Disabled people, regardless of whether they have Russian citizenship or not, have the right to receive tax benefits for real estate located in Russia, including land.

Persons with disabilities and groups, people with disabilities since childhood, disabled children, as well as pensioners who receive appropriate government payments in the manner prescribed by law can count on a discount on the payment of obligations to the budget.

The benefit consists of reducing the tax base by the cadastral value of 600 m2 of one land plot.

What are provided

The legislation of the Russian Federation defines both types of support measures and categories of citizens who can use certain options. An important factor is a person’s place of residence, since some support measures are regulated at the subject level.

At the Federation level, support measures are regulated by the following articles of the Tax Code of the Russian Federation:

- Art. 217 (regarding personal income tax);

- Art. 391 (in part of land);

- Art. 407 (regarding property).

Subjects of the Federation can establish additional provisions, for example, reducing the tax base. You can find out the specifics of regional taxation on the website of the Federal Tax Service, in the “Reference Information” section.

First you need to select the tax you are interested in.

The system will issue a regional regulation establishing tax rates and payment terms.

By clicking on the “Details” button, you will be taken to a page where rates, regional benefits, etc. are indicated.

Package of documents

To qualify for a subsidy, you must contact the Tax Service at your place of residence and clarify the details. This will be the first step in resolving this issue. The permit will not be ready immediately, and the amount of the tax is still unknown. It is necessary to submit an application, to which the documents required by law are attached.

It is advisable to immediately check this list with employees, since authorities can change it at their discretion. The standard package of papers for processing land tax includes the following information:

- sample application;

- original and copy of identity document;

- medical insurance;

- expert opinion on assignment of a disability group;

- certificate of residence;

- land documents;

- employment history;

- disability certificate.

Additionally, they may require an identification code, a bank statement about the person’s income and a military ID.

After this, all that remains is to submit the application in a convenient way. If a person does not have problems with the musculoskeletal system, then he is able to independently come to the institution and resolve all issues. In other cases, the case is entrusted to a friend or relative, but a power of attorney must be drawn up with a notary stating that this person represents the interests of the disabled person in a government agency.

Postal services are used in cases where the Tax Service is located in another city. The letter is sent as a registered letter and is required that the post office notify the sender of the receipt of the letter by the addressee.

It has become possible to submit an application online, without leaving your home, through the same service of the Tax Service. All operations are carried out through the subscriber's Personal Account.

The Tax Service is allowed to refuse to provide discounts and subsidies to persons who have given deliberately false information about themselves or in the absence of a complete list of required documents.

Who is eligible

Let us consider in more detail which categories of persons may be entitled to what.

| Category name | Options |

| Old age pensioners | Pensioners are exempt:

|

| veteran of labour | Benefits for pensioners:

|

| Citizens who continue to work | Tax benefit for pensioners:

|

| Disabled people of groups 1, 2, 3 |

|

Thus, tax benefits for pensioners on real estate, transport, personal income tax, and other types of them are a significant amount of help for the category of persons under consideration.

One of the categories of tax benefits is persons with limited legal capacity

Disability of a person arises as a result of injuries, diseases suffered or received at birth. The assignment of disability status and group is carried out by ITU. Persons with health problems and limited ability to live are assigned one of 3 disability groups. The conditions for appointment, revision of disability, and provision of social protection are defined in Federal Law No. 181-FZ dated November 24, 1995. Additionally, the PP dated July 27, 1996 No. 901 indicates the establishment of regional benefits for families with a disabled child.

Categories must be confirmed, while disabled people of group 1 are not recognized as able to work. For persons with 1st disability group, a number of benefits are provided, one of which is aimed at reducing the tax burden on land plots. The benefit is provided to both persons with acquired disabilities and those acquired at birth.

Land tax

Such collection is the authority of local authorities. But at the Federation level, mechanisms have been established that reduce the amount by the cadastral value of their existing land with an area of 600 square meters. m. This means that you do not need to pay for plots of 6 acres or less.

A complete exemption from payment can be established by the authorities of the municipalities of the subject, so information of this kind can be obtained from the local administration.

Article 395 of the Tax Code of the Russian Federation completely exempts from land tax only residents of the North, Siberia, and the Far East, if they belong to the category of small peoples.

Transport tax

This fee is regional. The Tax Code of the Russian Federation does not contain specific rules for exemption from payments for transport, but there are still some peculiarities.

Transport tax is not paid for:

- agricultural machinery;

- water transport with a power of less than 5 HP. With.;

- cars and motorcycles with a power of less than 100 hp. pp., as well as transport, which serves as a means of rehabilitation for the disabled.

Regional differences exist. Thus, some entities are reducing the rate or completely eliminating the payment of amounts.

This type of support is not available in all regions. The vast majority of areas maintain a tax on cars, regardless of whether a person uses the car throughout the year or seasonally.

Personal income tax

This fee is the main source of income for local budgets, therefore no benefits are provided at the federal level.

However, pension payments are not included in the tax base and, accordingly, are not subject to personal income tax. These are:

- pensions, social benefits;

- the amount of financial assistance from the employer to former employees who went on vacation, for sanatorium treatment, medical care, medications, but in the amount of no more than 4,000 rubles per year

In addition, by purchasing real estate, you can receive a personal income tax deduction. The conditions are the purchase at the expense of the senior citizen and the transfer of the object into his ownership.

Support measures of this type do not apply to real estate properties worth more than 300 million rubles.

You need to understand that if the property is used for profit (for example, renting out an apartment), the person will not receive any relief.

Who is entitled to

When considering the issue of being classified as disabled, it is worth considering that a person has certain restrictions in life regarding his mental state or other deviations.

The status is awarded after a special examination carried out by doctors and social workers. This is not only a state of health, but also the establishment of relationships with society.

The main factors for obtaining status are:

- the appearance of restrictions associated with complete or partial loss of the ability to move, talk, navigate, take care of oneself, and engage in work activities;

- deterioration in health that has affected changes in organs or the functions they perform in the body;

- presence of need for social assistance and support.

After examination and examination, the commission assigns the citizen one of the categories of disability. Three categories have been established, differing in the nature of restrictions and social status. Group 1 disability involves the identification of severe impairments that resulted in a significant change in functions in the body.

Disability group 2 is awarded if minor health impairments are confirmed and the person can lead a normal life. This group of the population is allowed to work under special regime conditions.

Group 2 disabled people must annually confirm their status during a medical and social examination. If a person’s health and condition have not changed within 6 years, then the status is assigned for life.

Benefits for pre-retirees

In the Russian Federation last year, there were lengthy consultations on the issue of supporting people whose retirement age has been raised. As a result, from 2021, Federal Law No. 378-FZ dated October 30, 2018 supplemented paragraph 5 of Article 391 of the Tax Code of the Russian Federation with an important provision that secured tax benefits for the “pre-retirement” category.

Who belongs to the category

The group under consideration includes only those who have 5 years or less left until the period when they will be assigned an old-age insurance pension. This category also includes persons for whom an old-age insurance pension is established on an early basis. In accordance with the new provisions of the law, men retire at 65 years old, women at 60 years old. This means that upon completion of the reform of the pension system, pre-retirees will include men over the age of 60 and women over 55 (if there are grounds for benefits upon retirement, the previously designated age). Thus, people who have less than five years left until retirement are eligible to claim new tax preferences.

In the coming period, while the transition stage continues, the age of the pre-retirement person will constantly change. In the period from 01/01/2019 to 12/31/2023, the pension threshold will be increased by one additional year, which means that the age of inclusion in the group of pre-retirees and the right to receive tax breaks will be adjusted.

Types of benefits for pensioners

For pensioners, the state has provided a list of taxes for which a person can apply and receive benefits.

Land tax benefits

A pensioner has the right to a tax benefit in the form of a reduction in payment by the cadastral value of 6 acres of land owned by him/her by right of ownership/lifelong ownership. This means that a plot of land within a given area is not subject to taxation - no tax payment is provided. If the area exceeds 6 acres, the tax payment on land will be calculated only in that part that exceeds 6 acres.

A pensioner can claim a tax benefit only for the 1st section.

IMPORTANT!

The right to the plot must be registered directly in the name of the pensioner - only in this case will he be able to claim a tax benefit.

Property tax benefits

A pensioner has the right to receive an exemption from tax payments for:

- apartment;

- House;

- garage;

- parking space;

- outbuilding with an area not exceeding 50 sq.m.

IMPORTANT!

A pre-retirement person can be exempt from tax payments for only one piece of real estate. If a pensioner has two apartments and two garages, the tax exemption will be established for only one apartment and one garage.

Transport tax

Transport tax benefits for pensioners do not apply to federal legislation. Each subject of the Russian Federation, both Moscow and any other, has the right to decide independently whether to provide such a measure of support to pensioners or not. Only the regional legislator decides who, in what amounts in rubles. or percentage and in what order can one claim a benefit for reducing the transport tax rate. In those regions where there is such a benefit for pensioners, it most often amounts to a discount of 50% of the amount of payment required by the pensioner.

Requirement for site assignment

Some lands do not allow owners or users the opportunity to reduce the tax base. The right to a tax reduction does not arise if the status of the plot is:

- Owned by an association of citizens - a garden partnership, a dacha cooperative.

- Purchased for the construction of an apartment building and warehouse buildings.

- Used for conducting commercial activities.

The deduction applies to agricultural plots or plots purchased for the construction of an individual house (IHC).

How to apply

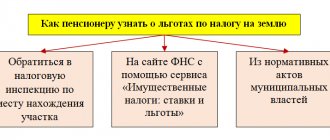

The answer to the question of how to apply for a tax benefit for a pensioner is as follows:

- contact your local Federal Tax Service office in person;

- send a set of documents by mail to the address of the local Federal Tax Service in the form of a registered letter;

- submit an application through the Federal Tax Service website;

- through your employer.

Documents you will need:

- Russian passport;

- certificate confirming status;

- TIN;

- documents on the ownership of the property for which a person claims a deduction.

Thus, the legislator, both at the Federation level and at the local level, has provided a number of concessions in the form of tax breaks for pensioners, while increasing the degree of their social protection.

❌ Grounds for refusal

The reasons for refusal to receive benefits may be as follows:

- incomplete package of documents;

- providing false information;

- errors in documents or expiration of certificates;

- errors or typos in the application;

- lack of grounds for receiving benefits;

- discrepancy between the tax authority to which the applicant applied and the taxpayer’s place of residence or the location of the land plot.

If a citizen does not agree with the decision made by the tax inspectorate, he has the right to appeal to a higher tax authority, the prosecutor's office or the court.