It is worth noting that refinancing is becoming a more popular banking procedure every year. This is due to the advantages and opportunities that it opens up for borrowers:

- lower interest rate on the loan;

- changing the loan term;

- possibility of merging loans;

- removal of collateral from encumbrance.

The reason for transferring a mortgage to another bank may be a citizen’s selection of an attractive offer with more favorable conditions than in the banking organization where the agreement is currently open. A housing loan is taken out for several years; it is possible that the situation on the lending market will change during this period.

It is advisable to transfer a mortgage loan to another organization in the following cases:

- the difference in interest rates in favor of the new mortgage is at least 2%;

- the transfer will help solve financial difficulties by increasing the term of debt repayment (monthly contributions will decrease, and the overpayment will increase slightly).

For the sake of a small profit, it is not worth moving from one bank to another, since the original credit institution will stop servicing and will not meet the client halfway next time. If you're having trouble paying off your debt, you could ask for a lower interest rate, but that usually doesn't work.

A bank whose loan is being repaid using the funds of another lender does not have the right to refuse or prevent the client from refinancing, however, in some cases, the transition is limited by the terms of the agreement, and taking out a mortgage from a third-party credit institution is a little more difficult.

Determining your mortgage refinancing goals

Basically, the need to refinance an existing loan arises when you need to:

- reduce the total cost of the loan when banks' lending rates change;

- change the loan currency;

- reduce your monthly payment;

- obtain additional borrowed funds secured by the same property.

Next, we’ll talk in more detail about cases where the goal is to reduce the overall costs of repaying the remaining portion of the loan. At the same time, information about the simplest analysis techniques will also be useful to those who pursue other goals of mortgage refinancing.

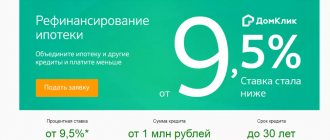

B&N Bank proposal “Change the loan rate to a lower one”

Before submitting an application for refinancing to the bank, you need to familiarize yourself with the requirements that B&N Bank imposes on the initial mortgage:

- currency - ruble;

- minimum balance – 500 thousand

; - timely payment of monthly contributions for the last six months

; - The initial loan has been valid for more than six months

.

Does your loan meet these requirements? Then read the terms of the loan:

- loan amount - 500 thousand - 30 million rubles if the loan was received in the Moscow or Leningrad regions, the cities of Moscow or St. Petersburg, and 15 million rubles if in other regions

; - contract duration – from 5 to 30 years

; - repayment method – equal payments;

- interest rate – from 9.65%

.

Advantages of the Binbank program:

- favorable interest rate;

- It is enough that the loan was received at least 6 months ago.

Flaws:

- the minimum validity period of refinancing agreements is 5 years;

- issuing amounts in excess of 15,000,000 rubles in the regions is impossible.

How to refinance a mortgage - a step-by-step plan

- Depending on the purpose of future loan refinancing, collect offers from banks. At the very first stage, it is not advisable to send applications en masse to all available credit organizations; it is better to use open information on websites.

- Select 4-5 banks with attractive rates and check whether they really allow you to improve lending conditions compared to the existing mortgage. We'll tell you how to do this later.

- Select the 2-3 best banks based on the results of your assessment and check with their employees what additional conditions they put forward - for example, insurance, commissions, mandatory paid services. It wouldn’t hurt to find out how the bank feels about the possibility of refinancing in the future, because the mortgage term is very long. It is possible that you will want to change your loan parameters again.

- Taking into account the new data, repeat the calculation of the total cost of the loan and make a decision. When communicating with bank specialists, you cannot allow them to drag you into paperwork. Having multiple credit applications will result in multiple inquiries to the credit bureaus, which will negatively impact your credit score. As a result, a loan from a bank with better conditions may not be available.

- Find out about mortgage refinancing from your bank: ask for information about whether this can be done on your existing loan. For its clients with a good credit history, the bank can offer very attractive conditions, since the risks for such borrowers are minimal. In addition, you do not have to spend a lot of time and money on refinancing at your bank; many documents about you and your property are already there.

- Analyze all the information that was collected and make a final decision.

- Submit an application for refinancing a mortgage loan and collect documents according to the bank’s list.

- Carefully study and sign the necessary documents,

- Pay off the previous debt and transfer the mortgage to a new bank. This is done together with a bank employee - with the old bank you remove the encumbrance on the apartment, with the new bank you impose it.

Technically, there are two options here:

- First, an application is submitted to remove the old mortgage, after 3 days Rosreestr executes it, then an application is submitted to impose an encumbrance on the property under a new loan. All this time, the new bank bears the risk of an unsecured loan, because in fact the money has been issued to you, but the collateral has not been formalized.

- Before giving you money, the old bank gives written consent to register a new mortgage “on top” of the old one, then it is registered, the new bank gives you the money, you pay off the old loan and remove the first mortgage with the old bank. As a result, the new bank risks much less, but the old bank has a risk, so this scheme is used less often.

In any real estate transaction, it is necessary to monitor its legal status in Rosreestr, since any errors and inaccuracies here can be very costly. In particular, when paying off a mortgage or refinancing, the removal of the encumbrance does not occur automatically, as many still believe. If you do not have an extract from Rosreestr on the absence of encumbrances on the apartment, then you must obtain it and keep it among the title documents for housing.

You can order an extract either in person or online. It is convenient to use the 24-hour official service EGRN.Reestr , which will generate a legally significant document from the state database of Rosreestr and send it by email.

How to apply online for a mortgage?

You can apply for a mortgage online, in which case you will find out the decision without visiting the bank. To do this, just go to its official website and fill out a form.

For example, in the Gazprombank application you must indicate:

- FULL NAME.;

- contact details (phone, email);

- residential address;

- passport data (series, number, etc.);

- the city where you will apply for a mortgage loan;

- desired loan parameters (term, amount, etc.);

- information about the availability of a Gazprombank salary card.

The application will immediately go to the bank manager. He will contact you by phone if additional information is needed.

How to refinance a mortgage profitably - we calculate the costs and compare them ourselves

Some mortgage agreements provide for a minimum period before the expiration of which the borrower has no right to refinance or repay the loan early; penalties may be established for violation.

However, it is equally important to consider another question: how long before it is possible to refinance a mortgage for it to be profitable?

There is often a recommendation that it is not profitable to restructure if half the term has passed. There is logic in this advice, since with a uniform loan repayment schedule over the loan term, the payment structure changes. At the beginning of the term, almost the entire amount is counted towards the payment of interest, and towards the end the loan itself is repaid.

The figure below shows an example of a graph of changes in the structure of a loan payment over the course of the loan - blue indicates the principal debt, gray indicates interest. The monthly payment is constant and amounts to 40 thousand rubles.

In the first half of the loan, the main share of the payment is interest; the principal debt is repaid at the end of the term

The graph shows when you can refinance your mortgage - at the beginning of the lending period, losses will be minimal. Theoretically, it is really unprofitable to refinance in the middle of the term or later - after all, the principal debt has not been repaid, and the interest has already been paid. After concluding a new loan agreement, you will have to pay according to the same scheme, albeit at a reduced interest rate. In fact, you will have to pay interest a second time on the same amount of principal. Therefore, it is believed that it makes sense to refinance the mortgage only at the beginning of the loan term.

However, this is too general a statement and does not take into account many nuances. In each case, you need to check the possible financial result yourself; the result may be unexpected.

How to do this, since the formulas for calculating annuity are complex and require special training? But no, there is a simple way to navigate the numbers, accessible to everyone.

Early repayment fee

Yes, keep in mind that often in loan agreements banks exclude the possibility of early repayment of refinanced debt without a commission. And it can also significantly increase the total amount you give to the bank.

Reveal your cards. How not to use a credit card Read more

How to make mortgage refinancing profitable - we calculate the costs and compare it ourselves

The general calculation procedure is as follows (then we will look at examples):

- Determine the total amount of the remaining loan payments . The payment schedule usually shows only the principal balance as of the date of the next payment. However, it is not difficult to calculate the total balance with interest; it is done like this:

Remaining payment amount = Scheduled monthly payment * Number of remaining months.

The resulting result will include both the balance of the debt and the interest due.

- Use any online calculator to calculate future payments on a new loan , based on the balance of the principal debt and the remaining term on the old loan at a new interest rate.

- Compare the results obtained from points 1 and 2 based on the overall result.

- To complete the assessment, you need to add to the calculations the cost of annual or one-time insurance for the entire remaining lending period for both loans, commissions when issuing a new loan, costs for preparing documents and state registration of the mortgage.

- The resulting result will clearly show how advisable it is to refinance.

Bank conditions

When refinancing, the real estate collateral is registered in favor of the bank that issued the new loan. It will be necessary to re-issue insurance for the collateral for the risks of loss or damage. You can insure your life and health if you wish.

Typically, refinancing involves obtaining a new loan at a lower interest rate than under the current agreement. The refinancing rate at VTB starts from 8.8%, at Alfa Bank - from 8.99%, at Gazprombank - from 9%, at UBRD - from 9.15%, at Sberbank, Promsvyazbank - from 9.9%, in Raiffeisenbank - from 10.25%. If you cancel life insurance, it will increase by 1%.

The term of a new loan in VTB, Sberbank, Alfa-Bank, Raiffeisenbank, Promsvyazbank and Gazprombank can be 30 years, and in UBRD - 25 years. The maximum loan amount for refinancing in Raiffeisenbank is 26 million rubles, in UBRD and Promsvyazbank - 30 million rubles, in Alfa Bank - 50 million rubles, in VTB and Gazprombank - 60 million rubles, and in Sberbank - 7 million rubles .

Calculation examples for comparing mortgage refinancing options

Example 1

We have an existing loan with the following parameters:

Loan amount: 3,000 thousand rubles.

Term: 15 years, 10 years paid, 5 years left.

Interest rate: 14%.

Balance of debt: 1,722 thousand rubles.

What remains to be paid along with interest is RUB 2,406 thousand. (we calculate according to the loan repayment schedule by multiplying the number of remaining payments by the amount of the monthly payment).

Insurance is not provided for the existing loan, and there are no penalties for early repayment. We are considering 3 proposals from banks to refinance the balance of the debt (RUB 1,722 thousand) for 5 years at a lower rate. A mandatory condition for new loans is life and property insurance. The purpose of refinancing is to save money.

| Indicators, thousand rubles. | Principal balance | % payable | Total debt with % | Payment per month | Insurance | Commissions one-time | Total | |

| in year | for the period | |||||||

| Current loan, total | 3 000 | 4 200 | ||||||

| including: | ||||||||

| Paid for 10 years | 1 278 | 3 516 | 4 794 | |||||

| 5 years left, rate 14% | 1 722 | 684 | 2 406 | 40 | 0 | 0 | 0 | 2 406 |

| Refinancing options: | ||||||||

| 5 years, rate 9.5% | 1 722 | 448 | 2 170 | 36 | 40 | 200 | 17 | 2 387 |

| 5 years, rate 11% | 1 722 | 524 | 2 245 | 37 | 40 | 200 | 17 | 2 462 |

| 5 years, rate 12% | 1 722 | 575 | 2 297 | 38 | 40 | 200 | 17 | 2 514 |

Conclusions:

- Despite the fact that much more than half of the loan term has passed, a reduction in the rate by even 2% provides savings on loan payments (column “Total debt with %”).

- The monthly loan payment will decrease, but there will be annual insurance costs.

- Taking into account additional costs for new loans (insurance and commissions), in 2 cases out of 3, the gain on the interest rate is lost, and refinancing becomes unprofitable (the “Total” column). If we take into account the expected costs of the refinancing procedure (real estate valuation, registration actions), then it is more profitable to continue paying the loan at a rate of 14% without new costs than to refinance it even at 9.5%.

Example 2

Let's consider the possibility of refinancing with extension - extending the loan term to reduce the size of the monthly payment. Under the terms of the new loan, interest rates will be lower, but there will be obligations for annual life and property insurance, as well as a one-time fee for issuing a loan.

| Indicators, thousand rubles. | Principal balance | % payable | Total debt with % | Payment per month | Insurance | Commissions one-time | Total | |

| in year | for the period | |||||||

| Current loan, total | 3 000 | 4 200 | ||||||

| including: | ||||||||

| Paid for 10 years | 1 278 | 3 516 | 4 794 | |||||

| 5 years left, rate 14% | 1 722 | 684 | 2 406 | 40 | 0 | 0 | 0 | 2 406 |

| Refinancing option: | ||||||||

| 10 years, rate 11% | 1 722 | 1 124 | 2 846 | 24 | 40 | 400 | 17 | 3 263 |

Conclusions:

- A reduction in the interest rate and a longer payment period reduces the monthly payment amount from 40 to 24 thousand rubles. — the credit burden decreases.

- As a result, the total amount of payments with interest increases by 440 thousand rubles, and taking into account insurance and commission, the cost of the loan increases by 857 thousand rubles. Instead of 2,406 thousand rubles. for 5 years you will have to pay 3,263 thousand rubles. in 10 years.

Additional expenses

If the rate on your existing loan that you want to refinance differs from the rate on the new loan by less than 3 percentage points, then all the savings will be eaten up by the necessary additional payments. The fact is that refinancing is a paid procedure, it includes various commissions and related payments, Bobkova suggests.

Another pitfall is the need to obtain insurance when refinancing, which in many banks is a mandatory condition for refinancing. Calculate the costs of it and how much it will affect the final benefit.

Let's summarize: when can you refinance your mortgage and how best to organize it?

The question of how long it will take to refinance a mortgage does not have a clear answer for all cases. You need to perform a calculation and compare the results with the current mortgage agreement.

Information about a reduction in the rate or the size of the monthly payment is not enough to make an informed decision; it is necessary to take into account all payments and expenses for the refinancing procedure.

How to refinance your mortgage most effectively?

- When evaluating lucrative offers from other banks, do not forget to make a request to yours - in order to retain a good client, the lender can significantly soften the terms of the existing loan or refinance. Then you won’t have to incur additional costs for real estate valuation, and the procedure itself will be simpler.

- At all stages of document preparation, explore opportunities to save time and money. For example, an extract from the Unified State Register can be obtained without a visit to the MFC or the Rosreestr authority. You can use the 24-hour online service EGRN.Reestr and receive an official extract with digital signature to your email. The document can be easily printed, downloaded to a flash drive or sent to the bank’s email.

Is a tax deduction possible when refinancing a mortgage?

Anyone who decides to refinance a target loan has the opportunity to receive a tax deduction of 13%. The maximum you can count on is 390 thousand rubles, because the tax deduction when refinancing a mortgage is limited to 3 million rubles. Please note an important nuance: not the entire debt is taken into account, but only the interest paid to the bank; only from their amount can you get back 13%.

Those who took out a loan before 2014 were more fortunate, when the amount from which tax was deducted was not yet fixed. If you are one of those lucky ones, then when you refinance your mortgage in 2021, you can count on a return of 13% of the entire amount of interest already paid to the bank.

However, you can lose the right to a tax deduction after refinancing. This happens if the documents do not contain references to the fact that the loan is issued specifically to pay off the original mortgage.

Who can be a co-borrower?

Most often, co-borrowers are relatives of the main borrower - spouse, parents, children, brothers and sisters. In total, you can attract up to 6 co-borrowers. If you are married, your spouse must be a required co-borrower. Exceptions are possible if a marriage contract is concluded between the spouses.

For example, to increase your chances of receiving a larger amount upon approval, you can involve co-borrowers - participants in salary projects. And when applying for a loan, you can note that you do not want to take into account the solvency of the co-borrower. This will reduce the list of required documents, but may reduce the maximum amount approved. Was the answer helpful?

Not really

Is it possible to refinance a mortgage with the same bank?

Before deciding where to refinance your mortgage, be sure to make an inquiry with your bank. Even if this is unprofitable for him, there is still a chance to get the go-ahead - many banks make concessions in order to retain a good client. The same bank where you took out the mortgage, instead of refinancing, can simply soften the conditions on the existing loan, that is, reduce the rate. This will be beneficial for you both in terms of finances and in terms of saving time: you will not need to spend money on real estate valuation again, collect a new package of documents, or wait for long checks. To reduce the rate, only an application is required.

Reasons for possible refusal

The bank will evaluate the borrower's solvency. If your income has recently decreased and is not enough to make a mortgage payment (the payment should not exceed an average of 40–60% of the family’s monthly income), the credit institution may refuse to refinance. In addition, the bank will check the housing that is pledged as collateral for the loan. If it has fallen into disrepair or, for example, is located in a dilapidated building, a mortgage loan may also be refused. If the existing loan was in arrears, there is a current overdue debt, or there was a restructuring, this is also a possible reason for refusal. A number of banks do not refinance loans for housing under construction.

How long does it take to refinance a mortgage?

There is a general requirement: you can refinance a target loan no earlier than 2 months from the date of lending. But each bank has its own conditions specified in the agreement. The papers indicate the terms after which the mortgage cannot be repaid early or refinanced. Otherwise, fines await. You will also receive a refusal to reduce rates if there are less than three months left before the payment deadline.

Requirements for the borrower

Typically, banks provide refinancing services to Russian citizens, but VTB, Raiffeisenbank, and Alfa-Bank allow citizens of any country to apply for a loan.

To receive a positive decision on your application, you must meet the following requirements:

- age at the time of application - from 21 years (in UBRD - from 23 years), and at the planned date of closing the loan - no more than 65 years (in Sberbank - 75 years, in UBRD - 70 years);

- availability of official employment and income that allows you to repay the loan on time;

- work experience at the current place - from six months (at UBRD - from 3 months);

- total experience – from one year.

What documents are needed to refinance a mortgage?

The package of documents for refinancing a mortgage in another bank is no different from the set of documents for obtaining a primary mortgage loan. You will need:

- Passport.

- SNILS.

- If you need to refinance a mortgage issued under the state program for lending to families at the birth of a second and subsequent child, you must provide birth certificates of the children.

- Certificate of employment, copy of work record book.

- Certificate of income in 2-NDFL format or in the bank form.

- A completed application form according to the bank's form.

- An agreement with the bank where the original mortgage was taken out.

- Certificate of debt balance.

As soon as the loan is approved, real estate documents will be required. This usually includes a purchase agreement and a valid insurance contract. But banks may require additional documents, including a certificate of ownership, an extract from the Unified State Register of Real Estate, cadastral information, and a certificate of valuation of the property.

Profitable or not

So, what is a profitable mortgage refinance? Before refinancing a mortgage, you should make a preliminary calculation taking into account all the parameters. In order not to be abstract, let's look at a specific example. This is refinancing the mortgage of our readers - a family from Novosibirsk.

Mortgage – refinancing with another bank:

Initial data Mortgage with a principal balance of 2,196,700 at 11% per annum. Number of months until mortgage completion is 196. There is no life insurance on the mortgage. Collateral insurance for an apartment does not provide for penalties for late provision of insurance. The mortgage was issued by Sberbank. Family of 3. Only my husband works. The wife is expecting the birth of her second child.

The best conditions for refinancing a mortgage in another bank at the moment are in Raiffeisenbank - 10.9% per annum (later we will look in more detail at refinancing mortgages from other banks and the best offers of 2021). Now let’s calculate whether it will be profitable for our family to move from Sberbank to Raiffeisenbank.

- Let's start with the interest rate. If you take out a mortgage from Raiffeisenbank for the same 196 months at 10.9% per annum, then the overpayment for the entire period will be 2,514,850. If you leave the mortgage with Sberbank, then the overpayment will be 2,541,677. The benefit from refinancing is 26,827 rubles.

- Now we consider further the additional costs of the mortgage, namely life insurance. Let's take an average rate of 0.5% of the principal balance. During the entire period you will have to insure yourself 17 times. The approximate payment for this period will be about 119,701. Our family does not have compulsory life insurance under the Sberbank mortgage. The benefit from refinancing, taking into account the previous point, is already negative - minus 92,874.

- The father of the family receives his salary, like a fairly large number of Russians, on a Sberbank card, which means that you will either need to pay a transfer fee of 1% of the amount, or look for a Raiffeisenbank ATM.

- It will be necessary to transfer the collateral from Sberbank to another bank and re-register the transaction, which means a lot of wasted time, nerves and registration costs.

- For the period until you transfer the collateral to a new bank, the interest rate will be increased by 1%, and this is another couple of thousand in excess overpayment.

It follows from this that for our readers from Novosibirsk, refinancing a loan for an apartment will be unprofitable for a number of reasons:

- The benefit from lower mortgage interest rates is minimal.

- The appearance of an obligation to insure one's life on a mortgage takes an additional more than 100 thousand rubles from the family.

- The assignment of a mortgage is associated with a large number of bureaucratic delays and additional expenses from the budget. Instead of working and bringing income to the family, dad will be forced to take time off from work and waste his time and nerves interacting with banks.

Subscribe to our project updates at the end of the post, and you will find out how, with the help of our project, this family will repay their mortgage profitably. To begin with, we recommend reading the post “Restructuring a mortgage with the help of the state”, it will tell the personal experience of this family from participating in the program to help mortgage borrowers.

When is it profitable to refinance? Let's outline a number of parameters that will help you make the right decision.

- The mortgage rate should be lower than the current 1%, or better yet, higher. In our example, refinancing at 10% per annum will bring a benefit of about 272,408 rubles. Even taking into account insurance, this is beneficial, because the mortgage will still be closed ahead of schedule due to maternity capital, a tax deduction on the mortgage and restructuring with the help of the state (follow this on our project).

- There are no additional commissions and payments for the mortgage (for example, insurance), or they are lower than the current ones.

- It is possible to transfer the mortgage to your salary bank or bank where it is convenient for you to make payments.

- You have a lot of free time and nerves to refinance.

Now you already roughly understand whether refinancing your mortgage is beneficial for you or not. Let's now learn more about how to refinance a mortgage.

Let's summarize: how to refinance your mortgage most effectively

- Information about a reduction in the rate or monthly payment amount is not enough to make an informed decision. It is necessary to take into account all payments and expenses for the refinancing procedure.

- The question of how long it will take to refinance a mortgage does not have a clear answer for all cases. You need to perform a calculation and compare the results with the current mortgage agreement.

- Evaluate different mortgage refinancing offers - which is more profitable. All banks have their own conditions.

- At all stages of document preparation, explore opportunities to save time and money. For example, an extract from the Unified State Register can be obtained without a visit to the MFC or the Rosreestr authority. You can use the 24-hour online service EGRN.Reestr and receive an official extract with digital signature to your email. The document can be easily printed, downloaded to a flash drive or sent to the bank’s email.

Remember reasonable caution: do not rush to immediately submit loan applications to several banks, first just collect and analyze the information. Banks will request information from credit bureaus on each application, and a large number of requests will negatively impact your credit rating .

Text: Natalia Petrakova, Olesya Moskevich

Why might another bank refuse?

The decision on each application for mortgage transfer is made individually. The bank has the right not to explain the reasons for the refusal.

Often a negative decision is made for the following reasons:

- Inconsistency of the refinanced mortgage with the requirements accepted by the bank. It must be issued at least 6-12 months ago, and there must be at least 3 months left until the end of the loan agreement. The mortgage loan being refinanced must not be in arrears and must not have been previously restructured.

- Bad credit history. Even if you regularly pay your mortgage, but are late in fulfilling your obligations on other loans, you should not hope for approval for refinancing.

- Your unstable financial situation. If the bank knows that your employer is having problems, they may also refuse to refinance your mortgage.