Property deduction when purchasing an apartment in a new building

A property tax deduction for personal income tax can be obtained, in particular, when purchasing an apartment under an equity participation agreement or a share in it.

When purchasing an apartment under a shared participation agreement, the right to a property deduction arises from the moment the buyer signs the Acceptance and Transfer Certificate of Housing.

The deduction amount is no more than 2,000,000 rubles.

For example, if an apartment in a new building without finishing was bought for 1,750,000 rubles. To receive a property deduction in the maximum amount, the cost of its repair can be included in the cost of the apartment, but in the amount of no more than 250,000 rubles (2,000,000 rubles - 1,750,000 rubles). If the apartment was purchased in a new building without finishing for 2,500,000 rubles, then there is no need for repair costs, because maximum amount 2,000,000 rub. (this does not apply to spouses sharing the property deduction).

Read in the berator “Practical Encyclopedia of an Accountant”

Property deduction when buying a home

Features of registration of deductions for finishing

There are several other parameters that must be taken into account when applying for a tax deduction for finishing.

A tax deduction for finishing an apartment can only be obtained if the contract specifies an “unfinished apartment.” If the apartment is completed, the deduction for finishing will be denied. Base: pp. 5 paragraph 3 art. 220 Tax Code of the Russian Federation.

An unfinished apartment must be purchased from the developer. If you buy an unfinished apartment on the secondary market, there is a high probability that you will be denied the deduction.

To begin with, make sure that the contract states that the apartment is sold unfinished. Although in this situation it is impossible to guarantee a deduction. You can refer to Letter of the Ministry of Finance of Russia dated April 20, 2012 No. 03-04-05/9-538, where a similar case was considered.

The contract must indicate that you are buying an apartment without finishing. Not without repairs, but rather without finishing. There is a possibility that the tax authority will refuse to provide a deduction for apartment renovation, indicating that renovation and decoration are different types of work. Reason: letter of the Ministry of Finance of Russia dated July 20, 2012 No. 03-04-05/7-892,

If the developer subsequently undertakes the finishing of your apartment, the contract must indicate which amount relates to the cost of the apartment and which amount refers to the cost of finishing.

Have a question or need to fill out 3-NDFL - we will help you!

To get a consultation

Property deduction for finishing an apartment

According to abc. 12 subp. 2 p. 1 art. 220 of the Tax Code of the Russian Federation, the actual costs of purchasing an apartment, room or share(s) can include:

- expenses for the acquisition of an apartment, room or share(s) in them or rights to an apartment, room in a house under construction;

- expenses for the purchase of finishing materials;

- expenses for work related to finishing the apartment, as well as expenses for developing design estimates for finishing work.

However, expenses for finishing an apartment can be deducted only if the share participation agreement specifies the acquisition of an unfinished apartment (rights to an apartment) without finishing or a share(s) in it

.

If it is impossible to determine under the contract that an unfinished apartment is being purchased, and also if the contract does not indicate that it was purchased without finishing, then the tax inspectors will refuse a deduction for finishing.

The Ministry of Finance of Russia reminds us of this in letter dated August 6, 2021 No. 03-04-05/63167.

Apartment finishing works include, in particular:

- plastering works;

- carpentry and joinery work;

- interior decoration;

- wall cladding/covering, floor covering;

- installation of windows, window frames, doors.

Please note that it is not possible to take into account costs associated with the redevelopment and reconstruction of premises, the purchase of plumbing and other equipment, registration of transactions, etc.

Read in the berator “Practical Encyclopedia of an Accountant”

Simplified property deduction

What construction costs cannot be included in the deduction?

You will not be able to receive a deduction for expenses for:

- redevelopment or reconstruction of an already built house;

- reconstruction of an already built house (a floor or extension was added);

- installation of plumbing, shower, gas or other equipment;

- construction of additional buildings or structures on the site (for example, a garage, fence, bathhouse, barn, etc.)

Example: Sidorov V.V. built a residential building, a brick garage and a bathhouse on his site. Sidorov can only include in the tax deduction the costs of building and finishing the house.

What if I also have insurance?

First of all, you should draw up an act on the bay and collect documents: insurance certificate, certificate of ownership, passport, says Vadim Bashir-Zade. Then, together with your neighbors, you need to go to the office of your insurance company and write a statement. After this, insurers will come to the neighbors to assess the damage.

Insurance compensation can be received depending on the recognition or non-recognition of the event as insured and on the terms of the contract. Often it is paid to the victim, in some cases to the culprit.

Insurers will compensate for repairs damaged by neighbors only if your civil liability is insured. The presence of a property insurance contract in such a situation has no legal significance, warns Nurida Ibragimova.

What documentation is required to apply for benefits?

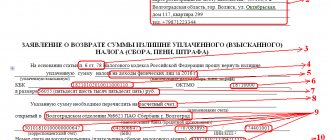

You need to start the procedure for receiving funds by collecting a minimum package of papers. When they are ready, go to the authorized authorities. In a standard situation, you need to collect the following documents for a tax deduction for repairs:

- confirmation of income (form 2NDFL);

- 3NDFL declaration and a copy of the housing purchase agreement;

- all acts and certificates proving rights to real estate;

- checks and other similar papers;

- application, TIN and passport of the applicant.

When submitting repair receipts for tax deduction, be sure to include specific materials. If there are invoices or an agreement with the construction company, attach them too. The certificate confirming the applicant's income will have to be marked with the seal of the employing company. This document must bear the signature of the manager.

The certificate and declaration are provided only in originals. And all contracts must be copied. Moreover, the agreement confirming the purchase of the object must contain information that it was transferred to the new owner without finishing. The application must indicate the details of the account to which the funds will be credited. One of the shareholders is a minor; a birth certificate of such an owner will be required.

Recommended article: How to properly file a tax deduction after refinancing a mortgage

In order to easily receive a tax deduction for home renovation, you need to pay special attention to filling out the 3-NDFL declaration (Instructions for filling out 3NDFL). It will take approximately three months to check the package of documents and application. The Federal Tax Service found inaccuracies or the necessary paper is missing - they will refuse compensation. The payments themselves are made in stages.

Extracts from the Unified State Register, certificates, acts of transfer of an object, etc. are used as documents confirming ownership rights. If you have taken out a mortgage loan with a bank, you will have to attach the corresponding agreement. It is advisable to take with you not only copies, but also originals. Although a lot depends on through which authority you submit the package of papers.

What to do if the apartment was purchased with a military mortgage

According to the law, when using someone else's funds (sponsor, employer, etc.) to purchase housing, a refund of personal income tax paid is impossible. Military mortgage involves the use of funds allocated from the savings-mortgage program (NIP). This means that when purchasing real estate, a serviceman does not spend his own money, which means he should not expect a return.

However, there are cases when you can count on such payments.

- Provide a package of documents containing a list of finishing materials for tax deduction, proving that your own funds were spent on their payment.

- The cost of housing in the mortgage agreement is greater than the amount of compensation under the NIP - 13% of personal income tax is returned from the difference between the two amounts.

Having in hand documents proving one of the above facts, you can count on tax benefits in the form of a 13% refund. Otherwise the procedure remains standard.

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Publication dateJuly 17, 2019October 25, 2019

Where to apply for tax benefits

Knowing how to return a tax deduction for apartment renovation, you also need to understand which department to apply for such a payment. The only authority is the Federal Tax Service, but there are different options for receiving funds.

- You can submit your application and papers directly to the tax authorities. Then you will need proof of income (2NDFL) and a declaration (3NDFL). The application must indicate the account details where the specific amount will be transferred.

- The second option is to apply through your employer. Then you won’t have to confirm your income and fill out a declaration. Along with the rest of the papers, you should come to the Federal Tax Service. After consideration of the application (within a month), a notification will be provided here. It is sent to the accounting department of the company where the applicant works. In this case, obtaining a tax deduction for apartment renovation is possible by refusing to pay 13% income tax.

- Or you can submit an appeal through the State Services portal. You only need to register, prepare the above documents (the declaration is filled out online), and fill out the application through your personal account.

In the first case, you can send an application to the Federal Tax Service in person, by mail or through a representative. But you will have to obtain a certificate from your place of work yourself. To eliminate the risk of refusal, you should first consult with a lawyer.

Are your neighbor's actions legal?

The neighbor’s actions are not conscientious, but they do not contradict the law, notes Nurida Ibragimova, head of the quality control department of the Amulex National Legal Service.

According to Arbat MCA lawyer Vadim Bashir-Zade, if the receipt does not specify the grounds for the transfer of funds, then it will not be possible to challenge the actions of the neighbors. “If it is impossible to conclude from the receipt that the money was transferred to compensate for damage from the bay, then there will be no unjust enrichment on the part of the neighbors in this case,” says the expert.

Moreover, if the receipt had been drawn up correctly, then you would not have to overpay twice. “If the neighbors hid from the insurance company the fact that they were compensated for the damage by receipt, then the insurance company will not be able to recover funds through subrogation [that is, demand compensation from the culprit - Sravni.ru],” says Bashir-Zadeh.

Tax deduction documents

Save checks, receipts, bills, receipts. The contents of the documents must directly indicate the purchase of finishing materials.

Keep in mind that the cost of construction tools is not deductible and only materials are taken into account. In addition, equipment cannot be taken into account in the deduction: split systems, plumbing fixtures, etc.

Carefully draw up contracts with contractors. Indicate all details of individual entrepreneurs and construction organizations, check seals and signatures.

When concluding an agreement with an individual, enter his passport details. If you work with a master without a contract, the cost of services will not be taken into account in the tax deduction for finishing the apartment.

Our experts will check your documents to obtain a tax deduction

Check documents

How is the benefit assigned?

The general rule is this: compensation for contributions for major repairs to pensioners and other beneficiaries is calculated based on the contribution per one square meter of total housing area per month, and it is determined by the regions.

This benefit is a refund of money paid on monthly receipts. If there are debts, payments are suspended.

If a citizen returns to work, the 50% compensation for capital repairs to pensioners over 70 years of age will no longer be paid. In addition, the benefit stops if a working relative is registered.

This measure of social support is not provided automatically, but upon application from the first day of the month following the month of application.

IMPORTANT!

In addition to the minimum contribution, local authorities also set a standard for the standard area of housing, and if the apartment is large, then even 100 percent compensation for major repairs for pensioners over 80 years of age will not cover the entire payment.