The processing and issuance of any bank loan begins with the submission of an application by a potential borrower. He turns to those banks that offer suitable terms of cooperation for him.

After this, the bank begins a full-scale verification of the candidate, especially carefully conducting an analysis in relation to mortgage borrowers. The bank must ensure the reliability and solvency of the new client, who will be required to pay mortgage payments without failure for several decades.

If the borrower’s candidacy does not raise any complaints or suspicions on the part of the bank, the lending institution approves the mortgage application.

But when the mortgage is approved, what to do next? Next, the candidate will have to go through several bureaucratic stages in a short time before he can receive credit money and buy his own home.

Review of documentation

If we talk about the timing of consideration, then a lot depends on how quickly a person responds to the bank’s requests for certificates or documents. Since the mortgage loan approval process consists of several steps, it also takes a lot of time.

Mortgage approval at Sberbank:

- At the first stage, a person goes to the nearest branch for advice.

- Then he selects an approximate property and receives an approximate cost of the mortgage loan.

- At the second stage, you should collect documents. The most important thing is certificates confirming the income level of a person and his co-borrowers.

- The final stage is characterized by waiting, which lasts 2-5 days.

If your mortgage is approved by Sberbank, here's what you need to do next:

- Search, select a property.

- Collect documents according to the list from the bank. They relate to mortgage housing.

- It is imperative to insure and evaluate the future property.

- Conclude an agreement for the purchase of an apartment (house).

- Make a down payment (using maternity capital is allowed).

- Draw up papers confirming the fact of transfer of mortgaged housing to the bank (as collateral).

- Receive an approved loan and transfer it to the seller of the apartment (house).

When clients ask how long to wait for mortgage approval at Sberbank, employees answer - about five days. This period is required by the bank in order to assess the readiness of documents and the solvency of the client. Next, a more detailed review of the transaction and related securities begins, which stretches for at least a month. This is a big disadvantage for the client, because often a purchase and sale transaction needs to be concluded very quickly.

Home valuation

An independent assessment of the value of the found residential property is necessary for the buyer. This will allow you to reasonably determine the amount of the mortgage loan. This procedure must be carried out by a qualified professional with appropriate accreditation. It is recommended to use the services of those appraisers who are already cooperating with the creditor bank, as this will significantly speed up the process of obtaining a mortgage, without allowing any disagreements to arise with the financial institution regarding the value of the collateral property and, accordingly, the amount of the loan issued.

The procedure for the valuation of collateralized real estate is paid by the home buyer, who, in fact, is the recipient of the mortgage. The appraiser charges approximately 3,000-5,000 rubles for his services. The expert’s report on the results of the assessment includes the following mandatory sections:

- market price of living space (apartment, individual building);

- liquid value of real estate;

- description of the characteristic features of a residential property.

How many days does it take to approve a mortgage at Sberbank?

Several factors affect the review period. The first factor is the type of mortgage lending. The bank has a time limit for approving each type of mortgage. For example, if a loan is needed to purchase housing on the primary or secondary market, then the processing time for documents is 2-5 days. Only working days are counted, not calendar days. The period is increased by one day if housing is purchased using a military mortgage or through on-lending.

These steps are necessary for the banking institution to evaluate its future borrower. Bank employees are interested in whether the client has a stable income and what social category of citizens he belongs to. No one argues with the fact that banks, first of all, pay attention to the client’s employment and income. Managers must be confident that the future borrower will repay the loan regularly. If a person has a good credit history and has no current loans, this increases his chances of getting a mortgage loan.

The category of salary clients is a priority because their income level is stable and known to the bank. Accordingly, there is no need to make inquiries and once again prove your solvency. This has a significant impact on the deadlines, because they are reduced to one, maximum two days. As for the rest, they submit a list of papers in the prescribed manner.

An application for a mortgage loan is considered at several stages. Therefore, at any of them questions may arise that will lead to an increase in time:

- Credit scoring. This is an automatic check based on the information entered. Its main task is to assess a person’s solvency. The assessment is based on personal data on family composition, income level, work activity and other factors. This step is characterized by a credit history check.

- In order to evaluate documents for authenticity, they must be checked by the bank's security service. Bank representatives can call the specified place of work and talk with the manager. The underwriting department's job is to assess risks. Department employees conduct analytical work and, based on it, draw conclusions about the client’s solvency.

There are several ways to find out if a mortgage has been approved by Sberbank. In most cases, the credit manager calls the client, informing him of the decision, or receives an SMS message. Once the mortgage is approved, the most critical part of the process begins. You need to select and agree on real estate. At the next stage, the bank sets aside 10 days to review documents for future mortgage housing. If the client made errors in the certificates, this increases the consideration for some more time. And, most importantly, banks have certain requirements for real estate. Their compliance is mandatory.

Finding suitable living space

searching for suitable real estate in advance , since finding the right option is sometimes not as easy as we would like. As a rule, searching for living space for subsequent purchase is a multi-criteria and complex task that takes into account a wide variety of preferences and wishes of the buyer. Cost, layout, area of location, availability of communications, degree of wear and tear, age of the building - all this, like many other nuances, is of significant importance for the buyer of an apartment, who will use it for a very long time.

It should be taken into account that each bank also has its own requirements for mortgaged housing - after all, an apartment purchased with a mortgage until the borrower repays all obligations is pledged to the lender.

Therefore, solving this problem should be approached extremely responsibly.

However, you should not greatly delay the search process, since the bank’s positive decision on a mortgage loan has a certain validity period, which also needs to be taken into account. For example, at Sberbank, mortgage approval is valid for strictly 3 (three) months, which are calculated from the moment the lender makes a positive verdict on the application previously submitted by the client. This means that if a mortgage applicant fails to obtain a targeted housing loan within three months, he will have to start the application and approval procedure all over again.

Bank requirements for mortgaged (collateralized) housing:

- The structure should not require major repairs.

- The purchased living space should not have the status of a communal apartment.

- Availability of a full set of connected networks and utilities.

- No illegal alterations in residential premises.

- There should be no registration of “problem” tenants in the apartment (for example, those in prison, those who are missing), who could subsequently reasonably claim to receive their share in this premises.

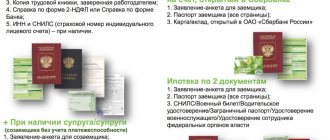

List of documents for mortgage approval at Sberbank

Clients who take the collection of documents seriously can count on a quick positive decision. To speed up the procedure, when applying to Sberbank for the first time, you need to have the following documents on hand:

- Russian passport with permanent registration. If it is missing, a temporary one will do.

- A written application from a client to receive a mortgage loan.

- A document confirming the fact of marriage.

- If there are children, then their birth certificates are needed.

- The client's profitability is confirmed in two ways. Providing a 2-NDFL certificate; if it is missing, a completed document based on the model of a banking institution will do. People of retirement age provide identification. If the client has an additional source of profit, this must be confirmed.

- A prerequisite is having a permanent job. A photocopy of the work book with a stamp and signature is suitable for proof.

When co-borrowers help to obtain a mortgage loan, the bank requires from them the same number of documents as from the main persons. It will be a positive fact if the husband and wife have jobs.

What is residential mortgage lending?

A mortgage is a loan program provided by a bank on the security of purchased or owned housing. The conditions for obtaining such a loan depend not only on the borrower’s solvency, but also on the availability of additional liquid property for foreclosure in the event of credit debt. It is worth noting that banking organizations have very strict requirements for this type of residential real estate, in particular, they should not have any encumbrances (previously issued pledges, seizure of the debtor’s property, etc.). In addition, the solvency and reliability of the borrower, the presence of previously received and unpaid loans, as well as other outstanding debt obligations are carefully checked. Banks, as a rule, request information on these issues from the BKI (credit history bureau). At the same time, a mortgage refers to credit programs with encumbrances, often requiring significant guarantees for execution (for example, the participation of a co-borrower or guarantor, who will also be responsible for the loan).

Why does a mortgage application take so long to process?

There can be many factors, and in most cases, they come from the client. For example, if he filled out the papers incorrectly or made mistakes. Main reasons:

- The fact that there is not one co-borrower, but several, leads to an increase in the consideration period. After all, each of them is carefully checked.

- Incomplete set of documents.

- The inability to find an apartment that the client likes and would be approved by the bank.

- The underwriting department may not meet the allotted deadline for verifying documents. This leads to the fact that certificates received before everyone else lose their relevance.

- Human factor. It manifests itself both on the part of borrowers and on the part of bank employees.

Mortgage benefits, military mortgage

Preferential military mortgage is an affordable loan product that NIS participants can use and receive a housing certificate after 3-5 years of service. The advantages of such a loan are: mortgage repayment period – up to 25 years, reduced interest rate. In addition to military personnel, the law provides for a preferential mortgage for maternity capital, which is accepted from the borrower as a down payment for an apartment, while the purchased property will be registered in the shared ownership of all members of the borrower's family. Mortgage lending is also provided to young families under the “Mortgage with State Support” program. The main advantage of this program is the possibility of deferring payment for up to 3 years; the amount of the state subsidy is 25% of the cost of the purchased residential property.

Speeding up the mortgage application process

Sberbank has created a service that allows you to quickly find suitable housing in new buildings. This is DomClick. What is important is that all real estate objects meet the bank's requirements. If you apply for a mortgage loan from this service, it will be included in the priority queue. For example, the processing time for an application is reduced to several days. This is also convenient for the client because there is no need to visit a bank branch. You can find out about the decision by email.

It is worth noting the fact that in order to reduce the time it takes to consider an application, you need to take care of choosing real estate in advance. This will help eliminate those options that do not meet the bank’s requirements. Having received approval, the client will begin to collect the necessary certificates, and not look for an apartment. It is also important for a person to know how long mortgage approval at Sberbank is valid. Because sometimes the allotted time is not enough to prepare documents.

What legal acts control residential mortgage lending?

The procedure for registering and obtaining a mortgage is regulated by the Federal Law “On Mortgages (Pledge of Real Estate)” No. 102-FZ dated July 16, 1998. The legal act discloses in detail the rights and obligations of banking organizations, conditions and requirements for drawing up a mortgage loan agreement. The value of a property is determined in accordance with the requirements of the Federal Law “On Valuation Activities”. The procedure and conditions for obtaining a mortgage are regulated by the provisions of the Civil Code of the Russian Federation on contracts, pledge of real estate, ownership and title ownership. The procedure for foreclosure on a property in the event of failure to fulfill obligations by the borrower is regulated by the norms of the Code of Civil Procedure of the Russian Federation and the Federal Law “On Enforcement Proceedings”.

Procedure after approval of the application

After the bank has approved the application and the client has found a suitable property, the most crucial moment comes. It consists of signing a mortgage agreement. The client’s task is to study the provided document in detail. This is especially true for those points where the loan amount, monthly payment, and obligations of the parties are written. The debt repayment schedule is formed separately, it is also worth checking.

Simultaneously with the mortgage agreement, an additional agreement on home insurance is signed. You cannot refuse this, otherwise the bank simply will not approve the mortgage. In addition, it is advisable to insure your life. The bank cannot oblige the client to do this, but the interest rate depends on the fulfillment of this condition. By insuring life, a person can count on reducing the interest rate by 1%. It seems like a small privilege, but if the loan is issued for years, it is very noticeable.

At the final stage, having concluded a deal, the client needs to enter his home into electronic registers.

You can ask a bank employee for help or contact the MFC. After preparing the documents, the banking institution transfers the entire loan amount to the account of the person who sold the property. After this, we can say with confidence that the transaction is completed. The client becomes the owner paying off the mortgage. Mortgage in Sberbank. This is why most mortgages are taken out from Sberbank. Mortgage conditions in 2021

How to get approval for a loan application?

Before describing the actions of the borrower after approval of the loan application, you need to stop at the very beginning of this entire procedure. The procedure begins with submitting a loan application.

A citizen has the right to apply to several credit institutions at once in order to increase his chances of success and choose more favorable loan repayment conditions in comparison.

Approval of a loan application is only a preliminary positive outcome regarding the borrower’s candidacy. The bank makes its decision only on the questionnaire submitted by the citizen, checking the data contained in it and the credit history of the borrower. The bank will make the final decision only after the candidate submits all the necessary documents to the bank.

Typically, filing an application occurs in several stages:

- Search for a credit institution . You can contact several banks. Before doing this, it is recommended to check that there are no debts on existing loans and use a loan calculator to select individual loan terms.

- Search for a mortgage program . There are a huge number of mortgage programs on the market, including preferential ones. Before submitting your application, you need to check whether your candidacy is suitable for government mortgage programs. They have reduced interest rates and real government financial assistance for paying monthly payments.

- Filling out the application form . Each bank has a special form of this document. Sometimes banks ask you to attach copies of documents on income and employment.

- Filing an application . Today, you can apply for a mortgage not only through a personal visit to a bank branch. Many of them have long switched to electronic processing of loan applications, which can be immediately filled out and submitted through the bank’s website.

A decision on an application is usually made within 2-3 days . Some banks even consider them within 24 hours. After this, the bank manager contacts the client by telephone and invites him to the office to discuss the terms of further cooperation.

Housing mortgage lending: pros and cons

To summarize the above, we note that the main advantages of mortgage lending are undoubtedly the ability to quickly purchase your own home and, if you have a constant high income, gradual repayment of the loan, without compromising the vital interests of the family. The main disadvantage of buying an apartment with a mortgage is the risk of losing your regular income, which can result in late mandatory payments. Those who bought an apartment with a mortgage in foreign currency are at greater risk - instability in the foreign exchange market can lead to higher repayments of the loan debt, depending on the exchange rate.

Banks provide refinancing of foreign currency mortgages based on the borrower’s application.

In case of a long delay, the bank has the right to go to court with demands to evict the debtor and his family from the apartment and put the property up for sale. A mortgage is undoubtedly an important step in the life of every borrower who wants to purchase their own apartment, however, before making this decision, it is necessary to carefully calculate all possible risks and create a reserve of funds, thanks to which mandatory payments will be made even if there is a loss of regular income.