Initially, the simplified tax regime did not provide for payments from property used in business. But over time, amendments were made to the laws. As a result, property tax under the simplified tax system has to be paid quite often, but we are talking exclusively about real estate. In this article we will look at such cases and tell you about all the nuances.

Free accounting services from 1C

Who pays and when

Until 2021, various assets, including movable ones, were considered property for tax purposes. Now only real estate is subject to payments. Legal entities pay corporate property tax on it, and individual entrepreneurs pay personal property tax. Both of these payments are regional, which means there are many nuances of taxation in each specific subject of the Russian Federation.

As for simplified companies and individual entrepreneurs, according to Article 346.11 of the Tax Code of the Russian Federation, their real estate should be exempt from taxation. Instead of property tax and a number of others, they make payments in connection with the application of the simplified tax system. However, there are exceptions to the rules of this article, and they significantly change everything.

Organizations

Paragraph 2 of Article 346.11 states that property tax under the simplified tax system is levied on real estate, the base for which is determined as their cadastral value. This applies to the company’s own real estate, as well as those owned by it under the right of economic management or received under a concession agreement.

Individual entrepreneurs

What about individual entrepreneurs on the simplified tax system and property tax in 2021? The situation is similar to that described above. The only difference is that entrepreneurs pay property tax for individuals, not organizations. It is levied on own real estate, which:

- used in business activities;

- is included in the list of objects for which the base is calculated as cadastral value.

Along with this, a citizen who is an entrepreneur may have personal real estate - an apartment, a dacha. She will be subject to the same tax, but at a different rate.

Free tax consultation

Types of preferences

Having found out whether there are tax holidays for beginning individual entrepreneurs (IP), how long they last and to whom they apply, you must also take into account the type of activity that you will be engaged in.

- When using a simplified taxation system, the following operate: agricultural enterprises, workshops for the production of semi-finished products and food products, footwear and light industry, woodworking and wood products, pulp and paper industry, chemical sector, production of rubber and plastic products, metallurgy, automobile production, equipment, education, healthcare, tourism, research activities.

- Those to whom the 1 percent rate applies: spinning cotton threads, preparing textiles and fabrics, sewing children's clothing and accessories, making wooden parts, toys, educational games, ceramic accessories, cork products and other folk and artistic crafts.

- A rate of three percent is levied on: cultivation of vegetables and mushrooms, seeds, berry crops, fishing, raising seedlings, livestock, beekeeping, making canned fish, shellfish, etc., production of fermented milk and cheese products, preschool education, work of guides and tour guides, operation sanatorium and resort complexes, providing social assistance to vulnerable segments of the population.

- When using the patent system, the following work works: repair and tailoring of shoes and clothing from various materials, maintenance of machinery and equipment, furniture restoration, services of photo studios and salons, film laboratories, training, tutoring, care services for the disabled, children, the elderly, folk art products, carpet manufacturing, cook services, pharmaceutical industry, rental services, forestry, dairy production, logging, drying of fruits and vegetables, activities related to translation and interpretation, production of bakery products, PC program development services, repair and maintenance of computer equipment , furniture production, etc.

Cadastral valuation

So, the cadastral value is a mandatory condition under which property tax is calculated on the property in 2021. It is not a constant, that is, it can change depending on various factors. To determine this value, a cadastral valuation of real estate is carried out.

Exactly which objects should be valued at cadastral value for tax purposes is specified in Article 378.2 of the Tax Code of the Russian Federation. These include:

- administrative, business and shopping centers;

- premises for offices, trade, catering establishments and services;

- some types of objects of foreign legal entities;

- residential real estate, garages, parking spaces, country houses, outbuildings on plots for individual housing construction or subsidiary plots, as well as unfinished construction projects.

This is a general list of object types. In each region, by decision of the authorities, their cadastral value is assessed. This year, the vast majority of regions (74 out of 85) evaluate real estate at cadastral value. Such an assessment can be carried out either selectively or in relation to all types of real estate. As an example, the administration of a constituent entity of the Russian Federation decides to conduct an assessment of all apartment buildings.

After determining the cadastral value, a law is issued stating that taxation of objects should be carried out on its basis.

List of taxable objects

A list of objects, the base for which is calculated as their cadastral value, is compiled in each constituent entity of the Russian Federation at the beginning of the year. It must be posted on the website of the executive authority and sent to the regional Federal Tax Service.

Thus, a business entity using a simplified system needs to check the list on the website of the administration of its region. If the object is included in it, therefore, it is subject to real estate tax even despite the application of the simplified tax system.

For example, in 2021 in St. Petersburg, 5,796 objects were subject to taxation, including residential premises, non-residential buildings and structures for various purposes, garages and parking spaces.

Tax amnesty

If a small enterprise has accumulated debts to the budget, then an individual entrepreneur can take advantage of the tax amnesty law. However, the state does not forgive every debt and not every business.

Who can count on amnesty

- Individual entrepreneurs who have a tax debt of any taxation regime: OSNO, simplified taxation system Income, simplified taxation system Income minus Expenses, PSN, Unified Agricultural Tax, UTII. As well as debt on insurance premiums, fines and penalties.

- Persons engaged in private practice (notaries, lawyers, arbitration managers) who have debts on insurance contributions to the Pension Fund of the Russian Federation.

What debt can be written off?

- Taxes that were generated before January 1, 2015;

- Insurance premiums unpaid before January 1, 2021.

If, according to all indicators, the individual entrepreneur meets the conditions of amnesty, then the amount of debt does not matter. The law does not provide for restrictions on numbers. You can read more about how the tax amnesty works in this article.

Property tax for organizations under the simplified tax system

The maximum rates at which objects of one type or another are subject to corporate property tax are prescribed in the Tax Code. But they are precisely determined by regional authorities. Property tax for simplified taxation system payers is levied at a maximum rate of 2%. Along with this, a zero rate is also applied.

The law allows regional authorities to set different rates for certain objects, payers, and tax periods. For example, in the Irkutsk region, for organizations using the simplified tax system in 2021, a rate of 1% applies to taxable property (by 2023 it will gradually increase to 1.5%). This is defined in the regional law dated October 8, 2007 No. 75-OZ.

For property tax on legal entities, benefits are provided at the federal level, which can be supplemented by regional ones.

Organizations usually pay property tax in 2021 quarterly: 3 advance payments and one final payment. The specific payment deadlines depend on the region, but generally this must be done before the end of the month following the reporting quarter. However, in a particular subject, a reporting period may not be established, so there is only a tax (calendar) year. In this case, the payment is made 1 time.

In 2021, the rules for taxation and reporting of property tax for legal entities were changed. Here are the main innovations that affect organizations:

- You now need to submit a declaration to the Federal Tax Service only once a year - until March 30 of the next year. Previously, it was necessary to submit calculations of advance payments;

- Previously, real estate assessed at cadastral value was taxed, provided that it was listed on the balance sheet as a fixed asset. Now there is no such condition;

- in 2021, the tax base of garages, parking spaces, construction “unfinished” and other objects is considered at the cadastral value.

In addition, this year the world is experiencing a crisis associated with the threat of the coronavirus pandemic. In this regard, some temporary changes to the commercial property tax were adopted.

Thus, the deadline for filing the declaration for 2021 was postponed - instead of March 30, it had to be submitted on June 30. In a number of regions, authorities have reduced tax rates and provided installment plans and other preferences. For example, in Moscow it was decided not to carry out a cadastral revaluation this year, although it was planned before the onset of the coronavirus crisis. To calculate taxes, the cadastral value of 2018 will be used. This will allow property owners to save about 3% on tax payments.

How to count

The formula for calculating the tax amount for the year is as follows:

Cadastral value * Rate.

To find out the cadastral value, you need to go to the Rosreestr website. You can check the rate for your property with the Federal Tax Service. In regions where there is a reporting period, the resulting value is divided by 4. This amount is paid once a quarter.

✐ Example ▼

Let’s take an organization from the Irkutsk region using the simplified tax system and calculate the property tax on its own retail premises, the cadastral value of which is 15 million rubles. We apply a rate of 0.5%: 15,000,000 * 0.5% = 75,000 rubles. This is the tax amount for the year. The size of each payment will be: 75,000 / 4 = 18,750 rubles.

How to use it correctly

At the registration stage, within a month after being registered, a person must submit to the Federal Tax Service an application about his desire to work under a simplified system. And when submitting a declaration for the year, he will need to indicate a tax duty of 0%. If during this period reports were submitted according to the standard procedure, you will no longer be able to return payments. An application is submitted similarly when registering an individual entrepreneur for a patent.

Individual entrepreneur tax on simplified tax system

With the tax on the property of entrepreneurs, which they use in business, everything is much simpler, since they do not have to calculate it themselves. This is what the Federal Tax Service does. Everything is exactly the same as with a citizen’s personal property. You just need to make sure that the tax authority knows about the property, and when the receipt arrives, pay the specified amount.

Tax payment is made once, since only the tax period is established. The deadline is December 1 of the following year. There is no need to submit any reports to the tax authority.

The maximum rate at which property tax is levied under the simplified tax system is 2%. The authorities of a particular subject of the Russian Federation can reduce it to zero or increase it, but not more than 3 times. As in the case of corporate property tax, rates can be differentiated.

Let's give an example of rates in St. Petersburg:

- garages and parking spaces are taxed at a rate of 0.3%;

- expensive real estate (more than 300 million rubles) - at a rate of 2%;

- residential real estate - at rates from 0.1 to 0.25% depending on the type and cost;

- some other objects - at a rate of 0.1%.

How to guarantee a tax holiday and what reports to submit

If you chose the simplified tax system form when registering an enterprise, then you will not need to fill out any additional paperwork to receive preferences. After completing the paperwork, you just need to submit a regular application to switch to a simplified system for a period of 365 days, you are exempt from advance and other payments. After the time has passed, you must submit a reporting declaration indicating your income and a rate of 0%. The same must be done at the end of the second year.

Those who plan to work under the PTS need to find out in advance whether there are benefits and how to take advantage of tax holidays (vacation) when opening new individual entrepreneurs. Information about exemption from payments to the state must be indicated simultaneously with the submission of the package of documents for obtaining a patent. The form contains several fields for this purpose, where the amount of the fee and the entity establishing the preferences are indicated. There is no need to submit a declaration. Upon expiration of the document, immediately purchase the next one, since the simplified conditions are valid for 2 periods without interruption.

conclusions

We looked at the property tax of organizations and the tax on property of entrepreneurs that is used in business, which are valid for payers of the simplified tax system. They are levied on the real estate for which the cadastral value has been determined. If it has not yet been installed, you do not need to pay taxes.

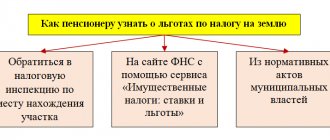

You can find out exactly whether a particular commercial real estate property is taxable or not by checking the list that is posted on the website of the regional executive authority. Individual entrepreneurs don’t have to worry - the Federal Tax Service will calculate the tax itself and send a receipt.

The taxes that business entities pay on their real estate are regional. Therefore, specific rates, payment terms, and benefits may vary. To find out all the nuances, we recommend that you familiarize yourself with the laws of the relevant constituent entity of the Russian Federation.

What should those individuals do who did not know about the vacation and have already paid their fees?

There are no clear recommendations providing an answer to this question in the current legislation. It is believed that if a person did not know about the tax grace period for individual entrepreneurs and has already paid the bills, he has the right to submit an updated declaration with a 0 rate and return the funds paid. To do this, you must attach explanatory documents confirming your right to become a beneficiary. Keep in mind that representatives of the responsible service will carefully check this information, not wanting to simply return the money. If we talk about PSN, the matter is much more complicated. After all, you have already applied and paid a certain amount for the patent. In this case, it is recommended to seek detailed advice from the nearest Federal Tax Service department.