Last update: 05/15/2021

Question:

I bought an apartment for myself and my child. Is it possible to get a tax deduction for children? And how to apply for a personal income tax refund when buying an apartment only for a child?

Answer:

Yes, parents can receive a tax deduction for their children if they include them among the owners when buying an apartment (for example, in shares). Moreover, it does not matter whether the child owns only a share of the apartment (along with the shares of the father and mother) or whether the property is entirely registered in the child’s name.

How it's done? There are some peculiarities here.

Since January 2014, more or less clear guidelines on this matter have appeared in the law. It says that parents who buy an apartment as the property of their minor children have the right to receive a property tax deduction the restrictions specified in the same article . And the limitation is the maximum possible deduction amount available to one person when buying a home - this is 2,000,000 rubles .

In other words, if a child under 18 years of age becomes the owner of the purchased property, then due to the fact that he himself does not earn money and cannot exercise his right to deduction, he, as it were, transfers the exercise of this right to his parents. And the father or mother receives a property deduction not only for their share, but also for the child’s share .

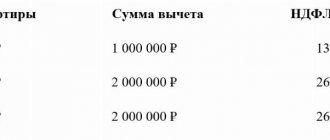

The child's share in some cases (see example below) allows parents to increase the amount of deduction available to them to the maximum. And from this maximum, issue yourself a personal income tax refund (13% of the deduction amount) for the purchase of an apartment. This usually happens when the parent’s share in the purchased property does not allow him to receive a tax deduction to the maximum extent. Then the parent supplements his deduction amount (for example, 1.2 million rubles for his share) with the deduction amount for the child’s share (0.8 million rubles). As a result, the maximum possible amount of tax is returned to the family = (1.2 million + 0.8 million) x 13% = 260,000 rubles.

What you need to know about the rights of minor children in an apartment purchase and sale transaction - see the Glossary at the link.

The owners of the purchased apartment may also include several minor children . Then the parents can, by agreement, distribute among themselves property deductions for the shares of their children, increasing each of their deductions. But regardless of whether a deduction is claimed for one or more children, its amount cannot exceed the limit of 2,000,000 rubles. per parent .

At the same time, the child’s formal consent to the transfer of his property deduction is not required at all; the parents themselves have the right to decide for him.

To make it clearer, below is a clear example of calculating the property tax deduction when purchasing an apartment with registration of a share of ownership for a child.

And for those who do not really understand what this deduction is and how it is applied, we advise you to first read about it in the Glossary - Tax deductions when buying an apartment (personal income tax refund).

Do you own an apartment? Don't forget about real estate taxes. When and how much to pay, what benefits exist - see the link.

This type of deduction can be used both when purchasing an apartment on the primary market (under an Equity Participation Agreement) and on the secondary market (under a Sale and Purchase Agreement).

The right to this deduction arises at the moment when:

- the shareholder signs the Apartment Acceptance and Transfer Certificate (in the primary market); or

- at the time of registration of ownership of the buyer (in the secondary market).

A property deduction (personal income tax refund) is provided to each owner (including a minor child) in the amount of expenses incurred for the purchase of housing, but not more than 2,000,000 rubles. (maximum).

By “expenses incurred” for each owner is meant (for tax purposes) the corresponding amount of his share, expressed in rubles. For example, 1/3 of a share in an apartment purchased for 9 million rubles. implies that the owner of this share “incurred expenses” of 3 million rubles. Of these, from 2 million rubles. he can get back 13%.

it is impossible for the parent to receive a tax deduction for the child’s share , since the amount of deduction available to the parent is already maximum.

You can increase your deduction amount at the expense of the children’s share only when purchasing an apartment of lower cost, when the parents’ shares expressed in rubles are less than 2,000,000 rubles . Then the children “come to their aid.”

How to buy an apartment for a child? Is it possible to register ownership only in his name, and how to do this correctly?

Who can claim a property deduction and when?

Property deduction is a taxpayer’s ability, established by tax legislation, to:

- return part of the personal income tax previously transferred to the budget;

- not pay tax at all or reduce its amount.

A person who has committed certain manipulations with personal property can receive a property deduction, such as:

- sale of property;

- buying a home;

- acquisition of land for housing construction and (or) implementation of this construction;

- concluding a contract for the purchase of property for state or municipal needs.

A person can count on a property deduction:

- having legal sources of income subject to personal income tax at a rate of 13%;

- being the owner of property (bought or sold);

- who paid for the purchased housing using their own or borrowed money;

- who has completed and sent the 3-NDFL declaration to the tax authorities (with supporting documents and an application for tax refund attached to it).

What personal income tax deductions can you get if you have no income? The answer to this question can be studied in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The following sections will reveal the subtleties and nuances of filling out 3-NDFL and calculating tax in the situation of receiving a property deduction.

IMPORTANT! The declaration for 2021 must be submitted using the new form from the Federal Tax Service order dated August 28, 2020 No. ED-7-11/ [email protected] you can here.

On our forum you can consult on any question you have when filling out the 3-NDFL declaration. For example, in this thread we share our experience on how to independently fill out the 3-NDFL declaration for treatment.

Sale of property and 3-NDFL (filling example)

The need to prepare a 3-NDFL declaration arises for an individual if he:

- received income from the sale of property owned by him;

- owned the sold property less than established in Art. 217.1 and clause 17.1 of Art. 217 of the Tax Code of the Russian Federation MSVI (minimum period of ownership of property).

The Tax Code provides for 2 types of property deductions when selling property:

- 1 million rub. (when selling real estate);

- 250,000 rub. (when selling other property).

Registration of the 3-NDFL declaration:

- mandatory if the period of ownership of the property was less than the MSVI (regardless of the amount of income received from its sale);

- is not required if more than the MSVI has passed from the beginning of ownership of the property to its sale (clause 17.1 of Article 217, subclause 2 of clause 1 of Article 228, clause 4 of Article 229 of the Tax Code of the Russian Federation).

Features of the definition of MSVI are shown in the diagram:

Examples will help you figure out whether to apply for 3-NDFL or not.

Example 1

Tumanov A.A. purchased an apartment in 2013. In 2021, he sold it for RUB 5,243,000. Dates:

- acquisitions - before 01/01/2016;

- ownership - more than 3 years.

Conclusion: filing 3-NDFL and paying personal income tax to Tumanov A.A. is not required.

Example 2

Sidorova G. E. in September 2021 sold an apartment privatized in December 2021 for RUB 3,200,000.

Deadlines:

- acquisition of property rights - after 01/01/2016;

- ownership - less than 5 years.

Conclusion: Sidorova G.E. needs to file 3-NDFL and pay tax.

Example 3

Tokarev S.G. purchased a car in December 2021, which he sold in September 2021 for 240,000 rubles.

Calculation of terms: the car was owned for 10 months. (less than 3 years).

Conclusion: Tokarev S.G. is obliged to report on the income received using the 3-NDFL declaration. There will be no need to pay personal income tax if he exercises his right to a property deduction (240,000 rubles < 250,000 rubles → personal income tax = 0 rubles).

We will tell you how Tokarev S.G. fill out 3-personal income tax in the next section.

Declaration and Convention on the Rights of the Child: differences

The Convention is a legal document, but the Declaration is not.

The Declaration provides for the same rights for all minors in upbringing, education, welfare, physical and spiritual development, and it does not matter what race the child is, what language he speaks, what religion he professes, etc.

Everything that is written in this declaration carries a call to parents, governments, and public organizations to respect and recognize the rights of children, as well as provide assistance in their implementation.

The Convention determines the will of minors to receive education, to spend rest and leisure, and to use other services of states that are members of the UN and have signed this document. This Convention is the first and main international legal document defining the rights of minors. The convention was signed by all countries that are members of the UN, except the United States and Somalia.

Right to citizenship and right to a name given by parents

This principle means that every person from the moment of birth has the right to his own name given to him by his parents, as well as to obtain citizenship. The latter gives the child the opportunity to have and use certain rights enshrined in the legislation of the country of residence. The question of which state he will become a citizen of is decided differently in different countries. Thus, children born in the United States have the right to obtain American citizenship. It does not matter who his mother and father are. A child born to parents with Russian citizenship automatically receives it, regardless of the country in which this event occurred. If the father and mother are citizens of different states, then most often they themselves decide what citizenship their children will have.

Right to health and social services

The child has the right to grow and develop in healthy conditions. The state is obliged to provide him and his mother (including the prenatal and postnatal period) with adequate care and health protection. He has the right to nutritious food appropriate to his age and needs, quality medical care, adequate housing conditions and entertainment.

The right to help a disabled child

If a child was born physically, mentally, mentally or socially disabled, he must be provided with the necessary care, care, education, as well as a special regime and training in connection with his special condition by the state, parents, social and medical authorities.

Formation of the concept of preschool education

As a type of pedagogical institution, the first kindergarten was organized at the beginning of the 19th century in New Lanark (Scotland) by the utopian socialist R. Owen - the so-called “school for small children.”

The very name “Kindergarten” (German: Kindergarten) came from Germany, it was invented in 1837 by the teacher Friedrich Wilhelm August Froebel. He also created an institution for games and activities for young children in the city of Bad Blankenburg. This institution existed for only about two years. He came up with the name “Kindergarten” from the consideration that children are the flowers of life, requiring skillful and careful care, and they should be raised by gardeners.

Froebel saw the kindergarten primarily as a school for mothers. The Italian physiologist and doctor Maria Montessori proposed her “Children’s House” as a replacement and continuation of family education with the goal of preparing children for life: teaching them how to dress, wash, set the table, eat, cook partly, wash dishes, clean their room and their toys, and also prepare for school by giving initial reading and writing skills. Montessori replaced desks and benches with light children's furniture that children themselves can carry. The children cleaned up their own dishes after meals, washed themselves and went to the toilet. The Montessori system presupposed the presence in the kindergarten of a playground with a corner reserved for a vegetable garden, where there were agricultural implements adapted for children. According to her concept, in her orphanage, children are masters and workers. At the same time, she emphasized the individual development of the child’s feelings, in which the interaction of children in a team and the actual goals of education faded into the background. Therefore, the Russian teacher Sergei Iosifovich Gessen criticized Montessori for being mechanical, neglecting play and imagination, children’s creativity, while Froebel focused on the growth of the child’s personality, requiring increasingly complex and versatile material that would “address his soul as a whole.”

Gessen concludes that “the isolation of individual feelings that characterizes the Montessori system must necessarily continue within the children’s community, in the children’s relationships with each other.” Rejecting all punishment, Montessori still admits that coercive methods must be used - for example, isolating naughty children in a corner, away from children's company.

The concept of education is determined entirely by the material to be educated. What should educate?

- this is the question that she only poses, naturally answering it: it is necessary to educate in a person everything that physiology and psychology finds in him!

Therefore, she quite consistently includes in her system of education the education of, for example, taste and smell, without even asking herself the question: why is the development of these senses necessary, what purpose can it pursue... A comprehensively developed person is not one who has developed vision, hearing, touch, smell, but above all, one who has become familiar with all the values of culture, that is, masters the method of scientific thinking, understands art, has a sense of law, and has an economic mindset.

In this regard, Froebel understood the task of educating a child much more deeply.

Kindergartens in modern Russia

At the beginning of the 21st century, there are more than 45 thousand preschool institutions in Russia. The modern preschool education system consists of nurseries, kindergartens, short-stay groups for children, and preschool education centers.

How to write a character reference for a child

When compiling, it tells about all the qualities and characteristics of a person. This document must always be present in the child’s card so that when transferring to another kindergarten or school there is an initial idea of the child.

Features of gaming activities

Play is an accessible activity for children. In the game, abilities and capabilities are fully revealed, thinking, emotional state, activity, communication and behavior in society are manifested.

With the help of games, children not only develop, but also go through the process of education. Interests and inclinations are revealed.

Features of the emotional-volitional sphere and personality

This paragraph describes emotions and feelings. How often can your mood change? To which he may react inappropriately. Can he control his actions?

Are there any negative aspects of character? All these qualities are well manifested in society.

How children's characteristics are formed

The starting point in the formation of a child’s individual characteristics is the psychotype, which is a hereditary factor. A balanced, calm baby will be able to learn to read faster, since he has a tendency to work hard. While his active, hyperactive friend will begin to walk earlier and will have a developed body.

The conditions in which a preschooler grows and develops are of no small importance. It is desirable that the child is constantly in the process of active learning - there are educational toys at home for learning and mental education, there are many friends in kindergarten, and the mother tries to regularly spend time with him. If the offspring is not given attention and needs are not taken care of, he will lag behind his peers.

In addition to providing conditions for personality development, pedagogical education plays an important role. It is desirable that the kindergarten and the family work in the same direction, instilling in the ward the same values and standards of behavior. Then the preschooler will not only learn to read and count on time, but also master other important skills. He will have a sufficient basis for moral and emotional evolution - the ability to empathize, express his love, and restrain aggression.

Age and individual developmental characteristics

Child psychologists argue that the foundation of basic life principles is created at an early age. At the same time, in the preschool period, the child’s personal characteristics are intensively formed. Kindergarteners begin to show their character and inclinations more clearly. This is explained by the development of speech - communication skills with peers and adults, the emergence of new aspects of cognition and the emergence of fresh forms of activity. At the same time, from 2 to 3 years of age, the ability to control objects or tools develops more actively, and from 3 to 4, the ability to imitate adults and be included in social life through play.

Position, occupation

If the candidate’s place of work or service is indicated, it is necessary to indicate the position held.

If the candidate does not have a place of work or service (and, accordingly, the position held), his occupation (documented activity of the candidate that generates income for him) or the status of a non-working candidate is indicated: pensioner, unemployed, student (indicating the name of the educational organization), housewife (householder) ), temporarily unemployed.

When indicating the status of a non-working candidate as “pensioner”, you should not write “pensioner of the Ministry of Defense”; the word “pensioner” should be in the masculine gender (you should not write “pensioner”).

The name of the position is indicated in accordance with the employment contract, service contract or staffing table.

When indicating a position, it is recommended not to repeat the name of the government body, organization or institution recorded as the place of work (with the exception of the positions “head of administration”, “member of the Federation Council”, but in these cases you should not write the full name of the place of work, but only the words “ administration" and "Federation Council").

Filling out 3-NDFL when selling a car

We use the data from example 3 of the previous section to fill out the 3-NDFL declaration with a property deduction.

Example 3 (continued).

Tokarev S.G. studied the structure of 3-NDFL and came to the conclusion that he will need to fill out the following declaration sheets:

- title page;

- section 1;

- section 2;

- Annex 1;

- Appendix 6.

Step 1. Tokarev began filling out the declaration with the title page. Here he indicated the correction number (for the primary declaration - 0), full name, data on the date and place of birth, citizenship and passport of S. G. Tokarev and other required information in the fields proposed for filling out.

Step 2. Next, he filled out Appendix 1 “Income from sources in the Russian Federation”

To further enter data, Tokarev S.G. used information about the buyer of the car from the sales contract:

- Entered information about the source of income payment on page 060 - the buyer of the vehicle. Since the buyer is an individual, Tokarev S.G. indicated only his full name.

- Information about income received:

- on page 020, the value 03 is the income code, meaning the sale of other property;

- on page 070 - 240,000 - the amount received from the sale of the vehicle.

Step 3. Next, Tokarev proceeded to filling out Appendix 6 “Calculation of property and tax deductions.” To do this, in p. 070, clause 3.1, he indicated the amount of property deduction in the amount of 240,000 rubles.

Step 4. In this step, Tokarev filled out section 2, indicating on page 010 the amount received for the car, and on page 040 - the amount of property deduction.

Step 5. Since the amount of tax payable is zero, in section 1 Tokarev indicated the value 0 on page 050, and on pages 020 and 030 KBK and OKTMO.

What documents are needed for property deduction?

For Tokarev S.G. from the example considered, the list of documents attached to 3-NDFL for obtaining a property deduction consists of 3 points:

- copy of passport (pages with personal data and registration);

- a copy of the car purchase and sale agreement;

- copies of payment documents.

When an individual applies for a property deduction when purchasing real estate, the list of documents for the 3-NDFL declaration will differ depending on the type of real estate and the form of its acquisition (see example in the diagram):

The taxpayer may need an additional document - a special notification from the tax authorities confirming the right of an individual to a property deduction (the notification form was approved by Order of the Federal Tax Service of Russia dated January 14, 2015 No. ММВ-7-11 / [email protected] ), if:

- expenses have been incurred for the purchase or new construction of real estate (including the payment of interest on repayment of targeted loans) - a property deduction for such situations is provided for in subclause. 3–4 p. 1 tbsp. 220 Tax Code of the Russian Federation;

- the individual intends to receive a property deduction at his place of work (clause 8 of Article 220 of the Tax Code of the Russian Federation).

To receive a notification, you must contact the inspectorate at your place of residence with an application and supporting documents.

What documents will be needed to receive notification, from what month and in what volume a property deduction will be provided at the taxpayer’s place of work, see here.

Peculiarities of registration of information about the place of work and position/occupation

Place of work: legislative (representative) body.

If a candidate is a deputy of a legislative (representative) body of state power or a representative body of a municipality, then “deputy” must be written in the title of his position.

The full name of the relevant legislative (representative) body is indicated as the place of work, and the position is either “deputy”, or after the word “deputy”, additional information about the work of the deputy in this body (in a commission, in a committee, etc.) is indicated, separated by a comma. P.). The name of the body of legislative (representative) power, the representative body of a municipal formation is indicated in accordance with the Constitution of the Russian Federation, the constitution (charter) of a subject of the Russian Federation, the charter of a municipal formation. For example:

Federation Council of the Federal Assembly of the Russian Federation, member of the Federation Council, member of the Social Policy Committee;

State Duma of the Federal Assembly of the Russian Federation, deputy;

State Duma of the Federal Assembly of the Russian Federation, deputy, member of the Transport Committee;

State Duma of the Federal Assembly of the Russian Federation, deputy, chairman of the Committee on International Affairs;

N regional Duma, deputy, chairman;

Meeting of deputies of the municipal formation "Plesetsk Municipal District", deputy, deputy chairman;

Council of the municipal formation "Closed administrative-territorial formation of Znamensk N-region", deputy.

The main place of work is the executive authority.

If the place of work or service is an executive authority, then the name of the position is indicated in accordance with the law, another regulatory act or in accordance with the employment contract (service contract).

The main place of work is a political party, public organization.

The names of positions in a political party, public organization (its regional or other structural unit) are indicated in accordance with the entry in the work book or a document confirming the specified information and signed by an authorized person of a political party, other public association or an authorized person of the corresponding structural unit of a political party, other public association. For example:

Head of the Central Executive Committee of the All-Russian Political Party “N”;

Deputy Secretary of the General Council of the Party;

Secretary of the Republican Committee of the N-th republican branch of the political party “M”;

member of the Board of the local Novoselkovsky branch of the Political Party “K” in the N region;

Chief of Staff of the regional branch of the political party “A” in the Udmurt Republic.

Formulas for calculating personal income tax when buying and selling property

Calculation of personal income tax when purchasing property

When purchasing real estate, the taxpayer can return part of the personal income tax from the budget. Standard formulas for calculating tax refunded from the budget (NDFLreturn) are as follows:

1. Property acquired without borrowing:

Personal income tax return = RN × 13%, if RN ≤ 2 million rubles,

Personal income tax return = 2,000,000 rub. × 13% = 260,000 rubles, if pH > 2 million rubles,

where РН – taxpayer’s expenses for new construction or purchase of housing;

2 million rub. – maximum property deduction when purchasing property.

2. A targeted loan (credit) was used to purchase real estate:

Personal income tax% = RP × 13%, if RP ≤ 3 million rubles,

Personal income tax% = 3,000,000 rubles. × 13% = 390,000 rubles, RP > 3 million rubles,

where personal income tax% is the amount of personal income tax refunded when paying interest on a target loan (credit);

RP - interest expenses paid;

3 million rub. – maximum property deduction for interest (if the target loan was received before 2014, the property deduction for interest is not legally limited by an upper limit).

3. The property was partially paid for with maternity capital funds:

Personal income tax return = (RN - MK) × 13%, if (RN - MK) ≤ 2 million rubles,

Personal income tax return = 2,000,000 rub. × 13% = 260,000 rubles, if (RN - MK) > 2 million rubles,

where MK is maternity capital funds spent on the purchase of real estate.

A similar formula is used to calculate tax if the property is paid for using funds:

- employers;

- budget;

- other persons.

4. Real estate was purchased from interdependent persons - in this situation, it will not be possible to return personal income tax, regardless of the value of the real estate, since in this situation the taxpayer does not have the right to a property deduction. The following are recognized as interdependent persons with the taxpayer (Article 105.1 of the Tax Code of the Russian Federation):

- his parents (adoptive parents);

- his children (including adopted ones);

- his spouse;

- his brothers and sisters;

- his guardian (trustee) and ward.

Calculation of personal income tax when selling property

Personal income tax payable (NDFLupl) is determined by the following formulas:

1. Income is received from the sale of land plots, residential buildings, apartments, rooms, garden houses, dachas, as well as shares in the specified property:

NDFLupl = (DPT - 1,000,000 rub.) × 13%, if DPT > 1 million rub.,

NDFLupl = 0, if DPT ≤ 1 million rubles,

where DPN is income from the sale of real estate;

1 million rub. - the maximum property deduction allowed by the Tax Code of the Russian Federation when selling real estate.

Example 1

Soloviev A.P. sold an apartment in 2021 for RUB 1,220,000. In the 3-NDFL declaration, he reflected income in the amount of 1,220,000 rubles. and a property deduction in the amount of 1 million rubles. Personal income tax payable was calculated using the formula:

NDFLupl = (1,220,000 rub. – 1,000,000 rub.) × 13% = 28,600 rub.

Example 2

Vasilyeva T.N. received 643,000 rubles from the buyer in 2021. under the contract of sale and purchase of the dacha. I filed a 3-NDFL declaration, indicating the income received (RUB 643,000) and a property deduction in the same amount. She will not have to pay personal income tax on this transaction (643,000 rubles ≤ 1 million rubles).

2. Income received from the sale of other property (car, garage or other items):

NDFLupl = (DPI - 250,000 rub.) × 13%, if DPI > 250,000 rub.,

NDFLupl = 0, if DPI ≤ 250,000 rub.,

where DPI is income from the sale of other property;

250,000 rub. - the maximum property deduction allowed by the Tax Code of the Russian Federation when selling other property.

Example 3

Two brothers, Stepan and Andrey Tumanov, decided to upgrade their cars in 2021. Before buying new cars, they sold their old cars:

- for 523,000 rub. (Stepan),

- 182,000 rub. (Andrey).

When calculating personal income tax payable, they used the following formulas:

Stepan: Personal income tax = (RUB 523,000 – RUB 250,000) × 13% = RUB 35,490;

Andrey: Personal income tax = 0, since 182,000 rubles. < RUB 250,000

At the end of 2021, both brothers declared their income by filing 3-NDFL. Stepan paid tax in the amount of 35,490 rubles, but Andrey did not have to pay anything.

For calculation formulas used to determine tax liabilities and for financial analysis purposes, please visit our portal:

- “Calculation of the tax burden in 2020-2021 (formula)”;

- “Calculation of the break-even point (formula and graph)”.

Second year of application of the property deduction: repeated 3-NDFL declaration

The situation when a property deduction can be applied for several years is typical for real estate purchase situations. For example, if the amount of personal income tax withheld from the taxpayer’s income (taxed at 13% personal income tax) for the period of filing 3-personal income tax is less than 260,000 rubles, the right to the balance of the unused deduction does not expire, but is transferred to subsequent periods.

Example

In 2021, stamper E. B. Lakhtina bought an apartment on the secondary housing market for RUB 1,760,000. During the specified period, personal income tax = 81,120 rubles was transferred to the budget from her salary. Amount of personal income tax to be refunded from the budget:

- calculated from the purchase price: RUB 1,760,000. × 13% = RUB 228,800;

- possible return (for 2021): RUB 81,120.

The balance of personal income tax that can be returned from the budget in subsequent periods: 228,800 – 81,120 = 147,680 rubles.

In 2021, Lakhtina E.B. got an additional part-time job in another company. At the end of 2021, the personal income tax transferred to the budget from the salary she received from 2 employers amounted to 127,000 rubles. - Lakhtina E.B. can return this amount from the budget by again submitting 3-NDFL and other required documents to the inspection (2-NDFL certificate for 2021, application for personal income tax return, documents confirming the purchase of housing).

The balance of the deduction is 20,680 rubles. (147,680 – 127,000) Lakhtina E.B. will return based on the results of 2021 if she again provides the necessary documents to the tax office.

How to distribute property deductions between parents and children

If an apartment, house, land plot or other residential property is registered to a family, including both parents and children, you can receive a property deduction for children.

Either one or both parents can increase their share. How the deduction will be distributed and who will receive it for the child is specified in the application, which, along with other documents, is submitted to the tax office.

Additionally, birth certificates of all children participating in the distribution of shares are attached.

Reason: letters of the Ministry of Finance of the Russian Federation dated March 14, 2013 N 03-04-05/7-223, July 5, 2012 N 03-04-05/5-845, July 4, 2012 N 03-04-05/5-841, July 3 2012 N 03-04-05/5-822, February 01, 2012 N 03-04-05/5-101.

You can also receive a property deduction for a child if the apartment is registered in the name of a parent, child or other relative.

A similar situation is discussed in the letter of the Ministry of Finance of the Russian Federation dated June 6, 2012 N 03-04-05/9-690.

The main thing is to remember: you can increase your deduction only within 2 million rubles.

Example:

A married couple purchased an apartment for 4 million rubles and registered it as joint shared ownership with their two children. Each family member, as the owner of 25% of the apartment, is due 1 million rubles in property deduction.

Since the children are still minors, the couple decided to distribute the children's shares to themselves - one share for each parent. As a result, adults will return 260 thousand rubles of overpaid personal income tax (13% x 2 million rubles).

Example:

You bought an apartment for 3 million rubles and registered it in the name of yourself, your mother and your minor son. Each owner owns 1/3 of the apartment and can receive a property deduction within this share.

But your child has no income and does not pay personal income tax. In this case, you can increase your share at the expense of your son’s share and return 260 thousand rubles to personal income tax (13% x 2 million rubles).

Results

The use of a property deduction allows you to return personal income tax from the budget (when purchasing real estate) or reduce the income tax payable (when selling property).

When filling out a 3-NDFL declaration for a property deduction, an individual needs to take into account many nuances (tenure of ownership of property, maximum allowed amount of deduction, etc.), and also collect a package of supporting documents (2-NDFL certificates, real estate purchase and sale agreement, transfer and acceptance certificate completed housing construction, etc.).

Sources:

- tax code of the Russian Federation

- Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to write occupation in the application form examples

Not only individuals, but also legal entities can also apply. We do not plan to mislead you, so we must make a reservation right away: not all legal services are provided free of charge. However, free legal advice is available to you 24 hours a day in Moscow and throughout Russia.

Opening of the first BOPS film production facility in Russia. Opening of a second contact center for 300 operators. Celebrating the 10th anniversary of the online store. Opening of the 40th retail store.

Neat owner, original title. The car is accompanied by an AUTOTEKA service report with information on operating history, maintenance, claims to insurance, mileage, etc.

Insurance companies do not have a direct relationship with conducting an independent examination after an accident, but in some cases they may themselves become the initiators of such an examination.

Filling out an application for a foreign passport through State Services