix to the filling procedure).

In columns 2 and 5 of section 3, the accountant notes:

the specific date of receipt of funds or any property; the period of use of material assets declared by the transferring party. If the period of use is not defined, then columns 2 and 5 remain empty.

In columns 3 and 6 you need to indicate the amount of funds received earlier than the reporting year with different periods of use.

If the company spent funds not for their intended purpose, they will have to be reflected in column 7.

The final stage of filling out section 3 will be summing up. There is a special line at the bottom of the page for this. Such amounts are included in non-operating income at the moment when the conditions for their receipt were violated.

At first glance, it may seem that only a professional can fill out a declaration under the simplified tax system. But if you spend a little time and arm yourself with the instructions provided, everything will not be so difficult. In this article, we deciphered all sections line by line and provided examples of calculations.

Declaration form and submission deadlines

The figure below shows the minimum set of necessary information about the current declaration form under the simplified tax system and the deadlines for reporting dates for individual entrepreneurs and companies:

The above deadlines for submitting a declaration under the simplified tax system must be observed by those taxpayers who continue to apply the simplified taxation system as usual. For those companies and individual entrepreneurs that have lost the right to use this special regime, the deadline for filing a declaration is different (clauses 2 and 3 of Article 346.23 of the Tax Code of the Russian Federation).

Since 2021, increased limits of the simplified tax system have been introduced, at which increased tax rates are applied, allowing taxpayers to continue to apply the simplified tax system when exceeding standard limits.

ConsultantPlus experts spoke in more detail about the innovations. Get free demo access to K+ and go to the Ready Solution to find out all the details of the changes.