To attract customers, some banking organizations announce the possibility of obtaining a real estate loan within one day. As practice shows, the approval period for an application can be several weeks. This period is primarily due to the bank’s desire to minimize possible losses. To do this, credit managers are required to conduct a thorough check of the client and calculate potential risks throughout the entire lending period. This is one of the reasons why banks take a long time to consider mortgages.

Mortgage approval at VTB - current bank offers

VTB offers a wide range of mortgage programs. Their gradation is determined by the type of apartment being purchased, the status of the borrower, and the possibility of implementing state support. Let us outline the main parameters for approving each mortgage:

- New building

. The maximum amount of approval is 60 million rubles, the minimum is 600 thousand rubles. Settlement rate – 9.1% and higher, repayment period – up to 30 years, down payment – 10% or more. - Secondary housing

. The approval conditions are the same as for a new building. It is possible to reduce the percentage to 8.9% when purchasing apartments from 65 sq.m. and payment of the initial amount from 20%. - Refinancing

. Favorable refinancing - the bank repays the existing mortgage at a reduced interest rate (from 8.8%). Approval of up to 30 million rubles is possible, but not more than 80% of the value of the property. - Military mortgage

. Individuals who have been participants in NIS for more than 3 years can count on approval from VTB. The maximum possible financing is 2.435 million rubles, the term is 20 years. Moreover, at the time of repayment of the loan, the borrower should not be older than 45 years. - Non-targeted collateral loan

. Loan for any needs up to 15 million rubles. subject to the provision of a real estate mortgage. Rate – from 11.1%, term – up to 20 years. - State support

. Lending to young families with children at a low rate of 6%. The grace period depends on the number of children. Approval can be obtained by both a husband and wife and a single parent. - Sale of collateral real estate

. Purchase of housing secured or owned by VTB.

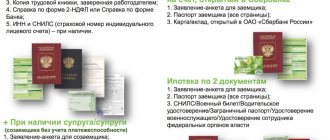

On a note. Those who want to get a mortgage approved without unnecessary delays can use the “Victory over formalities” program. Issuance of two documents at 9.6% per annum. The client must provide 40% down payment.

"Victory over formalities"

Last year, VTB24 Bank released a new tariff, which was liked by potential borrowers. In accordance with the basic provisions, citizens who meet the program requirements can take advantage of a unique offer - receiving an interest rate of 10%.

Current conditions:

- Age from 24 years;

- Availability of a VTB24 debit, credit or salary card;

- No late payments;

- Good credit history;

- The interest rate is reduced when insurance from VTB is activated.

The effect of the preferential rate of 10% from VTB can be recalculated if there are grounds for this. Newly-made owners must submit a number of documents that confirm the existence of grounds for this. After the grace period ends, the interest rate may increase by several percent.

Who will VTB approve a mortgage: requirements for borrowers

Applications from applicants working in the Russian Federation are accepted for consideration. In this case, registration and citizenship do not play a special role. When negotiating a mortgage, the main focus is on the applicant's income and credit history.

Important! The total work experience is at least 12 months; in the last place, the client must work for at least six months.

To increase the likelihood of approval of the transaction, financial support from co-borrowers is allowed. VTB allows you to call one, two or more guarantors. The following are considered reliable co-borrowers: solvent children, parents, common-law spouses, sisters, brothers and other close relatives.

The procedure for approving a mortgage at VTB 24 is very simple. The stages of processing and approving a home loan at VTB are standard. The decision whether or not to issue a mortgage is made after submitting an application and analyzing the solvency of the borrower and co-borrowers.

Will VTB approve a mortgage - preliminary calculation

You can find out the likelihood of approval yourself by calculating your mortgage using an online calculator. The result of the calculations will show how realistic it is to get a loan from VTB with your existing income. The service is provided on every page of the website with a mortgage product.

What to do:

- Fill out the form, enter: the market price of housing, the amount of the down payment and income.

- Click "Calculate".

- Evaluate the result.

Calculation of a mortgage at VTB 24 on the bank’s official website

The program will display on the screen how much you can take, for how long and what the amount of the monthly payment is. The data is quite arbitrary, but it reflects the general situation. For clearer information, you must apply for mortgage pre-approval.

Repayment methods

To repay a personal mortgage loan, it is not necessary to be personally present at the VTB Bank office. The loan can be repaid either in full or in part (including ahead of schedule) in one of the following ways:

- through branches of the Russian Post;

- using the all-Russian VTB ATM network;

- transferring funds through another bank;

- through the VTB website, when logging into the client’s personal account.

In addition, it is possible to repay the loan at the cash desk of any VTB branch. You will need to show your passport. However, the payer of the loan does not have to be the person in whose name the loan is issued - if you provide the loan agreement number, any authorized person can make the payment.

Applying for a mortgage

It is very easy to find out a preliminary decision at VTB. The company has developed a simple online survey form that allows borrowers to quickly assess their chances of approval. You can proceed to filling out the application by clicking on the “Fill out application” button.

The form must display:

- Personal data: full name, year of birth, contacts, E-mail.

- Job information: employer’s tax identification number, income, length of service.

- Mortgage information: condition of the property being purchased, region where the property is located, down payment, housing price, repayment period.

- Passport details.

After filling out the application, click on the “Submit” button and wait for a response.

Applying for a mortgage at VTB 24

VTB 24 approval: how long to wait for a banking decision

After submitting an application, potential borrowers are wondering how long VTB will approve a mortgage. The bank’s actions are standard in most cases:

- within three hours from the moment the application is sent for approval, a bank employee contacts the client and clarifies the missing information;

- the application can be approved within one or two days, then an SMS notification with a preliminary verdict will be sent to your phone; in the same way, VTB can refuse a mortgage;

- then the borrower collects a list of documents and brings them to the branch;

- final approval based on paper evaluation – in 1-5 days.

Under the “Victory over formalities” program, you won’t have to wait long for a decision – the VTB mortgage approval period has been reduced to 24 hours.

On a note. The validity period of the decision is 4 months. At this time, the client must have time to choose a suitable property and apply for money.

Late fees

For each day of delay on a mortgage, VTB charges penalties in the amount of 0.1-1% of the total debt. In case of non-payment, the penalties are as follows:

- A notice of debt is sent.

- The client is invited to the bank and together they look for ways to solve the problem.

- The creditor submits a statement of claim to the judicial authorities if the issue cannot be resolved amicably.

- Seizure of a property.

To avoid penalties, it is recommended to deposit at least part of the money.

List of required documents

If VTB has pre-approved your mortgage, you can begin collecting the following documents:

- application form;

- passport of a Russian citizen;

- insurance certificate of pension insurance;

- Form 2-NDFL, a certificate in the VTB form or income declaration is acceptable;

- a copy of the work book;

- military ID - for men under 27 years of age.

At VTB, a mortgage is approved in full with the client’s consent to comprehensive risk insurance: loss of ability to work/loss of life, damage to the purchased apartment, restrictions on property rights. Important! Insurance against the risk of loss or damage to collateral real estate is required for the approval of all VTB mortgages.

Insurance

There are three main types of insurance at VTB24:

- Property insurance;

- Borrower's life insurance;

- Title insurance.

VTB24 offers favorable conditions for insuring property purchased under the mortgage lending program. You will be provided with reliable protection from unforeseen situations.

Real estate title insurance makes it possible to protect your ownership of a designated property. This service is not required; without it, you will be given a mortgage with the same interest rate.

This insurance is a guarantee of consumer safety. It will protect you from the threat of losing ownership of a purchased apartment or private house. Under what circumstances can you lose purchased property?

- If there are errors identified by the specialist in the preparation of the purchase and sale agreement. In this case, the transaction is declared invalid.

- When a legal right holder suddenly appears, whose interests were not taken into account and agreed upon during the sale of residential property.

- If the person who made the transaction is declared incompetent for the period of signing the documents.

- If fraudulent techniques were used that became known to competent persons.

Title insurance guarantees that the remaining debt will be paid in full for you if any of these situations occur. The insurance premium can be up to 0.5% of the total amount.

VTB 24 approved a mortgage - how to find out the decision

As a rule, you don’t have to wait long - VTB promptly communicates the decision made. However, if the banker does not notify you of the loan approval or refusal within a week, you should not wait - it is better to act independently. You can find out the solution by calling the help desk - 8-800-100-24-24

. An alternative option is to leave a request to customer support. You can go to the contact form by clicking “Customer Care Service” - the button is located in the lower right corner of the site.

Contacts of VTB 24 Bank for communication

You can clarify information on the approval of a VTB 24 mortgage from the specialist who accepted the documents for consideration.

VTB offers borrowers flexible mortgage terms.

The bank is ready to approve an application based on two documents; cooperation with clients without registration and citizenship of the Russian Federation is acceptable. Mortgage approval at VTB 24 reviews / by NinulyaKiss

Why you can get rejected: reasons

VTB24 may refuse a mortgage in the following cases:

- Availability of outstanding or overdue loans . If the client has one or more other loans (especially for large amounts), the bank may refuse to provide him with a mortgage.

- Falsification of documents . Information about income, citizenship and other documents are carefully checked by employees. Therefore, their falsification may entail not only the refusal of the current application, but also being blacklisted by the bank.

- Income level is not high enough . Depending on the value of the property, the client must have a certain monthly salary, the amount of which is calculated by the bank. If the borrower receives less than what is needed to pay the loan, the bank will refuse him.

- Failure to meet other requirements . VTB may also refuse to apply to people who have insufficient work experience or who are not of an age suitable for high solvency.

According to Article 821 of the Civil Code of the Russian Federation, a financial institution is not required to indicate reasons for refusal, therefore, by law, a bank may not approve an application marked “without explanation.”

How often does a bank refuse borrowers: approximate statistics

In mid-2021, RBC published an article in which the head of VTB Bank Andrei Kostin focuses on tightening the requirements for applicants. This information applies to both conventional loans and mortgages. The head warned of a possible increase in mortgage refusals, but no specific figures were given.

Customer reviews on the banki.ru service indicate that mortgage refusals occur frequently, even after the application has been officially approved.