Free legal consultation by phone:

8

Property tax for individuals is a tax credited to the local budget at the location of the taxable object. This tax is mandatory for owners of houses, apartments, garages and other real estate. The only exception is pensioners in Russia.

In this article we will look at how to get property tax benefits for pensioners. We will also consider in detail all the subtleties related to this procedure.

Retirement age in the Russian Federation

Before moving on to the intricacies of providing property benefits, mention should be made of the retirement age in the Russian Federation. According to Federal Law N 400-FZ “On Insurance Pensions”, the retirement age is currently 60 years for men and 55 for women. However, according to recent changes in legislation, in the coming years, the retirement age will increase to 65 and 60 years, respectively.

We advise you to read:

- ✅ Benefits for property tax for individuals

- ✅ Land tax for pensioners

- ✅ How to calculate property tax for individuals

- ✅ Commercial real estate tax: amount, calculation procedure

The retirement age will increase by 1 year annually, with the exception of those Russians who will reach retirement age in the next 2 years. For them, the new retirement age will be reduced by 6 months.

Upon reaching the specified age, all citizens have the right to count on benefits associated with the abolition of payment of property tax. However, the tax abolition process is not automatic . The Federal Tax Service will continue to accrue mandatory tax liabilities and penalties for late payment.

Thus, in order to receive benefits, it is necessary to draw up an appropriate application and send it to the tax office . After this, the Federal Tax Service will recalculate previously accrued tax liabilities and issue the required property tax benefit for a citizen who has reached retirement age. The procedure for providing property tax benefits is regulated by Article 407 of the Tax Code of the Russian Federation and Letter of the Ministry of Finance of the Russian Federation No. 03-05-06-01/04

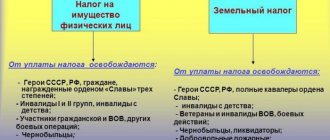

Preferential categories

The legislation allows for a number of grounds for obtaining tax breaks. Thus, some vehicles are not considered at all as an object of taxation according to federal regulations. This includes rowing boats, passenger cars equipped for use by disabled people, fishing vessels, agricultural transport, medical aviation, etc. The full list is given in paragraph 2 of Article 358 of the Tax Code of the Russian Federation.

In turn, preferences for privileged categories of citizens are established at the regional level, since transport tax collections replenish the regional budget. Most regions provide benefits:

- For pensioners.

- Heroes of the USSR and the Russian Federation.

- Disabled people of groups I and II.

- Large families.

- Veterans (disabled) of combat operations.

- Labor veterans.

- Representatives of a disabled child.

- Chernobyl victims and other persons who suffered radiation sickness due to working with nuclear installations.

Of course, not all subjects of the Russian Federation have introduced such benefits, and in some, if they have been introduced, they are differentiated depending on certain factors. For example, it is useless to write an application for tax benefits for pensioners in Moscow - the capital does not provide tax privileges for personal transport of this category of the population. And in St. Petersburg, the benefit will only apply to pensioners who own a domestic car with a capacity of up to 150 hp. With.

You can find out more about the availability of transport tax benefits in your region in this article.

What property tax benefits are available to pensioners?

According to Article 401 of the Tax Code of the Russian Federation, pensioners are exempt from paying property tax on their property. This regulatory legal act on exemption from tax obligations applies to the following real estate owned by pensioners:

- Apartments;

- Rooms;

- Houses classified as residential;

- Premises and structures intended for professional activities;

- Outbuildings located on lands intended for gardening work. Moreover, the area of such objects should not exceed 50 square meters;

- Garages;

- Parking spaces.

If we are talking about property whose cadastral value exceeds 3 million rubles, no benefits are provided. Pensioners are also not exempt from taxes if the real estate they own is used in business activities.

It is important to note that the benefit can be applied to only one object owned by the pensioner. It is also worth noting that representatives of authorized bodies, when considering the relevance of applying the benefit, do not take into account the number of reasons for its application.

If the applicant has not chosen an object in respect of which a tax benefit will be issued, Federal Tax Service employees will do this for him. In such situations, the property with the highest value is selected. All other real estate is subject to taxation in accordance with the general rules.

Cancellation of transport tax

Much was written about the imminent abolition of this type of tax at the beginning of 2018; moreover, the Ministry of Transport and the President of the Russian Federation have repeatedly spoken out in support of its elimination. But so far things have not gone beyond intentions.

At the initiative of a number of deputies, on June 5, 2021, ]]>draft bill]]> No. 480908-7 “On amendments to the Tax Code of the Russian Federation regarding the abolition of transport tax” was submitted. To compensate for the shortfall in revenue, the document proposes an increase in fuel excise taxes. Hypothetically, this would solve at least two problems:

- reducing the tax burden for those who rarely use their vehicle;

- eliminating the problem of non-payment (the collection rate of this tax in the constituent entities of the Russian Federation does not exceed 50%).

However, the bill did not pass beyond preliminary consideration by the State Duma. On July 2, 2021, the relevant committee returned the project for revision. Thus, it is premature to talk about abolishing the tax. Read more about this in our article.

Procedure for receiving benefits

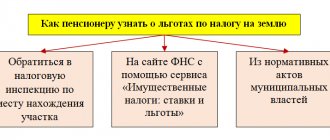

To receive property tax benefits, you must submit an application to the Federal Tax Service office in the territory where the property is located. In addition, you can contact the tax office at your place of registration, or one of the MFC centers.

It is important to note that in order to be exempt from tax obligations, the application must be submitted to the authorized body before November 1 of the year that is identified by the tax period. After this date, it will be impossible to make changes to the property nomenclature.

You can submit your application in person, through an intermediary using a notarized power of attorney, or by sending a registered letter with acknowledgment of receipt.

Simultaneously with the application of the applicant for benefits, a package of documents should be prepared:

- The applicant’s passport or a notarized power of attorney of the representative;

- Pensioner's ID;

- TIN;

- Title documents for real estate.

Tax deduction according to the Platon system

A special place among the beneficiaries is occupied by owners of heavy vehicles with a maximum weight of more than 12 tons, registered in the register of vehicles of the toll collection system (the so-called “Plato”).

Let us recall that one of the main goals of the transport tax is to replenish the budget in order to restore roads. The Platon system does the same thing: it collects funds for the damage that heavy trucks inevitably cause to highways. To avoid the situation of double payments, it was allowed to deduct payments for “Plato” from the amount of transport tax (Federal Law No. 249-FZ of 07/03/2016). As a result:

- The tax is not transferred at all if payments to compensate for damage to roads exceeded (or were equal to) the amount of tax for the same period;

- The tax is reduced by the amount of the payment if the latter was less than the amount of the calculated transport tax.

The deduction is valid for both individuals and companies.

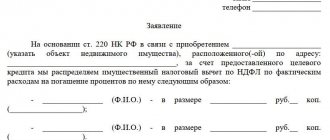

Drawing up an application

The current legislation of the Russian Federation does not provide for an official form of such a statement. This means that an application for a tax benefit for pensioners can be drawn up in free form.

In the application itself for the provision of property tax benefits to pensioners, you should state the essence of your request, as well as indicate the legal act on the basis of which the benefit should be provided. In addition, you should provide the following information:

- The name of the authority where it is submitted and its code;

- pensioner's TIN;

- Full name, date and place of birth of the applicant;

- Place of registration;

- Contact details;

- Legal grounds for granting benefits;

- List of attached documents;

- Date and initials.

There is also an option with a ready-made form , which has fixed forms to fill out. This option is preferable because there is much less chance of making a mistake when filling it out. Also, the tax office is much more willing to consider such applications.

The application is filled out as follows:

- In the header of the application we indicate information about the tax office where the application will be submitted;

- We indicate which of the property fees the application relates to;

- Property tax for individuals;

- In the grounds column we indicate the details of documents confirming the citizen’s right to receive a tax break;

- We indicate the property and its address;

- We enter the applicant’s personal data;

- We outline the essence of the request for benefits and indicate the reasons for this;

- Fill in the column fields. The left part is required to be completed if a citizen submits an application through a representative and not in person. The right column is filled in by Federal Tax Service employees. There they will indicate the registration number and date of receipt of the materials and describe the application;

- After filling out the application, we put a date and signature.

If 2 or more properties of the same category

As a rule, the benefit applies only to one taxpayer’s vehicle, one plot of land and one residential premises. But the beneficiary himself has the right to choose which of them to apply for the benefit. It is the selected object that needs to be included in the application for benefits.

Of course, if a 100% exemption can cover the tax on one vehicle, and the applicant owns a motorcycle and a car, then the car should be indicated. After all, there is less transport tax on a motorcycle.

As you know, only 6 acres of land are given preferential treatment. Which means:

- Having plots of land of 5 acres and 6 - it is more profitable to claim a benefit for the plot that is larger ;

- if both plots are equal or more than 6 acres, it doesn’t matter to which this benefit will be applied.

For residential premises owned by the taxpayer, the situation is the same . It is more profitable to apply for a benefit for premises with the maximum amount of tax payable.

The procedure for the entry into force of the benefit

After considering a pensioner’s application for abolition of property tax and checking all the documents presented, Federal Tax Service employees make a decision on granting benefits for the current year, subject to the timely submission of the pensioner’s application. As soon as the tax authorities decide that a given taxpayer can actually use the benefits provided, they come into force.

A citizen will begin to pay tax under preferential terms after the start of the next tax period before which an application for a tax break was submitted. Thus, to receive a relaxation this year, the application must be submitted before November 1 of the current year.

If in previous years a citizen entitled to a tax benefit did not use it for some reason, he can apply for a recalculation. Recalculation is allowed for the last three years from the date of writing the application. Thus, you can submit another application to compensate for previously paid taxes.

This statement specifies the time range and reason for the preference. In addition, it should be indicated that the applicant did not benefit from the benefit in previous years.

Application in the taxpayer’s personal account

More and more people are registering on the website of the Russian Tax Service and have a personal taxpayer account there. This is the most convenient way to communicate with the tax authority. In this case, you do not need to print and there is no need to visit in person .

You only need:

- Enter the office.

- Click the “My Property” button.

- Indicate the desired object as preferential.

In this case, the system will ask you to fill out the fields in the same way as a paper application.

Changing the object for which benefits are provided

As we have already said, the opportunity to receive a tax break is provided only once . It should be clarified here that this restriction applies to objects of the same type. For example, if a pensioner owns two apartments, he can receive benefits for only one of them.

If the pensioner subsequently wishes to change the object for which the benefit is provided, he must notify the Federal Tax Service of this fact. This can be done by re-submitting the application to the tax office. The application must indicate that you want to change the property for which the benefit is provided.

For changes to take effect this year, you must submit an application before November 1 of the current year.