An apartment mortgage agreement is an agreement under which one party, represented by the mortgagee, acting as a lender, provides funds for the purchase of real estate to the other party.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

In essence, a mortgage agreement is a regular loan. The main difference from a loan is the type of collateral, which is the apartment.

The subjects of such a transaction can be both individuals and legal entities. The parties to the mortgage agreement are the Mortgagor and the Mortgagee.

An apartment mortgage agreement, in accordance with the requirements of the legislation of the Russian Federation, is subject to mandatory written execution.

Below we will present an approximate version of the design of such an agreement and step by step we will analyze what provisions should appear in the text of this document.

What the law says

Banks can create their own models of mortgage agreements, but all of them must comply with the law. In Russia, the Mortgage Law FZ-102 is in force, Article 9 of which explains what must be included in the agreement. In total, the law defines 6 mandatory points:

- The document must indicate the subject of the mortgage, its valuation, and the period for repayment of funds.

- Description of the subject of the mortgage, that is, the property being purchased and pledged as collateral, its location.

- The result of a real estate assessment, which is required for all transactions.

- A complete description of the obligation, indicating the amount and basis for its occurrence.

- Timing and frequency of making payments to repay the loan.

- If a mortgage is drawn up, information about it is indicated in the agreement.

In general, an apartment purchase agreement with a mortgage is a complete description of the transaction. It specifies the rights and obligations of the parties, restrictions on the use of the pledged property, loan parameters, etc. If the borrower has any questions during the repayment process, he will find it in the text of the agreement.

A mortgage agreement is a voluminous document. Typically, banks give borrowers time to familiarize themselves with the agreement and send a sample of it to their personal account. That is, at the time of signing, the client is already familiar with everything that is specified in the document.

How does registration work?

This document must be in full compliance with Article 432 of the Civil Code of the Russian Federation, which contains some requirements. According to it, the document must contain such sections as the subject of the agreement, the assessment, the essence of the fulfillment of financial obligations, the size of the loan and the timing of the fulfillment of obligations by both parties.

It must be in writing . As for the text of the document, the law does not contain any strict requirements in this regard. However, both parties involved in the transaction must sign it.

It is worth noting that the paper must necessarily go through the state registration procedure in strict accordance with what is written in the law on mortgages. If this step is missed, the document will be considered void and will not receive legal force. It is worth noting that, as part of the mortgage agreement, the borrower must pay not only the loan itself, but also other amounts, for example, compensate the mortgagee for losses, pay a penalty, etc.

The main part of the mortgage agreement

In general, the borrower must read absolutely everything that is written in the document. In this case, he will be familiar with all aspects of the return. For example, usually important details are not verbally stated during registration: the procedure for early repayment, restrictions on actions with real estate, the amount of fines in case of delay, the situation in case of insurance not paid on time, etc. is not explained.

If we take the main part of the loan agreement on the mortgage of Sberbank, VTB and all other banks, then it contains the following important information:

- The first page always contains the characteristics of the loan itself. The interest rate, the amount spent on the loan, the amount of the monthly payment, the loan repayment period, and the currency of issue are written down in a prominent place;

- The interest rate and the conditions under which the bank can increase it are specified separately. This usually concerns non-payment of compulsory real estate insurance, non-renewal of title or personal insurance;

- number of monthly payments and payment date. This is the day of the month when the money should already be in the account, the bank will write it off to pay off the debt;

- procedure for early repayment of a mortgage. Options for changing the schedule if we are talking about partial early closure of the loan.

Usually this information is indicated in the first paragraphs, as it is the most important. But you should not limit yourself to reading only this information; be sure to read everything to the last line. The bank is in no hurry with this matter.

Who writes the paper?

If a person applies to a credit institution and wants to conclude a mortgage agreement, then bank specialists should be responsible for drawing up such paper. They must prepare it in accordance with all legal requirements mentioned above. The document is standard and therefore the same for all borrowers .

If a citizen who wants to take out a loan is not satisfied with some clause of the agreement, then he has the right to draw the attention of the bank specialist responsible for its preparation to it. If the claim is justified, he will pass on all the necessary information to the lawyers so that they can review the terms of the mortgage. However, it is worth remembering that in most such situations the future borrower’s request is not answered. All that remains is to either accept all the conditions or contact another bank.

Other important information about the transaction

In addition to the basic information, there is also additional information that is important. For example, each bank has its own restrictions on the use of the facility. The contract may stipulate a ban on leasing, registration of non-relatives, mandatory notification of long-term absence, etc.

Failure to comply with the conditions specified in the contract will result in fines or other punishment, including termination of the contract.

Important points:

- the purpose of issuing funds, indicating the address of the object and the number of the purchase and sale agreement;

- the borrower's liability for late payments, the amount of penalties when they begin to accrue;

- information that the creditor may assign claims to other third parties;

- the procedure for granting and repaying a mortgage loan;

- information about the title borrower, if he is involved in the transaction;

- information about the mortgage, if one is drawn up.

At the end of the document, all details of the parties are written down. This is a bank on the one hand and a borrower alone or with a co-borrower on the other. The agreement is drawn up in several copies, one must remain with the bank, one with the borrower.

The agreement may also stipulate the conditions for the bank to increase the rate unilaterally. The only reason can be the borrower's failure to fulfill the obligation to renew the insurance policies.

Sample mortgage agreement

Each bank has its own sample of loan agreements, but in general they are all identical and contain the same information. They may differ only in shape, color, and volume of pages.

Here is an example of a Sberbank loan agreement →

It can be taken as a standard. And if you consider that every second mortgage in Russia is issued by Sber, this example will be relevant to many.

Types of mortgage agreements

The content of the mortgage agreement also depends on the type of transaction. Mortgages vary, so the information in the main document may differ from the standard. In addition to the standard agreement, the following types of mortgages are concluded:

- shared That is, in addition to the bank and the borrower, the contract includes the developer. A different procedure for transferring ownership of an object is prescribed, so we are talking about a house under construction;

- social. Registration of a mortgage using government subsidies, which is also reflected in the contract;

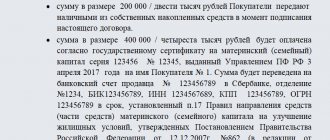

- using maternity capital. This fact is indicated as to what the maternity capital funds are used for: for the down payment, for increasing the loan amount;

- military A special program for NIS participants, under which a special mortgage agreement is drawn up.

So, the law does not provide for a single standard for mortgage loan agreements; they are drawn up by bank lawyers at their discretion. But the law talks about the facts that must be reflected in the contract. All banks comply with this.

Give your rating

Sequence of preliminary actions

Such a document can be drawn up only after the required package of documents has been submitted in full to the credit institution. Next, the credit committee must make a decision on the release of funds . Only after this can you begin to draw up a mortgage agreement. This procedure must be carried out at the bank that issues the loan to the borrower.

IMPORTANT : To sign such a paper, the borrower, a bank representative and the seller of the apartment must be present. In this case, the bank may require the debtor to include several guarantors in the transaction.

FAQ

Is it possible to terminate a mortgage agreement?

If the buyer has not yet received the money, termination is possible at any stage. Even if the contract has already been signed. The fact of issuance of a mortgage is considered the moment the seller receives money.

Is the payment schedule included in the mortgage agreement?

The contract specifies the main repayment parameters: the amount of the monthly payment, the repayment period in months and the date of debiting the funds. The schedule itself is a separate annex to the agreement.

What should I do if I lost my mortgage agreement?

To restore the document, contact the servicing bank. Issuance of duplicates is usually free.

What should I do if I find an error in the contract?

Sign the document only if it is drawn up correctly and all specified data corresponds to reality. If you find an error, notify the bank, it will prepare other forms.

Can I read the contract and then sign it?

This is what needs to be done. First, study carefully, and only then sign. The bank won't mind.

Is it possible to conclude a mortgage agreement between individuals?

The Civil Code of the Russian Federation does not regulate such transactions. The parties may enter into an agreement in the form of a receipt.

Sources:

- Domklik: SberBank loan agreement: what to look for when applying for a mortgage.

- ConsultantPlus: Federal Law “On Mortgage (Pledge of Real Estate)”.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

When should you contact a notary?

The assistance of such a specialist may be required when concluding a mortgage agreement between the bank and the borrower. The fact is that such an agreement can be certified by a notary. Thus, it becomes possible, if necessary, to adjust the agreement and eliminate some nuances.

However, such a measure is not mandatory today. Banks can independently develop standard forms of contracts without the help of specialists of this type. You can contact a notary to eliminate errors and speed up the state registration procedure. Each notary in such a situation will require the borrower to provide an original or a copy of the mortgage agreement. A corresponding statement must be attached to it.

It is worth remembering that even if a contract that is not certified by a notary is provided to the registration authorities, they usually require notarization of this copy.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

![Bank Zenit mortgage and refinancing [credit][sale]](https://bgrielt.ru/wp-content/uploads/bank-zenit-ipoteka-i-refinansirovanie-credit-sale4-330x140.jpg)