16K 1 3 min.

VTB mortgage borrowers are massively complaining about the bank’s own program being provided to them instead of holidays as part of state support. According to the bank’s program, loan terms are extended not by three to four months, but by three to four years, the overpayment reaches 2 million rubles. The bank claims that they enable this or that type of vacation only based on the borrower’s request, and the share of those wishing to disable the service is insignificant. Lawyers and human rights activists talk about violations of citizens' rights, but borrowers need to take care in advance to record actions confirming this fact.

Photo: Tatyana Gord, Kommersant / buy photo

Photo: Tatyana Gord, Kommersant / buy photo

Complaints from bank clients about the issuance of credit holidays are not uncommon (see Kommersant, May 28). However, in the last month, citizens have made numerous complaints on the banki.ru forum primarily against VTB - instead of mortgage holidays in accordance with 106-FZ, the bank provides them with its own programs.

Over the phone, borrowers receive standard information: an extension of the term by three to four months and an increase in the loan amount by interest accrued during the holiday period. But the payment schedule that appears after connecting the service differs from these conditions.

For one borrower, the loan term increased by three years, and the size - by more than 1.5 million rubles, for another - by four years and 2.2 million rubles. Clients from Moscow, St. Petersburg, and the Krasnodar Territory are complaining; there are dozens of complaints.

The bank informs dissatisfied borrowers that the service cannot be canceled once connected. However, in a number of cases he did carry out “corrective measures”, upon completion of which the service was canceled and the “repayment schedule was restored.” In other reviews, VTB is ready to cancel the service and return the old payment schedule to the borrower, subject to payment of funds for the months missed under the program.

How to get a loan: conditions for obtaining

In order for the bank to approve a mortgage application, the borrower must meet several mandatory conditions.

- Have Russian citizenship. This clause is mandatory if a mortgage agreement with state support is intended.

- Having a total work experience of more than one year. If a citizen has changed his job, before submitting an application he must work for more than 1 month after the probationary period.

- Having enough income to make monthly mortgage payments. The bank is considering the option of joint income. For example, the combined income of the borrower and his spouse, parents, children, brothers or sisters.

- The bank does not have specific age restrictions, but mortgage applications are more likely to be issued to citizens aged 21 to 65 years.

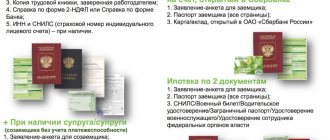

The borrower must provide the bank with the following documents to approve the application:

- A document confirming Russian citizenship, as well as permanent registration in Russia (Russian passport).

- Employment history.

- A document confirming the borrower's income level. Data can be provided using a special bank form, 2NDFL, or through a bank account statement, which contains information about the wages being credited. The income certificate requires information for the last year.

- SNILS.

- TIN (just indicate the number).

- An employment agreement with the organization in which the future borrower is currently employed.

- Men under 27 years of age must provide military identification.

In order to increase the chances of getting the application approved by the bank, the borrower is recommended to have the following documents with him (if any):

- document confirming higher education;

- about the availability of real estate;

- information about existing loans;

- marriage certificate, etc.

Decision notification

When submitting an application on the website (and when visiting a bank office too), the client provides a valid cell phone number, as well as an email. This number will receive a call from the credit manager as soon as VTB makes a decision to issue a loan or refuse it.

Moreover, if the form is filled out on the website, the manager calls back almost immediately to clarify the details. For information about the paper version of the application, read the article “Sample application form for a mortgage at VTB and instructions for filling it out.”

There is no way for a borrower to find out about VTB’s decision on a mortgage application via the Internet, since the bank does not maintain a unified database of applications. All that remains is to wait for information by phone. If a positive decision is made, the client will need to go to the mortgage branch of the bank with all the documents and sign an agreement.

Features of the approval procedure

After the bank client has filled out the application and provided all the necessary documents, the application approval procedure begins.

How long to wait for a decision: deadlines for reviewing an application

The application approval procedure takes on average from 1 to 5 days. However, the process may be delayed if new information arises that was not initially disclosed.

For example, a citizen did not provide information about his earlier loans. Also, the deadline may be delayed due to the general workload of the department to which the application was submitted.

The approval period depends on the reliability of the future borrower from the bank's point of view . Regular and positively proven clients of VTB24, as well as citizens with a salary card from this bank, can count on a faster decision.

How do I know if my application has been approved?

If the application is approved, a bank employee will personally notify the client about this using the phone number specified in the application form. If the bank does not approve the mortgage, the borrower will learn about this via SMS.

There are several ways to personally verify whether an application has passed the approval procedure:

- By bank phone number . A call to the VTB24 hotline will allow you to quickly verify whether the application is under consideration or whether the result is already ready.

- Using your personal account . The user needs to log into the VTB Online service, where he can find out information about the application review procedure.

How long does it last?

The validity period of approval at VTB24 is 122 days.

During this time, the client must have time to choose a suitable property that will meet not only his requirements, but also the requirements of the bank.

How long does mortgage approval last in VTB 2021?

After refusal, the client can again apply to VTB for a loan after 60 calendar days, but it is not so much the time period that is important as the initial reasons for the refusal.

The most important stage is approval of the application. As soon as the bank has made a positive decision, you can proceed to the next steps. You have 4 months left. Quite a lot of people simply do not understand the scheme of interaction with the bank, the terms of approval and, in general, their further actions.

Now you can buy an apartment in a new building and on the secondary market from 8.4%, if you take out a mortgage from VTB 24 partners and for an apartment of 65 sq.m.

What to do after receiving a notification?

After the client has received notification that his application has been approved, he needs to follow the following steps in sequence:

- Selection of real estate. During the period of mortgage approval, the client must have time to choose a property that will meet VTB requirements. Housing can be a new building, secondary real estate, a private house, a garage, a room, or a plot of land. VTB will also approve real estate from its own catalog.

- Approval of the choice by the bank. Once housing has been selected, you need to contact the bank, where an employee will provide a list of required documents. When all the information about the selected property has been sent to the bank, you must wait until the approval procedure is completed. It usually takes 3 to 5 business days.

- If the housing is approved, a bank employee will notify you and set a date and time for signing the documentation and concluding a mortgage agreement.

Mortgage application review period

On its website, VTB sets a vague deadline for making a decision - 1-5 days. The memorandum on mortgage lending, compiled by the same bank, names a period of 3-4 days, and it is best to focus on this period. At this time, the bank checks the information provided by the borrower, calculates the loan amount and the rate at which it is ready to issue borrowed funds.

There is a program “Victory over formalities”, where a mortgage is issued based on only two documents - where the bank promises to give an answer in just 24 hours.

Why you can get rejected: reasons

VTB24 may refuse a mortgage in the following cases:

- Availability of outstanding or overdue loans . If the client has one or more other loans (especially for large amounts), the bank may refuse to provide him with a mortgage.

- Falsification of documents . Information about income, citizenship and other documents are carefully checked by employees. Therefore, their falsification may entail not only the refusal of the current application, but also being blacklisted by the bank.

- Income level is not high enough . Depending on the value of the property, the client must have a certain monthly salary, the amount of which is calculated by the bank. If the borrower receives less than what is needed to pay the loan, the bank will refuse him.

- Failure to meet other requirements . VTB may also refuse to apply to people who have insufficient work experience or who are not of an age suitable for high solvency.

According to Article 821 of the Civil Code of the Russian Federation, a financial institution is not required to indicate reasons for refusal, therefore, by law, a bank may not approve an application marked “without explanation.”

How often does a bank refuse borrowers: approximate statistics

In mid-2021, RBC published an article in which the head of VTB Bank Andrei Kostin focuses on tightening the requirements for applicants. This information applies to both conventional loans and mortgages. The head warned of a possible increase in mortgage refusals, but no specific figures were given.

Customer reviews on the banki.ru service indicate that mortgage refusals occur frequently, even after the application has been officially approved.

Who reviews applications?

In this procedure, banks involve several of their departments simultaneously.

- Applications are subject to automatic scoring, and based on its results a certain amount of points will be assigned. If it does not reach a certain value, the client will be refused. In case of higher scores, the application will be sent to the next stage of consideration with a CI request. If it is bad, the bank will refuse to provide a mortgage loan.

- After scoring, the lender’s security service handles the application; it checks it for authenticity and relevance by submitting requests to the Federal Migration Service, the tax service, the Pension Fund of the Russian Federation, the borrower’s employer, guarantors, co-borrowers, etc.

- The application undergoes an analysis of the applicant’s documents in the analytical department with a forecast of the loan recipient’s ability to repay the mortgage throughout the entire loan term.

- The risk department assesses the risk of non-payment of the loan, the stability of the borrower’s work, etc.

Who will VTB approve a mortgage: requirements for borrowers

A Russian citizen who wants to purchase housing on preferential terms can fill out an application directly on the website. Submission of additional documentation is not mandatory, but may significantly influence the bank's decision. In addition, attracting co-borrowers from among close relatives will help you obtain a larger amount for the purchase of luxury housing.

By the way, our partners include not only developers, but also real estate agencies. It also makes sense to cooperate with them and we will tell you why.

You must be prepared to thoroughly check the information provided. Security officers can call the employer's telephone numbers indicated in the questionnaire to clarify information about the place of work, length of service, position, etc. The purpose of such checks is to identify false information.

Where is the mortgage interest rate lower?

The amount of interest charged depends on several factors:

- loan amount;

- the amount of funds paid as a down payment;

- term of the mortgage agreement.

Also, interest rates are significantly lower for salary and regular bank clients.

Current interest rates:

| Minimum (percentage per annum) | |

| Sberbank | 7,5% |

| VTB 24 | 9,3% |

The interest rate is calculated individually and depends, among other things, on the selected program. The lowest interest rates are charged on mortgages for the purchase of housing in a new building.

Lending conditions at VTB24

Mortgage lending at VTB24 is distinguished by its rules and requirements. Therefore, in order to be fully aware of what will be accompanied by obtaining a mortgage and what conditions the lender will have to fulfill for this.

General rules for lending at VTB24

Of course, each of the bank’s mortgage programs has its own conditions and features. However, there are general bank rules that all of its clients must follow, regardless of the mortgage offer they choose.

- You can only take out a loan in bank-supported currencies (rubles, dollars and euros);

- Mandatory insurance of the client's liability for the mortgage (life insurance is voluntary, but it is necessary to insure the risks of damage or complete destruction of the collateral property);

- The down payment on the mortgage must be no less than 10% and no more than 65% of the total loan amount (however, an exception is for loans that do not require a down payment);

- The minimum mortgage amount is 500,000 rubles , since the bank specializes in large loans.

Requirements for the borrower

Each bank puts forward its own requirements for potential borrowers.

This is caused by the fact that the lender cannot cooperate with a person if he is not sure that the borrower will definitely be able to return the mortgage to him and fulfill his obligation. The bank wants to avoid even the slightest risks.

belonging to the following categories of citizens can apply for a loan from VTB24

- Employees of this organization;

- Employees of companies that are accredited by the bank;

- Salary clients of VTB24.

Note! The people listed above have the right to receive a lower interest rate on a mortgage, and can also count on simplified acceptance of documents and an expedited application review process.

- Individuals;

- Legal entities;

- Individual entrepreneurs.

Advantages and disadvantages of lending at VTB24

After considering the lending conditions and the process of applying for a mortgage at VTB24, it is necessary to summarize and compare all the pros and cons of this lender.

| pros | Minuses |

| Fast application review | Strict requirements for the borrower |

| High quality service | You can only buy real estate from an accredited borrower |

| A variety of programs that allow each borrower to find a profitable mortgage for themselves | If the borrower refuses insurance, lending conditions are significantly tightened |

| Low interest rates compared to other popular lenders that specialize in large loans | Mandatory registration of collateral. |

| You can connect or remove insurance at any time | Mandatory assessment of the value of the property (in certain cases, the assessment results may be lower than the market value of the property) |

| The monthly payment amount is regularly sent via SMS | — |

| Early repayment of the loan does not require unnecessary expenses and does not cause dissatisfaction on the part of the bank | — |

Mortgage lending at VTB24 has its own characteristics. The bank has quite strict requirements, but at the same time favorable lending conditions. Mortgage programs are quite diverse - there are offers for different categories of clients, and you can get a loan in almost any convenient currency.