Individuals are required to pay taxes to the state treasury for all their real estate, be it an apartment, a garage, a house, or a plot of land. It’s good that they haven’t come up with an air tax yet, although they say a bill is already being prepared.

2020 turned out to be a difficult year for most Russians. Property tax benefits are at least some relief in these difficult times. What exactly are the benefits and how has the coronavirus affected property tax benefits in 2021?

Property tax benefits 2021 – what the law says

Property tax is calculated according to the rules established by law, taking into account tax rates and benefits (Details in the article: “Calculation and determination of tax based on cadastral value in 2021”).

2021 property tax benefits are determined by the Tax Code and local laws.

Local administrations do NOT have the right to cancel benefits or reduce tax deductions if they are established at the federal level.

Benefits in everyday life are considered to be all tax exemptions, as well as reductions in tax payments.

Along with the concept of a property tax benefit, in the legislation there is the concept of a tax deduction, that is, a reduction in the tax base.

Tax deductions are a kind of “discount” on tax payments. For example, an individual simply does not pay tax for 50 square meters. meters of your house or for 20 sq. meters of apartment (read details here).

Owners who registered property in December 2021

Those owners who registered ownership of real estate or cars after December 15, 2020 are not required to pay tax for 2020. This rule is provided for in Art. 396 and art. 408 of the Tax Code of the Russian Federation, which states that when registering property rights after the 15th day, this month is not included in the tax calculation. The obligation to pay it falls on the previous owner.

Therefore, if the registration of the right took place after December 15, 2021, but the notification for 2021 was still received, the new owner has the right not to pay tax. To avoid unnecessary disputes with the tax office, you should send a response to the tax office, attaching a copy of the purchase and sale agreement, informing that the tax was charged unlawfully (referring to Article 396 and Article 408 of the Tax Code of the Republic of Kazakhstan).

Coronavirus and 2021 personal property tax benefits

In 2021, before December 1, individual owners will have to pay tax on the property they owned in the previous year. At the same time, due to the spread of coronavirus infection, no additional benefits for the 2021 property tax or deferments are provided by the state.

Perhaps, after the end of quarantine and the weakening of the pandemic, the coronavirus will make its adjustments and the number of beneficiaries will be added when calculating the tax for 2021. But so far, no changes regarding the payment of property tax for individuals have been adopted.

Procedure for granting tax benefits

The concession is equal to the amount of the annual fee for a certain piece of property. The owner selects a unit from each type of real estate for which he will receive a benefit. Even if you qualify for multiple benefit categories at once, you can only select one unit from each type of ownership for the tax credit. For example, if you are a pensioner and a war veteran, you have two apartments and a private house, you will receive a discount for one apartment and one house.

If you fall into the category of beneficiaries, submit to the Federal Tax Service Inspectorate (Inspectorate of the Federal Tax Service) an application and documents that confirm your right. The application can be submitted through the taxpayer’s L/C, by registered mail with a list of attached documents, in person at the inspectorate and at the MFC (Multifunctional Center). If you do not submit an application, the inspectorate will assess taxes based on its data. The tax office may not have information about your benefits.

Tax relief for property tax – who is entitled to it?

Article 407 of the Tax Code contains a specific list of types of real estate (house, apartment, etc.) for which property tax benefits are provided, and also clearly indicates which taxpayers are entitled to tax benefits (pensioners, disabled people, etc.).

Personal property tax benefits are available only to certain categories of citizens:

- Heroes, war participants, military personnel and members of their families;

- Disabled people;

- Persons exposed to radiation;

- For pensioners;

- Individuals who use property as creative workshops, museums, libraries, etc.

- To all owners of outbuildings with an area of up to 50 sq.m.

To calculate property tax benefits, the law divides this property into 5 types:

- apartment, part or room

- residential house (part of it)

- a separate room for creative activities, a library, etc.

- outbuilding up to 50 sq.m.

- garage, parking place

At the same time, the benefit relies on only one type of property. So, if a beneficiary owns two houses, a garage and a parking space, only one house and either a garage or a parking space will be exempt from tax (depending on which property is subject to a higher tax).

Also, the Tax Code (Article 391) contains a list of persons who may not pay for 6 acres of land. These are the same pensioners, disabled people, participants of the Second World War, and also those with many children. This exemption is a tax deduction.

Persons who actually lost their property rights in 2021

Previously, there was a procedure according to which the owner was responsible for paying taxes until the property was deregistered. But now the rules have changed in favor of owners whose properties actually do not exist, but they continue to be listed “on paper.” For example, stolen cars, burned or demolished houses and outbuildings, etc.

Now the tax is not charged from the 1st day of the month when the actual destruction of the object occurred. Previously, accrual stopped from the date of its removal from cadastral registration.

To obtain tax exemption, you will need to submit an application to the Federal Tax Service. It must be accompanied by documents confirming the demolition of the property or its loss for another reason (Article 408 of the Tax Code of the Russian Federation).

As for stolen cars, you no longer have to pay tax:

- during the search period;

- at the end of the search, if the car was not found (Article 358 of the Tax Code of the Russian Federation).

Previously, the owner was exempt from tax only for the period of operational-search activities.

If you still need to pay taxes, but do not do it on time, you will be subject to penalties and debt collection through the courts. ConsultantPlus experts told us how this happens and whether there will be another fine. Get trial online access to K+ for free and proceed to the explanations.

How to fill out an application for property tax relief?

How can you declare that you are a beneficiary? To do this, you need to fill out an application for property tax relief.

An application for a tax benefit for individuals is filled out through the MFC or government services in electronic form and is reviewed by the tax authorities within 30 days. After which a reasoned response is given, perhaps the tax authorities will request any supporting documents.

Disabled people, pensioners and owners of outbuildings up to 50 sq. m. meters, this application should not be filled out, because the tax authorities already have information about their status and the benefit is calculated automatically, but some categories of citizens (for example, family members of military personnel) must take care of filling out an application for a property tax benefit themselves, otherwise they will have to pay tax.

Property tax breaks, tax deductions and other tax exemptions are publicly available information. Local authorities can identify certain categories of citizens in need of social support and establish additional deductions and benefits. To stay informed, contact your local tax authority for further clarification.

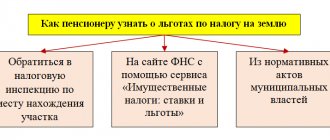

Land tax

Federal legislation does not provide for exemption from land tax. But starting from the tax period of 2021, when calculating land tax, the tax base is reduced by the cadastral value of 600 square meters of land area (tax deduction) owned, permanent (perpetual) use or lifetime inheritable possession of pensioners receiving pensions assigned in accordance with the procedure established by law.

In accordance with Article 387 of the Tax Code, when establishing land tax, regulatory legal acts of representative bodies of municipalities (laws of Moscow, St. Petersburg and Sevastopol) may additionally establish tax benefits, including tax deductions for certain categories of taxpayers.

Procedure for making advance tax payments

The organization independently calculates the amount of tax payments using the following formulas: Amount of tax for the tax period = tax rate * tax base.

The amount of tax to be transferred to the budget at the end of the tax period = Tax rate * Tax base - advance payments.

It is easy to make a mistake when calculating tax payments. Especially if you have property in different constituent entities of the Russian Federation and their regulations differ from each other. Seek help from a specialist.

If an organization has property in different regions, it must determine the fee for the property according to the rules of the region in which it is located. The fee must be paid according to the procedure approved there. Companies must submit a declaration and calculations for advance payments to the Federal Tax Service at the end of each reporting and tax period. Calculations are provided by the 30th of April, July and October. The declaration must be submitted by March 30 of the following year.

Reconciliation of information with data from the Federal Tax Service

If a company does not agree with the calculation of property taxes made by the tax authorities, it has the right to ask to reconcile the data used for the calculation. For these purposes, the company must send an application to the Federal Tax Service for a tax reconciliation. To do this, you can use the recommended application form presented in the letter of the Federal Tax Service dated October 28, 2020 No. AB-4-19 / [email protected] The application can be submitted both on paper (in person, by mail or through the MFC) and in electronic form via TKS . Having received the application, tax authorities will check the information that served as the basis for calculating taxes and generate a statement of reconciliation of calculations. This act is generated no later than 5 working days (3 days if an electronic application is sent) from the date of registration of the application received from the company (letter of the Federal Tax Service dated 03/09/2021 No. AB-4-19/2990). Next, the act of joint reconciliation of calculations is handed over (sent by registered mail) or transferred to the taxpayer in electronic form via TKS or through the taxpayer’s personal account on the Federal Tax Service website. The deadline for sending the act is no later than the day following the day of its preparation (clause 11, clause 1, article 32 of the Tax Code of the Russian Federation).

Which organizations pay the property tax?

Tax payers include domestic companies and foreign firms that have branches or real estate in Russia. Legal entities with the simplified tax system or a single tax on imputed income are exempt. FIFA and its subsidiaries and football associations do not pay the fee. The levy is levied on: fixed assets of an enterprise, investments in material assets, and residential premises. In order for property to fall into the category of fixed assets, it must be used by the company for more than a year, be more expensive than ten thousand rubles, be involved in production and bring financial benefit to the company. Land plots are not subject to tax.

Payment of taxes by parents for children (Definition of the Constitutional Court of the Russian Federation of June 30, 2021 N 1467-O)

Report at the conference “Tax Law in Decisions of the Constitutional Court of the Russian Federation,” April 20 - 28, 2021. You can take part in the conference by leaving a comment on this report and on the reports of other conference participants. Conference program at this link.

Problem

Questions about the tax obligations of minor children, their forced collection and the need for parents (legal representatives) to pay taxes for minor children (or the absence of such a need) are not very often covered in the media. One gets the impression that this topic is to a certain extent hushed up as a “delicate” one, and the tax authorities (bailiff service) are not too eager to actually collect such debts from minors in the absence of voluntary payment, preferring to convince parents (legal representatives) of the need for their voluntary payment. .

Now the situation with voluntary payment has been simplified due to the presence in paragraph 1 of Art. 45 of the Tax Code of the Russian Federation provides that tax payment can be made for the taxpayer by another person. Perhaps the lack of significant information that tax authorities are actively collecting taxes from children is predetermined by the fact that so far in Russia children are not the owners of a significant amount of taxable property.

Author's opinion

The Federal Tax Service of Russia provides some clarifications (both at the level of the Service and at the level of lower tax authorities).

- In particular, the following information was published on the official website in January 2014: if a child has become the owner of rights to some property in the form of a real estate property (a residential building, apartment, room, cottage, garage, other building, premises and structure, as well as shares in the right of common ownership of the specified property), then he has an obligation to pay property tax for individuals[1].

- In September 2021, the following was clarified: parents (adoptive parents, guardians, trustees), as legal representatives of minor children who have taxable property, manage it, including fulfilling tax payment obligations. Consequently, individuals recognized as payers of real estate taxes, regardless of age, are required to pay tax in relation to the real estate they own or own[2].

In October 2021, similar information was published: the legislation does not establish the specifics of collecting debts from minors for personal property taxes (as well as for other property taxes). At the same time, due to their age, minor taxpayers participate in tax relations through their legal representatives, which include their parents, adoptive parents or guardians. When a property tax debt is identified in relation to real estate owned by a minor, the tax authority usually makes a demand for collection of the arrears of property tax and penalties in court against the legal representatives of the minor[3].

- Letter of the Federal Tax Service of Russia for Moscow dated April 16, 2012 No. 20‑14/ [email protected] explains that on behalf of a minor child who received income from the sale of real estate, a tax return in form 3‑NDFL is filled out by his parent (adoptive parent, guardian) as the legal representative of the child. Tax payment on behalf of the child is also carried out by his parent as a legal representative. In addition, his legal representative is also responsible for non-payment of taxes.

Explanations are also given by other specialists. There are very emotional publications (2003, in Rossiyskaya Gazeta): when forcing a child to pay property tax, tax officials refer to the Tax Code and to the Law of the Russian Federation of December 9, 1991 No. 2003‑1 “On the property tax of individuals.” Both there and there are no benefits for children, so formally the inspectors are right. Although the demands are absurd, these are our laws - officials are justified[4].

Emotions have recently manifested themselves in a related topic - during the discussion of the “bankruptcy” Rulings of the RF Armed Forces concerning situations in which parents deliberately transferred property to their children, opposing the foreclosure of it by creditors (including dated December 23, 2021. No. 305-ES19-13326). The Collegium of the RF Supreme Court for Economic Disputes qualified such transactions for the transfer of property as a way to prevent creditors of a bankrupt company from collecting debt from it, it follows from the definition[5].

Yu.V. Tai and S.L. Budylin, commenting on the said Determination of the Armed Forces of the Russian Federation, indicated the following: as far as can be understood from one phrase of the Collegium, the responsibility of children is limited to the value of the gifts they received from their parents[6].

Another example of a publication on “children’s” taxes: according to the fair opinion of N. Verkhova (dated October 26, 2021), the provisions of tax legislation, in particular Chapters 31 and 32 of the Tax Code of the Russian Federation, apply equally to all individuals, regardless of their age , including to minors. However, the Tax Code of the Russian Federation does not contain a direct rule obliging legal representatives to pay tax for those they represent[7]. This publication provides examples of judicial acts of courts of general jurisdiction, which resolved the issue of collecting taxes from minor children.

In particular, the wording of the Decision of the Investigative Committee on administrative cases of the Sverdlovsk Regional Court dated July 20, 2016 in case No. 33a-11161/2016 is interesting (the tax authority’s requirement to collect land tax from a minor Ch.A.A. was considered): “Collect from Ch. .A.A., represented by legal representatives Chigvintsev A.S., Chigvintseva O.S., to the budget the debt on land tax for 2013 in the amount of 165,002 rubles.”

The Resolution of the Thirteenth Arbitration Court of Appeal dated February 16, 2012 No. 13AP‑1017/12 made the following conclusion: the obligation to perform necessary legal actions on behalf of minors, including in relation to the obligation to pay taxes calculated in connection with the minor’s possession of property ownership is entrusted to the parents.

Another example is given: in the Appeal Determination of the Investigative Committee for Administrative Cases of the Supreme Court of the Altai Republic dated September 1, 2021 in case No. 33a-871/2016, the following is stated: in the dispute considered, the minor Tyshchenko N.N., as the owner of vehicles, is obliged to the force of the Civil Code of the Russian Federation to bear the burden of maintaining his property, including participation in the payment of taxes in relation to this property, which implies the obligation to perform the necessary legal actions on his behalf by the parent - Tyshchenko T.M., including in relation to the obligation to pay transport tax. Responsibility for Tyshchenko T.M. the obligation to pay arrears and penalties for transport tax cannot be considered contrary to current legislation.

Another example: The decision of the Third Cassation Court of General Jurisdiction dated January 29, 2021 No. 88‑1462/2020 upheld the judicial acts of the lower courts, according to which the plaintiff’s demands for the recovery of debt for housing from the defendant, the plaintiff’s ex-husband, were partially satisfied premises and utilities, payment of property taxes for children.

Thus, it should be recognized that courts of general jurisdiction, directly or indirectly, in a number of cases impose the responsibility for paying property taxes of minor children on their parents (legal representatives). Sometimes this approach is predetermined by the legal position set out in the Resolution of the Constitutional Court of the Russian Federation of March 13, 2008 No. 5-P: as participants in relations of common shared ownership, minor children are obliged, by virtue of the Civil Code of the Russian Federation, to bear the burden of maintaining the property belonging to them (Article 210), including participation in the payment of taxes in relation to this property (Article 249), which implies the obligation for the parents to perform the necessary legal actions on their behalf, including in relation to the obligation to pay taxes. However, in this act of the Constitutional Court of the Russian Federation there is no direct indication that taxes not paid by parents for children can be recovered from parents, although in practice this is often the case.

Some regulatory confirmation of the obligation of parents to pay taxes for children should include: from Art. 86 “Participation of parents in additional expenses for children” of the RF IC. Perhaps, due to the topic under consideration, in the Resolution of the Plenum of the Armed Forces of the Russian Federation of December 26, 2021 No. 56 “On the application of legislation by courts when considering cases related to the collection of alimony” there is a direct explanation as to whether they should be taken into account when calculating the amount of alimony for children There are no tax obligations.

However, since the draft of the said Resolution of the Plenum of the Armed Forces of the Russian Federation, discussed on December 19, 2021, is available, its paragraph 9 is noteworthy: “Resolving the question of whether a person applying for alimony is in need of help, if the law connects the presence of this circumstance the possibility of collecting alimony (Articles 85 and 87, paragraphs two and four of paragraph 2 of Article 89, paragraphs three to five of paragraph 1 of Article 90, Articles 93–97 of the RF IC), it is necessary to find out whether the financial situation of the person is sufficient to meet his vital needs taking into account his age, state of health and other circumstances (purchase of necessary food, clothing, medicines, payment of housing and utility bills, payment of taxes, etc.) (hereinafter referred to as vital needs)”[8]. The corresponding paragraph in the ultimately adopted Resolution of the Plenum of the Supreme Court of the Russian Federation is the same, No. 9, but there is no mention of taxes in it.

Thus, the Supreme Court of the Russian Federation “changed its mind” during the week between the meetings of the Plenum and decided not to say that paying taxes (including by children) is a vital necessity.

In connection with the above, of particular interest is the Determination of the Constitutional Court of the Russian Federation of June 30, 2021 No. 1467-O, which actually does not regard as incorrect the practice of courts of general jurisdiction, within the framework of which funds are collected from the alimony payer to pay for utilities and payment of taxes for a minor child. The applicant believed that the provisions of the Civil Code of the Russian Federation and the Investigative Committee of the Russian Federation that he challenged contradicted Art. 17 (part 3), 18, 19, 38 (part 2) and 55 of the Constitution of the Russian Federation, since, according to the meaning given to them by law enforcement practice, they allow additional collection of funds from the alimony payer to pay utility bills and pay taxes for a minor child . According to the Court, the challenged norms of the Civil Code of the Russian Federation and the Investigative Committee of the Russian Federation are aimed at ensuring a balance of interests of minor children and their parents. The contested norms themselves cannot be regarded as violating the constitutional rights of the applicant listed in the complaint.

Accordingly, the Constitutional Court of the Russian Federation actually agrees with the possibility of collecting money from the alimony payer to pay taxes for a minor child.

At the same time, for quite a long time, by virtue of Part 2 of Art. 32.2 of the Code of Administrative Offenses of the Russian Federation, in the absence of independent income from a minor, an administrative fine is collected from his parents or other legal representatives. Interested parties and law enforcers, apparently, do not see any problems with the constitutionality of this provision, because There are no corresponding acts of the Constitutional Court of the Russian Federation. In the Ruling of the Constitutional Court of the Russian Federation of February 9, 2021 No. 213-O, this provision is mentioned, but no doubts about its constitutionality are expressed.

CONCLUSION:

It should be assumed that sooner or later the Constitutional Court of the Russian Federation may directly raise the question of whether parents (legal representatives) should pay taxes for their children. Most likely, the Constitutional Court of the Russian Federation, taking into account, incl. The already established volume of practice of courts of general jurisdiction will answer this question positively.

[1] Are children required to pay personal property taxes? // URL: https://www.nalog.ru/rn54/news/tax_doc_news/4494544/

[2] The Federal Tax Service of Russia clarified the procedure for paying taxes on real estate of minors // URL: https://www.nalog.ru/rn77/news/tax_doc_news/7792178/

[3] Collection of arrears and penalties for property taxes from an individual // URL: https://www.nalog.ru/rn25/ifns/r25_14/info/10077267/

[4] A. Rodionov. Does the child have to pay property taxes? // URL: https://rg.ru/2003/12/02/rebenok.html

[5] The Supreme Court clarified the rules for collecting debts from children of owners of bankrupt companies // URL: https://www.vedomosti.ru/economics/news/2019/12/26/819769-vs

[6] Tai Yu.V., Budylin S.L. The son is responsible for his father. Vicarious liability of family members of the director in the bankruptcy of the company. Commentary on the Determination of the Judicial Collegium on Economic Disputes of the Supreme Court of the Russian Federation dated December 23, 2019 No. 305-ES19-13326 // Bulletin of Economic Justice of the Russian Federation. – 2021. – No. 6. – P. 4 – 22.

[7] URL: https://www.garant.ru/consult/nalog/1148731/

[8] The Plenum of the Supreme Court told when it is possible to collect alimony not according to the rules // URL: https://pravo.ru/news/view/146743/

What is the tax base for legal entities

The tax base is the average annual value of the property. An accountant or appraiser calculates it taking into account depreciation, which is determined according to depreciation standards. For real estate, the cadastral value of the property serves as the tax base. Such deductions are funds that an enterprise sets aside for the repair of equipment and premises of the enterprise. The amount of contributions is calculated separately for each type of equipment and real estate, taking into account their wear and tear and frequency of use. Average property value is the property value divided by 12 and increased by one.

Tax benefits for organizations

The property tax may not be paid:

- penal organizations;

- religious institutions;

- associations of people with disabilities;

- pharmaceutical manufacturers;

- prosthetic and orthopedic companies;

- bar associations, legal bureaus;

- innovation and research centers;

- representatives of a special or free economic zone;

- ;

- shipbuilding organizations;

- institutes involved in offshore exploration;

- companies with high energy efficiency.

Regions may include other preferential organizations in the list. To find out if tax benefits are available for your association, contact your local tax authority.