The alienation of a share in an LLC actually represents a transfer of the corresponding part of the capital in the authorized capital. This process can be carried out either by selling it or in another way that is not prohibited by law, for example, by donating it to any person. Moreover, it seems possible to sell or donate a share of the authorized capital both to a third party and to the LLC itself, in which the co-founder is a member, if one wishes to leave it.

In this article, we will try to analyze in detail how the alienation of a share in an LLC occurs, using the example of its sale to a third party, and also consider some of the nuances that arise when a part of the authorized capital is alienated in favor of the company itself.

Preparation and procedure for drawing up an offer

As already stated earlier, the founder must first send an offer to alienate the share to the other founders. The offer is essentially an offer to purchase part of the authorized capital; it contains the main provisions of the sales agreement, which may include the subject of the transaction itself, its price, as well as other conditions.

The addressees are the other founders of the company, or the founder, if he is the only one, or the company itself.

The offer form is not established by law, but, in accordance with it, must contain the following data:

1. Information about the seller, which includes his full name, passport details, INN and OGRN (if the seller is a legal entity) and so on.

2. Information about the organization, about the share of property for alienation, including its nominal value and size.

3. Information about the possible buyer. This column must be filled in similarly to the column with information about the seller.

4. Subject and conditions of the proposed transaction.

5. The procedure in which the value of the alienated share is calculated.

6. The period during which the transaction must be accepted. Often this period is one month, unless otherwise provided by the organization’s charter.

7. Date and signature of the seller.

Direction of the offer

You can send an offer directly to the company itself. You can do this in the following ways:

• Hand over personally to an authorized representative of the organization, who must certify with his signature the fact of its receipt.

• Send through a notary.

• Send by registered mail via post. In this case, it is necessary to have an inventory of the investment, as well as a notification of delivery.

Despite the fact that the law does not oblige the offer to be sent to other co-founders, it is still necessary to give them copies of the offer. The founders have the right to accept the offer within a month. If the seller of the share wishes to transfer it to a third party, and the other founders do not object to this manipulation, then they can send a statement of their consent to the seller. If the offer was not accepted within a month or another period provided for by the charter of the LLC, other founders lose the right of priority to receive a share in the authorized capital.

The procedure for determining the value of the alienated share

What is the value of the alienated share? This question is asked quite often. The procedure according to which the value of the alienated share in an LLC is determined is established by clause 6.1 of Article 23 of the Federal Law on LLC.

In accordance with this federal law, the cost is determined in accordance with the financial statements of the organization, taking into account the share of the person who leaves the limited liability company.

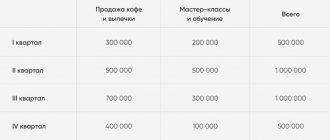

In this case, the data reflected in the reports for the period preceding the date of drawing up the alienation application are taken into account. That is, if a quarter is taken as the reporting period, and the application was drawn up in the second quarter, then the reporting period taken into account will be the first quarter of the year. The period within which the required amount must be paid is 3 months.

It is important to note that the cost of the share cannot be paid if the company's assets had a negative value in the reporting period.

Drawing up an agreement on the sale and purchase of the alienated share

Drawing up an agreement is the next step when alienating a share in an LLC if the transfer is carried out on a reimbursable basis. In this case, the document must be drawn up in writing and then certified by a notary. The procedure for notarization is the same when selling to both other founders and third parties. We'll talk about the certification procedure later.

The main condition is to draw up an agreement that will meet legal standards, including all significant circumstances and terms of the transaction.

Circumstances that are considered legally significant and must be reflected in the share alienation agreement are:

• The actual place and date of conclusion of the contract.

• Complete and authentic information about the seller of the share.

• Complete and authentic information about the buyers (buyer) of the share.

• Information about the alienated share, including its characteristics, as well as its nominal value.

• The order in which settlements are made between the parties.

• Details of the parties, as well as their signatures with transcripts.

When drawing up a transaction for the alienation of shares, you should pay attention to the following nuances:

• Information that characterizes the parties to the transaction must be indicated in full. They must necessarily contain passport data if the parties are represented by individuals, as well as OGRN, the place where the registration was made, and full data if the parties are represented by legal entities.

• The alienated share, its size, as well as nominal and actual value must be clearly indicated.

• The term and procedure for payment for the alienated share must be strictly defined.

• The contract may contain information about the consequences that may occur in case of non-compliance with the terms of the contract.

• It seems advisable to indicate in the contract who is responsible for the costs of completing the transaction.

The more complete the data is presented, the easier the transaction confirmation procedure will be.

Alienation and difficulties in selling shares in common property rights

The party acting as a participant in the common share has full rights to a portion of the share of this property.

There is a provision in the Civil Code that states that after selling their part of the share, the remaining participants can buy it without any problems. This provision does not apply to sales from public contracts and auctions. The person selling a share of the property must inform all other participants in writing about this. The notice must include the price and conditions under which the share is sold. In situations where other participants in the entire property do not buy that part of the share that is being sold or refuse to buy it, then the seller has the right to sell it on absolutely any terms and any representative can act as the buyer. If there is a need for the assistance of a notary, you should understand that you will be expected to provide evidence that all parties to the transaction are aware of your decision. It is far from uncommon for situations when the owners of a common share themselves give the notary a waiver of their rights to the preemptive acquisition of this share.

Sometimes situations arise when obtaining this evidence seems like an insurmountable obstacle. The person representing the owner of the alienated share refuses the notary upon his arrival at the agency to sign the necessary documents. Or he comes, but is not going to sign anything, but gives verbal consent to this fact. In this case, you need to submit a statement to him. In the document, the seller is obliged to acquaint the owner of the common share with the decision he has made, in this way he will be able to inform him. Most often, the statement is arbitrary. You must provide the following information:

- item of sale;

- address of the location of the property;

- the price at which the property will be sold or the property for which the exchange will be made;

- other terms of sale.

It is worth pointing out that the seller has every right to change the conditions under which sales will be made at absolutely any time. When such changes occur, it would be correct to notify all shareholders of the property who have the right to apply for its purchase. In situations where the property is sold at a higher price than the original price set initially, there is no need to provide evidence of notification. However, in the event of a price reduction, such proof is required. Absolutely everyone sooner or later comes face to face with the alienation of things and objects. I would like to take a closer look at the order in which these processes occur.

regulation is also worth paying attention to . It is worth paying attention to certain points that play a vital role in the actual alienation of real estate. In the event of a purchase and sale, the most necessary and important thing is the moment when the property is owned jointly with other persons, the party has the right to sell its share of the property with the consent of all participants in the transaction, in case of disagreement, a period of 30 days is given from the time of notification of fact of sale. The second thing that deserves attention is the fact of registration of children in the property that will be sold. If the situation concerns a minor child, then this entails certain additional complications, because in order to sell you must have the permission of the body of the guardianship council. This permission can be issued only after submitting information about the new location of registration and residence of the child, which, according to its conditions, cannot be worse than the previous one.

The process of certifying a transaction with a notary

The transaction will be declared invalid if it is not certified by a notary.

An application to a notary is not required if there has been a transfer of the share of the authorized capital from a participant to the community as a result of the exclusion of the former. Since in fact there was no deal.

That is, the transaction is not certified by a notary in the following cases:

- When transferring a share to the company in the manner prescribed by Article 23 of the LLC Law.

- In case of distribution of a share that belongs to the company between the participants of the company and the sale of a share that belongs to the company, a participant or a third party. This is regulated by Article 24 of the LLC Law.

- When is the right of first refusal used? In this case, an offer is sent to sell part or all of the share in accordance with Article 21 of the LLC Law.

- If a participant leaves the company, then the share is alienated regardless of the consent of the company members, according to the rules of Article 26 of the LLC Law.

A notarized transaction for the alienation of an LLC share has undeniable advantages:

- The notary guarantees legality, since all documents are checked for compliance with the law, the identities of the parties to the transaction are established, and the legal capacity and powers are also determined. Also, existing arrests and encumbrances in relation to the alienated share are identified. If anything is violated, the notary cannot certify the transaction.

- The change of ownership occurs quickly - immediately after the transaction is certified by a notary.

- Changes in the Unified State Register of Legal Entities are registered within 5 working days.

In the event that the transfer of the share has been made, and the buyer avoids the obligation to pay for it or have it notarized, then the seller of the share of the authorized capital has every right to go to court in order to recognize the transaction for the alienation of the share as not notarized. If the court satisfies the claim, then further steps to certify the transaction will not be required.

Transactions with LLC shares

Notarization of transactions for the alienation of shares in the authorized capital of LLC

Since July 1, 2009, the law has established a mandatory notarial form for transactions on the alienation of shares or part of a share in the authorized capital of a Limited Liability Company, as well as pledge agreements. Failure to comply with the notarial form of the transaction entails its invalidity.

There are several types of similar transactions with shares of an LLC, but most often a notary certifies agreements of purchase and sale, pledge and donation of the Participant’s share in whole or in part in the authorized capital of the LLC.

To certify such agreements, you can contact any notary of the Russian Federation, regardless of the location of the company whose share in the authorized capital is being alienated. We will draw up a draft agreement taking into account your wishes and conditions. If the parties themselves developed the agreement, the notary will check whether the content of the agreement corresponds to the actual intentions of the parties and whether it does not contradict the requirements of the law.

As for the list of documents required to conclude a transaction, there is no exhaustive list of such documents. Obviously, the legal capacity of a legal entity is verified. This means that documents must be submitted confirming the registration of the legal entity, the Charter, the agreement on the establishment of the company, an extract from the Unified State Register of Legal Entities with a period of no more than 5 days, a protocol (order) on the appointment of the head of the legal entity. If the parties act under a power of attorney, then it must be notarized and with the most specific powers.

The Company and participants must confirm compliance with the deadlines and procedures for using the pre-emptive right and obtaining the necessary consents. Please note that the authenticity of the signature of a company participant waiving the pre-emptive right to purchase must be notarized (clause 6 of Article 21 of the Federal Law “On Limited Liability Companies”). If the notary deems it necessary, he has the right to request protocols from the competent body of the company on the approval of a major transaction or a transaction in which there is an interest.

In addition, the notary will require from the seller the title documents on the basis of which the share was acquired (memorandum of association, purchase and sale agreement). If the party to the transaction is an individual, you must provide a notarized consent of the spouse to the alienation or purchase of the share.

When a foreign legal entity participates in a transaction, the notary is presented with documents confirming its registration and its location, as well as the authority of the person who, on behalf of the participant - a legal entity of another state, will sign a share purchase and sale agreement. These documents must be legalized and translated into Russian.

Please note that the law does not provide for mandatory certification of the agreement on the establishment of a company. However, if a share (part of a share) of the authorized capital of the LLC is subsequently alienated, a notarized copy of such an agreement must be presented to the notary.

A share or part of a share in the authorized capital of a company passes to its acquirer from the moment of notarization of the transaction, and in cases that do not require notarization, from the moment of making relevant changes to the unified state register of legal entities on the basis of title documents.

In accordance with the new law, the notary who certified the transaction for the alienation of a share in the authorized capital of the company is obliged, within three days from the date of such certification, to submit to the tax authority an application for amendments to the Unified State Register of Legal Entities , signed by the company participant alienating the share (seller). The authenticity of the signature on the application is certified by a notary at the same time as the agreement is certified. Since the application comes from the participant alienating the share, responsibility for the correct preparation of this document lies with the applicant .

Attention ! The applicant on behalf of a legal entity can be either the seller himself (i.e., a representative of a legal entity who has the right to act without a power of attorney), or an individual acting for him under a power of attorney .

If the seller of the transaction is an individual , the application to the tax authority can only be signed by him personally . The exercise of the rights of an individual applicant by power of attorney is not provided for by the law “On State Registration of Legal Entities and Individual Entrepreneurs”.

The notary submits the application to the tax authority in person or by mail with acknowledgment of delivery. When an employee of the tax authority accepts an application, a stamp is affixed to the copy of the application remaining in the notary’s files with a note indicating the date of receipt, registration number and the date of issuance of the certificate of amendment to the Unified State Register of Legal Entities. Only the applicant (seller) can receive a certificate from the tax authority on the specified day . Therefore, in order to avoid the tax authority sending the certificate by mail, we recommend that sellers of shares issue a notarized power of attorney to receive the certificate.

The refusal of the tax authority to make changes to the Unified State Register of Legal Entities does not entail the consequences of invalidity of the transaction, since it, as mentioned above, is considered completed from the moment of its notarization.

Due to the significant amount of work associated with checking the constituent documents of the company whose share is being alienated, interested parties submit a complete package of documents in copies to the notary’s office several days before the expected date of the transaction. You can bring documents at any time during the opening hours of the notary's office. The notary will check the documents, if the necessary ones are missing, he will request them, prepare a draft agreement, coordinate it with the parties and certify it at the appointed time. When signing the agreement, the presence of the general director of the LLC is required.

Pledge of a share in an LLC

Pledge agreements for shares in an LLC are concluded to secure material obligations of any nature. If the debtor does not repay the debt within the prescribed period, the creditor has the right to collect it through the sale of the pledged property, and the sale of the pledged property must be carried out in the manner prescribed by law. The legislation allows the conclusion of share pledge agreements with legal entities, entrepreneurs and citizens. The pledgor may be the debtor himself or any other person willing to secure his obligations.

A pledge of a share in an LLC can only arise on the basis of law or by virtue of a contract. An agreement to pledge a share in an LLC is possible only when this is not prohibited by the charter of the given Company.

The pledge of a share in the authorized capital of the company is carried out according to the rules established in clause 11 of Art. 21, art. 22 Federal Law No. 14. In accordance with them, this agreement must be certified by a notary. Pledge of the share of an LLC participant is possible only if it is paid for. If, when the need arises to complete a transaction, it is not fully paid, the founder has the right to issue a pledge of a part of the share that corresponds to the contribution made.

When concluding a pledge agreement, the notary is obliged to verify the person’s authority to transfer the share as pledge in the manner prescribed for the alienation of the share. Just as in the case of the alienation of a share, from January 1, 2021, an application for making appropriate changes to the Unified State Register of Legal Entities in connection with the pledge of a share is signed and transmitted electronically by a notary to the registration authority, except in cases where the pledge arises in the future. If a pledge of a share on the basis of a law or a pledge agreement arises in the future, an application for making appropriate changes to the Unified State Register of Legal Entities is signed and sent to the registering authority by the pledgor no later than three days from the date of fulfillment of all conditions and the occurrence of all deadlines necessary for the occurrence of a pledge. The entry on the pledge of the share is canceled based on the application of the pledgee.

Documents provided to the notary to certify the transaction for the alienation of a share

The package of documents that must be transferred to the notary to certify the transaction is strictly regulated by law.

The list of these papers includes:

- The agreement under which the alienation of a share of the authorized capital took place. Must be provided in quantities of three.

- Documents that can confirm the seller’s right to dispose of shares. Such documents are: an agreement on the acquisition of a share, a constituent agreement, a certificate of inheritance.

- Extract from the unified state register of registration of legal entities.

- Documents confirming payment for the share being sold.

- LLC Charter.

- Memorandum of association.

- Documents that confirm the consent of other founders to the alienation of a share of the authorized capital.

- Other documents that may be required depending on the circumstances. An example would be consent to the alienation of the seller's spouse.

Calculation when making property transactions

The next point is the calculation option . The Bank of Russia has introduced certain requirements regarding non-cash payments when making transactions not exceeding a certain value. In the event that the sale price exceeds the established amount, in order to make payments under the contract, then you need to open bank accounts and make cashless payments.

Regarding the issue of donation , all documents that are at the disposal of the notary are no different from what is submitted during the purchase and sale. It should be remembered that the person who receives the gift (unless of course both parties are close relatives) has an obligation to pay tax on such a gift in the amount of 5% of the total value of the property. The price is determined during a perfect appraisal.

And of course, details regarding the exchange . The package of documents is completely similar to that for sale and purchase, however, in addition, it should be noted that in a situation where the objects of exchange are real estate on both sides, everyone is required to prepare the necessary package of documents. From all of the above, it can be clearly seen that this process has undergone significant simplifications compared to the order that was in use previously. It is important to remember that certain difficulties always arise; they can arise due to controversial issues, lack of documents, or due to the text of contracts. At this point, it would be logical to consult with specialists, at a minimum, to obtain data that will be useful for understanding the essence of the overall situation. As a result of the emergence of more or less serious problems, help from a specialist will really be needed, because this can significantly facilitate the execution of the process.

We briefly examined what alienation of property is, the meaning of this term in the field of business relations between citizens of the Russian Federation. Leave your comments or additions to the material.

Entry into the Unified State Register of Legal Entities

After the actual alienation of a share in the authorized capital of an organization, data on this must be entered into the Unified State Register of Legal Entities. Documents evidencing the alienation must be submitted to the relevant authorities by a notary. He must submit an application to make changes to the Unified State Register of Legal Entities no later than two days after the alienation transaction has been certified. A copy of this statement must subsequently be submitted to the LLC. This transfer must be carried out within three days after the transfer of rights to the alienated share.

That is, neither the buyer nor the seller is required to take any action to transfer data to the registrar. This responsibility rests entirely with the notary who certified the alienation transaction. He sends the documents himself and then reports them to the public.

Method three: unique. Contribution of a share to the net assets of another company

A unique way to change the owner of a company is to contribute his share to the property of another company, where he is also a participant, in order to increase its net assets (clause 3.4, clause 1, Article 251 of the Tax Code of the Russian Federation). We have already written about contributions to net assets several times in our newsletter as one of the tax-free ways to transfer property.

Using the same method, you can change a company member under the following conditions:

- the previous owner of a share in the authorized capital of one company is also a participant in the acquiring company. He contributes the alienated share to the property of his other company in order to increase its net assets. Thus, the acquiring company will become the owner of the share. There are no tax consequences for either the transferor or the receiving party;

- the charter of the company acquiring the share must indicate the possibility of a participant making a contribution to the Company’s property, including for the purpose of increasing its net assets (including disproportionately to contributions, including any property).

For example: it is required to ensure participation (LLC "HA") in LLC "Trading House".

One of the owners participates in both companies, who will transfer his 100% in Trading House LLC to the net assets of XA LLC. Nuances:

- the transaction is subject to notarization, but not all notaries are ready to formalize it due to the uniqueness of the procedure. For convenience, in addition to the decision (protocol) on the contribution to net assets, it is necessary to draw up an agreement on the transfer of the share.

- remember, if more than 25% of a company is alienated using the simplified tax system, it will lose the right to special rights. regime, since in its authorized capital the share of another legal entity will be more than 25%.

Features of the alienation of a share of the authorized capital in favor of the company

This procedure is similar to the alienation procedure in favor of a third party. Despite this, the alienation of a share of property in favor of society has some nuances. Let's look at them in more detail.

• In accordance with federal legislation, the company receives the pre-emptive right to acquire the alienated share within a week after the founders of the organization decided not to use such a right, or within the same period after the founders refused to acquire the alienated share. In this case, the company must send acceptance to the buyer's offer. The charter may establish a different period during which the company’s preemptive right is valid.

• In accordance with federal legislation, the share acquired by the company must be proportionally distributed among its founders within a year or may be put up for sale.

Alienation of the share of the sole founder

As follows from the regulations, it is impossible for the sole founder to leave the LLC. The only option in which termination of the founder’s participation in the activities of the LLC is allowed is the liquidation of the legal entity. The founder himself can decide on this.

Alienation of a share in ownership by the sole founder, however, is possible. And it can be made in favor of a third party. However, before alienation is carried out, this person must be included in the founders with the obligatory entry of data on changes in composition in the Unified State Register of Legal Entities.

Based on the foregoing, we can conclude that, in general terms, the procedure for alienating a share to a limited liability company is the same, regardless of whose benefit it occurs. In each case, the execution of a transaction requires drawing up an agreement, having it notarized, and then submitting an application to make changes to the Unified State Register of Legal Entities. Differences exist only at the preparation stage.

When the composition of LLC participants is changed

The need to change the composition of owners (participants) of a limited liability company (LLC) may arise for various reasons:

- sale of the company to a third party buyer;

- consolidation of the real owner in a single legal structure of a group of companies (for example, its inclusion in Asset Custodian - Management Company LLC, which provides management services to the entire holding and owns key property for it);

- the inclusion of new business partners, investors, and other third parties, for example, the director of an operating company, to increase his motivation for outstanding results of his work (although, as a rule, we rarely support the last reason for changes, believing that a hired employee can be motivated financially other than by giving a share in the authorized capital of the company).

In general, there may be several reasons for changing the composition of LLC participants, as well as legal mechanisms for their implementation. At the same time, the choice of each of the instruments must be carried out taking into account the economic interests of both the former participant of the Company and the future, expressed, first of all, in the occurrence or absence of tax obligations for them under the transaction. You also need to remember the financial consequences for society itself in some cases.