How to prepare documents for application

If the debt belongs to an individual, it is necessary to file a claim in a magistrate’s court or a court of general jurisdiction, in other words, a district court. If the debtor is an organization, you should apply to the arbitration court.

The activities of arbitration courts are based on uniformity. If a court decision was made in one of the subjects of the Russian Federation, which contains conditions/circumstances suitable for this process, you can refer to it, including on the condition that the decision was made in another subject of the federation. When considering a case and making a decision, arbitration courts are based on judicial arbitration practice.

The BIT.Debt Management program solves the problems of effective management of electronic documentation with the ability to create any documents based on templates with automatic calculation of state duty.

Document templates loaded into the program:

- Pre-trial claim

- Statement of claim

- Application for a court order

- Application for replacement of a party

- Application for initiation of enforcement proceedings

What role does it play?

In practice, one of the most common accounting statements for the court is about debt . Debtor and/or creditor. She simultaneously performs:

- supporting document (duplicates the necessary information from accounting and tax accounting);

- We prove to the court and the parties to the conflict the existence of specific facts.

Also see “Changes in state duty in 2021: how much you will have to pay.”

A package of documents in the magistrate's court and the court of general jurisdiction

To submit an application to a court of general jurisdiction/magistrates' court, a claim must be filed. It is compiled according to the number of defendants, another separate copy is for the court. The list of mandatory components includes calculating the amount of debt. If a penalty is charged, detailed calculation information will also be needed. A description of the amount owed is attached on a separate sheet.

You will also need a copy of the minutes of the general meeting of owners on the selection of a management company or a copy of the minutes on the selection of the chairman of the board. Instead of these documents, the claim may be accompanied by an extract from the minutes of the general meeting, the required details:

- the name of the document is “Extract from the minutes of the general meeting”;

- name of the homeowners association or housing construction cooperative;

- questions regarding the choice of management organization.

The extract is issued for a specific date. It is endorsed as follows: “The extract was compiled as of....., the extract is correct.” The document is signed by the chairman of the board or general director of the management company. An extract from the minutes of the board of directors is prepared in a similar manner. The claim is filed by the organization, therefore the following documents are attached to the claim:

- a copy of the certificate of the main state registration number;

- an identification number;

- payment order for payment of state duty.

The program implements a mechanism for batch sending of documents, which will not allow you to send a batch of documents if any of the documents are not attached.

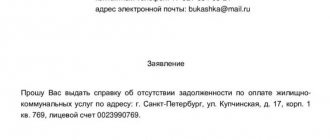

The purpose of issuing a certificate of absence of debt for housing and communal services

A document indicating that the citizen does not have any debt on housing and communal services is not issued in all situations when the relationship concerns residential premises.

The list includes:

- sale of apartment;

- receiving a request from a government agency;

- registration of utility subsidies.

The certificate is for informational purposes only. The act is used to relieve the owner of the premises from the negative consequences resulting from non-payment of housing and communal services.

Please note : the certificate is in written form and is valid for a month after issue.

Where to go for help

Before applying for a document indicating the absence of debt for housing and communal services, you need to consider in what areas the citizen is interested in information.

The following areas of payment can be distinguished:

- rent;

- depositing funds for the consumption of electrical energy;

- for major repairs;

- use of gas and other services.

Depending on what document a citizen needs to draw up, he should contact the authority conducting residential or financial activities. Sometimes the owner needs to collect several such certificates.

Options for applying for the act in question are provided. A citizen can go to a multifunctional center or use the services of a single portal of State Services and a homeowners’ association. In addition, an organization operating in the housing and communal services sector or a management company has the opportunity to issue a certificate.

Documents to the arbitration court

The requirements for applying to an arbitration court are more serious. The package of documents must include a claim with a copy of the receipt for delivery to the defendant. Or a signature will be required to confirm receipt of the notification. The arbitration court is provided with a receipt confirming the preliminary sending of the claim to the defendant. In magistrates' courts, judges themselves send claims to defendants.

Additional documents are attached to the application in the form of an extract from the unified state register of legal entities - for the defendant and the plaintiff. Another mandatory document is copies of contracts, which can be submitted immediately with the application or during further consideration of the case. In the arbitration court, cases are considered quickly and even in the absence of the parties. Therefore, when filing a claim, the preparation of a package of documents must be approached with particular seriousness. The plaintiff can supplement the minimum list with other documents that he considers necessary - an agreement for the maintenance of property, an agreement with resource supply companies.

The debt is calculated in a separate document - broken down by the amount of debt and penalties. The amount of debt can be indicated total or by month; information about accrual and payment is entered into the table. There is no uniform filling standard.

According to the owners, it is unlawful to indicate the total amount of debt. For details, you can make copies of payment receipts for the entire debt period, which indicate the following details:

- name of utilities;

- rates;

- amounts billed to owners;

- if available, meter readings.

The document also contains information regarding the maintenance and repair of common property.

Copies of receipts are attached as additions to the document with calculations of the total amount of debt. The plaintiff can sew them together and sign them in the upper corner as “Appendix No. to the calculation of debt from the date ..”. But this is not a mandatory requirement. The document must reflect the period of debt and the date on which the penalty is calculated. The amount of the penalty is constantly increasing, as it is calculated based on the number of days of delay. If the amount of the penalty increases, then formally the amount of the subject of the claim also increases. Accordingly, it is necessary to increase this amount each time by filing an application to change the claims and pay an additional state fee. And this may serve as a reason for the defendant to file a motion to postpone consideration of the application until the requirements presented are reviewed.

Application documents

In order for the document to be promptly issued at the request of the applicant, it is necessary to transfer the originals or notarized copies of documents to the settlement center, homeowners association or management company:

- passport or other document that identifies the applicant;

- an apartment purchase and sale agreement or a document on receipt of an inheritance, donation, or other form of transfer for full or partial use of real estate, including a rental agreement;

- accurate data from metering devices (you can attach photo printouts from the meters);

- statements or originals of bank documents on payment of fees for housing and utility services.

If you are submitting a package of documents to a specific company providing utility services, and not to the ERC, it is enough to show your passport, contract and digital information on electricity or water metering. As a rule, these companies have payment statements, since they are promptly received by the company from banking institutions.

If the homeowner requests the issuance of a certificate, and the utility organization refuses to provide it to him, then the applicant has the right to point to the norm of the Code of Administrative Offenses. Refusal to provide information to a citizen or lawyer may have consequences.

Information about a citizen’s current obligations to a company or municipal enterprise for utility bills refers to the list of information that a citizen has the right to receive in a form convenient for him. That is why delay in issuing a certificate is an illegal action, which is punishable by a fine.

Procedure for filing a claim

In arbitration and magistrate courts, as well as courts of general jurisdiction, the algorithm of actions will be different. The process of applying to courts of general jurisdiction and magistrates' courts includes several simple steps:

- filing a claim;

- preparation of documents;

- payment of state duty;

- submitting an application.

As mentioned above, the claim is drawn up according to the number of defendants, and another copy is prepared for the court. If the plaintiff submits documents to the court on his own, he needs to prepare an additional copy, which will have a stamp on acceptance of the claim or a covering letter. If documents are sent by valuable mail with a list of attachments, an additional copy is not required.

Procedure for filing a claim

To file a claim in arbitration court, the claim is initially sent to the defendant. Upon expiration of the debt repayment period:

- a claim is filed;

- all documents are prepared;

- state duty is paid;

- the plaintiff sends a statement of claim to the defendant with a package of documents;

- then the plaintiff attaches a receipt to the statement of claim for delivery to the defendant and submits documents to the court.

The statement of claim is also submitted to the arbitration court by the number of parties, third parties are taken into account. All copies are certified with the inscription “Copy is correct. Chairman full name." Certified by the seal and signature of the chairman/general director of the management company. At their discretion, district and arbitration courts may request original documents.

Amounts of state duties

The amount of fees for filing claims in courts of general jurisdiction and arbitration courts will differ. The fee for a claim for collection of non-payments in the magistrate's court is set as a percentage. For a statement of a non-property nature, for example, about recognizing the actions of the owner as invalid, the state fee is 4 thousand rubles. For supervisory appeals, the fee is 50% of the initial fee. The amount of the fee to the arbitration court is calculated using a similar scheme, but in this case the amount for monetary claims will be different.

Changes are regularly made to the Tax Code, including changes to the amounts of state duties. In case of incomplete payment of the fee, the judges will leave the claim without progress. If the amount of the fee is large and there are not enough available funds, an application to reduce the amount of the fee is drawn up. But this will require a strong economic justification:

- difficult financial situation;

- a large number of debtors, while the plaintiff company fulfills its obligations to resource supply companies in a timely manner. If there are reconciliation reports, you can attach copies of them and a summary table of the total amount of debt for the object.

The plaintiff may ask to be exempted from paying the fee completely or to reduce the amount of the fee and assign obligations to the defendant.

What is it for?

The main purpose of obtaining such a document is to ensure the financial accuracy of a citizen who owns residential real estate. It will protect the new homeowner from unfounded claims against him regarding payment for utilities.

Government authorities also require the issuance of a certificate, since they undertake obligations to protect the interests of other residents of the house. If a citizen intends to leave the country, including temporarily, he must also report to the state that he has no debts for the energy resources used and home maintenance services.

Certificates of absence of debt on rent and other utility (housing) services are also necessary to confirm the status of a solvent, bona fide bank client. As a rule, such documents are necessary to apply for a loan or open a mortgage agreement.

Drawing up a statement of claim

The statement of claim is drawn up based on the specific circumstances of the case. But there are basic characteristics that must be reflected in the document:

- regulations;

- references to normative legal acts and judicial practice of the courts - Supreme, Supreme Arbitration;

- the period for which the debt arose;

- amount of debt and penalties.

Obligations to pay utility bills and payment terms are established for both owners and tenants. The corresponding rule is specified in Article 153 of the LC. Obligations to pay for utilities arise from legal entities and individuals who act as owners, arising from the moment of registration. Many owners, after receiving property as an inheritance, do not contact the Rosresstra Office to obtain a certificate of ownership. It is from the date indicated in this document that payments for utilities should be made.

In the case of construction, the contract states that the owners are responsible for paying for utilities from the moment the object is transferred under the acceptance certificate. If an individual acts as a tenant and the apartment is not privatized, utilities are charged from the moment the rental agreement is signed.

The Housing Code (Articles 110, 138 and 162) states that if a management company, a housing construction company or a homeowners' association is selected for a building, then all payments are made through the management body. Failure to comply with the terms of the agreement does not exempt the owners from paying for utilities, in accordance with Article 162 of the Civil Code, paragraph 5 of part 3 of Article 67 of the Housing Code, paragraph 7 354 of the Government Decree.

If the parties have entered into an agreement, including orally, and there is a fact of using utilities, the absence of payment or payment in full does not indicate a failure to fulfill the terms of the agreement. This provision is confirmed by Article 438, paragraph 1 of Article 540 and 548 of the Civil Code.

To prove the owner’s obligations, the motivation part can be drawn up on the basis of Article 210 of the Civil Code. You can make an additional reference to Article 249 of the Civil Code and to Wasser’s definition of August 14, 2009, according to which all owners undertake to pay payments in proportion to their share.

If there are several owners, the claim must be brought against everyone, regardless of age. Persons under the age of majority have legal representatives. There is one more nuance regarding property that has several owners. Each of them has certain shares. As a rule, the claim is brought for a total amount, the owners are listed as defendants. The debt is collected from persons who have official income.

Article 249, paragraph 1 of the Civil Code of the Russian Federation of the Plenum of the Supreme Court dated July 2, 2009 No. 14 states that the claim must be brought in separate amounts, divided by each owner in accordance with his shares in property rights.

But courts of general jurisdiction have a different opinion. The appeal ruling of the Moscow City Court dated November 20, 2013 states that if the owners do not independently apply to the management body, where they ask to divide the shares and issue receipts, then the amount of the debt is collected jointly and the division into shares is not made.

When drawing up a statement of claim, the plaintiff may be faced with a situation where registered persons live in the apartment without ownership rights. These may be members of the owner's family. In this case, it is mandatory to register for persons who are subject to requirements on the basis of Part 3 of Article 31 of the Housing Code. All categories of persons, including registered ones, without ownership rights, who are members of the owner’s family, living in the apartment, are required to pay for consumed utilities.

In a non-privatized apartment, demands are initially put forward to collect the debt from the tenant; if he does not pay, then to municipal authorities or the state. A similar rule applies to tenants, especially non-residential premises. If the organization that owns a non-residential premises transfers the property under a lease agreement, the tenant often undertakes to pay for utilities. In this case, the tenant must be named as the defendant.

It is important to consider that initially the claim is granted not to the owner, but to the tenant if the apartment is in state municipal ownership. If the premises are leased, then to the tenant, and only then to the owner, the state or the lessor. The statement of claim must be provided to all registered persons and all owners. A separate article on general meetings and limitation periods has been included in the Civil Code.

Debt collection for housing and utilities in court

Despite the fact that every property owner must bear the burden of maintaining their property, often owners “forget” to pay for utilities. In order to collect the debt and compensate for losses, management organizations and homeowners associations are forced to go to court to collect debts for utility services. This article will discuss how a management organization or HOA can collect debt for utilities.

At what point does the obligation to pay for housing and utilities begin?

In accordance with Art. 153 of the Housing Code of the Russian Federation, the obligation to pay for residential premises and utilities arises from:

- tenants of residential premises under a social tenancy agreement, tenants of residential premises under a tenancy agreement for residential premises of a social housing stock, tenants of residential premises of a state or municipal housing stock, tenants of residential premises under a tenancy agreement for residential premises of a state or municipal housing stock from the moment of conclusion of the relevant agreements

- members of the housing cooperative from the moment of provision of residential premises by the housing cooperative (signing of the act)

- owners of the premises from the moment ownership rights arise

- persons who accepted from the developer

(the person providing the construction of an apartment building) after issuing permission to put an apartment building into operation, premises in this building from the moment of transfer of the premises under a transfer deed or other transfer document - developers

(persons ensuring the construction of an apartment building) in relation to premises in this building that have not been transferred to other persons under a transfer deed or other transfer document, from the moment of issuance of permission to put the apartment building into operation

In addition, family members of the owner of residential premises who are legally capable and limited by the court, living in the residential premises, including former family members who retain the right to use the residential premises, bear joint and several liability with the owner for the obligations arising from the use of this residential premises, unless otherwise not established by agreement between the owner and his family members.

Based on the explanations set out in the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 27, 2017 No. 22, members of the owner’s family are liable only for obligations to pay for utilities. The obligation to pay fees for the maintenance of residential premises (payment for the maintenance and current repairs of common property in an apartment building, as well as utilities consumed during the use and maintenance of common property in an apartment building) and contributions for major repairs is borne only by the owner of the residential premises.

Step-by-step instructions “Collecting debt for utilities in court”

To collect debts for utilities, as well as penalties for late payment or interest under Art. 395 of the Civil Code of the Russian Federation, we recommend adhering to the following algorithm.

Step 1. Clarification of information about the existence of bankruptcy proceedings against the debtor

From the date the arbitration court issues a ruling recognizing as justified an application to declare a citizen bankrupt and introduce the restructuring of his debts (for individuals), supervision (for legal entities), the following consequences occur, in particular:

- the deadline for fulfilling monetary obligations that arose before the court accepted the application is considered to have occurred

- the accrual of penalties (fines, fines), other financial sanctions and interest on a citizen’s obligations, except for current payments, ceases

The procedure for the creditor's actions and the time frame for protecting its property interests in the event of bankruptcy of the debtor depends on the legal nature of the claims against the debtor, as well as on the procedure introduced in relation to the debtor. You can familiarize yourself with the procedure for the bankruptcy of a debtor in the article “Bankruptcy of a debtor: what should a creditor do?” This article will further discuss the actions of the creditor when collecting a debt if the debtor is not bankrupt.

Step 2. Preparation and submission of a claim demanding payment of debt for utilities, other amounts (penalties, interest under Article 395 of the Civil Code of the Russian Federation)

If the debtor is an individual, then when collecting debt for utility services, filing a claim is not mandatory. When considering a dispute between legal entities in an arbitration court, pre-trial settlement of the dispute is mandatory (this requirement is established by the Arbitration Procedure Code of the Russian Federation in relation to disputes regarding the collection of funds under claims arising from contracts, other transactions, due to unjust enrichment). However, in any case, we recommend drawing up and sending a claim for payment of debt for utilities and other amounts. Having received a claim, the debtor can voluntarily satisfy your demands, which will avoid going to court. If he does not, you will have additional evidence of the defendant's dishonest behavior.

We recommend that you detail all your future claims in your complaint. Also indicate in the claim the amount of interest/penalty; to do this, determine the period for accrual of interest (penalty) and provide their calculation. If the claim is signed not by the manager (the person listed in the Unified State Register of Legal Entities), but by a representative under a power of attorney, attach a copy of the power of attorney, which contains the authority to sign such documents.

Send the claim to a legal entity (individual entrepreneur) at the so-called “legal address” - the address contained in the Unified State Register of Legal Entities (USRIP), and to the address indicated by the debtor, for example, in the contract as a postal address. In order to clarify the current “legal” address, use the free service “Check yourself and your counterparty” on the website of the Federal Tax Service of Russia. After widespread mass checks by tax inspectors on the accuracy of the addresses of legal entities, many addresses indicated in the Unified State Register of Legal Entities began to coincide with actual addresses.

The owner-individual must send demands to his place of residence. Also, additionally send the claim to the address of the property, for which no fee is paid.

We recommend sending the claim to the debtor by registered mail with a list of the contents and keeping the postal receipt and list of the contents, since it is advisable to attach these documents to the claim (and when filing a claim in an arbitration court, it is mandatory). When delivering a claim against signature, you must ensure the authority of the person accepting the claim; when the claim is received by a representative, obtain a copy of the representative’s power of attorney. You can additionally send a claim by email or serve it in another way in order to resolve the issue amicably.

What is the deadline for responding to a claim for payment of debt for utilities?

The general claim period is 30 calendar days from the date of sending the claim to the debtor, unless a different period is established in the service agreement (for example, the parties can provide for a claim period of 15 days from the date of sending the claim, or vice versa, increase the claim period, it can also be changed in the contract the moment from which the claim period is calculated, indicating, for example, from the date of receipt of the claim by the debtor). Once again, we draw your attention to the fact that compliance with the claim deadline when filing a claim in a court of general jurisdiction in this category of dispute is not necessary.

Step 3. Preparation and submission of an application for an order (statement of claim demanding the collection of debt for utilities) to the court

Limitation period for cases of debt collection for utility services

Requests for collection of debt for utilities, interest (penalties) for late payment for services provided are subject to a general three-year statute of limitations established in paragraph 1 of Art. 196 of the Civil Code of the Russian Federation. The limitation period for utilities is calculated separately for each late payment. Payment is determined for each day of delay.

As a general rule, in accordance with Art. Housing Code of the Russian Federation, the monthly fee for maintenance and utilities is paid before the 10th day of the month following the expiration of the month (based on the explanations of the Plenum of the Supreme Court of the Russian Federation, up to the 10th day inclusive), unless a different period is established by the management agreement or a decision of the members of the HOA, housing cooperative.

Example: When filing a claim in court in July 2021, claims for collection of debt for utilities starting from June 2021 and earlier will go beyond the limitation period.

Also, when calculating the limitation period for collecting penalties (interest) for late payment for services, it is necessary to proceed from the fact that the period is calculated separately for each day of delay.

An example of calculating the limitation period for collecting a penalty:

Payment deadline - November 6, 2017.

The penalty for payment, which must be made before 06.11.2017, begins to run from 07.11.2017, the limitation period for the penalty is calculated for each day of delay, that is, for the day of delay on 07.11.2017 it expires on 07.11.2020, 08.11.2017 - 08.11.2020, etc. A statement of claim can be filed in court even after the expiration of the statute of limitations, but if the defendant in court declares that the statute of limitations has expired, the court will refuse to collect the debt, interest (penalty), for which the statute of limitations for going to court has expired. It is also important to take into account that, within the meaning of paragraph 3 of Article 202 of the Civil Code of the Russian Federation, the parties’ compliance with the claim procedure provided for by law is not counted towards the limitation period, in fact extending it for this period of time (if such a period is mandatory).

At the same time, the defendant may, for some reason, fail to declare the statute of limitations expired (for example, if he does not receive notice of the consideration of the case in court, does not appear in court and does not send written objections, out of ignorance, etc.), in In this case, the court will satisfy the claim. Therefore, when going to court, it is necessary to assess the risks: how high is the likelihood of filing objections, what is the difference in the amount of the state fee paid for consideration of the claim in court, if claims are filed with an expired statute of limitations (if the claims are refused due to the expiration of the statute of limitations, the state fee will not be returned).

Jurisdiction and jurisdiction in cases of debt collection for utility services, procedure for resolving disputes

If the owner of the premises is an individual, then such a case is within the jurisdiction of a court of general jurisdiction. If the owner is a legal entity, then cases of collection of utility debts from the legal entity are subject to the jurisdiction of the arbitration court.

Requirements for individuals to collect debts for payment of housing and utilities, telephone services, not exceeding 500,000 rubles, are subject to consideration in the order of writ proceedings. The exceptions are the following cases: the defendant’s place of residence is abroad; From the documents a dispute about the right is discerned. If a creditor (a management company, a HOA, etc.) files a claim based on these requirements, rather than an application for an order, the court will return the claim.

Applications for the issuance of an order (any claims considered by order, up to 500 thousand rubles), as well as claims for a collection amount of less than 50 thousand rubles, are subject to the jurisdiction of the magistrate court, claims for a collection amount of more than 50 thousand rubles - to the city (district) court .

A claim for collection of arrears of payment for housing and utilities or an application for the issuance of an order shall be filed at the defendant’s place of residence. If the defendant has a debt in relation to an apartment of which he is the owner and in which he is registered, then the claim is filed at this place of residence of the defendant. If the defendant has a debt on an apartment of which he is the owner, but the defendant is registered at his place of residence at a different address, then a claim for debt collection should be filed at the place (address) of registration of the defendant. In this case, the claim must be filed in the court that has jurisdiction over the defendant’s registered address. Otherwise, there will be a violation of the rules of territorial jurisdiction (examples from practice: Appeal ruling of the Moscow City Court dated 04/02/2018 in case No. 33-13900/2018, Appeal ruling of the Moscow City Court dated 03/02/2018 in case No. 33-8168/2018 ).

When filing a claim for collection of utility debt (application for an order), it is important to remember who is the defendant (debtor) for such claims. As we discussed earlier, the obligation to pay for the maintenance of residential premises is established both for the owners of residential premises in an apartment building and for tenants of residential premises under a social tenancy agreement, and in a number of cases such an obligation is established for non-owners using the premises (this mainly applies to to equity holders and shareholders who received the keys to the apartment and signed the transfer and acceptance certificate). If an apartment is owned by several persons, then a claim for debt collection in a joint and several manner is brought against all owners of the apartment (for example, Determination of the Moscow City Court dated June 15, 2018 No. 4g-7642/2018). If members of his family live in the apartment together with the owner, then the defendants in the claim for the collection, jointly and severally, of debts for payment for residential premises and utilities will be the owner and members of his family (for example, Determination of the Moscow City Court dated April 16, 2018 No. 4G-2897 /2018).

A statement of claim may be filed in court:

- through an electronic system for filing documents with the court

- personally or through a representative on the expedition of the ship

- sent by Russian Post or other postal/courier service

How to draw up a statement of claim for the collection of debts for utility services?

Basic requirements for a claim:

- make a claim in writing

- indicate in it the name of the court to which the claim is being sent; data of the plaintiff, defendant, third parties

- describe the requirements in the claim with references to the provisions of the law, contract and other regulations

- indicate the price of the claim (it includes the total amount of the debt that you are asking to collect, as well as accrued penalties, interest; state fees and other legal expenses do not need to be included in the cost of the claim; attach to the claim a calculation of the claims, indicate the amount of the state duty; we recommend that you submit a calculation of the amount to be recovered amounts as an appendix to the claim and indicate in the claim itself that the calculation is given in the appendix)

- when filing a claim with the arbitration court, indicate in the claim the date the claim was sent to the defendant, the claim period

- You can also file a petition for the imposition of interim measures - measures aimed at ensuring the execution of a court decision to collect money, as well as immediately formulate other petitions in the claim, including a petition to obtain evidence from the defendant or other persons

- indicate in the statement of claim a list of attached documents

If the above requirements are not met, the court will leave the statement of claim without proceeding. This will mean suspending the process of accepting the claim for consideration in order to eliminate shortcomings in the preparation and filing of the claim. After the plaintiff eliminates these shortcomings, the court will accept the claim, otherwise the court will return the claim. Errors in the claim, incompleteness of the attached documents can significantly increase the period of debt collection, which is very important in the process of actual execution of the court decision on collection (the financial condition of the defendant can change very quickly).

The heading of the claim indicates the name of the court, details of the plaintiff, defendant, third parties, the price of the claim and the amount of the state duty.

Similar requirements apply to an application for a court order.

Statement of claim for collection of debt for utilities

In your claim for collection of utility debts, please indicate the following circumstances and evidence that confirms them:

- the fact that the plaintiff incurred expenses related to the management and maintenance of an apartment building (performing work to properly maintain residential premises in the house, providing utilities, etc.). Such expenses can be confirmed by agreements concluded by the plaintiff with resource supply, service and other organizations - for example, an agreement for the supply of drinking water and the receipt of wastewater into the city sewer; energy supply agreement for consumers of thermal energy in hot water; heat supply contract; an agreement for the performance of maintenance work on the intra-house gas pipeline and diagnostics of gas appliances, taking into account emergency dispatch support in residential buildings; contract for maintenance of elevators; agreement on deratation, disinfestation, disinfection; a maintenance agreement for the intercom system; contract for the provision of security services; agreement for the provision of services of an entrance attendant (concierge); an agreement on the performance of technical work in an apartment building; an agreement on eliminating accidents in heating, water supply, sewerage and electricity systems; agreement on the removal and disposal of KGM; agreement on the removal of solid household waste; insurance contract for housing stock, civil liability and property (for example, Determination of the Moscow City Court dated October 11, 2017 No. 4g-11994/2017, Appeal determinations of the Moscow City Court dated March 22, 2018 in case No. 33-3031/2018, dated March 16, 2018 to case No. 33-10137/2018). Also, in support of his expenses, the plaintiff can present to the court acts of work performed under the above contracts, acts of acceptance and delivery of services, tariffs, estimates (including operating cost estimates), reconciliation acts, invoices, payment orders, and other documents confirming the fact of actual performance works and provision of services, decisions and minutes of meetings of HOA members, decisions of the arbitration court, decisions on the completion of enforcement proceedings (for example, the Appeal ruling of the Moscow City Court dated April 10, 2018 in case No. 33-15405/2018).

- the fact that the defendant has a debt to pay for housing and utilities to the plaintiff.

The plaintiff can confirm it by presenting to the court an extract from the personal account for the apartment; history of accruals or calculation of accruals (receipts) on the personal account of the apartment; summary statements of charges and payments for residential premises, utilities and other services; a certificate of financial status of the apartment account for a certain period; financial personal account; certificate of payment for housing, utilities and other services; a certificate of accrual and payment for housing and communal services or a certificate of the status of settlements for the payer; turnover sheet for the personal account (tenant's turnover sheet, balance sheet) (for example, Appeal rulings of the Moscow City Court dated 04/10/2018 in case No. 33-14436/2018, dated 03/22/2018 in case No. 33-11404/2018). The presence of a debt on the part of the defendant may also be evidenced by debt receipts and a single housing document, a certificate of debt (certificate of debt growth dynamics), a certificate of debt calculation, an act of reconciliation of accruals (for example, Determination of the Moscow City Court dated May 25, 2018 No. 4g-5940/2018 , Appeal ruling of the Moscow City Court dated 03/06/2018 in case No. 33-9166/2018). Also, the plaintiff can confirm the validity of his claims by calculating the defendant’s debt for a specific period, an addition to such calculation and a certificate according to which all payments submitted by the defendant for the disputed period in question are taken into account (for example, Cassation ruling of the Moscow City Court dated June 30, 2017 No. 4g-8292/ 2017). Typically, the court checks the calculation submitted by the plaintiff, including for its compliance with the tariffs in force at the time of provision of services, established by regulations, and arithmetic correctness (for example, Appeal rulings of the Moscow City Court dated April 24, 2018 in case No. 33-18327/2018 , dated 04/12/2018 in case No. 33-16167/2018). If the plaintiff has not provided evidence confirming the amount of the defendant’s debt, its calculation and collection period, the court refuses to satisfy the claim against the defendant in whole or in part (for example, Determination of the Moscow City Court dated April 13, 2018 No. 4g-2073/2018).

These circumstances, based on judicial practice, are the subject of consideration of a dispute regarding the collection of debt for utilities.

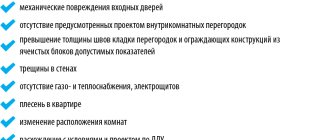

In this category of disputes, the defendant may file counterclaims (counterclaims), including:

— on the obligation to recalculate fees for utilities and housing maintenance (for example, Resolutions of the Moscow City Court dated May 25, 2018 No. 4g-6795/2018, dated March 30, 2018 No. 4g-4053/2018);

— on the collection of overpayments and the obligation to recalculate (for example, the Appeal ruling of the Moscow City Court dated March 30, 2017 in case No. 33-12480/2017);

— on declaring illegal actions to charge fees for services, reducing the amount of debt (for example, the Appeal ruling of the Moscow City Court dated 04/06/2018 in case No. 33-5334/2018);

- on the recovery from the management company of overpaid amounts under the management agreement, on payment for residential premises and utilities for the apartment, on the obligation to conclude an agreement with the plaintiff for the provision of utilities for the apartment (for example, the Appeal ruling of the Moscow City Court dated March 30, 2017 in the case No. 33-12480/2017);

- on compensation for moral damage (for example, Determination of the Moscow City Court dated May 2, 2017 No. 4g-4322/2017);

— on the obligation to dismantle the plug on the drainage drain (for example, the Appeal ruling of the Moscow City Court dated January 26, 2018 in case No. 33-3474/2018).

In the petition part, clearly formulate your claims. You need to list the requirements for the debtor with references to the standards. It can be:

- amount of debt for utilities

- the amount of penalties (penalties) and/or interest under Art. 395 Civil Code of the Russian Federation

- legal expenses (state fees, representative expenses)

When going to court, we recommend that you file all possible penalties for collection from the debtor, including for previous delays in paying for utility services on the part of the defendant, while taking into account the statute of limitations.

Penalty (penalty) for late payment of rent and utilities

Article 155 of the Housing Code of the Russian Federation establishes a legal penalty for late payment of fees for utilities and maintenance. The penalty begins to flow from the 31st day containing the Penalty rate depends on the period of delay (progressive penalty).

- 1/150 of the refinancing rate of the Central Bank of the Russian Federation, effective on the day of actual payment, of the amount not paid on time for each day of delay - from 31 days of delay to 90 days of delay (inclusive)

- 1/130 of the refinancing rate of the Central Bank of the Russian Federation, valid on the day of actual payment, of the amount not paid on time for each day of delay - from 91 days of delay.

The penalty is accrued up to and including the day of actual payment of the penalty.

In this case, an increase in the amount of penalties established by law in the contract is not allowed.

In addition, if the court considers the amount of the penalty to be disproportionate to the consequences of failure to fulfill the obligation, it has the right, on the basis of Art. 333 of the Civil Code of the Russian Federation to reduce the amount of the penalty. If the debtor is a commercial organization, an individual entrepreneur, as well as a non-profit organization when it carries out income-generating activities, the reduction of the penalty by the court is allowed only upon a substantiated application of such a debtor, which can be made in any form.

Before filing a claim for collection of debt for utilities to the arbitration court, it is necessary to send the claim and documents to it to the defendant, third parties (send the claim in a valuable letter with an inventory of the attachments, list all the documents sent in the inventory).

When applying to a court of general jurisdiction, the defendant does not need to first send a claim; you must attach a copy of the claim and a set of documents for the defendant(s).

Documents for collecting debts for utilities in court

When filing a claim for collection of utility debts in court, you must attach the following documents:

- a copy of the management agreement, other documents confirming the provision of utility services and the existence of debt (examples of such documents are indicated above)

- calculation of claims for debt collection, penalties, interest from the defendant

- copies of documents confirming compliance with the claim deadline (inventory of the attachment, postal receipt, notification of receipt or printout of information from the Russian Post website) - for the arbitration court

- a copy of the certificate of registration of the plaintiff as a legal entity

- a copy of the decision to appoint a person acting without a power of attorney on behalf of the legal entity - the plaintiff

- extracts from the Unified State Register of Legal Entities (USRIP) regarding the plaintiff and defendant

- a copy of the power of attorney, if the claim is signed by a representative

- documents confirming the sending of the claim and documents to it to the defendant, third parties (postal receipt of dispatch, list of attachments)

- copies of documents confirming payment of legal costs (if any - for example, when engaging a lawyer to collect a debt)

- document confirming payment of the state fee for consideration of the claim in court

State fee for consideration of a claim for collection of debt for utilities in court

The process of debt collection in court is not free; to file a claim, you must pay a state fee or submit a request for an installment plan/deferment of payment of the state fee in the prescribed manner (in some cases, plaintiffs are exempt from paying the state fee, in this case it is necessary to indicate the basis for the exemption from paying the fee). Otherwise, the court will issue a ruling to dismiss the claim, in which it will propose to eliminate the violations committed.

The amount of the state duty is established by the Tax Code of the Russian Federation and in cases of debt collection depends on the price of the claim and the jurisdiction of the dispute (in arbitration courts, debt collection is “more expensive”). When applying for a court order, a fee is paid in the amount of 50% of the fee payable when filing a claim. You can calculate the fee and find out the details for paying it on the court’s website.

Step 4. Protecting interests in court

So, after filing a claim, subject to compliance with all requirements established by law, the court issues a ruling to accept the claim for proceedings.

When considering a case in a claim proceeding (with some exceptions), the court schedules a hearing to consider the claim. As a rule, the consideration of a claim in court for the collection of debt for utility services takes 1.5-2 months. Also, in certain cases, a claim can be considered in a simplified manner (without calling the parties, with a reduced time frame for consideration and entry into force of a court decision).

When considering a case by writ, the court does not notify the debtor about the consideration of the application, and the court hearing is not held. A court order on the merits of the stated claim is issued within 5 days from the date of receipt of the application for the court order. The judge sends a copy of the court order to the debtor, who, within 10 days from the date of receipt of the order, has the right to submit objections regarding its execution. At the same time, the judge in any case cancels the court order if the debtor raises objections regarding its execution within the prescribed period.

After filing a claim in court, you can track the progress of the case on the court’s website (acceptance of the claim by the court, scheduling a court hearing if the case is being considered in the general manner, issuing a court decision, court order, etc.).

Step 5. Obtaining a court decision and writ of execution (or court order)

Based on the results of the consideration of the case, a court decision or court order is issued (in writ proceedings). The procedure and timing for the entry into force of a court decision (court order) are established depending on the procedure for resolving the dispute.

- in the order of writ proceedings - after 10 days from the date of receipt of a copy of the court order by the debtor, if no objections are received from the debtor within this period

- in simplified proceedings - after 15 days from the date of its adoption, unless an appeal is filed

- in the order of consideration according to the general rules of claim proceedings - after a month from the date of its adoption, unless an appeal is filed. If an appeal is filed, the decision, unless it is canceled or changed, enters into legal force from the date of adoption of the decision of the appellate court.

Step 6. Execution of the court decision, actual collection of debt, interest (penalties) for utilities

After the court decision enters into legal force, the plaintiff is issued a writ of execution, which indicates the amount to be recovered. If the case was considered in the order of writ proceedings, then the court order that has entered into legal force is equivalent to a writ of execution; there is no additional need to obtain a writ of execution. A writ of execution also does not need to be obtained if the debtor executes the court decision voluntarily.

For the purpose of collection, a writ of execution (court order) is submitted:

- to the bank where the debtor has an account

- to the bailiff service at the location of the debtor

Need a debt collection lawyer? To assess the prospects for debt collection and calculate the cost of our services, call us at 8 (495) 223-48-91 or submit a request.

Order

General meeting

Chapter 9.1 of the Civil Code specifies the requirements that the minutes of the general meeting must meet. Mandatory document details:

- place of compilation;

- date of the protocol;

- form of the meeting;

- required quorum at the meeting;

- agenda;

- voting results by issue - “for”, “against”, “abstained”;

- information about the persons who carried out the vote count.

If the minutes of the general meeting do not contain the listed information, the general meeting may be cancelled. The Civil Code specifies the reasons for filing an appeal against the minutes of a general meeting, for example, if the owner was not notified of the meeting or voted against it. In this case, he has six months to appeal the protocol. If the owner abstained during voting, then it will not be possible to appeal the decision. If the number of votes of the owner is not reflected in the voting results, the general meeting also cannot be declared invalid.

Purpose of the certificate

A document may be needed for various reasons. Its main purpose is to provide information about whether a particular apartment owner has debts for utility services. The document is most often required in situations:

- provided to the bank as confirmation that the potential borrower is solvent and can therefore easily cope with loan payments;

- when selling a property, buyers often require this certificate to make sure that after registering the property they will not have to face a significant debt to the management company;

- if a citizen participates in various tenders or competitions, then investors or shareholders are often interested in receiving this information;

- if a person applies for Russian citizenship on the basis of having a residence permit, for example, he owns an apartment, then he needs a certificate stating that he has no debts to the management company;

- Often a certificate is needed from the guardianship authorities or the courts;

- Often a document is required if you need to apply for various subsidies or benefits, as well as preferential loans or other types of support from the state.

Why do you need a certificate stating that there are no debts for housing and communal services? This video will tell you:

When preparing a certain package of documents, which includes this certificate, it is important to request it as late as possible, since it is accepted in a situation if it was issued no earlier than 10 days ago.

Who can apply

This certificate is provided only to the tenant or owner of the residential premises, and members of his family can also apply for it. In this case, the applicant must be an adult citizen.

It is allowed to use the help of a representative, but he must have with him a power of attorney correctly drawn up and certified by a notary. To obtain a certificate, you will need a few documents, so you need to present a passport, as well as a document confirming the right to real estate.

Legislative regulation

Based on Art. 155 of the Housing Code, all citizens must pay funds for housing and communal services, and if they do not complete this process, they will develop a debt. You can find out about its availability from a special certificate, which is valid for only 10 days.

Limitation periods

The general limitation period is 3 years. But you need to take into account Article 200 of the Civil Code, which states that the limitation period begins to run from the moment a claim for payment of the debt is presented, provided that the period is not defined or is determined by the moment of fulfillment of obligations/the moment of demand.

The period is not interrupted if an agreement is signed with the debtor, for example, on repayment of payments and continues after the expiration of the time provided for repayment of the debt - but not more than 10 years.

BIT.Debt management is a specialized CRM system for debt collection at all stages.

- Increases the percentage of successful collections by 30%;

- Increases employee productivity by 2 times;

- Allows you to scale quickly;

- Speeds up pre-trial collection;

- Reduces refusals in court by 2 times;

- Reduces collection costs.

More details Request a demo

Nuances and possible problems

The main problems that may arise due to the presence of debt for housing and communal services are associated with real estate purchase and sale transactions. Despite the fact that the law does not provide for the transfer of debt from the previous owner to the new one, most management companies use this procedure in practice. The fact is that collecting obligations in court takes a lot of time. Management companies try to avoid lawsuits by shifting responsibility to the new owner of the apartment.

To avoid trouble, the buyer is recommended to ask the seller in advance to provide written confirmation of the absence of debt.

Attention! If you have debts, you should discuss with the seller of the apartment the methods and timing of their repayment and indicate these nuances in the purchase and sale agreement. This will make it possible in the future, if necessary, to collect debts from the previous owner of the property through the court.

The following measures apply to citizens who refuse to pay utility bills:

- eviction if the debtor lives in the apartment on the basis of a lease agreement;

- refusal to privatize real estate;

- refusal to supply utilities (water, electricity, gas), of which residents must be notified in advance;

- forced collection of debt by court decision.