Any person who owns certain real estate is required to pay property tax on it. Such real estate includes not only an apartment or house, but also garages. At the same time, it is important to understand how the garage tax is calculated correctly, what factors influence the amount of this fee, and also who can take advantage of benefits to reduce the amount of payment.

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Types of garage taxes

Taxation is a complex and specific process that involves the study of all the features of human life. It is required to pay taxes on various incomes or property, which includes the garage.

This structure is considered the optimal place to store a car. It is considered real estate, so all owners are required to pay tax on it.

The board is divided into three different elements:

- tax on property represented by a direct garage and intended for storing a car;

- income tax on profits received if the premises are rented, sold or used in other ways to earn money;

- tax on land located under the garage, if title to it is also registered.

Each such fee has its own nuances and characteristics, and different interest rates are used for them.

There are different payment periods, so it is advisable for each taxpayer to thoroughly study the different tax codes related to these fees.

How is garage tax calculated based on the cadastral value? Watch in this video:

General information

Taxation is a very labor-intensive process that affects all areas of citizens’ lives without exception, including the use of real estate.

The main objects of taxation are:

- residential real estate;

- technical buildings and so on.

Income tax on a garage building is payable if:

- completing a purchase and sale transaction;

- when registering a deed of gift;

- when trying to inherit.

During the sale of a garage building, the seller is required to pay a tax in the amount of 13% (for non-residents of the country - 30%) of the cost, which was specified in the agreement.

The only exceptions are situations in which:

- the cost of the building is less than 250 thousand rubles;

- The seller has owned the garage for more than 3 years.

Important: if the ownership period is calculated in relation to the building located in the GSK, then it should be counted from the period of full payment of the share.

Nuances of calculating and paying property tax

Every garage owner should know that this building is represented by real estate, therefore, for it, like for various apartments or houses, you have to pay property tax.

Important! This fee is paid regardless of what the external and internal condition of the object is, so even if it is a dilapidated structure, the fee is still charged.

If you do not pay the funds on time, this is grounds for the Federal Tax Service to bring the defaulter to administrative responsibility. Based on Art. 402 of the Tax Code, the amount of tax is influenced by the value of the object.

Article 402. Tax base

1. The tax base for taxable objects is determined based on their cadastral value, except for the cases provided for in paragraph 2 of this article.

The specified procedure for determining the tax base can be established by regulatory legal acts of representative bodies of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol) after approval by a constituent entity of the Russian Federation in the prescribed manner of the results of determining the cadastral value of real estate objects.

2. The tax base in relation to taxable objects, with the exception of the objects specified in paragraph 3 of this article, is determined based on their inventory value in the event that the subject of the Russian Federation does not make the decision provided for in paragraph three of paragraph 1 of this article.

3. The tax base in relation to taxable objects included in the list determined in accordance with paragraph 7 of Article 378.2 of this Code, as well as taxable objects provided for in paragraph two of paragraph 10 of Article 378.2 of this Code, is determined based on the cadastral value of these taxable objects.

To determine the price of the garage, an assessment is carried out by BTI employees, after which this information is entered into the appropriate documentation.

Therefore, in order to obtain information about the cost of a particular garage, you need to take an extract from the Unified State Register or apply for a special certificate from the BTI, Rosreestr or the Federal Tax Service.

Tax rates

The calculation procedure assumes that the cost of the object is multiplied by the rate, and the resulting value can also be multiplied by a special deflator coefficient.

Most cities still use inventory value, but regions are gradually switching to using cadastral value. This leads to an increase in the tax amount, and by 2021 a complete transition to this value is planned.

The size of the rate is determined by regional authorities, but at the federal level there are certain nuances that must be taken into account by every owner of such an object:

- if, after multiplying the cost of the garage by the coefficient, the result is an amount not exceeding 300 thousand rubles, then the rate is 0.1%;

- if the result varies from 300 to 500 thousand rubles, then the rate will range from 0.1 to 0.3 percent;

- if the price multiplied by the deflator exceeds 500 thousand rubles, then a rate is used that can vary from 0.3 to 2 percent.

Important! The final rate depends entirely on the decision of the municipal authorities, and they also decide what the deflator coefficient will be.

Examples of garage tax calculations. Photo: images.myshared.ru

The necessary information that is needed to carry out calculations is usually located on the official website of the local administration.

What are the differences between the market and cadastral value of real estate? See the link for answers.

The calculation can be done manually or using an online calculator, so you can get an accurate value with minimal effort.

Payment order

The income received from the sale of the garage will need to be declared. To do this, after the sale, the owner fills out a declaration in form 3-NDFL. It is accompanied by all the necessary documents that allow you to receive a property deduction, namely:

- Copy of civil passport.

- A copy of the pension certificate.

- Certificate of employment in form 2-NDFL for working pensioners. (You do not need to indicate the pension amount).

- A purchase and sale agreement drawn up in accordance with all the rules.

- A document that confirms that the seller has received the amount specified in the contract.

- Extract from Rosreestr confirming ownership.

- Documents indicating that the building was previously acquired by the seller, if any.

If you have all the necessary documents for the garage, you can submit a declaration to the regional inspectorate in several ways:

- When visiting the FMS service in person at your place of residence. It is allowed to submit documents by another person with a power of attorney certified by a notary.

- By registered mail with return notification.

- Using the State Services Internet portal.

The deadlines for filing a declaration are strictly fixed. The document recording the completed transaction for the sale of non-residential real estate must be submitted to the regional Federal Tax Service before April 30 of the next year after the sale transaction. As soon as the documents are verified by the tax inspector, the confirmed amount indicated in the declaration must be paid to the specified details.

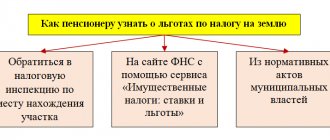

Features of determining land tax

Since the garage is located on a certain plot of land, if it is registered as a property, then you will also have to pay tax on it.

For this, different payment methods can be used:

- if the garage is located in a cooperative, then usually the building itself is the property of the owner, but the land is owned by the cooperative, so it is this organization that must pay the fee, after which the owner of the garage returns the required amount to the accounting department;

- if the land is registered as a property, then this fact is registered in Rosreestr, so employees of the Federal Tax Service are required to draw up receipts themselves, which are then sent to the land owners.

Garages are often located in cooperatives that have the right to exemption from land taxes, so the owners of these buildings may not pay this fee.

How is land tax calculated?

If there is a need to pay and remit this fee, then each taxpayer must understand this process. To do this, the cadastral value of the land must be multiplied by the rate.

The rate can vary significantly from region to region, with an average percentage of 1.5% being commonly used.

Tax payment is made from the moment the land begins to be used for its intended purpose. In this case, you will have to pay a fee even if the garage is just being built.

What tax is due after a garage sale? See here.

Features of the bill adopted in 2021

According to Art.

401 of the Tax Code of the Russian Federation, all structures are real estate if they are firmly connected to the land. However, their movement is impossible without serious damage to the structure. They must have an independent economic purpose and act separately in civil circulation. Thus, the barn and bathhouse can be transferred to the tenant separately. As a result, these structures are recognized as real estate for which taxes must be paid. If a person is both disabled and retired, he does not need to pay property tax on a building of any purpose and of any size. The building can be for both residential and non-residential purposes. As a result, such a person has the opportunity not to pay tax for an outbuilding with an area of up to 50 square meters. m., located in a gardening partnership.

If the property is not registered in the cadastral register, from 2019 a double land tax will be imposed on it.

Features of income tax

Such a fee is paid if a certain profit is received from the garage. It can be obtained through sale or rental. In this case, it does not matter by what method the object was registered as property.

The size of such a fee is standard and equal to 13% of the profit received for residents, but for non-residents an increased rate of 30% is used.

The funds are paid even if a deed of gift is issued to a non-relative, so the recipient still has a certain income from which a fee is paid, but the seller in such a situation does not pay the funds.

The percentage is set only by the federal government, so local governments cannot lower the rate.

Should pensioners pay garage tax?

If the garage is inherited, then payments are calculated individually, since the price of the object is taken into account:

- if the heirs of the first stage receive the object, then they pay 0.3% of the cost of the structure;

- for other heirs the rate increases to 0.6%, but up to 1 million rubles.

If an object is given to family members, they are exempt from paying this fee.

Such citizens include parents, children or official spouses, as well as brothers or sisters, but they must have common parents with the donor.

How to register a garage as your property? What documents are needed? Detailed instructions here.

Rules for calculating income tax

Income tax is calculated by employees of the Federal Tax Service, and the process is considered to be quite prompt and simple. Payment of the fee must be realized by all citizens, therefore their citizenship and place of residence are not taken into account.

If the property is sold, the seller, represented by the former owner, must pay tax on the income received. However, there are certain situations in which you can obtain an exemption from transferring these funds.

These include:

- the cost of the garage does not exceed 250 thousand rubles;

- its area is less than 50 square meters. m.;

- the garage has been owned by the owner for more than five years, if it was previously purchased, and if it was received as a gift or by inheritance, then more than three years must pass.

The tax is paid not only by the owners, but also even by people who own the object on the basis of drawing up a life-long use agreement, which is usually formed for an indefinite period

But.

People who are beneficiaries are exempt from the fee.

Calculation example

For example, the owner of a garage decides to sell this object, which was purchased 2 years ago for 340 thousand rubles. The size of the structure exceeds 50 square meters. m.

Property for sale for 420 thousand rubles. to strangers. In this case, the amount of the fee will be equal to: (420-340)*13%=10,400 rubles.

Important! If after the sale of an object you still receive notifications from the Federal Tax Service about the need to pay various fees for it, then you need to come to the branch of this institution with an agreement on the basis of which the right to the garage was transferred to another person.

Who are the beneficiaries?

When calculating property taxes, the ability of many citizens to benefit from certain benefits provided by benefits is taken into account. They may completely waive payments or provide various discounts.

Changes are regularly made to legislation, on the basis of which more and more people can be considered beneficiaries.

Rules for calculating property taxes, see this video:

These include:

- heroes of the Russian Federation and the USSR;

- disabled people of the first two groups;

- disabled since childhood;

- veterans and participants of the Second World War;

- combat veterans;

- pensioners;

- people involved in eliminating the consequences of the Chernobyl accident;

- military families who have lost their breadwinners;

- military personnel whose service life exceeds 20 years;

- people who have become disabled as a result of the use or creation of military or space technology.

Preferential categories are exempt from paying garage tax.

Important! If the beneficiary owns several garages, then exemption can be obtained exclusively for one object.

Categories of citizens who are entitled to receive relief

Since the property tax of citizens, both movable and immovable, is considered mandatory, all categories pay it accordingly:

- all owners of garage buildings who are over 18 years old. Recent changes in legislation make it possible to pay a fee to the parents of a minor garage owner;

- legal entities (organizations, firms);

- private entrepreneurs.

As for the category of the population who have the right to receive relief and are included in the list of “Real Estate Tax Beneficiaries”, they include:

- citizens of retirement age;

- disabled people. People often ask, does a disabled person from the Great Patriotic War pay for boxing? It all depends on the disability group; keep in mind that group 3 is not included in the list of beneficiaries of the “garage” fee;

- war veterans. Not only WWII veterans are included, but also those who fought in Afghanistan and Chechnya;

- citizens bearing the title Hero of the USSR and the Russian Federation;

- persons liable for military service with at least 20 years of experience;

- families of those military personnel who died in the line of duty;

- nuclear scientists (citizens who took part in testing weapons that had a nuclear warhead);

- residents who use taxable property for cultural or artistic activities.

Please note that the following categories of citizens are not exempt from paying tax:

- large families;

- families falling into the category of “poor”.

For these categories, a discount is provided in some regions of the country. Information about a possible tax discount must be clarified at the regional office of the Federal Tax Service.

However, please note that the so-called “luxury real estate” does not fall under preferential taxation for the property tax. What is meant? This is the property of individuals, the total value of which exceeds 300 million rubles. Such citizens are not included in the list of beneficiaries for this type of taxation.

As you can see, the garage duty is a completely legal type of taxation with several subtypes, which has a lot of subtleties in the process of its calculation, as well as a separate list of citizens who fall into the category of “beneficiaries”, special conditions for receiving benefits.

When do you not need to pay taxes?

Obligations to pay taxes do not arise in the following cases:

- rental of buildings and land;

- renting land under the garage.

Do tenants need to pay tax? Only owners are required to make contributions to the budget. Tenants are exempt from this.