The owner, land user, landowner and tenant have different rights.

The owner of the land plot has the greatest amount of rights or powers.

The rights of the landowner, land user and tenant are smaller in scope.

Moreover, their rights are always derived from the rights of the owner.

Note.

2 ways to receive a plot of land from the state :

- no bidding,

- on the auction.

Step-by-step instructions will help you obtain municipal or state land in any of the ways.

try it now

Ready-made samples of applications, diagrams and other documents will make it easier to obtain a land plot.

Let's look at the rights of the owner of a land plot to understand what the first difference is.

Responsibilities

Land user and landowner are persons who have not only rights, but also responsibilities. The latter include:

- Exploitation of a land plot with its purposeful purpose and the use of methods that will not harm the environment, in particular the land plot itself as an object of nature.

- Preservation of boundary, geodetic and other special signs that are installed on the site in accordance with the law.

- Implementation of environmental protection measures, in particular compliance with fire safety.

- Timely start of land use, if this fact is provided for in the contract.

- Timely payment of land tax.

- Compliance with all urban planning regulations when using the land plot.

- Compliance and adherence to construction, environmental, sanitary, hygienic, fire safety standards and regulations.

- Suppression of pollution, depletion, degradation, impoverishment of land and soil on a specific land plot.

- Compliance with other requirements provided for by the RF Land Code.

The land user and tenant have only the right to own and use the land plot.

Unlike the owner, the land user and tenant do not have the right to dispose of the site.

In other words, the land user and tenant can only own and use the plot.

The land user and tenant cannot determine the legal fate of the site, that is, dispose of it.

The landowner's limited right to dispose of the plot (transfer by inheritance) distinguishes him from the land user and tenant.

2nd difference.

Owner

The owner always has three powers. In other words, no matter what object he possesses, he has three powers.

Ownership.

Possession of an object is physical possession of it. The ability to control the property. Ownership is a key right because the rest of the owner's rights are based on it.

Right of use.

Use is the extraction of useful properties from the possession of an object of property.

In other words, by exercising the right of use, the owner exploits the object and derives consumer benefit from it.

The right of use is always related to the right of ownership, because you can use an object only by owning it.

Right of disposal.

An order is an opportunity to determine the legal fate of an object.

The right of disposal is exercised through sale, donation, lease, gratuitous use, by inheritance, as well as in other ways.

Thus, the owner has all 3 powers. Each of the 3 rights can be transferred by the owner to other persons.

Owner, land user, land owner, tenant own land on different grounds.

The basis refers to the type of right on which the land was acquired.

The owner owns the land by right of ownership.

The land user owns the plot on the right of free use or on the right of permanent (indefinite) use.

See all 14 ways to obtain a plot of land for free use in a separate article at the link. The right of permanent, unlimited use is available only to certain organizations and authorities.

Citizens cannot have a plot of land with the right of permanent, unlimited use.

Rights

The Land Code of the Russian Federation regulates certain rights that landowners and land users have. So, ch. 6 tbsp. 40, 41 and 43 provide the following rights:

- Independent management on your own land plot.

- Use for personal needs, in the manner prescribed by law, of minerals, fresh water, ponds located on the site.

- Construction of residential, industrial, cultural, domestic and other buildings in accordance with the intended purpose of the site, urban planning regulations and in compliance with all necessary safety measures and standards.

- Carrying out irrigation, drainage, cultural, technical and other works in accordance with the law; construction of ponds and other water bodies taking into account environmental, construction, sanitary requirements and standards.

- Planting and sowing crops, obtaining agricultural products and income from their sale. The exception is cases when the land is leased, for indefinite or free use.

- Exercise of owned rights to a land plot, unless otherwise provided by law.

The landowner owns and uses the land plot on the right of lifelong inheritable ownership.

At the moment, it is not possible to obtain a plot of land on the right of lifelong inheritable ownership.

The impossibility of obtaining land for lifelong inheritable ownership is explained by the following reasons.

The right of lifelong inheritable ownership was still in effect in the USSR.

The new land code, introduced in 2001, recognizes this right.

However, it does not provide for the opportunity for new landowners to receive plots of land for lifelong inheritable ownership.

In other words, the old landowners retained the rights to previously acquired plots.

At the same time, the emergence of new landowners is legally impossible.

Thus, lifelong inheritable ownership is a disappearing type of right.

Land ownership

According to ch. 3 of the Land Code of the Russian Federation, land ownership can be:

- Private. Landowners in this case are citizens who acquired plots of land in accordance with the legislation of the country.

- State. Land users are individuals and legal entities, municipalities.

- Federal. The rights to the land belong to the Russian Federation.

- Municipal. Here the landowner is the municipality.

- Subjective. We are talking about plots of land belonging to the constituent entities of the Russian Federation.

Part IV. Land tax: basic concepts

When faced with land tax, it is important to understand its essence and main characteristics: who should pay land tax and how, for what objects, whether there are exceptions from taxation and corresponding benefits. In this article we will answer these and other questions by examining the elements of land tax in more detail.

Let us remind you before this that land tax is a local tax, that is, the general provisions are enshrined in Chapter 31 of the Tax Code of the Russian Federation, and the establishment of the tax and its detailed regulation (rates, benefits) are carried out at the local level by regulatory legal acts of municipalities. As for cities of federal significance, land tax is regulated by the laws of these entities.

Taxpayers

According to Article 388 of the Tax Code of the Russian Federation, land tax is required to be paid by individuals and legal entities that own land plots:

- on the right of ownership;

- on the right of perpetual use;

- on the right of lifelong inheritable ownership.

If the land plot is transferred as a contribution to a mutual investment fund (UIF), then the tax payer is the management company.

The peculiarity of land tax is manifested in the presence of use rights among the “taxable” rights, which is largely due to historical prerequisites. In Soviet times, private ownership of land did not exist, and land rent was collected for use. The land tax was introduced in 1981, however, in essence, it was of a rental nature.

In 1990, the right of lifelong inheritable ownership was introduced for citizens. Since the entry into force of the RF Land Code, land plots cannot be provided under this right, and its indication in the RF Tax Code is of a “transitional” nature.

It is important to note that the status of a land tax payer is interconnected with the principle of state registration of rights to land plots and is determined by the moment of making the corresponding entry about the right to a land plot in the Unified State Register of Real Estate, and not by the actual use of the land plot or other legal facts.

There are several exceptions to this rule, which were once drawn to the attention of the Supreme Arbitration Court of the Russian Federation in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 23, 2009 No. 54:

- if the right to a land plot arose before the entry into force of the Federal Law of July 21, 1997 No. 122-FZ “On State Registration of Rights to Real Estate and Transactions with It” (currently no longer in force) and is confirmed by relevant documents, then this is equivalent to a record in the Unified State Register and the obligation to pay land tax still arises (Article 6 of the Federal Law of July 13, 2015 No. 218-FZ “On State Registration of Real Estate”);

- if there is universal legal succession, that is, inheritance and reorganization of a legal entity (except for separation, because here a new legal entity is created without liquidation of the previous one), the obligation to pay land tax arises from the moment the inheritance is opened (Article 396 of the Tax Code of the Russian Federation) or the corresponding entry is made in the Unified State Register of Legal Entities about reorganization.

Who shouldn't pay land tax?

The legislator specifically listed those who do not pay land tax. These include:

- individuals and organizations owning a land plot with the right of free use;

- individuals and organizations owning a land plot under a lease agreement.

In addition, land tax is not levied on “legal defaulters” thanks to the corresponding benefits, which we will discuss later in this article.

Object of taxation

According to Article 389 of the Tax Code of the Russian Federation, land tax is levied on land plots that are located within the boundaries of municipalities, as well as cities of federal significance.

Thus, the land plot must meet certain conditions:

- be located in an area where land tax has been introduced;

- belong to a person on the corresponding right, which, as a general rule, is registered;

- not be excluded from land taxation.

If we talked about the first points earlier, we have not yet considered the last one. It is no less important, since not every land plot is subject to land tax.

Land plots excluded from taxation

What land plots are excluded from land taxation? We will talk about “state”

and

“serious”

land plots, which, as a general rule, cannot be privately owned and have special state, historical, and environmental significance. So, these include:

- land plots withdrawn from circulation (within the boundaries of national parks, under FSB facilities, etc.);

- land plots under particularly valuable cultural heritage sites, sites on the World Heritage List, historical and cultural reserves, archaeological heritage sites, museum reserves;

- land plots of the forest fund category;

- land plots under state water bodies (water fund lands);

- land plots from the common property of an apartment building.

The tax base

The tax base, that is, the cost (quantitative and qualitative) assessment of a land plot for tax purposes, is expressed in cadastral value. It is this that is used as the basis for determining the amount of land tax.

The cadastral value is established as a result of conducting a state cadastral valuation and entering the relevant data into the Unified State Register of Real Estate. However, everything is not so simple here: the number of claims to challenge assessment results, according to information from Rosreestr, is increasing every year and in 2021 amounted to 22,737.

We will discuss the cadastral value, the procedure for determining and reducing it in more detail in the following articles.

Tax rates

Article 394 of the Tax Code of the Russian Federation provides that specific land tax rates are established by the representative bodies of municipalities. Land tax rates may vary depending on the category and permitted use. but within the following limits established by the Tax Code of the Russian Federation:

- 0.3% for agricultural land, housing, private plots, gardening, vegetable gardening or livestock farming, dacha farming, as well as for land plots with limited circulation (that is, state or municipal property) provided for the purposes of defense and security .

The Constitutional Court of the Russian Federation, the Supreme Arbitration Court of the Russian Federation and the Ministry of Finance of Russia paid special attention to the latter - details of the decisions can be found in the list of documents below. And we will dwell on this in more detail when, in the following articles, we examine cases of reducing land taxes.

- 1.5% for other land plots.

In most cases, municipalities have maximum rates, but there are opposite examples when the land tax rate is lower than those mentioned in federal legislation. Thus, 0.1% in relation to land plots of private household plots and housing stock in the Beloglinsky district of the Krasnodar Territory or 0.01% in relation to land plots of educational, healthcare, physical culture and sports institutions in the Elovsky district of the Perm Territory.

You can find out what land tax rates are in effect in the constituent entities of the Russian Federation on the website of the Federal Tax Service of Russia or in our special register.

Tax benefits

Tax benefits for land tax are fixed in the form of exemption from paying tax and reducing its amount.

At the federal level, according to Article 395 of the Tax Code of the Russian Federation, the following are exempt from the obligation to pay land tax:

- bodies of the penal system;

- public organizations of disabled people;

- religious organizations;

- communities of indigenous peoples of the North, Siberia and the Far East of Russia;

- residents of a special economic zone;

- participants of the free economic zone;

- management companies of the Skolkovo innovation center;

- funds of innovative research centers.

As a rule, such an exemption applies to those land plots that the subjects directly use in their activities.

In addition, from 2021 it is possible to reduce the amount of land tax (tax deduction) due to a reduction in the tax base by the cadastral value of 600 sq.m., that is, in the case of a land plot of 600 sq.m. the tax base may become zero and actually exempt from paying tax. However, a reduction in the amount of land tax (tax deduction) is possible only for socially vulnerable segments of the population: pensioners, disabled people, veterans of the Great Patriotic War and some others.

Additional benefits are established at the regional and local levels.

Thus, in cities of federal significance, authorities, local governments and institutions are exempt from paying land tax. In St. Petersburg, the land tax for research centers has been reduced to 35%. In Moscow, the list of “legal non-payers” of land tax is wider and includes a parent in a large family, sports organizations, private non-profit health organizations and other entities if the land plots used are not leased (100% or a deduction of 1 million rubles).

At the local level, as a rule, local governments and municipal institutions, socially vulnerable segments of the population are actually exempt from paying land tax, however, there are municipalities in which additional benefits are not established - in the Nekrassovsky district of the Yaroslavl region, the Chita district of the Trans-Baikal Territory.

Sanitary and epidemiological situation in connection with the coronavirus pandemic in 2021

made its own adjustments to the administration of land tax. Thus, the deadline for payment of advance payments has been extended to October 30, 2020 and December 30, 2020 for the first and second quarters, respectively, under certain conditions:

- the organization is included in the unified list of small and medium-sized businesses;

- the organization is included in the list of “victims of coronavirus” according to the Decree of the Government of the Russian Federation of April 3, 2021 No. 434 “On approval of the list of sectors of the Russian economy that were most affected by the worsening situation as a result of the spread of the new coronavirus infection”;

- the organization is included in the list of socially oriented non-profit organizations that receive support during restrictions due to coronavirus, if the municipality provides for advance payments of land tax.

However, it is important to understand here that we are talking specifically about deferment of payment of advance payments for land tax, and not about exemption. In our opinion, a deferment in itself is not a good measure to support taxpayers, because here we are talking about the principle “you don’t have to pay now, but then you’ll pay twice as much at once.” For landowners, this situation seems more depressing, because they need to find money for “later” in conditions when, in fact, the land is idle and does not generate adequate income.

Follow our publications on this blog or on our company website: mitsan.pro

Sources Regulatory legal acts 1. Tax Code of the Russian Federation (part two) dated 05.08.2000 No. 117-FZ. 2. Decree of the Government of the Russian Federation of April 3, 2021 No. 434 “On approval of the list of sectors of the Russian economy that were most affected by the worsening situation as a result of the spread of the new coronavirus infection.” 3. Decision of the Council of the Beloglinsky rural settlement of the Beloglinsky district of the Krasnodar Territory No. 73 § 4 of November 23, 2018 “On land tax.” 4. Decision of the Council of the urban settlement “Novokruchininskoye” of the Chita municipal district of the Trans-Baikal Territory No. 44 dated November 28, 2014 “On the establishment of a land tax on the territory of the urban settlement “Novokruchininskoye” 5. Law of the city of Sevastopol No. 81-ZS dated November 26, 2014 “On land tax” . 6. Law of St. Petersburg No. 617-105 dated November 23, 2012 “On land tax in St. Petersburg.” 7. Law of the city of Moscow No. 74 of November 24, 2004 “On land tax.” 8. Decision of the Municipal Council of the rural settlement of Burmakino No. 5 dated October 29, 2014 “On the establishment of land tax on the territory of the rural settlement of Burmakino.” 9. Decision of the Council of Deputies of the Dubrovsky rural settlement of the Elovsky municipal district of the Perm Territory No. 55 dated July 22, 2010 “On land tax.” 10. Letter of the Ministry of Finance of Russia dated January 21, 2020 No. 03-05-06-02/3068. 11. Ruling of the Constitutional Court of the Russian Federation dated December 6, 2018 No. 3109-O “On the refusal to accept for consideration the complaint of the open joint-stock company “325 Aircraft Repair Plant” for violation of constitutional rights and freedoms by subparagraph 3 of paragraph 2 of Article 389 of the Tax Code of the Russian Federation and subparagraph 5 paragraph 5 of Article 27 of the Land Code of the Russian Federation" 12. Determination of the Supreme Arbitration Court of the Russian Federation dated November 25, 2013 No. VAS-16014/13 in case No. A51-23181/2012 13. Letter of the Ministry of Finance of Russia dated December 11, 2013 No. 03-05-05-02/ 54346 14. Resolutions of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 23, 2009 No. 54, 15. Letter of the Ministry of Finance of Russia dated June 21, 2018 No. 03-05-05-02/42312. [1] Pepelyaev S.G., Popov P.A., Khachatryan N.R., Ivlieva M.F. Legal basis of property taxation. M., 2016. P. 104, 105.

[2] Fundamentals of legislation of the USSR and union republics on land dated February 28, 1990 No. 1251-1

[3] Resolutions of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 23, 2009 No. 54, Letter of the Ministry of Finance of Russia dated January 21, 2020 No. 03-05-06-02/3068

[4] Letter of the Ministry of Finance of Russia dated June 21, 2018 No. 03-05-05-02/42312

[5]URL; https://rosreestr.ru/site/activity/kadastrovaya-otsenka/rassmotrenie-sporov-o-rezultatakh-opredeleni….

[6] Ruling of the Constitutional Court of the Russian Federation dated December 6, 2018 No. 3109-O “On the refusal to accept for consideration the complaint of the open joint-stock company “325 Aircraft Repair Plant” for violation of constitutional rights and freedoms by subparagraph 3 of paragraph 2 of Article 389 of the Tax Code of the Russian Federation and subparagraph 5 paragraph 5 article 27 of the Land Code of the Russian Federation"

[7] Determination of the Supreme Arbitration Court of the Russian Federation dated November 25, 2013 No. VAS-16014/13 in case No. A51-23181/2012

[8] Letter of the Ministry of Finance of Russia dated December 11, 2013 No. 03-05-05-02/54346

[9] Decision of the Council of the Beloglinsky rural settlement of the Beloglinsky district of the Krasnodar Territory No. 73 § 4 of November 23, 2018 “On land tax”

[10] Decision of the Council of Deputies of the Dubrovsky rural settlement of the Elovsky municipal district of the Perm Territory No. 55 dated July 22, 2010 “On land tax”

[11] Law of the city of Sevastopol No. 81-ЗС dated November 26, 2014 “On land tax”

[12] Law of St. Petersburg No. 617-105 of November 23, 2012 “On land tax in St. Petersburg”

[13] Moscow City Law No. 74 of November 24, 2004 “On Land Tax”

[14] Decision of the Municipal Council of the rural settlement of Burmakino No. 5 of October 29, 2014 “On the establishment of land tax on the territory of the rural settlement of Burmakino”

[15] Decision of the Council of the urban settlement “Novokruchininskoye” of the Chita municipal district of the Trans-Baikal Territory No. 44 dated November 28, 2014 “On the establishment of land tax on the territory of the urban settlement “Novokruchininskoye”

Certificate of ownership

What documents can confirm the right to dispose of a land plot?

Until recently, there were no strict legal requirements for the design and registration of land plots. Some owners still carry out activities on the land, for example, engage in personal farming, but are not its legal owners.

They cannot sell their plot or rent it out, since they must first obtain a certificate of ownership and register their property with Rosreestr. The title document, one of the most important, is the certificate of ownership issued by Rosreestr.

If the owner does not have such a certificate, he must keep the papers according to which the land was transferred to him. This could be a purchase and sale agreement, a deed of gift, a will. You should have technical documentation for the site, including a land surveying plan issued after establishing the exact boundaries, a technical plan.

Individual residential buildings, dachas, and other buildings have been built on many plots. To ensure that no one can lay claim to them, the buildings must be properly designed.

IMPORTANT! All listed documents have great legal weight. They should be stored carefully.

In case of any controversial issue regarding real estate, both the certificate of ownership of the land plot and the documents for the house built on the site will help protect your powers.

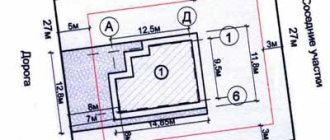

Site fencing

According to the law, the owner can fence his territory, but the fencing structure must be located on his land . The fence will allow you to highlight the area and protect it. Before installing a fence, you need to check whether the site has been surveyed and how accurate the boundaries are.

If neighbors have built any structures on his land without the owner's knowledge, they may be demolished. In this case, no claims can be made against the owner, since the land is only his property.

Legislation

The disposal of the site should not contradict legal norms. But the owner is also reliably protected in his rights. What documents can you resort to to protect your rights and interests?

The main documents are Article 46 of the Constitution of the Russian Federation, Articles 11, 12 of the Civil Code, Articles 59, 61 of the Land Code.

If you lack confidence in your own legal knowledge, you should seek the help of a lawyer experienced in land and property issues to protect your right as an owner.

Establishment of a private easement based on a court decision

If it is necessary to establish a private easement, any citizen can carry out this operation in court.

It is important to remember that the judicial authority is not competent to oblige the owner of the site to sign an agreement on the establishment of a private easement.

The court makes a decision according to which registration of the land encumbrance is possible.

A court decision to establish a private easement must contain all the terms of the agreement. The judicial authority can independently determine these conditions, but if such an operation is impossible, then a special expert who deals with land issues is involved in the trial.

In addition to the conditions, the court decision must contain precise information about the location of the land. For this purpose, additional cadastral work may be assigned, the result of which will be the determination of the boundaries and location of the territory.

Violations

Land and civil legislation carefully protects the rights and interests of land owners. And there are a number of offenses in relation to property that are punishable by law.

- These include land squatting, which is not so rare.

- Littering of land by owners of adjacent territories or nearby enterprises.

- Deterioration of land quality due to the actions of third parties.

- Damage to signs that indicated land survey boundaries.

The adoption of regional laws that contradict state laws or even the Constitution may also be considered a violation of the rights of land owners.