Back in 2003, the Federal Law “On Currency Regulation and Currency Control” (No. 173-FZ of December 10, 2003) was adopted. But we all buy apartments and other real estate for rubles, what does this law have to do with it, you ask? But what does it have to do with...

According to this law, the use of rubles as a means of payment for transactions between residents and non-residents is also considered a currency transaction.

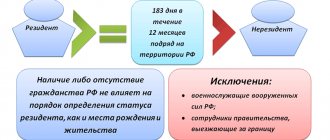

Residents here (we are talking about individuals) mean citizens of the Russian Federation and foreign citizens and stateless persons permanently residing in the territory of the Russian Federation on the basis of a residence permit. All others are non-residents.

Do not confuse this with the concepts of tax residents and non-residents. Here it is interpreted exactly as written above.

Thus, if a resident bought an apartment or other real estate from a non-resident, or vice versa, a non-resident made such a purchase from a resident, then this is the settlement of the transaction - this is a foreign exchange transaction.

Risks when buying an apartment on your own

Real estate purchase and sale transactions involving non-residents and foreigners have become a source of significant financial risks, along with the legal defects of the real estate itself. At the same time, both sellers of Russian real estate and buyers do not pay any attention to the danger posed by the seemingly “formal” stage of a real estate transaction – settlements under the contract. For violations of currency legislation when paying for an apartment in Russia, it ranges from 75 to 100% of the transaction amount. Moreover, depending on the specific circumstances, both parties to the transaction - both the seller and the buyer - may be subject to this fine.

Results

The income of non-residents received from sources in the Russian Federation is subject to personal income tax at a rate of 30%, with the exception of income in the form of dividends and labor income of certain categories of non-residents. At the same time, non-residents cannot reduce their income by tax deductions provided for in Art. 218-221 Tax Code of the Russian Federation.

Sources:

- Tax Code of the Russian Federation

- Resolution of the Constitutional Court of the Russian Federation dated March 1, 2012 No. 6-P

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Currency resident and foreigner - the relationship between concepts and significance for currency control

Currency resident of Russia - individuals who are citizens of the Russian Federation (Article 2 of the Law of the Russian Federation “On Currency Regulation and Currency Control” No. 173-FZ). Foreigners can also become currency residents of the Russian Federation if they permanently reside in the Russian Federation on the basis of a residence permit provided for by the legislation of the Russian Federation, foreign citizens and stateless persons.

Foreign exchange non-resident - individuals who do not comply with the above rules. The above provisions of Article 2 of the Currency Law have been in effect since 2021, and have a significant difference from the previously valid edition - 2017. Citizens of the Russian Federation are always currency residents of the Russian Federation . Foreigners - Non-citizens of the Russian Federation, are non-currency residents of the Russian Federation, but in certain circumstances, foreigners become currency residents. The significance of resident/non-resident status for real estate transactions - when performing currency transactions, a resident is obliged to comply with the currency legislation of the Russian Federation.

Insurance premiums

In addition to income, Russian employers transfer monthly insurance contributions from payments to employees. Contributions go to different funds and are intended for different purposes:

- pension;

- health insurance;

- insurance in case of maternity or temporary disability (VNIM);

- insurance against accidents at work or occupational diseases.

Pensions are in charge of the Pension Fund, medical insurance is in charge of the Federal Compulsory Medical Insurance Fund, and insurance of accidents at work is in charge of the little-known FSS. PHOTO: fss.ru

The status of a foreigner affects what contributions are assessed to him.

- Pension contributions (22%) and insurance in case of temporary disability (1.8%) are deducted from payments temporarily staying foreigners

- Pension (22%), medical insurance (5.1%), and VNiM insurance (2.9%) are deducted from payments made temporarily (TRP) or permanently (PRP) to IG residents as well as residents of the EAEU

- Pensions (22%) and VNiM (2.9%) are deducted from payments to highly qualified specialists

What are the risks of settlements in real estate transactions if a foreigner is involved in the transaction?

For carrying out prohibited currency transactions or for carrying out currency transactions in violation of the law, liability is established in the form of fines from 4,000 rubles to 100% of the currency transaction.

Currency transactions are controlled by banks and the Federal Tax Service of the Russian Federation (FTS RF) represented by territorial tax inspectorates. Since the Federal Tax Service receives information about 100% of transactions online, and a significant part of transactions go through banks, it is not at all difficult for a citizen of the Russian Federation to “get into” a controversial situation.

Russian currency legislation is confusing and prohibitive in many respects.

Since 2014 legislation has changed significantly and repeatedly, which in total has led and continues to lead to massive violations of foreign exchange transactions. For example, parties to a transaction should not be reassured by the legal provision according to which currency transactions between residents of the Russian Federation and non-residents are carried out without restrictions. This phrase in the law “On Currency Regulation and Currency Control” is easy to read, remember, and creates a false impression.

Most realtors, and even notaries, do not know another article, according to which settlements when carrying out currency transactions are made by resident individuals through bank accounts in authorized banks . This means that under an apartment purchase and sale transaction, settlements between a resident of the Russian Federation and a non-resident of the Russian Federation in cash Russian and foreign currency are prohibited. For violation of such a ban, a fine of 75-100% of the amount of the currency transaction is established. (Part 1 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation) Contains the law on currency regulation and other surprises. In 2021, information appeared about the facts of claims regarding transactions with non-residents.

Is it still possible to reduce the income of non-residents?

There is no judicial practice on this matter, so an alternative point of view may theoretically exist, but it has not appeared anywhere and has not proven its validity.

Nevertheless, we will present arguments in favor of this approach. So, in paragraph 4 of Art. 210 of the Tax Code of the Russian Federation states that tax deductions determined by Art. 218–221 of the Tax Code of the Russian Federation, do not apply to non-residents. However, this rule does not say that the tax base cannot be reduced by the amount of expenses if they are related to the purchase of subsequently sold property. That is, there is no direct ban on such an operation in the Tax Code of the Russian Federation.

And since it is not called a tax deduction, then refer to clause 4 of Art. 210 of the Tax Code of the Russian Federation as containing a prohibitive norm is incorrect.

In addition, there is another position that speaks in favor of such a decision. It is contained in the very definition of income established in Art. 41 Tax Code of the Russian Federation. Income represents an economic benefit in kind or in cash, if such benefit can be measured.

In relation to this situation, personal income tax should be levied only on that part of the income that can be considered economically profitable. And this benefit can only be assessed by subtracting the costs of purchasing property from total income. This right is provided by sub. 2 p. 2 art. 220 Tax Code of the Russian Federation. That is, income tax from non-residents can theoretically be levied on net income, the definition of which is contained in the resolution of the Constitutional Court of the Russian Federation dated March 1, 2012 No. 6-P (clause 2), dated March 13, 2008 No. 5-P (clause 3).

However, given the lack of judicial practice on this issue, before submitting a tax return, it is better to make a request to the tax authority with a request to indicate the most correct path.

Find out how to pay insurance premiums for highly qualified specialists by getting free trial access to ConsultantPlus.

Currency transactions in real estate transactions

There is a misconception that currency transactions are the purchase and sale of foreign currency, and therefore, in a real estate transaction with payment in rubles, there are no currency transactions, which means that currency legislation can be ignored when purchasing and selling real estate in Russia.

According to Russian currency legislation, a foreign exchange operation is a transaction established by law with foreign exchange values and the currency of the Russian Federation (with Russian rubles), with securities, and most importantly, foreign exchange operations are the use of foreign exchange values and the currency of the Russian Federation as a means of payment!

Foreign exchange transactions in real estate purchase and sale transactions in Russia are:

— use between residents of Russia as a means of payment of foreign currency and the currency of the Russian Federation (Russian rubles);

— import into the Russian Federation and export from the Russian Federation of currency values, the currency of the Russian Federation and domestic securities;

- transfer of foreign currency, currency of the Russian Federation from an account opened outside the territory of the Russian Federation to the account of the same person opened in the territory of the Russian Federation, and from an account opened in the territory of the Russian Federation to the account of the same person opened outside the territory of the Russian Federation;

— transfer of Russian currency from a resident’s account opened outside the territory of the Russian Federation to the account of another resident opened in the territory of the Russian Federation, and from a resident’s account opened in the territory of the Russian Federation to the account of another resident opened outside the territory of the Russian Federation;

— transfer of Russian currency from a resident’s account opened outside the territory of the Russian Federation to the account of another resident opened outside the territory of the Russian Federation;

— transfer of Russian currency from a resident’s account opened outside the territory of the Russian Federation to the account of the same resident opened outside the territory of the Russian Federation.

If a non-Russian resident is involved in a transaction with Russian real estate, one currency transaction will definitely be the use of foreign currency or Russian currency as a means of payment. In real transactions there will be several foreign exchange transactions. Violations can be committed in each. The amount of the fine can significantly exceed the amount of the real estate transaction.

Land fee

The amount of land tax does not depend on the citizenship of its owner. Taxpayers are everyone who owns land by right of ownership, perpetual use or lifelong inheritable possession. Land tenants do not pay such a fee.

Payment occurs once a year, before December 31st. The cadastral value of the site is taken as the initial base, and the rate is set by local municipal authorities. However, it cannot exceed:

- 0.3% in relation to agricultural land, plots for personal farming, gardening or vegetable gardening, plots occupied by housing and infrastructure;

- 1.5% for other lands.

What are currency values?

Currency values - foreign currency and foreign securities. Moreover, currency values include cash foreign currency and funds in foreign currency in bank accounts.

Thus, settlements in real estate transactions between residents and non-residents, and sometimes settlements between residents of Russia, may turn out to be foreign exchange transactions. Therefore, currency transactions when making payments for real estate must be identified in advance and settlements must be planned in advance in compliance with currency legislation.

A foreigner buys real estate in Russia - what are the currency transactions?

A foreign buyer of real estate is, in most cases, a foreign currency non-resident of Russia; a seller of real estate in Russia, as a rule, is a foreign currency resident.

Payment for real estate located in Russia under transactions is carried out in cash or non-cash form. Russians do not trust banks and prefer cash payments in rubles rather than in foreign currency.

When preparing to buy real estate in Russia, a foreigner needs to take into account. Payment for real estate in cash foreign currency and cash Russian rubles to a Russian resident is prohibited, and non-cash foreign currency can only be transferred to a Russian citizen to an account in an authorized bank. (Authorized bank is a bank that has a license from the Central Bank of the Russian Federation for operations with foreign currency). Such authorized banks are almost all banks in Russia. Obviously, it is convenient and safe to pay through a bank account. But here, too, not everything is simple.

Peculiarities of Russian legislation: The buyer will become the owner of the property only after making a record in the Unified State Register of Real Estate (USRN) of the buyer's rights to the purchased property and a record of the termination of the seller's ownership rights. The period for making an entry in the Unified State Register is 7 working days. Paying even when signing an agreement is dangerous, what if the property is not registered?

Safe payments for real estate transactions in Russia are carried out through a bank - through a safe deposit box or letter of credit, with access conditions (disclosure of the letter of credit). In one case, a foreigner needs to legally receive cash and deposit it in a safe deposit box, in the other, he needs to place money in an account in an authorized Russian bank in Russia (letter of credit). In any of these options, in order to comply with currency laws, a foreigner must legally bring money into Russia - bring in cash or transfer it to an account opened in his name in Russia. At the same time, a resident of the Russian Federation cannot accept cash from a non-resident.

Attention: A foreigner must open an account in Russia in his own name and deposit money into it, or use a bank account to receive funds.

Only then can the funds be used in the transaction for payment.

A different procedure for making payments will lead to a violation of currency laws or to the loss of security of the transaction for one of the parties.

Settlements through foreign accounts of Russian sellers who are residents of the Russian Federation are regularly considered as an option. You should not do this - it is expressly prohibited by law.

A foreigner sells real estate located in Russia

The conditions for compliance with Russian currency legislation and security of payments are similar to the procedure for a foreigner purchasing real estate in Russia, with the exception of two circumstances.

1) Foreign exchange non-residents have the right, without restrictions, to transfer funds from their accounts in authorized banks in Russia to their accounts in foreign banks. Transfers are possible in Russian rubles and foreign currencies. Accordingly, Russian banks, as currency control agents, will verify the legality of foreign exchange transactions performed by a foreigner.

2) When planning to transfer money from the sale of real estate located in Russia to a non-resident’s foreign account, it is necessary to ensure that the amounts transferred by the non-resident from an account in an authorized bank to a foreign account correspond to the amounts specified in the apartment purchase and sale agreement and in other transaction documents. This information is controlled by foreign banks when crediting money to foreign accounts of non-residents by source of origin, in order to detect tax evasion and money laundering.

Accessed December 22, 2021.

Moscow