Maintaining contractual document flow is one of the key tasks in the work of any organization, and a process such as concluding a contract requires increased attention. It is worth noting that this process includes every step of working with the contract, from creation and approval to making adjustments and monitoring compliance with the obligations of the parties.

The full cycle of working with a contract is a complex process, which usually involves several divisions of the company, which entails a high risk of errors and very vague deadlines for the entry into force of the document.

Often work is based on the principle: whoever is free is responsible. But this is fundamentally wrong.

Properly organized and regulated work with contracts significantly reduces these risks, while automation of contract approval completely eliminates them and makes this process absolutely transparent.

In what cases and why do they enter into a contract?

There are several reasons for concluding such an agreement with an individual:

- The need to perform a task that cannot be performed by full-time employees, and hiring an employee on staff is impractical, since the work is one-time.

- Hiring a new employee for a trial period. DP allows the employee to receive a salary in the agreed amount, and if he does not pass the probationary period, there will be no record of the contract in his employment record, which does not spoil the overall picture of his work experience with short-term employment.

- There is a need to expand the staff (for example, new tasks have appeared in the department), but it is not yet possible to change the staffing table. They contract with the specialist for a period of time until the staffing table changes, and then employ him on a permanent basis.

But we must remember that DP is such only in the first case. In the rest, if there are disagreements or claims from the contractor, the agreement may be considered a labor agreement - in court proceedings.

This applies to DP with an individual. If we talk about contracts with individual entrepreneurs and legal entities, they are concluded for the performance of certain works, as described in the first paragraph.

Don't forget the details

Determine the format of the draft agreement. Initially, it is not necessary to have a paper original or an electronic contract; a regular file compiled in Word or pdf is sufficient.

Calculate the approximate timing of approvals , but do not give too much time for each stage; if employees are overloaded, they will delay until the deadline - the approval period will be greatly delayed.

Clarify information related to trade secrets that cannot be disclosed.

Discuss an algorithm of actions in case it is not possible to reach a consensus on the text of the contract.

If you have a legal department or lawyer, then most likely he himself knows what to do. If not, try to pay attention to some important features:

- The text of the contract must comply with current legislation . If you don’t plan to fundamentally adjust anything in it in the future, it’s better to ask a professional lawyer to draw up several standard drafts. Check references to laws or articles of the Tax Code, if they are present in the text;

- Study the judicial practice related to your type of activity - what stumbling blocks most often prevent you from running a business smoothly, what errors in the contract can affect the outcome of the case, etc.;

- Focus on your own interests first . If the counterparty does not comply with some conditions, he will note this and you will be able to find a “golden mean”, but contracts are not always carefully studied, so your task is to ensure your own financial and legal security;

- Clearly discuss the terms of the contract, the terms of transfer of documents, the conditions and amount of payment . If the contract is concluded for a long period, and the specific terms of the transaction are stipulated, for example, in specifications, then it is necessary to monitor the signing of such documents as strictly as the contract itself;

- In case of complaints, describe the procedure - to whom they are transferred, in what form and within what time frame. This applies to claims on both sides. Here, too, it is important to study judicial practice and the most common causes of litigation.

DP terms

Conditions are the clauses of the document that describe all the nuances of performing the work and paying for them. Among the conditions there are mandatory or essential ones - without them the DP is considered not concluded.

Prerequisites

Essential or mandatory conditions include:

- type of work required (subject of the agreement);

- deadlines for their implementation;

- payment amount;

- conditions for prepayment.

All essential terms are agreed upon by the counterparties, otherwise the contract will not be considered concluded, which is important if it comes to litigation.

What conditions should not be in the contract?

The document does not stipulate the following conditions:

- a clause on the contractor’s compliance with the company’s operating hours or other rules - the contractor is not an employee of the company;

- clause on guarantees or social obligations on the part of the customer - such conditions apply only to company employees;

- condition on sending the contractor on a business trip (business trip is the subject of the employment contract).

If the document contains such clauses, in the event of legal proceedings the document may be recognized as an employment contract.

Working conditions: workplace and materials

According to the employment contract, the employer provides the employee with proper working conditions . It highlights the work area, computer, tools, uniform, materials and instruments. Conducts safety training.

According to the GPC agreement, the customer is not responsible for the contractor’s workplace . The contractor himself selects and equips his workplace. The customer can transfer tools and materials for the work to the contractor, and then this is written in the contract. If there is no such clause in the contract, the contractor works with his own tools and materials.

Taxation

When drawing up such an agreement, counterparties are not exempt from paying taxes and insurance premiums. But a lot depends on who the TD was concluded with.

With an individual

If the contractor is an individual, the customer assumes the obligations of the tax agent. Payment of personal income tax and insurance premiums is required. This is true provided that the contractor provides the customer with certain services, performs any work for the company, or creates an intellectual, creative product with the subsequent transfer of rights to it.

The Pension Fund and the Federal Compulsory Medical Insurance Fund are also paid, similarly to an employment contract. The rate for pension contributions is 22% of the contract amount, the rate for health insurance is 5.1%.

With a legal entity

If the contractor is a legal entity, then paying taxes is its responsibility, since the beneficiary under the contract is the contractor.

An exception is cooperation with a foreign legal entity. In this case, the tax agent is the customer company, since the foreign organization is not registered with the tax authorities in Russia. As a rule, foreign companies are VAT payers, and the customer must make this payment on the day the contractor receives payment.

With IP

If a contract is concluded with an individual entrepreneur, then it is the individual entrepreneur who must pay taxes, taking into account the form of taxation he has chosen.

GPA for work between individuals - what are its consequences?

The Civil Code of the Russian Federation does not prevent the conclusion of a civil contract between individuals. However, a number of questions arise here regarding who is responsible for paying taxes on the income received by the executor. Let us recall that each of the parties to such an agreement may be an individual entrepreneur, and due to this, the following options for the parties to the agreement are possible:

- both of them (the employer and the contractor) are individual entrepreneurs;

- the employer is an individual entrepreneur, and the performer is an ordinary individual;

- the employer is an ordinary individual, and the contractor is an individual entrepreneur;

- both of them are ordinary individuals.

In the first option, the relationship is the same as between legal entities or between a legal entity and an individual entrepreneur, i.e., everyone pays the taxes required for him, and the amount of payment under the GPA is a regular settlement between counterparties.

In the second option, the individual entrepreneur, in relation to income paid to an individual, is the payer of insurance premiums and the tax agent for personal income tax withheld from this income.

In the third option, the individual employer does not impose any taxes on the income paid to the individual entrepreneur. The latter makes all the necessary payments from his own income.

And with the fourth option, both parties have a need to make tax payments and prepare reports:

- for the contractor - in relation to the tax on income received, since the individual employer is not included in the number of tax agents (clause 1 of Article 226 of the Tax Code of the Russian Federation);

- from the employer - in relation to insurance premiums from this income (subclause 1, clause 1, article 419, clause 2, article 420 of the Tax Code of the Russian Federation).

The latter requires, accordingly, registration with the Federal Tax Service as a payer of contributions. Thus, both parties with this version of the GPA have consequences that are not desirable in contracts of this kind that are concluded infrequently.

Types of agreement

A contract can be concluded for the performance of certain works - a special document is drawn up for each type. There are 4 types of contracts, each of which is concluded when ordering certain types of work.

Domestic

Under this agreement, work is performed to satisfy the customer’s needs, domestic or personal. This category includes services for sewing clothes, installing doors and windows, and performing other work. Important - the result of the work should not be intended for commercial use. In fact, even if you call an electrician to replace an outlet, you are entering into a household contract with him, but only verbally.

Building

The parties enter into such an agreement when it is necessary to construct, repair, or reconstruct an object (building or structure). In accordance with the DP, the contractor is obliged to complete construction, repair or installation work within the specified time frame, and the customer is obliged to provide the contractor with the conditions for work, the finished object and make payment.

For design and survey work

According to such a document, the contractor’s responsibilities include survey work or the development of technical and design documents. DP can be consensual, remunerative or bilateral.

If an agreement on survey work is concluded, then only a legal entity licensed to perform such work can act as a contractor.

Works for municipal and state needs

Such an agreement is concluded when there is a need for construction, survey or design work that meets the needs of the Russian Federation or a constituent entity of the Russian Federation. Financing of the work is carried out from the state or municipal budget, or from an extra-budgetary source.

The customer of the work can be either a state or municipal body. The executor is a legal or natural person.

Unlike other work contracts, which are regulated only by the Civil Code, a work contract for state or municipal needs is also regulated by the relevant law.

For what purpose can contracts be concluded?

Each capable citizen of the Russian Federation, on average, enters into about 10 transactions per day, accompanied by an oral agreement between the parties. The statistics for written documents are much smaller – no more than two documents per Russian per day.

Current legislation allows the use of both written and oral forms. However, for a number of transactions characterized by the complexity of the legal consequences of both parties, mandatory strict requirements have been established:

- Written opinion only;

- The need for notarization.

Documentation of any contractual legal relations pursues the following goals:

- Accurate written recording of all agreements reached between the parties;

- Consolidation of an exhaustive list of rights, obligations and legal consequences of their failure to comply;

- Protecting the interests of the parties to the transaction from violations by each other, third parties or government bodies.

If it is necessary to protect the position of one of the parties in court, an oral agreement cannot be presented as a strong evidence base. If there is a written form, as a rule, the dispute is resolved through pre-trial settlement.

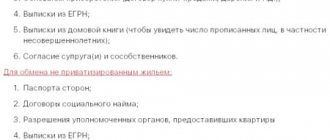

What documents are needed for registration?

If one of the parties to the agreement is a legal entity, the following documents are required from it:

- constituent;

- OGRN certificate;

- TIN/KPP;

- a document confirming the legal address of the legal entity;

- protocol on the appointment of the head of the organization;

- extract from the Unified State Register of Legal Entities;

- in some cases - Form-2 and balance sheet;

- a document confirming the identity of the person authorized to enter into an agreement on behalf of the company.

The same package of documents is required from the second party to the contract, if it is also a legal entity.

If the party to the agreement is an individual entrepreneur, the following documents are required from him:

- passport data;

- TIN;

- individual entrepreneur registration certificate;

- a document confirming the legal address of the individual entrepreneur;

- extract from the Unified State Register of Individual Entrepreneurs.

If a certain person acts on behalf of an individual entrepreneur, the full name of this person is required.

If the party to the agreement is an individual, the following documents are required from him:

- passport details;

- certificate of compulsory pension insurance;

- TIN;

- registration address.

If certain skills or knowledge are required from the contractor to perform work under the contract, the package of documents also includes a diploma or certificate confirming the relevant education.

If payment is intended to be made to a bank account, the number of the card or account to which the customer is obliged to transfer money is indicated.

If the performer is a foreign citizen, additional documents are required from him - a patent or permission to work in the Russian Federation, medical insurance, payment of personal income tax.

Personal income tax and insurance premiums

The employer acts as a tax agent in both cases . He withholds and pays 13% to the tax office on a monthly basis from the salaries of employees working under any type of contract.

This does not apply to contracts concluded with individual entrepreneurs. Entrepreneurs pay taxes themselves. To avoid tax claims, ask the individual entrepreneur for documents about his status.

Both types of employees may qualify for tax deductions. True, contractors can apply to the customer for it only while the contract is in force.

For employees under an employment contract, the employer pays monthly insurance contributions in the amount of 30% of the salary - to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Compulsory Compulsory Medical Insurance Fund. Additionally, he is obliged to transfer contributions for insurance against accidents and occupational diseases at the rate applicable to the organization.

For employees under a GPC agreement, contributions must also be paid, but in a smaller amount . Contributions to the Social Insurance Fund in case of temporary disability or maternity are not accrued, and contributions for injuries are paid only if this is provided for in the contract. So 27.1% of the salary is transferred to the Federal Tax Service.

Contributions to the Pension Fund are paid in any case, and under any agreement, the pension savings of the employee or performer grow.

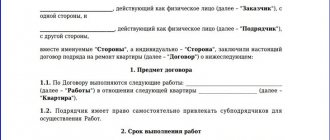

How to draw up a contract

To draw up a contract, just download the appropriate sample form. It can be edited in accordance with the specifics of the contract. But you need to pay special attention to some points.

Subject of the agreement

This clause is an essential condition of the contract. This section must indicate:

- Name, type, content and scope of work to be performed by the contractor. This information can be indicated in the text of the contract, or, if the amount of information is large, in a special annex to the document.

- Description of the object in relation to which the contractor must carry out work. For example, if processing of an item is necessary, a detailed description of the item is performed.

- The result of the work is a detailed description of the result that will satisfy the customer.

Deadline

It is also considered an essential condition, and if the document does not indicate the deadlines for completing the work, the contract may be considered not concluded.

When forming a clause on deadlines, they are indicated in one of two ways:

- The exact start and completion dates of work are prescribed.

- The start date of the work is prescribed, as well as the period for its completion, in calendar or working days.

Also, the deadlines may be indicated in the annex to the contract, and this is advisable if the work is to be carried out in stages.

Cost of work and payment procedure

This condition is not essential, but it should be agreed upon and indicated in the document. This is necessary to reduce the risk of disputes that may arise if the document does not indicate the cost of the work. Moreover, the law provides for the option of drawing up an agreement even without agreeing on its price - in accordance with clause 3 of Art. 424 Civil Code of the Russian Federation.

The price of the work consists of two components: the cost of materials, operation of equipment and other expenses, plus payment to the contractor. If there are a lot of expenses for materials or machinery, equipment, an estimate is drawn up as an appendix to the main document.

In some cases, the contract contains a clause with the terms of the guarantee retention.

The procedure for delivery and acceptance of work on DP

This paragraph indicates how and when the contractor reports to the customer on the progress of work or its completion.

Rights and obligations of the parties

Here all the points that relate to the transaction are written down, even those that seem elementary and obvious. For example, the customer is obliged to accept the result of the work within the specified time frame. If this is not specified, the customer may be tempted to delay the deadline for acceptance and payment, which, of course, the contractor will not like.

But you need to remember that some conditions can turn a contract into an employment contract. Such requalification is possible if the following points are present:

- the need to work according to the schedule established by the company;

- requirement to comply with internal regulations;

- permanent work of a contractor with regular payment;

- prohibited subcontracting.

These conditions may apply only to full-time employees of the company.

Where to begin?

The Regulations include several sections:

- Formation of projects, sample contracts for various types of transactions;

- Checking the counterparty with whom the transaction will be concluded and providing your own supporting documents (what can and cannot be transferred);

- Coordination;

- Signature order;

- Transaction control;

- Storage and archiving.

For each stage, a responsible person must be appointed who will keep records, coordinate the work and monitor implementation.

When you have prepared the regulations, you can move on to drawing up standard forms that will be universal and can be used without special approval.

In such an agreement, you can immediately establish the usual conditions for customers, for example, the delivery time for goods is 10 working days, transportation costs are at the expense of the buyer, 100% prepayment. If any conditions change, they must be agreed upon according to the regulations.

Ways to sign an agreement

Once all terms have been agreed upon and reflected in the contract, it must be signed by both parties. Today this can be done in several ways.

Online

An electronic document, if properly executed, has full legal force. Each party signs it using a qualified electronic signature. It is obtained from a certification center accredited by the Ministry of Telecom and Mass Communications.

You can also create and sign an agreement on the appropriate resources - on the trading platform, on sites that provide the opportunity to sign agreements, in special electronic document management systems. This opportunity is also available on the State Services portal.

By proxy

The document can be signed not by the counterparty personally, but by his authorized representative. In this case, the person must have the appropriate powers, which are formalized by a notary (by power of attorney).

Personally

The standard way of signing documents is for counterparties to meet, study the agreement and sign it.

By mail

The paper agreement is sent by one party by mail. The second party signs the document and sends it back.

Duration and legal force

The legislator gives the parties to the agreement the right to establish the validity period of the relevant agreement. The exception is cases where such deadlines are directly established by the current regulatory legal legislation (Article 425 of the Civil Code of Russia).

The legitimacy of a document is determined by a number of factors:

- Compliance with the rules for drawing up contracts;

- Indication of necessary conditions;

- Whether the parties have sufficient competence to enter into the relevant type of transaction, etc.

As a general rule, an agreement gains legal force from the moment it is signed, and its invalidity or insignificance is established in court.

Features of termination

A contract, like any other, can be terminated, but only under certain conditions.

By agreement of the parties

In such cases, both parties agree to terminate cooperation.

Unilaterally

The customer terminates the contract in the following situations:

- violation by the contractor of the terms of the agreement, poor quality of work;

- failure to meet deadlines;

- increasing the cost of work without prior approval;

- invalidity of the transfer and acceptance act.

The contractor can also terminate the agreement if the customer:

- does not want to compensate for the increase in the cost of materials;

- due to inaction or opposition from the customer, the work process is slowed down;

- due to the fault of the customer, there is a threat to the result of the work.

Through the court

They go to court if the parties have not reached a peaceful agreement.

FSS claims

Contributions for injuries at work and occupational diseases are still administered by the Social Insurance Fund. Therefore, the fund is also interested in requalifying contracts, especially in organizations with high tariffs.

The FSS is extremely vigilant, so it often goes to court even in cases where the contract does not contain obvious signs of an employment relationship. Because of this, they are less and less able to reclassify the contract.

The contract must be drawn up carefully and competently. Any mistake increases the FSS’s chance of winning a legal dispute.

In one of the latest examples, the territorial branch of the FSS of the Russian Federation conducted an on-site inspection of the company and, as a result, assessed additional insurance premiums, penalties and a fine. The company entered into GPC agreements with the drivers, and the court reclassified them as labor contracts.

The fund believed that contracts with drivers are similar to fixed-term labor contracts; payments under them are a hidden form of salary and are subject to contributions.

The arguments were as follows:

- drivers received working transport and a garage;

- drivers received a regular salary in a fixed amount;

- the contract did not specify a specific scope of work (the parties were not interested in the result, but in the process);

- workers performed a labor function, and not one-time tasks.

The society tried to challenge the position of the FSS in court and received support in three instances. The courts proceeded from the fact that the contracts contained features characteristic of GPD: the presence of a specific type of service (driving a vehicle on the instructions of the customer), a fixed amount for the result of the service, the involvement of drivers as needed and not on an ongoing basis, no payments in the absence of orders .

However, in another similar case, the court satisfied the demands of the Social Insurance Fund for additional contributions.

The Supreme Court found that the organization entered into contracts with individuals to perform permanent, rather than one-time, work. It did not define a specific scope of work, and the relationship between the parties was of a long-term nature: for several years the contract was drawn up with the same person. In addition, the company provided the performers with a workplace, equipment and tools, and the work they performed regularly was paid twice a month. The staffing table contained a position with labor functions similar to the work performed by the contractor under the contract.

The court considered these circumstances sufficient to re-qualify the contract.

The FSS has a letter that it prepared for its territorial branches. The letter provides practical recommendations on the distinction between a civil process contract and an employment contract. These recommendations are still relevant today.

The difference between a work contract and an employment contract and other contracts

| Options | Work agreement | Employment contract | Contract for paid services |

| Parties to the agreement | The parties are equal, neither is obliged to obey the other | The employee must obey the rules of the organization | The parties are equal, neither is obliged to obey the other |

| Subject of the agreement | One-time execution of work | Constant performance of work duties | One-time execution of work |

| Payment | The price of the work is fixed, payment is one-time, based on the result of the work | Guaranteed, regular, does not depend on the result of work | The price of the work is fixed, payment is one-time, based on the result of the work |

| Deadlines | Fixed-term contract | Permanent contract | Fixed-term contract |

| Procedure for conclusion and termination | Regulated by the civil code | Regulated by the Labor Code | Regulated by the civil code |

From the employment contract

It differs from a contract employment contract in almost every way. Different legal spheres of regulation, relationships between the parties, and so on. Cooperation under an employment contract is recorded in the contractor’s work book; the employee is obliged to comply with the company’s internal regulations, but receives the right to vacation, sick leave, and so on.

From a contract for paid services

In many ways, the contracts are similar, but there is one difference: the contract does not imply the transfer of the result to the customer in the form of an object. Indeed, if we are talking about a service, it cannot be transferred as a material object (for example, a transportation service).

Summary

A GPC agreement is not a simple document or formality. Before signing it, you must carefully read all the terms and conditions.

If you do not understand something or doubt that the document protects your interests, be sure to consult with lawyers. A civil law contract is not an employment agreement, where the employee is seriously protected by the norms of the Labor Code of the Russian Federation. Most often, GPC protects the interests of the customer and can have many nuances in relation to the contractor.

Author: Kadrof.ru (KadrofID: 79032) Added: 05/30/2019 at 13:14

To favorites

Comments (49)

Valentina (KadrofID: 100310)

Please tell me, when you work under a civil service agreement, the employer provides income certificates to apply for a subsidy

04/05/2020 at 14:25

Sergey Antropov (KadrofID: 5)

Valentina, if you are asking about a certificate of income in form 2-NDFL, then you can receive such a certificate when working under a GPC agreement. In it, the employer will reflect the income you received and taxes withheld. The issuance of such a certificate is regulated by Art. 230 of the Tax Code of the Russian Federation.

05/01/2020 at 17:37

Natalia (KadrofID: 111378)

Tell me, if a person is employed under a GPC agreement, can he register with the labor exchange?

08/05/2020 at 01:20

Sergey Antropov (KadrofID: 5)

Natalya, no. According to the Law of the Russian Federation of April 19, 1991 N 1032-1 Article 2, such citizens are considered employed, i.e. having income.

08/05/2020 at 22:21

Maxim (KadrofID: 111438)

Tell me, is the existence of a Civil Legal Agreement (CLA) without receiving income for a certain period of time equivalent to conducting business during this period? After all, in fact, since there is no income, then there is actually no activity! And the concluded GPC Agreement is only a formal necessity for the possible conduct of activities.

08/06/2020 at 10:29

Sergey Antropov (KadrofID: 5)

Maxim, the term conducting business is usually used for individual entrepreneurs or organizations. A GPC agreement is concluded with an individual to perform certain work. Therefore, please clarify your question.

08/07/2020 at 22:48

Olga (KadrofID: 112288)

If, as your article says, the main thing is the result, and not the process, is it then legal for the organization to require me to work according to the schedule they have determined (I am not satisfied with such a schedule)?

08/22/2020 at 15:47

Tatiana (KadrofID: 113091)

Can individuals be attracted? Is a person working under a GPC agreement liable for illegal conduct of business activities?

09.09.2020 at 11:34

Sergey Antropov (KadrofID: 5)

Olga, legally no, but in practice it is better to agree with the customer on working conditions acceptable to both parties. After all, the customer can initiate termination of the contract.

09.09.2020 at 22:29

Sergey Antropov (KadrofID: 5)

Tatyana, if you are not disguising your business activities under the guise of GPC, then I see no reason. You pay taxes, you do work.

09.09.2020 at 22:30

Enver (KadrofID: 114155)

Can the employment center check the number and date of the GPC agreement?

09.30.2020 at 21:47

Annushka24 (KadrofID: 114304)

Hello. She worked under a contract for the provision of paid services. During this time I received another education. To receive a tax deduction for training, I asked for a 2NDFL certificate. I was told that I was not entitled to such a certificate precisely because I worked under such an Agreement and did not pay taxes. I objected that, by law, the employer had to pay taxes. I was refused. What to do? Should I file with the Labor Inspectorate or court? Or will everything be useless? I read the contract carefully. The tax issue is not addressed in any way.

04.10.2020 at 01:31

Sergey Antropov (KadrofID: 5)

Enver, I’m not sure that CZ has such capabilities. They are most likely checking to see if any fees have been paid for the employee by the customer. After all, taxes are withheld from payments under civil contracts.

05.10.2020 at 13:48

Yulia Bocharova (KadrofID: 115423)

Tell me whether the amount of contributions should be included in the contract amount, or whether the amount should be included with personal income tax. Now there are disagreements in the institution on this issue. Previously, the amount with personal income tax was indicated, but a new chief accountant came in and now we are calculating all taxes.

10/24/2020 at 07:04

Juliana (KadrofID: 116010)

If I am registered with the Employment Center and receive unemployment benefits and I have registered for a job or part-time job under a GPC agreement, can I lose my benefit payment for the past month? Does the employment center have the right to suspend benefit payments?

02.11.2020 at 15:09

Roman (KadrofID: 116273)

The GPC agreement specifies the amount of 10,000 rubles, after signing the work acceptance certificate, I receive 8,700 rubles, that is, only personal income tax is withheld, and the article states that the employer must pay contributions to the Compulsory Medical Insurance Fund and the Pension Fund. Is this possible or have I misunderstood something? And also, how should my work be reflected on the tax website?

06.11.2020 at 02:01

Sergey Antropov (KadrofID: 5)

Yulia, as far as I know, the contract specifies the amount that includes personal income tax. Tax is withheld when paying money to individuals. face. I think that this can be stated in the documents as a separate paragraph.

07.11.2020 at 22:00

Sergey Antropov (KadrofID: 5)

Juliana, a citizen loses the right to receive benefits after employment. Because ceases to be unemployed. If I understand your question correctly, you have already received what was paid earlier and are not obligated to return it. But since you started working, you no longer have to receive benefits.

07.11.2020 at 22:01

Sergey Antropov (KadrofID: 5)

Hello, Annushka24! When paying money to individuals. For individuals, organizations act as a tax agent and must withhold and transfer taxes to the budget themselves. I assume that the organization for which you worked did not officially carry out the contract and did not pay taxes, and therefore does not want to issue you a certificate. If you worked somewhere else, try to get a certificate there to receive a personal income tax refund.

07.11.2020 at 22:20

Larisa (KadrofID: 116709)

Hello, how can I get Azerbaijani citizens to work for an individual entrepreneur on a patent if they do not have SNILS?

11/13/2020 at 18:41

Vladimir (KadrofID: 116906)

Hello, the employment center sent a letter demanding the return of the paid benefits due to the fact that I was working at that time under a civil service agreement. It turned out that since last year I have been accruing experience at Yandex LLC without payments. What can I do? Can I be sued or forced to return benefits?

16.11.2020 at 21:21

Tatiana (KadrofID: 118674)

I worked under a GPC contract and am a pensioner. I moved to another region and submitted documents to the Pension Fund to reimburse the relocation costs. The Pension Fund requires a certificate stating that I did not receive these payments from the organization with which the GPC agreement is concluded. Is it legal for the Pension Fund to require such certificates and is the organization obligated to issue them?

12/14/2020 at 11:17

Sergey Antropov (KadrofID: 5)

Hello, Vladimir! If you sent a letter, then this question will not be put on hold. It’s better to react, come to the employment center and figure everything out. If, according to the law, you were not entitled to benefits, because... worked, then unfortunately, the benefits will be required to be returned.

12/19/2020 at 12:58

Sergey Antropov (KadrofID: 5)

Hello Tatiana! The Pension Fund of the Russian Federation is a state structure and must act in accordance with the laws. If they ask for a certificate, it means they need it. Therefore, it is better to provide it. The organization must issue it, there are no obstacles to this.

12/19/2020 at 12:59

DMITRIY KOLESNIKOV (KadrofID: 119033)

Is it possible, while working under the GPC, to get another job officially using a work book?

12/20/2020 at 14:31

Annushka (KadrofID: 120205)

Hello. Can I get a job under the civil labor law without resigning from my previous job, where I worked under an employment contract (where I am on maternity leave)?

01/11/2021 at 15:33

Maria (KadrofID: 121179)

Good afternoon Please tell me, if a GPC agreement for the provision of services is concluded with an individual occasionally (2 times a year or once a year), will an employment relationship be considered in this case? The agreement is concluded of a purely civil nature; the frequency of concluding such agreements with the same person is simply not clear. The term for completing services is about 10 days.

01/25/2021 at 21:46

Maria (KadrofID: 121179)

Hello, DMITRIY KOLESNIKOV! Yes, you can, since according to the GPH agreement you perform certain work or services are provided, this is regulated by civil law, not labor law. You have the right to enter into labor relations and these relations, accordingly, will be regulated by the Labor Code of the Russian Federation.

01/25/2021 at 21:54

Maria (KadrofID: 121179)

Hello, Annushka! If you are not a civil servant, you can enter into a civil contract. State owners are increasingly strict in this regard, since a conflict of interest may be perceived, and most often there is a ban on engaging in other income-generating activities.

01/25/2021 at 22:02

Sergey Antropov (KadrofID: 5)

Dmitry, it’s possible, because... work on GPC may not be the main one.

Annushka, I think so, because... You can work part-time. Just in case, I recommend checking your employment contract and checking to see if there are any clauses prohibiting you from working in other places.

01/25/2021 at 22:34

Sergey Antropov (KadrofID: 5)

Good afternoon, Maria! You need to look at the details, but since the services are provided periodically and not constantly, it seems to me that such a relationship is unlikely to be classified as an employment relationship. You can ask the contractor to register for self-employment and work with him in this status. In this case, I don’t see any risks at all, because... a self-employed person can work with a legal entity without any problems. persons and provide them with services at any frequency. You can read more about this mode in the article:

02/06/2021 at 15:00

Alexander (KadrofID: 124264)

I work under a GPC agreement. The customer pays for my services monthly after signing the Certificate of Work Completed. At the moment I am busy looking for another job where I want to get a job according to the Labor Code of the Russian Federation. Accordingly, I want to terminate the GPA, but the terms of termination are not specified in the contract. But there is a general term of the contract in the subject of the contract. The question is whether I have the right to terminate the contract without paying any compensation to the Customer BEFORE the expiration of our contract. I have a GPA until December 31, 2021, and for example, I will find a job in the summer of 2021. Will I be able to calmly terminate the GPA without losses for me? Thank you

03/15/2021 at 21:47

Sergey Antropov (KadrofID: 5)

Alexander, the GPC agreement can be terminated by agreement of the parties. If the customer agrees to terminate the relationship with you, then draw up a corresponding document. In it, write down that the parties have no claims against each other, and all other conditions that are important to you.

03/21/2021 at 19:06

Alexandra (KadrofID: 126088)

Good afternoon. Tell me, how can I conclude a GPC agreement with a citizen of another country (Kazakhstan, Belarus, Ukraine)? What taxes do you need to pay? What are the risks for the customer and the contractor? On the basis of such an agreement, can a citizen of another country stay on the territory of the Russian Federation for longer than 3 months, if a period for completing the work is prescribed (six months, a year)? Will the GPC agreement have the same force as the TD for migration? Is it possible to draw up such an agreement between relatives, one of whom has a Russian passport?

04/20/2021 at 09:22

Sergey Antropov (KadrofID: 5)

Good afternoon, Alexandra!

As far as I know, it is possible to draw up a GPC agreement with a citizen of a country that is part of the EAEU (Russia, Belarus, Armenia, Kazakhstan and Kyrgyzstan) without any problems. The performer is required to have a passport (if it is in a foreign language, then a notarized translation of the document), a migration card and a license (if the performer’s activities are licensed). At the same time, citizens of the EAEU member countries do not require a patent or work permit.

The Ministry of Internal Affairs must be notified of the conclusion and termination of a civil process agreement with a foreign citizen.

If the performer is a resident of Russia (that is, is on the territory of the Russian Federation for 183 days or more during the year), then the personal income tax rate will be 13%. If he is a non-resident, then 30%. Insurance premium rates, as far as I know, are the same as for Russian citizens.

04/24/2021 at 11:29

Irina (KadrofID: 126474)

Tell me, is the existence of a Civil Legal Agreement (CLA) without receiving income for a certain period of time equivalent to conducting business during this period? After all, in fact, since there is no income, then there is actually no activity! Having left my main job, the GPC agreement for joint activities (application of loans from the bank) remained unclosed. I closed it 2 weeks later. The employment center considered this to be my last place of work and prescribed a minimum allowance, although I provided all the income certificates from my main place of work. Is it possible to challenge the decision of the central office?

04/28/2021 at 11:43

Sergey Antropov (KadrofID: 5)

Good afternoon, Irina! Lawyers can give an exact answer to this question. I can assume that the actions of the Central Bank in this case are legal, since the presence of a GPC agreement means that the person works somewhere.

05/01/2021 at 16:10

Alex (KadrofID: 129916)

Hello. The spouse is temporarily unemployed, which is why her parents lose the right to a subsidy for housing and communal services. If a wife gets a temporary job under a civil contract, can the employer issue her a certificate of income and are such incomes taken into account in the average income of family members for six months to calculate the subsidy? Thank you!

07/22/2021 at 13:31

Sergey Antropov (KadrofID: 5)

Hello Alex! From the information that I was able to find, it follows that income from GPC agreements is taken into account when calculating subsidies.

07.27.2021 at 23:17

Meerim (KadrofID: 130258)

Hello! I am not a citizen of Russia and worked under a civil contract and now I am in a position. I wanted to register at the hospital. Is it possible to get a medical pole through GPC?

07/30/2021 at 17:47

Sergey Antropov (KadrofID: 5)

Hello, Meerim! As far as I know, foreign citizens have the right to receive a compulsory medical insurance policy. I recommend that you contact insurance companies. They will tell you exactly what documents are needed to obtain the policy.

08/08/2021 at 12:23

[email protected] (KadrofID: 131830)

Good afternoon, can you tell me that I have an individual entrepreneur, but the employer wants to conclude a GPC agreement with me as an individual and not with an individual entrepreneur, is it possible to do this?

09/07/2021 at 05:23

Sergey Antropov (KadrofID: 5)

Hello! Yes, you can. In this case, you work as an individual. the person and taxes on payments will be paid for you by the customer. He will not be your employer, because... The GPC agreement is not an employment agreement. He will be the customer.

09.12.2021 at 23:06

Natalia (KadrofID: 134435)

I am officially employed, and I have a contract agreement (educational services) with another organization. Every month I read up to 50 hours in varying amounts. Yesterday they said that with this part-time job you can only work for 18 hours. Tell me, are there any restrictions?

07.11.2021 at 14:23

Sergey Antropov (KadrofID: 5)

Natalya, the length of the working day when working part-time is regulated by Art. 284 Labor Code of the Russian Federation. According to this article, you can work part-time for up to 4 hours a day. In this case, the total number of hours per month should not exceed half of the standard working time established for the employee at his main place. Usually this is 160 hours, i.e. You can work part-time for up to 80 hours. But there are categories of workers whose norm is less.

It is also better to check with personnel officers whether work under a GPC agreement is a part-time job. Because The Labor Code of the Russian Federation regulates only employment contracts. GPC is not one of them.

11/14/2021 at 2:17 pm

Olga (KadrofID: 135685)

Good afternoon. Is it possible to work as a salesperson in a grocery store? Is there a risk for the employer?

12/03/2021 at 14:13

Sergey Antropov (KadrofID: 5)

Hello Olga! I doubt that the seller can work under a GPC agreement. For the employer, there is a risk of reclassification of such a contract into an employment contract with additional assessment of the corresponding contributions:

12/11/2021 at 22:47

IGOR (KadrofID: 136296)

I work under the GPC and perform the duties of a janitor for the period of his suspension from work. services are provided temporarily. the start date for services is indicated, the cost of services per month is stated - constant, the organization is a budgetary one, they said the amount is constant, they will soon increase the minimum wage, can I legally demand an increase in payment for my services. And what are my risks when a former employee leaves.

12/17/2021 at 18:07

Sergey Antropov (KadrofID: 5)

Hello, Igor! The GPC agreement is not an employment agreement, therefore the increase in the minimum wage does not apply to it. The customer pays the amount specified in the contract. When a former employee returns to work, they may not renew the GPC, that is, they may refuse your services.

12/24/2021 at 21:53

Advantages and disadvantages

A contract is concluded in many cases. And, like any form of cooperation, it has its pros and cons.

For employee

The advantages of DP for an employee include:

- you may not comply with the company’s internal regulations;

- independence from the customer;

- the ability to combine several types of activities;

- subcontractors can be involved;

- In the future, you can conclude an employment contract.

The disadvantages include the instability of such relationships and the lack of social guarantees.

For the employer

The employer benefits from such an agreement due to the absence of the obligation to provide the contractor with materials and a workplace (unless otherwise specified in the agreement). Also, the customer does not have to pay the contractor for sick leave or vacation. There is no need for insurance premiums either.

The disadvantages include the inability to interfere with the work process.

Internal labor regulations

Each full-time employee works at a time agreed with the operating hours of the organization itself . Therefore, he is obliged to work according to the company's rules. Come and leave work at the appointed time, have lunch and rest, and take technical breaks. Absence from work without a good reason is permitted only on non-working days: holidays and weekends established by the staffing schedule.

The full-time employee remains under the control of the employer throughout the working day.

Persons working under GPC agreements are not required to obey the customer’s internal rules . They do not obey the officials of the organization and its regulations.

The contractor can work at night, when the entire staff of the organization is resting, and sleep well during working hours. Weekends also do not affect the work process in any way. The main thing is to submit the result of the work on time.

FAQ

Who should be responsible for accidental damage to materials needed for work?

The risks are borne by the party that provided the materials, unless this point was specified in the DP and there are no other conditions.

If work is accidentally damaged or destroyed, who is responsible?

Until the customer accepts the work, all responsibility rests with the contractor, unless otherwise specified in the DP.

Can I enter into an agreement with two or three contractors at once?

Yes, there is such a possibility if the subject of the obligation is indivisible.

Buying and registering a used car: preparing for the deal

Buying and selling used cars is a very common transaction today. However, many people have questions about how to properly fill out the necessary papers. If this is your first time deciding to buy a car second-hand, you need to approach the issue with all seriousness. Once you have found the right vehicle, you need to clearly agree on the main points of the transaction. This will save you from surprises and conflicts at the next stages of registration. Discuss:

- price;

- form, procedure and terms of payment;

- replacing or maintaining license plates and insurance;

- deadlines for handing over keys.

The seller may raise the question of making an advance payment, but only you can decide whether you agree to this or not. This situation is regulated by Article 487 of the Civil Code of the Russian Federation. If you will pay in full using borrowed funds, choose the most advantageous offer from the bank. You can view the offer with the lowest interest rate here.

Additionally, before you move on to signing the papers, it is important to check the vehicle's history. Almost all the necessary information is contained in the vehicle passport (PTS). It records:

- information about former owners;

- year of manufacture, license plate number, VIN code, body number;

- technical characteristics of the vehicle.

Please pay special attention to the fact that the seller is required to provide you with the original PTS upon registration. If he only has a copy in his hands, this is a reason to think about it. Of course, you shouldn’t immediately panic and refuse to purchase, but in this case you need to approach checking the car with special care. It's very easy to do this today. For example, you can use the Autocode service. Based on the license plate number or VIN code, the system will provide a detailed history of the car and will allow you to verify the “cleanliness” of the vehicle purchased second-hand without wasting extra time.

If you are a professional car seller, use the “Autocode Pro” unlimited car check service. “Autocode Pro” allows you to quickly check a large number of cars, add comments to reports, create your own lists of liquid vehicles, quickly compare options and store data about cars in an orderly form. A subscription to unlimited car checks costs 2,500 rubles per month.

Don’t forget to check the license plate data from the PTS with the real data of the car before completing the paperwork, and also look at the service and warranty books.

By the way, you can now buy a car second-hand both with license plates (you can change them later if you wish) and without. There is no longer any need to deregister it (with the exception of sales abroad). And transit numbers are no longer required either, which simplifies the procedure.

Also read: What the PTS will tell you: how buyers of used cars are deceived

Can an employee refuse to sign an agreement?

Cases when a liability agreement is signed with an already working employee are quite rare. The legal value of a document concluded after hiring is difficult to prove. Often in such situations the problem has to be resolved through the courts.

Typically, a contract is signed upon hiring. In such a situation, the employee’s categorical refusal to sign the agreement can be considered as unwillingness to occupy the specified position.

If the profession involves financial responsibility, and the applicant refuses to sign, you have the right to refuse to hire him. This situation is interpreted as a lack of agreement on important labor issues.

If an existing employee refuses to sign a contract, this is regarded as a refusal to perform job duties and serves as a valid reason for dismissal.

By adhering to the above rules, you can protect your company from unwanted financial losses and protect against unnecessary litigation.

Check the obligations, offenses and reputation of the counterparty

The integrity of the counterparty affects how it fulfills the terms of transactions and works with partners. You can check the integrity of the counterparty in publicly available electronic services of tax and other authorities, as well as in open sources such as the media and social networks.

Checking in tax electronic services. Using the government services “Business Risks and Transparent Business” you can view the registration data of the counterparty, information about the founders and directors, types of activities, the presence of tax debts, and also find out if the company does not provide reports.

Checking in the media and open sources. Study what they write about the company on the Internet, media, and social networks. To do this, you can look at the company’s website, read news in the media mentioning the company and top officials, and customer reviews. In addition to these free methods, there are also paid ones, for example, checking a counterparty using the Kontur.Focus database of information resources.

Checking on court websites and in databases of court decisions. By looking at whether there are any legal cases against the counterparty, you will understand how conscientiously he fulfills his obligations under the concluded contracts. You can check the counterparty in the largest open database of judicial acts and decisions “Judicial and regulatory acts of the Russian Federation”. It contains data on all cases that were heard in courts of various levels, and a search using keywords, for example, by the name of the counterparty. On the website “Data Bank of Enforcement Proceedings of the Federal Bailiff Service” you can see whether there are open cases against the counterparty and for what amount he has not already fulfilled his obligations.

Check in the journal “Bulletin of State Registration”. In order not to sign an agreement with a counterparty who no longer has the right to operate, you need to make sure that the individual entrepreneur or LLC has not been liquidated or declared bankrupt. The journal “Bulletin of State Registration” publishes information about the liquidation of companies.

Yulia Makarova, lawyer at

If during the audit it turned out that the counterparty does not pay taxes, and other companies have already filed a lawsuit against it due to failure to fulfill obligations, this means that the counterparty is behaving in bad faith with its partners and is violating contractual obligations. Once you start cooperating with such a counterparty, you may not get what you expected when concluding the deal. Therefore, in this case, it is better not to sign the contract and find another partner.

Supply (purchase and sale) agreement

First of all, accounting staff need to accurately formulate the subject of the contract, that is, determine the list of goods that will be supplied. These are the names that should be reflected on the seller's invoices. Discrepancies in the names of goods indicated in the documents may lead to refusal to deduct VAT from the buyer.

A contract can provide not only legal guarantees for the company, but also form the basis for tax planning and optimization.

Another important point for maintaining tax records for purchases and sales is the correct and timely exchange of documents. For the buyer, this is the receipt of an invoice along with the goods in the form TORG-12, and for the seller - the return of a signed waybill (TTN in form T1), which confirms the latter’s transportation costs in the event of a sale of goods with delivery. The absence of TORG-12 from the buyer will allow tax authorities to doubt the legality of registering the goods and challenge the VAT amounts accepted for deduction. In turn, the seller, who incurred the costs of delivering the goods and did not receive the TTN back, runs the risk of receiving a refusal from inspectors to confirm transportation costs that reduce the income tax base, and as a result, non-acceptance of VAT deduction amounts claimed for such a transaction. The purchase and sale agreement must precisely define the terms and list of documents that the parties will exchange, as well as indicate what sanctions await the violator of this contract.

There is one more clause in the supply agreement that is often not taken into account: the conditions for acceptance and return of defective goods. Failure to comply with the terms of the contract when a defect is identified gives the seller the right to refuse to replace such goods not only based on legal considerations, but also due to the refusal of the tax authorities to confirm such expenses of the seller when writing off such amounts as expenses for the purpose of calculating income tax.

When drawing up a purchase and sale agreement, especially if the goods are supplied on a post-payment basis or with delivery, it is necessary to accurately determine the moment of transfer of ownership, since it is this clause of the agreement that gives the seller the right to reflect the sale of goods on the accounting accounts.

Procedure for registration of PTS

When the procedure for registering a contract for the purchase of a car in person is completed, it is necessary to make a new entry in the vehicle passport. Be careful when filling it out and write legibly! You need to enter:

- date of purchase;

- number of the document confirming ownership and date of registration;

- signatures of the seller and buyer.

Please note that if one of the parties to the transaction has the status of a legal entity, the signature must be certified by a seal.

If there is no free space left in your passport (this happens infrequently, but it happens), you will have to go with the seller to the traffic police to get a new one. The inspection staff will replace the document (all data will be checked against the electronic database) and re-register the car.

This concludes the process of purchasing a used car. After making an entry in the PTS, the money is transferred. It is better to transfer funds by bank transfer (unless another method was initially agreed upon). In this case, the fact of the transfer will be additionally recorded, which will protect the buyer.