The Tax Code (TC) of the Russian Federation provides for the opportunity to apply for social tax deductions for expenses on pension contributions.

According to paragraph 4 of Art. 219 of the Tax Code of the Russian Federation, citizens who made contributions to non-state pension provision (under an agreement with a non-state pension fund) or voluntary pension insurance (contributions are transferred to an insurance company) can receive a deduction. You can receive a deduction for an agreement concluded not only in your favor, but also in favor of your spouse, parents (including adoptive parents), disabled children (including adopted children or those under guardianship).

Clause 5 of Art. 219 of the Tax Code of the Russian Federation defines another social tax deduction: for expenses on paying additional contributions to the funded part of the labor pension. They are transferred to the Pension Fund by participants in the state pension co-financing program, which was possible to join until December 31, 2014. Participants annually transfer additional insurance contributions in the amount of 2 to 12 thousand rubles to the funded part of the pension.

Multiplication by subtraction. How will the new tax deduction work? More details

What expenses are covered by the social tax deduction?

The rules for providing a social tax deduction for expenses on non-state pension provision, voluntary pension insurance or life insurance, contributions to the funded part of the labor pension are determined by clauses 4 and 5, art. 219 of the Tax Code of the Russian Federation. A social deduction can be received by an individual who pays personal income tax for contributions to:

- agreements on non-state pension provision of NPFs;

- agreements on voluntary pension insurance with insurance companies;

- voluntary life insurance contracts. Provided that these contracts are concluded for a period of five years or more;

- additional contributions to the funded part of the labor pension.

Deductions for pension contributions are entitled to be applied by a taxpayer who paid them directly or submitted a corresponding application to the accounting department. If these contributions are paid for him by the employer, then the citizen has no right to them.

Bankiros.ru

How much and when to pay

Contributions are paid per year in a fixed amount. The amount of contributions for 2021 is 32,448 rubles, in 2022 it will be 34,445 rubles, and in 2023 - 36,723 rubles. This is how much one year of insurance experience costs under Art. 430 Tax Code of the Russian Federation.

If you subscribe not from the beginning of the year, contributions will be proportionally reduced for less than a full year. If you unsubscribe before the end of the year or don’t pay the full amount, the same. But the insurance period will also be purchased in a smaller amount.

Payments must be made by December 31st. You can deposit the entire amount at once or add money little by little at any frequency - the Federal Tax Service allows this.

The status of an individual personal account will be visible in “My Tax” or it can be viewed through a request on State Services.

If you don’t pay your fees, the tax office will not forcibly withdraw them from your card. The Pension Fund simply will not accrue the insurance period.

What features do contracts for social insurance and voluntary pension contributions have?

A citizen can enter into contracts for insurance and pension provision and pay contributions for them:

- in your favor;

- for your spouse;

- parents;

- disabled children, including those adopted or under guardianship.

What is the maximum amount possible to receive a deduction?

The maximum amount of contributions from which tax is calculated is 120 thousand rubles. This amount covers all social deductions. Therefore, if you incurred other expenses in the same year, for example, for treatment or education, you will have to determine the expenses or part of each category for which the deduction will be calculated.

Bankiros.ru

How to get a deduction for the payment of insurance and pension contributions?

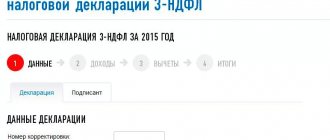

- Fill out the declaration in form 3-NDFL at the end of the year in which the contributions were paid. You can find it on the Federal Tax Service website.

- Obtain a certificate from the accounting department at your place of work about the amounts of taxes withheld for the desired year in form 2-NDFL.

- Prepare a copy of the agreement or insurance policy with the NPF or insurance company.

- If you paid additional pension contributions to the funded part of your retirement pension, order a certificate from your accounting department about the amounts of contributions transferred on your instructions.

- Prepare documents that confirm your relationship or guardianship over the persons for whom you transferred contributions or in whose interests you entered into a life insurance agreement.

- Prepare copies of payment documents that confirm your expenses for premiums and insurance services. These can be cash register receipts, cash orders, payment orders and more.

- Submit your deduction declaration to the tax office at your place of residence. Attach documents that confirm your expenses and your right to a tax deduction. If you have incurred expenses for the contributions of your relatives, also attach to the declaration copies of documents that confirm your relationship.

- Be prepared for the fact that verification of your declaration and documents may take up to three months. After this, the payment will be transferred to you within a month.

Bankiros.ru

When submitting a return for deduction, be sure to take with you the originals of all documents attached to it. Thus, the tax inspector will be able, if necessary, to verify the authenticity of the declared data.

If contributions for non-state pensions and insurance were withheld by the employer from the employee’s salary, the deduction can be received before the end of the financial year. To do this, you must provide the employer with a certificate for deduction from the Federal Tax Service. The employer will suspend the withholding of personal income tax from your wages.

Bankiros.ru

How is the tax deduction calculated?

Let's look at the example of contributions to non-state pension provision. Social tax deduction is 13% of the amount of contributions paid. To find out the amount of social deduction, you need to multiply the total amount of contributions by 13%.

For example, you make annual contributions to a non-state pension fund. Their total amount was 15 thousand rubles. The amount of social tax deduction = 15,000 * 13% = 1,950 rubles. Since this amount is lower than the amount of personal income tax you paid, you are entitled to the entire deduction amount - 1,950 rubles.

In this case, the maximum amount for deduction is 120 thousand rubles. Even if you transfer contributions to a non-state pension fund for an annual amount of 135 thousand rubles, you can only receive a deduction from 120 thousand, i.e. 15,600 rubles.

“Pension” personal income tax

Pensions in the Russian Federation can be accumulated either in a state pension fund (including under voluntary insurance contracts for the funded part of a pension) or in a non-state one. The effect of state pension provision is regulated by the laws “On State Pension Security” dated December 15, 2001 No. 166-FZ and “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

Non-state pension provision is carried out in accordance with the Law “On Non-State Pension Funds” dated 05/07/1998 No. 75-FZ (hereinafter referred to as Law No. 75-FZ).

Based on this, the Tax Code provides for different procedures for taxing pensions formed by transferring contributions to state or non-state funds.

State-supported pensions are not subject to personal income tax, with the exception of payments if an individual has voluntary insurance of the funded part of the pension (clause 2 of Article 217 of the Tax Code of the Russian Federation).

But any citizen can enter into a pension agreement with a non-state pension fund (NPF), which operates on the basis of a license. Under this agreement, the citizen (also known as the investor) undertakes to pay pension contributions, and the fund – to pay a non-state pension when pension grounds arise (Article 3 of Law No. 75-FZ).

This pension is additional to the state pension. It is also not subject to taxation, but provided that the agreement is concluded by the investor in his own favor, and he also transfers contributions (paragraph 4, paragraph 1, article 213 of the Tax Code of the Russian Federation).

But if an organization has concluded a pension agreement in favor of its employees and, on its own initiative, transfers pension contributions to the employees’ personal accounts in the NPF from its own funds, then the situation is different.

Contributions are not subject to personal income tax (paragraph 5, clause 1, article 213.1 of the Tax Code of the Russian Federation). But upon retirement, workers receive an additional non-state pension minus personal income tax (paragraph 2, paragraph 2, article 213.1 of the Tax Code of the Russian Federation).

In this case, the NPF is a tax agent in relation to the investor. It calculates, withholds and transfers tax on pension payments to the budget (clause 2 of Article 226 of the Tax Code of the Russian Federation).

In the same way, taxation of contributions and payments under agreements with non-state pension funds concluded by individuals in favor of other individuals is provided.

Personal income tax contributions are not subject to personal income tax (paragraph 6, paragraph 1, article 213.1 of the Tax Code of the Russian Federation), but you will need to pay personal income tax on your pension (paragraph 3, paragraph 2, article 213.1 of the Tax Code of the Russian Federation).

The apartment was purchased before retirement

In this case, according to Letter of the Ministry of Finance of the Russian Federation No. 03-04-05/40681 dated July 12, 2021, you do not have to wait for the next year and file a declaration for the four previous years in the year of retirement.

As always, documents are submitted to the tax office the next year after obtaining ownership of housing, and not earlier.

Example:

In 2021 you bought an apartment, in 2021 you issued a deduction and returned the tax for 2021. Retire in 2021. You now have the right in 2021 to get a tax refund for 2021, 2021, 2021 and 2016. You have already received a deduction for 2021 when you were not yet a pensioner, which means there remains a deduction for the working months of 2021 and in full for 2021 and 2021.

Deduction for treatment

To receive a deduction after your own treatment or treatment of close relatives, you must have on hand all the documents confirming the purchase of medicines and the payment for direct treatment. You can submit an application either directly to the Federal Tax Service or to your employer. In the first case, the entire due amount will be refunded in full.

, and in the second case, the payment will be partially reimbursed along with wages through the payment of funds without repaying income taxes until the debt is fully reimbursed. Funds spent on voluntary health insurance are also refundable.

You can receive a deduction if the payments were not made from the employer’s funds. The maximum costs from which you can receive a deduction is 120,000 rubles

. The exception is expensive treatment. For this, you can count on compensation for the entire amount spent. You can study what exactly refers to expensive treatment in PP No. 458 dated 04/08/2020.

Charity deduction

According to paragraph 1 of Article 219 Under the Tax Code of the Russian Federation, a taxpayer has the right to a deduction if he makes deductions from his official income for charity-related purposes:

- Support for organizations involved in science, culture, non-professional sports, educational process, healthcare, provision of legal and social assistance, environmental protection and wildlife;

- Financing of religious organizations to ensure the implementation of their statutory activities.

The deduction will be provided within 13% of the funds spent, but not more than up to 25% of the annual income

. For example, if a payer receives 600 thousand rubles a year and spends 70 thousand on charity, then he will receive 9,100 rubles as a deduction.

But if 300 thousand rubles are spent on charity (which is 50% of income), then you can only count on a deduction from an amount of up to 120 thousand rubles, and only 15,600 rubles will be returned.

worth noting :

- To receive a deduction, you need to spend money on charity only in cash;

- The organization spends the funds received exclusively on the basic needs of its own activities;

- Funds should be transferred to the organization’s balance sheet only directly;

- The taxpayer cannot claim any benefits from the sponsored organization.

Study deduction

As previously mentioned, you can receive compensation both for paying for your own education and for educating your wards, children and brothers/sisters. The main thing is that the educational institution where the training takes place must certainly have a license to operate.

The specialization of educational institutions can be varied:

- Kindergartens and preschool educational centers and clubs;

- Schools and studios, clubs and developmental courses;

- Specialized schools (evening schools, driving schools, music, choreography, theater arts, etc.);

- Courses and centers for advanced training or retraining;

- Lyceums, schools, technical schools and universities.

As for the amount of the deduction, it cannot exceed 13% of 120,000 rubles spent per year on one’s own education or that of a brother/sister and 50,000 rubles on the education of children and wards.

If a child has two parents, and they both plan to apply for a deduction, then it is worth considering that you can still only count on up to 50,000 rubles. This means that individual parents will only be able to receive compensation in the amount of up to 25,000 rubles each.

But if there are two or more children, then you need to know that compensation for the amount spent on education - up to 50 thousand rubles - is due for each child.