Donating a share is perhaps the easiest way to transfer part of a residential property to a relative or any other person. The main advantage is that you usually don’t need to ask anyone for permission, and the recipient receives rights to square meters only for signing the contract. Read about these and other subtleties of giving in our material.

What is a share in an apartment

An apartment can belong to several owners at once, being in their joint or shared ownership. In Russian law these are two different concepts.

What you need to know about shared ownership

- Joint ownership means that the apartment is not divided into shares. For example, a couple bought and simply registered a living space for two, or a family of four privatized housing.

- Shared ownership is the property of two or more people on the basis of common ownership with the determination of the share of each owner. There are many options for its appearance: spouses or close relatives can divide the housing into shares, the apartment was inherited by several relatives at once, etc.

Children can also be the legal owners of part of the home. For example, the basis for allocating a share in an apartment to a minor is its purchase using maternity capital. In this case, the child’s share in the apartment cannot be less than what is due to him by law.

After allocating a share, it must be registered in the Unified State Register of Real Estate.

In the documents, the shares are designated as ½, ⅓, ¼ of the apartment. Moreover, each owner owns not a specific part of the housing, but the entire apartment. He has the right to use any of her rooms, every centimeter, at will. Usually, share owners themselves agree on who will live in which premises. In cases where the issue cannot be resolved peacefully, the court helps. In particularly difficult situations, the share is allocated in kind, if, of course, there are technical conditions for this (it is possible to equip a hotel entrance and a personal bathroom in the room).

Tax rate and how much to pay

Let me remind you that there is no separate gift tax. When a citizen was given an apartment as a gift, he received income in the form of its value. Personal income tax should be paid on this income.

The personal income tax rate for residents of the Russian Federation is 13% - clause 1.1 of Art. 224 Tax Code of the Russian Federation. These are those who have been in Russia for at least 183 days over the past 12 months - clause 2 of Art. 207 of the Tax Code of the Russian Federation. If less, the citizen is considered a non-resident. Personal income tax for non-residents is 30% - clause 3 of Art. 224 Tax Code of the Russian Federation. The presence or absence of Russian citizenship does not play any role here. The main thing is the number of days of residence in the country.

The donee pays personal income tax on the cadastral value of the apartment or share given to him - clause 6 of Art. 214.10 Tax Code of the Russian Federation. The cost as of January 1 of the year in which the contract was registered is applied.

Show calculation examples ↓ Example No. 1: Olga gave an apartment to her nephew, who is a resident of the Russian Federation. The cadastral value of the apartment is 3,500,000 rubles. The nephew must pay 13% * 3,500,000 = 455,000 rubles in tax.

Example No. 2. Alexander gave the apartment to his mother-in-law and father-in-law. Each has 1/2 share in the right. They are both residents of the Russian Federation. The cadastral value of the apartment is 4,600,000 rubles. Each recipient must pay 13% * (4,600,000 * 1/2) = 299,000 rubles.

Other articles

Before donating, I advise you to check the apartment for encumbrances.

Who has the right to give and who is prohibited

To donate a share of ownership in an apartment, you need to meet several requirements:

- Own housing and a share, the right to it must be registered with Rosreestr;

- Be of legal age;

- Be competent and mentally healthy.

Many people mistakenly believe that making such a generous gift is as difficult as selling part of the home, because other owners may object. However, in this regard, donating a share in an apartment and selling it are two different things.

To donate a share, the consent of others is not required, because it is a gratuitous transaction. That is, the donor does not receive money for it.

Sales fall into the category of compensated transactions, therefore, the disposal of shared property is permitted only with the consent of all its owners. For example, a husband will not be able to sell a share in an apartment, bypassing his wife. Moreover, this applies not only to the sale of a share in an apartment, but also to the redevelopment of housing.

Service No. 2 - submission of a gift agreement for registration of the transaction

Now the notary must submit the notary agreement for registration with the rest of the documents HIMSELF AND FOR FREE, because this is already included in the service for certifying the transaction. Notaries have such responsibilities since February 2021 on the basis of Art. 1 of Federal Law dated August 3, 2018 N 338-FZ. This law excluded the notary's tariff from Art. 22.1 Fundamentals about notaries, and there he added to the 2nd paragraph - that a notary does not have the right to charge money for additional legal services. Explanations of the Federal Notary Chamber - link.

Participants in the transaction must pay the notary only the state fee for registering the transaction - 2000 rubles (clause 22, clause 1, article 333.33 of the Tax Code of the Russian Federation). If a notary submits documents electronically, Rosreestr has set a discount of 30% - you only need to pay 1,400 rubles. According to the law, the state fee is paid by the donee, because he is the beneficiary, but in practice the notary doesn’t care who gives the money.

After the transaction is registered in Rosreestr, the donee will become the new owner of the share. The documents can be collected from the notary. Some notaries notify you about this by phone, while others will have to call you yourself.

Of course, the parties can refuse and submit the agreement for registration themselves. You will also have to pay 2000 rubles. for state duty.

List of persons who do not have the right to donate shares:

- Minor children;

- Citizens who are undergoing treatment, maintenance and education in hospitals, nursing homes, boarding schools, and orphanages. Their relatives will also not be able to give a share to anyone;

- Representatives of young children and incapacitated citizens;

- Owners of a share of an apartment pledged to credit institutions (the bank gives permission only in exceptional cases);

- Owners whose share is less than the minimum amount established by law. We are talking about the minimum living space per person. The norms are prescribed in regional regulations and vary from 8 to 15 square meters. m. In this case, you cannot either sell a share in the apartment or donate it as a gift;

- Commercial structures that decided to make a gift transaction among themselves. But a legal entity can make a similar gift to an individual and vice versa.

How to give property as a gift?

Gifting is, without a doubt, one of the most common methods of transferring property. Under a gift agreement, you can transfer anything - a collection of paintings, a car. Very often they resort to donation when they want to transfer real estate to relatives or friends - an apartment, a house, a plot of land. And in the case of such valuable gifts, it is important to ensure that the contract is drawn up legally. At the same time, it is important to remember about some pitfalls.

A gift agreement, or “deed of gift”, as this document is often called, is an agreement under which one party (the donor) gratuitously transfers or undertakes to transfer ownership of property to the other party (the donee). The gift agreement must be concluded in writing.

An important nuance: donation is a free transaction! That is, you cannot demand that the person to whom you are going to give a gift fulfill any obligations towards you, for example, demand to pay you money, transfer any property in return, provide any service, etc.

It is very important to understand: as soon as you put your signature on the agreement, which says that you are giving your apartment, for example, to your sister, the apartment no longer belongs to you. And you can be written out of it at any time and even evicted. On completely legal grounds. That is why, when planning to enter into a gift agreement, you need to think especially carefully.

It often happens that older people become victims of their own lack of awareness of the consequences of giving. They give their property to complete strangers, who assure them that after the apartment becomes the property of the recipient, they will be able to live in it peacefully. They convince you that a donation is an analogue of a will or a life annuity agreement, they promise monthly payments and swear that the apartment will remain yours until your death! This becomes the decisive argument - naive old people sign the contract and end up on the street.

Those who enter into a gift agreement in simple written form, that is, without a notary, are especially at risk. Such amateurish activity increases the likelihood that important terms will be missed when drawing up a contract, and mistakes will be made that could lead to a violation of your rights and invalidation of the transaction. In this case, the parties to the transaction have to defend their rights in court, unfortunately, not always successfully.

To minimize risks, it is better to have the contract notarized. After all, a notary will not only help you draw up a draft agreement, he will definitely explain all the legal consequences of the step you are about to take and will guarantee that the parties were not misled and entered into a gift agreement. Sometimes the donor or his relatives try to challenge the gift agreement, convincing the court that the donor did not understand the essence of the transaction, was not aware of the consequences of signing the agreement, thought that the ownership right would pass to the donee only after he, the donor, died and so on. In the case when the gift agreement is certified by a notary, the likelihood that it will be challenged is minimal, because all notarial acts have increased evidentiary power. An additional guarantee can be video recording materials, the right to conduct which is given to the notary by law. Only a notary can ensure that the interests of both the donor and the recipient are observed in the event of an attempt to challenge the transaction in court. By certifying the gift agreement in accordance with your stated will, the notary will conduct the necessary set of legally significant checks in accordance with the requirements of current legislation. If we are talking about donating shares of real estate, then such an agreement is subject to mandatory notarization. If we are talking about whole real estate (apartment, house, land), then the parties have the right to choose a simple written form or notarization. When making a choice, it is important to understand that today only the notary bears full property responsibility for certified transactions.

Many people wonder: is it possible to take the gift back? The law provides for the possibility of canceling a donation in cases where:

- the donee has made an attempt on the life of the donor, the life of one of his family members or close relatives, or has intentionally caused bodily harm to the donor. In case of intentional deprivation of life of the donor by the donee, the right to demand in court the cancellation of the donation belongs to the heirs of the donor;

- the recipient’s handling of a donated item, which is of great non-property value to the donor, creates the threat of its irretrievable loss. In such a situation, the donor has the right to demand in court that the donation be cancelled;

— the gift agreement itself provides for the right of the donor to cancel the gift if he survives the donee. In this case, the donated real estate will return to the property of the donor and will not be inherited by the heirs of the donee.

It is also important to know in what cases a gift agreement can be challenged:

1. If a transaction is invalid on the grounds established by law, due to its recognition as such by the court, it is recognized as voidable.

2. If a transaction, on the grounds established by law and regardless of whether it is declared invalid by the court, is invalid, then it is void.

For example, invalid transactions may be those that violate the requirements of the law or other legal act or were made for a purpose contrary to the foundations of law and order or morality, or are imaginary (made only for appearance, without the intention of creating corresponding legal consequences) and feigned (made with the aim of cover another transaction, including a transaction on different terms). Transactions made by a citizen recognized as incompetent or limited in legal capacity by a court, a minor citizen, transactions made without the legally required consent of a third party or a state body or local government, made under the influence of a material misconception or under the influence of deception, violence may also be declared invalid. , threats, or unfavorable circumstances.

If there are grounds to challenge the gift agreement, the violated rights can be defended in court.

The time frame for challenging a contract is provided for in Article 181 of the Civil Code of the Russian Federation and, depending on the grounds of the claim, varies from one to three years. an agreement under which one party (the donor) gratuitously transfers or undertakes to transfer to the other party (the donee) certain property or a property right (claim) to himself or a third party, or releases or undertakes to release it from a property obligation to himself or a third party. Gratuitousness is the main classifying feature of a gift agreement; if there is a counter-transfer of a thing or right or a counter-obligation, the contract is not recognized as a gift. An agreement providing for the transfer of a gift to the donee after the death of the donor is void. land plots, subsoil plots and everything that is firmly connected to the land, that is, objects the movement of which is impossible without disproportionate damage to their purpose, including buildings, structures, unfinished construction objects, as well as parts of buildings intended to accommodate vehicles (car spaces). Immovable property also includes aircraft, sea vessels and inland navigation vessels subject to state registration. an agreement between two or more persons on the establishment, modification or termination of civil rights and obligations. The party to the gift agreement on whose behalf the donation is made. Donors can be citizens, legal entities and the state. The ability of citizens to conclude donation agreements is influenced by the scope of their legal capacity. Actions of citizens and legal entities aimed at establishing, changing or terminating civil rights and obligations. Land plots, subsoil plots and everything that is firmly connected to the land, that is, objects whose movement is impossible without disproportionate damage to their purpose, including buildings, structures, unfinished construction sites, as well as parts of buildings intended to accommodate vehicles (parking spaces). Immovable property also includes aircraft, sea vessels and inland navigation vessels subject to state registration. an official authorized by the state who has the right to perform notarial acts on behalf of the Russian Federation in the interests of Russian citizens and organizations (legal entities). legal entities and individuals who enter into or have entered into an agreement with each other. A party to the agreement may be the state (the Russian Federation, its constituent entities), which act on an equal footing with other participants in civil law relations. Verification of the legality of the transaction, including whether each party has the right to complete it. Carried out by a notary or an official who has the right to perform such a notarial act, in the manner determined by the Fundamentals of the legislation of the Russian Federation on notaries and civil legislation. a party to a gift agreement, a person accepting a gift or exempted by the donor from fulfilling an obligation both to himself and to third parties.

Who can you donate a share to?

By law, a deed of gift can be issued to almost anyone. You can transfer a share in an apartment free of charge to a relative, friend, good acquaintance or a complete stranger. There are no obstacles to this, even if there is a minor co-owner.

The transaction has its own characteristics when it comes to a gift to a minor. Until the age of 14, a child will not be able to sign a donation agreement for a share of the apartment; his parents must do this for him. And from 14 to 18 years old, children sign themselves, but with the permission of their legal representatives. Otherwise, the transaction will be considered illegal.

And yet, the legislation has provided a list of persons to whom it is prohibited to give shares in apartments in order to combat corruption:

- Employees of educational, medical and social institutions, if the donor is their client or a relative of the client;

- Employees in state, municipal bodies, state banks, if the gift is somehow related to the performance of their official duties.

How to give your son a home in 2021

The procedure for executing a contract for a house to a son today is similar to the procedure for transferring any other real estate. At the same time, we remind you that, along with the package of documents listed above, the donor is obliged to provide the specialists of the MFC or Rosreestr with the relevant title documents (in accordance with the norms described in part 1 of Article 552 of the Civil Code of the Russian Federation) for the plot of land on which the main building is erected.

In the event that this land plot is leased by the donor from the state, when drawing up an agreement to donate a house, the right to rent this plot from the state passes to the donee , in accordance with the provisions established by Article 35 of the Civil Code of the Russian Federation.

If a private house is transferred along with the land plot on which the building was erected, the actual area of the plot and all its main characteristics must be recorded in the deed of gift. Also, it is necessary to record in the contents of the contract all technical buildings located on this land plot.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

We remind you that, according to the current legislation of the Russian Federation, as of 2021, when donating a house, the donor also transfers along with it the land plot on which it is located (Article 273 of the Civil Code of the Russian Federation), since the transferred property is inseparable from the land. Moreover, if the gift is a share in the ownership of a private house, the plot of land must be divided and calculated in proportion to the donated share.

In cases where a parent or both parents decide to give their son a certain part of the house, they are obliged to allocate it in kind by conducting an appropriate construction and technical examination, the results of which will include:

- the real market value of the entire house;

- possible land surveying options;

- actual cost of redevelopment;

- possibility of dividing a house, etc.

ARTICLE RECOMMENDED FOR YOU:

Is it possible to donate an apartment with a mortgage?

Afterwards, the parties should build a separate kitchen, bathroom and entrance. Thus, if the allocated part of the house meets the established technical requirements, it can be registered in the cadastral register, and then a contract for donating the house to the son can be drawn up in the generally established manner.

Do I need a notary to donate a share?

- A notary is required: there are several owners in the apartment with their shares, one or two decided to give them to someone else. Notarized consent is required from the spouse if the purchase of a share in an apartment or house occurred during marriage.

- A notary is not needed: all owners give shares in one transaction. The notarial consent of the spouse is not necessary if the share was given to the owner before marriage, was given as a gift, acquired as an inheritance, was privatized during marriage, or a marriage contract was drawn up, which stipulated the details of ownership of the property.

Donation of an apartment to a minor child in 2021 - features and pitfalls

According to current Russian legislation, a minor is considered a person who is 14 years old but has not yet reached the age of majority (18 years old). Thus, based on what is described in Article 26 of the Civil Code of the Russian Federation, a minor citizen of the Russian Federation can be present and participate in the execution of a deed of gift in his favor. The gift agreement must be signed by both parties to the transaction and certified by the present signature of the legal representative of the child’s interests.

At the same time, based on the norms and provisions mentioned in Article 28 of the Civil Code of the Russian Federation - when donating in favor of a minor son or daughter who has not reached the age of 14 years - the transaction is formalized exclusively by the child’s representative, without his participation.

Important

After official registration of ownership of the donated living space, the minor will act as its legal owner, although he will not be able to independently dispose of the apartment or house until he turns 18 years old.

If in the case described above, the parents or the child have a desire to sell the gift, then, according to paragraph 2 of Article 37 of the Civil Code of the Russian Federation, the parties will be able to do this only if permission to conduct the transaction is given by a specialist from the guardianship and trusteeship authority, which in 90% can only be obtained if such a transaction is needed to improve the living conditions of the child himself.

Who pays the tax when a parent signs an agreement to donate an apartment for a child?

Based on the content of paragraph 18.1 of Article 217 of the Tax Code of the Russian Federation, any property, including real estate, that acts as the subject of a gift transaction between close relatives is not taxed!

So, after the official transfer of ownership rights to the donee, he will have to pay only property tax (according to the provisions of Article 401 of the Tax Code of the Russian Federation), annually. It is worth noting that, according to the norms of the legislation in force in the Russian Federation, minor citizens are classified by the legislator as full-fledged taxpayers. That is why many donor parents have a question: who will pay the property tax after registering a deed of gift for an apartment for their son or daughter?

Of course, parents can also pay taxes for a minor child. To do this, they only need to indicate the details of their son or daughter. At the same time, in some cases, children can take advantage of certain benefits, which are established for each region separately.

What documents are needed for the deed of gift?

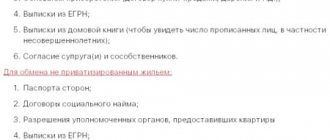

For a share donation agreement, you will need the same documents as for the sale of an apartment:

- Documents on the basis of which the share was received: certificate of inheritance, purchase and sale agreement, etc.;

- Extract from the Unified State Register of Real Estate for residential premises;

- Extract from the house register and financial and personal account;

- Technical passport or explication of the apartment and floor plan;

- Passports of the donor and recipient.

To quickly order an extract from the Unified State Register, use the Unified State Register Service. It is enough to indicate the cadastral number or address of the property. And you will have the finished extract in 30 minutes.

In special cases it is necessary to prepare:

- Marriage certificate;

- Child's birth certificate;

- Notarized consent of the donor's spouse;

- Documents about the relationship of the parties, if the gift is intended for a close relative;

- A certificate from a psychoneurological clinic confirming the legal capacity of the parties.

How to give your son a garage in 2021

First, it is necessary to determine the type of property to which the property being transferred as a gift belongs. So, if the garage (based on information from Part 1 of Article 130 of the Civil Code of the Russian Federation) relates to real estate, the donation of the garage should be made in the general manner, that is, similar to the donation of most real estate objects, with mandatory state registration of the new owner’s ownership in the MFC or Rosreestr.

At the same time, for the above-mentioned registration, the parties, in addition to the standard package of documents, will need title papers for the land plot on which the garage was built.

Important

If the building is located on land owned by the parents (donor), the transfer of ownership must be formalized in accordance with the general procedure, with the obligatory provision of the relevant documentation and the transfer of all parameters of the building and the site in the deed of gift to the son.

If the garage transferred by the parents to their son is part of the GSK or a garage-building cooperative, the size and procedure for the transfer are regulated by the Charter of this cooperative.

Thus, the son’s ownership right to the garage donated to him by his parent will be formed only after making the full share contribution (based on the provisions given in Part 4 of Article 218 of the Civil Code of the Russian Federation). Simply put, to donate this type of real estate, the recipient needs to repay the share in full, and then provide documents about this to the registration authority.

Why do you need a USRN extract when donating a share and where to get it?

The list of documents for donating a share in an apartment includes an extract from the Unified State Register of Real Estate. This certificate is mandatory; without it, Rosreestr will not register the ownership of the person who received the gift. The extract from the Unified State Register indicates all owners of the apartment. The donor thereby proves his ownership of the housing or share in the apartment.

But the main point that is most important for a share donation agreement is encumbrances. The statement contains section 2 “Information on registered rights”, which reflects the presence of arrests, unpaid mortgages to the bank, bans and other restrictions. If the property is encumbered, then you cannot give even just a share to a close relative, not to mention the entire premises. The conclusion of a donation agreement for a share in the apartment or its entirety will be refused.

Ordering an extract is easy and simple if you use the services of the EGRN.Reester service. This is faster than in the offices of Rosreestr or MFC - without queues, online. It is enough to indicate the cadastral number or address of the property, and you will have a ready-made extract in half an hour.

Text: Olesya Moskevich

What gifts do you not need to pay tax on?

According to Russian law, not all gifts need to be shared.

- Money . If you receive a cash gift, the government cannot tax you.

- Off the list. If you were given an item that does not qualify as a taxable gift. This is neither an apartment, nor a car, nor a stock. Then you can sleep peacefully and not think about taxes.

- From relatives. There is no need to pay tax when donating an apartment between close relatives. You will be exempt from the duty if the apartment was given to you by the husband with whom you are officially married. The same goes for the wife. In addition, the tax will not affect gifts from children, parents, grandparents, siblings and half-siblings.

That is, if a father gives his daughter an apartment, none of them will pay the fee. And if the property passes from uncle to niece, the transaction will be subject to tax.

Arbitrage practice

To cancel a deed of gift, evidence is needed to confirm the existence of grounds. Audio and video recordings and documents are presented to the courts, and witnesses are called, but this does not guarantee the satisfaction of claims.

But there are examples of decisions where plaintiffs managed to obtain in court the cancellation of transactions made with brothers, sisters and other citizens:

- Decision No. 2-55/2019 2-55/2019(2-775/2018;)~M-675/2018 2-775/2018 M-675/2018 dated June 17, 2021 in case No. 2-55/2019 ;

- Decision No. 2-2788/2018 2-2788/2018~M-2443/2018 M-2443/2018 dated June 26, 2021 in case No. 2-2788/2018;

- Decision No. 2-1773/2017 2-1773/2017 ~ M-1803/2017 M-1803/2017 dated October 18, 2021 in case No. 2-1773/2017.

Legal advice: courts carefully study the circumstances of the case and evidence, so it is recommended to seek help in challenging a lawyer in order to increase the chance of satisfaction of the claims. Challenging a contract on your own is extremely problematic.