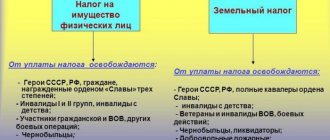

Who can count on federal tax breaks?

Different groups of the population can apply for benefits. Among them:

- awarded the Order of Glory, third degree;

- disabled children or disabled people of the first and second groups;

- combatants;

- military personnel with more than 20 years of service who were discharged for health reasons;

- pensioners and others.

In addition, entrepreneurs do not pay taxes on some property they use in their work. To do this, they must choose one of the following taxation systems: simplified tax system, PSN, tax for the production of agricultural goods or tax on imputed income. The list of persons who can count on regional benefits may be wider. Check with your tax office for the required information.

Results

It is not always necessary to pay the tax immediately if a notice is received. In some cases, the fact that it is issued does not mean that the recipient is responsible for paying property, land or car taxes. If there are grounds for exemption (benefits, actual loss of property, registration of property rights in the second half of the month), then the tax may not be paid even if there is a notification from the Federal Tax Service.

We always promptly tell you more about the calculation and payment of transport tax in our section “Transport Tax” .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What property is included in the preferential group?

Tax benefits are provided for certain groups of real estate. Thus, property tax may not be charged for:

- apartment, its share;

- private house or part thereof;

- household objects;

- structures less than 50 sq.m., located on a land plot for the construction of housing and summer cottages, subsidiary plots;

- workshops;

- parking places;

- garages;

- residential buildings for museums, galleries, libraries.

Some regions include other objects on the list. In order to find out what additional types of real estate fall into the category of preferential properties, contact your local branch of the Federal Tax Service (Federal Tax Service).

Procedure for granting tax benefits

The concession is equal to the amount of the annual fee for a certain piece of property. The owner selects a unit from each type of real estate for which he will receive a benefit. Even if you qualify for multiple benefit categories at once, you can only select one unit from each type of ownership for the tax credit. For example, if you are a pensioner and a war veteran, you have two apartments and a private house, you will receive a discount for one apartment and one house.

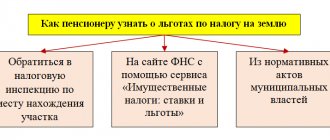

If you fall into the category of beneficiaries, submit to the Federal Tax Service Inspectorate (Inspectorate of the Federal Tax Service) an application and documents that confirm your right. The application can be submitted through the taxpayer’s L/C, by registered mail with a list of attached documents, in person at the inspectorate and at the MFC (Multifunctional Center). If you do not submit an application, the inspectorate will assess taxes based on its data. The tax office may not have information about your benefits.

Transport tax

In accordance with Article 356 of the Tax Code, the tax is established by the code itself and the laws of the constituent entities of the Russian Federation on tax, is put into effect in accordance with the Code by the laws of the constituent entities of the Russian Federation on tax and is obligatory for payment in the territory of the corresponding region.

Federal legislation also does not provide benefits for this tax. At the same time, when establishing a tax, the laws of the constituent entities of the Russian Federation may provide for tax benefits and grounds for their use by the taxpayer.

PS

Information on the availability of benefits for personal property tax, transport and land taxes for privileged categories of persons can be obtained on the official website of the Federal Tax Service of Russia in the service “Reference information on rates and benefits for property taxes”.

Property tax for individuals

This fee is local and must be paid in your administrative district. Payers are individuals with the right to property, which is the object of taxation. The size of the property fee depends on its cadastral or inventory (until 2019) value and the tax rate in your region. You can find out cadastral information about your property on the EGRN (Unified State Register of Real Estate) portal. To do this, enter the individual cadastral number of your property or its exact address on the website.

The property tax is assessed by the tax organization based on the information of the cadastral chamber. The fee is assessed for the past period for each property. If the payer has lost ownership, the duty is calculated based on the full months of ownership in the tax period.

When property tax benefits are provided automatically and do not require applications

The Federal Tax Service clarified which benefits for personal property tax and land tax should be applied to the “non-declaration procedure” (letter dated June 25, 2019 No. BS-4-21 / [email protected] ).

The Department notes that individuals belonging to one of the preferential categories (specified in subparagraphs 2-4, 7-10 of paragraph 5 of Article 391 of the Tax Code of the Russian Federation) and entitled to land tax benefits, including in the form of a deduction, may not submit application for a tax benefit and failure to report refusal to apply it.

In the absence of an application, a tax benefit will be provided on the basis of information received by the tax authority in accordance with the Tax Code of the Russian Federation and other federal laws.

In this case we are talking about the following preferential groups of citizens:

- disabled people of disability groups I and II;

- disabled since childhood, disabled children;

- veterans and disabled people of the Great Patriotic War, as well as veterans and disabled people of combat operations;

- individuals who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology;

- pensioners receiving pensions assigned in the manner established by pension legislation, as well as persons who have reached the ages of 60 and 55 years (men and women, respectively), who are paid a monthly lifelong allowance;

- an individual who meets the conditions necessary for the assignment of a pension in accordance with the legislation in force on December 31, 2021;

- individuals with three or more minor children.

The same applies to property tax benefits for individuals provided to persons who belong to the listed groups (specified in subparagraphs 2, 3, 10, 10.1, 12, 15 of paragraph 1 of Article 407 of the Tax Code of the Russian Federation).

Accordingly, benefits are provided to such taxpayers without their application based on information received by tax authorities from other departments.

The Federal Tax Service clarifies that the application of the listed provisions does not depend on the level of establishment of tax benefits for the taxes in question.

This means that the non-declaration procedure can apply to tax benefits directly established by the Tax Code of the Russian Federation, as well as to benefits established by local authorities.

BUKHPROSVET

If the payer wants to indicate (change) specific real estate objects in respect of which he wishes to enjoy tax benefits, he will have to send a corresponding notification to the Federal Tax Service.

A notification about the selected taxable items in respect of which a tax benefit is provided is submitted to any tax authority of the payer's choice. It is also possible to submit a notification through the “Taxpayer’s Personal Account”.

The notification must be submitted no later than December 31 of the current year.

Notification of the selected land plot will need to be in the form approved by Order of the Federal Tax Service of Russia dated March 26, 2018 No. ММВ-7-21/ [email protected] For real estate objects, a notification approved by Order of the Federal Tax Service of Russia dated July 13, 2015 No. ММВ-7-11 is used. / [email protected]

If notification is not provided, a tax benefit is granted in respect of one object of each type with the maximum calculated amount of tax.

Tax deductions for personal property

In addition to the opportunity not to pay fees for some property, all citizens can take advantage of deductions. However, owners who enjoy tax privileges can only receive a deduction for property to which the benefit does not apply. For example, a pensioner can receive a tax credit for a private house if he already uses the tax credit for an apartment. For taxes calculated based on cadastral value, this value is reduced:

- for 20 sq.m. for apartments and houses;

- for 10 sq.m. for rooms and parts of the apartment;

- for 50 sq.m. for private houses, but taking into account all buildings on the land plot;

- one million rubles for a real estate complex;

- for 5 sq.m. for an apartment and seven for a house for each child, if there are more than three in the living space.

Any citizen who owns real estate can receive a tax deduction when paying a fee. To do this, he needs to fill out an application confirming the right to receive a tax deduction. You can find a sample document on the official website of the Federal Tax Service: https://www.nalog.ru.

Article 407 of the Tax Code of the Russian Federation. Tax benefits (current version)

The procedure for issuing an electronic document containing information about classifying a citizen as a citizen of pre-retirement age was approved by Resolution of the Pension Fund Board of October 29, 2018 N 464p, and the Fund interacts with the Ministry of Justice of Russia for the purpose of its registration.

Information on classifying a citizen as a citizen of pre-retirement age in the specified document, as well as in the corresponding type of SMEV information, is planned to be generated on the date as of which the information is provided, based on the data available to the territorial body of the Pension Fund of the Russian Federation.

At the same time, taking into account that a citizen can apply for tax benefits and, accordingly, obtain information about being classified as citizens of pre-retirement age, after his right to a pension arises according to the norms in force as of December 31, 2021, the Fund plans to reflect in the document or response to an interdepartmental request from the Federal Tax Service of Russia the date of reaching the age that gives the right to a pension according to the standards in force on December 31, 2021.

According to the Pension Fund of Russia, this approach will ensure the rights of citizens to receive tax benefits without the need for additional applications.

New in legislation.

On January 1, 2021, a new subclause 10.1 of clause 1 of Article 407 of the Tax Code of the Russian Federation came into force, which introduced a new category of taxpayers entitled to receive a tax benefit on the property tax of individuals - individuals who meet the conditions necessary for the assignment of a pension in accordance with with the legislation of the Russian Federation in force as of December 31, 2018.

Official position.

The information of the Federal Tax Service of Russia “On the procedure for taxation of capital construction projects for individuals from 2021” also states that from 2021, persons of pre-retirement age who meet the conditions determined by the legislation of the Russian Federation necessary for assigning a pension on December 31, 2021, have the right to a benefit that exempts them from paying tax on one object of a certain type.

Changes can also occur at the regional and municipal level, since executive authorities of constituent entities of the Russian Federation have the authority to approve the results of the state cadastral valuation of real estate, and local governments can set tax rates and benefits. More information about this information can be found using the “Reference information on rates and benefits for property taxes.”

(The text of the document is given in accordance with the publication on the website https://www.nalog.ru as of December 18, 2018).

Paragraph 2 of Article 407 of the Tax Code of the Russian Federation determines the amount of the tax benefit: in the amount of tax payable by the taxpayer in relation to an object of taxation that is owned by the taxpayer and is not used by the taxpayer in business activities.

In relation to paragraph 3 of Article 407 of the Tax Code of the Russian Federation, an important clarification was given in the letter of the Ministry of Finance of Russia dated December 7, 2017 N 03-05-06-01/81421.

The Financial Department explained that from paragraph 3 of Article 407 of the Tax Code of the Russian Federation it follows that a taxpayer who is both a pensioner and a disabled person of disability group II has the right to be exempt from paying property tax for individuals in relation to the following objects:

1) one residential building (residential buildings for the purpose of calculating property tax for individuals also include houses (regardless of their purpose - residential or non-residential), as well as residential buildings located on land plots provided for running personal subsidiary, dacha farming, vegetable gardening, horticulture, individual housing construction) regardless of its area;

2) one economic building or structure, the area of each of which does not exceed 50 square meters. meters and which are located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction.

Thus, all buildings located on a plot of land provided for gardening, and which are not residential buildings, are recognized as commercial buildings (including a summer kitchen, a bathhouse).

Taking into account the above, pensioners who are also disabled people of disability group II are exempt from paying property tax for individuals in relation to one house, as well as a bathhouse or summer kitchen, the area of which does not exceed 50 square meters. meters.

Paragraph 4 of the commented article established the categories of objects in respect of which a tax benefit for the property tax of individuals can be applied. It is necessary to take into account that subparagraphs 1 and 2 of paragraph 4 of Article 407 of the Tax Code of the Russian Federation are in effect in an updated version, which came into force on January 1, 2021. At the same time, subparagraphs 1 and 2 of paragraph 4 of Article 407 of the Tax Code of the Russian Federation apply to legal relations related to the calculation of property tax for individuals from January 1, 2021.

Official position.

The letter of the Ministry of Finance of Russia dated August 17, 2018 N 03-05-06-01/58257 states that the Tax Code of the Russian Federation on personal property tax provides for restrictions only in relation to the types of real estate that are subject to exemption at the federal level. Meanwhile, tax advantages established at the federal level are minimal. Additional tax benefits not provided for by Chapters 31 and 32 of the Tax Code of the Russian Federation may be established by the relevant representative bodies of municipalities.

Letter of the Ministry of Finance of Russia dated 04/03/2017 N 03-05-04-01/19308 is devoted to an important issue - on determining the types of real estate when providing property tax benefits to individuals.

It is clarified that if the real estate object is a building, then the purpose of such an object in the Unified State Register of Real Estate is reflected in a residential building, non-residential building, apartment building, residential building, if the real estate object is a premises - residential premises or non-residential premises.

Thus, a number of non-residential objects (garage, outbuildings or structures) are subject to state cadastral registration as non-residential buildings, premises, structures without indicating the specific name of the object or its permitted use.

For example, garages, according to established rules, are subject to state cadastral registration and state registration of rights as non-residential buildings (premises, structures). There are cases of state cadastral registration and state registration of rights to residential premises without indicating a specific type of residential premises (residential building, apartment, room).

These circumstances lead to the fact that citizens who actually own real estate that are subject to tax exemption are deprived of the right to a tax break on the property tax of individuals.

Arbitrage practice.

Let's consider a specific example from judicial practice on the application of tax benefits for personal property tax.

Thus, by Resolution of the Presidium of the Supreme Court of the Republic of Karelia dated May 23, 2018 N 44g-10/2018, it was refused to satisfy the demands of an individual to the Federal Tax Service Inspectorate for the return of the amount of overpaid tax.

As follows from the case materials, the plaintiff is a pensioner, a veteran of military service. He owns an unfinished construction project - a residential building and a plot of land. In accordance with the tax notice, the plaintiff paid personal property tax and land tax. The defendant refused his application for a tax benefit for these objects, since the unfinished construction project, the owner of which is the plaintiff, is not included in the list of objects for which the benefit is provided.

The courts of the first two instances satisfied the individual's claim. The tax authority appealed the court's decision in cassation and indicated in the complaint that in satisfying the plaintiff's claims, the court applied norms of law that were not subject to application, namely the Town Planning and Housing Codes, and also considered the “linguistic construction” of the concept of an unfinished construction object in the case, in which does not require this. Paragraph 4 of Article 407 of the Tax Code of the Russian Federation provides for benefits for the property of individuals in relation to the types of real estate objects defined by this article, the list of which does not include unfinished construction objects. Thus, obliging the tax authority to return the paid tax to the plaintiff, the courts, in violation of the rules of law, actually recognized the unfinished construction site as a residential building and thereby went beyond the stated claims.

The Supreme Court of the Republic of Karelia supported the conclusion of the tax authority in this case.

In resolving the dispute and satisfying the stated requirements, the court of first instance proceeded from the fact that the evidence presented by the plaintiff, in particular the permission to put into operation the disputed residential building, issued in 2012, assigning a postal address to the house, registration of the plaintiff and his family members in the specified premises in 2013, the conclusion of agreements with organizations providing utility services gives reason to believe that the plaintiff owns by right of ownership a piece of real estate, the purpose of which is a residential building. Based on the foregoing, the court came to the conclusion that the plaintiff is subject to the provisions of Article 407 of the Tax Code of the Russian Federation on the provision of benefits in relation to this residential building and the land plot on which it is located, and, as a result, the amount of tax paid is subject to refund.

The appellate court agreed with the conclusion of the magistrate and noted that state registration does not certify the possibility of using the object for its intended purpose, but only confirms the existence of ownership of real estate for a certain person. Objects of unfinished construction should be recognized as objects for which there is no permission to put into operation. In the case under consideration, the specified permission is available; accordingly, this property is recognized as a residential building.

These conclusions of the courts are based on incorrect interpretation and application of the rules of substantive law governing controversial legal relations.

According to Article 8 of the Federal Law of July 13, 2015 N 218-FZ, information about buildings, structures, premises, parking spaces, unfinished construction projects, unified real estate complexes, including their purpose, must be entered into the Unified State Register of Real Estate. In accordance with Part 8 of Article 40 of the said Federal Law, removal from the state cadastral registration of an unfinished construction object and state registration of termination of rights to this object, if the state cadastral registration and state registration of rights in relation to it were carried out earlier, are carried out simultaneously with the state cadastral registration of those created in as a result of the completion of the construction of this building, structure or all premises or parking spaces in them and state registration of rights to them.

Consequently, the right of ownership of real estate arises from the moment of state registration of ownership of this property.

Thus, in the situation under consideration, before registering the ownership of a residential building, the taxpayer was the owner of another piece of real estate - an unfinished residential building.

Since, when considering issues of providing taxpayers with tax benefits and other preferences for personal property tax, tax authorities are guided by information received under Article 85 of the Tax Code of the Russian Federation, as well as information contained in documents submitted by the taxpayer to confirm his right to a tax benefit, then The conclusions of the courts that the unfinished residential building owned by the plaintiff during the disputed period is actually a residential building, and accordingly the plaintiff has the right to a tax benefit provided for in Article 407 of the Tax Code of the Russian Federation, do not comply with the provisions of the current legislation.

New in legislation.

Paragraph 5 of the commented article is valid from January 1, 2021 in a new edition and from this date an exception to this rule has been added: it does not apply to garages and parking spaces located at the facilities specified in subparagraph 2 of paragraph 2 of Article 406 of the Tax Code of the Russian Federation.

When applying paragraph 6 of the commented article, it is also necessary to be guided by:

— letter of the Federal Tax Service of Russia dated October 12, 2017 N BS-4-21/ [email protected] “On the procedure for confirming the right of an individual to tax benefits on property taxes”;

— Order of the Federal Tax Service of Russia dated November 14, 2017 N ММВ-7-21/ [email protected] “On approval of the application form for the provision of tax benefits for transport tax, land tax, personal property tax, the procedure for filling it out and the format for submitting the application for the provision tax benefits in electronic form", which came into force on January 1, 2021.

When applying the provisions of paragraph 7 of Article 407, it is also necessary to be guided by Order of the Federal Tax Service of Russia dated November 15, 2017 N ММВ-7-21 / [email protected] “On approval of the Recommended format for submitting a notification on selected taxable objects in respect of which a tax benefit for property tax is provided individuals, in electronic form and on the recognition of the Order of the Federal Tax Service of Russia dated September 10, 2015 N ММВ-7-6/ [email protected] .”

Which organizations pay the property tax?

Tax payers include domestic companies and foreign firms that have branches or real estate in Russia. Legal entities with the simplified tax system or a single tax on imputed income are exempt. FIFA and its subsidiaries and football associations do not pay the fee. The levy is levied on: fixed assets of an enterprise, investments in material assets, and residential premises. In order for property to fall into the category of fixed assets, it must be used by the company for more than a year, be more expensive than ten thousand rubles, be involved in production and bring financial benefit to the company. Land plots are not subject to tax.

New tax payment procedure

According to current rules, organizations calculate and pay property taxes independently. At the same time, in order to eliminate possible errors and identify arrears, the Federal Tax Service at the end of the tax period and after the expiration of payment deadlines sends out special messages to organizations about the amounts of taxes calculated by the tax authorities. Messages are sent according to the form approved. by order of the Federal Tax Service dated July 5, 2019 No. ММВ-7-21/ [email protected] in one of the following ways:

- in electronic form via TKS;

- through the taxpayer’s personal account;

- by registered mail;

- directly to the head or representative of the organization in person against signature.

The messages indicate the object of taxation, the taxable base, the tax period, the tax rate and the amount of calculated tax (clause 4 of Article 363, clause 5 of Article 397 of the Tax Code of the Russian Federation, paragraph 3 of clause 6 of Article 386 of the Tax Code of the Russian Federation). If you disagree with the calculation of taxes, the company has the right to submit its objections and documents confirming the correct calculation of taxes. The general deadline for submitting objections to the Federal Tax Service is within 10 days from the date of receipt of the notification about the calculated amounts of taxes.

But if this deadline is missed, the tax authorities will still have to consider the received explanations and documents and, if there are legal grounds, recalculate the amount of taxes calculated in the message (letter of the Federal Tax Service dated August 14, 2019 No. AS-4-21 / [email protected] ).

In this case, the organization has the right to independently submit an application to the Federal Tax Service to provide it with reports on the amounts of taxes calculated by the tax authority. A unified application form for the issuance of messages on the amounts of transport, land tax and property tax of organizations calculated by the Federal Tax Service. by order of the Federal Tax Service dated 07/09/2021 No. ED-7-21/ [email protected] At the same time, in relation to the application for the provision of reports on the calculated amounts of property tax for organizations, this form is applied starting from January 1, 2023.

What is the tax base for legal entities

The tax base is the average annual value of the property. An accountant or appraiser calculates it taking into account depreciation, which is determined according to depreciation standards. For real estate, the cadastral value of the property serves as the tax base. Such deductions are funds that an enterprise sets aside for the repair of equipment and premises of the enterprise. The amount of contributions is calculated separately for each type of equipment and real estate, taking into account their wear and tear and frequency of use. Average property value is the property value divided by 12 and increased by one.

Tax benefits for organizations

The property tax may not be paid:

- penal organizations;

- religious institutions;

- associations of people with disabilities;

- pharmaceutical manufacturers;

- prosthetic and orthopedic companies;

- bar associations, legal bureaus;

- innovation and research centers;

- representatives of a special or free economic zone;

- ;

- shipbuilding organizations;

- institutes involved in offshore exploration;

- companies with high energy efficiency.

Regions may include other preferential organizations in the list. To find out if tax benefits are available for your association, contact your local tax authority.

Procedure for making advance tax payments

The organization independently calculates the amount of tax payments using the following formulas: Amount of tax for the tax period = tax rate * tax base.

The amount of tax to be transferred to the budget at the end of the tax period = Tax rate * Tax base - advance payments.

It is easy to make a mistake when calculating tax payments. Especially if you have property in different constituent entities of the Russian Federation and their regulations differ from each other. Seek help from a specialist.

If an organization has property in different regions, it must determine the fee for the property according to the rules of the region in which it is located. The fee must be paid according to the procedure approved there. Companies must submit a declaration and calculations for advance payments to the Federal Tax Service at the end of each reporting and tax period. Calculations are provided by the 30th of April, July and October. The declaration must be submitted by March 30 of the following year.

Who is not supposed to pay taxes?

Our country allows a number of citizens not to pay taxes on their real estate at all. Article 407 of the Tax Code of the Russian Federation lists all categories of beneficiaries:

- Heroes of the former USSR and present-day Russia.

- People who have the Order of Glory of 3 degrees.

- I and II disability groups.

- Citizens with childhood disabilities.

- WWII participants, military veterans;

- Defenders of the USSR and the Russian Federation, including partisan formations, headquarters and military institutions.

- Civilian employees in regular positions in the army, navy, and state security during the Second World War.

- Participants in the defense actions of the Second World War, for whom length of service was counted when calculating their pension.

- Persons receiving social benefits after radiation disasters: Chernobyl; p/o "Mayak"; tests in Semipalatinsk.

- Military personnel discharged after twenty years of regular service or longer.

- Participants in the liquidation of consequences of radiation disasters.

- Military families who have lost their breadwinners.

- Pensioners receiving lifelong benefits under pension legislation.

- Everyone who retired from military service, but was called up for military training in Afghanistan and other countries to conduct combat operations.

- Disabled persons due to radiation sickness due to ongoing tests or exercises.

- Wives, mothers, fathers and children of military and government officials killed in the line of duty.

- Citizens of creative professions, for the period of use of the premises for workshops, ateliers, museums, exhibitions, libraries and other areas of cultural creativity (only for the period of professional use).

- Owners of private buildings for economic purposes, each of which is no more than 50 square meters.

If you are included in the listed categories and do not use your private property for business, the amount of the benefit is equal to the amount of the tax. Single complexes are excluded from the list of real estate; benefits do not apply to them.